- Home

- »

- Consumer F&B

- »

-

Digestive Health Supplements Market Size Report, 2033GVR Report cover

![Digestive Health Supplements Market Size, Share & Trend Report]()

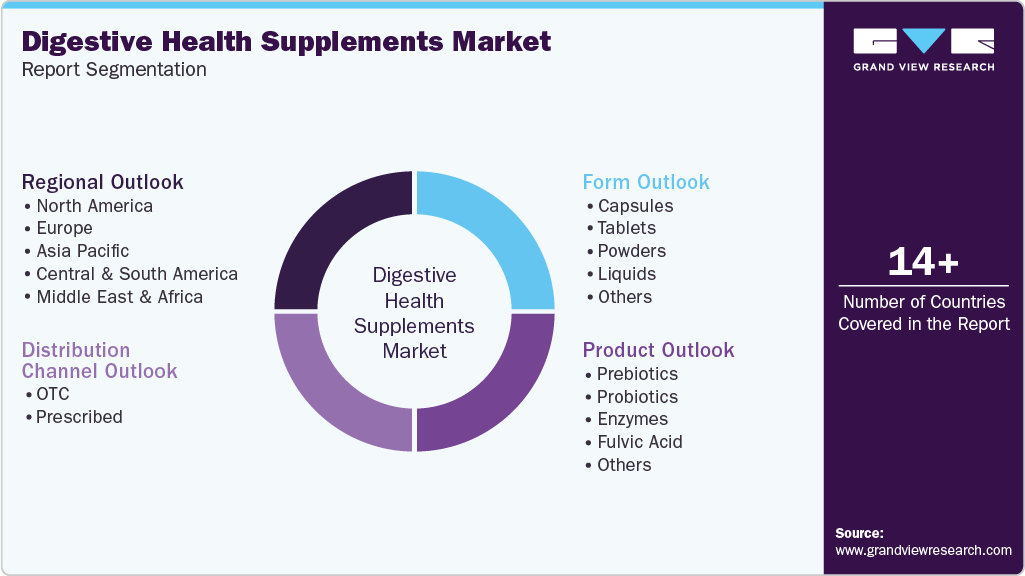

Digestive Health Supplements Market (2025 - 2033) Size, Share & Trend Analysis Report By Product (Prebiotics, Probiotics), By Form (Capsules, Tablets), By Distribution Channel (Over-the-counter (OTC), Prescribed), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-998-2

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digestive Health Supplements Market Summary

