- Home

- »

- Next Generation Technologies

- »

-

Digital Evidence Management Market, Industry Report, 2030GVR Report cover

![Digital Evidence Management Market Size, Share, & Trends Report]()

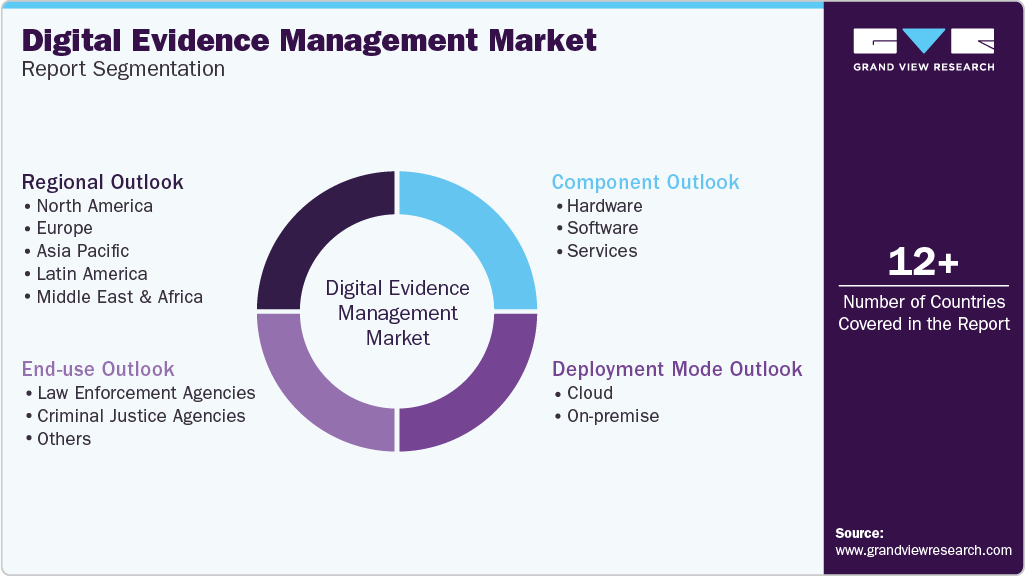

Digital Evidence Management Market (2025 - 2030) Size, Share, & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment Mode (On Premise, Cloud), By End User (Law Enforcement Agencies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-599-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Evidence Management Market Summary

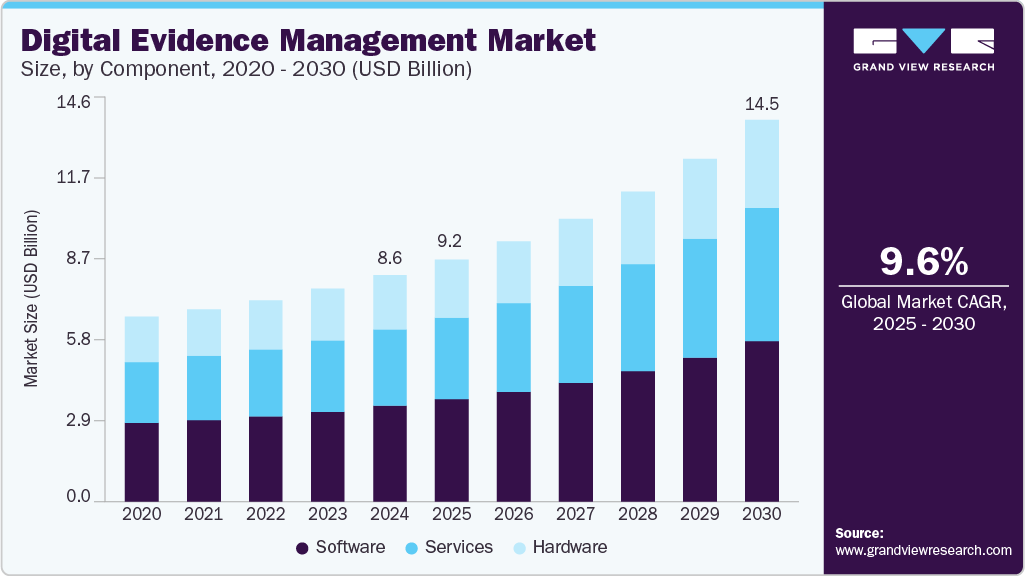

The global digital evidence management market size was estimated at USD 8.58 billion in 2024 and is projected to reach USD 14.47 billion by 2030, growing at a CAGR of 9.6% from 2025 to 2030. This market is growing rapidly, which supports the secure capture, storage, analysis, and sharing of digital evidence across law enforcement, judicial, and corporate entities.

