- Home

- »

- Disinfectants & Preservatives

- »

-

Detergent Alcohols Market Size, Share, Industry Report, 2030GVR Report cover

![Detergent Alcohols Market Size, Share & Trends Report]()

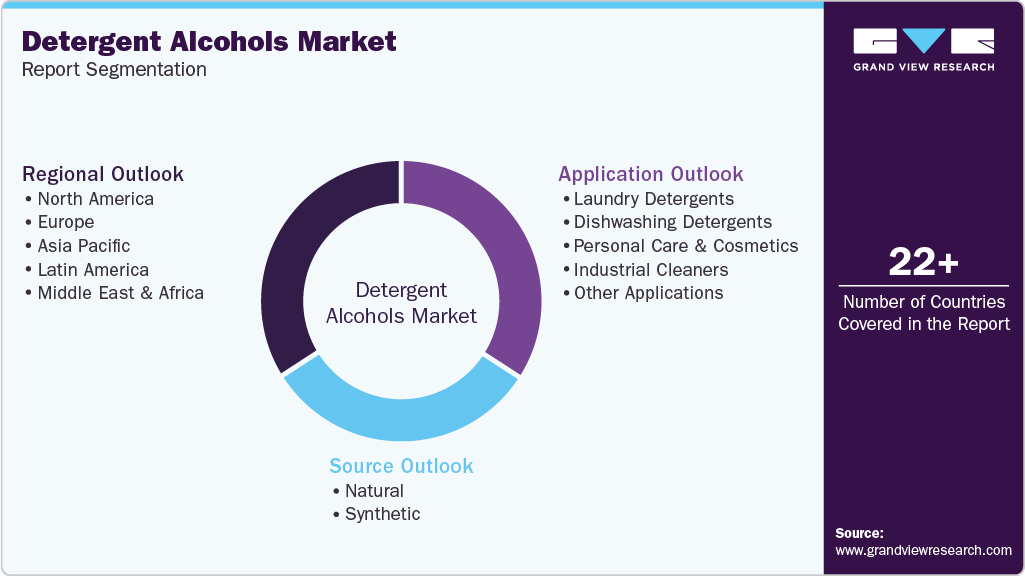

Detergent Alcohols Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Natural, Synthetic), By Application (Laundry Detergents, Dishwashing Detergents) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-617-9

- Number of Report Pages: 34

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Detergent Alcohols Market Summary

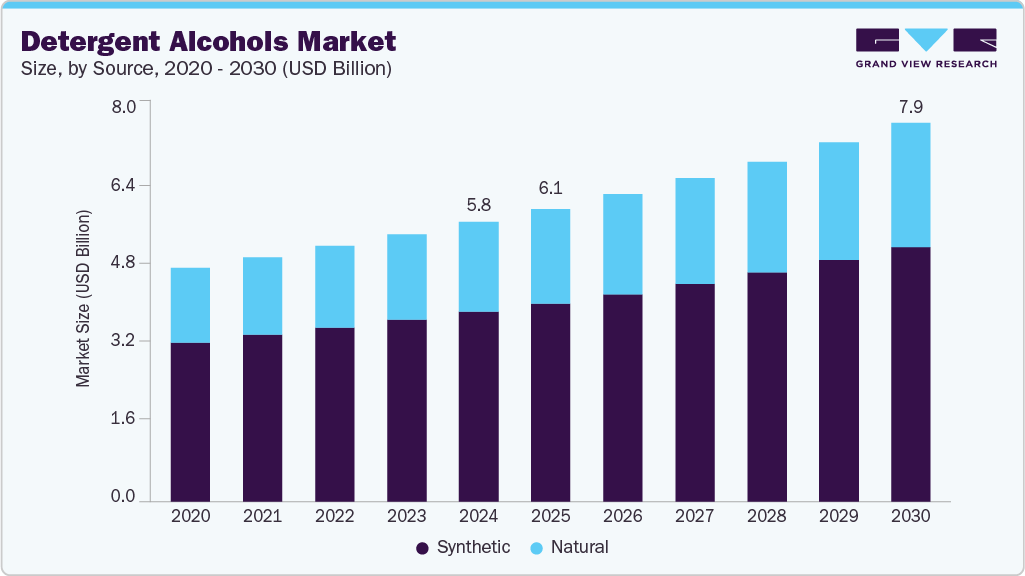

The global detergent alcohols market size was estimated at USD 5.84 billion in 2024 and is projected to reach USD 7.91 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The market is primarily driven by the growing demand for surfactants across domestic and industrial cleaning applications, supported by rising hygiene awareness and urbanization.

