- Home

- »

- Pharmaceuticals

- »

-

Alopecia Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Alopecia Market Size, Share & Trends Report]()

Alopecia Market (2025 - 2030) Size, Share & Trends Analysis Report By Disease Type (Alopecia Areata, Cicatricial, Traction, Androgenetic Alopecia), By Treatment, By Gender, By Sales Channel, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-856-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alopecia Market Summary

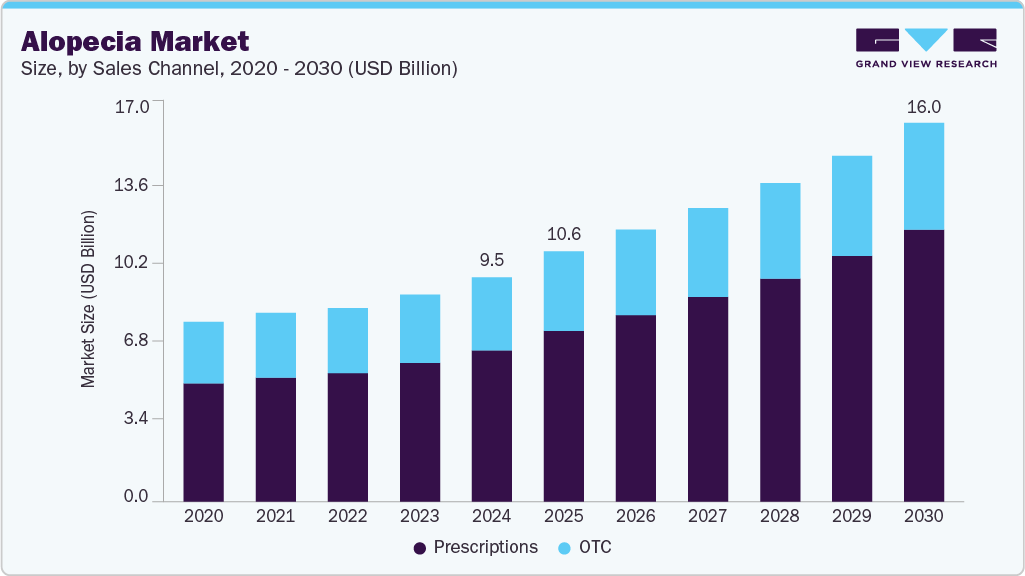

The global alopecia market size was estimated at USD 9.48 billion in 2024 and is projected to reach USD 16.02 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. One of the major driving factors for the market is the increasing awareness regarding alopecia treatment options, as people are becoming more conscious of their appearance and actively seeking solutions to address hair loss.

Key Market Trends & Insights

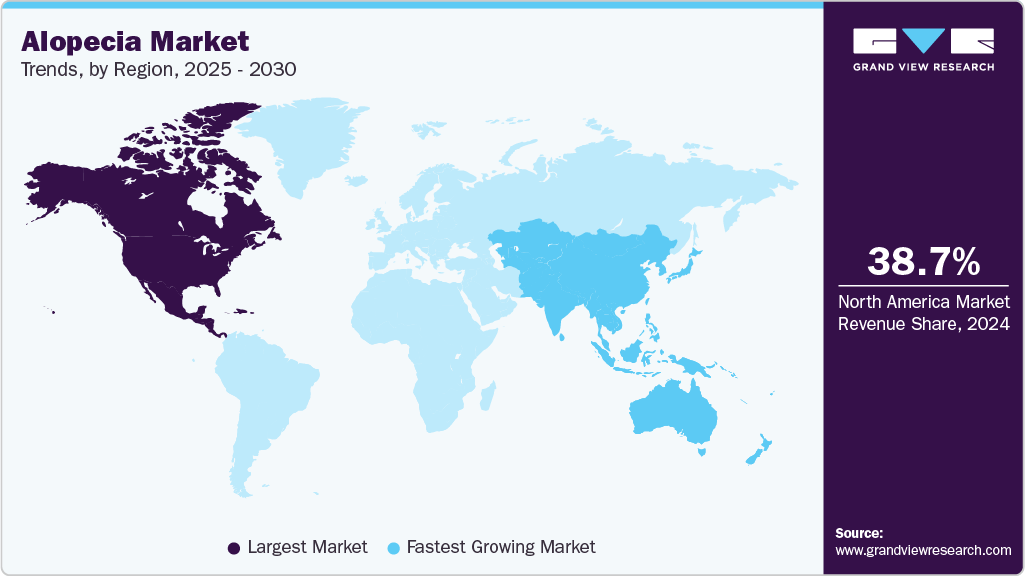

- North America Alopecia market leads the global market, accounting for the largest regional share of 38.73% in 2024.