Key Market Trends & Insights

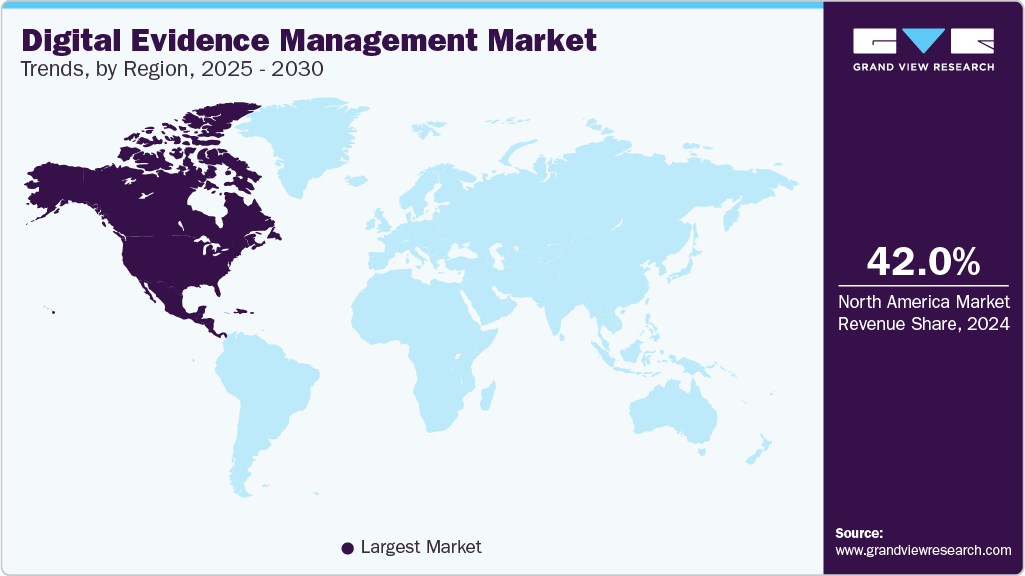

- North America digital evidence management market held a significant revenue share of over 42.0% of market in 2024.

- The digital evidence management market in the U.S. is expected to grow significantly from 2025 to 2030.

- By component, the software segment accounted for the largest revenue share of over 42.0% in 2024.

- By deployment mode, the cloud segment accounted for the largest revenue share in 2024.

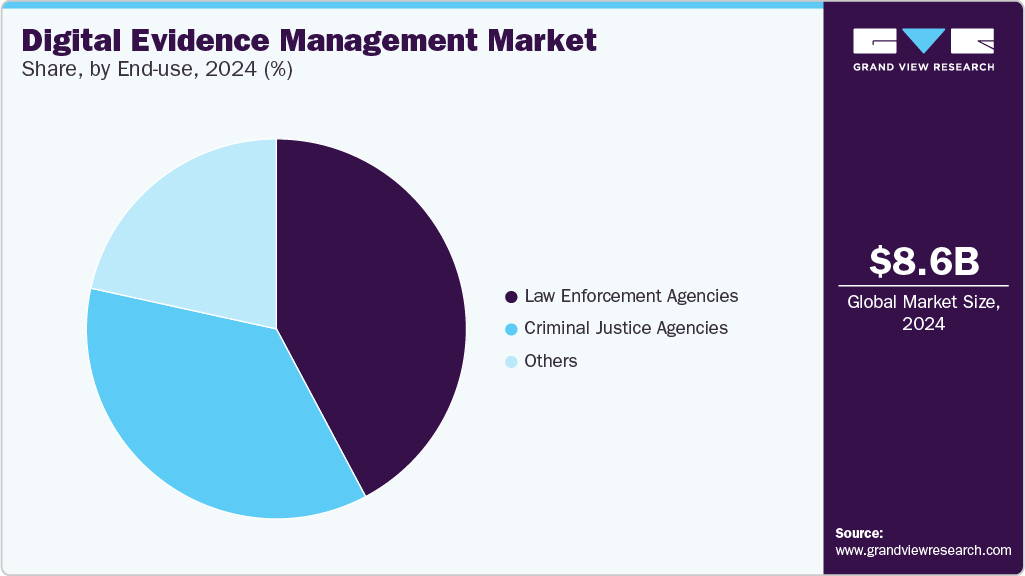

- By end user, the law enforcement agencies segment accounted for the largest revenue share of over 42.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.58 Billion

