- Home

- »

- Next Generation Technologies

- »

-

Digital Payment Market Size, Share, Industry Report, 2030GVR Report cover

![Digital Payment Market Size, Share & Trends Report]()

Digital Payment Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution(Application Program Interface, Payment Gateway), By Mode Of Payment, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-021-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Payment Market Summary

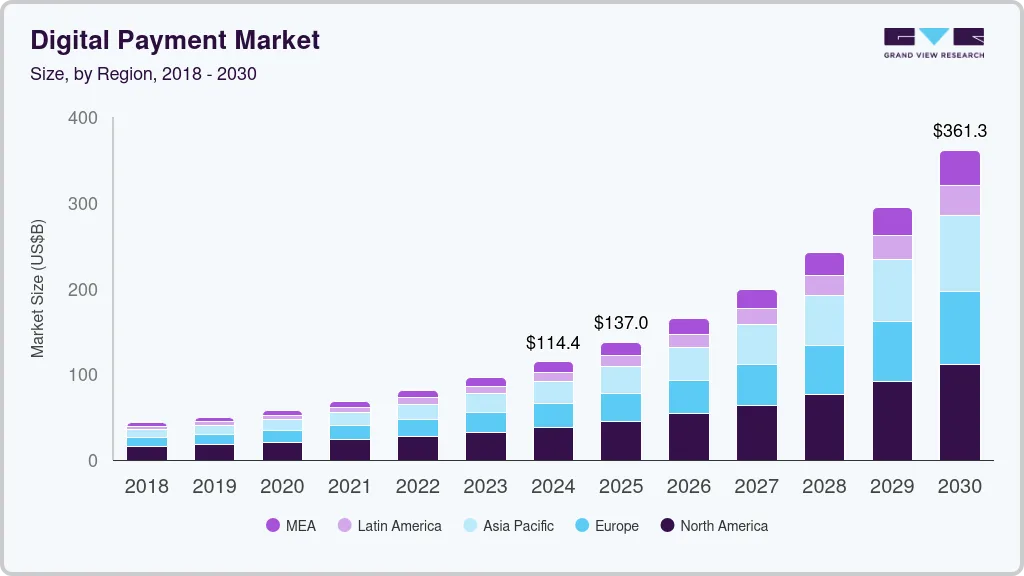

The global digital payment market size was estimated at USD 114.41 billion in 2024 and is projected to reach USD 361.30 billion by 2030, growing at a CAGR of 21.4% from 2025 to 2030. According to the data published by The World Bank, at the end of 2021, over two-thirds of the adults worldwide were making or receiving digital payments, and the number is expected to increase further in the coming years.

Key Market Trends & Insights

- North America dominated the digital payment industry and accounted for a 33.5% share in 2024.

- The digital payment industry in the U.S. is witnessing robust growth, driven by a confluence of technological advancements, shifting consumer preferences, and supportive regulatory developments.

- By solution, the payment processing segment led the market and accounted for 26.7% of the global revenue in 2024.

- By mode of payment, the point of sales segment accounted for the largest market revenue share in 2024.

- By deployment, the on-premise segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 114.41 Billion

- 2030 Projected Market Size: USD 361.30 Billion

- CAGR (2025-2030): 21.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing adoption of digital payments can be attributed to growing smartphone penetration, increasing internet penetration, increasing adoption of contactless payment methods during the pandemic, and the rise in government initiatives to promote digital payments.According to Kepios Pte. Ltd., at the start of Q4 2023, 5.30 billion people globally (equivalent to 65.7% of the world’s total population) were using the internet, and around 84% of the mobile phones in use were smartphones. This surge in internet penetration and widespread smartphone usage has propelled the growth of the digital payment industry. Increased connectivity empowers more people to embrace digital transactions, enhancing convenience and accessibility, thus contributing to the market’s growth.

Governments across the globe are taking strategic initiatives to promote digital payments. For instance, in December 2023, the governments of the Philippines and Ghana joined international organizations, including the United Nations (UN) World Food Program and UN-housed Better Than Cash Alliance, to initiate a new 'call to action' aimed at promoting responsible digital payments. Launched at COP28 in the UAE, this global initiative encourages governments, financial institutions, and the private sector to adopt digital payments for efficient emergency responses. Such government initiatives are significantly contributing to the market’s growth.

The pandemic spurred a surge in contactless payments as safety concerns drove people to embrace touch-free transactions. In April 2020, Mastercard announced that it witnessed a 40% jump in contactless payments, including tap-to-pay and mobile pay. This shift accelerated the adoption of digital payments, favoring contactless methods like mobile wallets and cards. This trend bolstered the digital payment market, emphasizing convenience and hygiene, further driving its widespread acceptance.

