- Home

- »

- Healthcare IT

- »

-

Dental Practice Management Software Market Report, 2033GVR Report cover

![Dental Practice Management Software Market Size, Share, & Trends Report]()

Dental Practice Management Software Market (2025 - 2033) Size, Share, & Trends Analysis Report By Deployment Mode (On-premise, Web-based, Cloud-based), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-303-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Practice Management Software Market Summary

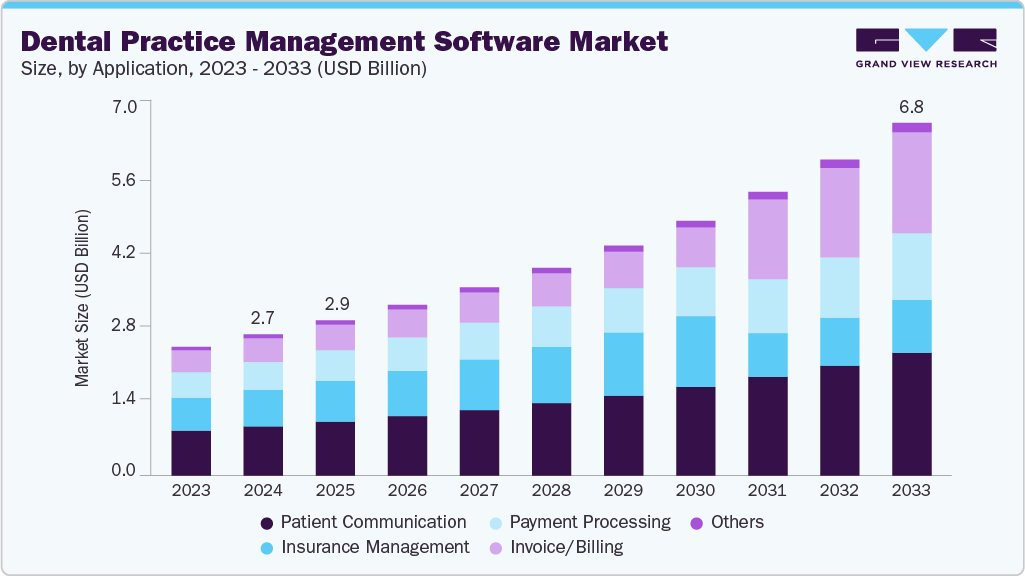

The global dental practice management software market size was estimated at USD 2.71 billion in 2024 and is projected to reach USD 6.77 billion by 2033, growing at a CAGR of 10.8% from 2025 to 2033. The market is expected to grow significantly, driven by the increasing dental visits, growing focus & awareness about oral health in Europe & the U.S., and rapid technological advancements.

Key Market Trends & Insights

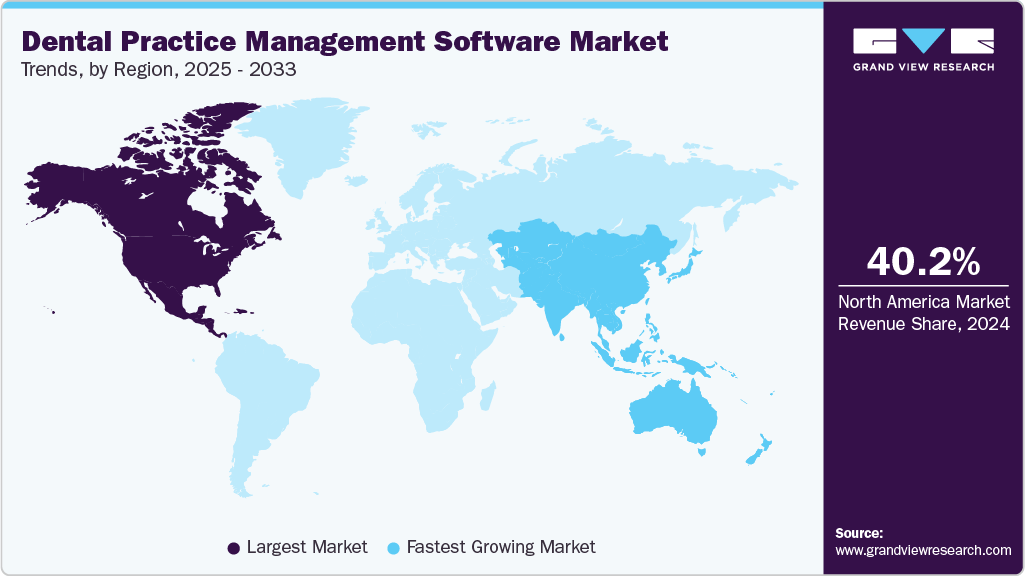

- North America dental practice management software market held the largest share of 40.21% of the global market in 2024.

