- Home

- »

- Digital Media

- »

-

Digital Marketing Software Market Size, Industry Report 2033GVR Report cover

![Digital Marketing Software Market Size, Share & Trends Report]()

Digital Marketing Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Software, Services), By Software (CRM Software, Email Marketing), By Service, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-001-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Marketing Software Market Summary

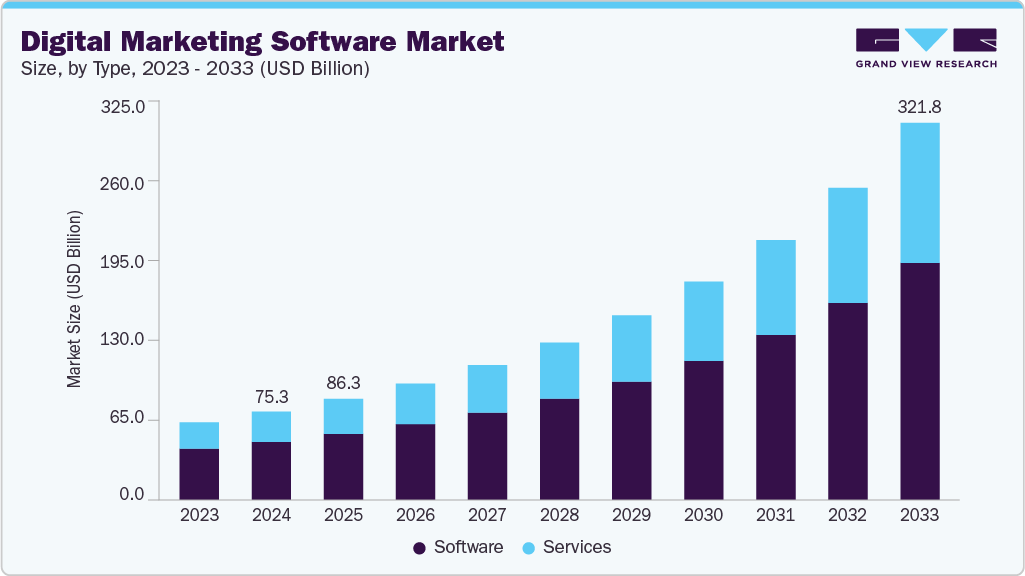

The global digital marketing software market size was estimated at USD 75.34 billion in 2024 and is projected to reach USD 321.77 billion by 2033, growing at a CAGR of 17.9% from 2025 to 2033. This market growth is driven by the rapid shift of businesses toward digital platforms for customer engagement and revenue generation.

Key Market Trends & Insights

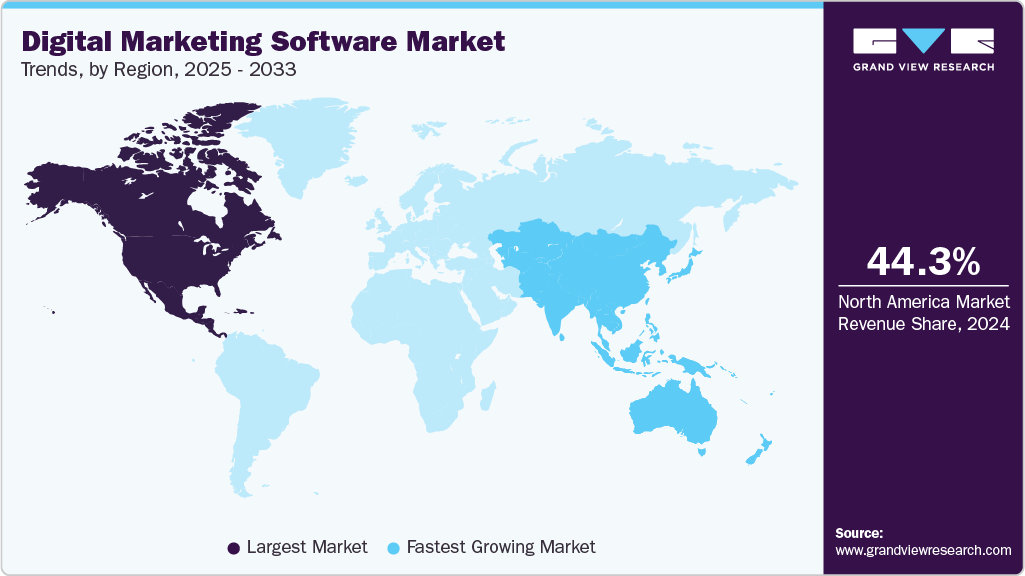

- North America digital marketing software dominated the global market with the largest revenue share of 44.3% in 2024.

