- Home

- »

- IT Services & Applications

- »

-

Device As A Service Market Size, Share & Growth Report 2030GVR Report cover

![Device As A Service Market Size, Share & Trends Report]()

Device As A Service Market (2023 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Device Type (Desktop, Laptop, Notebook And Tablets), By Enterprise Size, By End-Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-627-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Device As A Service Market Summary

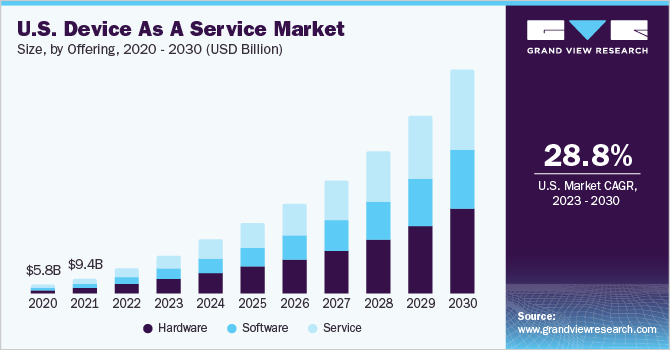

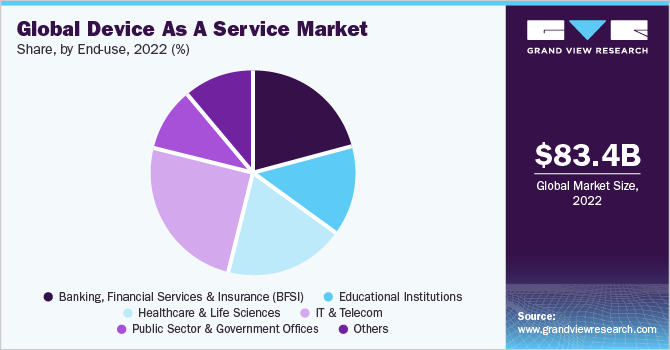

The global device as a service market size was valued at USD 83.38 billion in 2022 and is projected to reach USD 757.17 billion by 2030, growing at a CAGR of 29.1% from 2023 to 2030. The promising growth prospects of the market can be attributed to the growing demand for a subscription model that allows end-users to switch from a capital expenditure-based model to an operating expenses-based model and acquire the latest technology.

Key Market Trends & Insights

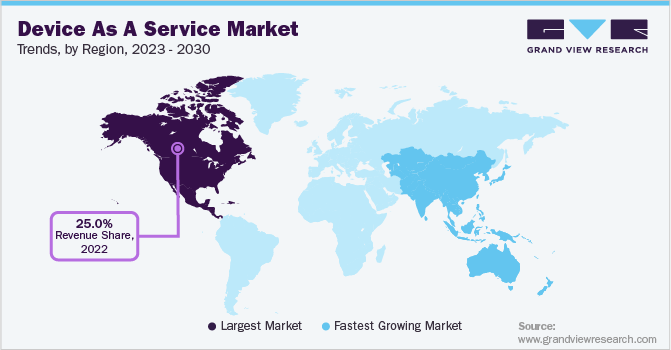

- The North America region accounted for the largest share of around 25.0% in 2022.

- Asia Pacific is expected to exhibit the fastest CAGR over the forecast period.

- By device type, the desktop segment dominated the market in 2022 with a revenue share of more than 40%.

- By enterprise size, the large enterprise segment accounted for the highest revenue share of the market in 2022 with a revenue share of more than 60%.

- By end use, the IT and telecom segment dominated the market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 83.38 Billion

- 2030 Projected Market Size: USD 757.17 Billion

- CAGR (2023-2030): 29.1%

- North America: Largest market in 2022

The increasing adoption of cloud services in developing countries is expected to drive the market. Furthermore, the adoption of contact-based services and solutions by small and medium enterprises is expected to favor the growth of the market.

The COVID-19 pandemic had a positive impact on the industry. The pandemic significantly changed the work dynamics globally, compelling businesses to prioritize the adoption of cloud and remote working practices to curb the spread of COVID-19 infections. Furthermore, the pandemic has encouraged digital transformation activities and the adoption of several technologies, boosting the adoption of the device as a service (DaaS) model.

DaaS enables timely upgrade and maintenance of software and hardware, allowing companies to reduce the IT burden; moreover, the model helps avoid technological obsolescence, ultimately enhancing productivity. Flexible structuring of device-as-a-service offers businesses to scale up/scale down device count and attached services. These factors are expected to drive the market in the forecast period.