- The dental practice management software industry in the U.S. is expected to grow significantly over the forecast period.

- Based on deployment, the web based segment held the highest market share of 55.54% in 2024.

- Based on application, the patient communication segment held the highest market share in 2024.

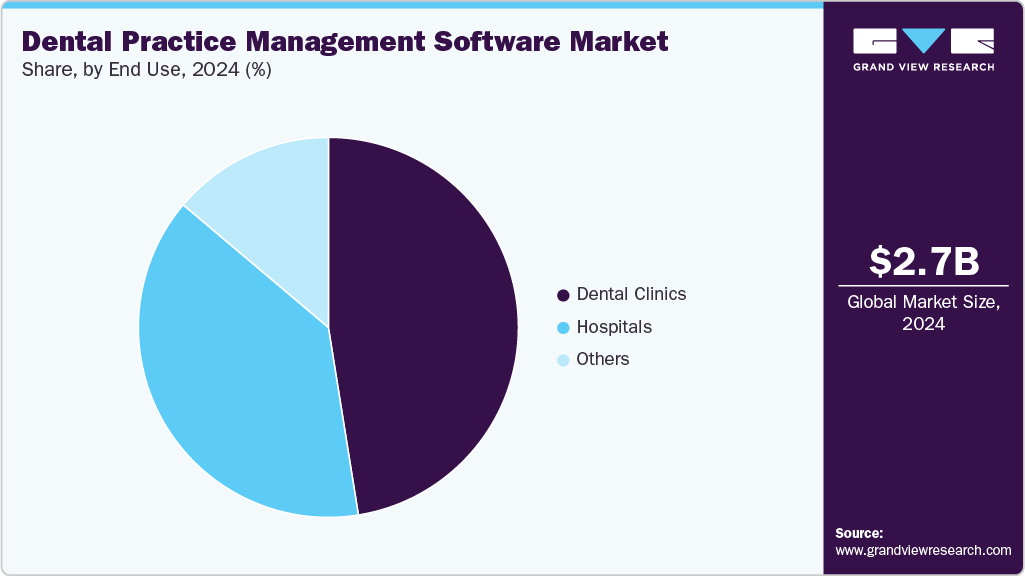

- By end use, the dental clinics segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.71 Billion

- 2033 Projected Market Size: USD 6.77 Billion

- CAGR (2025-2033): 10.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The Health Information Technology for Economic and Clinical Health (HITEC) Act encourages and accelerates the use of health information technology in the U.S. The adoption of healthcare IT solutions, especially by specialty clinics such as oral practices, is anticipated to increase insurance coverage. These factors are expected to boost the demand for oral services, thereby driving the need for DPM software.An increase in independent dental practices due to supportive government initiatives about oral health and an increase in dental visits witnessed high footfall in recent years. According to the American Dental Association (ADA), 202,304 dentists were practicing in 2023 in the U.S. According to the American Health Policy Institute, the dentist workforce is expected to witness rapid growth, reaching 67 dentists per 100,000 people in 2040. This increase in dental practices can be attributed to increased awareness and demand for dental care over the past few years.

Furthermore, the dental practice management software market is witnessing a surge in the development and integration of new technologies, including cloud computing and artificial intelligence (AI). Automation of processes enables patients to access various management solutions. For instance, in January 2024, Smilefy, Inc. launched Smilefy 4.0, a 3D smile design software program powered by AI. The software allows dental professionals to create 3D smile designs, generate 3D print-ready models, and offer patients a trial to view their new smiles in advance. This facilitates communication and helps establish realistic expectations.

The high cost of dental procedures in many countries is due to added lawsuits and malpractice insurance costs. Thus, people residing in the U.S. and Canada travel to other countries, such as Mexico and Costa Rica, for cheaper dental care. According to the Costa Rica Star, over 42% of the total medical tourists in Costa Rica seek dental care, which includes 80% of visitors from the U.S., 10% from Canada, and the rest from Central America and the Caribbean. In addition, dental clinics meet the national and international standards of hygiene & safety in these countries. Moreover, patients save more than 75% on costs for the same service, quality, and materials.