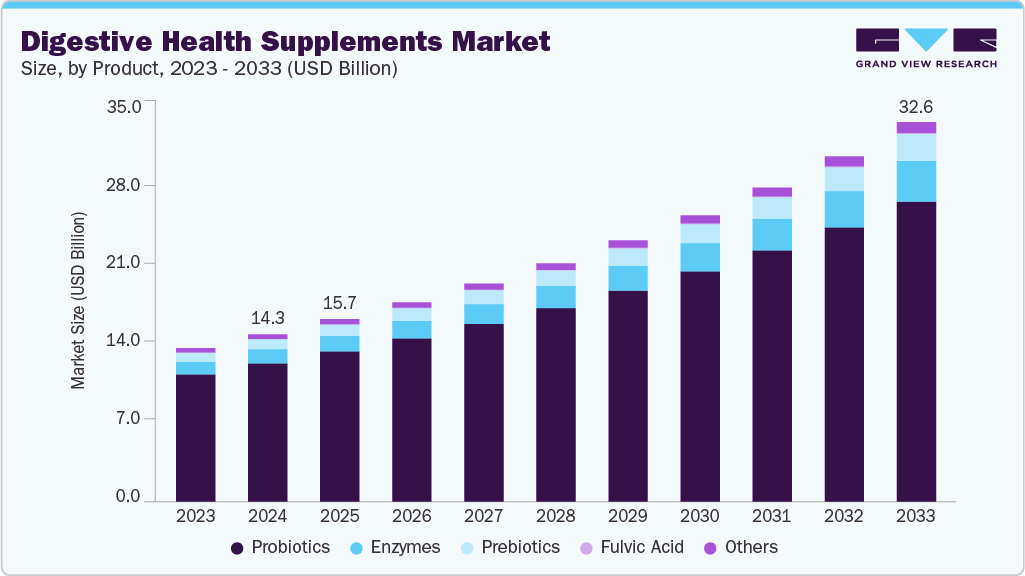

The global digestive health supplements market size was estimated at USD 14,357.7 million in 2024 and is projected to reach USD 32,579.2 million by 2033, growing at a CAGR of 9.6% from 2025 to 2033. The rising trend of fitness and sports nutrition is influencing the digestive health supplements industry.

Key Market Trends & Insights

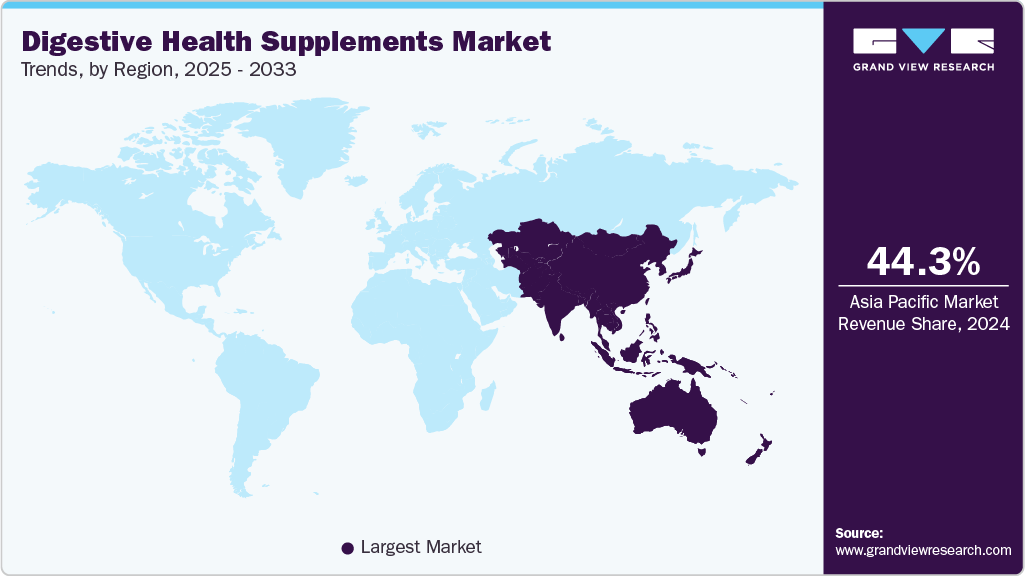

- Asia Pacific held the largest share of the digestive health supplements market in 2024, accounting for 44.3%.

- The Middle East & Africa digestive health supplements market is expected to experience a CAGR of 10.2% over the forecast period.

- By product, the probiotics segment held the largest share of 82.6% in 2024.

- By form, the liquids digestive health supplements segment is poised to witness a CAGR of 11.1% over the forecast period.

- The OTC segment held the largest market share of 73.8% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 14,357.7 Million

