- Home

- »

- Next Generation Technologies

- »

-

Digital Business Support System Market Size Report, 2030GVR Report cover

![Digital Business Support System Market Size, Share & Trends Report]()

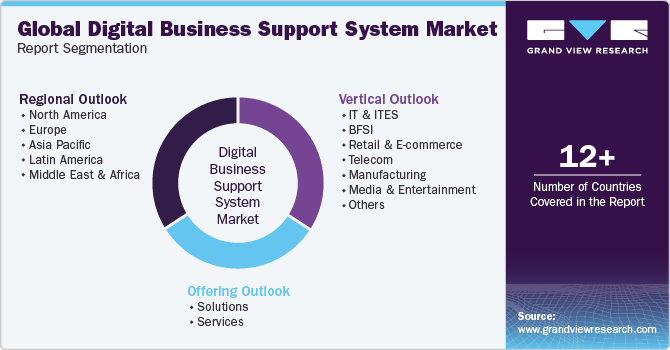

Digital Business Support System Market (2023 - 2030) Size, Share & Trends Analysis Report By Offering (Solutions, Services), By Vertical (IT And ITES, BFSI, Retail & E-commerce, Telecom, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-149-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Business Support System Market Summary

The global digital business support system market size was estimated at USD 5.55 billion in 2022 and is projected to reach USD 18.80 billion by 2030, growing at a compound annual growth rate (CAGR) of 16.3% from 2023 to 2030. The market is a rapidly growing sector within the IT and telecommunications industries, making substantial investments to modernize their BSS for advanced services like 5G and IoT.

Key Market Trends & Insights

- North America dominated the market in 2022, accounting for over 38% share of the global revenue.

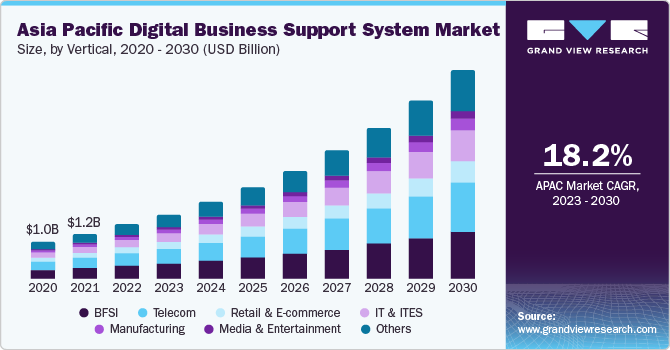

- Asia Pacific is anticipated to register the fastest CAGR over the forecast period.

- Based on vertical, the BFSI segment led the market in 2022, accounting for over 23.0% of the global revenue.

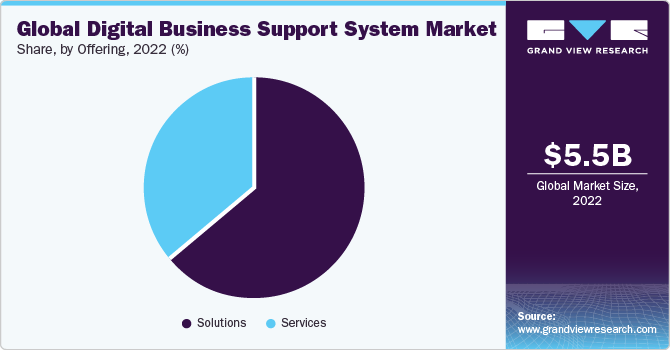

- Based on offering, the solutions segment led the market in 2022, accounting for a 64.0% share of the global revenue.

Market Size & Forecast

- 2022 Market Size: USD 5.55 Billion

- 2030 Projected Market Size: USD 18.80 Billion

- CAGR (2023-2030): 16.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Digital business support systems (BSS) are software platforms vital for businesses looking to manage operations and customer interactions in the digital realm, facilitating digital transformation, improved customer experiences, and the monetization of digital services.

