- Home

- »

- Next Generation Technologies

- »

-

Digital Remittance Market Size, Share, Industry Report, 2030GVR Report cover

![Digital Remittance Market Size, Share & Trends Report]()

Digital Remittance Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Inward Digital Remittance, Outward Digital Remittance), By Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-520-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Remittance Market Summary

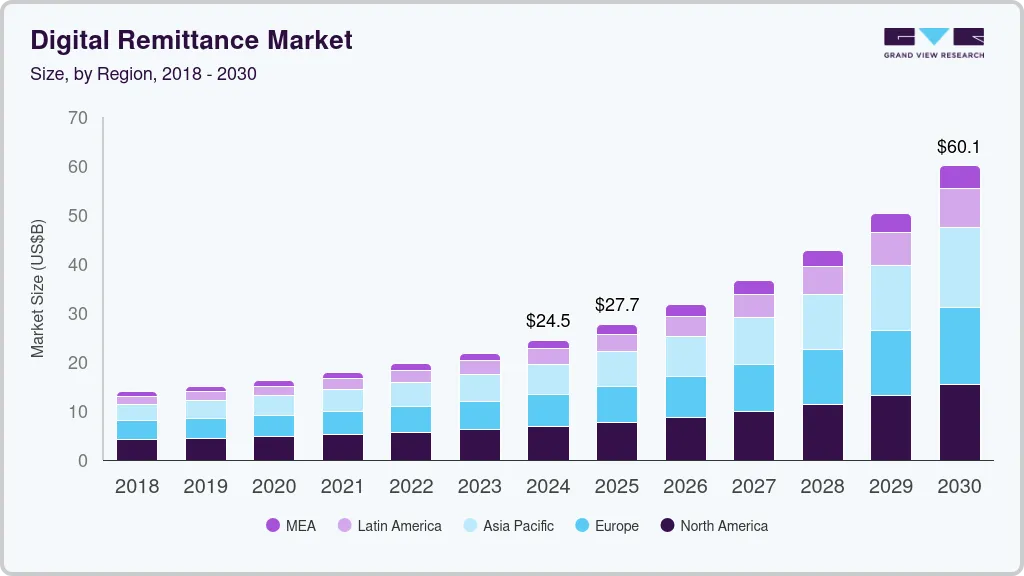

The global digital remittance market size was estimated at USD 24,480.6 million in 2024 and is projected to reach USD 60,051.6 million by 2030, growing at a CAGR of 16.7% from 2025 to 2030. The market growth can be attributed to the increasing fund transfers from migrant workers to their families.

Key Market Trends & Insights

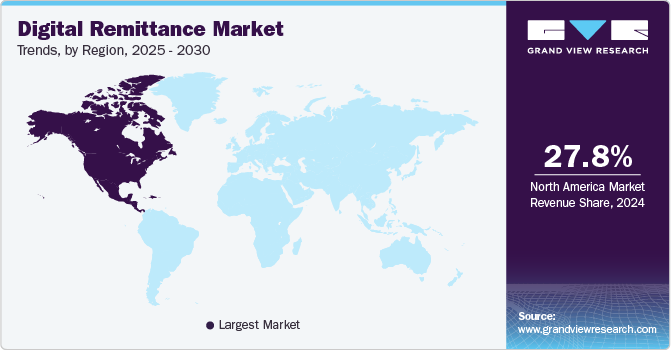

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of type, outward digital remittance accounted for a revenue of USD 15,866.3 million in 2024.

- Inward Digital Remittance is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 24,480.6 Million

- 2030 Projected Market Size: USD 60,051.6 Million

- CAGR (2025-2030): 16.7%

- North America: Largest market in 2024

Moreover, the increasing number of cross-border transactions and the growing adoption of mobile-based payment channels are further expected to propel market growth over the forecast period.

The proliferation of the digital platform for remittance is expected to encourage customers to move toward online transactions. Moreover, the rising penetration of mobile devices across the globe in recent years has encouraged the adoption of digital technology in remittance services and cross-border payments. Customers across the globe are also shifting toward digital remittance services as they help reduce the money transfer time and remittance costs. Moreover, digital remittance services offer high privacy and protection for consumers’ money.