Despite the growing adoption of digital payments across the globe, the market faces significant constraints in terms of payment fraud. According to Merchant Savvy, a UK-based consulting firm, global payment fraud is expected to increase continuously and is projected to cost USD 40.62 billion by 2027. The rise in payment fraud poses a significant challenge to the market’s growth, necessitating robust security measures and innovative strategies to mitigate risks and ensure consumer trust in digital payment systems.

Solution Insights

Payment processing led the market and accounted for 26.7% of the global revenue in 2024. The increasing preference for online shopping across the globe is prompting retailers to adopt payment processing solutions to provide customers with seamless checkout experiences. Players providing payment processing solutions are launching new products that are harnessing the innovation in the market. For instance, in April 2023, GrubMarket, a food tech/eCommerce company operating in the U.S., announced the launch of GrubPay, a powerful payment processing platform that facilitates secure and safe payments for food wholesalers and distributors. With the launch, GrubMarket became the first eCommerce platform to offer a fully integrated payment processing solution.

The payment gateway segment is expected to register the fastest CAGR during the forecast period. There is an increasing demand for payment gateway solutions from merchants as they enable convenient payment. Furthermore, payment gateways are used for in-store payments to allow customers to make payments via smartphones and the Internet. Thus, the growing adoption of payment gateways among the in-store retail shops drives the segment growth.

Mode of Payment Insights

Point of sales accounted for the largest market revenue share in 2024. Retail stores use point-of-sale systems for processing transactions. These systems offer benefits, such as fast checkout options, customized customer experience, and multiple payment options. Retailers worldwide adopt cloud-based points of sales systems to increase their efficiency and improve service effectiveness.

Net banking is expected to register a significant CAGR of 21.3% during the forecast period. The benefits offered by net banking, including ease of banking, improved time efficiency, and activity tracking, are among the major factors driving the segment growth. As a result, various countries across the world are witnessing an increase in net banking users. According to the statistics provided by Forbes Media LLC, as of 2022, approximately 78% of U.S. adults in the U.S. preferred to use financial services via mobile applications or online websites.

Deployment Insights

The on-premise segment accounted for the largest market revenue share in 2024. The on-premise deployment of digital payment provides organizations with complete control over applications and systems, which can be easily managed by the organization’s IT staff. Moreover, the increased frequency of financial fraud amid the COVID-19 pandemic is also one of the major factors driving the demand for on-premise solutions among organizations. According to the statistics provided by Merchant Savvy, a merchant service provider, global payment fraud increased from USD 9.84 billion in 2011 to USD 32.39 billion in 2020; it is projected to reach USD 40.62 billion by 2027, a 25% increase from 2020.

The cloud segment is expected to register a significant CAGR during the forecast period. The continued rollout of smart city projects, coupled with the rising number of unmanned retail stores, is one of the major factors driving the growth of the segment. Furthermore, efforts taken by payment companies to launch cloud-based payment products is driving the market’s growth. For instance, in November 2023, a payments platform Payment24, announced the launch of a cloud-based financial product named Cloud Switch. This cloud-based payment platform is fully integrated, hardware-less payment switch that supports various payment methods, and is designed to serve the needs of retailers, merchants, fuel retailers, and acquiring banks.

Enterprise Size Insights

Large enterprises accounted for the largest revenue share of 58.6 in 2024. Large retail stores increasingly demand digital payment solutions to enable their customers to conduct payments by maintaining social distancing. Digital payment methods, such as smart banking cards, point of sales solutions, and e-wallets, are used by retailers to reduce checkout time. At the same time, retailers are also focusing on providing innovative payment solutions for customers. For instance, in October 2023, TodayPay Inc. announced a payment technology solution that is designed to help merchants offer their customers instant refunds in multiple payment choices. Such initiatives are harnessing the segment’s growth.

Small & medium enterprises are expected to register significant CAGR during the forecast period. Small & medium enterprises are shifting from paper-based invoicing to digital invoicing as paper-based billing systems are expensive, prone to errors, and inefficient. Payment solution providers are focusing on launching new products to cater to SMEs. For instance, in August 2023, Melio, a prominent B2B payments platform, announced the launch of Pay Over Time, the first product that enables small businesses to pay vendors and business bills in monthly installments. Additionally, the product powered by Credit Key will provide eligible small businesses with instant access to capital of up to USD 50,000 through their Melio account. Such instances are contributing to the small and medium enterprises segment’s growth.

