- Home

- »

- Clothing, Footwear & Accessories

- »

-

Diamond Jewelry Market Size & Share Analysis Report, 2030GVR Report cover

![Diamond Jewelry Market Size, Share & Trends Report]()

Diamond Jewelry Market (2024 - 2030) Size, Share & Trends Analysis Report By Cut (Round Brilliant Cut Diamond), By Clarity (VS2), By Color (Near Colorless), By Carat (0.50 CT), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-035-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Diamond Jewelry Market Summary

The global diamond jewelry market size was estimated at USD 90.01 billion in 2023 and is projected to reach USD 482.2 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. The market is primarily driven by the growth of the beauty and fashion industry which has resulted in the rise of fashion sense among the global population.

Key Market Trends & Insights

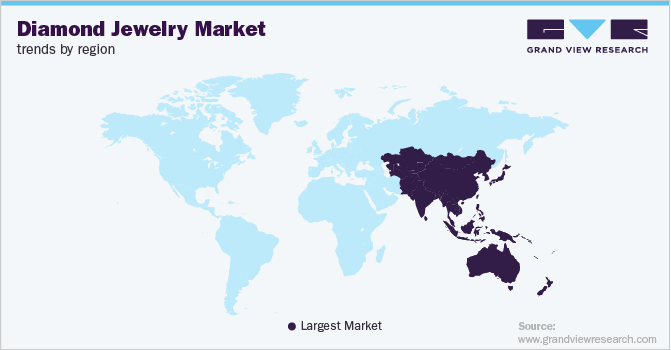

- Asia Pacific accounted for the largest marker in 2022.

- By clarity, the Very Slightly Included (VS2) category holds the segment is expected to grow at the fastest CAGR of 4.9% from 2023 to 2030.

- By color, the Near-colorless diamonds hold the dominant share of 56.59% in 2022.

- By carat, the 0.50 carat diamonds segment is expected to be the fastest-growing segment with a 4.8% CAGR from 2023 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 90.01 Billion

- 2030 Projected Market Size: USD 482.2 Billion

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2022

The increasing consumer disposable income and higher spending capacity on precious jewelry to reflect status are likely to drive the demand. Nowadays, millennials prefer self-expression, which has been driving the demand for new designs and trend styles, and the growing popularity of bridal makeup has spurred the demand for diamond jewelry globally. The millennials are more inclined to branded products and fashionable designs that are convergent with their personal style and opt for jewelry that is versatile and can be worn during any occasion, whether formal or informal. Therefore, these evolving trends including colored diamonds, mismatched stones, and asymmetric earrings are encouraging manufacturers to design jewelry to address the emerging trends in the diamond market.

Moreover, the increasing spending power of the female population is fueling the sales of diamond jewelry across the globe. The preference for jewelry varies in different countries and regions. Traditional occasions, ceremonies, and rituals play a pivotal role when it comes to the demand for jewelry. For instance, diamond jewelry is mostly preferred for weddings and engagements in western countries. Customers prefer purchasing jewelry from both local and international brands as these brands offer value-added products and unique designs. Also, the growth of the e-commerce sector is playing a pivotal role in creating new trends in the jewelry market.

Cut Insights

The round brilliant cut diamonds have gained widespread acceptance due to their symmetry, structure, and light-dancing reflections. Such features have made these diamonds a perfect choice for engagement rings among consumers. Also, these diamonds represent a major proportion of the diamond shapes sold globally and are the costliest of all diamonds sold in the market.

Worldwide jewelry manufacturers such as Tiffany & Co., Chow Tai Fook Jewellery Group Limited, and others have been the drivers of the sales of round-cut diamonds with trendsetting looks and designs to captivate customers. In May 2021, Tiffany & Co. unveiled 'Charles Tiffany Setting', a men's engagement ring with a bold solitaire diamond. The engagement rings are available in round cut diamonds and emerald cut diamonds.

Princess-cut diamonds have gained significant popularity because of their modern appearance and trendsetting design. In addition, the diamond has 58 facets that fit well with a halo engagement ring setting. These diamonds are more economical than other shapes and hardly 20% of these diamonds are utilized globally. The princess-cut diamonds are the second most popular diamond chosen for engagement rings across America.