- By type, the alopecia areata held the largest market share of 34.61% in 2024.

- By technology, the pharmaceutical segment dominates the global alopecia market with a share of 98.8% in 2024.

- By gender. the male alopecia segment dominated the market in 2024 with a market share of 53.79%.

- By distribution channel, the sales channel for the alopecia market is dominated by the prescription segment with a share of 67.57%.

Market Size & Forecast

- 2024 Market Size: USD 9.48 Billion

- 2030 Projected Market Size: USD 16.02 Billion

- CAGR (2025-2030): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global market for hair loss treatment is experiencing significant growth, driven by the rising prevalence of hair loss, technological advancements in alopecia therapies, and an increase in chronic diseases linked to hair loss. According to the American Hair Loss Association, over 95% of hair loss in men is attributed to androgenetic alopecia. Additionally, the International Society of Hair Restoration Surgery reports that approximately 40% of men experience some degree of hair loss by age 35, increasing to 65% by age 60, 70% by age 80, and 80% by age 85.The growing prevalence of hair loss is one of the major factors driving market growth. According to data published by the Journal of Clinical and Diagnostic Research (JCDR), around 60% of the global population has hair thinning problems, and pattern hair loss is the most common form of hair loss in both males and females. Moreover, around 2% of the global population is at risk of developing alopecia areata in their lifetime globally, irrespective of gender.

The global rise in healthcare expenditure is also a major factor in the market's growth. Major countries in North America, Asia Pacific, Latin America, and Europe are witnessing a significant increase in per capita healthcare expenditure. For instance, according to the American Medical Association article published in March 2023, the healthcare expenditure in the U.S. increase by 2.7% in 2021 than previous year to USD 12,914 per capita or USD 4.3 trillion. Moreover, according to the Office for National Statistics (ONS) article published in May 2023, the UK's healthcare expenditure in 2022 was approximately USD 304.55 billion, an increase of 0.7% over the previous year.

Key factors responsible for the increase in healthcare expenditures include increasing consumer disposable income and growing emphasis on aesthetic appearance. Furthermore, according to the OECD data, healthcare expenditure are increasing in developed as well as developing countries, which may help bridge the infrastructure gap in addressing the unmet medical needs of the population.

The growing number of awareness initiatives by organizations such as the National Alopecia Areata Foundation and the American Hair Loss Association is contributing to increased healthcare expenditure and greater public knowledge of hair regrowth and treatment options. Additionally, the Affordable Care Act of 2010 has improved access to healthcare insurance, particularly benefiting economically disadvantaged individuals and boosting overall treatment rates. Furthermore, rising awareness about hair loss is driving demand for painless therapies with minimal side effects, further accelerating global market growth.

In May 2025, Alys Pharmaceuticals initiated a Phase IIa clinical trial for ALY-101, a novel siRNA-based therapy developed in collaboration with UMass Chan Medical School, targeting alopecia areata. The first patient received an intradermal injection of ALY-101, which selectively inhibits JAK1, a key driver of inflammation in alopecia areata. The trial aims to evaluate the safety and tolerability of ALY-101, with participants receiving injections every four weeks over an eight-week period. The study is expected to be completed in 2026.

Pipeline Analysis

There are currently 134 drugs in development for alopecia, with 129 being developed by companies and five by universities or research institutes. Among these, 39 drugs are in active development by 114 different organizations, with the preclinical stage representing the most active phase, accounting for 52 candidates. Notable companies involved in this pipeline include Epibiotech, Medispan, and Veradermics. Developing key therapeutic targets include Tyrosine Protein Kinase JAK1, Androgen Receptor, and 3-Oxo 5-Alpha Steroid 4 Dehydrogenase 2. This robust pipeline, particularly the focus on novel molecular targets and the high volume of preclinical research, suggests a strong future for the alopecia treatment market. As these therapies progress through clinical trials, they are expected to expand treatment options, improve efficacy, and meet the growing demand for advanced, targeted, and minimally invasive solutions-ultimately driving significant market growth in the coming years.