- 2033 Projected Market Size: USD 32,579.2 Million

- CAGR (2025-2033): 9.6%

- Asia Pacific: Largest market in 2024

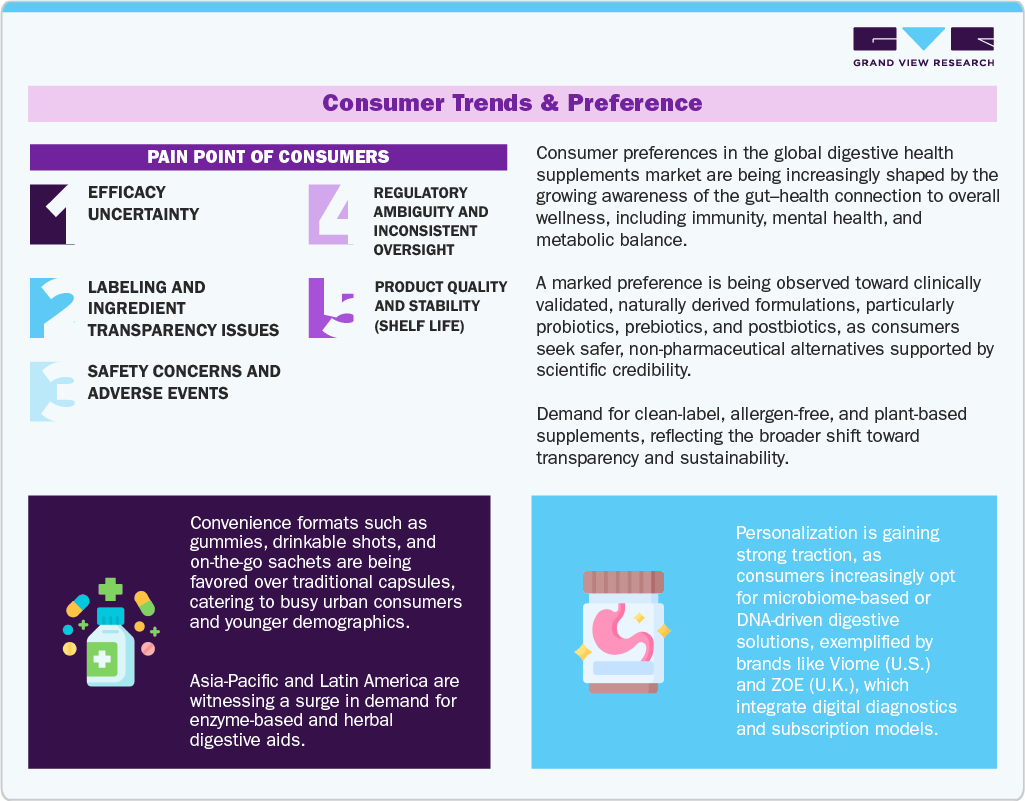

There is an increasing demand for supplements that enhance performance, aid in muscle recovery, and promote overall physical well-being, driven by a growing population of fitness enthusiasts and athletes. The digestive health supplements market is also seeing a rise in demand for products that promote mental well-being. Consumers are becoming more aware of the connection between nutrition and mental health. As a result, there has been an increased interest in supplements that can aid in cognitive function, stress management, and mood enhancement.The rising prevalence of digestive issues can be attributed to sedentary lifestyles, the adoption of Western diets rich in processed foods, and the increasing stressors of modern life. It includes conditions such as Irritable Bowel Syndrome (IBS), Inflammatory Bowel Diseases (IBD), acid reflux, and functional dyspepsia, which have become increasingly common and are affecting a significant portion of the global population.

According to a report by the United European Gastroenterology (UEG) in 2023, Gastrointestinal (GI) and liver disorders have a significant impact on the people of Europe, causing nearly one million deaths each year across all age groups. These conditions are associated with significant morbidity and healthcare expenses. The incidence and prevalence of many GI disorders are highest among the young and elderly, and as Europe's population ages, the disease burden is expected to increase.

Digestive health supplements are formulated with key ingredients, such as probiotics, prebiotics, fiber, and specific vitamins. Probiotics are beneficial bacteria that help to maintain a balanced gut microbiome, supporting optimal digestive function. Prebiotics provide nourishment for the beneficial bacteria, promoting their growth and activity. Fibers aid in regular bowel movements and support a healthy gut environment.

Specific vitamins, like those associated with immune health or stress reduction, may also be included in these supplements to address broader health concerns related to gastrointestinal well-being. Over the years, people have begun considering their pets as an integral part of their family, and this has propelled the demand for natural, nutritious, and healthy food supplements essential for the overall growth and well-being of companion animals.