- The digital marketing software industry in the U.S. is expected to grow significantly over the forecast period.

- By type, software led the market and held the largest revenue share of 65.7% in 2024.

- By deployment, the cloud segment led the market and held the largest revenue share in 2024.

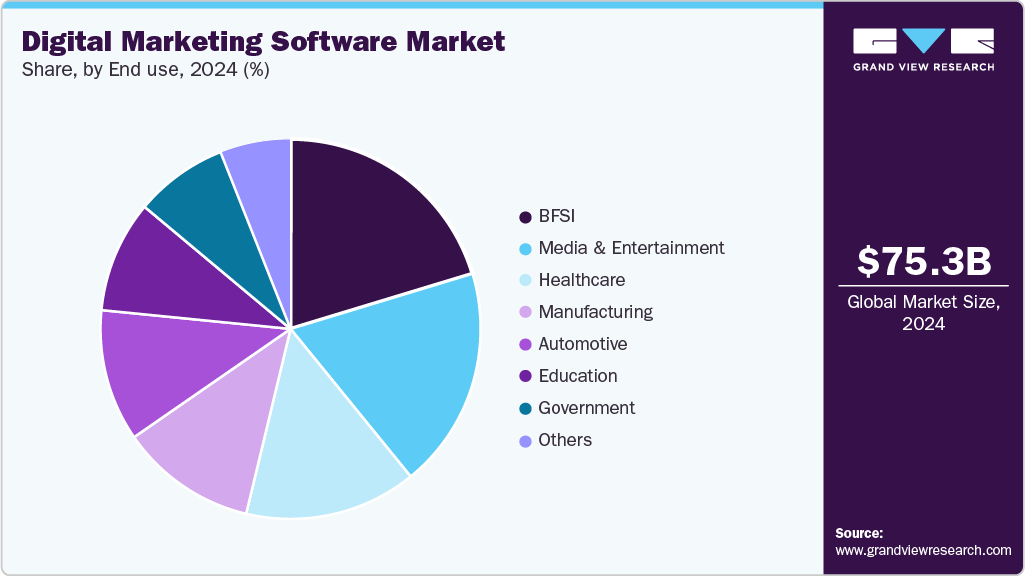

- By end use, the media & entertainment segment is expected to expand significantly over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 75.34 Billion

- 2033 Projected Market Size: USD 321.77 Billion

- CAGR (2025-2033): 17.9%

- North America: Largest market in 2024

With consumers spending more time online on social media, e-commerce sites, or content platforms, businesses are compelled to invest in digital tools to enhance visibility, brand awareness, and personalized communication. This shift has accelerated in the post-pandemic era, where online interactions have become essential for business continuity and customer retention.The widespread penetration of smartphones and high-speed internet globally has fueled the demand for digital marketing solutions. Mobile-first strategies are now integral to marketing campaigns, prompting software providers to offer mobile-optimized solutions for campaign management, customer analytics, and real-time engagement. The increasing time consumers spend on mobile applications and social platforms has made targeted mobile advertising a crucial focus, thereby boosting demand for advanced digital marketing tools.

The integration of artificial intelligence (AI) and machine learning (ML) technologies into digital marketing software is transforming the way businesses understand and interact with their audiences. Predictive analytics, real-time personalization, and automated content generation are enabling marketers to improve ROI and customer experience significantly. These technologies also allow businesses to process vast volumes of customer data to uncover trends, improve targeting, and optimize ad spend. For instance, in October 2024, LiveRamp announced the integration of its first artificial intelligence (AI) connections into its global network. This strategic move allows marketers to harness the capabilities of AI more effectively within LiveRamp’s expansive ecosystem, enhancing their ability to personalize and measure consumer interactions. The goal is to provide marketers with maximum flexibility, seamless interoperability, and access to cutting-edge AI tools to optimize campaign outcomes.

