- Home

- »

- Healthcare IT

- »

-

Diabetes Management Apps Market, Industry Report, 2030GVR Report cover

![Diabetes Management Apps Market Size, Share & Trends Report]()

Diabetes Management Apps Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Type 1 Diabetes, Type 2 Diabetes), By Functionality, By Platform, By Subscription Model, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-588-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Diabetes Management Apps Market Trends

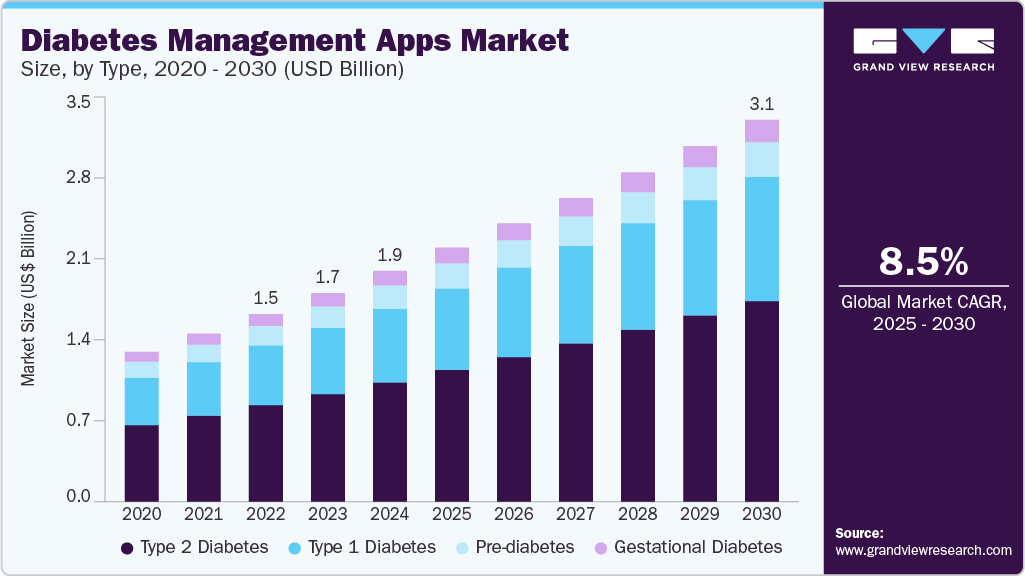

The global diabetes management apps market was estimated at USD 1.87 billion in 2024 and is expected to expand at a CAGR of 8.5% from 2025 to 2030. This growth is primarily driven by the rising prevalence of diabetes, technological advancements, and innovation.

Key Highlights:

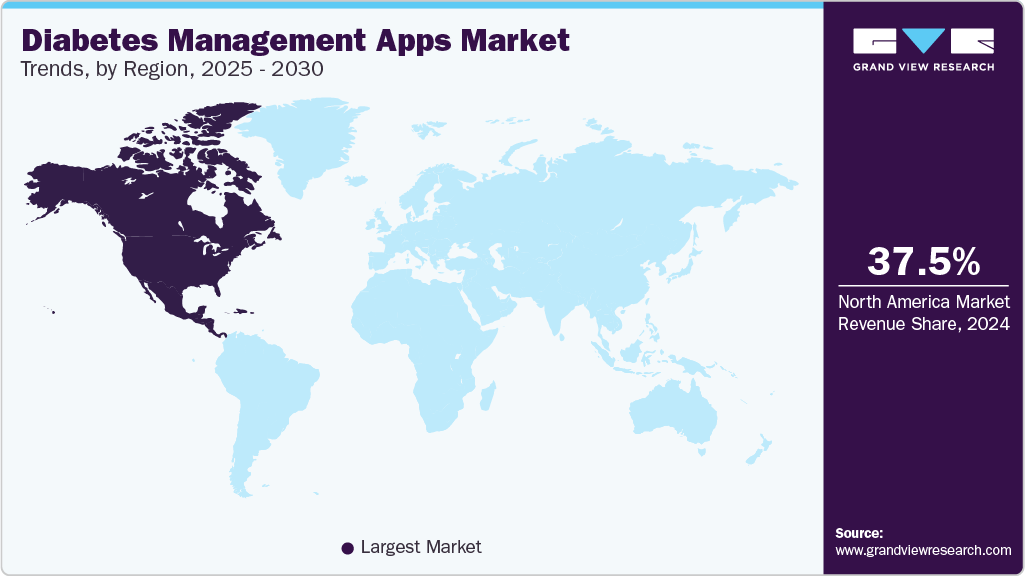

- North America dominated the diabetes management apps market with a revenue share of 37.46% in 2024.