Consumer Insights for Digestive Health Supplements Market

Product Insights

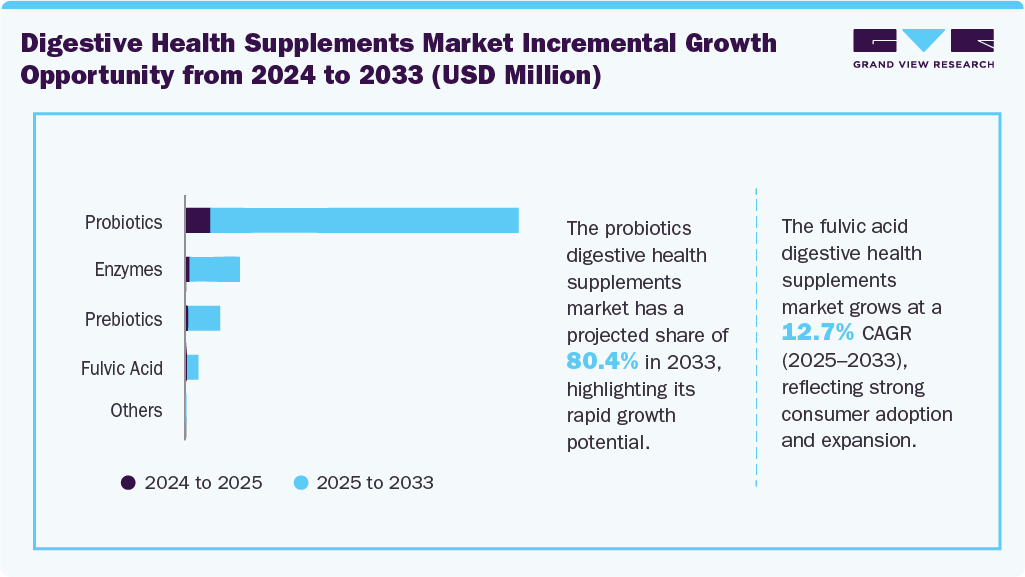

The probiotics digestive health supplements market accounted for the largest share of 82.6% of the revenue in 2024. The prevalence of gastrointestinal disorders, including irritable bowel syndrome (IBS) and inflammatory bowel diseases, has a crucial and diverse function in maintaining a healthy gut microbiome. The efficacy of probiotics in alleviating symptoms and promoting gut health aligns with the growing consumer inclination towards functional and preventive healthcare solutions. It is particularly evident among the geriatric population, who have a heightened awareness of digestive health issues.

The fulvic acid segment is projected to grow at the fastest CAGR of 12.7% from 2025 to 2033. The escalating interest in natural and plant-based solutions is shaping consumer preferences, driving the demand for fulvic acid supplements. Fulvic acids, sourced from organic materials, have gained popularity due to their alignment with the clean-label trend. Besides, their perceived natural qualities have made them appealing to consumers who value transparent and authentic products.

Form Insights

The capsules digestive health supplements accounted for the largest share of 41.2% of the revenue in 2024. The preference for easy-to-consume and on-the-go solutions contributes to the popularity of capsule supplements. The encapsulation format provides a convenient and portable option for consumers with busy lifestyles. It allows them to support their digestive health and immunity without adhering to complex routines. This aligns with the broader trend of consumers seeking wellness solutions that seamlessly integrate into their daily lives.

The liquids segment is projected to grow at the fastest CAGR of 11.1% from 2025 to 2033. Liquid formulations are often designed for rapid absorption, ensuring that the active ingredients are efficiently delivered into the bloodstream. This focus on bioavailability provides quick and effective results, enhancing the perceived efficacy of liquid formulations in promoting digestive health and immune support.

