- Home

- »

- Medical Devices

- »

-

Dental Microsurgery Market Size, Industry Report, 2030GVR Report cover

![Dental Microsurgery Market Size, Share & Trends Report]()

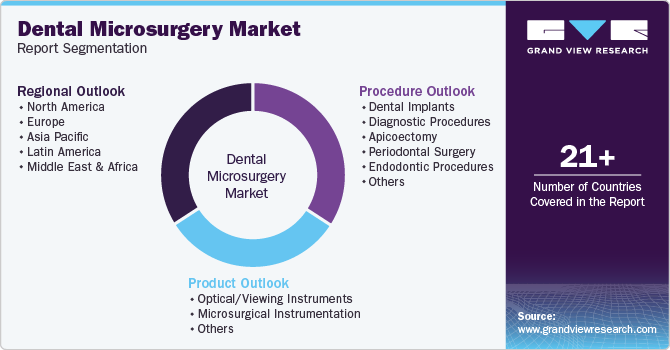

Dental Microsurgery Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Optical/Viewing Instruments, Microsurgical Instrumentation), By Procedure (Apicoectomy), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-595-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Microsurgery Market Size & Trends

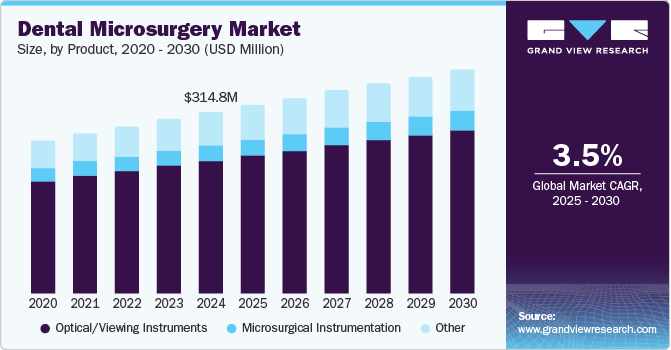

The global dental microsurgery market size was estimated at USD 314.8 million in 2024 and is projected to grow at a CAGR of 3.5% from 2025 to 2030. Rising prevalence of dental conditions, such as tooth loss, periodontal disorder, dental caries, oral cancer, oro-dental trauma, and Non-Communicable Diseases (NCD), is projected to drive growth. Growing awareness regarding dental aesthetics among the young population, coupled with the increasing availability of dental aesthetic treatments, is expected to fuel the growth further. Cosmetic surgery is one of the fastest-growing sectors of the dental industry. Rising demand for cosmetic dental surgeries, such as gum lifts, bonding, implants, bridging, and straightening, is expected to propel the demand for dental microsurgery.

In 2021, the combined global age-standardized prevalence of major oral conditions, including severe periodontitis, edentulism, untreated caries, and other oral disorders, was approximately 45,900 cases per 100,000 population, affecting an estimated 3.69 billion people worldwide. Furthermore, according to the WHO, in 2022, an estimated 389,846 new cases of lip and oral cavity cancers were reported globally, resulting in 188,438 deaths. Oral cancer is more prevalent among men and older adults, tends to have a higher mortality rate in men than in women, and shows significant variation based on socioeconomic status.

The Korean Dental Association plays a key role in maintaining excellent dental care standards in Seoul, providing both locals and visitors with quality dental services. Cosmetic dentistry is increasingly popular in South Korea, with procedures such as 1-day smile makeovers and dental veneers drawing significant interest. The country also has a dental implant success rate of over 90%, positioning it as a major hub for implant treatments worldwide.

Product Insights

The optical/viewing instruments segment dominated the dental microsurgery market with the largest revenue share of 73.1% in 2024. Dentists' high preference for the product has driven the growth. In addition, the benefits of these instruments, such as the integration of side-by-side lenses that are angled to focus on a particular object for a magnified picture, flexibility in increasing thickness and lens diameter, and adjustments as per clinical needs, increase the demand for the segment.

The microsurgical instrumentation segment is expected to grow at a significant CAGR of 3.2% over the forecast period. Dental treatments and surgeries such as endodontics (root canal treatment), periodontics (gum treatment), and oral surgery are factors responsible for the segment's growing demand. Over 15 million root canal treatments are performed annually in India. Over 41,000 RCTs are carried out nationwide daily, with individual endodontists performing approximately 25 weekly procedures. In March 2025, the Japanese Society of Periodontology, comprising 12,977 members, played a significant role in highlighting the diverse causes, clinical presentations, and treatment approaches for periodontitis, leading to greater public awareness of the disease in Japan.

