Dental Suture Market Size & Trends

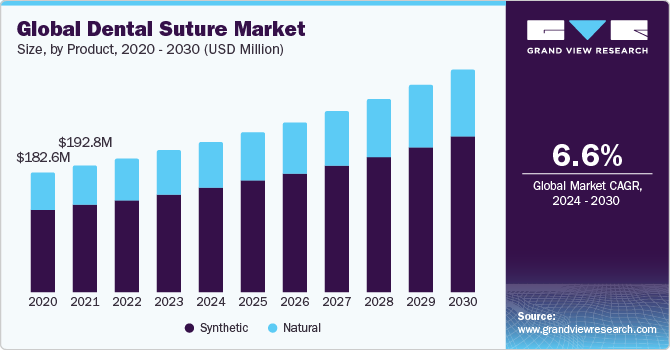

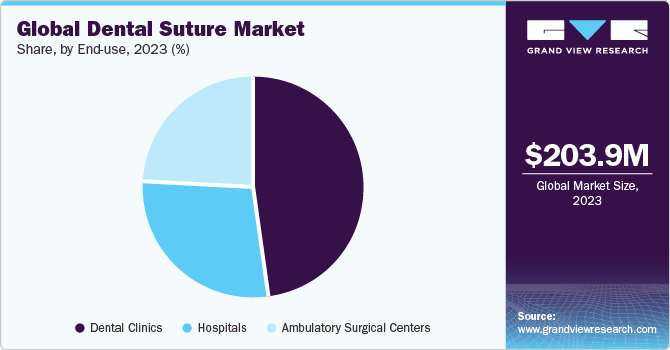

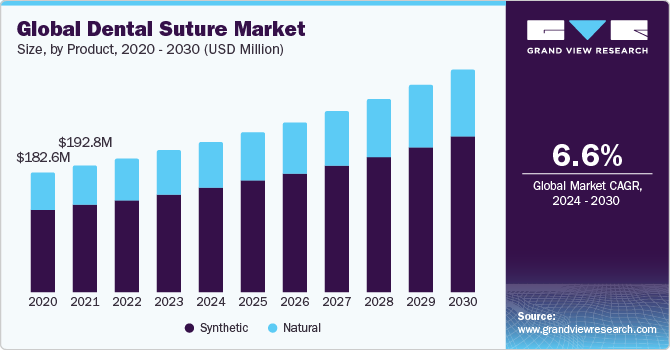

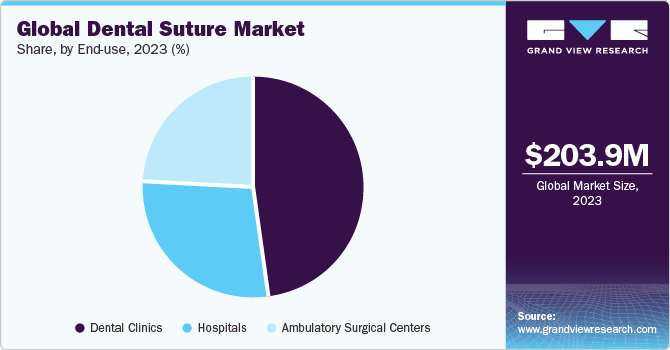

The global dental suture market size was valued at USD 203.9 million in 2023 and is expected to grow at a CAGR of 6.6% from 2024 to 2030. The dental suture is a fibrous material that can be utilized to stitch wounds during dental surgery. There are two types of sutures based on material such as synthetic and natural. The synthetic dental sutures can be made using polyester, nylon, and polyglycolic acid. The natural dental sutures can be made using silk, chromic gut linen, and plain gut.

The outbreak of COVID-19 pandemic negatively impacted growth of the dental suture market in 2020. Due to the outbreak of COVID-19 in 2020, dentists avoided going to the clinic for practice, opting instead for prescribing antibiotics and consultations remotely. Dental clinics remained closed as dentists would have become the potential carriers of disease.