- The diabetes management apps market in the U.S. dominated North America in 2024.

- In terms of type segment, the type 2 diabetes segment dominated the market with the largest revenue share of 51.63% in 2024

- In terms of platform segment, the Android segment dominated the market with a revenue share of 50.32% in 2024

- In terms of functionality segment, the blood glucose monitoring apps segment dominated the market with a revenue share of 51.06% in 2024

As digital technology continues to evolve, the market is anticipated to introduce a variety of innovations in diabetes management that significantly transform how the condition is managed.

In recent years, the number of smartphone applications designed for diabetes management has surged, with over a hundred apps currently available on online app stores to assist patients in tracking their blood glucose levels. Technological innovations are expected to drive growth in the diabetes management app industry. By incorporating AI into glucose monitoring applications, these advancements enhance predictive capabilities for blood sugar management and facilitate more personalized treatment strategies. For example, in December 2024, DexCom, Inc., a glucose biosensing company, introduced its proprietary Generative AI (GenAI) platform. This development made DexCom the first Continuous Glucose Monitor (CGM) manufacturer to embed GenAI into its glucose biosensing technology. The platform analyzes individual health data patterns, establishing a precise link between lifestyle choices and glucose levels, while offering actionable insights to help improve metabolic health.

A significant market driver in the diabetes management apps industry is the strategic expansion of leading medical device manufacturers, such as Abbott, Dexcom, Inc., Medtronic, and Insulet Corporation, into digital health platforms. These companies are known for their advanced glucose monitoring hardware; they increasingly integrate their devices with mobile apps and software solutions to offer a more comprehensive diabetes management ecosystem. This shift is due to patient demand for more convenient, connected care and a proactive move to capture value in the rapidly growing market.

The entry of major glucose monitoring device manufacturers into the market is owing to evolving patient needs and a strategic growth initiative. By aligning their devices with digital platforms, these companies drive market growth, improve patient outcomes, and shape the future of connected diabetes care.

Company Name

App Name

Description

Abbott

FREESTYLE LIBRE 3

Continuous Glucose Monitoring System with Optional Real-Time Alarms App

FREESTYLE LIBRE 2

Flash Glucose Monitoring System with Optional Real-Time Alarms App

FREESTYLE LIBRELINK

Glucose Monitoring Patient App

LIBRELINKUP

Glucose Monitoring Caregiver App

Insulet Corporation

Omnipod VIEW

The Omnipod DISPLAY app allows for a convenient display of Personal Diabetes Manager (PDM) data on the user's iOS smartphone, including Pod status and insulin tracking.

Omnipod DISPLAY

Moreover, wearable fitness devices are used for measuring & compiling user activity data and synchronizing it with a suitable diabetes management application. According to the 2023 NIH report, nearly one in three Americans utilize a wearable device, such as a smartwatch or band, to monitor their health and fitness. Moreover, the International Data Corporation (IDC) has reported that in the third quarter of 2023, worldwide shipments of wearable devices increased by 2.6% compared to the previous year, setting a new third-quarter record with a total of 148.4 million units.