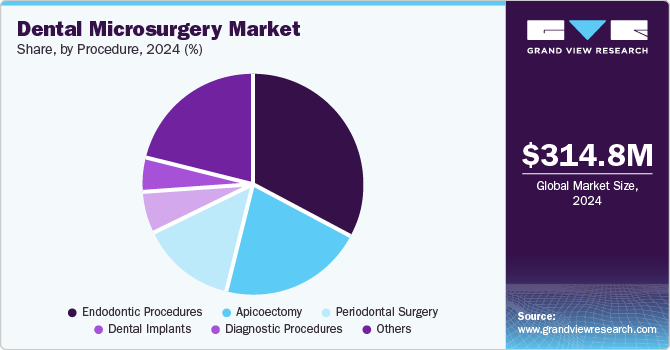

Procedure Insights

The endodontic procedures led the dental microsurgery industry, with the largest revenue share in 2024. Endodontics comprises conditions such as pulpotomy, pathologic surgery, and avulsed teeth. Endodontic procedures are reserved for deep cavities that have reached the tooth's pulp, causing an infection or damage to the nerve. According to the Global Burden of Disease Study, dental caries is among the most widespread preventable non-communicable diseases globally, affecting an estimated 2.5 billion people. Over the past decade, the prevalence of dental caries has risen by 14.6%, with even higher rates reported in several African countries.

The apicoectomy segment is expected to grow significantly over the forecast period. This procedure is usually performed when a root canal treatment doesn’t completely resolve an infection or when the root tip is the source of the issue. It helps preserve a tooth that would otherwise require extraction. Some of the top-ranked institutions for this procedure, including Michigan Medicine (U.S.), Charité - Universitatsmedizin Berlin (Germany), University Hospitals Leuven (Belgium), and Bangkok International Dental Center (Thailand), have further increased the demand for this segment.

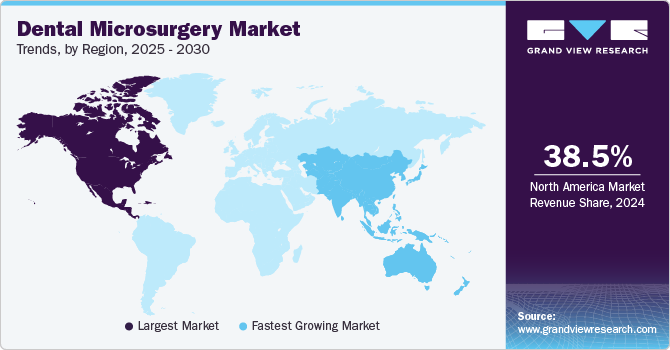

Regional Insights

The North America dental microsurgery market dominated the global market with the largest revenue share of 38.5% in 2024. The growth is attributed to the growing incidence of dental disorders, especially among the geriatric population. Factors such as the adoption of innovative techniques and high consumer disposable income are projected to fuel the regional growth further. Furthermore, periodontal surgery costs significantly less in Mexico, with prices starting at approximately USD 350 per quadrant. This makes Mexico an appealing option for individuals seeking periodontal surgery at an affordable price.

U.S. Dental Microsurgery Market Trends

The U.S. dental microsurgery market dominated the North American market with the largest revenue share in 2024. Growing dental diseases and advancements in procedures and technology, such as surgical microscopes and specialized instruments, have driven the market demand. Each year, dentists and endodontists in the U.S. perform more than 15 million root canal procedures. In addition, tooth decay affects nearly 46% of children in the U.S. Furthermore, in 2021, the American Cancer Society estimated that approximately 54,010 new cases of cancer affecting the oral cavity would be diagnosed in the U.S.

Europe Dental Microsurgery Market Trends

The European dental microsurgery market held a substantial market share in 2024. Majordental health concerns include dental diseases such as caries (tooth decay), periodontal disease (gum disease), and oral cancer, which further increase the demand for the dental microsurgery industry.

According to WHO, in 2019, the region had the highest prevalence of major oral diseases in 50.1% of the adult population. It had the highest caries prevalence in permanent teeth, affecting 33.6% of its population, or nearly 335 million people. It also had the second highest rate of tooth loss, with 25.2% of people aged 20 and over, about 88 million, affected, representing a prevalence of 12.4%, nearly double the global rate of 6.8%. In addition, the region had the second highest number of new oral cancer cases, with nearly 70,000, making up 18.5% of global cases, and over 26,500 deaths from oral cancers in 2020.