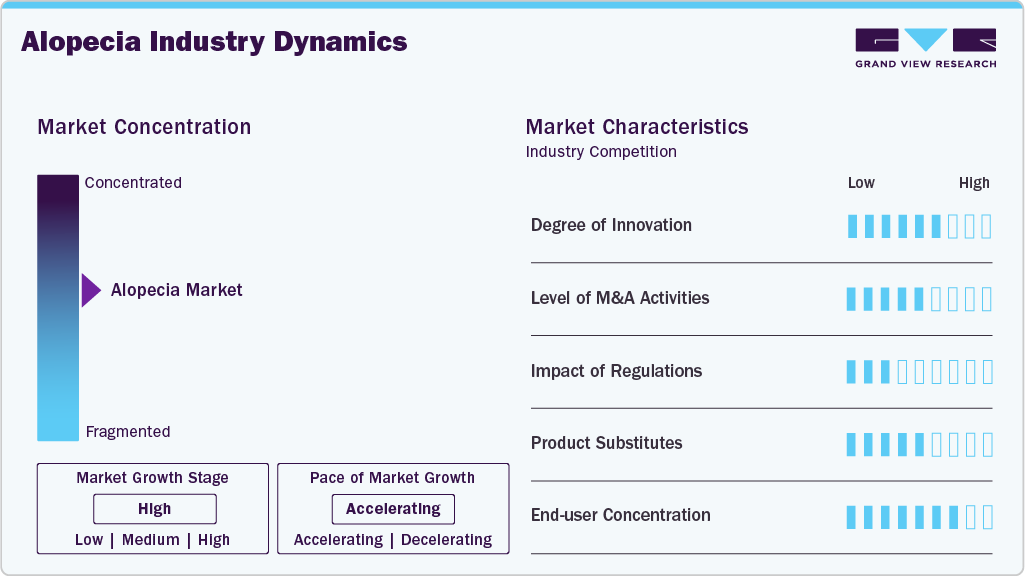

Market Concentration & Characteristics

The alopecia treatment market is witnessing growing innovation across both pharmaceutical and device segments. The emergence of JAK inhibitors for conditions like Alopecia Areata, Totalis, and Universalis introduces a targeted, immunomodulatory approach-similar in concept to FcRn inhibitors in autoimmune diseases. Drugs like ruxolitinib and baricitinib aim to restore hair growth by interfering with the autoimmune response while minimizing systemic side effects. Topical and oral minoxidil, finasteride, and corticosteroids remain foundational for Androgenetic Alopecia and Traction Alopecia, especially among males, but newer formulations, individualized dosing, and dual-action therapies are improving adherence and outcomes. Devices like laser helmets, caps, and combs (from Lexington Intl., Apira Science, Theradome, and others) offer non-invasive alternatives with growing OTC demand, particularly in homecare settings.

New entrants face considerable challenges, including complex dermatological trial design, long timelines for efficacy measurement (e.g., hair regrowth cycles), and high R&D costs for novel molecules like JAK inhibitors. The topical market, while more accessible, is dominated by legacy products such as minoxidil and finasteride, with well-established OTC and prescription variants. Manufacturing precision, especially for combination therapies or biologics, regulatory hurdles for novel mechanisms, and achieving differentiation in a crowded topical and oral segment add to the entry barriers. Brand loyalty and dermatologist preference further strengthen incumbents like Pfizer, Merck, and Sun Pharmaceuticals.

Alopecia drugs must meet rigorous clinical and aesthetic endpoints, particularly in chronic or autoimmune subtypes such as Alopecia Areata and Alopecia Universalis. FDA approvals for JAK inhibitors in dermatology have opened regulatory pathways but include strict post-market surveillance and black box warnings for systemic use. Orphan drug designations, especially for rare subtypes, help expedite development but come with long-term safety obligations. In global markets, Health Technology Assessments (HTAs) emphasize cost-effectiveness, favoring combination products and long-lasting outcomes-critical for public reimbursement systems.