The endless chains of mediators, hidden charges, and paperwork involved in money transfers made the process costly and arduous. However, the adoption of digital remittance services has helped businesses and customers enjoy more affordable, faster, and value-added money transfer services. The costs involved in transferring money have reduced drastically as a result of healthier competition between market players.

The rising popularity of digital remittance services among low-wage migrant workers, who use these services to send money to their families, is compelling several governing bodies to pay attention to and regulate the digital remittance industry. Moreover, foreign remittances play an important role in the economic development of emerging markets. Due to this, authorized regulators control and monitor money transfer fees to encourage customers to continue using digital remittance services and effectively contribute to their home country’s economic growth. These factors are expected to contribute to market growth over the forecast period.

The increasing adoption and ease of digital payments are expected to create growth opportunities for the market over the forecast period. However, the lack of awareness about digital remittance services and high remittance prices are expected to hinder market growth. Moreover, security hindrances such as terrorist financing and money laundering could also negatively impact the market growth over the forecast period.

Type Insights

Based on type, the outward digital remittance segment led the market with the largest revenue share of 57.7% in 2024. People living in other countries are sending money home to support their families. Financial institutions and banks are helping these people in sending money home quickly and safely. International banks and financial institutions are focusing on charging low fees and increasing their customer network. International outward remittances are done on a safe banking network, thereby limiting the chances of financial harm and fraud to both the sender and the recipient.

The inward digital remittance segment is expected to grow at a significant CAGR during the forecast period. Increasing adoption of mobile payment technology for money transfer among migrants is anticipated to propel the segment growth over the forecast period. Numerous financial institutions and banks across the globe are focusing on adopting real-time banking technology to leverage Immediate Payment Service (IMPS). Furthermore, this technology enables banks to offer services to both non-resident and resident customers of the banks. Migrant workers are focusing on using wire transfer services for inward remittances as these services are considered the safest, fastest, and most popular modes of fund transfer.

Channel Insights

Based on channel, the money transfer operators segment held the largest market share in 2024. Money transfer operators are regularly able to provide lower transfer costs than banks. Moreover, these money transfer companies offer the same level of reliability and security as banks. The speed of the money transaction is one of the significant benefits offered by money transfer operators. Money transfers can be initiated immediately and processed within a day or two. The introduction of digital-first money transfer operators and the rapid introduction of funding and digital initiation capabilities from established money transfer operators are expected to drive the segment growth over the forecast period.

The online platform segment is expected to register at the fastest CAGR during the forecast period. Online money transfer platforms efficiently manage transfers of funds between organizations as well as organizations and their customers. These platforms allow users to have access to money transactions directly and execute the fund transfer process more easily. Numerous online money transfer platforms are focusing on offering user-friendly services to their clients. These platforms are helping clients navigate their sites easily. Furthermore, the increasing adoption of digital wallets is expected to accentuate the segment growth. Digital wallets enable customers to track their funds from their digital wallet application.

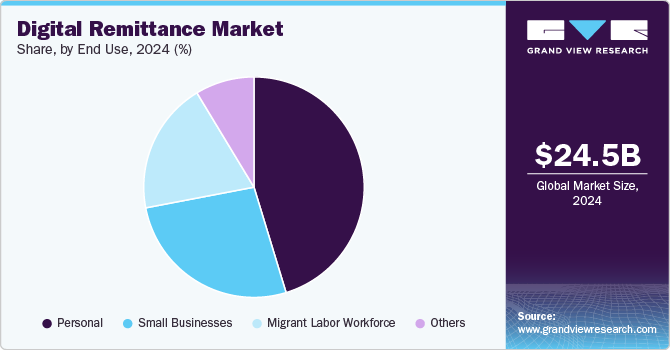

End Use Insights

Based on end use, the personal segment dominated the market in 2024. New products and services are being widely developed to facilitate convenient usage of financial customer accounts. Moreover, increasing global migration is expected to drive the adoption of digital remittance services by personnel to send money to their home country. Growing smartphone and internet penetration across the globe is anticipated to propel the personal segment growth over the forecast period. Innovative solutions are already beginning to change the landscape of remittance services by increasing convenience and reducing costs for senders of remittances and their families.

