- Home

- »

- Next Generation Technologies

- »

-

Digital Signature Market Size & Share, Industry Report, 2030GVR Report cover

![Digital Signature Market Size, Share & Trends Report]()

Digital Signature Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Level, By Deployment, By End-use, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-074-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Signature Market Summary

The global digital signature market size was estimated at USD 5.2 billion in 2024 and is projected to reach USD 38.16 billion by 2030, growing at a CAGR of 40.5% from 2025 to 2030. A digital signature is an encrypted, electronic stamp of authentication on digital information such as electronic documents, email messages, or macros.

Key Market Trends & Insights

- North America dominated the market and accounted for a 32.48% share in 2024.

- The digital signature market in Asia Pacific is anticipated to witness the fastest growth.

- Based on component, the solutions segment led the market and accounted for 47.9% in 2024.

- In terms of level, advanced Electronic Signatures (AES) accounted for the largest market revenue share in 2024.

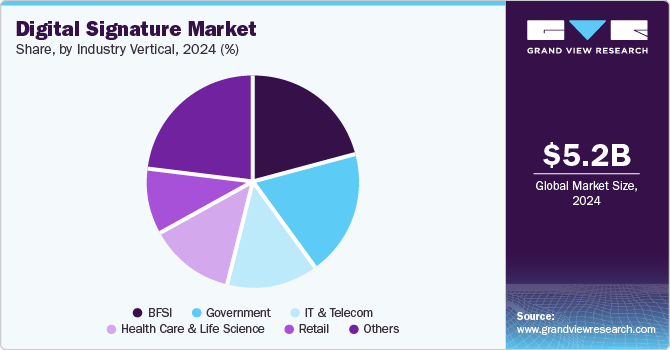

- Based on industry vertical, the BFSI segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.2 Billion

- 2030 Projected Market Size: USD 38.16 Billion

- CAGR (2025-2030): 40.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing investments among digital signature solution-providing companies are a major factor behind the increasing recognition of digital signatures in the business landscape. In addition, the increasing adoption of smartphones and rising internet penetration are further driving market growth.

The market growth is also attributed to the benefits of the solutions, including faster tracking, remote signature, proof of origin, integrity and authentication validation, security and safety of electronic documents, and improved customer experience. For instance, instead of physically visiting the office, branch, or store, with digital signatures, customers can sign documents anywhere, anytime on any device. This technology makes it easier and faster to interact with businesses, which is specifically important for customers. This, in turn, leads to higher satisfaction and customer retention. Such benefits provided by digital signatures are expected to bode well for market growth.

Numerous digital signature solution providers are focusing on launching new solutions to help customers with an improved experience. For instance, in May 2023, APS Bank plc launched an innovative digital signatures solution, enabling customers to sign select documents remotely, without visiting a branch. The solution was introduced to help make the Bank’s customer experience simpler. Digital signatures provide a convenient and secure method for digitally signing documents, simultaneously contributing to reducing the bank’s carbon footprint. Besides being beneficial to the environment, the solution also enhances efficiency by automating back-end processes such as document scanning and filing.

The growing adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Blockchain in digital signature solutions further contributes to market growth. Blockchain integration is gaining popularity, providing tamper-proof storage and verification for signed documents. AI and Machine Learning (ML) are utilized for signature verification and advanced authentication. Thus, integrating emerging technologies such as blockchain, AI, and IoT unlocks new possibilities in the market.

Despite the various benefits of digital signature solutions, some challenges could hamper market growth. The lack of awareness among individuals about the legality of digital signatures is a major challenge restraining market growth. The varying legal regulation and recognition of digital signatures across various jurisdictions is the major factor responsible for this lack of awareness. In addition, the heavy dependency on technology and technical complexity also hinders the large-scale adoption of e-signatures.

Component Insights

The solutions segment led the market and accounted for 47.9% in 2024. The segment includes software and hardware required for signing documents digitally. This segment’s growth can be attributed to the convenience this solution offers users. It enables users to sign documents remotely and digitally, safely and securely. For instance, in January 2022, Entrust Corporation announced the completion of the Common Criteria evaluation for its remote Qualified Signature Creation Device (QSCD). This enables the company to develop a solution that complies with eIDAS regulations, bringing together the Entrust Signature Activation Module (SAM) and nShield Hardware Security Modules (HSMs).

The services segment is expected to register the fastest CAGR from 2025 to 2030. The growth of this segment can be attributed to increasing safety and security concerns while signing a document. Furthermore, rising cloud adoption for digital signature services also bodes well for the segment's growth. In addition, Digital Signature Services (DSS) enable businesses, organizations, and individuals to access services focusing on consulting, implementation, and training. For instance, nowina.lu provides DSS that helps businesses transition from paper-based processes to digital workflows and enhance the digital experience by prioritizing interoperability, which can drive growth and give businesses a competitive advantage.