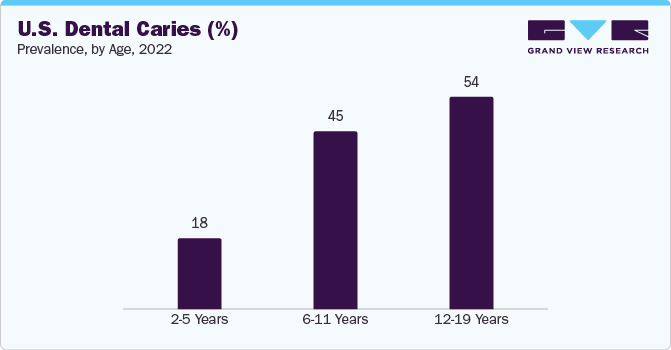

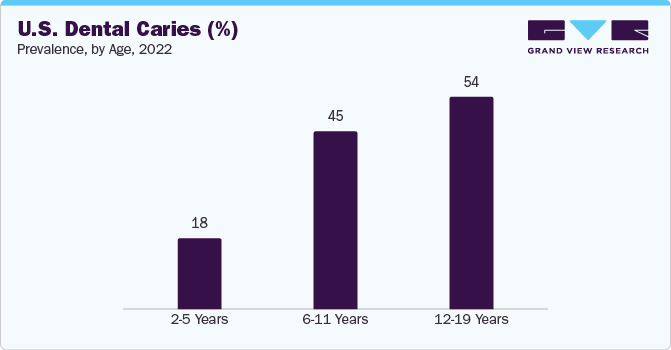

The rise in the prevalence of dental diseases, the increase in the number of dental surgeries and cosmetic dentistry, the surge in dental tourism in emerging economies, and technological advancements in dental sutures are the significant factors that drive the market growth. For instance, according to the WHO Global Oral Health Status Report (2022), it is estimated that 3.5 billion people globally suffer from oral diseases, 514 million children suffer from dental caries, and 2 billion people have caries of permanent teeth. The demand for dental procedures is increasing with the growing geriatric population, rising oral care owing to increasing tooth & oral ailments, and rising advancements in dental procedure technologies over the years.

Material Insights

Based on the material, the dental suture market is segmented into synthetic and natural. The synthetic segment held the largest market share in 2023. Synthetic sutures are the most popular suture material owing to their low tissue reactivity, high tensile strength, mild tissue reaction, bacterial growth inhibition, and good elasticity.

Type Insights

On the basis of type the market is segmented into absorbable and non-absorbable. Non-absorbable held the largest market share in 2023. Increase in number of non-absorbable products available in market, wide advantages of this type as compared to absorbable type, cost effectiveness, and increasing demand are the major factors drives the market growth.

End-Use Insights

Based on end use, the dental suture market is segmented into dental clinics, hospitals, and ambulatory surgical centers. The dental clinic was the largest revenue segment in 2023 because most dental patients visited private dental clinics due to the availability of dental experts. Owners run more than 80% of dental facilities. There is a rise in the number of independent dental clinics across the globe. This trend is expected to continue during the forecast period due to specialists' availability, cost efficiency, and technologically advanced equipment.

Regional Insights

North America dominated the market in 2023 owing to growing awareness of oral health and rapid growth in the target population. In addition, the increasing number of dental procedures will likely boost the regional market in the forecast period. Prominent drivers are technological advancements in the field of diagnosis of dental diseases, a rise in the incidence of dental problems, the surge in dental care services coupled with an increase in the number of dental clinics & hospitals, and a rise in dental care expenditure. In addition, poor diet and bad lifestyle, majorly among teenagers, lead to dental problems, driving the need for dental burs during the forecast period. Moreover, the demand for cosmetic dentistry is also surging, which is anticipated to boost market growth.

Asia Pacific is anticipated to witness the fastest growth from 2024 to 2030 due to the rising adoption of new dental technologies and growing awareness about oral care & hygiene, an increase in the number of dental procedures, a rise in the prevalence of periodontitis, and favorable government initiatives. Countries in the region are also popular for their low-cost dental treatment, which makes them a preferred location for medical tourism. The growing adoption of cosmetic dental procedures is one of the significant factors driving the market.

Competitive Insights

Key players operating in the market are Mani, Inc., HYGITECH, SMI, Theragenics (CP Medical), DemeTECH Corporation, Osteogenics Biomedical, Lux Sutures, Sutumed, Weigao Group, and Katsan Medical Devices. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. In May 2022, the Medical Microinstruments (MMI) SpA launched Symani Surgical System Simulator. In April 2021, Dolphin Suture extended its dental product range in India and introduced a non-absorbable polytetrafluoroethylene dental suture.