- Home

- »

- Medical Devices

- »

-

Dental Tourism Market Share, Growth & Trends Report, 2030GVR Report cover

![Dental Tourism Market Size, Share & Trends Report]()

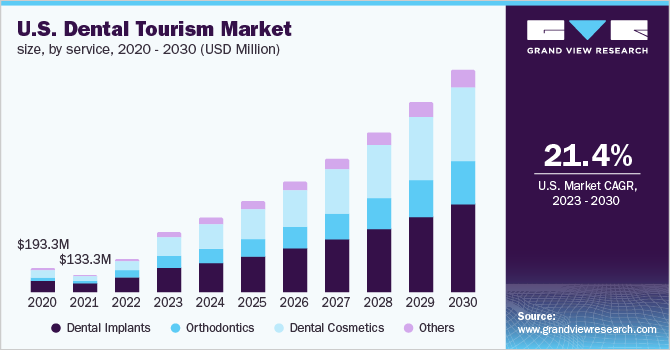

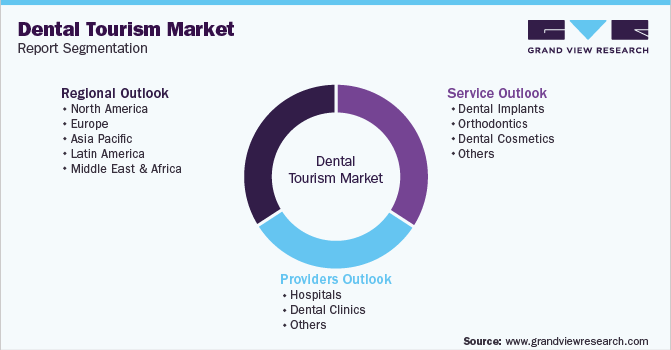

Dental Tourism Market Size, Share & Trends Analysis Report By Service (Dental Implants, Orthodontics), By Provider (Hospitals, Dental Clinics), By Region (Europe, North America, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-031-3

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overviews

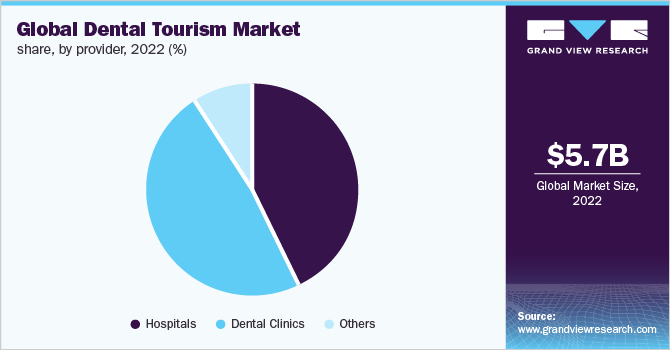

The global dental tourism market size was valued at USD 5.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 22.0% from 2023 to 2030. The increasing prevalence of dental abnormalities and demand for aesthetic dentistry around the world are the main factors driving the industry's growth. Long waiting periods for dental care in the home country combined with lower treatment costs and superior services abroad are also anticipated to drive the industry expansion during the forecast period. The industry is growing due to promotional strategies including the start of web ads highlighting healthcare providers' affordable offerings. Consumer interest is sparked in adopting appealing medical-tourism packages by offering undivided attention to healthcare and providing reasonable lodging, recognizing both treatment and recreational options. The COVID-19 pandemic has significantly affected the dental care economy.

Dentist practices were closed in many countries due to the strict restrictions imposed. The American Dental Association advised private and government dentists to put off elective operations in March 2020. Oral examinations, routine regular cleaning, radiography, cosmetic procedures, and orthodontic treatments without pain medication were among the procedures that were delayed, according to the ADA. The pandemic affected global and regional dental tourism as most dentist practices were canceled during the period.

For instance, a recent report published by Dental Tribune International claimed that 86% of their practices had to lay off employees due to the COVID-19 outbreak. Dental tourism is a subcategory of medical tourism and comprises travelers who seek dental care outside of their local healthcare systems. The main benefits of dental tourism include reasonable pricing for high-quality procedures, highly skilled staff, quicker treatment times, and the newest medical technology and tools. The top countries for dental tourists are Thailand, Mexico, Turkey, India, and Hungary. Mexico accounts for 25% of all dental tourists globally. Hungary serves patients from Europe, while India treats predominantly Asian patients and some U.S. nationals.

