- Home

- »

- Healthcare IT

- »

-

Digital Therapeutics Market Size, Industry Report, 2030GVR Report cover

![Digital Therapeutics Market Size, Share & Trends Report]()

Digital Therapeutics Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Diabetes, Obesity), By End Use (Patients, Providers, Payers, Employers), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-768-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Therapeutics Market Summary

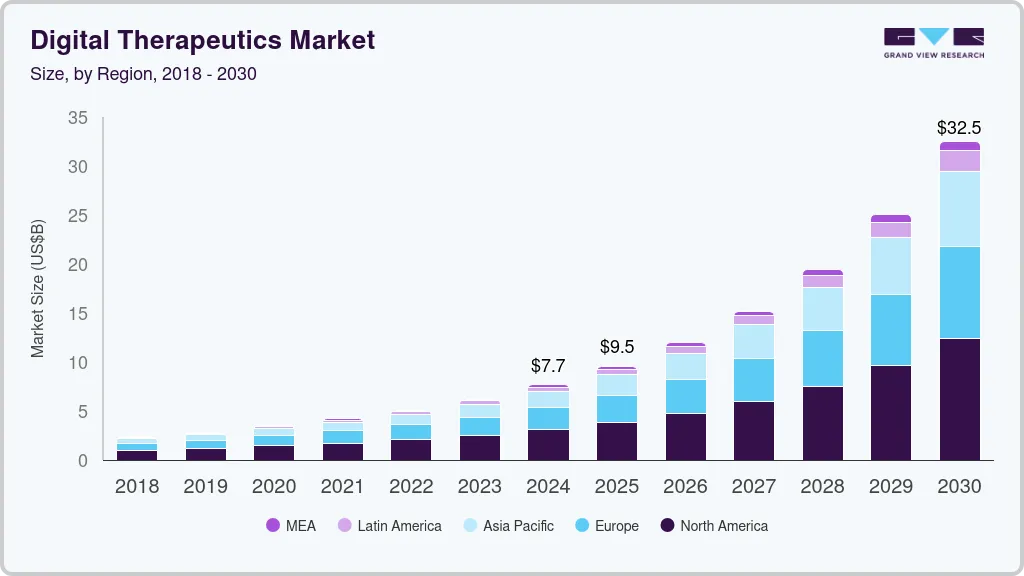

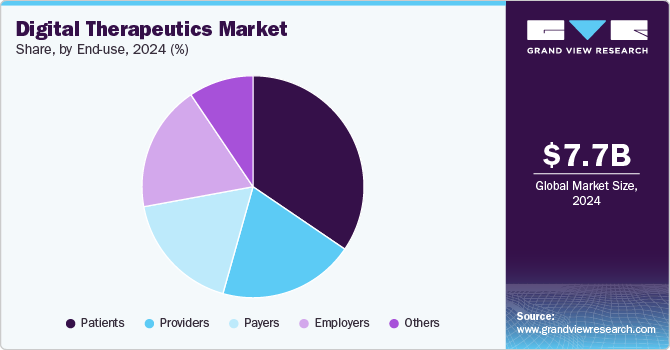

The global digital therapeutics market size was estimated at USD 7.67 billion in 2024 and is projected to reach USD 32.5 billion by 2030, growing at a CAGR of 27.77% from 2025 to 2030. Market growth is primarily driven by the cost-effectiveness of digital health technology for providers and patients and rising smartphone penetration in developed & developing countries.

Key Market Trends & Insights

- North America digital therapeutics industry dominated globally with a revenue share of 40.11% in 2024.

- The U.S. digital therapeutics industry held the majority of revenue share of 85.40% in 2024.

- In terms of application, the diabetes segment dominated the market with largest market share of 29.75% in 2024.

- In terms of end use, the patient segment held the largest market share of 34.50% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.67 Billion

- 2030 Projected Market Size: USD 32.5 Billion

- CAGR (2025-2030): 27.77%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing demand for patient-centric care & integrated healthcare systems is expected to drive market growth. In addition, supportive reimbursement, COVID-19 pandemic, early signs of reimbursement, and rising incidence of chronic diseases are also expected to fuel the market growth.