- 2030 Projected Market Size: USD 14.47 Billion

- CAGR (2025-2030): 9.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With the proliferation of digital devices and online platforms, digital evidence, such as video footage, emails, social media interactions, and forensic data, has become central to investigations and legal proceedings. The need to manage this evidence in a structured, tamper-proof, and legally admissible manner has led to the emergence of advanced DEM platforms. The digital evidence management (DEM) market growth is driven by the rapid and continuous increase in digital content generation. Modern law enforcement agencies now rely heavily on body-worn cameras, dashcams, surveillance systems, mobile phones, and digital communications such as emails and social media, all of which generate vast amounts of evidence daily. This surge in digital data volume has made traditional, manual methods of storing, cataloging, and sharing evidence inefficient, error-prone, and legally inadequate.

Manual systems often struggle to maintain the chain of custody, prevent data tampering, or provide quick access to critical files during investigations or legal proceedings. In contrast, DEM platforms offer automated, secure, and searchable systems that can handle large-scale digital evidence effectively. These solutions ensure compliance with legal standards, support data integrity, and improve investigation efficiency, making them an indispensable tool in today’s data-driven law enforcement landscape.

The growing prevalence of cybercrime and technology-enabled offenses, such as financial fraud, cyberbullying, hacking, and cyberterrorism, has heightened the demand for capturing, managing, and preserving digital footprints. In many investigations, digital evidence plays a central role in identifying suspects and proving intent.

However, for this evidence to be legally admissible in court, it must meet strict standards regarding authenticity, integrity, and chain of custody. Digital Evidence Management (DEM) platforms address these requirements by providing secure, tamper-proof systems with features like encryption, automated audit trails, and access controls. These capabilities ensure that digital evidence remains trustworthy, traceable, and compliant with legal and regulatory frameworks throughout the investigation lifecycle.

A major barrier to adopting digital evidence management (DEM) systems is the high cost of implementation. Smaller law enforcement agencies and public sector bodies often operate under tight budgets, making it difficult to invest in the necessary infrastructure, integrate with legacy systems, and train personnel. These financial constraints are especially pronounced in low-income regions or smaller municipalities, limiting their ability to adopt and maintain comprehensive DEM solutions.

Component Insights

The software segment accounted for the largest revenue share of over 42.0% in 2024. The rapid expansion of digital devices such as smartphones, body-worn cameras, and surveillance systems has resulted in a massive surge in digital evidence generation. The growing volume and complexity of data pose significant challenges for law enforcement agencies, which must manage, review, and act on evidence swiftly and accurately.

Traditional methods are no longer sufficient to handle this scale and diversity. As a result, there is an increasing demand for advanced Digital Evidence Management (DEM) software that can streamline evidence collection, ensure secure storage, and enable efficient analysis. These software solutions help improve investigation speed, maintain data integrity, and support informed decision-making in real-time or high-pressure scenarios.

The services segment is anticipated to grow at a significant CAGR of 10.4% during the forecast period. Deploying digital evidence management (DEM) systems is often complex because it requires seamless integration with existing infrastructure and legacy systems, while also ensuring compliance with various regulatory standards. This complexity drives the need for specialized services like consulting, system integration, and data migration to ensure smooth and effective deployment.

Additionally, organizations differ in size, jurisdiction, and operational needs, creating demand for customized solutions tailored to their unique requirements. This leads to a growing need for bespoke software development and personalized training programs, enabling users to fully leverage the DEM system’s capabilities and maintain compliance, ultimately improving the efficiency and effectiveness of digital evidence management.

Deployment Mode Insights

The cloud segment accounted for the largest revenue share in 2024. Cloud-based digital evidence management (DEM) solutions provide significant scalability and flexibility, which are vital in today’s data-heavy law enforcement environment. These systems allow agencies to dynamically expand or reduce storage capacity based on the volume of incoming digital evidence, such as video from body-worn cameras, dashcams, and surveillance footage.

Unlike traditional on-premise setups, cloud solutions eliminate the need for large upfront infrastructure investments, offering a more cost-effective and agile approach. This flexibility ensures that agencies can efficiently manage sudden surges in evidence without disruption. As digital content continues to grow exponentially, the ability to quickly adapt storage and processing capabilities makes cloud-based DEM platforms increasingly essential.

The on premise segment is expected to register a CAGR of 7.8% during the forecast period. Many organizations, particularly in the public sector, already operate with established IT infrastructures and legacy systems. On-premises digital evidence management (DEM) solutions offer the advantage of seamless integration with these existing frameworks. This compatibility ensures a smoother transition without overhauling current systems and helps preserve previous technology investments. As a result, agencies can modernize their evidence management processes while minimizing operational disruption and maintaining continuity in their workflows.

