- Home

- »

- Next Generation Technologies

- »

-

Digital Advertising Market Size, Share, Industry Report, 2030GVR Report cover

![Digital Advertising Market Size, Share & Trends Report]()

Digital Advertising Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform (Computer, Smartphone), By Format (Text, Image, Video), By Offering (Solution, Services), By Type (Search Advertising, Banner Advertising), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-166-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Advertising Market Summary

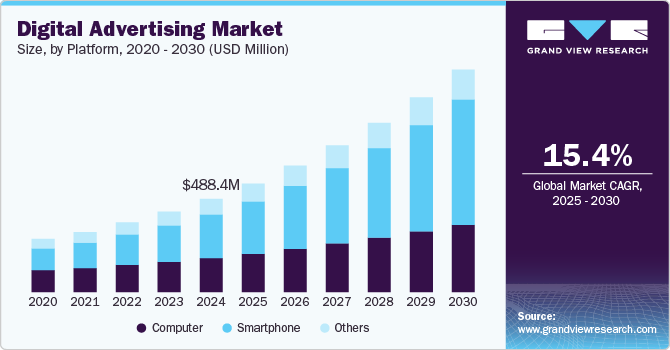

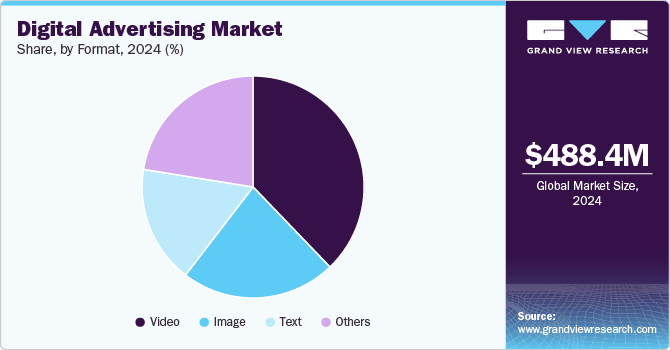

The global digital advertising market size was estimated at USD 488.4 million in 2024 and is projected to reach USD 1,164.25 million by 2030, growing at a CAGR of 15.4% from 2025 to 2030. Video advertising continues to grow in importance as consumers prefer engaging with video content over static ads.

Key Market Trends & Insights

- North America's digital advertising market is anticipated to account for the highest revenue share, over 31% in 2024

- By format, the video segment recorded the largest revenue share in 2024.

- By offering, the solution segment recorded the largest revenue share in 2024.

- By type, the search advertising segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 488.4 Million

- 2030 Projected Market Size: USD 1,164.25 Million

- CAGR (2025-2030): 15.4%

- North America: Largest market in 2024

Platforms like YouTube, Instagram, and TikTok are increasingly becoming the go-to for advertisers looking to reach a broad audience through dynamic video content. Short-form videos are gaining traction, as they capture consumer attention quickly and efficiently. Digital advertising will continue to see a dominance of video as brands recognize the effectiveness of visual storytelling.

Influencer marketing is a rapidly expanding trend within digital advertising, as brands leverage influencers promote products authentically to niche audiences. Social media platforms like Instagram, YouTube, and TikTok provide a rich environment for influencer collaborations, making them key in expanding brand reach. With a growing preference for organic, relatable content, many businesses are now turning to micro and nano-influencers for more personalized engagement. Digital advertising’s reliance on influencers will keep growing as more brands prioritize social proof and trust-building.

With increasing concerns about data privacy, digital advertising is shifting towards more transparent and compliant practices. Regulations like GDPR and CCPA are forcing businesses to rethink how they collect, store, and use customer data. Consumers are now more aware of their data rights, leading brands to find new ways to engage with their audiences while respecting privacy. This shift will push the digital advertising industry to prioritize data protection and ethical advertising practices.