Digital therapeutics (DTx) are software-based interventions designed to treat medical conditions through clinically validated means. These solutions are transforming healthcare by enabling patients to take greater control over their care, similar to consumer wellness apps, but with a key difference: they focus on delivering clinical outcomes.

Digital Therapeutics from Different Perspectives

Perspective

Key Points

Consumer

Empowerment and Engagement: Tools for symptom tracking, medication reminders, and behavioral coaching.

Accessibility: Available on smartphones, making it easy for users to integrate into daily routines.

Provider

Clinical Integration: DTx are increasingly integrated into clinical workflows to monitor patient progress and adjust treatments.

Efficacy and Evidence: Providers prioritize DTx with strong clinical evidence showing effectiveness for specific conditions.

Regulatory Approval: Preference for DTx with regulatory clearance or approval to ensure safety and efficacy.

Patient Engagement: Tools that enhance patient engagement and adherence to treatment plans are highly valued.

Payer

Cost-Effectiveness: Payers assess DTx based on their potential to reduce healthcare costs through prevention and improved disease management.

Coverage Policies: Some payers are beginning to cover DTx, particularly for chronic conditions such as diabetes and mental health disorders.

Data-Driven Decisions: Payers use real-world data and outcomes to make informed decisions about coverage.

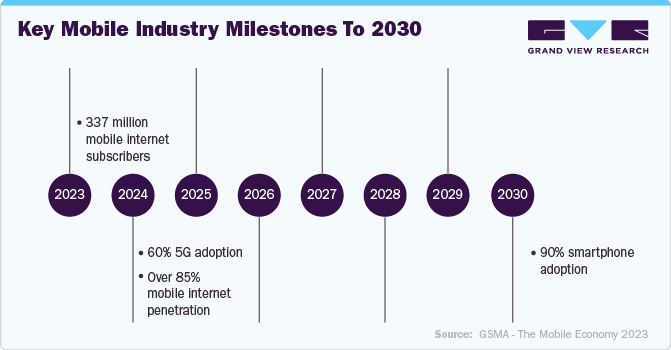

The rise in internet penetration across the globe had a positive impact on the market. According to the GSM Association (GSMA) statistics published in the Mobile Economy 2024 report, around 5.6 billion people across the globe subscribed to mobile services in 2023, and the number of unique mobile subscribers is expected to reach 6.3 billion by 2030. For instance, as per the Mobile Economy 2023 report, smartphone penetration was around 76% in 2022 and is expected to reach 92% by 2030. As this number grows, the awareness and adoption of intelligent health moaretoring is anticipated to improve.

The COVID-19 pandemic notably propelled the rate of change in digital therapeutics by accelerating regulatory flexibility, thus expanding access to digital health products, and fueling patient demand. The pandemic has increased demand for accessible and convenient digital health solutions. For instance, as per the guidelines released by FDA in April 2020, stating that for the duration of pandemic, it would enable the use and distribution of digital health therapeutic devices for psychiatric disorders. Thus, vendors can commercialize their solutions without complying with usual regulatory requirements, provided the devices do not create any undue public health emergency.

The increasing incidence of chronic diseases significantly contributes to the growth of the market. As per CDC's National Center for Chronic Disease Prevention and Health Promotion, 6 in 10 American adults suffer from a chronic disease, while 4 out of 10 adults have two or more chronic diseases. For instance, in January 2024, Amazon Health initiated a new program titled Health Condition Programs targeting chronic health issues. This new effort allows consumers to explore digital health advantages aimed at aiding in the management of chronic diseases, including diabetes and hypertension. Moreover, chronic lung disease, cancer, Alzheimer's disease, diabetes, cardiovascular diseases, and chronic kidney disease have been identified as leading causes of death and disability in the country.