End User Insights

The law enforcement agencies segment accounted for the largest revenue share of over 42.0% in 2024. The rapid rise in cybercrime and technology-driven offenses such as financial fraud, identity theft, cyberbullying, and cyberterrorism has significantly amplified the need for robust digital evidence handling by law enforcement agencies. These crimes often leave complex digital footprints that must be captured, managed, and preserved with high integrity for legal proceedings.

Digital Evidence Management (DEM) platforms provide essential capabilities to meet these demands through secure, tamper-proof storage systems. Key features such as encryption, automated audit trails, and strict access controls ensure the authenticity and chain of custody of evidence. These functionalities help ensure that digital evidence remains admissible in court while supporting more efficient and reliable investigations.

The criminal justice agencies segment is expected to grow at a CAGR of 9.9% during the forecast period. Prosecutors, public defenders, and courts increasingly rely on digital evidence management (DEM) solutions as digital evidence becomes central to legal proceedings. Traditional storage methods like CDs and USBs pose risks of loss and security breaches. DEM systems streamline data storage, security, and tracking within courtroom workflows, ensuring efficient and secure handling of evidence. These solutions enhance transparency, reduce manual effort, and support fair and timely administration of justice.

Regional Insights

North America digital evidence management market held a significant revenue share of over 42.0% of market in 2024. The North America market is set for strong growth driven by rising cybercrime, advanced law enforcement infrastructure, and high-tech adoption. The U.S. leads the region, with agencies increasingly using digital evidence to address cyber threats like ransomware, phishing, and financial fraud.

U.S. Digital Evidence Management Market Trends

The digital evidence management market in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. Department of Justice supports digital evidence management through significant funding, including nearly USD 1.2 billion in 2020 grants to law enforcement agencies. These funds help improve evidence handling technologies, promoting widespread adoption and implementation of advanced DEM solutions nationwide to enhance law enforcement capabilities.

Europe Digital Evidence Management Market Trends

The digital evidence management marketin Europe is expected to grow at a CAGR of 9.9% from 2025 to 2030. The EU’s smart city initiatives, funded by Horizon Europe, integrate AI-powered surveillance and digital evidence management (DEM) for public safety. Cities like London, Barcelona, and Amsterdam use AI-driven CCTV analytics to collect, analyze, and store real-time evidence, enhancing law enforcement efficiency and compliance with GDPR and data protection laws.

The UK digital evidence management market is expected to grow rapidly in the coming years. The UK's police modernization, including the Met Police's body-worn cameras and cloud evidence systems, drives DEM growth. Simultaneously, rising cybercrime pushes the NCA and regional forces to adopt advanced digital forensics tools for investigations. These factors accelerate demand for secure, scalable Digital Evidence Management solutions nationwide.

Germany digital evidence management market held a substantial revenue share in 2024. Germany’s smart city initiatives in Berlin, Munich, and Hamburg integrate AI-powered surveillance and real-time analytics to enhance public safety. These systems automatically collect, analyze, and manage digital evidence from CCTV, sensors, and IoT devices, improving law enforcement efficiency while complying with strict EU data privacy laws (GDPR).

Asia Pacific Digital Evidence Management Market Trends

The digital evidence management marketin the Asia Pacific is expected to grow at the highest CAGR of 10.6% from 2025 to 2030. Rising cybercrime and digital fraud, including cyberattacks and financial scams, are fueling the demand for advanced forensic tools like Cellebrite and MSAB. These tools help law enforcement agencies efficiently extract, analyze, and manage digital evidence, enhancing investigation accuracy and speeding up case resolution in the Asia Pacific region.

The digital evidence management market in China held a substantial revenue share in 2024. China's police digitization drives DEM growth with bodycams, drones, and cloud evidence systems for law enforcement. Meanwhile, tech giants like Hikvision, Dahua, and Huawei leverage AI-powered video analytics to automate evidence processing, enabling real-time crime detection and forensic efficiency under China's Smart City initiatives.

The digital evidence management market in Japan held a substantial revenue share in 2024. The adoption of emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and blockchain has enhanced the capabilities of DEM systems across Japan. These technologies facilitate automated analysis, pattern recognition, and secure evidence tracking, improving the efficiency and accuracy of digital evidence management.

The digital evidence management market in India is growing due to the increasing prevalence of cybercrimes, such as financial fraud, cyberbullying, and cyberterrorism, heightening the need for capturing and preserving digital footprints. DEM platforms address these requirements by providing secure, tamper-proof systems with features like encryption, automated audit trails, and access controls.