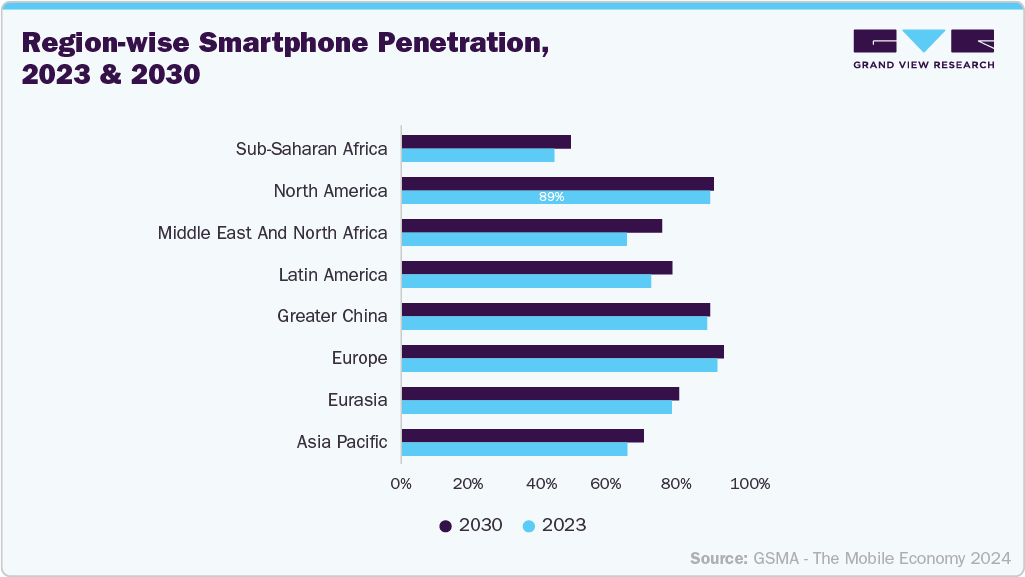

Furthermore, according to the GSM Association (GSMA) statistics published in the Mobile Economy 2024 report, around 5.6 billion people across the globe subscribed to mobile services in 2023, and the number of unique mobile subscribers is expected to reach 6.3 billion by 2030. Moreover, the increasing penetration of smartphones is another key factor expected to facilitate market growth. As per the Mobile Economy 2023 report, smartphone penetration was around 76% in 2022 and is expected to reach 92% by 2030. Thus, the growing adoption of smartphones is expected to drive market growth over the forecast period.

The Internet of Things (IoT) has been one of healthcare's most adopted digital platforms. With efficient data backup through integrated analytics, strong mobile connectivity, and advanced wearable devices, IoT has evolved and reached a point where it is drastically transforming the healthcare sector by facilitating various activities, such as efficient user activity tracking. However, dieticians and nutritionist clinics strive to personalize the digital experience according to individual patient preferences, contributing to the increasing adoption of IoT worldwide. For example, GE Healthcare collaborated with Lifesum AB to provide Lifesum employees with the tools to stay healthier and manage their blood sugar levels.

Case Study: "Enhancing Diabetes Self-Management Through Mobile Health: A Case Study on the Glucose Buddy App"

Diabetes is a chronic condition requiring consistent self-management to maintain glycemic control and prevent complications. With the rise of mobile health solutions, apps such as Glucose Buddy aim to support patients in tracking and managing their condition daily. This case study explores the effectiveness of Glucose Buddy in enhancing diabetes self-management among adults with type 1 diabetes.

Aim: To evaluate the effectiveness of the Glucose Buddy smartphone application in improving diabetes self-management among adults with type 1 diabetes.

Objective: To assess whether the use of Glucose Buddy shows:

-

Improved glycemic control (measured by HbA1c levels)

-

Enhanced diabetes management behaviors

-

Increased diabetes knowledge and self-efficacy

-

Higher treatment satisfaction

-

Feasibility and acceptability of the app.

Observation: A randomized controlled trial was conducted with 75 randomly assigned participants.

- Intervention Group: Received the Glucose Buddy app, which includes features such as blood glucose tracking, food logging, medication tracking, and exercise monitoring.

- Control Group: Received standard diabetes care without the app.

The intervention lasted for 6 months, during which participants in the intervention group used the app to log their diabetes-related data.

Result:

-

Glycemic Control: The intervention group reported a significant reduction in HbA1c levels compared to the control group.

-

Blood Glucose Levels: Participants in the intervention group experienced improved blood glucose levels.