Type Insights

The software segment dominated the market and accounted for the revenue share of 65.7% in 2024. The integration of AI and machine learning into digital marketing software is changing campaign management and customer engagement. AI-powered tools are being used for predictive analytics, dynamic pricing, content personalization, and even automated content creation. These technologies enhance the efficiency of marketing processes and provide deep insights into consumer preferences, making them indispensable in the software stack of modern marketing departments. The services segment is anticipated to grow at a significant CAGR during the forecast period. With the rise of multichannel marketing and real-time customer engagement needs, businesses prefer to outsource their digital marketing operations to managed service providers (MSPs). These providers handle campaign from execution and content creation to performance monitoring and optimization. This allows companies to focus on core operations while leveraging support to run high-performance digital

Software Insights

The CRM software segment dominated the market with a revenue share of 22.3% in 2024. As organizations increasingly shift toward customer-centric business models, CRM software has become a component of digital marketing strategies. CRM platforms enable businesses to collect, store, and analyze customer data to deliver personalized and timely marketing messages. The ability to track customer interactions across multiple touchpoints, email, social media, web, and mobile, has made CRM tools indispensable for creating cohesive and effective marketing campaigns that enhance customer engagement and loyalty.

The social media segment is anticipated to grow at a significant CAGR during the forecast period. The exponential growth of global social media users is a fundamental driver of the social media software segment within the digital marketing landscape. Platforms such as Facebook, Instagram, LinkedIn, TikTok, and X now serve as critical channels for brand engagement, customer service, and product discovery. Businesses across industries are increasingly leveraging these platforms to reach their audiences where they are most active, resulting in growing demand for software that can manage, schedule, and analyze social media campaigns effectively.

Services Insights

The professional services segment dominated the market with the largest revenue share in 2024. Enterprises aiming to scale their digital marketing operations across geographies or business units often require structured change management and rollout plans. Professional service providers support this growth by offering scalable deployment models, organizational training, and change adoption frameworks. Their involvement helps reduce implementation risks and ensures smoother transitions to digital-first marketing strategies, especially in large organizations with complex hierarchies and diverse customer bases.

The managed services segment is expected to grow at a significant CAGR over the forecast period driven by the growing preference among businesses to outsource the management of their digital marketing software and operations. As digital marketing becomes more complex, with the need for constant optimization, content creation, platform integration, and data analysis, many companies, particularly SMEs and non-tech enterprises, are turning to managed service providers (MSPs) to handle day-to-day operations efficiently. This allows organizations to focus on core business functions while still leveraging advanced marketing technologies and strategies.

Deployment Insights

The cloud segment dominated the market and accounted for the largest revenue share in 2024. The rapid digital transformation across industries is propelling the adoption of cloud-based digital marketing software. Businesses are increasingly favoring cloud solutions due to their scalability, flexibility, and cost-effectiveness compared to traditional on-premises systems. Cloud-based platforms enable organizations to quickly deploy marketing tools, update features in real-time, and eliminate the need for extensive hardware or IT infrastructure. This shift has significantly broadened the market base, allowing even small and mid-sized enterprises to adopt sophisticated marketing technologies.

The on-premise segment is expected to grow at a significant CAGR over the forecast period owing to the continued preference among certain enterprises, particularly in highly regulated industries, for complete control over their data, infrastructure, and digital marketing environments. On-premise deployments provide businesses with the ability to customize systems deeply and manage security protocols directly, which is especially important for organizations dealing with sensitive customer information or operating in regions with strict data sovereignty laws.

