- Home

- »

- Advanced Interior Materials

- »

-

Diamond Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Diamond Market Size, Share & Trends Report]()

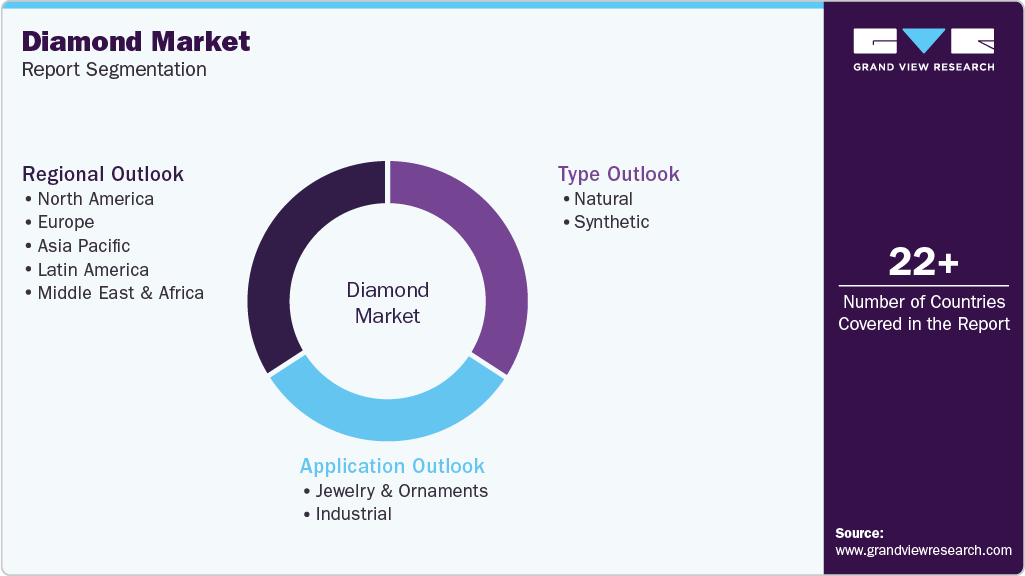

Diamond Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Application (Jewelry & Ornaments, Industrial), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-4-68038-111-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Diamond Market Summary

The global diamond market size was estimated at USD 42.74 billion in 2025 and is projected to reach USD 53.16 billion by 2033, growing at a CAGR of 2.7% from 2026 to 2033. The increasing demand for branded and customized jewelry, especially among millennials and Gen Z, is significantly supporting market growth.

Key Market Trends & Insights

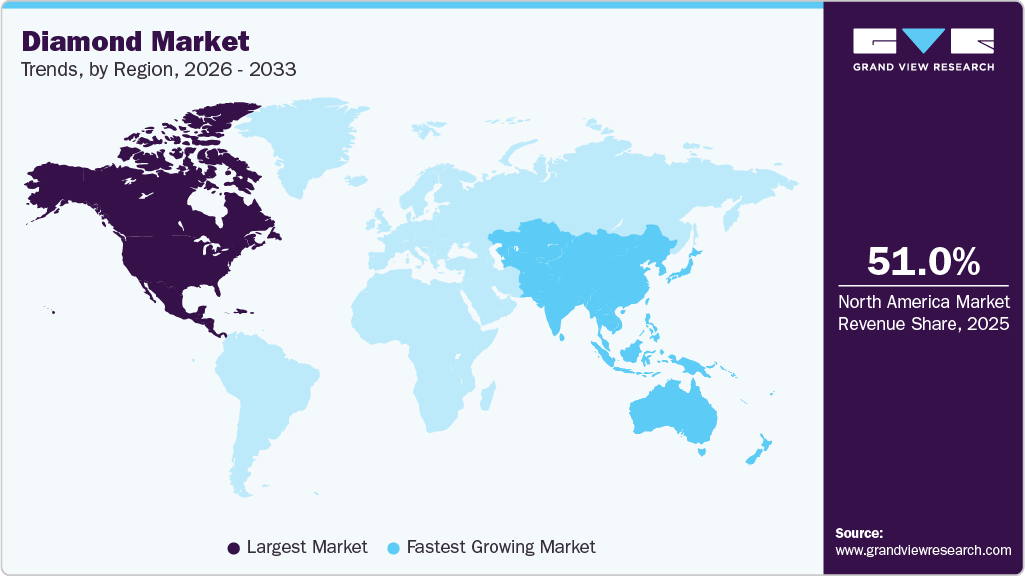

- The North America diamond market held over 51.0% of the revenue share of the global market in 2025.