-

Diabetes Management Behaviors: There was an increase in self-reported diabetes management behaviors among the intervention group.

-

Knowledge and Self-Efficacy: The intervention group reported greater diabetes knowledge and self-efficacy.

-

Treatment Satisfaction: Higher levels of treatment satisfaction were observed in the intervention group.

-

Engagement:

High engagement with the app was reported, with participants actively using its features.

Conclusion: The Glucose Buddy app has proven effective in enhancing diabetes management by lowering HbA1c levels and improving blood glucose regulation. This study highlights the potential of mobile applications in assisting individuals with chronic conditions such as diabetes. Glucose Buddy is a valuable resource for diabetes monitoring and management, providing features that facilitate tracking, education, and interaction with healthcare providers.

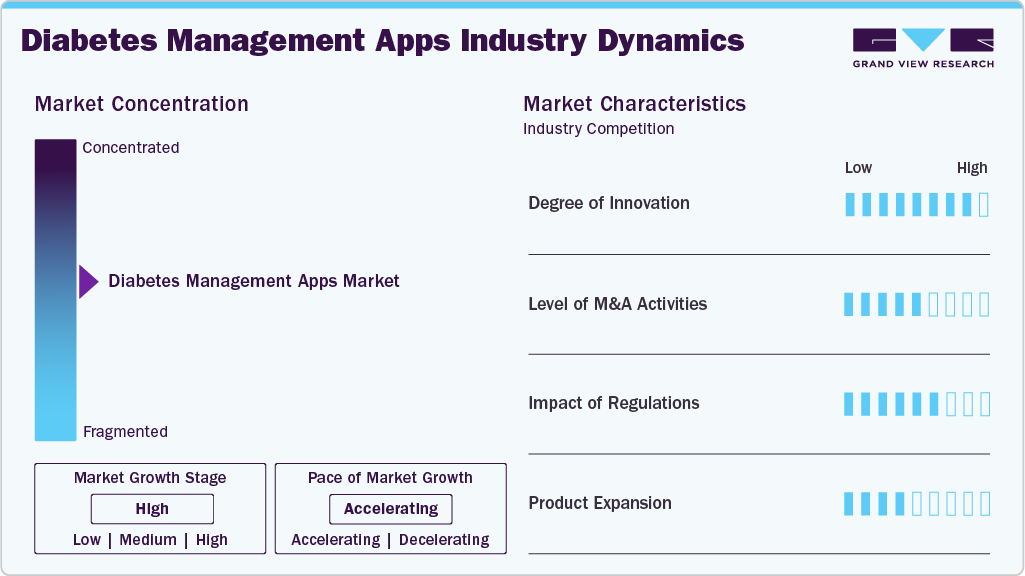

Market Concentration & Characteristics

The global market is characterized by a high degree of innovation, owing to the development of technologically advanced solutions driven by factors such as advancements in artificial intelligence (AI) functionalities. For instance, in June 2024, Abbott announced that the U.S. Food and Drug Administration (FDA) had cleared two new over-the-counter continuous glucose monitoring (CGM) systems - Lingo and Libre Rio. Both are built on Abbott’s renowned FreeStyle Libre CGM technology, which is currently used by approximately 6 million people worldwide.

The market is characterized by medium merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for advanced solutions to maintain a competitive edge, to gain access to new technologies and advancements, and the need to consolidate in a rapidly growing market. For instance, in March 2022, Glooko, a digital diabetes management company , acquired DIABNEXT, a Paris-based diabetes care platform. The addition of DIABNEXT's app expands Glooko's offerings with a unique platform that helps better customize the patient experience and enhance health outcomes for individuals with diabetes.

The diabetes management apps companies are mandated to abide by several regulations, which ensure patient and data safety. The Medicines & Healthcare Products Regulatory Agency (MHRA) and National Health Service (NHS) have set regulations for health-related mobile apps in the UK. Moreover, the EU Medical Device Regulation (MDR) establishes requirements for the safety and performance of medical devices, including mobile health apps and devices.