Therapies like targeted, periodic, and immunologically focused are conceptually paralleled by emerging JAK inhibitors and PRP (platelet-rich plasma) in alopecia, which promise reduced treatment burden with sustained benefits. However, IVIg, corticosteroids, and traditional topicals like minoxidil and betamethasone dipropionate remain the mainstay, especially in less severe or early-stage cases. Device-based solutions such as laser helmets and caps offer a non-drug alternative, increasingly used in combination therapy. Nevertheless, consumer preference for non-invasive, home-based, and aesthetic-focused solutions drives demand for user-friendly products.

Companies such as Janssen, Pfizer, Cipla, and Dr. Reddy’s are actively expanding into emerging markets in Asia, Latin America, and Eastern Europe, where underdiagnosis of alopecia, particularly among female patients, remains a challenge. Local partnerships, tele-dermatology initiatives, and OTC accessibility are central to increasing treatment penetration. Distribution strategies are adapting to include dermatology clinics and homecare channels, supported by digital marketing and e-pharmacies to reach younger, tech-savvy consumers. Expansion efforts are tailored to gender-specific prevalence patterns, with traction and cicatricial alopecia more common in female populations, influencing product development and outreach strategies.

Disease Type Insights

Alopecia areata held the largest market share of 34.61% in 2024, driven by high disease prevalence and growing patient consumer awareness. According to the National Alopecia Areata Foundation, around 147 million people are affected by alopecia areata globally, out of this, around 6.8 million people live in the U.S. only. The segment is anticipated to grow at a significant growth rate over the forecast period owing to the rise in the development of novel therapy and favorable initiatives in the approval process. For instance, in October 2023, Sun Pharmaceutical Industries Ltd announced the acceptance of a New Drug Application (NDA) by the U.S. FDA. The NDA will be used for deuruxolitinib to treat severe alopecia areata.

The alopecia universalis segment is anticipated to grow at the fastest CAGR over the forecast period. Increasing awareness regarding severe forms of alopecia and an increase in research activities to develop novel and effective treatment options are expected to drive the market growth over the forecast period. According to the Genetic and Rare Diseases Information Center (GARD), around 7% to 25% of people suffering from alopecia areata develop alopecia totalis and alopecia universalis. Moreover, the presence of pipeline drugs such as baricitinib, deuruxolitinib, and ritlecitinib for the treatment of severe conditions of alopecia areata is expected to propel the segment growth over the forecast period.

Treatment Insights

The pharmaceutical segment dominates the global alopecia market with a share of 98.8% in 2024. This dominance is primarily attributed to the affordability of pharmaceutical products and high usage of prescription and OTC drugs. Finasteride and minoxidil are the most common drugs used to treat any form of alopecia. Finasteride and minoxidil are the only U.S. approved drugs for the treatment of both Female Pattern Hair Loss (FPHL) and as well as Male Pattern Hair Loss (MPHL). Moreover, the major pharmaceutical companies such as Lilly, Pfizer Inc., Concert Pharmaceuticals are actively involved in the development of novel drugs to treat alopecia, which is anticipated to drive the market growth over the forecast period. For instance, in December 2023, Aclaris Therapeutics announced a license agreement with Sun Pharmaceutical Industries, Inc. This agreement will enable Aclaris Therapeutics to access Sun Pharma's JAK inhibitor and other isotopic forms of ruxolitinib to treat androgenetic alopecia or alopecia areata.

The devices segment is expected to grow at the fastest growth rate during the forecast period. Increasing adoption of painless treatment coupled with minimal side effects and adoption of home-used laser devices are forces driving the segment growth in the next 5 to 8 years. Low-level laser therapy offers the convenience of at-home use and minimizes the need for clinical visits. Moreover, it provides a non-pharmacological and non-surgical viable therapeutic action for hair restoration due to which the market is expected to grow steadily over the forecast period. FDA clearance for low-level laser therapy devices, such as iRestore and Hairmax, for treatment of most commonly occurring forms of alopecia, such as the androgenetic alopecia, is likely to boost the market growth for the same over the forecast period.

Gender Insights

The male alopecia segment dominated the market in 2024 with a market share of 53.79%, owing to the high prevalence of hair loss in the male population worldwide. Androgenetic alopecia is the most common alopecia in the male population. It is estimated that approximately 50 percent of men experience some degree of hair loss at an average age of 50 with over 95% of cases being the androgenetic type. Moreover, factors such as the increased amount of tobacco intake in men and a rising geriatric population are expected to further propel the market over the forecast period.