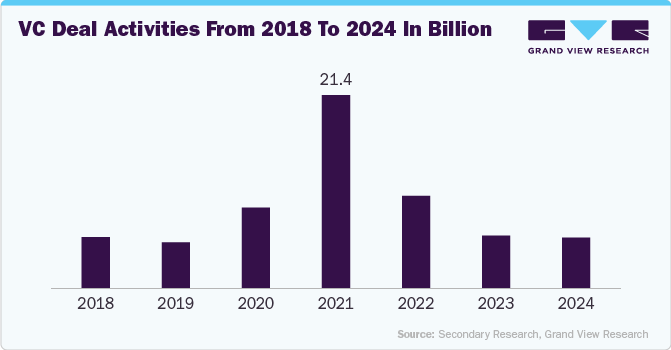

Venture capital investment in digital health totaled USD 2.2 billion in Q3, representing a 41.1% increase from Q2 and marking the highest quarterly total since 2022. This surge was driven by seven major deals valued at USD 100 million. The largest was Flo Health’s USD 200 million Series C round, which elevated the company to unicorn status with a valuation of USD 1.2 billion. Behavioral telehealth platform Rula also became a unicorn after raising USD 125 million at a valuation of USD 1.3 billion. Other significant deals included Foodsmart’s USD 200 million Series D and Maven’s USD 150 million Series F. Although total funding rose sharply, the number of deals remained consistent with the previous quarter. This pushed the median deal size to a record USD 6.5 million, reflecting a trend toward backing more mature startups with established customer bases. As a result, the funding environment has become more challenging for early-stage companies, with only 25 pre-seed and seed deals recorded in 2024.

The regulatory landscape for digital therapeutics is becoming favorable, with increasing recognition of their potential benefits. This is encouraging more investment and development in digital therapeutics (DTx) and making it easier for companies to bring their products to market. There is a growing movement towards value-based care, which emphasizes the quality and effectiveness of care over the quantity of services provided. Digital therapeutics products are suited to value-based care models, as they can be shown to improve patient outcomes and reduce healthcare costs. Recent regulatory changes, such as the FDA's establishment of the Digital Health Center of Excellenceand the introduction of new reimbursement codes for remote therapeutic monitoring (RTM), are further supporting the adoption of DTx. Remote therapeutic monitoring codes (98975, 98976, 98977, 98980, and 98981) specify initial setup, education, and device provision, plus two codes for clinician time spent on RTM treatment. These codes support clinical staff in performing RTM remotely, aligning with existing remote and chronic care policies.

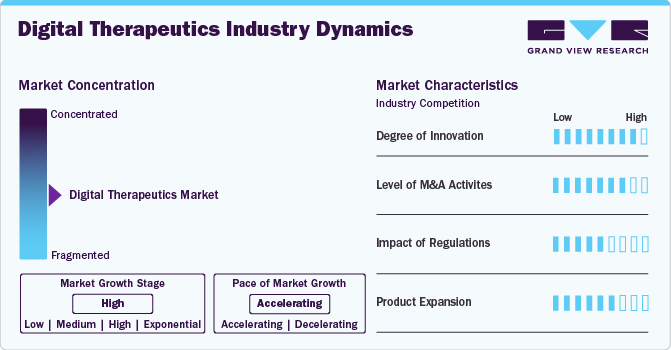

Market Concentration & Characteristics

The digital therapeutics industry is marked by a high degree of innovation. According to recent data, as of April 2024, there are 739 digital therapeutics devices in various stages of development worldwide, with 649 actively being developed. This includes 390 products in the early stages and 259 in the later stages. Key players in this market include companies such as Alex Therapeutics, Pear Therapeutics, and Click Therapeutics, among others. These companies are innovating and launching products. For instance, in November 2023, AstraZeneca launched Evinova, a new health technology division aimed at driving innovation throughout the life sciences industry. This division will focus on enhancing the conduction of clinical trials and improving health results.

In recent years, both the U.S. and Europe have taken significant regulatory steps to promote the development of digital health technologies, impacting the digital therapeutics industry. For instance, in the U.S., the FDA's 2017 Digital Health Innovation Action Plan, part of the 21st Century Cures Act, introduced a precertification program allowing low-risk digital health software to be marketed with minimal oversight and reclassified certain medical software to be no longer regulated as medical devices. Key U.S. laws include HIPAA, the FD&C Act, the FTC Act, and the FTC's Health Breach Notification Rule, ensuring privacy, data security, and safe app performance.

The market is witnessing a high level of mergers and acquisitions (M&A) activity. Major healthcare and technology companies are acquiring smaller, innovative firms to enhance their product portfolios and leverage advanced technologies. For instance, in May 2024, digital therapeutics company Akili, known for its video game treatment for ADHD, will be acquired for USD 34 million. Akili is set to merge with Virtual Therapeutics, forming a larger digital health organization.