Integration of Artificial Intelligence into Dental Practice Management Platforms

Integrating artificial intelligence (AI) into dental practice management platforms has significantly transformed the operations of dental practices. AI-powered features such as automated scheduling, patient communication, billing optimization, clinical data analysis, and predictive analytics enhance workflow efficiency and enable data-driven decision-making for dental professionals. These advanced capabilities reduce administrative burdens and increase the time available for patient care, leading to enhanced productivity and improved patient satisfaction.

Furthermore, AI facilitates personalization in patient engagement through automated reminders, tailored treatment recommendations, and real-time feedback mechanisms, leading to higher patient retention and adherence to dental care plans. For instance, in October 2024, Open Dental partnered with Bola AI to integrate Bola AI's Voice Perio software into its practice management solution. This software enables dental professionals to record periodontal data in real-time by speaking values aloud. This AI-powered voice technology streamlines clinical workflows, reduces documentation burden, and enhances patient engagement by facilitating conversations about periodontal health. Moreover, as dental practices increasingly implement digital solutions for remote consultations and teledentistry, AI is crucial in enhancing communication and facilitating virtual diagnostics.

The following are some Recent Strategic Initiatives in AI in Dental Practice Management

Company

Month & Year

Initiative

Adit

May 2025

Adit introduced an orthodontic-specific version of its all-in-one practice management platform, enhancing treatment tracking, scheduling, communication, and payment processing.

RevenueWell

May 2025

RevenueWell partnered with Mila Health to introduce an advanced AI-powered assistant for dental practices. This assistant enhances patient experience with 24/7 service, automates 90% of care management tasks, and significantly reduces no-show rates.

“At RevenueWell, we are leaders in modernizing oral care in 11,200 practices and over 4 MM patients. With this launch, we are bringing the next-generation artificial intelligence (AI) tools to our customers to reinvent the way they reach their patients for oral health, and increase revenue, while automating complex tasks such as treatment plan follow-up and pre-procedure preparation.”

-Katherine Shuman, CEO of RevenueWell.

Sensei

April 2025

Sensei and DentalMonitoring announced a strategic integration to incorporate AI-powered remote monitoring into Sensei Cloud Ortho. This collaboration streamlines workflows, supports hybrid care models, and enables multi-site scalability with AI insights and 3D visualization, enhancing personalized, efficient orthodontic care.

“By bringing DentalMonitoring’s AI-powered remote monitoring capabilities directly into Sensei Cloud, we’re empowering practices to deliver smarter, faster, and more personalized care-without added complexity.”

-Philippe Salah, CEO and co-founder of DentalMonitoring

Intiveo

February 2025

Intiveo launched Intiveo Voice, an integrated communication solution for dental and specialty practices. This platform combines RingCentral’s AI-powered cloud-based phone system with Intiveo’s patient engagement software, streamlining workflows.

Software of Excellence

May 2024

·Software of Excellence partnered with Pearl to integrate Pearl’s Second Opinion AI dental diagnostic software into its EXACT practice management system.

“Together, we are enabling a higher standard of care for Software of Excellence customers and helping to enhance dental AI efficiency by empowering practices in leading dental markets with seamless access to one of dentistry’s most comprehensive AI-powered toolset.”

-Ophir Tanz, founder and CEO of Pearl.

LIBERTY Dental Plan

March 2024

LIBERTY Dental Plan launched innovations in oral health by integrating generative AI (GenAI) into its care management and benefits programs. The enhancements include AI-powered tools for personalized care management, improved member engagement, and streamlined administrative processes.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The dental practice management market is fragmented, with the presence of several emerging players entering the market. The degree of innovation, product expansion, and the impact of regulations on the market is moderate. The level of partnerships and collaborations is high.

The market is witnessing a moderate degree of innovation, with several market players launching new products to improve their market penetration. In January 2024, Napa EX/MEDX LLC introduced Image Sync for Vyne Trellis, a revenue acceleration platform. This innovative tool ensures smooth integration among supported imaging systems. Its primary benefit lies in enabling users to upload high-quality patient images to claims effortlessly. This capability empowers practices to expedite claim processing, reduce reimbursement time, and optimize workflow efficiency.