Cloud-based BSS solutions are becoming very popular for their flexibility, scalability, and cost-effectiveness, enabling several companies to migrate from legacy on-premises systems to cloud-based alternatives. With an increasing emphasis on digital transformation initiatives, BSS solutions have become extremely crucial for streamlining operations, improving customer experiences, and leveraging data for decision-making, including self-service options, personalization, and real-time customer behavior insights.

Digital BSS systems are essential for businesses aiming to adopt new monetization models and boost revenue. They offer the adaptability and agility needed to accommodate various pricing models, bundled services, and subscription-based offerings. These systems support diverse pricing structures, from usage-based to tiered pricing, allowing businesses to tailor pricing to different customer segments. They furthermore facilitate the creation as well as management of bundled services, making it more convenient for customers to address their needs and reducing acquisition & retention costs. These systems are necessary for the management of subscription-based services, automating recurring billing, and offering self-service options to customers. Further monetization helps businesses cut costs by automating manual processes, enhancing customer experiences with personalized services, and providing valuable insights from customer behavior data for product and service development.

Digital BSS systems have played a vital role in the digital transformation initiatives of businesses across different industries. These systems drive automation and efficiency in customer-facing processes, resulting in a more seamless and personalized customer experience across all channels, with self-service capabilities for tasks such as account management and order tracking. They significantly enhance operational efficiency by automating manual tasks, freeing up employees to focus on strategic initiatives and overall business efficiency. Furthermore, digital BSS systems accelerate product and service innovation, simplifying the launch and scaling of new products, owing to their cloud-based nature and adaptable configuration for supporting new products and services.

The emergence of cutting-edge solutions and innovative commercial models are driving the growth of the digital BSS market. Cutting-edge BSS solutions leverage technologies such as cloud computing, artificial intelligence, and machine learning to automate processes, enhance customer engagement, and create new revenue opportunities. For instance, AI-powered BSS systems enable personalized customer offerings, efficient self-service support, real-time fraud detection, and flexible pricing models. Besides, new commercial models like subscription services and usage-based billing are gaining traction, necessitating agile and scalable BSS systems. Digital BSS solutions are well-suited for these models due to their inherent flexibility and adaptability.

Vertical Insights

The BFSI segment led the market in 2022, accounting for over 23.0% of the global revenue. This prominence is attributed to the rising adoption of digital banking and online financial services, driving the demand for advanced billing, customer management, and revenue assurance solutions within the sector. The emergence of cutting-edge technologies like artificial intelligence, machine learning, and blockchain is driving the adoption of digital BSS solutions in the BFSI sector. Furthermore, the necessity for real-time analytics, the demand for personalized customer interactions, compliance with regulatory standards, and the need for cost reduction and operational efficiency enhancements are driving the segment's growth.

The IT & ITES segment is expected to experience significant growth during the forecast period. This is attributed to the widespread digital transformation initiatives across industries, where efficient BSS solutions are crucial for operational management and superior customer experiences. With the increasing demand for cloud services, the integration of cloud-based services is becoming essential for IT & ITES companies. These firms face heightened customer expectations, necessitating BSS solutions for managing relationships, billing, and service delivery. BSS solutions also play a crucial role in managing outsourcing relationships and ensuring smooth operations within the IT & ITES sector, collectively driving growth in this segment within the digital BSS market.

Offering Insights

The solutions segment led the market in 2022, accounting for a 64.0% share of the global revenue. Digital BSS encompasses a diverse range of solutions, such as order management, product management, customer management, and revenue & billing management, and has been instrumental in assisting telecommunications and communication service providers with their digital operations. The segment's growth is attributed to the surging demand for digital transformation within the telecom industry, where providers elevate customer experiences, streamline their operations, and adapt to the constantly evolving technological landscape. The segment's expansion has been influenced by the widespread adoption of mobile devices, the data-intensive nature of IoT, and the rapid proliferation of cloud computing.