Interactive and immersive ad formats, such as augmented reality (AR) and virtual reality (VR), are gaining popularity in digital advertising. These formats offer consumers a more engaging experience by allowing them to interact with products or services before making a purchase decision. Brands are increasingly integrating these technologies into campaigns, especially in the gaming and retail sectors, where they can create virtual try-ons or product demonstrations. The growing use of AR and VR in digital advertising is expected to revolutionize consumer interactions with brands.

With mobile devices becoming the primary means of accessing the internet, digital advertising is increasingly focusing on mobile-first strategies. Marketers are optimizing their campaigns for mobile users by creating ads that are responsive and easy to view on smaller screens. Mobile advertising platforms, such as social media apps and search engines, provide advertisers with advanced targeting capabilities to reach consumers on-the-go. As mobile usage continues to rise, mobile-first digital advertising strategies will be essential for brands seeking to connect with their audience.

Voice search and smart speakers are transforming how consumers interact with digital advertising. As the use of voice-activated devices like Amazon’s Alexa and Google Home grows, advertisers are exploring new ways to engage users through voice search optimization and voice-activated ads. Brands are adapting by creating content that is conversational and tailored to voice search queries. Digital advertising will continue to evolve with this trend, as marketers develop strategies that fit the natural flow of voice commands.

Platform Insights

The smartphone segment recorded the largest revenue share of over 46% in 2024. The smartphone segment in digital advertising is experiencing significant growth as mobile devices have become the primary tool for consumers to access content, shop, and interact with brands. Advertisers are increasingly focusing on mobile-first strategies, optimizing their campaigns for smaller screens, and using features like location targeting, push notifications, and in-app advertisements. With the rise of social media platforms and mobile commerce, smartphones offer advertisers unparalleled opportunities to engage users in real time. The shift toward mobile-driven experiences is pushing companies to create more personalized and interactive ads, resulting in higher engagement rates and faster purchasing decisions. As smartphone usage continues to dominate, this segment will remain critical in shaping the future of digital advertising.

The computer segment is projected to register the highest CAGR of over 11% from 2025 to 2030. The computer segment in digital advertising is seeing continuous growth as businesses increasingly rely on advanced computing technologies to enhance their marketing efforts. With the rise of AI, machine learning, and big data analytics, companies are using powerful computer systems to optimize ad targeting, personalize content, and analyze vast amounts of consumer data. These technologies enable businesses to make data-driven decisions, automate processes, and improve the efficiency of their campaigns. Additionally, advancements in computer processing power allow for more sophisticated ad formats, such as interactive ads and dynamic content, which engage users more effectively and drive better results. As technology continues to advance, the computer segment will remain a key enabler of innovation in the digital advertising industry.

Format Insights

The video segment recorded the largest revenue share in 2024. driven by the powerful influence of video ads on audiences. Many businesses are increasingly utilizing engaging video content to build brand awareness across multiple platforms, particularly social media channels like YouTube, Instagram, Facebook, and TikTok. Short-form video ads, such as how-to guides and customer testimonials, allow companies to effectively position their products in the market. Additionally, video ads have a broader reach, offering more opportunities to engage with target audiences and accelerate purchasing decisions.

The text segment is projected to register the significant CAGR from 2025 to 2030. The segmental growth is fueled by the rising adoption of AR applications across multiple sectors. Organizations are recognizing the value of AR software for enhancing training simulations, facilitating remote assistance, and creating immersive experiences in gaming and retail. As businesses continue to invest in digital transformation and seek ways to improve operational efficiency and user engagement, the demand for AR software is expected to grow significantly in the coming years.

Offering Insights

The solution segment recorded the largest revenue share in 2024. The solution segment in digital advertising is experiencing significant growth as businesses increasingly seek comprehensive, integrated platforms to manage and optimize their campaigns. As advertisers face the complexities of multichannel marketing, they are turning to solution providers that offer end-to-end services, from content creation to data analytics and campaign optimization. These platforms enable companies to streamline their advertising efforts, enhance targeting precision, and improve ROI by consolidating data and insights in one place. Additionally, the growing demand for AI-driven solutions that can automate processes like ad bidding, content personalization, and audience segmentation is further driving this trend. As companies continue to prioritize efficiency, scalability, and performance, the solution segment is expected to play a pivotal role in shaping the future of digital advertising.