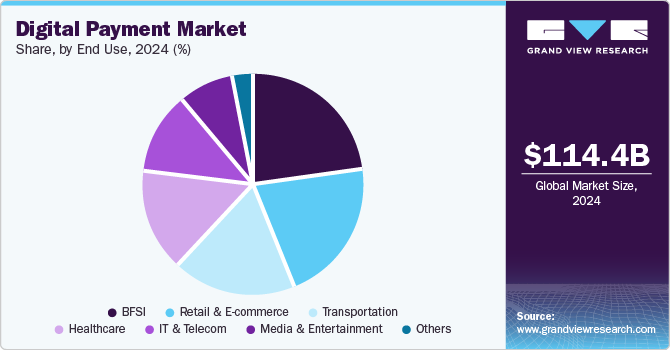

End Use Insights

BFSI end use led the market with a share of 23.2% in 2024. The rising demand for digital remittance for domestic and cross-border transactions is encouraging banks to adopt digital payment solutions. Moreover, banks are also enhancing their offerings to compete with digital payment solutions providers, such as Google, Amazon, and Facebook. For instance, in October 2023, U.S. Bank announced the launch of Avvance, a multi-channel embedded point of sale lending solution.

Retail & e-commerce is anticipated to expand at the fastest CAGR over the forecast period. The growing use of mobile-based payment solutions among customers for retail payments is one of the major factors driving the segment's growth. At the same time, the rising number of unmanned retail stores worldwide is also driving market growth. According to an article published by NXP Semiconductors, the number of unmanned stores was estimated to reach 44,138 globally by 2023. The growing number of unmanned stores is creating demand for digital payment solutions.

Regional Insights

North America dominated the digital payment industry and accounted for a 33.5% share in 2024. The regional market benefits from factors such as the growing deployment of technology improvements in smart parking meters. For instance, in January 2022, Des Moines, a city in Iowa, witnessed the launch of a new parking payment system in some parts of the city. The new USD 3.5 million system will enable motorists to park in any spot and pay either through a sidewalk pay station or an app. Such initiatives are driving the region’s growth.

U.S. Digital Payment Market Trends

The digital payment industry in the U.S. is witnessing robust growth, driven by a confluence of technological advancements, shifting consumer preferences, and supportive regulatory developments. One of the primary drivers is the increasing adoption of mobile and digital wallets such as Apple Pay, Google Pay, and Samsung Pay. These platforms offer convenience, speed, and security, encouraging consumers to shift from traditional payment methods to digital alternatives.

Asia Pacific Digital Payment Market Trends

Asia Pacific is anticipated to witness the fastest CAGR of 23.2% during the forecast period. This rapid growth can be attributed to the region’s increasing smartphone penetration, rising internet usage, and the widespread adoption of digital wallets and QR-code-based payment systems. Governments across countries such as India, China, and Indonesia are actively promoting cashless economies through policy support, regulatory reforms, and financial inclusion initiatives. Moreover, the proliferation of fintech startups and strong investment in payment infrastructure are further fueling the region’s digital transformation, making the Asia Pacific a hotspot for innovation and expansion in the digital payments space.

India digital payment market is expected to witness growth during the forecast period. One of the key trends in the market is the expansion of the Unified Payments Interface (UPI). UPI has become the dominant payment system in India, handling a large portion of digital transactions. The Reserve Bank of India (RBI) is further enhancing UPI with innovations like UPI Lite and UPI Tap & Pay, which aim to provide faster and more convenient solutions for microtransactions. Additionally, India is working toward internationalizing UPI, which could streamline cross-border payments and reduce reliance on global payment systems like Visa and Mastercard.

Digital payment market in China is expected to witness growth over the forecast period. The integration of digital payment systems with e-commerce platforms has also fueled the growth of the market. E-commerce giants like Taobao and JD.com have seamlessly incorporated digital payments into their platforms, making transactions easier for users. This integration has expanded the reach of digital payment systems, particularly in rural areas, where access to traditional banking services may be limited. The growing e-commerce sector in China continues to benefit from the rise of digital payments, facilitating the rapid adoption of online shopping across diverse demographic groups.

Europe Digital Payment Market Trends

Europe is anticipated to witness significant growth in the digital payments industry over the forecast period. The regional market’s growth can be attributed to the efforts taken by banks in Europe to launch a European payment initiative aimed at effectively creating a unified payment solution for merchants and consumers across the region. Such initiatives are expected to harness the regional market’s growth. Moreover, the digital campaign launched by the Italian government to increase electronic payments in the country is also propelling the regional market growth.

German digital payment market is projected to register a CAGR of 20.7% from 2025 to 2030. The introduction of new payment initiatives, such as the Wero digital wallet, is expected to further accelerate the adoption of digital payments in the country. This robust growth trajectory is also supported by the expanding e-commerce sector, where digital payments have become the primary method for online transactions.