The services segment is expected to experience significant growth in the coming years. Digital BSS services are instrumental in facilitating this transformation by modernizing billing, customer management, and revenue assurance processes. Moreover, the growing complexity of digital services provided by enterprises necessitates more agile and scalable solutions, which digital BSS services can offer. There is a rise in demand for managed services, as many enterprises need more in-house expertise to implement and manage digital BSS solutions. Managed service providers offer comprehensive solutions covering planning, implementation, and ongoing support and maintenance.

Regional Insights

North America dominated the market in 2022, accounting for over 38% share of the global revenue. The region's growth is attributed to the growing adoption of digital BSS solutions by the telecommunications and communication service providers on digital transformation. The region has advanced technological infrastructure, an extensive customer base, and the industry's pursuit of more efficient and streamlined business operations in the digital era. The U.S. and Canada are slated to provide promising growth opportunities within the digital BSS market. These countries possess well-established IT and telecom sectors, and their contribution toward digital innovation is likely to spur increased demand for BSS solutions.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The growth is attributed to the rise in internet and smartphone penetration rates, fostering the adoption of online shopping and services and driving the demand for digital BSS solutions. Rising disposable incomes among consumers in the region are leading to increased expenditure on online goods and services, further fueling the demand for these solutions. Moreover, numerous government initiatives in the region that promote digital transformation are creating new opportunities for digital BSS solutions.

Key Companies & Market Share Insights

In the digital BSS market, both established companies and startups are focusing on a range of strategies, encompassing organic and inorganic approaches such as mergers and acquisitions, product development, technological advancements, innovations, and geographical expansion. These industry players are actively introducing new digital BSS products and solutions to cater to the changing requirements of the customers. Additionally, they are investing in enhancing and innovating their existing offerings. Moreover, collaborations and partnerships with other firms broaden their array of product offerings and solutions, thus reflecting the dynamic and competitive landscape of the digital BSS market.

In January 2023, Schurz Communications Inc., a U.S.-based cloud-managed services provider and a broadband media group, extended its partnership with Netcracker for digital BSS. This collaboration aims to enhance customer service quality and efficiency in Schurz Communications Inc.'s contact center operations. The company will leverage Netcracker's Agent Desktop feature to improve agent performance and resolve customer issues more effectively.

Key Digital Business Support System Companies:

- Accenture

- Amdocs

- Huawei Technologies Co.Ltd

- Telefonaktiebolaget LM Ericsson

- CSG Systems International, Inc.

- Nokia

- IBM Corporation

- ZTE Corporation

- Optiva, Inc.

- Hansen Technologies

Digital Business Support System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.52 billion

Revenue forecast in 2030

USD 18.80 billion

Growth rate

CAGR of 16.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Accenture; Amdocs; Huawei Technologies Co.Ltd; Telefonaktiebolaget LM Ericsson; CSG Systems International, Inc.; Nokia; IBM Corporation; ZTE Corporation; Optiva, Inc.; Hansen Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Business Support System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital business support system market report based on offering, vertical, and region:

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solutions

-

Order Management

-

Product Management

-

Customer Management

-

Revenue & Billing Management

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & ITES

-

BFSI

-

Retail & E-commerce

-

Telecom

-

Manufacturing

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital business support system market size was estimated at USD 5.55 billion in 2022 and is expected to reach USD 6.52 billion in 2023.

b. The global digital business support system market is expected to grow at a compound annual growth rate of 16.3% from 2023 to 2030 to reach USD 18.80 billion by 2030.

b. North America dominated the market in 2022, accounting for over 38% share of the global revenue. The region's growth is attributed to the growing adoption of digital BSS solutions by the telecommunications and communication service providers on digital transformation.

b. Some key players operating in the digital business support system market include Accenture; Amdocs; Huawei Technologies Co.Ltd; Telefonaktiebolaget LM Ericsson; CSG Systems International, Inc.; Nokia; IBM Corporation; ZTE Corporation; Optiva, Inc.; Hansen Technologies.

b. Key factors driving the digital business support system market growth include the emergence of cutting-edge BSS solutions and commercial models and growing online transactions, and the use of multiple mobile devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.