Distribution Channel Insights

The digestive health supplements market through Over-the-counter (OTC) accounted for the largest share of around 73.8% of the global revenue in 2024. The widespread availability of digestive health supplements in these retail outlets makes it easier for consumers to incorporate these products into their daily routines. Moreover, the diverse range of options and competitive pricing in hypermarkets and supermarkets contribute to the segment's growth, appealing to a broad spectrum of consumers with varying preferences and budgets.

The prescribed distribution channel is projected to grow at a significant CAGR of 8.6% from 2025 to 2033. Growth in the prescribed digestive health supplements is being primarily driven by the increasing medical recognition of gut health as a determinant of systemic wellness and its linkage to chronic conditions such as irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), lactose intolerance, and antibiotic-associated dysbiosis.

Regional Insights

The North America digestive health supplements industry accounted for the revenue share of 24.1% in 2024. The market is experiencing notable growth, driven by an increasing awareness of the health benefits associated with digestive health supplements. Consumers in North America are increasingly becoming proactive about their health. A major proportion of the population is focusing on physical fitness and bodily well-being. This awareness fosters a focus on preventative measures, including the use of digestive health supplements to address digestive tract issues. In addition, the easy availability of these supplements in supermarkets, pharmacies, and e-commerce platforms boosts market growth.

U.S. Digestive Health Supplements Market Trends

The U.S. digestive health supplements industry led the North American market in 2024, holding the largest market share with 70.5% (of the region’s total revenue). A large population prefers consumption of ultra-processed food and sugar-rich beverages. This has resulted in two-thirds of Americans experiencing gut-related issues, as per a study by MDVIP and Ipsos conducted in March 2023. A predominance of obesity, digestive system disorders, and lifestyle-related diseases on account of poor eating habits may further lead to serious issues such as diabetes and heart disease. High consumption of over-processed, high-sodium content, and junk foods has led to over half of the American population consuming OTC digestive products to address associated disorders, leading to increased demand.

Europe Digestive Health Supplements Market Trends

The digestive health supplements industry in Europe held the market share of 21.8% in 2024. A busy lifestyle in Europe has led to the rapid emergence of several fast food chains. The increased consumption of junk food from these outlets can lead to digestive tract issues. According to a report from the United European Gastroenterology (UEG), over 330 million people in Europe are living with gut-related disorders. With an aging population, this number is expected to increase steadily. Unattended ailments may lead to more serious health issues, such as cancer, which drives the demand for preventive medication, including digestive supplements.

The UK digestive health supplements industry presents promising opportunities in the regional landscape. A large population in the UK is experiencing digestive problems such as coeliac disease, irritable bowel syndrome (IBS), and acid reflux. This creates a strong demand for external enzymes that can alleviate symptoms and improve digestive functioning. Digestive health supplements cater to this need, offering targeted solutions for various gut-related concerns. Additionally, a robust distribution network of supermarkets and advertising efforts by manufacturers help maintain a steady demand for these products.

Asia Pacific Digestive Health Supplements Market Trends

The digestive health supplements industry in the Asia Pacific accounted for a 44.3% market share in 2024. The region is poised to expand at the fastest CAGR of 12.0% from 2025 to 2033. Asia Pacific is experiencing a rise in digestive health problems such as bloating, constipation, irritable bowel syndrome, and cholecystitis. This is partly due to a shift towards a Western diet that is high in processed foods, saturated fats, bread, and sodium in salty snacks. Urbanization and changing lifestyles in these countries are significant contributors to market growth. Rising disposable income enables consumers to invest in preventive healthcare and prioritize digestive well-being, resulting in strong demand for digestive health supplements.

The India digestive health supplements industry held the market share of 8.4% in 2024. India has witnessed an accelerated adoption of the western culture in recent years. This is primarily reflected in food habits. Global restaurant chains are expanding their base in major Indian cities. With significant disposable income, people are buying ultra-processed food items that are packed with preservatives. An increasingly sedentary lifestyle further fuels the issue of gut health, leading to a steady rise in the number of patients having digestive problems. These factors combine to fuel the demand for digestive supplements and propel market growth in India.

