- Home

- »

- Pharmaceuticals

- »

-

Dermatological Drugs Market Size Report, 2022 - 2028GVR Report cover

![Dermatological Drugs Market Size, Share & Trends Report]()

Dermatological Drugs Market Size, Share & Trends Analysis Report By Indication (Acne, Psoriasis, Rosacea, Alopecia), By Region, And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-934-2

- Number of Report Pages: 78

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Healthcare

Report Overview

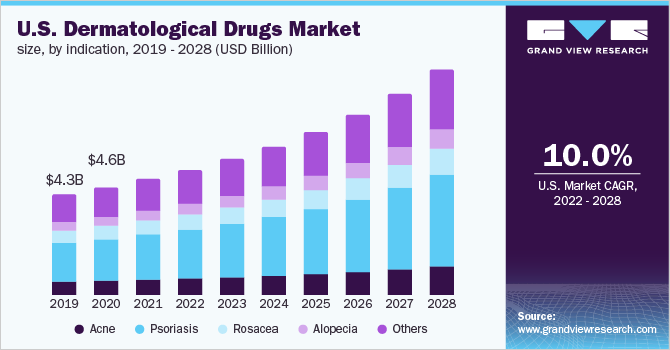

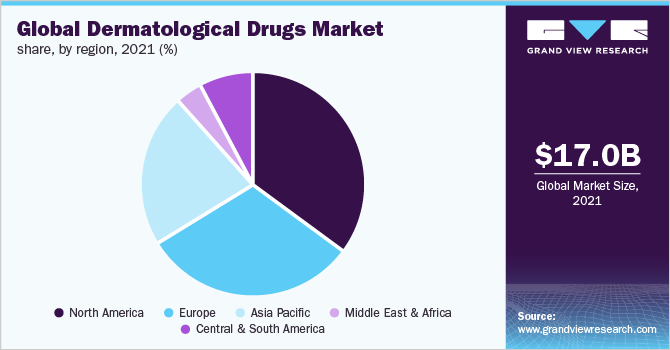

The global dermatological drugs market size was valued at USD 17.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.8% from 2022 to 2028. The key factors driving the global dermatological drug market are parasites, fungus, and other microorganisms living on the skin; bacteria trapped in skin pores and hair follicles; holding in various fluids; preventing dehydration, and increasing pollution levels. Moreover, growing awareness of skin diseases and increasing demand for rapid diagnosis, are also contributing to the growth of the dermatological drugs market. Increasing demand for innovative drugs & growing R&D investments in developing new drugs will contribute to the market revenue.

During the COVID-19 pandemic and lockdown situation, the governments of various countries restricted physical movement, and citizens preferred to stay at home as a precautionary measure. Supply chains of oncology drugs were disturbed. Considering the urgency and emergency of dermatological drugs, the supply of drugs is allowed to become normal. Thus, a negligible impact of the pandemic is observed on the market revenue.

Dermatology is a branch of medical science that deals with the diagnosis, prevention, and treatment of various skin-related diseases, including hairs and nails. Dermatological drugs involve drugs that are used to treat skin diseases. The goal of dermatological drugs is to prevent skin disorders. Skin treatment includes laser therapy, topical & systemic medications, photodynamic therapy, radiotherapy, vitiligo surgery, and dermatological surgery. These dermatological drugs are also used for skincare to maintain skin features such as glow and healthiness.

This target market is expected to grow rapidly during the forecast period, owing to the increasing geriatric population, rising awareness of skin problems, soaring people's spending power, and huge reserves of dermatology drugs. In addition, the increasing prevalence of skin diseases is one of the biggest factors driving the growth of the dermatology drug market. Stress, eating habits, environmental and genetic factors, and aging are the most important factors contributing to the development of skin diseases in millions of people worldwide. According to the data published by the World Health Organization, skin diseases are one of the most common forms of health disorders, affecting nearly 900 million people worldwide at one time.

Despite efforts to manage dermatological skin conditions, there is a higher demand for the development of low-cost and therapeutically effective medicines. The growing prevalence of acne infections, atopic dermatitis (eczema), and other diseases in the population has prompted pharmaceutical companies to produce drugs for skin diseases. Companies are increasing their spending on research and development activities. For instance, in 2020, Alembic Pharmaceuticals' received FDA approval for topical retinoid “Adapalene Gel USP 0.3%” for acne vulgaris in patients ages 12 years and older.