Level Insights

Advanced Electronic Signatures (AES) accounted for the largest market revenue share in 2024. This dominance is primarily due to the adoption of AES for signatures for sensitive documents and high-value transactions. AES signatures are created by leveraging cryptographic algorithms that protect signatures from forgery. Furthermore, AES eliminates the need for physical documents and wet ink signatures, thereby reducing the costs of digital signatures.

The Qualified Electronic Signatures (QES) segment is expected to register the fastest CAGR from 2025 to 2030. This growth can be attributed to its high level of trust via face-to-face ID verification. QES requires identity authentication before issuing a digital certificate, and customers are requested to electronically identify themselves during the signing process when prompted to verify their ID. Hence, as the most secure and assured signing method, demand for QES will grow from 2025 to 2030.

Deployment Insights

The on-premise segment dominated the digital signature market in 2024. Enterprises operating across industries, including healthcare, government, and medical, are sometimes subject to stringent state and federal laws governing the security and protection of their data and digital signature processes. For these companies, on-premise digital signature solutions are often required to ensure compliance with these regulations. This approach allows companies greater control over their data and signature flow while adhering to strict guidelines. As a result, on-premise digital signature solutions are the preferred choice for many enterprises, as they offer the best way to secure and manage their data and online signatures. Furthermore, companies such as airSlate Inc. and DigiSigner offer on-premise digital signature solutions to users, enabling them to ensure and maintain high data security.

Cloud is expected to register the fastest CAGR from 2025 to 2030. Increasing adoption of the cloud by several enterprises across the globe is expected to drive the segment's growth. For instance, in December 2022, according to Zippia, Inc., an internet publishing company, nearly 94% of enterprises across the U.S. used cloud services. Furthermore, companies such as Entrust Corporation are involved in offering a cloud-based turnkey solution that integrates with desktop and web applications supporting digital signatures. Hence, the aforementioned factors are expected to fuel the segment’s growth.

End Use Insights

The businesses segment accounted for the largest market revenue share in 2024. This growth can be attributed to businesses' increasing adoption of digital signatures worldwide. Integrating digital signature solutions with existing workflow platforms and tools has simplified business document management processes. Furthermore, benefits, such as improved customer experience by adding a digital signature, are expected to fuel the segment’s growth.

The organizations segment is expected to register the fastest CAGR from 2025 to 2030. This growth can be attributed to non-profit organizations' increasing adoption of digital signatures. Furthermore, various key companies offer digital signature solutions to non-profit organizations. For instance, companies such as Zoho Corporation Pvt. Ltd. and DocuSign, Inc. provide digital signature solutions for non-profit organizations. Moreover, the increasing development of digital signature solutions for the non-profit sector is anticipated to drive the segment’s growth. For instance, in October 2022, Convene launched the Digital Signature Suite, equipped with robust functionalities to enhance signing workflows with speed and security. This offering is designed for the company’s board governance clients spanning the GCC region's private, government, and non-profit sectors.

Industry Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2024. This segment's growth is propelled by the rising adoption of digital transformation and the imperative for secure and efficient authentication procedures. Digital signatures provide various benefits, such as reduced paperwork, enhanced security, and streamlined operations. In the BFSI sector, where security and compliance are paramount, digital signatures authentically authenticate and authorize contracts, transactions, and other finance-related documents. Hence, growing digitalization across the BFSI sectors is anticipated to propel the segment's growth.

The government segment is expected to register the fastest CAGR from 2025 to 2030. The COVID-19 pandemic compelled government organizations and agencies to embrace digital signatures for signing documents electronically. Furthermore, governments in various jurisdictions have enacted revisions to digital signature laws, approving their usage. As a result, government agencies are now actively seeking to provide citizens with a highly digitized experience. E-signature technology empowers individuals, non-profits, and government entities to continue conducting essential business in a secure and contact-free manner through digital signatures.

Regional Insights

North America dominated the market and accounted for a 32.48% share in 2024. The presence of prominent digital signature solution providers, such as DocuSign, Inc., Adobe, and Entrust Corporation, is anticipated to fuel the regional market’s growth. Furthermore, a favorable legal environment for digital signatures across the North American region is anticipated to fuel its adoption in the upcoming years. In addition, a region is an early adopter of technology and suitable cloud infrastructure; the North American region is embracing digital signatures.

U.S. Digital Signature Industry Trends

The digital signature market in the U.S. is expected to grow at a significant CAGR. Businesses are increasingly adopting e-business workflow and paperless documentation to save costs, streamline their processes, and boost productivity, driving the demand for digital signature solutions in the U.S.

Canada digital signature industry is expected to grow at a significant CAGR from 2025 to 2030. Digital signatures are commonly utilized in Canada because they streamline the contractual process within a digital environment. The vast presence of laws and regulations governing the use of digital signatures in Canada is boosting the market’s growth.