Product expansion in the industry involves introducing new & advanced products and solutions in the market to expand company’s position. For instance, in October 2023, Better Therapeutics, Inc., a prescription digital therapeutics (PDT) for cardio-metabolic diseases, announced the launch of AspyreRx. This is the cognitive behavioral therapy app authorized by the U.S. Food and Drug Administration as a Class II device for treating adults with type 2 diabetes.

Application Insights

The diabetes segment dominated the market with largest market share of 29.75% in 2024 and is expected to register the fastest CAGR over the forecast period. Factors that drives the segment growth include the growing prevalence of diabetes and other related chronic diseases. According to a 2023 report by the Institute for Health Metrics and Evaluation, over half a billion people globally are living with diabetes, impacting men, women, and children of all ages in every country.

The obesity segment held the second-largest market share, due to growing obesity in population globally. Digital therapeutics provide cost-effective solutions for treatment of many chronic diseases, which is expected to fuel the segment growth in the near future. CVDs and smoking cessation, along with obesity, are expected to demonstrate significant growth rates during the forecast period.

End Use Insights

The patient segment held the largest market share of 34.50% in 2024 and is anticipated to register the fastest growth rate over the forecast period, owing to patients' rapid adoption of digital therapeutics. Patients are provided with care programs that are personalized and based on scientific evidence. Digital therapeutics also improve access to care for people, especially those from rural and remote areas. It can help providers monitor patients in real time, identify the gap in care, and provide timely interventions. It improves the efficiency of care delivery through evidence-based care therapies. This solution can reduce the need for frequent intervention by physicians in managing people with chronic conditions.

On the other hand, the providers segment held the second largest share in 2024. The growth of the providers' end use segment can be attributed to more providers leveraging digital therapeutics to support and deliver medically proven therapies outside of a care setting and provide reliable patient engagement. Payers are increasingly interested in covering digital therapeutics, which shows a significant growth scope. Also, they are encouraged to undertake initiatives by business models that facilitate adherence and enhance efficacy while reducing costs.

Regional Insights

North America digital therapeutics industry dominated globally with a revenue share of 40.11% in 2024. The overall market in the region is expected to grow significantly over the forecast period, owing to the increased use of digital health products and favorable reimbursement scenarios that focus on improving quality of life through improved tracking & diagnostics. Factors such as rapid growth in the adoption of smartphones, advancements in coverage networks, acute shortage of primary caregivers, and rise in prevalence of chronic diseases, geriatric population, costs of healthcare, & need for improved prevention & management of chronic conditions are driving the growth of digital therapeutics in North America.

U.S. Digital Therapeutics Market Trends

The U.S. digital therapeutics industry held the majority of revenue share of 85.40% in 2024. The continuously changing digital landscape, rising consumerism in healthcare, the COVID-19 pandemic, and initiatives by key companies, including mergers, acquisitions, funding, etc., are some of the key factors fueling the market growth. For instance, in October 2021, Click Therapeutics, Inc. received USD 52 million in Series B funding from multiple investors. This enabled the development and commercialization of the company’s prescription digital therapeutic pipeline while also helping the company advance its platform capabilities.

Europe Digital Therapeutics Market Trends

Europe’s digital therapeutics industry is expected to gain momentum over the forecast period due to the growing adoption of apps by healthcare providers and patients. The presence of developed economies, such as Germany, the UK, France, Spain, and Italy, is expected to fuel the market in Europe during the forecast period. The EC’s Digital Single Market Strategy can furnish consumers and businesses with access to online services & goods across Europe, providing necessary conditions for the growth of the digital network & allied services, which is expected to help maximize the growth potential of the European economy.

The UK digital therapeutics industry is experiencing rapid growth, driven by increasing demand for evidence-based solutions to manage chronic diseases such as diabetes, mental health disorders, and cardiovascular issues. Factors contributing to this expansion include the rising prevalence of chronic conditions, heightened awareness of proactive healthcare management, and the convenience offered by digital solutions. The market encompasses a variety of products that can be utilized independently or alongside traditional therapies, emphasizing the importance of clinical validation and user-friendly design. In addition, the growing penetration of smartphones and healthcare applications supports the adoption of digital therapeutics among consumers, marking a significant shift towards integrated and patient-centered care in the UK healthcare landscape.