Key Market Trends & Insights

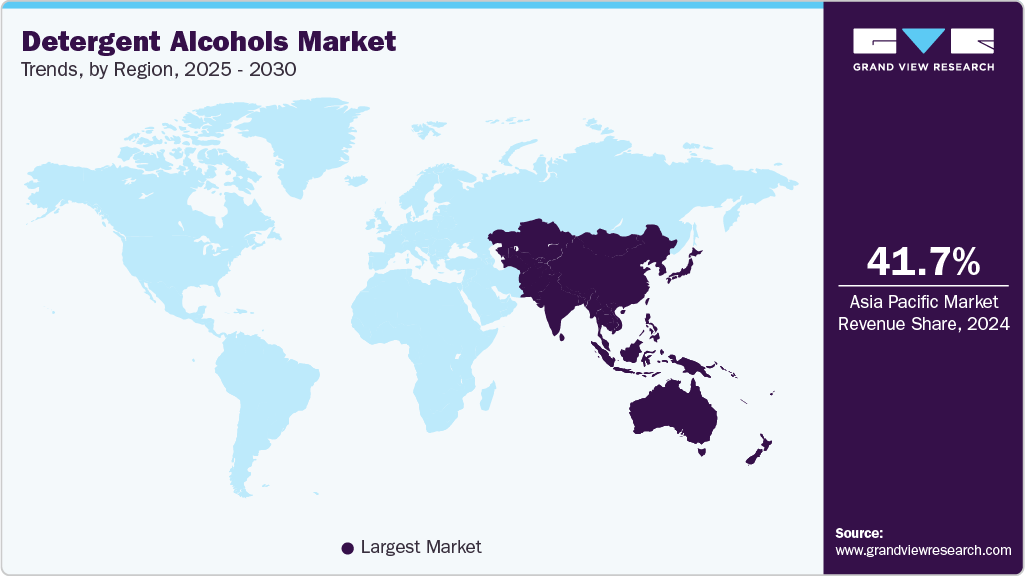

- Asia Pacific held the largest revenue share of 41.7% in 2024 due to the region’s strong manufacturing base.

- China detergent alcohols market is key within the Asia Pacific region.

- By source, the synthetic segment accounted for the largest revenue share of 67.8% in 2024.