Asia Pacific Digital Signature Market Trends

The digital signature market in Asia Pacific is anticipated to witness the fastest growth. The region's growth can be attributed to efforts by the government to enhance citizens' access to digital experiences. Countries, including India and China, are adopting digital technologies, leading to growth in digital signature adoption across regions. Furthermore, a favorable legal environment across the region is anticipated to fuel regional growth from 2025 to 2030.

China digital signature industry is expected to grow at a significant CAGR from 2025 to 2030. China's commitment to accelerating digitalization has led to the widespread adoption of digital signatures across diverse industries, which is driving the country's market growth.

The digital signature market in India is expected to grow at a significant CAGR from 2025 to 2030. Increasing government initiatives to promote the use of digital signatures across various sectors, including financial services, e-governance, and legal documentation, are driving market growth in India.

Japan digital signature market is expected to grow at a significant CAGR from 2025 to 2030. Digital signature tools are expected to gain substantial traction in the country due to their capacity to mitigate concerns about fraud, identity theft, and data breaches.

Europe Digital Signature Market Trends

The digital signature market in Europe is expected to grow at a significant CAGR from 2025 to 2030. The strong regulatory framework and the rapid adoption of digital solutions across various industries are major factors behind market growth.

The UK digital signature market is expected to grow at a significant CAGR from 2025 to 2030. This growth is primarily driven by increasing government initiatives related to digital signatures.

MEA Digital Signature Market Trends

The digital signature market in MEAisexpected to grow at a significant CAGR from 2025 to 2030. Increasing smartphone penetration and usage, and demand for mobile-friendly digital signature solutions that allow users to sign documents conveniently using their tablets or smartphones, are boosting market growth.

The KSA digital signature market is expected to grow at a significant CAGR from 2025 to 2030. The increasing adoption of digital technologies in various industries under the KSA government's Vision 2030 initiative, which aims to diversify the country's economy and promote digital transformation, is expected to create lucrative opportunities for market growth.

Key Digital Signature Company Insights

Some key companies operating in the market include Docusign, Inc., Visma, Adobe Inc., GlobalSign, and Entrust Corporation.

-

Docusign, Inc. is one of the prominent companies in the digital signature technology. The company provides an electronic signature solution that facilitates the electronic signing of agreements on various devices, ensuring a secure process that can be done virtually from any location worldwide.

-

Visma develops and provides software to small, medium, and large enterprises and the public sector to improve the work-life of millions of people around the globe. The company provides several digital tools that empower businesses and organizations to effectively organize, analyze, and enhance their day-to-day operations.

Key Digital Signature Companies:

The following are the leading companies in the digital signature market. These companies collectively hold the largest market share and dictate industry trends.

- Docusign, Inc.

- SIGNiX, Inc.

- Adobe Inc.

- OneSpan Inc.

- GlobalSign

- IdenTrust, Inc.

- PrimeKey AB

- Visma

- Ascertia

- Topaz Systems, Inc.

- Entrust Corporation

Recent Developments

-

In July 2024, Protean eGov Technologies introduced 'eSignPro', an advanced digital signature and e-stamping solution to enhance the efficiency and security of digital transactions. This enterprise-grade tool integrates with Protean’s smart documentation suite, offering features like workflow automation, custom templates, and maker-checker functionalities to streamline business operations and reduce costs. By digitizing processes such as account opening, re-KYC, lending, and contract execution, eSignPro addresses physical documentation's financial and environmental challenges. The platform provides universal access through channels like WhatsApp, SMS, and email, facilitating faster turnaround times and improved risk control.

-

In March 2024, Sadq, a digital signature solution provider, and PROVEN Consult, an intelligent automation solution provider, signed a Memorandum of Understanding (MoU). The MoU marks the start of a collaboration to offer clients cutting-edge solutions. The partnership will integrate Sadq’s seamless e-signature solution, enhancing efficiency and productivity in document signing processes across industries. Moreover, PROVEN Consult will incorporate its Sanad.ai Arabic OCR technology, known for its accuracy in text extraction, into the joint offerings. This partnership highlights both companies’ commitment to using innovative technology to improve business operations and deliver enhanced client value.

Digital Signature Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.98 billion

Revenue forecast in 2030

USD 38.16 billion

Growth rate

CAGR of 40.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, level, deployment, end use, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; China; India; Japan; Australia; South Korea; Brazil; UAE; The Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Docusign, Inc.; SIGNiX, Inc.; Adobe Inc.; OneSpan Inc.; GlobalSign; IdenTrust, Inc.; PrimeKey AB; Visma; Ascertia; Topaz Systems, Inc.; Entrust Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Signature Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital signature market based on component, level, deployment, end use, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Level Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Electronic Signatures (AES)

-

Qualified Electronic Signatures (QES)

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individuals

-

Businesses

-

Organizations

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Health Care & Life Science

-

IT & Telecom

-

Government

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

The Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.