Germany’s digital therapeutics industry is anticipated to exhibit growth owing to its well-established healthcare infrastructure, availability of technologically, advanced & connected medical devices, and easy access to patient health information. Moreover, the increasing incidence of lifestyle-associated disorders creates a demand for personal health monitoring devices, which is anticipated to boost the market over the forecast period. Furthermore, initiatives by government and private players in the country are also driving the growth of the market. For instance, the introduction of the Digital Healthcare Act in 2019 established the Digital Health Applications (DiGA) program, which provides a streamlined pathway for the evaluation, listing, and reimbursement of DTx products.

Asia Pacific Digital Therapeutics Market Trends

The Asia Pacific digital therapeutics industry is anticipated to witness substantial growth, with the fastest CAGR over the forecast period, due to increased government spending on healthcare and high demand for IT services. The demand for healthcare IT systems has been growing as they enable efficient management of hospitals' clinical, financial, and administrative aspects. An increase in demand for adequate healthcare, improved access to the internet, and a rise in smartphone penetration are the factors facilitating a rapid increase in Asia Pacific market.

The digital therapeutics industry in Japan is expected to grow over the forecast period, owing to the advancing digital infrastructure and the growing senior population. In addition, the Ministry of Health, Labor & Welfare launched several initiatives to improve existing healthcare infrastructure. In April 2021, Jolly Good, Inc. established a specialized DTx Division to develop digital therapeutics using VR and AI technologies. The company planned a corporate expansion of digital therapeutics worldwide.

The digital therapeutics industry in China is experiencing rapid growth, driven by increasing chronic disease prevalence and strong government support for digital health initiatives. Key players in the market include Alibaba Health, WeDoctor, and Omada Health, which are leveraging digital technologies to provide evidence-based therapeutic interventions through software and mobile applications. Technological advancements and the growing acceptance of digital health solutions among consumers further fuel the market's expansion. For instance, in February 2023, NERVTEX, a company based in China that specializes in digital therapy solutions for neurological conditions, received authorization from the China National Medical Products Administration for its artificial intelligence-driven software designed to analyze movement disorders.

Latin America Digital Therapeutics Market Trends

Latin America’s digital therapeutics industry is expected to grow owing to rapid technological advancements and increasing digitalization. This can be attributed to various factors, such as an increase in healthcare awareness and the availability of technically advanced procedures for the diagnosis and treatment of critical diseases. The increasing penetration of the internet has also led to the growing use of e-prescribing systems in the region. Furthermore, governments in the region are boosting their investment, while local and global private sector firms are investing significantly in the area to improve their footprint.

The Brazil digital therapeutics industry is witnessing significant growth, driven by an increased awareness of the benefits of digital health solutions among both healthcare providers and patients. This market's expansion is further fueled by supportive government policies aimed at integrating digital solutions into the national healthcare system and growing investment in health tech startups. As access to smartphones and internet connectivity continues to increase across the country, digital therapeutics are becoming increasingly accessible, thereby driving growth in the country.

Middle East & Africa Digital Therapeutics Market Trends

The digital therapeutics industry in the MEA is driven by the increasing adoption of digital therapeutics owing to the growing use of smartphones in this region. This is expected to facilitate the adoption of connected health services in the MEA, resulting in market growth. Advancements in healthcare are expected to boost the adoption of digital health solutions, including digital therapeutics. Growing internet usage in the healthcare sector facilitates various healthcare practices, equipment functions, patient database maintenance, etc., which is expected to drive the growth of the market.

The digital therapeutics industry in South Africa is growing at a slower pace, majorly due to a need for established healthcare infrastructure and limited awareness regarding technological advancements. Although the South African market is in the nascent stage, an increase in the adoption of advanced technologies in healthcare is expected to boost the market. For instance, The National Digital Health Strategy for South Africa, from 2019 to 2024, aims to strengthen governance in the digital health sector, establish strong integrated platforms to advance information system development, and build the necessary infrastructure in collaboration with various government departments.