Clarity Insights

The Very Slightly Included (VS2) category holds the dominant share of the segment and is expected to grow at the fastest CAGR of 4.9% from 2023 to 2030. The diamonds are easily noticeable at 10x magnification. The inclusion will be located in a difficult-to-spot location and due to its large blemishes, it can be easily viewed under magnification. These diamonds are the most popular choice for engagement rings and are viewed as the most popular diamond clarity among different clarities of diamonds.

Also, SI1, Slightly Included 1st Degree represents the top 10% of all the world's diamonds for engagement rings and has the highest value in terms of its popularity and resale value. Also, the inclusions of 1st Degree are observed under 10x magnification easily and may have inclusions that can be viewed through a human eye.

Color Insights

The Near-colorless diamonds hold the dominant share of 56.59% in 2022 and is expected to lead the overall segmental share during the forecast timeline 2023-2030. Near-colorless diamonds have a color grade ranging from G to J. The color of these diamonds may be noticeable when compared to a colorless diamond, but they will usually appear colorless when viewed on their own.

Diamonds in this grade offer the best value because they are less expensive than colorless diamonds but lack any tint that is visible to the naked eye. These diamonds are colorless when mounted in jewelry. Also, these diamond color ranges are gaining huge demand among diamond traders from auctions, exhibitions, and private sales events globally. For instance, in May 2022, a 228.31-carat, near colorless (G-color), pear-shaped diamond was sold for around USD 22 million at Christie’s Geneva in Switzerland.

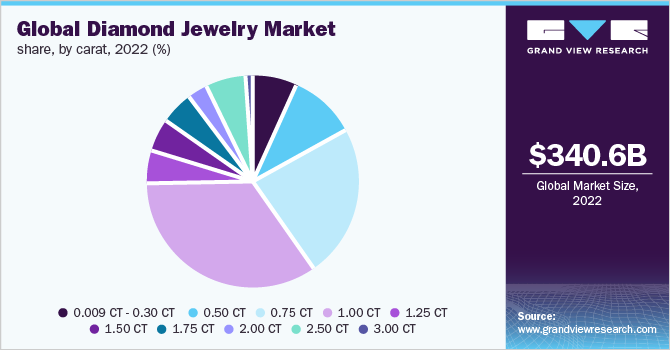

Carat Insights

A 1-carat diamond weighs around 200 milligrams and it is easily affordable due to its price. The 1-carat diamond falls on the low-category budget for the ones who try to minimize their search requirements based on low and affordable pricing options. In addition, 1-carat diamonds are increasingly accepted as a jewelry option.

The 0.50 carat diamonds is expected to be the fastest-growing segment with a 4.8% CAGR from 2023 to 2030. The 0.50 CT or half-carat diamonds are widely accepted as a popular choice for wedding rings because of their price which is lower compared to their above weights. Also, these diamonds look appealing with solitaire and halo settings and have gained widespread acceptance.

Also, the diamond fits well with a white metal band which can appear like a mirror to reflect the diamond's size. These diamonds are well suited to yellow and rose gold settings and make the diamond appear bigger than its actual size.

Regional Insights

In Asia Pacific, the market is expected to expand significantly and the market is anticipated to grow progressively in the coming years. The demand for lab-grown jewelry products is driving the regional market. According to the Gem & Jewellery Export Promotion Council (GJEPC) data, lab-grown diamonds in India witnessed tremendous growth of 105% in 2022 as compared to the previous year. The report revealed that the lab-grown units in Surat city in India was USD 325.45 million in April and May 2022, compared to USD 164.52 million in April and May 2021.

Moreover, Japan is also among the largest luxury jewelry markets in the region. Japanese consumers have shown a high preference for delicate handmade jewelry items. Necklaces made up of a simple silver chain with a pendant of any shape are some of the most common jewelry items preferred by Japanese women. Some of the popular luxury jewelry brands in Japan are Tasaki and Ginza Tanaka.