Service Insights

Based on services, the dental implants segment held the largest revenue share of around 37% in 2022. The rising incidence of dental injuries due to car accidents and sports injuries are factors supporting the need for dental implants. According to a report by the American Academy for Implant Dentistry, each year, over 15 million individuals in the U.S. receive crown and bridge replacements for missing teeth, supporting the need for dental implants. Dental implants are long-term replacements that are said to be a restorative treatment that protects and supports natural bone while simultaneously serving as a secure foundation for a prosthesis.

The dental cosmetics segment is also expected to grow significantly in the coming years. Cosmetic dentistry is thriving because developing nations have created a great quantity of disposable wealth. Consolidated partnerships and collaboration among key companies in this industry are frequent phenomena to stay ahead of other competitors. For instance, in March 2019, Align Technology, Inc. and Benco Dental, a privately-owned dental distributor in the U.S., announced a distribution deal for Align Technology, Inc.’s iTero Element Intraoral Scanner, which is designed to assist dentists in a variety of orthodontic and restorative operations with higher precision and viewing capabilities.

Provider Insights

On the basis of providers, the global industry has been further categorized into hospitals, dental clinics, and others. The dental clinics provider segment dominated the industry in 2022 and accounted for the maximum share of 48.6% of the overall revenue. The segment is expected to witness a lucrative growth rate during the forecast period. Dental practices are growing all around the world. The number of independent dentistry clinics is expected to increase in the years to come.

This is due to the increased competition among providers and the demand for cost-effective treatments. The regulatory scenario for dental clinics is stringent, especially in regions, such as North America. However, healthcare systems worldwide believe the risk of infection in clinics is low and in some cases are unaware of infections due to unsafe practices. Some systems recommend patients be tested for conditions, such as hepatitis B virus, hepatitis C virus, and HIV.

Regional Insights

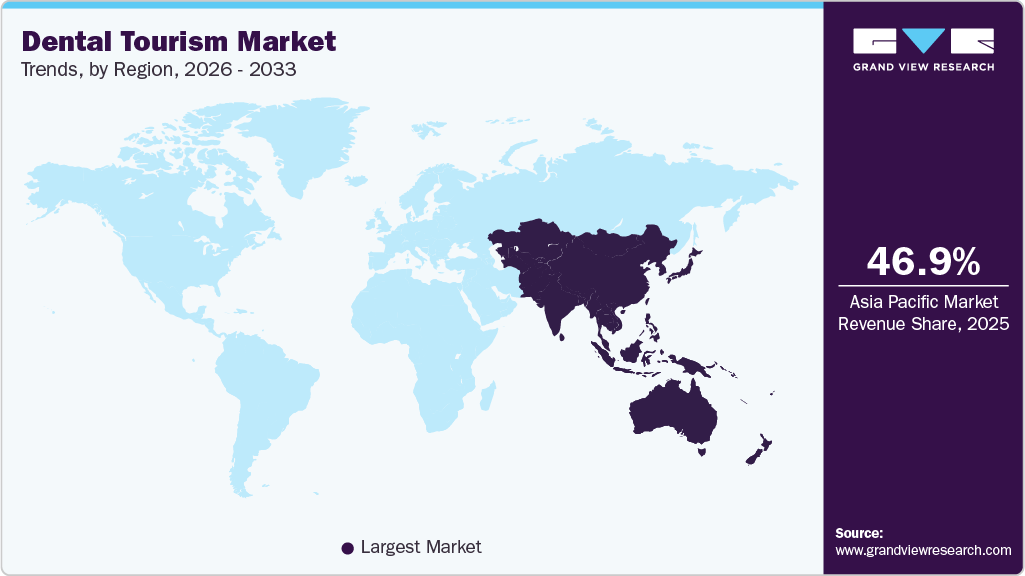

Asia Pacific dominated the industry in 2022 and accounted for the largest revenue share of over 46% due to the robust dental care markets in India, Thailand, and Malaysia. The cost of treatment in countries, such as India, Brazil, and Thailand, is one-third that in the U.K. or the U.S. Medical tourism destinations provide affordable and easily accessible services, such as medical, cosmetic, and dental surgeries, at significantly lower costs. Low labor cost is the major factor for affordable medical treatment at popular medical tourism destinations. The Europe region is expected to witness the fastest CAGR during the forecast period.