The services segment is projected to register a highest CAGR from 2025 to 2030. The services segment in digital advertising is rapidly evolving as businesses increasingly turn to specialized agencies and technology providers for expertise in managing their advertising campaigns. These services include campaign strategy, creative development, data analytics, and performance optimization, helping brands effectively navigate the complex digital landscape. With the growing demand for personalized customer experiences, service providers are offering tailored solutions that leverage advanced targeting and automation tools. As competition intensifies and customer expectations rise, the services segment is essential for businesses looking to enhance their ad performance and drive higher engagement and conversions.

Type Insights

The search advertising segment accounted for the largest revenue share in 2024. This advertising format allows businesses to monitor their campaigns, measure success rates, and track user interactions with ads. These insights enable companies to optimize their strategies by selecting the most effective keywords and planning future campaigns. Additionally, search engines provide advertisers with the ability to target specific audience characteristics such as age, gender, and location, enabling the creation of highly tailored ads. These advantages are driving growth in the search advertising segment.

The interstitial advertising segment is anticipated to record the highest CAGR from 2025 to 2030. Interstitial ads are full-screen advertisements displayed at natural transition points within an app, such as after completing a task or between activities. Their engaging and eye-catching format results in higher click-through rates, which, in turn, contribute to greater conversion rates. This effectiveness in capturing user attention and prompting action is fueling demand for interstitial advertising and driving growth in this segment.

End Use Insights

The retail segment accounted for the largest revenue share in 2024, This growth is driven by retailers increasingly leveraging digital channels such as websites, search engines, social media, and email to promote their products and engage with customers. These platforms enable retailers to expand their reach, personalize their messaging, and enhance customer engagement. For instance, in August 2023, Walmart expanded its digital advertising capabilities by displaying targeted ads from third-party brands on screens in its self-checkout lanes, allowing advertisers to choose specific locations or regions for their campaigns.

The education segment is anticipated to record the highest CAGR from 2025 to 2030. Educational institutions recognize the growing importance of digital advertising to enhance their online presence, broaden their reach, and attract students. The increased use of social media for marketing educational services, along with the rising demand for online and distance learning, presents significant growth opportunities in this sector. A notable example is the May 2023 launch of Versity, an online professional development platform created by Endeavor and Harvard University. Such initiatives are expected to drive demand for digital advertising solutions in the education sector, fueling continued growth in this segment over the forecast period.

Regional Insights

North America's digital advertising market is anticipated to account for the highest revenue share, over 31% in 2024. E-commerce continues to thrive in North America, with a growing trend in digital shopping ads across platforms like Google, Amazon, and social media. Brands are increasingly leveraging these platforms to create targeted and interactive shopping experiences, integrating products directly into ads for seamless purchasing. The rise of mobile shopping also drives this trend, pushing businesses to adapt ads for a mobile-first experience. As consumers become more accustomed to online shopping, these types of digital ads are expected to become even more essential for brands.

U.S. Digital Advertising Market Trends

The U.S. digital advertising market held a dominant position in 2024, Data privacy continues to be a critical focus in the U.S., as consumers demand more transparency and control over their personal data. Laws such as CCPA are pushing businesses to adopt clearer data policies, and there is an increasing trend towards privacy-conscious advertising practices. Advertisers are prioritizing first-party data and moving away from third-party data sources to ensure compliance while maintaining trust with consumers. This trend also aligns with the rise of privacy-focused advertising solutions, such as contextual targeting, which don't rely on personal data.

Europe Digital Advertising Market Trends

European digital advertising market is expected to grow at a CAGR of over 14% from 2025 to 2030, In Europe, sustainability is becoming a key focus in digital advertising as both consumers and businesses increasingly prioritize environmental responsibility. Brands are using green advertising strategies to promote eco-friendly products and services, aligning their values with the growing demand for sustainable solutions. The European market is particularly responsive to these efforts, with consumers more likely to engage with brands that are transparent about their sustainability efforts. This trend is expected to continue gaining momentum as climate-conscious behaviors influence purchasing decisions.