Key Digital Evidence Management Company Insights

The key market players in the global digital evidence management market include Motorola Solutions, NICE Ltd., Panasonic Corporation, IBM Corporation, Hitachi, Ltd., VIDIZMO LLC, Cellebrite, OpenText Corporation, Axon Enterprise, Inc., Oracle Corporation, Guardify, Verint Systems Inc., Digital Ally, Inc., Safe Fleet, and Tracker Products LLC. The companies are focusing on various strategic initiatives, including new Hardware development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, Guardify announced that it had completed the acquisition of Engage Vision, a platform focused on AI-powered video intelligence with expertise in object detection, tracking, and analysis. This acquisition will boost Guardify's offerings by incorporating advanced computer vision technology into its digital evidence management solutions. The combined capabilities are expected to enhance investigative processes, improve case handling, and strengthen security monitoring through better evidence review, automated detection, and real-time data analysis.

-

In February 2025, The Fire Department of New York (FDNY) partnered with NICE to implement NICE Investigate, a cloud-based digital evidence management solution. This integration aims to streamline the collection, analysis, and sharing of digital evidence in fire investigations. By consolidating various data sources into a unified platform, the FDNY seeks to enhance investigative efficiency and expedite case resolutions.

-

In March 2024, Veritone introduced its Intelligent Digital Evidence Management System (iDEMS), an AI-powered, cloud-based platform designed to modernize digital evidence handling for public safety and judicial agencies. iDEMS centralizes various media types—such as audio, video, and documents—into a secure system, automating workflows and enhancing evidence analysis. Key features include automated redaction, advanced search capabilities, and seamless integration with existing systems, all aimed at accelerating investigations and improving case management.

Key Digital Evidence Management Companies:

The following are the leading companies in the digital evidence management market. These companies collectively hold the largest market share and dictate industry trends.

- Axon Enterprise, Inc.

- Cellebrite

- Digital Ally, Inc.

- Guardify

- Hitachi, Ltd.

- IBM Corporation

- Motorola Solutions

- NICE Ltd.

- OpenText Corporation

- Oracle Corporation

- Panasonic Corporation

- Safe Fleet

- Tracker Products LLC

- Verint Systems Inc.

- VIDIZMO LLC

Digital Evidence Management Market Report Scope

Report Attribute

Details

Market size in 2025

USD 9.16 billion

Market Size forecast in 2030

USD 14.47 billion

Growth rate

CAGR of 9.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD billion and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Motorola Solutions; NICE Ltd.; Panasonic Corporation; IBM Corporation; Hitachi, Ltd.; VIDIZMO LLC; Cellebrite; OpenText Corporation; Axon Enterprise, Inc.; Oracle Corporation; Guardify; Verint Systems Inc.; Digital Ally, Inc.; Safe Fleet; Tracker Products LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Evidence Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital evidence management marketreport based on component, deployment mode, end user, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Evidence Collection, Storage, and Sharing

-

Evidence Analytics and Visualization

-

Evidence Security

-

-

Services

-

Digital Investigation and Consulting

-

System Integration

-

Support and Maintenance

-

Training and Education

-

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Law Enforcement Agencies

-

Criminal Justice Agencies

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital evidence management market size was estimated at USD 8.58 billion in 2024 and is expected to reach USD 9.08 billion in 2025.

b. The global digital evidence management market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2030 to reach USD 14.47 billion by 2030.

b. The cloud segment accounted for the largest market share in 2024. Cloud-based digital evidence management (DEM) solutions provide significant scalability and flexibility, which are vital in today’s data-heavy law enforcement environment. These systems allow agencies to dynamically expand or reduce storage capacity based on the volume of incoming digital evidence, such as video from body-worn cameras, dashcams, and surveillance footage.

b. Some of the companies operating in the digital evidence management market include Motorola Solutions, NICE Ltd., Panasonic Corporation, IBM Corporation, Hitachi, Ltd., VIDIZMO LLC, Cellebrite, OpenText Corporation, Axon Enterprise, Inc., Oracle Corporation, Guardify, Verint Systems Inc., Digital Ally, Inc., Safe Fleet, Tracker Products

b. The digital evidence management (DEM) market growth is driven by the rapid and continuous increase in digital content generation. Modern law enforcement agencies now rely heavily on body-worn cameras, dashcams, surveillance systems, mobile phones, and digital communications such as emails and social media, all of which generate vast amounts of evidence daily.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.