However, the female alopecia market is anticipated to grow at the fastest rate over the forecast period. The female segment is experiencing rapid growth in the alopecia market due to increased awareness, changing societal norms, stress and lifestyle factors, advancements in treatment options, social media influence, hormonal changes, targeted marketing, and an aging population. These factors collectively contribute to hair loss in women, driving the demand for alopecia treatments and encouraging the development of specialized solutions for the female demographic.

Sales Channel Insights

The sales channel for the alopecia market is dominated by the prescription segment with a share of 67.57%, due to the high number of visits to dermatologists for hair loss treatment. Moreover, a strong product pipeline, growing disposable incomes, and rising prevalence of chronic diseases which ultimately lead to hair loss are expected to drive the segment growth at the fastest rate over the forecast period.

However, the OTC segment is driving the market with a significant growth rate. It is widely used in the developing regions where players find multiple opportunities to address unmet medical needs of a large patient pool across countries such as China, Japan, Mexico, Brazil, and India. Moreover, OTC drugs remain the preferred choice of medication amongst males suffering from androgenetic alopecia and for other types of hair loss conditions where there is a lack of approved drugs, leading consumers to rely on off-label or OTC drugs.

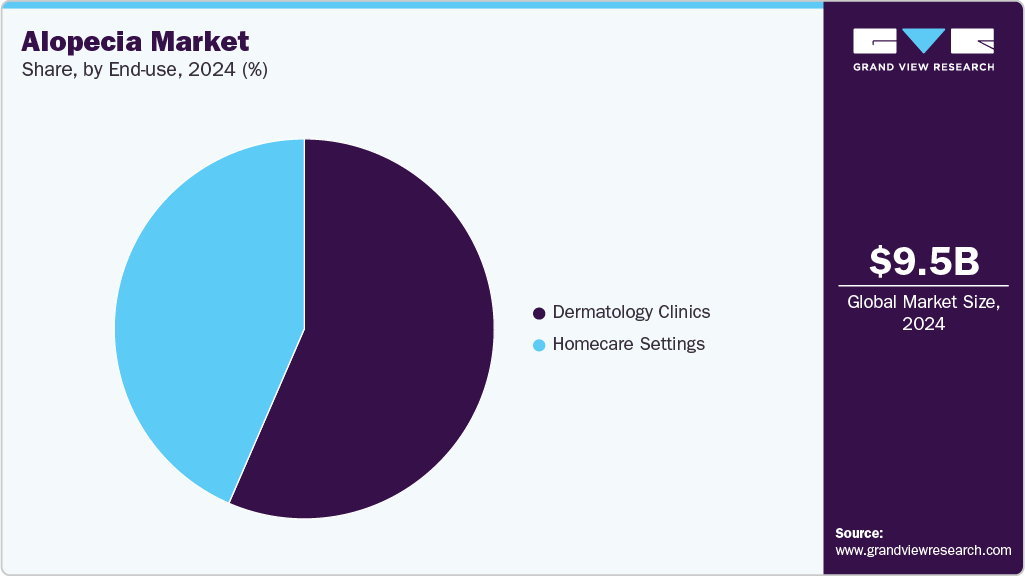

End Use Insights

The dermatology clinics segment dominated market with a share of 56.50% in 2024. Modern treatment methods such as laser technology, a strong product pipeline, and heightened consumer awareness regarding the use of prescription medicines are the main factors responsible for the continued growth of the segment. Given the consulting dermatologist’s ability to provide appropriate customized medications or therapy that yield effective results, they are often considered the preferred option for the treatment of alopecia.

The home care setting segment will be the fastest-growing segment over the forecast period owing to convenience, ease of usage, and patient comfort. Moreover, a growing number of regulatory approvals are being given for home-use devices in addition to the increasing adoption of non-invasive procedures such as laser therapy that do not require any lifestyle changes. For instance, in June 2023, the FDA approved the alopecia areata treatment by Yale. The treatment uses ritlecitinib - a Janus kinase (JAK) inhibitor that can be used to treat alopecia areata in adolescents and adults.