Market players are expanding their business by entering new geographical regions and launching new tools to strengthen their market position and expand their product portfolio. For instance, in September 2024, Abbott, a pharmaceutical company, announced the launch of Lingo, a prescription-free continuous glucose monitoring system in the U.S. This system features a biosensor and a mobile app aimed at consumers looking to enhance their overall health and wellness. Lingo utilizes the same technology as Abbott's FreeStyle Libre continuous glucose monitoring, which is currently used by over 6 million individuals with diabetes worldwide.

Type Insights

By type, the type 2 diabetes segment dominated the market with the largest revenue share of 51.63% in 2024 and is expected to grow at the fastest CAGR over the forecast period. Metabolic disorders and obesity are strongly linked to the widespread occurrence of type 2 diabetes, a common metabolic problem. The growing prevalence of type 2 diabetes across various countries boosts the market growth. For instance, according to the Australian Bureau of Statistics, one in twenty (1.3 million or 5.3%) individuals in Australia had diabetes in 2022. Moreover, according to the Australian Institute of Health and Welfare, 1.2 million (4.6%) individuals in Australia had type 2 diabetes in 2021.

The type 1 diabetes segment is anticipated to grow significantly over the forecast period. The type 1 diabetes segment is anticipated to grow at a significant CAGR over the forecast period, owing to the growing incidence of type 1 diabetes in teenagers and children. This surge in prevalence is fueling the need for innovative treatment solutions that offer greater convenience and efficacy in disease management. For instance, according to the Robert Koch Institute, a German federal government agency, almost 34,600 adolescents and children in Germany had type 1 diabetes in 2022.

Platform Insights

By platform, the Android segment dominated the market with a revenue share of 50.32% in 2024. The widespread adoption of Android smartphones globally is expected to drive segment growth over the forecast period. As per the Backlinko report, as of Q4 2023, Android smartphones represented 56% of global quarterly smartphone sales. Furthermore, the Android operating system has undergone continuous improvements. These include enhanced Application Programming Interface (API) integrations and machine learning capabilities. These enhancements strengthen the functionality and accuracy of diabetes management apps.

The iOS segment is anticipated to grow at the fastest CAGR over the forecast period. The high adoption of iOS devices is one of the major factors propelling growth and is expected to continue to boost the segment over the forecast period. For instance, according to the Demandsage report, as of 2023, there were 153 million iPhone users in the U.S. In addition, according to the Backlinko report, in 2023, Apple delivered 231.8 million iPhones across the globe. The following are some of the key benefits of using iOS for diabetes management apps,

-

Premium User Experience: Apple prioritizes high-quality design and user experience, ensuring that diabetes management apps on iOS offer a polished and intuitive interface. This leads to higher engagement and satisfaction among users.

- Access to Advanced Features: iOS users benefit from advanced features such as Apple Health integration, which allows apps to sync and consolidate health data from various sources, providing a comprehensive view of a user’s diet, activity, and overall health.

Functionality Insights

By functionality, the blood glucose monitoring apps segment dominated the market with a revenue share of 51.06% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing demand for convenience, growing approvals, continuous monitoring, and real-time data tracking. For instance, in July 2024, Roche, a healthcare company[8] , obtained the CE Mark approval for its Accu-Chek SmartGuide continuous glucose monitoring (CGM) solution. It helps people with diabetes manage their blood sugar levels more effectively. It includes a CGM sensor, a dedicated app for viewing glucose data, and a predictive app that utilizes AI to forecast future glucose trends. The system aims to empower users to make informed decisions about their insulin therapy and reduce the risk of hypoglycemia.

The diet & nutrition planning apps segment is expected to grow significantly during the forecast period. Favorable government initiatives, growing health consciousness, and a rising number of educational programs regarding developing healthcare, diet, nutrition, & fitness-related apps to control blood glucose level fuel market growth. For instance, the Expanded Food and Nutrition Education Program (EFNEP) is the first nutrition education program in the U.S. financed by the National Institute of Food and Agriculture (NIFA), an agency of the U.S. Department of Agriculture (USDA). This initiative provides nutrition-related education to low-income families & youth.