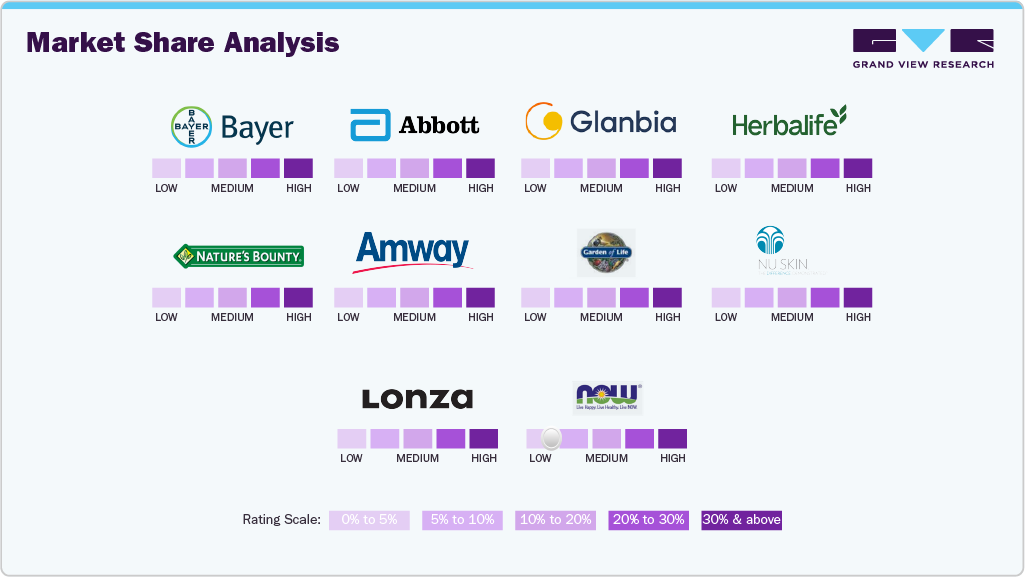

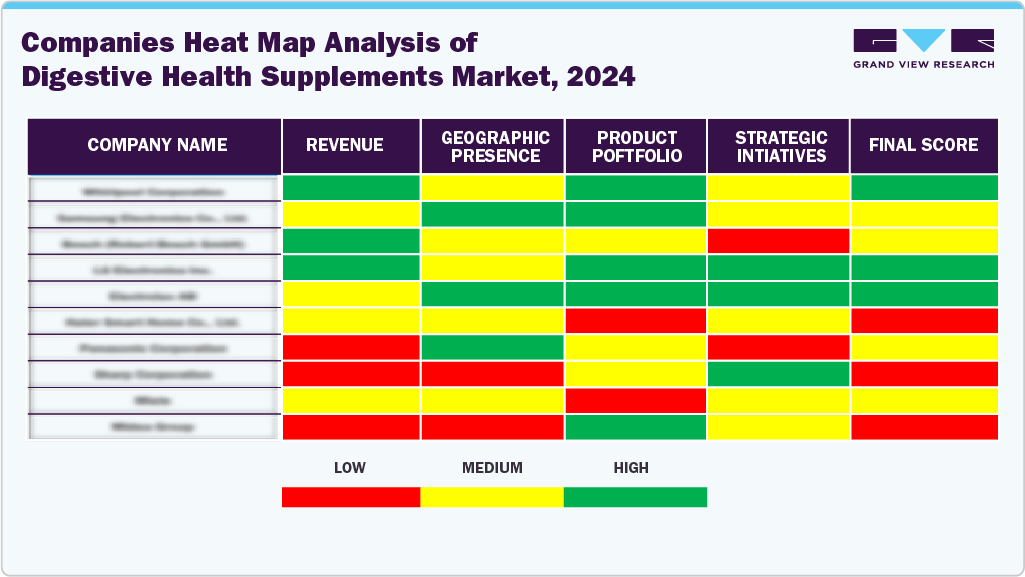

Key Digestive Health Supplements Company Insights

Some key companies involved in the global digestive health supplements market include Abbott, Glanbia plc, and Amway Corporation.