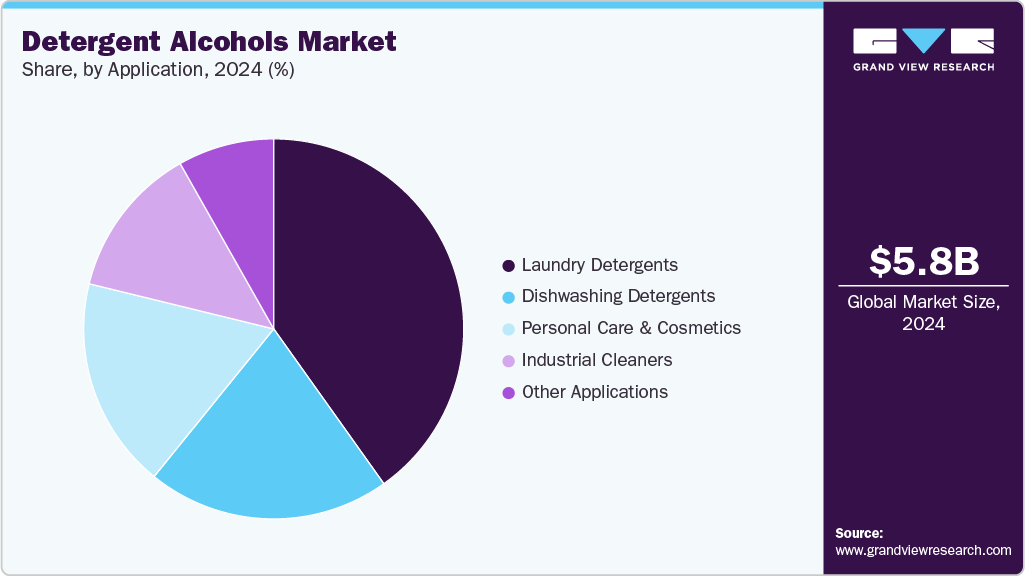

- By application, the laundry detergents segment held the largest revenue share of 40.2% in 2024

Market Size & Forecast

- 2024 Market Size: USD 5.84 Billion

- 2030 Projected Market Size: USD 7.91 Million

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

In addition, the increasing consumer shift toward eco-friendly and bio-based products is accelerating the adoption of natural detergent alcohols, particularly in cosmetics and personal care. The market is further supported by expanding the personal care & cosmetics and industrial cleaners’ sectors, which utilize detergent alcohols for their emulsifying and stabilizing properties.The detergent alcohols market presents significant growth opportunities through the rising demand for sustainable and bio-based formulations, especially in the personal care and homecare segments. Innovations in oleochemical processing and increasing investments in green chemistry are expected to drive product diversification. Furthermore, emerging economies in Asia Pacific, Latin America, and Africa offer untapped potential due to expanding middle-class populations, urbanization, and evolving hygiene standards.

One of the key challenges facing the industry is the volatility in raw material prices, particularly for natural sources such as palm and coconut oil, which are affected by climatic and geopolitical factors. In addition, the market faces intense competition from synthetic alternatives and substitute surfactants. Compliance with varying international quality, environmental, and safety standards adds further complexity for global manufacturers.

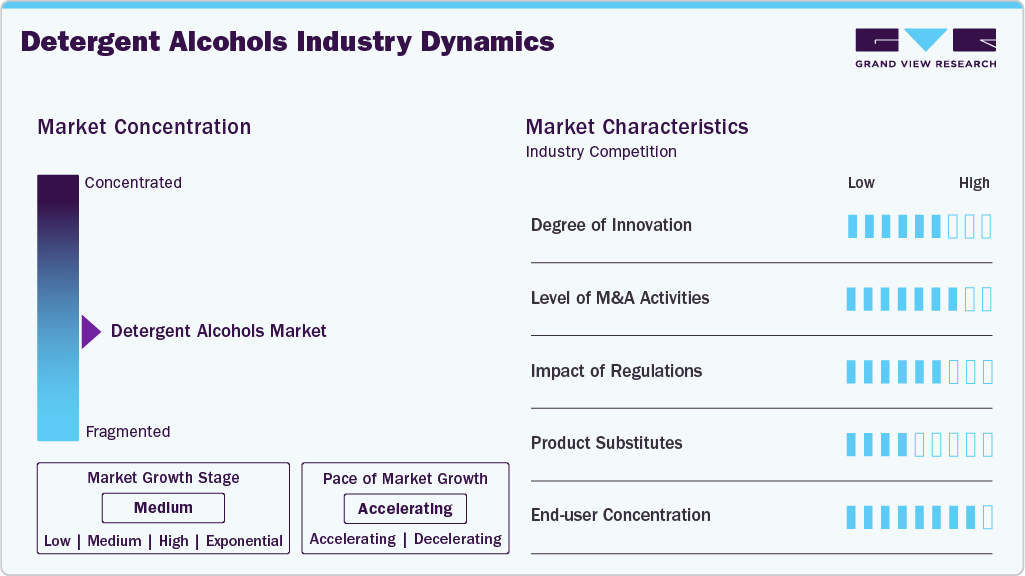

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Sasol Ltd., BASF SE, KLK OLEO, Wilmar International, and Godrej Industries dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

These companies are strategically focused on vertical integration, geographic expansion, and product innovation to enhance their market position. These companies are also investing in R&D and digital platforms to improve operational efficiency and meet evolving customer demands for environmentally responsible and high-performance formulations.