Enterprise Size Insights

Thelarge enterprises segment dominated the market and accounted for the largest revenue share in 2024. Large organizations typically operate within complex IT environments that include ERP, CRM, customer service platforms, and data warehouses. Digital marketing software that can seamlessly integrate into these broader ecosystems is in high demand. The need for synchronized operations, cross-functional data sharing, and unified customer profiles drives large enterprises to adopt enterprise-grade marketing platforms that support API integrations, data interoperability, and centralized campaign management.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. Many SMEs operate in local or niche markets and seek tools that help them engage with specific customer segments effectively. Digital marketing platforms that offer geo-targeting, local SEO tools, and region-specific campaign customization are particularly valuable. The ability to reach targeted audiences with personalized messaging-while managing ad spend efficiently,makes these tools an attractive proposition for SMEs looking to maximize impact within limited budgets.

End Use Insights

The BFSI segment dominated the market and accounted for a revenue share of over 20.0% in 2024. The emergence of digital-native fintech players is reshaping customer expectations for convenience, speed, and digital experience. In response, traditional banks and insurers are accelerating their digital marketing capabilities to remain competitive. This includes adopting AI-powered chatbots, real-time push notifications, dynamic content, and hyper-targeted ads, which are enabled by advanced digital marketing software. The fintech disruption has thus become a catalyst for broader digital adoption across the BFSI sector.

The media & entertainment segment is expected to grow at a significant CAGR over the forecast period. As content-driven business models continue to dominate the media and entertainment landscape, measuring the performance of marketing campaigns and ensuring monetization are top priorities. Digital marketing software provides tools for tracking ad performance, measuring content reach, and analyzing user engagement metrics, enabling businesses to determine the effectiveness of their campaigns. For advertising-supported platforms, tools that offer ad optimization, programmatic advertising, and audience segmentation are particularly valuable in maximizing ad revenue and improving ROI.

Regional Insights

The digital marketing software industry in North America dominated the global market with the largest revenue share of 44.3% in 2024, driven by the increasing digitalization of businesses across industries, particularly in sectors such as retail, healthcare, and finance. North American companies are heavily investing in advanced marketing technologies such as AI, machine learning, and big data analytics to enhance personalization, optimize customer engagement, and streamline marketing operations. The region also benefits from the presence of numerous technology-driven startups and established players in the marketing technology space, fostering innovation and adoption of cutting-edge solutions.

U.S. Digital Marketing Software Market Trends

The digital marketing software industry in the U.S. is expected to grow significantly at a CAGR of 16.9% from 2025 to 2033 driven by a highly competitive business environment and the increasing emphasis on customer-centric marketing strategies. With a high penetration of internet users, mobile devices, and social media platforms, U.S. companies are heavily relying on digital marketing software to target diverse consumer segments across multiple channels. The rise of e-commerce, along with data privacy regulations like CCPA, is driving demand for advanced analytics and automation tools that ensure compliance while optimizing marketing efforts.

Europe Digital Marketing Software Market Trends

The digital marketing software industry in Europe is anticipated to register a considerable growth from 2025 to 2033 due to the region's strong emphasis on data privacy and compliance, particularly with the implementation of GDPR. European businesses are adopting digital marketing technologies that align with strict regulatory requirements while leveraging tools for customer segmentation, content personalization, and cross-channel marketing. The growing popularity of e-commerce and the shift toward digital-first strategies among traditional industries such as automotive and luxury goods are also contributing to market growth.

The UK digital marketing software industry is expected to grow rapidly in the coming years owing to the increasing adoption of digital marketing technologies across small and medium-sized enterprises (SMEs) and large corporations. With a strong focus on digital transformation, UK businesses are investing in software solutions that enable data-driven decision-making, customer journey optimization, and marketing automation. In addition, the UK's strong digital infrastructure and high internet penetration are driving demand for cloud-based solutions that provide scalability and flexibility for businesses of all sizes.

The Germany digital marketing software industry held a substantial market share in 2024, driven by the country’s thriving automotive, manufacturing, and retail sectors, which are increasingly relying on digital marketing solutions to engage customers and build brand loyalty. The focus on automation, AI-powered marketing, and data analytics is transforming traditional marketing approaches in Germany, enabling companies to target customers more effectively across multiple channels.