The UK digital advertising market is expected to grow rapidly in the coming years, In the UK, there is a growing focus on contextual advertising as companies adapt to increased privacy regulations and the phasing out of third-party cookies. Contextual targeting allows advertisers to serve ads based on the content a user is consuming, rather than relying on personal data. This approach aligns with stricter privacy laws like GDPR, which emphasize user consent and data transparency. Brands are focusing on providing value through relevant, non-invasive advertising that respects consumer privacy.

Germany, known for its strong commitment to sustainability, is seeing a rise in ethical and eco-conscious advertising. Brands are increasingly aligning their messaging with environmental values, focusing on sustainability and responsible consumption. German consumers are highly responsive to brands that promote eco-friendly products, and digital advertising campaigns that emphasize environmental responsibility are gaining traction. This trend aligns with broader societal movements toward sustainability and is expected to shape the future of advertising in Germany.

Asia Pacific Digital Advertising Market Trends

The Asia-Pacific digital advertising market is projected to grow at the highest CAGR, of over 17% from 2025 to 2030. In the Asia Pacific region, mobile and video advertising are leading trends, with advertisers increasingly tailoring their content to fit mobile-first experiences. With the surge in mobile device use across markets, including China and India, short-form video content on platforms like TikTok and WeChat has become a dominant format for reaching audiences. This mobile-first strategy is also spurred by the rise in mobile commerce, where users are purchasing directly from their mobile devices.

The Japan digital advertising market is expected to grow rapidly in the coming years. In Japan, brands are increasingly adopting omnichannel marketing strategies, combining digital advertising with traditional media like TV, print, and outdoor advertising. The goal is to create seamless customer experiences across multiple touchpoints, both online and offline. This trend is particularly effective in Japan’s highly tech-savvy market, where consumers expect consistency in messaging across all platforms. With the rise of digital shopping and mobile-first behaviors, brands are focusing on synchronized campaigns to maximize reach and impact.

The China digital advertising market held a substantial market share in 2024. In China, super apps like WeChat and Alipay dominate, offering integrated services that blend social media, messaging, e-commerce, and mobile payments. These platforms are central to digital advertising strategies, enabling advertisers to target users based on their activities across various services. The rise of super apps also means that brands can use a single platform to reach consumers through multiple touchpoints, including shopping, gaming, and content consumption. As these platforms evolve, they offer even more sophisticated tools for advertisers to deliver hyper-targeted ads.

Key Digital Advertising Company Insights

Some of the key players operating in the market include Adobe, Microsoft Corporation, among others.

-

Adobe is a global leader in creative software and digital marketing solutions, providing a wide array of tools for advertisers. The company specializes in helping businesses create, manage, and optimize their digital content across various platforms, including websites, social media, and mobile. Through Adobe Experience Cloud, Adobe offers analytics, personalization, and advertising tools designed to enhance customer experiences and drive marketing performance. Its long-established presence in the market makes it a mature and trusted name in digital advertising.

-

Microsoft Corporation has a well-established digital advertising division, primarily through its search engine Bing and Microsoft Advertising platform. The company specializes in providing search and display advertising solutions, leveraging its vast user base across various digital products like LinkedIn and Office 365. Microsoft’s advertising offerings allow brands to target audiences based on search behavior, professional demographics, and more. Its integration with other Microsoft products makes it a powerful tool for advertisers aiming to reach diverse and highly engaged users.

Some of the emerging market players in the global digital advertising industry include Byte Dance. and Disruptive, among others

-

ByteDance specializes in social media and content creation, with its flagship platform TikTok leading the charge in short-form video content. The company focuses on leveraging AI to personalize content and advertising, making it highly attractive for brands targeting younger, engaged audiences. ByteDance has also expanded its advertising services, providing businesses with innovative ways to connect with global users through immersive, creative ads. The company's rapid growth and disruptive potential have made it a major player in the digital advertising space.