- The diamond market in the Asia Pacific region is growing at a significant rate.

- By type, the natural diamond held over 71.0% of the revenue share of the global market in 2025.

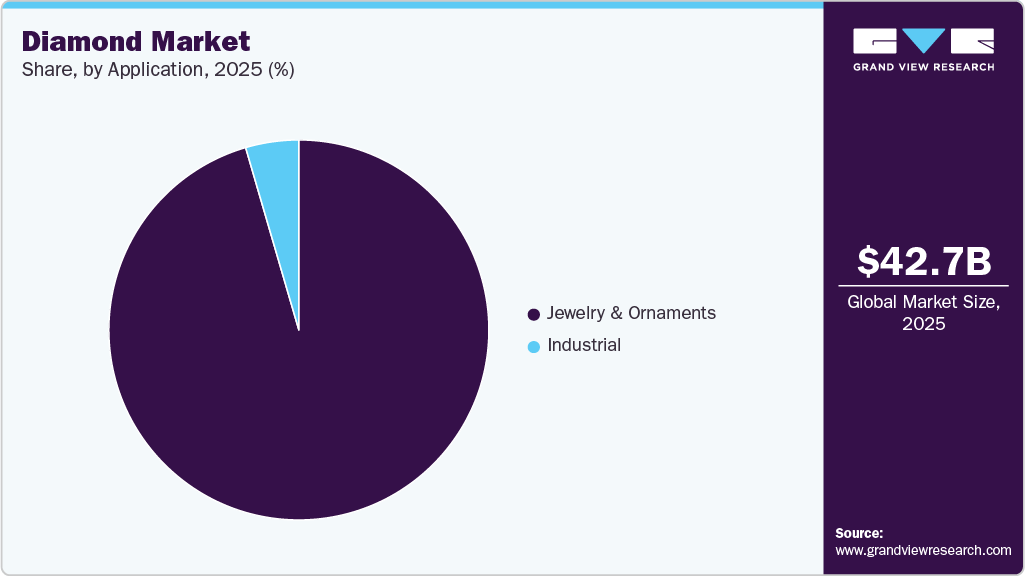

- By application, the jewelry & ornaments segment held over 95.0% of the revenue share of the global market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 42.74 Billion

- 2033 Projected Market Size: USD 53.16 Billion

- CAGR (2026-2033): 2.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In addition, the rising adoption of digital traceability and ethical sourcing practices is boosting consumer confidence and accelerating global diamond sales. Sustainability has become a central pillar shaping the modern diamond industry, as both producers and consumers increasingly emphasize responsible sourcing and environmental stewardship. Major mining companies are investing in low-impact extraction technologies, renewable energy integration, and full mine-to-market traceability to minimize ecological disruption and improve transparency. Blockchain-based tracking, carbon-neutral mining initiatives, recycled diamonds, and eco-certifications are steadily gaining momentum, encouraging brands to showcase verifiable sustainability credentials. These initiatives not only reduce the industry’s environmental footprint but also help safeguard local communities and ecosystems around mining sites, reinforcing long-term trust and accountability across the supply chain.

Consumer preferences in the diamond market are shifting toward personalized, branded, and story-driven purchases, moving beyond traditional luxury consumption. Millennials and Gen Z buyers, in particular, value authenticity, ethical sourcing, and emotional connection, leading to strong demand for bespoke engagement rings and custom jewelry designs. Lab-grown diamonds have also become mainstream, driven by competitive pricing, sustainable perception, and identical physical characteristics to natural stones. Meanwhile, premium natural diamonds continue to attract high-net-worth consumers who prioritize rarity and investment value. This diversification in preferences has broadened the market, allowing both natural and lab-grown diamonds to coexist and thrive as complementary segments within the luxury market.

Drivers, Opportunities & Restraints

The global diamond market is experiencing steady growth as consumers increasingly seek luxury products that strike a balance between affordability and emotional value. Lab-grown diamonds play a major role in this trend, particularly among younger buyers, due to their lower price point and similar visual appeal to natural stones. This shift was recently reflected in India's sharp rise in lab-grown diamond exports to the UAE in 2024, highlighting growing international demand for accessible diamond jewelry. At the same time, the renewed interest in natural diamonds, driven by their rarity and long-term value perception, continues to anchor market expansion.