Source Insights

The synthetic segment accounted for the largest revenue share of 67.8% in 2024. Synthetic detergent alcohols, typically derived from petrochemical feedstocks, have long dominated industrial applications due to their consistent quality, scalability, and competitive pricing. They are widely used in large-scale manufacturing of surfactants for cleaning and industrial processes where efficiency and performance are prioritized over environmental concerns. However, rising regulatory pressure such as EU’s Detergents Regulation, EC No 648/2004 and regulations imposed by EPA in the US, are gradually challenging the dominance of synthetics, particularly in regions with stricter environmental regulations such as Europe and North America.

In contrast, natural detergent alcohols, sourced primarily from renewable resources like palm and coconut oils, are witnessing increasing demand driven by sustainability trends, eco-labeling requirements, and consumer preference for plant-based ingredients. These alcohols are favored in personal care and home care products where biodegradability, skin compatibility, and environmental responsibility are key selling points. Brands and manufacturers are leveraging this trend to differentiate their offerings, especially in premium segments. Although production costs and availability of raw materials such as palm oil, ethylene, aluminum alkyls, and paraffins (n-alkanes) remain constraints. The advancements in oleochemical processing such as enzymatic alcoholysis and transesterification technique are expected to enhance the competitiveness and scalability of natural detergent alcohols over the coming years.

Application Insights

The laundry detergents segment held the largest revenue share of 40.2% in 2024. Detergent alcohols serve as key precursors in the production of surfactants that deliver emulsifying, foaming, and degreasing properties essential for cleaning performance. Rapid urbanization, improved living standards, and heightened hygiene awareness, particularly in emerging economies, continue to boost consumption of these products. In addition, growing environmental consciousness is prompting formulators to shift toward biodegradable and plant-based alcohols, aligning product development with sustainability goals and regulatory frameworks.

Meanwhile, the personal care & cosmetics and industrial cleaners’ segments are witnessing strong growth, fueled by rising demand for multifunctional, skin-friendly, and eco-labeled ingredients in personal hygiene and beauty products. Detergent alcohols are widely used in formulations such as shampoos, lotions, and cleansers for their emulsifying and texturizing roles. In the industrial sector, detergent alcohols are critical for producing heavy-duty cleaning agents used in healthcare, food processing, and manufacturing, where regulatory compliance and cleaning efficacy are paramount. The other applications segment encompassing personal care & cosmetics, industrial cleaners, and other applications production continues to expand as manufacturers explore new high-value uses for both synthetic and bio-based alcohols, adding depth and resilience to the overall market.

Regional Insights

Asia Pacific held the largest revenue share of 41.7% in 2024 due to the region’s strong manufacturing base, high consumption of cleaning and personal care products, and the presence of major oleochemical producers in countries such as China, Malaysia, Indonesia, and India. Rapid urbanization, rising disposable incomes, and increasing awareness of hygiene and sustainability further fueled demand across both domestic and industrial applications. In addition, the availability of natural feedstocks such as palm and coconut oils supported large-scale production of bio-based detergent alcohols, strengthening the region’s competitive edge.

China detergent alcohols market is key within the Asia Pacific region, driven by its vast consumer base and rapidly growing industrial sector. The country’s expanding middle class and rising urbanization have significantly increased demand for detergent alcohols in household cleaning and personal care products.

North America Detergent Alcohols Market Trends

North America held the second largest revenue share of 26.4% in 2024. The region represents a mature and innovation-driven market for detergent alcohols, with strong demand from the personal care, personal care & cosmetics, and industrial cleaning sectors. The region’s stringent environmental regulations and consumer preference for sustainable, bio-based ingredients are accelerating the shift toward natural detergent alcohols. Moreover, well-established supply chains and advanced manufacturing infrastructure support consistent product quality and availability, enabling key players to effectively cater to both domestic consumption and export markets.

U.S. Detergent Alcohols Market Trends

The U.S. market for detergent alcohols is characterized by robust demand from household cleaning and personal care industries, driven by increasing consumer focus on health, hygiene, and sustainability. Stringent regulatory frameworks and growing investments in green chemistry are encouraging manufacturers to adopt bio-based and environmentally friendly detergent alcohols.