Asia Pacific Dental Microsurgery Market Trends

The Asia Pacific dental microsurgery market is expected to grow at the fastest CAGR of 4.1% over the forecast period. The major factors include a growing geriatric population, medical tourism, and government initiatives for optimal oral health. In addition, a rising number of conferences and events regarding microsurgery is expected to fuel the regional demand for dental microsurgery. Rising demand for advanced technologies for treating dental disorders is also expected to fuel regional growth. The growing prevalence of cosmetic dental surgery in South Korea further increases the demand for the dental microsurgery industry.

The China dental microsurgery market led the Asia Pacific market with the largest revenue share in 2024. The high rates of dental caries and periodontal disease, especially in children and the elderly, drive the market. According to the latest National Oral Health Survey in China, early childhood caries prevalence in children aged 3, 4, and 5 is 50.8%, 63.6%, and 71.9%, respectively. Among 5-year-olds, the rate of dental caries has increased by 5.8% compared to a decade ago. Some of the major companies in China that offer dental microsurgery products are Zumax Medical Co., Ltd.; Chengdu CORDER Optics & Electronics Co., Ltd.; and Guangzhou Lingchen Trading Co., Ltd.

Key Dental Microsurgery Company Insights

Some of the major companies in the dental microsurgery industry are Carl Zeiss Meditec AG, Global Surgical Corporation, and Albert Waeschle, among others. These companies invest in advanced technologies, expand their product portfolios, and maintain strong R&D initiatives.

-

Carl Zeiss Meditec AG specializes in ophthalmology and microsurgery. It offers advanced diagnostic and surgical solutions, including ophthalmic lasers, surgical microscopes, and intraoperative radiotherapy systems.

-

Global Surgical Corporation offers a range of products, including the A-Series dental microscopes, known for their ergonomic design and high-resolution optics. It specializes in dental and ENT surgical microscopes.

Key Dental Microsurgery Companies:

The following are the leading companies in the dental microsurgery market. These companies collectively hold the largest market share and dictate industry trends.

- Carl Zeiss Meditec AG

- Global Surgical Corporation

- Albert Waeschle.

- SYNOVIS MICRO COMPANIES ALLIANCE, INC.

- Hu-Friedy Mfg. Co., LLC.

Recent Developments

-

In February 2025, MIS introduced the LYNX implant, a versatile, cost-effective solution for diverse clinical needs in implant dentistry. It has been designed for strong primary stability, even in immediate placements, it mirrors the MIS C1’s dimensions and prosthetics. Each implant includes a sterile, single-use drill, ensuring top hygiene.

-

In May 2024, Korean startup MediThinQ launched the SCOPEYE 3D Micro Surgery Solution, featuring a wearable Eyes Up Display and a portable 3D microscope, ideal for a vast range of applications such as plastic surgery, microsurgery, dental procedures, hair transplant surgery, ophthalmology, and dermatology. Offering high-resolution 3D optics, enhanced precision, and ergonomic comfort, it enables advanced, mobile surgeries.

-

In February 2023, Kerr introduced elements Connect, a cordless endodontic motor, and Apex Connect, an electronic apex locator, ideal for dental microsurgery. Connect offers Rotary, Reciprocation, and Adaptive motions, which ensure flexibility and precision.

Dental Microsurgery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 327.2 million

Revenue forecast in 2030

USD 389.2 million

Growth Rate

CAGR of 3.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, procedure, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait.

Key companies profiled

Carl Zeiss Meditec AG; Global Surgical Corporation; Albert Waeschle.; SYNOVIS MICRO COMPANIES ALLIANCE, INC.; Hu-Friedy Mfg. Co., LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Microsurgery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental microsurgery market report based on product, procedure, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Optical/Viewing Instruments

-

Microsurgical Instrumentation

-

Others

-

-

Procedure Outlook (Revenue, USD Million; 2018 - 2030)

-

Dental Implants

-

Diagnostic Procedures

-

Apicoectomy

-

Periodontal Surgery

-

Endodontic Procedures

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental microsurgery market size was estimated at USD 314.8 million in 2024 and is expected to reach USD 327.2 million in 2025.

b. The global dental microsurgery market is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2030 to reach USD 389.2 million by 2030.

b. North America dominated the dental microsurgery market with a share of 38.5% in 2024. This is attributable to growing incidence of dental disorders, especially among geriatric population

b. Some key players operating in the dental microsurgery market include Carl Zeiss Meditech Group; Global Surgical Corporation; Albert Waeschle Ltd.; Synovis Micro Companies Alliance, Inc.; and Hu-Friedy.

b. Key factors that are driving the market growth include rising prevalence of dental conditions and growing awareness regarding dental aesthetics among young population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.