A major opportunity for the market lies in brand storytelling and strategic product positioning. Natural diamond companies are increasingly focusing on authenticity, heritage, and emotional symbolism to differentiate themselves, particularly as customers show a renewed appreciation for exclusive and rare gemstones. Recent consumer trends in 2025 indicate that high-net-worth buyers are gravitating toward premium natural stones as investment-oriented luxury purchases. On the other side of the spectrum, ongoing technological improvements in lab-grown diamond production, particularly in China and India, are helping jewelry brands introduce stylish and budget-friendly pieces, thereby widening the consumer base and opening strong growth channels.

The biggest restraint affecting the diamond market is price instability, which has intensified across both natural and lab-grown categories. Entering 2025, global reports highlighted substantial price declines for natural diamonds and even sharper drops for lab-grown stones due to oversupply and aggressive production expansion. This volatility has placed pressure on profit margins for mining companies, wholesalers, and retailers. In addition, the perception that lab-grown diamonds lose value rapidly after purchase has caused some consumers to hesitate, resulting in slower purchase decisions and heightened uncertainty in the market.

Type Insights

Natural diamonds dominate the global diamond market due to their rarity, intrinsic value, and long-standing perception as symbols of luxury and status. They are primarily mined in countries such as Russia, Botswana, Canada, and Australia, with major producers such as De Beers and ALROSA leading the sector. Natural diamonds are highly sought after for high-value purchases, particularly in bridal jewelry and luxury collections, where consumers associate them with authenticity, investment potential, and emotional significance.

Synthetic diamonds are gaining traction as cost-effective, ethical alternatives to natural stones. Advanced technologies, such as HPHT and CVD, enable the production of gem-quality stones that are visually and chemically like natural diamonds. While their market share is smaller, lab-grown diamonds are increasingly used in fashion jewelry and mid-range luxury segments, appealing to younger consumers who seek sustainability and affordability.

Application Insights

Jewelry & ornaments remain the largest application for diamonds, accounting for most of the global demand. Diamonds are widely used in engagement rings, necklaces, bracelets, and other luxury accessories, with high consumer preference for certified and branded stones. Rising disposable incomes in emerging markets, such as India and China, along with a growing trend of personalized and bespoke jewelry, have reinforced the dominance of this segment.

Industrial applications are smaller in comparison but remain significant due to diamonds’ hardness, thermal conductivity, and precision-cutting properties. They are used in cutting, grinding, drilling, and polishing tools, as well as in high-tech applications such as semiconductor manufacturing. Synthetic diamonds dominate industrial use due to cost efficiency, controlled quality, and scalability, supporting steady growth even as jewelry continues to drive overall market revenues.

Regional Insights

North America Diamond Market Trends

The North American diamond market continues to grow steadily, driven by strong demand for engagement jewelry, premium luxury purchases, and the expansion of retail channels, including online custom jewelry platforms. Consumers in this region are increasingly valuing ethical sourcing, traceability, and certified diamonds, prompting suppliers to strengthen their transparency and sustainability measures. While lab-grown diamonds are gaining popularity due to affordability and design flexibility, natural diamonds still dominate high-value purchases among affluent buyers.

U.S. Diamond Market Trends

The United States remains the largest consumer market for diamonds, driven by high spending on weddings, anniversaries, and personal luxury gifting. The shift toward personalized and designer jewelry is fueling growth across branded retail and digital-first jewelers. With younger consumers showing strong interest in sustainable luxury, lab-grown diamonds are witnessing significant adoption; however, premium natural stones continue to retain strong appeal for high-net-worth individuals seeking rarity, investment potential, and exclusivity.

Asia Pacific Diamond Market Trends

The Asia Pacific is the fastest-growing regional market, driven by rising disposable incomes, shifts in urban lifestyles, and the expansion of jewelry retail networks in India, China, and Southeast Asia. The increasing cultural preference for diamond jewelry at weddings and festive occasions continues to drive strong demand. India is emerging as a hub for both diamond polishing and lab-grown diamond production, while China’s luxury consumer base is rebounding, further accelerating regional market growth.

Europe Diamond Market Trends

The European diamond market is shaped by a strong luxury heritage, with demand concentrated in fashion-forward consumer segments and high-end jewelry brands across France, Italy, Belgium, and the UK Sustainability and ethical sourcing are highly prioritized in this region, leading brands to adopt transparent supply chains, recycled diamonds, and eco-certified collections. Despite economic fluctuations, European buyers continue to favor branded jewelry and rare natural diamonds that offer craftsmanship, prestige, and timeless value.

Key Diamond Company Insights

Some of the key players operating in the market include De Beers Group, ALROSA, Rio Tinto Diamonds, and others.