Regional Insights

North America Alopecia market leads the global market, accounting for the largest regional share of 38.73% in 2024, driven by high prevalence rates of androgenetic alopecia in both men and women, as well as increasing awareness about early diagnosis and cosmetic treatments. The popularity of prescription drugs like finasteride and minoxidil, along with growing demand for laser devices such as helmets and caps, is bolstering market growth. The region also sees strong demand for platelet-rich plasma (PRP) therapy offered in dermatology clinics. High consumer spending, coupled with a growing preference for at-home OTC treatments, supports rapid adoption across genders and age groups.

U.S. Alopecia Market Trends

In the United States, androgenetic alopecia remains the most commonly treated condition, particularly among male patients. Over-the-counter minoxidil continues to dominate in homecare settings, while dermatology clinics report increasing uptake of JAK inhibitors and corticosteroids for severe forms like alopecia areata and universalis. Devices such as Theradome helmets and iRestore are popular among female users seeking non-invasive options. Pharmaceutical companies like Merck and Pfizer maintain strong brand recognition, while digital health and tele-dermatology platforms expand prescription access.

Europe Alopecia Market Trends

Europe represents a mature market for alopecia therapies with increasing focus on female-pattern hair loss and cicatricial alopecia. Adoption of prescription treatments, particularly topical corticosteroids like fluocinolone acetonide, is widespread across dermatology clinics. Germany and France see high interest in laser-based devices, supported by clinical endorsements. Despite cost-containment policies, specialty pharmacies across the region enable wide distribution of both prescription and OTC medications. PRP therapy is growing in urban centers, especially for alopecia totalis and traction alopecia in females.

The UK Alopecia Market is growing due to the country’sthe National Health Service (NHS) offers limited coverage for cosmetic hair loss, driving self-funded access to OTC products and devices. Female patients are increasingly opting for PRP and JAK inhibitor trials targeting alopecia areata. Clinical interest in combination therapies such as minoxidil with finasteride is increasing, especially among male patients with advanced androgenetic alopecia. Clinics often recommend brands like iGrow and Revian, while prescriptions for topical steroids remain steady.

Alopecia Market in Germany is experiencing growth due to the country’s emphasizes on innovative therapies, with dermatology clinics routinely offering laser devices and PRP treatments. The market sees growing prescription rates for oral minoxidil in both male and female patients suffering from alopecia totalis. Specialty pharmacies play a key role in distributing niche therapies like JAK inhibitors. Local pharmaceutical companies are collaborating with international device makers to expand market reach.

France alopecia market is marked by strong interest in prescription corticosteroids for cicatricial and universalis cases, especially in female patients. PRP is widely available in aesthetic clinics. OTC topical minoxidil and prescription finasteride are commonly used among males with pattern baldness. Government campaigns promoting early dermatologic consultation help with timely diagnosis and intervention.

Asia Pacific Alopecia Market Trends

Asia Pacific shows the fastest growth in the global alopecia market, fueled by rising cosmetic concerns and access to affordable treatments. Countries like Japan and South Korea lead in adoption of advanced laser helmets and oral treatments. Increasing awareness about alopecia in females-particularly traction and cicatricial forms-is expanding the female patient base. PRP therapy and OTC medications are witnessing exponential growth, particularly in urban centers.

Japan Alopecia market is technologically advanced, with strong uptake of devices like the iRestore and Theradome helmets. Male patients frequently use oral finasteride, while PRP is increasingly offered to female patients with alopecia areata. High standards of aesthetic care drive innovation in clinics, and digital platforms facilitate prescription renewals. Cultural openness toward cosmetic treatments enhance market growth.

Alopecia market in China is expanding due to the rising middle class and growing focus on appearance are key drivers for the alopecia market. OTC minoxidil is widely available in urban pharmacies, while dermatology clinics offer PRP and laser treatments for female patients with traction alopecia. Awareness campaigns by pharmaceutical companies and local influencers are increasing public knowledge of early-stage treatments. Collaborations with global players are strengthening market access to new therapies.

Latin America Alopecia Market Trends

Latin America’s market is growing due to improved healthcare access and rising awareness of alopecia among both genders. OTC products dominate in homecare settings, but clinics are beginning to offer PRP and oral corticosteroid treatments. Male-pattern baldness remains the leading condition treated, although female traction and cicatricial alopecia cases are rising in visibility. Educational campaigns are improving diagnosis rates and expanding the market.