The level of partnerships & collaborations in market is high due to several key market players including Henry Schein, Inc., Nextgen Healthcare, Inc., Carestream Dental, LLC, CD Newco, LLC (Curve Dental), involved in partnerships & collaboration activities to expand their market presence. For instance, in November 2022, Henry Schein, Inc. partnered with VideaHealth, a leading dental AI-platform. As a result, Henry Schein One introduced Dentrix Detect AI-powered and manufactured by VideaHealth, an AI-enabled X-ray analysis tool that integrates directly into Dentrix Practice Management Systems.

The impact of regulations on the dental practice management software market is moderate. However, the market is expected to experience growth due to favorable government policies and laws that ensure the data safety and efficacy of dental practice management software services. For instance, in April 2021, the Kuwait Communication & Information Technology Regulatory Authority (CITRA) released the Data Privacy Protection Regulation, No.42 of 2021. All dental practice management vendors and healthcare IT companies are required to comply with these regulations.

The degree of innovation in the market is low due to factors such as slow adoption of new technology by practices, regulatory constraints, and cost considerations. These factors collectively hinder the development of groundbreaking features and solutions, resulting in a relatively low level of innovation compared to other industries.

The level of regional expansion in the market is low due to changes in regulatory frameworks and the specific demands of target customers in low- and medium-income countries. However, some of the market players are expanding their presence in various regions to gain market share. For instance, in May 2023, P1 Dental Partners selected Henry Schein, Inc.’s software: Dentrix Ascend, a cloud-based dental practice management software, and Jarvis Analytics, a dental analytics tool, to provide its partner dentists with a seamless practice management workflow across over 40 practices, helping elevate patient care and drive practice success.

Case Study Insights: ROOT Periodontics & Implant Centers' Transition to Care Stack for Enhanced Operational Efficiency

ROOT Periodontics & Implant Centers, a multi-location dental practice headquartered in Dallas, Texas, faced significant operational challenges due to fragmented systems and inefficiencies inherent in their previous desktop-based software. Seeking a comprehensive solution to streamline operations, improve patient scheduling, and enhance overall efficiency, ROOT transitioned to CareStack's cloud-based dental practice management software. This case study outlines the challenges encountered, the solutions implemented, and the outcomes achieved through this transition.

Challenge

Operating across seven locations, ROOT Periodontics & Implant Centers utilized a desktop-based system that led to fragmented patient and referral information. The team faced multiple operational hurdles, including:

-

Multiple logins for different systems.

-

Unexpected system blocks disrupting workflows.

-

Inability to schedule patients seamlessly across various locations.

These challenges hindered their ability to provide consistent and efficient patient care, necessitating a unified platform to centralize operations.

Solution

After evaluating various options, ROOT selected CareStack, an all-in-one, cloud-based dental practice management software, to address its operational challenges. The implementation process included:

-

Centralizing operations to ensure seamless scheduling and unified patient information.

-

Eliminating system blocks and the need for multiple logins.

-

Utilizing CareStack's referral portal to communicate and share patient information with over 400 referral providers in a HIPAA-compliant manner.

-

Leveraging robust reporting and analytics tools to monitor key performance indicators (KPIs) in real-time.

The onboarding process began with their first location in December 2019, with customized training plans developed for different user groups to ensure a smooth transition.

Result/Outcome

The integration of CareStack's comprehensive solutions led to significant improvements in ROOT's operations:

-

A 35% increase in gross production.

-

A 29% increase in new patient acquisition.

-

Enhanced patient experience through efficient scheduling and centralized information.

-

Improved business performance, with all KPIs showing positive trends.

“Robust reporting and analytics - provided me with a better way to watch the numbers and see things real time and quickly. All our KPIs have improved. Overall, we have seen our business improve since being on CareStack.”

-Dana VeachCOO, ROOT Periodontics & Implant Centers

Deployment Mode Insights

The web-based segment dominated the market with a revenue share of 55.57% in 2024. The growth is attributed to its increased security, quick updates, unrestricted storage space, and low cost. The rise in adoption of DPM software in oral practices for reporting, billing, scheduling, patient charting, and treatment planning is expected to boost segment growth.