Asia Pacific Digital Marketing Software Market Trends

Asia Pacific digital marketing software industry held a significant share in the global market in 2024, due to the region’s accelerating digital transformation, particularly in emerging economies such as India, Southeast Asia, and Australia. The increasing adoption of smartphones, social media, and e-commerce is driving demand for digital marketing solutions that facilitate personalized marketing campaigns, customer engagement, and real-time analytics.

The Japan digital marketing software industry is expected to grow rapidly in the coming years driven by the nation’s technological advancements and high level of internet penetration, particularly among tech-savvy consumers. Japanese companies, especially in sectors such as electronics, automotive, and entertainment, are leveraging digital marketing software to enhance customer engagement through personalized campaigns, AI-driven insights, and automation tools.

The China digital marketing software industry held a substantial market share in 2024, due to the country’s massive consumer base, high mobile internet penetration, and the widespread use of e-commerce platforms. With companies looking to target vast and diverse consumer segments, there is growing demand for digital marketing solutions that enable hyper-targeted advertising, social media integration, and data analytics.

Key Digital Marketing Software Company Insights

Key players operating in the digital marketing software industry are Adobe, Salesforce.com, Inc., Oracle Corporation, Microsoft, and SAP SE. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2025, Adobe launched the Adobe Experience Platform Agent Orchestrator, enabling businesses to use AI agents for optimizing websites, automating content production, refining audiences, and scaling digital media. The company also introduced Brand Concierge, an AI-driven app that delivers personalized, brand-centric customer experiences by leveraging a company's unique attributes and customer data.

-

In May 2024, Salesforce, Inc. expanded its Einstein Copilot capabilities with new features aimed at assisting merchants and marketers. The conversational AI assistant now supports businesses of all sizes in managing marketing and merchandising tasks, with its existing sales and service functionalities. Moreover, Salesforce, Inc. introduced new tools for integrating commerce and business data, along with an AI-powered personalization decision engine, enabling companies to tailor customer interactions across all touchpoints using data from any source.

Key Digital Marketing Software Companies:

The following are the leading companies in the digital marketing software market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Hewlett-Packard Enterprise Company

- Hubspot, Inc.

- IBM Corporation

- Marketo, Inc.

- Microsoft

- Oracle Corporation

- Salesforce.com, Inc.

- SAP SE

- SAS Institute, Inc.

Digital Marketing Software Market Report Scope

Report Attribute

Details

Market size in 2025

USD 86.27 billion

Revenue forecast in 2033

USD 321.77 billion

Growth rate

CAGR of 17.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, software, services, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Adobe; Hewlett Packard Enterprise Company; Hubspot, Inc.; IBM Corporation; Marketo, Inc.; Microsoft; Oracle Corporation; Salesforce, Inc.; SAP SE; SAS Institute, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Marketing Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global digital marketing software market report based on type, software, services, deployment, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

-

Software Outlook (Revenue, USD Billion, 2021 - 2033)

-

CRM Software

-

Email Marketing

-

Social Media

-

Search Marketing

-

Content Management

-

Marketing Automation

-

Campaign Management

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2021 - 2033)

-

Professional Services

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

BFSI

-

Education

-

Government

-

Healthcare

-

Manufacturing

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital marketing software market size was estimated at USD 75.34 billion in 2024 and is expected to reach USD 86.27 billion in 2025.

b. The global digital marketing software market is expected to grow at a compound annual growth rate of 17.9% from 2025 to 2033 to reach USD 321.77 billion by 2033.

b. The digital marketing software market in North America dominated the global market with the largest revenue share of 44.3% in 2024, driven by the increasing digitalization of businesses across industries, particularly in sectors like retail, healthcare, and finance.

b. Some key players operating in the digital marketing software market include Adobe, Hewlett Packard Enterprise Company, Hubspot, Inc., IBM Corporation, Marketo, Inc., Microsoft, Oracle Corporation, Salesforce, inc., SAP SE, SAS Institute, Inc.

b. Key factors that are driving the digital marketing software market growth include the rapid shift of businesses toward digital platforms for customer engagement and revenue generation. With consumers spending more time online, on social media, e-commerce sites, or content platforms, businesses are compelled to invest in digital tools to enhance visibility, brand awareness, and personalized communication.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.