Subscription Model Insights

By subscription model, the subscription-based segment dominated the market with a revenue share of 33.14% in 2024. Growth in the Subscription-based segment is driven by increasing consumer demand for personalized health solutions and the rising prevalence of diet-related conditions such as diabetes. Subscription-based diabetes management apps offer enhanced features beyond free versions, often including advanced data analysis, personalized insights, and integration with other devices. These apps typically provide tools to track blood glucose, insulin, medications, and other relevant metrics, along with features to analyze trends, set goals, and share data with healthcare providers. For example, Glooko, Diabetes: M, and Glucose Buddy provide a premium subscription model for diabetes management.

The ad-supported segment is anticipated to grow at the fastest CAGR over the forecast period. Numerous individuals struggle to pay monthly or yearly subscription fees, especially those in developing or underdeveloped countries. Ad-supported models help close this affordability gap by providing free access to essential app features, including blood glucose monitoring, dietary tracking, medication reminders, and health education. This approach enables app developers to connect with a broader audience. Thus, such factors are anticipated to boost the market growth over the forecast period.

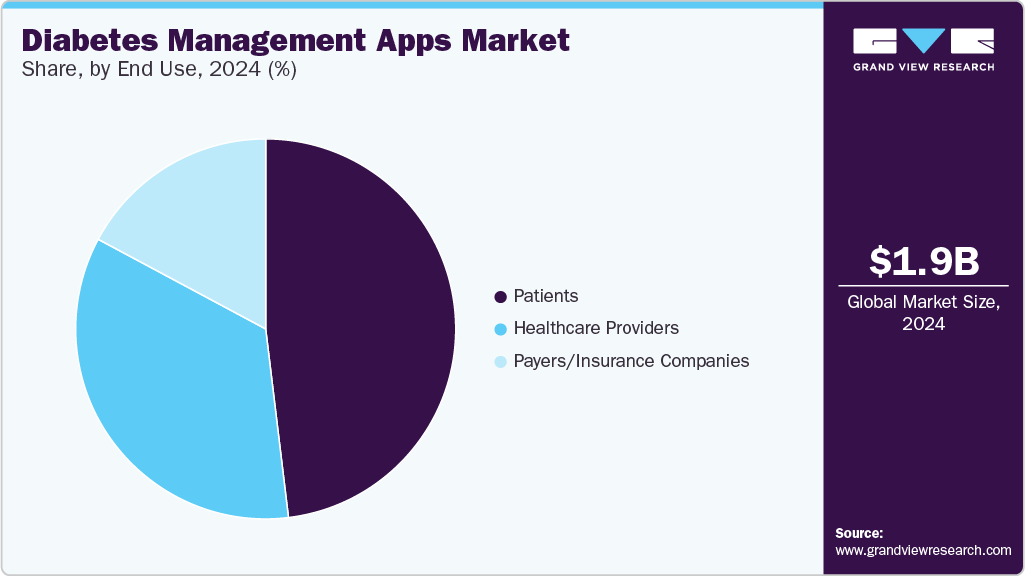

End Use Insights

By end use, the patients segment dominated the market with a revenue share of 48.09% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The widespread use of smartphones and improved internet access has provided patients access to medical-grade applications that allow real-time data tracking, customized insights, and effortless communication with healthcare professionals. Several apps connect with wearable devices such as continuous glucose monitors (CGMs) and fitness trackers, giving patients a comprehensive view of their health. This level of convenience, along with a growing preference for self-management of chronic conditions, is driving the increasing adoption of diabetes management apps among patients.

The healthcare providers segment is anticipated to grow significantly over the forecast period. Healthcare providers play an increasingly essential role in adopting and integrating diabetes management apps, driven by the need to enhance patient outcomes and improve workflow efficiency. As diabetes cases rise worldwide, providers face pressure to deliver personalized, continuous, and data-driven care. Diabetes management apps offer a scalable solution by enabling providers to remotely monitor patients’ health metrics, such as blood glucose levels, medication adherence, diet, and physical activity, outside clinical settings. This continuous data stream supports early intervention, proactive treatment adjustments, and better long-term outcomes.