-

Disruptive Advertising is a digital marketing agency that specializes in performance-driven strategies, helping businesses optimize their online advertising efforts. The company focuses on improving return on investment (ROI) through tailored PPC (pay-per-click) campaigns, search engine optimization (SEO), and social media advertising. By leveraging data analytics and optimization techniques, Disruptive Advertising aims to ensure clients' ad budgets are spent efficiently. Their specialized services cater to businesses seeking to boost digital sales and leads.

Key Digital Advertising Companies:

The following are the leading companies in the digital advertising market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Amazon.com Inc.

- AOL (Yahoo)

- Baidu

- ByteDance

- Dentsu Inc.

- Disruptive Advertising

- Globo

- IAC

- Meta

- Microsoft Corporation

- Tencent Holdings Ltd.

- Verizon

- WebFX

- X Corp. (formerly Twitter Inc.)

Recent Developments

-

In May 2023, Google, Inc. expanded its collaboration with SAP SE to introduce a comprehensive open data solution. This solution will enable customers to build a complete data cloud, integrating data from their enterprise systems via SAP Datasphere and Google’s data cloud. It also provides businesses with the ability to monitor their real-time data, optimizing their investments in Google Cloud and SAP software.

-

In May 2023, Google, Inc. announced its plans to incorporate generative AI features into its products, including Search and Gmail. Additionally, Google will leverage PaLM 2-powered tools to assist advertisers in creating media content and generating YouTube video ideas. The company is also experimenting with providing creators with five video ideas based on specific topics.

-

In January 2023, Twitter entered a partnership with Integral Ad Science and DoubleVerify Holdings Inc. to offer advertisers detailed insights into the content displayed alongside their ads. This collaboration will provide tweet-level analysis and ensure independent verification that ads are being viewed by real users. The partnership aims to enhance transparency and improve ad effectiveness.

Digital Advertising Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 567.9 million

Revenue forecast in 2030

USD 1,164.25 million

Growth rate

CAGR of 15.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, Format, Offering, Type, End Use, And Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

Amazon.com Inc.; Dentsu Inc.; Microsoft Corporation; Meta; Adobe; Baidu; AOL (Yahoo); Tencent Holdings Ltd.; ByteDance; Verizon; IAC; WebFX; Disruptive Advertising; Globo; X Corp. (formerly Twitter Inc.)

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Advertising Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital advertising market report based on platform, format, offering, type, end use, and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Computer

-

Smartphone

-

Others

-

-

Format Outlook (Revenue, USD Billion, 2018 - 2030)

-

Text

-

Image

-

Video

-

Others

-

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Search Advertising

-

Banner Advertising

-

Video Advertising

-

Social Media Advertising

-

Native Advertising

-

Interstitial Advertising

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Automotive

-

IT & Telecommunication

-

Healthcare

-

Consumer Electronics

-

Retail

-

Media & Entertainment

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the digital advertising market include Amazon.com Inc., Microsoft, Meta, Adobe, Baidu, Google LLC AOL (Yahoo), Tencent Holdings Ltd., ByteDance, Verizon, IAC, WebFX, Disruptive Advertising, IBM Corporation, X Corp. (formerly Twitter Inc.)

b. Key factors that are driving the digital advertising market growth include growing internet and smartphone penetration, increasing prominence of social media platforms, expansion of e-commerce sector, and technological advancements to include AI, ML, and analytics.

b. The global digital advertising market size was estimated at USD 488.40 billion in 2024 and is expected to reach USD 567.85 billion in 2025.

b. The global digital advertising market is expected to grow at a compound annual growth rate of 15.4% from 2025 to 2030 to reach USD 1,164.25 billion by 2030.

b. North America dominated the digital advertising market with a share of over 31% in 2024. This is attributable to higher smartphone usage, the growing popularity of mobile streaming services, and considerable demand for e-commerce platforms in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.