Furthermore, the rapid adoption of the subscription model, higher policy compliance, increased user productivity, reduction in help desk spending, and the growing need for cost-efficient and secured devices have accelerated the market growth. The boost in the startup ecosystem is expected to drive the demand for the DaaS model. However, the lack of technical expertise and adoption of CYOD policies could hamper the growth of the market.

The device-as-a-service model is gaining popularity among large as well as small and medium enterprises as it allows them to lease hardware such as laptops, desktops, smartphones, and tablets with preconfigured software or services. The increased adoption of IoT is also expected to drive the demand for the model. Technological advancements, increasing penetration of high-speed networks, and growing advancements of web services are other factors expected to drive the market.

Offering Insights

The service segment dominated the market in 2022 and accounted for over 35%. The device-as-a-service model includes services such as support and maintenance. It consists of a set of device lifecycle services, including deployment & integration, installation, asset recovery services, and maintenance & repair as per the requirement of the end-user. The services are often flexible and can be optimized and tailored. The rising demand for DaaS services has encouraged several managed service providers and value-added resellers to partner with hardware manufacturers and software vendors to provide device-as-a-service solutions under their own brand. Furthermore, continuous support and services of electronic devices ensure the smooth functioning of the enterprise, offering the end-user flexibility in terms of payment.

The hardware segment is anticipated to register a considerable growth over the forecast period. The hardware segment includes desktops, laptops, tablets, notebooks, smartphones, and peripherals. The increasing interest of enterprises in different types of hardware solutions such as desktops, laptops, and notebooks combined in a single offering is expected to foster the growth of the market. Furthermore, IT infrastructure quickly becomes outdated, and an upgrade is required every few years. Hardware leasing offers small and medium enterprises the chance to timely upgrade equipment and adopt the latest technologies without having to purchase them outright.

Device Type Insights

The desktop segment dominated the market in 2022 with a revenue share of more than 40%. Government initiatives to improve infrastructure and increase demand for cloud-based virtual services are expected to boost the demand for the device-as-a-service model in the desktop segment. Furthermore, an increase in the number of smart devices and the growing trend for IT centralization are expected to further drive the growth of the segment.

The smartphone and peripheral segment is expected to exhibit the highest CAGR in the forecast period. Device-as-a-service solutions for smartphones offer organizations the benefits of using the latest technologies, lower cost of usage, and enterprise security. The smartphones industry has been steadily growing over the past few years and smartphones with advanced features are being launched continually. The DaaS model allows users to have the latest devices by only paying a subscription fee. Apple, Samsung, and OnePlus are among the largest manufacturers of smartphones globally and also some of the leading players in the market. Peripherals in the device-as-a-service model include graphic cards, tape drives, expansion cards, microphones, image scanners, digital cameras, webcams, and loudspeakers.

Enterprise Size Insights

The large enterprise segment accounted for the highest revenue share of the market in 2022 with a revenue share of more than 60%. Device-as-a-service aids enterprises to prioritize their investments by leasing hardware and associated services instead of buying high-cost products. The model minimizes cost and increases the profit by tracking expenses daily. Besides, along with the growing awareness about the model, these factors are expected to drive the growth of the segment.

The small & medium enterprise segment is estimated to attain the highest CAGR in the forecast period. Small and medium enterprise owners and IT leaders have an array of tasks, including managing inventories and avoiding cyberattacks. Moreover, small & medium enterprises prefer the operating expenses business model over capital expenditure owing to the cost and flexibility benefits offered. These factors lead to the high adoption of the device-as-a-service model in small and medium enterprises. The COVID-19 pandemic has accelerated ongoing digital transformation efforts, further boosting the demand for the device-as-a-service model among small and medium enterprises.

End-use Insights

The IT and telecom segment dominated the market in 2022 with a revenue share of over 20%. The IT and telecom vertical consists of internet service providers, telecommunication companies, cable companies, and satellite companies. Security, reliability, and high performance of IT devices are critical for the fundamental operations in the sector; thus, this segment generates the most significant demand for devices such as desktops, laptops, notebooks, tablets, and smartphones. Moreover. constant updates of software and related services are comparatively high in the industry, driving the adoption of the device-as-a-service model.