-

Abbott is an American multinational healthcare and medical devices company. The company offers a range of digestive medications under the name Pankreoflat digestive enzyme liquid, tablets, creon tablets, cremaffin liquid, glucerna, combinorm, and digene to address various digestion and pancreatic enzyme-related disorders.

-

Amway offers products in the areas of personal care, beauty, nutrition, and homecare. The company markets its digestive enzymes under the brand Nutrilite. It is available in capsule form and supports the body’s normal digestion of carbohydrates, protein, and dairy. Amway offers products made from natural ingredients to address liver-related issues under the same brand.

Key Digestive Health Supplements Companies:

The following are the leading companies in the digestive health supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Abbott

- Glanbia plc

- Herbalife Nutrition Ltd.

- Nature’s Bounty

- Amway Corporation

- Garden of Life

- NU SKIN

- Lonza Group Ltd.

- NOW Foods

Recent Developments

-

In April 2024, Bayer Consumer Health announced the launch of the plant-based digestive health product Iberogast in the United States. The product consists of a proprietary six-herb blend. It leverages natural powers to offer dual-action relief for individuals experiencing occasional digestive symptoms, relieving stomach upsets and restoring their digestive function.

-

In August 2023, Herbalife announced the launch of the Herbalife V plant-based supplement line. These products have been verified non-GMO, certified USDA Organic, certified kosher, and certified vegan and plant-based by FoodChain ID. The line consists of plant-based protein shakes with 20 grams of protein; a greens booster prepared using organic fruits and vegetables, green tea, and superfood powders; a formula for supporting immune health containing vitamins C & D and zinc; and a digestive health formula incorporating guar fiber and oat.

Digestive Health Supplements Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 15,665.6 million

Revenue Forecast in 2033

USD 32,579.2 million

Growth Rate (Revenue)

CAGR of 9.6% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative (Revenue) units

Revenue in USD Million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Sweden; Netherlands; Spain; Denmark; China; Japan; Australia & New Zealand; Hong Kong; Singapore; India; Brazil; South Africa; UAE

Key companies profiled

Abbott; Glanbia plc; Amway Corp.; Bayer AG; Herbalife Nutrition Ltd.; Nature’s Bounty; Garden of Life; NU SKIN; Lonza Group Ltd.; NOW Foods

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digestive Health Supplements Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global digestive health supplements market report on the basis of product, form, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Prebiotics

-

Probiotics

-

Enzymes

-

Fulvic Acid

-

Others

-

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules

-

Tablets

-

Powders

-

Liquids

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

OTC

-

Supermarkets/Hypermarkets/Food Stores

-

Drug Stores & Pharmacies

-

Convenience Stores

-

Online

-

Others

-

-

Prescribed

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Netherlands

-

Denmark

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia & New Zealand

-

Hong Kong

-

Singapore

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global digestive health supplements market size was estimated at USD 14,357.7 million in 2024 and is expected to reach USD 15,665.6 million in 2025.

b. The global digestive health supplements market is expected to witness 9.6% revenue growth from 2025 to 2033 to reach USD 32,579.2 million by 2033.

b. Asia Pacific region dominated the digestive health supplements market with a revenue share of 44.3% in the year 2024. Urbanization and changing lifestyles in these countries are major contributing factors to market growth.

b. The key market players in the digestive health supplements market includes Bayer AG, Abbott, Glanbia plc, Herbalife Nutrition Ltd., Nature’s Bounty, Amway Corporation, Garden of Life, NU SKIN, Lonza Group Ltd., NOW Foods

b. The rising trend of fitness and sports nutrition is influencing the digestive health supplements industry. There is an increasing demand for supplements that enhance performance, aid in muscle recovery, and promote overall physical well-being, driven by a growing population of fitness enthusiasts and athletes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.