-

De Beers Group, established in 1888, is one of the world’s most influential diamond companies and a leading force across the global diamond value chain. The company specializes in diamond exploration, mining, sorting, and trading, as well as polished diamond branding through the De Beers Jewelers and Forevermark labels. De Beers integrates technological innovation, ethical sourcing, and sustainability programs to reinforce transparent and responsible mining practices. Its customer network includes major luxury jewelry brands and global diamond distributors across North America, Europe, the Middle East, and the Asia Pacific region.

-

ALROSA, founded in 1992, is Russia’s largest diamond mining company and the world’s top producer of rough diamonds by volume. The company operates major mining assets across Yakutia and the Arkhangelsk region, using advanced geological exploration and mining technologies to support long-term resource sustainability. ALROSA plays a crucial role in supplying high-quality rough stones to the global polishing and jewelry markets, partnering with leading cutting centers in Belgium, India, China, and the UAE. Its diversified client base includes global diamond manufacturers and luxury jewelry houses.

-

Rio Tinto Diamonds, established as part of the Rio Tinto Group in 1873, is a major global producer of diamonds known for operating premium mines such as Argyle and Diavik. The company is highly regarded for its portfolio of rare and premium diamonds, including pink, yellow, and champagne stones, which have strong demand in the luxury jewelry sector. Rio Tinto integrates sustainable mining practices, digital traceability solutions, and supply-chain transparency to enhance consumer confidence in ethically sourced natural diamonds. Its customers include premium jewelry brands, diamond polishing centers, and certified global trading networks.

Key Diamond Companies:

The following are the leading companies in the diamond market. These companies collectively hold the largest market share and dictate industry trends.

- ALROSA

- Anglo American plc.

- Debswana Diamond Company Ltd.

- De Beers Group

- Dominion Diamond Corporation

- Gem Diamonds

- Lucara Diamond Corporation

- Petra Diamonds

- Rio Tinto Diamonds

- Rockwell Diamonds

Recent Developments

-

In October 2025, De Beers launched the GemFair Digital Traceability Program, expanding blockchain-based tracking from mine to retail store. This initiative enables buyers to verify the ethical origin of every diamond, supporting stronger compliance with global responsible-sourcing frameworks and enhancing consumer confidence in natural diamonds.

-

In June 2025, ALROSA completed the commercial rollout of its AI-powered grading and sorting technology, improving precision in rough-diamond classification and accelerating auction readiness. The upgrade is expected to reduce processing time by 22% and increase the overall value yield from each mined batch.

-

In March 2025, Rio Tinto announced the launch of its Select Diamantaire Partnership Program, providing preferred buyers with direct access to premium stones, including rare fancy-color diamonds. The program is intended to strengthen supply chain stability, enhance price transparency, and secure long-term offtake agreements with top polishing and jewelry houses.

Diamond Market Report Scope

Report Attribute

Details

Market definition

The market size reflects the annual value of diamond demand across jewelry, ornamental, and industrial uses.

Market size value in 2026

USD 44.06 billion

Revenue forecast in 2033

USD 53.16 billion

Growth rate

CAGR of 2.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2026 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil

Key companies profiled

ALROSA; Anglo American plc.; Debswana Diamond Company Ltd.; De Beers Group; Dominion Diamond Corporation; Gem Diamonds; Lucara Diamond Corporation; Petra Diamonds; Rio Tinto Diamonds; Rockwell Diamonds

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diamond Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global diamond market report by type, application, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural

-

Synthetic

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Jewelry & Ornaments

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global diamond market size was estimated at USD 42.74 billion in 2025 and is projected to reach USD 44.06 billion by 2026.

b. The global diamond market is expected to grow at a compound annual growth rate of 2.7% from 2026 to 2033 to reach USD 53.16 billion by 2033.

b. By type, the natural diamond held over 71.0% of the revenue share of the global market in 2025.

b. Some of the key vendors in the global diamond market include ALROSA, Anglo-American plc.; Debswana Diamond Company Ltd.; De Beers Group; Dominion Diamond Corporation; Gem Diamonds; Lucara Diamond Corporation; Petra Diamonds; Rio Tinto Diamonds; Rockwell Diamonds, and others.

b. The key factor driving the growth of the global diamond market is the rising consumer demand for luxury jewellery supported by increasing disposable incomes, especially in emerging economies. Growing brand-driven and personalized bridal trends are further amplifying purchases across both natural and lab-grown segments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.