The migrant labor workforce is projected to grow at a significant CAGR over the forecast period. The digital remittance service helps the migrant labor workforce to compare fund transfer costs and effectively locate support organizations. Moreover, this service has made it easier and more affordable for migrant workers to send money home. Advances in fintech and innovation in cross-border payments are further expected to drive the segment growth.

Regional Insights

North America digital remittance market dominated the largest revenue share of 27.77% in 2024.The region is home to prominent financial service and communication companies, such as Continental Exchange Solutions, Inc.; Western Union Holdings, Inc., and MoneyGram. Numerous people migrate to the North American region in search of better education and job opportunities as well as for business purposes. The rising number of immigrants in the region is expected to create growth opportunities for the digital remittance service providers in the region.

U.S. Digital Remittance Market Trends

The U.S. digital remittance market accounted for the largest market share in 2024 due to the increasing migrant population and cross-border payment needs. According to The World Bank Group, U.S. personal remittance received stood at USD 7.74 billion in 2023. This level of transactions creates a significant demand for digital remittance in the country.

Europe Digital Remittance Industry Trends

The Europe digital remittance market was identified as a lucrative region in 2024. The favorable regulatory environment in the region fuels the growth of the market. The European Union (EU) has implemented regulations to promote transparency, security, and competition in financial services. Policies like the Revised Payment Services Directive (PSD2) encourage innovation and competition in the payments market, enabling fintech companies to thrive. These regulations ensure that digital remittance platforms operate with high levels of consumer protection, instilling trust among users and driving adoption.

The UK digital remittance market is expected to grow at a rapid CAGR during the forecast period, due to the increasing focus on speed and convenience. The modern customer prioritizes speed and convenience in financial transactions, and digital remittance platforms are meeting these expectations with instant or same-day transfers. Unlike traditional methods that could take several days, digital solutions offer seamless user experiences with features like one-tap transfers, transaction tracking, and integration with e-wallets.

The Germany digital remittance market held a substantial market share in 2024, owing to the substantial immigrant population, with workers and families hailing from countries such as Turkey, Poland, Romania, and Syria. Many of these individuals regularly send remittances to their home countries to support their families. The high demand for cross-border money transfers makes Germany a key market for digital remittance services.

Asia Pacific Digital Remittance Industry Trends

The digital remittance market in Asia Pacific is anticipated to grow at a significant CAGR during the forecast period. Numerous citizens from the Asia Pacific region send thousands of trillion dollars in remittances yearly to colleagues, business partners, and families in foreign countries. Growth in the adoption of banking and financial services in the region is expected to propel regional market growth over the forecast period.

The Japan digital remittance market is expected to grow at a rapid CAGR during the forecast period, due to the increasing adoption of Fintech solutions. The fintech industry in Japan has been growing rapidly, with startups and established players investing in digital remittance services. Providers like PayPay and Rakuten Remit leverage advanced technologies to improve user experiences. These companies offer multilingual customer support, integrations with digital wallets, and partnerships with global remittance networks, further driving market growth.

The digital remittance market in China held a substantial market share in 2024, owing to high smartphone penetration in the country, providing a solid foundation for the growth of digital remittance services. The widespread use of smartphones enables consumers to access user-friendly mobile applications for instant cross-border money transfers.

Key Digital Remittance Company Insights

Some of the key companies in the digital remittance industry include MoneyGram, PayPal Holdings, Inc., Digital Wallet Corporation, WorldRemit Ltd., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

MoneyGram International, Inc. is a money transfer and payment services company. The company offers a range of financial services, including money transfers, bill payment solutions, and mobile payments, operating through a vast network of agents and retail locations across more than 200 countries and territories. MoneyGram is particularly known for its ability to provide fast and reliable remittance services, catering to the needs of immigrants and expatriates sending money back home.