Key Companies & Market Share Insights

The diamond jewelry industry is always changing and updating. To stay head-on in the market, players tend to launch new strategies more frequently. Market players are focusing on increasing investments in R&D to innovate new and attractive solutions for consumers for ease of purchasing diamond jewelry in the market. Moreover, major players are targeting new regions and demography to increase the sales of the products, by either entering the new market solely or by collaborating with local brands and retailers across the globe.

-

Indian lifestyle and premium accessories retailer Tata Cliq Luxury collaborated with France-based fashion boutique Le Mill to launch the fashion boutique on the e-commerce platform. The partnership was aimed at connecting Indian customers with the European fashion scene and offer trendsetting fashion labels - including jewelry - to the Indian audience.

-

Hong Kong retailer Chow Sang launched 'The Future Rocks,' an e-commerce platform that specializes in jewelry products made from lab-grown diamonds and recycled metals.

Some of the prominent players in the global diamond jewelry market include:

-

Tiffany & Co.

-

Bulgari S.p.A.

-

Cartier

-

Signet Jewelers

-

De Beers plc

-

Pandora Jewelry, LLC

-

Chow Tai Fook Jewellery Group Limited

-

Swarovski AG

-

Petra Diamonds Limited

-

Trans Hex Group

Diamond Jewelry Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 93.47 billion

Revenue forecast in 2030

USD 482.2 billion

Growth Rate (Revenue)

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cut, clarity, color, carat, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Brazil; Saudi Arabia; UAE

Key companies profiled

Tiffany & Co.; Bulgari S.p.A.; Cartier; Signet Jewelers; De Beers plc; Pandora Jewelry, LLC; Chow Tai Fook Jewellery Group Limited; Swarovski AG; Petra Diamonds Limited; Trans Hex Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Diamond Jewelry Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global diamond jewelry market report based on cut, clarity, color, carat, and region:

-

Cut Outlook (Revenue, USD Million, 2018 - 2030)

-

Round Brilliant Cut Diamond

-

Princess Cut Diamond

-

Emerald Cut Diamond

-

Radiant Cut Diamond

-

Cushion Cut Diamond

-

Oval Cut Diamond

-

Asscher Cut Diamond

-

Marquise Cut Diamond

-

Pear Cut Diamond

-

Heart Cut Diamond

-

Others

-

-

Clarity Outlook (Revenue, USD Million, 2018 - 2030)

-

FL and IF

-

I (1/2/3)

-

VVS 1

-

VVS 2

-

VS 1

-

VS 2

-

SI 1

-

SI 2

-

-

Color Outlook (Revenue, USD Million, 2018 - 2030)

-

Colorless (GRADE D/E/F)

-

Near Colorless (GRADE G/H/I/J)

-

Faint (K/L/M)

-

Very Light (GRADE N/O/P/Q/R)

-

Light (GRADE S/T/U/V/W/X/Y/Z)

-

-

Carat Outlook (Revenue, USD Million, 2018 - 2030)

-

0.009 CT - 0.30 CT

-

0.50 CT

-

0.75 CT

-

CT

-

1.25 CT

-

1.50 CT

-

1.75 CT

-

2.00 CT

-

2.50 CT

-

3.00 CT

-

3.50 CT

-

4.00 CT

-

5.00 CT and Above

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global diamond jewelry market size was estimated at USD 340.6 billion in 2022 and is expected to reach USD 353.2 billion in 2023.

b. The global diamond jewelry market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 482.2 billion by 2030.

b. Asia Pacific dominated the diamond jewelry market with a share of 59.49% in 2022. The demand for lab-grown jewelry products is driving the regional market. According to the Gem & Jewellery Export Promotion Council (GJEPC) data, lab-grown diamonds in India witnessed a tremendous growth of 105% in 2022 as compared to the previous year.

b. Some key players operating in the diamond jewelry market include Tiffany & Co., Bulgari S.p.A., Cartier, Signet Jewelers, De Beers plc, Pandora Jewelry, LLC, Chow Tai Fook Jewellery Group Limited, Swarovski AG, Petra Diamonds Limited, Trans Hex Group

b. Key factors that are driving the diamond jewelry market growth include growth of the beauty and fashion industry which has resulted in the rise of fashion sense among the global population. The increasing consumer disposable income and higher spending capacity on precious jewelry to reflect status are likely to drive the demand for the diamond jewelry market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.