Cloud-based segment is expected to grow at the fastest CAGR during the forecast period, owing to the new software launches, collaborations, and mergers among key players aimed at providing cloud-based solutions to their consumers are projected to drive this segment's growth. For instance, in September 2022, Carestream Dental launched Sensei Cloud for Oral Surgery, a cloud-based practice management software solution for oral and maxillofacial surgery. This innovation aimed to provide user-friendly and readily accessible management solutions for oral and maxillofacial surgery specialists.

Application Insights

The patient communication segment dominated the market with the largest revenue share of 34.82% in 2024. Effective communication influences patient retention, adherence to treatment plans, and overall experience. As dental practices increasingly prioritize patient-centric care, the demand for robust communication tools has grown significantly.

Furthermore, the rising emphasis on personalized patient experiences and the integration of artificial intelligence-driven communication tools, such as chatbots and virtual assistants, have further contributed to the segment's market dominance. These innovations allow dental providers to tailor interactions based on patient history and preferences, improving satisfaction and trust. For instance, in June 2024, Heygent Dental AI launched an innovative AI-Powered Patient Engagement and Communication Platform tailored for dental clinics. This platform utilizes conversational AI to manage patient interactions, automate appointment bookings, and enhance engagement.

The insurance management segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by increasing complexities in dental insurance processes and the growing need for automation and accuracy in claims handling. In addition, the segment’s growth is propelled by the demand for integrated software solutions that simplify and streamline tasks such as insurance verifications, pre-authorizations, claims submissions, and reimbursements, thereby minimizing administrative burden and human error.

End Use Insights

The dental clinics segment accounted for the largest revenue share of 47.48% in 2024. The rise in dental visits is expected to increase the need for software to manage patient data and treatment regimes. Thus, many dental clinics are adopting Electronic Dental Records (EDR) and appointment scheduling platforms. EDR can be easily integrated with DPM software, which boosts segment growth.

The hospitals segment is expected to experience the fastest growth during the forecast period. This growth is attributed to the high frequency of oral care visits and the adoption of DPM software solutions in Dental Clinics. The cloud based DPM software offers greater storage capacity through cloud servers, allowing for the storage of significant volumes of patient data, making it the perfect choice for major Dental Clinics with high patient volumes.For instance, Birmingham Dental Hospital in Europe has invested in a new facility equipped with all dental services for 120,000 patients with 98.7% positive feedback.

Regional Insights

North America dental practice management software market held the largest market share of 40.21% in 2024. This is attributed to various factors such as supportive government regulations for healthcare Information Technology (IT), high disposable income, and a large geriatric population in the U.S. & Canada. The presence of major players, such as Curve Dental and Henry Schein One, increasing funding for start-up businesses, and the growing adoption of oral care services by baby boomers are some of the key factors expected to propel market growth in North America.

U.S. Dental Practice Management Software Market Trends

The dental practice management software market in the U.S. held the largest revenue share of 89.67% in 2024, owing to an increase in number of dental practices & dentists in the U.S. According to the American Dental Association (ADA), there were around 201,117 practicing dentists in 2020 across the U.S., accounting for an increase of 2.7% from 2015.

The dental practice management software market in Canada is expected to witness the fastest growth over the forecast period. This can be attributed to growing awareness regarding oral health in the country is expected to propel the demand for dental health services during the forecast period.

Europe Dental Practice Management Software Market Trends

The dental practice management software market in Europe is anticipated to grow significantly due to rapid technological advancements and increasing consumer spending capacity. According to NHS Dental Statistics for England, 18.1 million adults were seen by an NHS dentist in the 24 months up to June 2023.

The dental practice management software market in the Germany held the largest share in 2024, owing to the increasing awareness regarding oral health in the country.

Denmark dental practice management software market is expected to witness the fastest growth over the forecast period. This can be attributed to the implementation of advanced IT frameworks in Dental Clinics and general practitioner centers.

The dental practice management software market in the UK is expected to grow significantly over the forecast period. This can be attributed to the increasing number of dental practices and supportive government initiatives being undertaken to raise awareness about oral care & dental check-ups among children.

Asia Pacific Dental Practice Management Software Market Trends

Asia Pacific is expected to witness the fastest growth over the forecast period. With the growing investments by healthcare IT companies in the region and improving economic conditions & healthcare infrastructure are favoring the market growth.

The dental practice management software market in Japan held the largest share in 2023, owing to the increasing prevalence of dental disorders and the presence of a robust healthcare infrastructure.