-

WorldRemit Ltd. is an online money transfer service that enables users to send money internationally to over 100 countries. The company has revolutionized the remittance industry by providing a fast, secure, and convenient alternative to traditional cash-based money transfer methods. WorldRemit allows customers to send money using various methods, including bank transfers, mobile money, airtime top-ups, and cash pickups, catering to a diverse clientele of over 5.7 million users.

Key Digital Remittance Companies:

The following are the leading companies in the digital remittance market. These companies collectively hold the largest market share and dictate industry trends.

- Azimo Limited

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- PayPal Holdings, Inc.

- Ria Financial Services Ltd.

- TransferGo Ltd.

- TransferWise Ltd.

- Western Union Holdings, Inc.

- WorldRemit Ltd.

Recent Developments

-

In April 2024, MoneyGram International formed a partnership with Tencent Financial Technology to facilitate digital remittances directly to Weixin Pay wallet users in China. This collaboration enables consumers to send funds through MoneyGram's online platform, allowing seamless transactions to one of the most popular payment services in the country.

-

In October 2023, IndusInd Bank announced a strategic partnership with Viamericas Corporation to enhance its remittance services through the re-launched Indus Fast Remit (IFR) platform. This partnership aims to facilitate digital inward remittances specifically for Non-Resident Indians (NRIs) residing in the U.S., allowing them to send money back to India with greater ease and efficiency. The IFR platform will enable users to execute remittance transactions using automated debit payment methods and overseas bank accounts. It will leverage Viamericas' established infrastructure and its Rupee Drawing Arrangement (RDA) with the Reserve Bank of India.

Digital Remittance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.71 billion

Revenue forecast in 2030

USD 60.05 billion

Growth rate

CAGR of 16.7% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

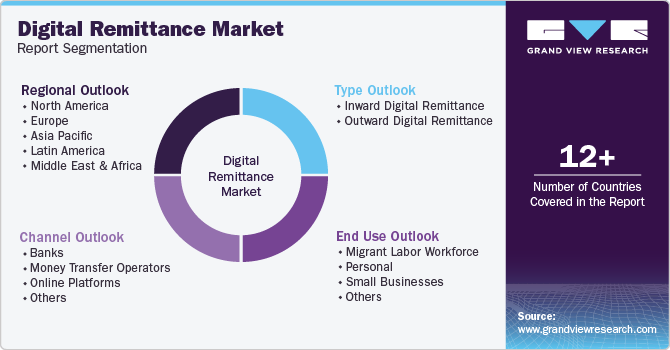

Segments covered

Type, channel, end use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

Azimo Limited; Digital Wallet Corporation; InstaReM Pvt. Ltd.; MoneyGram; PayPal Holdings, Inc.; Ria Financial Services Ltd.; TransferGo Ltd.; TransferWise Ltd.; Western Union Holdings, Inc.; WorldRemit Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Remittance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital remittance market report based on type, channel, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Inward Digital Remittance

-

Outward Digital Remittance

-

-

Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banks

-

Money Transfer Operators

-

Online Platforms

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Migrant Labor Workforce

-

Personal

-

Small Businesses

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital remittance market size was estimated at USD 24.48 billion in 2024 and is expected to reach USD 27.71 billion in 2025.

b. The global digital remittance market is expected to grow at a compound annual growth rate of 16.7% from 2025 to 2030 to reach USD 60.05 billion by 2030.

b. North America dominated the digital remittance market with a share of 27.77% in 2024. This is attributable to the regional market growth as several people migrate to North America in search of better job opportunities and education, as well as for business purposes.

b. Some key players operating in the digital remittance market include Azimo Limited; Digital Wallet Corporation; InstaReM Pvt. Ltd.; MoneyGram; PayPal Holdings, Inc.; Ria Financial Services Ltd.; TransferGo Ltd.; TransferWise Ltd.; Western Union Holdings, Inc.; WorldRemit Ltd.

b. Key factors that are driving the digital remittance market growth include growth in cross-border transactions and mobile-based payment channels and reduced transfer time and remittance cost.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.