Key Digital Payment Company Insights

Some of the key companies in the digital payment industry include PayPal Holdings Inc.; Aliant Payments; Aurus Inc.; Adyen; and Financial Software & Systems Pvt. Ltd. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies. For instance, leading digital payment providers are expanding their service offerings by integrating advanced technologies like blockchain and artificial intelligence to meet the rising demand for secure, efficient, and innovative payment solutions. These efforts are aimed at providing enhanced user experience, driving customer engagement, and supporting the shift towards cashless and digital financial transactions.

-

PayPal Holdings Inc. is a digital payment and technology platform company that enables mobile and digital payment on behalf of merchants and customers worldwide. The company is focused on providing simpler and safer ways for businesses of all sizes to accept payments from mobile devices, merchant websites, offline retail locations, applications, and other platforms.

-

Mastercard Incorporated is a technology company that connects digital partners, merchants, governments, financial institutions, consumers, and other entities globally. Mastercard Incorporated also provides digital payment solutions, such as Masterpass, a global digital payment service that allows consumers to make fast, simple, and secure transactions on any device and across any channel.

Key Digital Payment Companies:

The following are the leading companies in the digital payment market. These companies collectively hold the largest market share and dictate industry trends.

- Aliant Payments

- Aurus Inc.

- Adyen

- Financial Software & Systems Pvt. Ltd.

- PayPal Holdings Inc.

- Novatti Group Pty Ltd.

- ACI Worldwide, Inc.

- Global Payments Inc.

- Wirecard

- Authorize.Net

Recent Developments

-

In September 2024, PayPal Holdings Inc. launched its PayPal Complete Payments (PPCP) platform in Hong Kong, providing businesses with a robust and flexible payment solution designed to enhance global e-commerce operations. The platform enables merchants to accept a wide range of payment methods, including PayPal, Apple Pay, Google Pay, Alipay, and major credit and debit cards such as Visa and Mastercard.

-

In December 2023, Visa Inc. declared a definitive agreement to secure a majority stake in Prosa, a prominent payments processor in Mexico, with the aim of expediting the acceptance of secure and inventive digital payments within the nation. Under this agreement, Prosa will maintain its autonomy as a company, retaining its technological framework, while Visa plans to improve Prosa's array of products by introducing novel digital solutions.

-

In November 2023, PayU, provider of digital payment solutions in India, launched three mobile app Software Development Kits (SDKs), designed to deliver seamless payment experiences on mobile devices. These innovations are tailored to improve user interaction and have significantly boosted transaction success rates by up to 56%.

-

In November 2022, Conduent Incorporated, a worldwide technology enterprise, introduced its latest Digital Integrated Payments Hub. This innovation is geared towards granting businesses and public sector agencies access to secure, efficient, and expedited methods for sending, receiving, or requesting payments.

Digital Payment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 137.04 billion

Revenue forecast in 2030

USD 361.30 billion

Growth rate

CAGR of 21.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, mode of payment, deployment, enterprise size, end use, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdome of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Aliant Payments; Aurus Inc.; Adyen; Financial Software & Systems Pvt. Ltd.; PayPal Holdings Inc.; Novatti Group Pty Ltd.; ACI Worldwide, Inc.; Global Payments Inc.; Wirecard; Authorize.Net

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Payment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the digital payment market report based on solution, mode of payment, deployment, enterprise size, end use, and region:

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Application Program Interface

-

Payment Gateway

-

Payment Processing

-

Payment Security & Fraud Management

-

Transaction Risk Management

-

Others

-

-

Mode of Payment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Bank Cards

-

Digital Currencies

-

Digital Wallets

-

Net Banking

-

Point of Sales

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Healthcare

-

IT & Telecom

-

Media & Entertainment

-

Retail & E-commerce

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital payment market size was estimated at USD 114.41 billion in 2024 and is expected to reach USD 137.04 billion in 2025.

b. The global digital payment market is expected to grow at a compound annual growth rate of 21.4% from 2025 to 2030 to reach USD 361.30 billion by 2030.

b. North America dominated the digital payment market with a share of 33.5% in 2024. This is attributable to the existence of a large number of digital payment solution providers in the region. The expansion of the mobile commerce industry, coupled with the developed digital economy in North America, are additional factors driving the market.

b. Some key players operating in the digital payment market include Total System Services, Inc.; Wirecard AG; Novetti Group Limited; PayPal Holdings Inc.; ACI Worldwide Inc.; and Adyen N.V.

b. Key factors that are driving the digital payment market growth include increasing government initiatives for the promotion of digital payments and the growing penetration of smartphones.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.