Regional Insights

North America dominated the diabetes management apps market with a revenue share of 37.46% in 2024. Several factors, such as the high adoption rate of advanced healthcare technologies, the presence of a large number of healthcare professionals, and the presence of well-established healthcare infrastructure, coupled with the increasing focus on digital health and health solutions, have contributed to the widespread use of diabetes management apps in this region. Furthermore, the growing penetration of smartphones is a key factor expected to boost the adoption of diabetes management apps in this region. For instance, according to Business of Apps, over 30 million individuals have actively used smartphones in Canada each year since 2020, with 31.2 million users recorded in 2023.

U.S. Diabetes Management Apps Market Trends

The diabetes management apps market in the U.S. dominated North America in 2024. This is attributed to the increasing prevalence of diabetes in the nation and the growing need for advanced solutions that facilitate real-time monitoring, enhance glycemic control, and provide greater convenience for patients. For instance, the International Diabetes Federation (IDF) reports that around 32.2 million individuals in the U.S. were affected by diabetes in 2024, with this figure expected to reach 34.7 million by 2030.

Europe Diabetes Management Apps Market Trends

The diabetes management apps market in Europe is expected to grow significantly over the forecast period. The increasing demand for mobile healthcare apps among consumers in the region is expected to supplement market growth. For instance, according to data published by Business of Apps, 25% of people in the UK used workout/fitness apps in 2023, and 15% used nutrition/diet apps.

The UK diabetes management apps industry is expected to grow significantly during the forecast period, owing to the rising incidence of diabetes, advanced healthcare infrastructure, and the launch of new devices in the country. For instance, in June 2024, Insulet Corporation launched the Omnipod 5, which works with Dexcom G6 and Abbott FreeStyle Libre 2 Plus continuous glucose monitor (CGM) sensors. This device is accessible in the UK and the Netherlands for individuals aged two and above with type 1 diabetes. It is the first and only tubeless automated insulin delivery (AID) system that integrates with the CGM sensor brands, Dexcom and Abbott FreeStyle Libre.

Asia Pacific Diabetes Management Apps Market Trends

The diabetes management apps industry in Asia Pacificis expected to register the fastest growth rate over the forecast period. The growing awareness and demand for convenient healthcare solutions among Asia Pacific consumers contribute to expanding the market. In addition, the widespread adoption of smartphones and improved Internet connectivity has made diabetes management apps more accessible to a broader audience. According to The Mobile Economy 2023 by GSMA, unique mobile subscriptions in Asia Pacific reached 1.73 billion by the end of 2022, estimated to reach 2.11 billion by 2023.

China diabetes management apps market is anticipated to register considerable growth during the forecast period. The growing patient population and increasing internet penetration in China can spur the country’s market. According to data from the China Internet Network Information Center (CNNIC), as of December 2022, China has 1.067 billion Internet users, an increase of 35.49 million since December 2021. Internet penetration has increased by 2.6%, reaching 75.6%. Moreover, the increasing use of smartphones is expected to drive the adoption of mobile platforms for diabetes management apps.

Latin America Diabetes Management Apps Market Trends

The diabetes management apps industry in Latin America is anticipated to witness considerable growth over the forecast period. Latin America is considered to have a large pool of healthcare human resources and tech entrepreneurs, which is one of the key factors driving the market. In addition, buyers' increasing expenditures on electronic and mobile devices contribute to market growth.

Brazil diabetes management apps industry is anticipated to register considerable growth during the forecast period. The growing adoption of digital solutions to manage the rising prevalence of chronic diseases is expected to drive market growth in Brazil. For instance, GilcOnLine is an app that allows individuals to manage diabetes by enabling them to view their sugar levels and calculate insulin doses & calorie intakes.

Middle East and Africa Diabetes Management Apps Market Trends

The diabetes management apps market in the Middle East and Africa is anticipated to grow considerably over the forecast period. With the increasing penetration of smartphones and government initiatives, entrepreneurs and healthcare professionals are inclined toward smartphones for better and healthier lifestyles. In addition, the rising awareness among people has increased the potential for digital health apps in the market.