Increasing adoption of the French healthcare system as an alternative to the American healthcare system owing to the growing medical prices in the U.S. for various treatments including dental care, women's care, preventive care, cancer treatment, cosmetic surgery, and other major surgeries/treatment procedures, is contributing to the market growth. For instance, according to the article titled “The Future of Medical Tourism in France” published in January 2020, tooth extraction in the U.S. costs USD 300 per tooth without insurance for an average person, plus any additional work that needs to be done, whereas in France, the estimated cost is around USD 40 per tooth, which also covers the majority of extra necessary dental work.

Key Companies & Market Share Insights

The key players have made a significant contribution to the market growth. For instance, in March 2018, the “Two Sunny Cities. One Break” campaign launched by the Israel Ministry of Tourism proved to be successful in the promotion of Tel Aviv and Jerusalem as city destinations. The ministry is further taking measures to develop other cities, mainly Arava and Negev, into tourism destinations. Various initiatives undertaken by various governments to revive the tourism sector amid the pandemic are anticipated to contribute to industry growth.

For instance, on 13th August 2020, the government of Portugal announced the launch of its travel insurance scheme for international tourists, which includes medical, surgical, hospital, and pharmaceutical expenses, amidst the COVID-19 pandemic to revive the tourism sector and ensure a safe visit for tourists. An increasing number of inbound tourists is positively influencing the market growth. Some of the prominent players in the global dental tourism market include:

-

Franco-Vietnamese Hospital

-

Apollo Hospitals Enterprise Ltd.

-

Fortis Healthcare

-

Clove Dental

-

Medlife Group

-

Raffles Medical Group

-

Oris Dental Centre

-

Dubai Dental Hospital

-

Imperial Dental Specialist Center

-

Liberty Dental Clinic

-

ThantakIt International Dental Center

-

ARC Dental Clinic

Dental Tourism Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.9 billion

Revenue forecast in 2030

USD 43.9 billion

Growth rate

CAGR of 22.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Service, provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Costa Rica; Italy; Spain; Poland; Czech Republic; Hungary; Japan; China; India; Thailand; Malaysia; Philippines; Brazil; Mexico; UAE; Israel

Key companies profiled

Franco-Vietnamese Hospital; Apollo Hospitals Enterprise Ltd.; Fortis Healthcare; Clove Dental; Medlife Group; Raffles Medical Group; Oris Dental Centre; Dubai Dental Hospital; Imperial Dental Specialist Center; Liberty Dental Clinic; ThantakIt International Dental Center; ARC Dental Clinic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Tourism Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global dental tourism market report based on service, provider, and region:

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Dental Implants

-

Orthodontics

-

Dental Cosmetics

-

Others

-

-

Providers Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Dental Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Costa Rica

-

-

Europe

-

Italy

-

Spain

-

Poland

-

Czech Republic

-

Hungary

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Malaysia

-

Philippines

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global dental tourism market size was estimated at USD 5.7 billion in 2022 and is expected to reach USD 10.9 billion in 2023.

b. The global dental tourism market is expected to grow at a compound annual growth rate of 22.0% from 2023 to 2030 to reach USD 43.9 billion by 2030.

b. The Asia Pacific region dominated the market in 2022 with a revenue share of around 45%. In 2022, Malaysia was the second-largest market for dental tourism in Asia Pacific, after India and Thailand. The cost of treatment in countries such as India, Brazil, and Thailand is one-third that in the UK or the U.S. Medical tourism destinations provide affordable and easily accessible services, such as medical, cosmetic, and dental surgeries, at significantly lower costs.

b. Some of the key market players operating in the dental tourism market are Franco-Vietnamese Hospital, Apollo Hospitals Enterprise Ltd, Fortis Healthcare, Clove Dental, Medlife Group, Raffles Medical Group, Oris Dental Centre, among others.

b. The increasing prevalence of dental abnormalities and the rising demand for aesthetic dentistry around the world are the main factors driving the global dental tourism market. Long waiting periods for dental care in the home country combined with lower treatment costs and superior services abroad are anticipated to drive market expansion during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."