The growing awareness about the device-as-a-service model and its benefits, along with the shift in preference to the OpEx model in a bid to reduce investment in IT infrastructure, are expected to drive the growth of the segment over the forecast period. The shift to remote working and homeschooling due to the pandemic has furthered the adoption of IT assets in this industry. Furthermore, telecommunication companies are aggressively investing in resources and focusing on providing them with the highest quality of services, which are expected to boost the demand for the DaaS model over the forecast period.

Regional Insights

North America accounted for the highest revenue share of over 25% in 2022. North America is one of the first adopters of the latest technologies such as cloud computing, the IoT, and new service models such as device-as-a-service. The regional market is also viable in terms of government rules and regulations for startups and large enterprises. These factors are anticipated to drive the market. Growing demand from IT and telecom for the device-as-a-service model and the rising demand for mobile devices in several industries are also expected to favor the growth of the market.

The Asia Pacific device as a service market is expected to exhibit the highest CAGR over the forecast period. Asia Pacific is home to some of the fastest-growing economies, such as India and China. The presence of a large workforce involved in the IT and telecom industry and a large number of enterprises are expected to boost the demand for the device-as-a-service model. Furthermore, the presence of several life sciences and retail organizations, the rising number of small and medium-sized enterprises, and the increasing awareness about DaaS are expected to drive the market over the forecast period. The increasing internet penetration rate and the unabated growth of several industries in countries such as China, India, and Japan could also bode well for the growth of the regional market.

Key Companies & Market Share Insights

The device as a service market is competitive, characterized by the presence of several small and large market players. These players are pursuing various strategies such as product launch and development, pertaining to hardware, software, and services to cement their foothold in the market and expand further. For instance, in April 2022, Accenture PLC launched Sovereign Cloud Practice to assist businesses in taking benefit of disruptive new cloud technologies by leveraging trusted frameworks, services, and controls. Sovereign cloud is a strategy that enables organizations to control their data's location, access to, and processing in a cloud environment in reaction to new, developing industry standards and regulations in specific countries or sectors. Some of the prominent players operating in the global device as a service market are:

-

Accenture PLC

-

Acer Inc.

-

Apple Inc.

-

Atea Global Services Ltd.

-

Cisco Systems, Inc.

-

Cognizant

-

CompuCom Systems, Inc.

-

Computacenter plc

-

Dell Technologies Inc.

-

Intel Corporation

-

Hewlett Packard Enterprise Development LP

-

Lenovo

Device As A Service Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 126.79 billion

Revenue forecast in 2030

USD 757.17 billion

Growth Rate

CAGR of 29.1 % from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, device type, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; Japan; India; Mexico; Brazil

Key Companies Profiled

Accenture PLC; Acer Inc.; Apple Inc.; Cisco; Cognizant; Computacenter; Dell Technologies; Intel Corporation; Hewlett Packard; Lenovo

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Device As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global device as a service market report based on offering, device type, enterprise size, end-use, and region:

-

Offering Outlook (Revenue, USD Billion; 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Device Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Desktop

-

Laptop, Notebook and Tablet

-

Smartphone and Peripheral

-

-

Enterprise Size Outlook (Revenue, USD Billion; 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Banking, Financial Services and Insurance (BFSI)

-

Educational Institutions

-

Healthcare and Life Sciences

-

IT & Telecom

-

Public Sector and Government Offices

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global device-as-a-service market size was estimated at USD 83.38 billion in 2022 and is expected to reach USD 126.79 billion in 2023.

b. The global device-as-a-service market is expected to grow at a compound annual growth rate of 29.1% from 2023 to 2030 to reach USD 757.17 billion by 2030.

b. North America dominated the device-as-a-service market with a share of over 25% in 2022. North America is one of the first adopters of the latest technologies such as cloud computing, the IoT, and new service models such as device-as-a-service. The regional market is also viable in terms of government rules and regulations for startups and large enterprises. These factors are anticipated to drive the market.

b. Some key players operating in the DaaS market include Accenture; Acer Inc.; Apple Inc.; Cisco; Cognizant; Computacenter; Dell Technologies; Intel Corporation; Hewlett Packard, and Lenovo.

b. The promising growth prospects of the DaaS market can be attributed to the growing demand for a subscription model that can allow end-users to switch from a capital expenditure-based model to an operating expense-based model and acquire the latest technology. The increasing adoption of cloud services in developing countries is expected to drive the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.