India dental practice management software market is witnessing growth due to the increasing prevalence of dental diseases are expected to contribute to the growth.

Key Dental Practice Management Software Company Insights

The market is highly fragmented, with the presence of many country-level players. With the growing elderly population and the need for mobile health, a few smaller competitors are entering the industry and are expected to gain a significant share of the market. Some emerging players in the market are, Dental Intelligence, Inc, Jarvis Analytics, Practice Analytics, ABELMed Inc., and Practice-Web, Inc.

Key Dental Practice Management Software Companies:

The following are the leading companies in the dental practice management software market. These companies collectively hold the largest market share and dictate industry trends.

- Henry Schein, Inc.

- Carestream Dental, LLC

- DentiMax

- Practice-Web, Inc.

- Nextgen Healthcare, Inc.

- ACE Dental Software

- Datacon Dental Systems, Inc.

- CareStack (Good Methods Global Inc.)

- CD Nevco, LLC (Curve Dental)

- Dentiflow

Recent Developments

-

For instance, in January 2025, Pearl partnered with Centaur to expand the adoption of its Second Opinion AI dental diagnostic software across Australia and the Middle East. This collaboration expands access to AI-powered disease detection in dental X-rays for professionals across Australia and the Middle East, enhancing diagnostic accuracy, clinical efficiency, and patient communication.

“Second Opinion represents the next generation of diagnostic tools for the dental profession. By incorporating AI-powered evaluations, we’re enabling dental professionals across the Asia Pacific and Middle East to improve diagnostic accuracy, streamline patient communication, and ultimately deliver a higher standard of care.”

-Sean Perera, CTO of Centaur

-

In October 2024, Archy, a provider of cloud-based automation software for dental practices, raised USD 15 million in Series A funding to Optimize Dental Practices with AI-powered automation.

-

In October 2024, Maxim Software Systems launched Mint Ops, a comprehensive ecosystem designed to support dental clinics across Canada. Mint Ops integrates MaxiDent’s trusted practice management software with additional operations, marketing, staffing, and patient communication solutions.

-

In August 2023, Henry Schein, Inc. acquired majority shares of Large Practice Sales (LPS) LLC, which is a leading consultant to individual dental practices. LPS helps these practices in their sale or partnership with larger general practice and dental specialists.

-

In May 2023, Henry Schein, Inc. acquired the Regional Health Care Group Pty Ltd, a medical products distribution company that serves public- and private-sector customers in New Zealand and Australia.

-

In November 2022, Pearl and Curve Dental partnered to integrate Pearl’s Second Opinion disease detection abilities within Curve Dental’s SuperHero practice management system, providing Curve’s 70,000 users in the U.S. and Canada with FDA-cleared clinical AI capabilities.

Dental Practice Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.98 billion

Revenue forecast in 2033

USD 6.77 billion

Growth rate

CAGR of 10.8% from 2025 to 2033

Base Year

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Henry Schein, Inc.; Carestream Dental, LLC; DentiMax; Practice-Web, Inc.; Nextgen Healthcare, Inc.; ACE Dental Software; Datacon Dental Systems, Inc.; CareStack (Good Methods Global Inc.); CD Nevco, LLC (Curve Dental); Dentiflow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Practice Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dental practice management software market report based on deployment mode, application, end use, and region.

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premise

-

Web-based

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Patient Communication

-

Invoice/Billing

-

Payment Processing

-

Insurance Management

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Dental Clinics

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental practice management software market size was estimated at USD 2.71 billion in 2024 and is expected to reach USD 2.98 billion in 2025.

b. The global dental practice management software market is expected to grow at a compound annual growth rate of 10.8% from 2025 to 2033 to reach USD 6.77 billion by 2033.

b. North America dominated the dental practice management software market with a share of 40.21% in 2024. This is attributable to the strategic presence of major players, increasing funding in start-up businesses, and rapid adoption of the latest technologies.

b. Some key players operating in the dental practice management software market include Henry Schein, Inc., Carestream Dental, LLC, DentiMax, Practice-Web, Inc., Nextgen Healthcare, Inc. (NXGN Management, LLC), ACE Dental, Datacon Dental Systems, Inc., CareStack (Good Methods Global Inc.), CD Newco, LLC (Curve Dental), and Dentiflow.

b. Market growth can be attributed to the growing geriatric population, increasing focus and awareness on oral health in the Europe & United States, and increasing technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.