The initiatives by governments and private organizations to develop the pharmaceutical industry are driving the growth of the market. Furthermore, the increasing number of approvals for dermatology products is propelling the growth of the market. For instance, in December 2021, pharmaceutical company AbbVie Inc. announced that the U.S. Food and Drug Administration (FDA) approved Rinvoq (upadacitinib) for the treatment of patients with active psoriatic arthritis. However, the presence of acne treatment alternatives such as light or laser therapy, chemical peels, micro-needling, microdermabrasion, and lesion removal is expected to restrain the growth of the dermatology market during the forecast period.

Indication Insights

The psoriasis segment dominated the market with a revenue share of more than 35.0% in 2021 and is expected to expand with the highest CAGR of 11.5% from 2022 to 2028. Psoriasis is caused by the immune system mistakenly attacking healthy skin cells. Psoriasis is not a contagious disease. The disease causes swollen fingers and toes, foot pain, lower back pain, nail changes, and eye inflammation. Psoriasis can be triggered by stress, skin injury, infections, some drugs, and heavy drinking. Psoriasis is found in all age groups but is majorly seen in adults and contributes to the global dermatology drug revenue.

The alopecia segment is likely to expand with the second-highest CAGR of 10.9% from 2022 to 2028. Alopecia caused due to the body’s immune system attacking hair follicles resulting in hair loss. Alopecia is an autoimmune disorder that results in hair coming out. Both men and women suffer from Alopecia due to an imbalance of hormones, hair care treatments, scalp infections, and possible side effects of some medications. Additionally, hereditary hair loss is the most common cause of hair loss globally. Citizens are careful about hair loss and visit hospitals for diagnosis. Hair loss requires ongoing treatments for a long period and contributes to the market growth rate.

Regional Insights

Asia Pacific is likely to expand at the highest CAGR of 12.2% from 2022 to 2028. Countries such as China and India, with the largest populations in the world, are expected to have many patients with skin diseases during the forecast period. Continuous improvement in the life science industry and health services and the awareness of skin diseases and their treatment are factors contributing to the highest growth of this market. Moreover, increasing incomes and the purchasing power of citizens are witnessing a significant growth rate in this market.

Europe held the second-largest revenue share of more than 30.0% in 2021 and is expected to continue with a growth of 11% during the forecast period. Factors such as increasing large investment in the healthcare sector, greater prevalence of healthcare insurance among the masses, and supportive regulatory frameworks of the pharmaceutical industry in this region are attributed to the market revenue generation.

Key Companies & Market Share Insights

The market is characterized by the presence of various well-established players as well as several small and medium-sized players. Pharmaceutical vendors are focusing on research activities to launch new chemical formulae of drugs to cure skin diseases and make patients feel relaxed with the most appropriate drug. Moreover, pharmaceutical vendors are expanding their reach across all the regions of the world to increase their revenues. Such initiatives are expected to boost the adoption rate of dermatological drugs. The vendors are aggressively following organic as well as inorganic strategies to expand their footprints across the globe. Some prominent players in the global dermatological drugs market include:

-

Novartis AG

-

Amgen Inc

-

AbbVie Inc

-

Johnson & Johnson

-

Leo Pharma A/S

-

Eli Lilly and Company

-

GlaxoSmithKline Plc

-

AstraZeneca plc

-

Pfizer Inc

-

Merck KGaA

Dermatological Drugs Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 18.5 billion

Revenue forecast in 2028

USD 34.9 billion

Growth Rate

CAGR of 10.8% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; France; U.K.; China; India; Brazil; South Africa

Key companies profiled

Novartis AG, Amgen Inc, AbbVie Inc, Johnson & Johnson, Leo Pharma A/S, Eli Lilly and Company, GlaxoSmithKline Plc, AstraZeneca plc, Pfizer Inc, Merck KGaA

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global dermatological drugs market report based on indication and region:

-

Indication Outlook (Revenue, USD Million, 2017 - 2028)

-

Acne

-

Psoriasis

-

Rosacea

-

Alopecia

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dermatological drugs market size was estimated at USD 17.0 billion in 2021 and is expected to reach USD 18.5 billion in 2022.

b. The global dermatological drugs market is expected to grow at a compound annual growth rate of 10.8% from 2022 to 2028 to reach USD 34.9 billion by 2028.

b. North America dominated the dermatological drugs market with a share of 35.3% in 2021. This is attributable to growing awareness of skin diseases along with increasing demand for the innovative drugs.

b. Some key players operating in the dermatological drugs market include Novartis AG; Amgen Inc; AbbVie Inc; Johnson & Johnson; Leo Pharma A/S; Eli Lilly and Company; GlaxoSmithKline Plc; AstraZeneca plc; Pfizer Inc; and Merck KGaA.

b. Key factors that are driving the dermatological drugs market growth include the increasing geriatric population, rising awareness of skin problems, soaring people's spending power, and huge reserves of dermatology drugs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."