Brazil alopecia market leads the Latin American market with a vibrant aesthetic culture and a growing middle class seeking treatments for androgenetic and areata forms of alopecia. Dermatology clinics offer a wide range of therapies, from PRP to laser helmets. Male patients prefer finasteride and oral minoxidil, while females increasingly seek advanced topical solutions and low-level laser therapy. The presence of local and international players facilitates wide availability of solutions.

Middle East & Africa Alopecia Market Trends

MEA is emerging as a key region with rising demand for affordable alopecia treatments. Increased awareness through social media and clinical education is driving early adoption of minoxidil-based treatments. Gender-specific conditions like traction alopecia in women and androgenetic alopecia in men dominate. Market players are introducing laser devices and oral medications via specialty pharmacies in the UAE and Saudi Arabia.

Saudi Arabia Alopecia Market is thriving due to the rising country’s investment in healthcare and growing cosmetic awareness support a rising demand for alopecia therapies. Male patients frequently use oral finasteride, while clinics report growing female interest in PRP for cicatricial and areata forms. Laser helmets are gaining popularity as premium home-use devices. Educational seminars and dermatology conferences help promote newer options like JAK inhibitors and combination therapies.

Key Alopecia Company Insights

Major players in the alopecia market include Janssen Global Services Inc., Cipla Limited, Merck & Co., GlaxoSmithKline plc, Sun Pharmaceuticals, Dr. Reddy’s, Viatris Inc., Pfizer, and Lilly. Device manufacturers such as Lexington Intl. (HairMax), Apira Science (iGrow), Revian, and Theradome play a significant role in the at-home segment. Companies are focused on product innovation, combination therapies, and expanding gender-specific solutions. Strategic partnerships, digital outreach, and dermatology clinic collaborations are key to sustaining competitive edge.

Key Alopecia Companies:

The following are the leading companies in the alopecia market. These companies collectively hold the largest market share and dictate industry trends.

- Janssen Global Services Inc.

- Cipla Limited

- Merck & Co., Inc.

- GlaxoSmithKline plc

- Sun Pharmaceuticals Industries Ltd

- Dr. Reddy’s Laboratories Ltd

- Aurobindo Pharma

- Viatris Inc.

- Pfizer, Inc.

- Lilly

- Lexington Intl., LLC (Devices)

- Freedom Laser Therapy (iRestore ID-520 helmet)

- Curallux, LLC.

- Apira Science Inc. (iGROW Laser)

- Revian Inc.

- Theradome

- Lutronic

Recent Developments

-

In March 2025, Q32 Bio presented promising results from a phase 2a clinical trial of bempikibart, a novel bifunctional monoclonal antibody targeting the IL-7 receptor alpha and thymic stromal lymphopoietin (TSLP) pathways, for the treatment of severe alopecia areata (AA). The study, known as SIGNAL-AA Part A, demonstrated significant hair regrowth in patients, with effects persisting even after cessation of treatment. These findings suggest that bempikibart may offer a durable therapeutic option for AA, potentially transforming the current treatment landscape.

-

In April 2025, Sun Pharmaceutical Industries Ltd received a favorable ruling from the US Court of Appeals for the Federal Circuit, which vacated a preliminary injunction that had previously halted the launch of its alopecia areata drug, Leqselvi (deuruxolitinib), in the United States. This decision allows Sun Pharma to proceed with the commercialization of Leqselvi, an oral Janus kinase (JAK) inhibitor approved by the FDA in July 2024 for the treatment of severe alopecia areata. Despite the ongoing patent litigation with Incyte Corporation, the lifting of the injunction enables Sun Pharma to introduce Leqselvi to the US market, with plans to launch in the second quarter of the fiscal year.

-

In March 2025, researchers at NYU Langone Health published a study in the Journal of the American Academy of Dermatology demonstrating that lower doses of doxycycline (20 mg twice daily) are as effective as higher doses (up to 100 mg twice daily) in treating lymphocytic scarring alopecia, a rare autoimmune condition causing permanent hair loss. The study found no significant difference in treatment efficacy between the two dosing regimens, but patients on the lower dose experienced fewer side effects, such as nausea and gastrointestinal discomfort. This suggests that lower-dose doxycycline could be a safer, equally effective option for managing this form of alopecia.