Kuwait diabetes management apps industry is anticipated to grow considerably during the forecast period. Kuwait’s healthcare sector is experiencing a surge in demand for fitness app solutions, including diabetes management apps. The increasing prevalence of chronic diseases such as diabetes and growing awareness regarding health are fueling the market growth. For instance, according to the International Diabetes Federation, a total of 803,400 cases of diabetes in adults were reported in 2021 in Kuwait. The prevalence rate of diabetes in adults in Kuwait is 25.5%.

Key Diabetes Management Apps Company Insights

Key participants in the diabetes management apps industry focus on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and business footprints.

Key Diabetes Management Apps Companies:

The following are the leading companies in the diabetes management apps market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Dexcom, Inc.

- Medtronic

- Insulet Corporation

- F. Hoffmann-La Roche Ltd

- Glooko, Inc.

- Diabetes: M

- DarioHealth Corp.

- LifeScan IP Holdings, LLC

Recent Developments

-

In November 2024, Medtronic announced the FDA clearance for its InPen app, which now includes a missed meal dose detection feature. This advancement sets the stage for the upcoming launch of its Smart MDI system, which will be integrated with the Simplera continuous glucose monitor (CGM).

-

In January 2024, Abbott and Tandem Diabetes Care, Inc. announced that the t:slim X2 insulin pump with Control-IQ technology is now integrated with Abbott's FreeStyle Libre 2 Plus sensor. This offers users in the U.S. the benefits of a hybrid closed-loop system that helps manage and prevent high and low blood sugar levels.

Diabetes Management Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.06 billion

Revenue forecast in 2030

USD 3.09 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, functionality, end use, subscription model, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Dexcom, Inc.; Medtronic; Insulet Corporation; F. Hoffmann-La Roche Ltd; Glooko, Inc.; Diabetes: M; DarioHealth Corp.; LifeScan IP Holdings, LLC; Glucose Buddy (Azumio)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diabetes Management Apps Market Report Segmentation

This report forecasts revenue growth and provides a global, regional, and country levels an analysis of the latest trends in each sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global diabetes management apps market report based on type, platform, functionality, end use, subscription model, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Type 1 Diabetes

-

Type 2 Diabetes

-

Gestational Diabetes

-

Pre-diabetes

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

iOS

-

Android

-

Web-based Applications

-

Integrated Digital Ecosystems

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Glucose Monitoring Apps

-

Insulin Tracking Apps

-

Diet & Nutrition Planning Apps

-

Physical Activity Tracking Apps

-

-

Subscription model Outlook (Revenue, USD Million, 2018 - 2030)

-

Freemium

-

Subscription-Based

-

One-time Purchase

-

Ad-Supported

-

Insurance Reimbursement-Based

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Healthcare Providers

-

Payers/Insurance Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global diabetes management apps market size was estimated at USD 1.87 billion in 2024 and is expected to reach USD 2.06 billion in 2025.

b. The global diabetes management apps market is expected to grow at a compound annual growth rate of 8.48% from 2025 to 2030 to reach USD 3.09 billion by 2030.

b. North America dominated the diabetes management apps market with a share of 37.46% in 2024. Several factors, such as the high adoption rate of advanced healthcare technologies, the presence of a large number of healthcare professionals, and the presence of well-established healthcare infrastructure, coupled with the increasing focus on digital health and health solutions, have contributed to the widespread use of diabetes management apps in this region.

b. Some key players operating in the diabetes management apps market include Abbott, Dexcom, Inc., Medtronic, Insulet Corporation, F. Hoffmann-La Roche Ltd , Glooko, Inc., Diabetes: M, DarioHealth Corp., LifeScan IP Holdings, LLC, Glucose Buddy (Azumio).

b. The growth of the diabetes management app industry is primarily driven by the rising prevalence of diabetes, advancements in technology, and innovation. For instance, according to the International Diabetes Federation, approximately 589 million adult s were living with diabetes in 2024, and this figure is projected to climb to 853 million by 2050. As digital technology continues to evolve, the market is anticipated to introduce a variety of innovations in diabetes management that significantly transform how the condition is managed.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.