Europe Detergent Alcohols Market Trends

Europe is a significant market for detergent alcohol, driven by stringent environmental regulations, strong consumer demand for sustainable and bio-based products, and high awareness of product safety and efficacy. The region’s mature personal care and industrial cleaning sectors continue to adopt eco-friendly formulations, encouraging manufacturers to invest in renewable feedstock and green production technologies. In addition, Europe’s emphasis on circular economy principles and sustainability certifications is shaping product innovation and supply chain transparency across the detergent alcohols value chain.

Germany stands out as a key market within Europe due to its advanced chemical manufacturing industry and leadership in sustainable product development. Strong regulatory frameworks promote environmental responsibility and high consumer preference for natural and certified bio-based ingredients drive growth in detergent alcohols consumption.

Latin America Detergent Alcohols Market Trends

Latin America is an emerging market for detergent alcohols, driven by growing urbanization, rising disposable incomes, and increasing awareness of hygiene and personal care products. The region benefits from abundant natural feedstock availability, particularly palm and coconut oils, supporting the production of bio-based detergent alcohols. However, infrastructural challenges and fluctuating raw material prices present obstacles.

Middle East & Africa Detergent Alcohols Market Trends

The Middle East & Africa market for detergent alcohols is gradually expanding, fueled by increasing industrialization, improving hygiene standards, and rising demand for personal care products. While the region relies heavily on imports for both synthetic and natural detergent alcohols, growing investments in petrochemical industries and oleochemical production hubs, especially in the Gulf Cooperation Council (GCC) countries, are expected to boost local manufacturing capacity.

Key Detergent Alcohols Company Insights

Key players, such as SABIC, Kao Corporation, SASOL, and Musim Mas Group, are dominating the market.

SABIC

-

SABIC is one of the global leaders in the petrochemical industry. The company is a key player in the synthetic detergent alcohols market, leveraging its integrated production capabilities and extensive feedstock access to deliver cost-efficient, high-quality products. SABIC focuses on innovation and sustainability by investing in advanced technologies to improve product performance while reducing environmental impact. The company’s strong global distribution network and strategic partnerships enable it to serve diverse end use industries such as cleaning, personal care, and industrial applications, solidifying its position as a preferred supplier in the detergent alcohols market.

Key Detergent Alcohols Companies:

The following are the leading companies in the detergent alcohols market. These companies collectively hold the largest market share and dictate industry trends.

- Sasol Ltd.

- BASF SE

- KLK OLEO

- Wilmar International

- Godrej Industries

- Procter & Gamble Chemicals

- Emery Oleochemicals

- Ecogreen Oleochemicals

- Kao Corporation

- VVF Ltd.

Global Detergent Alcohols Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.11 billion

Revenue forecast in 2030

USD 7.91 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, source, region

Regional scope

North America; Europe; Asia Pacific; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Sasol Ltd.; BASF SE; KLK OLEO; Wilmar International; Godrej Industries; Procter & Gamble Chemicals; Emery; Oleochemicals; Ecogreen Oleochemicals; Kao Corporation; VVF Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Detergent Alcohols Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global detergent alcohols market report based on application, source, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Laundry Detergents

-

Dishwashing Detergents

-

Personal Care & Cosmetics

-

Industrial Cleaners

-

Other Applications

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The synthetic segment accounted for the largest revenue share due to its cost-effectiveness, consistent quality, and large-scale availability, making it the preferred choice for high-volume applications in industrial and household cleaning products.

b. Some of the key players operating in the detergent alcohols market include Sasol Ltd., BASF SE, KLK OLEO, Wilmar International, Godrej Industries, Procter & Gamble Chemicals, Emery Oleochemicals, Ecogreen Oleochemicals, Kao Corporation, VVF Ltd.

b. The market is driven by rising demand for cleaning and personal care products, fueled by growing hygiene awareness, urbanization, and population growth. Additionally, the shift toward sustainable formulations is boosting the adoption of bio-based detergent alcohols across key applications.

b. The global detergent alcohols market size was estimated at USD 5.84 billion in 2024 and is expected to reach USD 6.11 billion in 2025.

b. The Detergent Alcohols market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 7.91 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.