-

In September 2024, Hudson Therapeutics, the U.S. subsidiary of Shaperon, announced Shaperon's entry into the global alopecia areata treatment market. This move follows the identification of a promising drug candidate developed through Shaperon's proprietary AI-based platform, AIDEN. The candidate has demonstrated over 100 times greater anti-inflammatory efficacy compared to existing therapies in preclinical studies. Shaperon plans to discuss translational research with key opinion leaders at the European Academy of Dermatology and Venereology (EADV) meeting and explore a small-scale preclinical trial using patient tissue grafted onto mice. This development marks a significant milestone in leveraging AI for drug discovery in autoimmune disorders like alopecia areata.

-

In July 2023, REVIAN Inc. announced that the Revian Red Hair Growth System is expected to be in a second study. It is anticipated as an effective treatment option for Central Centrifugal Cicatricial Alopecia ("CCCA").

-

In June 2023, Pfizer Inc. announced the approval of LITFULO by the U.S. FDA. It is the first treatment that is approved and used for adolescents (12+) to treat severe alopecia areata.

- In January 2023, Sun Pharmaceuticals Industries Ltd announced the acquisition of Concert Pharmaceuticals. The latter is a biotechnology company specializing in treating alopecia areata.

Alopecia Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.57 billion

Revenue forecast in 2030

USD 16.02 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report Updated

June 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease type, treatment, gender, sales channel, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Norway; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; UAE; South Africa; Saudi Arabia; Kuwait

Key companies profiled

Janssen Global Services Inc.; Cipla Limited; Merck & Co., Inc.; GlaxoSmithKline plc; Sun Pharmaceuticals Industries Ltd; Dr. Reddy’s Laboratories Ltd; Aurobindo Pharma; Viatris Inc.; Pfizer, Inc.; Lilly; Lexington Intl., LLC (Devices); Freedom Laser Therapy (iRestore ID-520 helmet); Curallux, LLC.; Apira Science Inc. (iGROW Laser); Revian Inc.; Theradome; Lutronic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alopecia Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alopecia market report based on disease type, treatment, gender, sales channel, end-use, and region.

-

Disease Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Alopecia Areata

-

Male

-

Female

-

-

Cicatricial Alopecia

-

Male

-

Female

-

-

Traction Alopecia

-

Male

-

Female

-

-

Alopecia Totalis

-

Male

-

Female

-

-

Alopecia Universalis

-

Male

-

Female

-

-

Androgenetic Alopecia

-

Male

-

Female

-

-

Others

-

Male

-

Female

-

-

-

Treatment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceuticals

-

Topical

-

OTC

-

Minoxidil

-

Others

-

-

Prescription

-

Betamethasone Dipropionate

-

Fluocinolone Acetonide

-

Finasteride

-

Minoxidil

-

-

-

Oral

-

OTC

-

Prescription

-

Minoxidil

-

Finasteride

-

Corticosteroids

-

Others (JAK inhibitors and others)

-

-

-

PRP

-

-

Devices

-

Laser Cap

-

Laser Comb

-

Laser Helmet

-

-

-

Gender Outlook (Revenue, USD Billion, 2018 - 2030)

-

Male

-

Female

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescriptions

-

OTC

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Homecare Settings

-

Dermatology Clinics

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global alopecia market size was valued at USD 8.77 billion in 2023 and is anticipated to reach USD 9.48 billion in 2024.

b. The global alopecia market is expected to witness a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 16.02 billion by 2030.

b. Some key players operating in the alopecia market include Johnson & Johnson Services, Inc, Merck & Co., Inc., Cipla Limited, Sun Pharmaceuticals Industries Ltd, Dr. Reddy’s Laboratories Ltd, GlaxoSmithKline plc, Aurobindo Pharma, Mylan N.V. (Viatris Inc.), iRestore Hair Growth System, Theradome.

b. Dermatology clinics dominated the alopecia market with a share of 56.50% in 2023. An increasing number of transplantation and restoration surgeries, coupled with the widespread application of prescription medicines, is expected to contribute significantly to the market position of dermatology clinics.

b. Key factors that are driving the alopecia market growth include technological advancements, improvement in reimbursement scenario, and increasing healthcare expenditure across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.