Key Digital Therapeutics Company Insights

The global digital therapeutics industry is highly competitive and is dominated by a few renowned companies. Participants are adopting various strategies such as mergers, partnerships, collaborations, and acquisitions to enhance their marketplace presence.

Key Digital Therapeutics Companies:

The following are the leading companies in the digital therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- OMADA HEALTH, INC.

- Welldoc, Inc.

- 2Morrow, Inc

- Livongo Health, Inc. (Teladoc Health, Inc.)

- Propeller Health (ResMed)

- Fitbit LLC

- Mango Health

- CANARY HEALTH

- Noom, Inc.

- Pear Therapeutics, Inc.

- Akili Interactive Labs, Inc.

- HYGIEIA

- DarioHealth Corp.

- BigHealth

- GAIA AG

- Limbix Health, Inc.

Recent Developments

-

In October 2024, Click Therapeutics, Inc. launched Software-Enhanced Drug therapies under its new Click SE offering, introducing a novel category of prescription digital therapeutics aligned with growing FDA interest in Prescription Drug-Use Related Software (PDURS) guidance.

“Soon, each drug could have a ‘smart’ dosage that combines a highly validated, fully digital therapeutic with traditional pharmacotherapy - a software-enhanced drug. Our Click SE™ products will be ‘smart’ in this way. They will be designed to respond and adapt to patients, whether through personalized neuromodulatory interventions, responsive side effect management, or adaptive dose titration with the goal of enhancing overall adherence and efficacy.”

- said Han Chiu, chief technology officer of Click Therapeutics.

- In March 2025, ATA Action acquired the Digital Therapeutics Alliance (DTA), a global provider promoting digital therapeutics access. This merger strengthens advocacy efforts to support innovative technologies reshaping healthcare and enhancing patient outcomes.

“We will continue to advance and expand our efforts to strengthen state and federal policy, ensuring that telehealth is established as a permanent and essential modality of care. And, with DTA’s expertise influencing policies affecting innovative technologies, we are expanding our advocacy efforts to support digital health tools such as digital therapeutics, digital diagnostics, remote monitoring devices and artificial intelligence.”

- Kyle Zebley, executive director, ATA Action and senior vice president, public policy at the ATA

- In May 2024, Otsuka announced the launch of a subsidiary focused on data and technology. This entity, named Otsuka Precision Health, will commercialize Rejoyn, a digital therapeutic specifically designed for individuals suffering from major depressive disorder.

-

In January 2024, Eli Lilly and Company announced the launch of LillyDirect, a digital healthcare platform for U.S. patients managing obesity, migraine, and diabetes. LillyDirect provides a suite of disease management tools, enabling personalized support, access to independent healthcare providers, and the convenience of direct delivery of certain Lilly medications to homes through third-party pharmacy services.

-

In November 2023, Curavit Clinical Research, a virtual contract research organization, introduced a new service for clinical trials focused on Health Economics and Outcomes Research (HEOR). This latest inclusion in clinical trials aims to give pharmaceutical companies a deeper understanding of their product's value and potential in the market.

-

In July 2023, Big Health, known for its non-pharmacological digital mental health solutions, announced the acquisition of Limbix, a company specializing in digital therapeutics for adolescents and young adults experiencing depressive symptoms. This acquisition allows Big Health to broaden its array of therapeutic offerings, adding SparkRx, aimed at treating depression in adolescents, and a product under development for adolescent anxiety to its established programs. These flagship programs include Sleepio, designed to combat insomnia, and Daylight, to alleviate anxiety, catering to individuals 18 years and older.

Digital Therapeutics Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 9.55 billion

The revenue forecast in 2030

USD 32.5 billion

Growth Rate

CAGR of 27.77% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

OMADA HEALTH, INC.; Welldoc, Inc.; 2Morrow, Inc; Teladoc Health, Inc.; Propeller Health (ResMed); Fitbit LLC; CANARY HEALTH; Noom, Inc.; Pear Therapeutics, Inc.; Akili Interactive Labs, Inc.; HYGIEIA; DarioHealth Corp.; BigHealth; GAIA AG; Limbix Health, Inc.; Mango Health

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

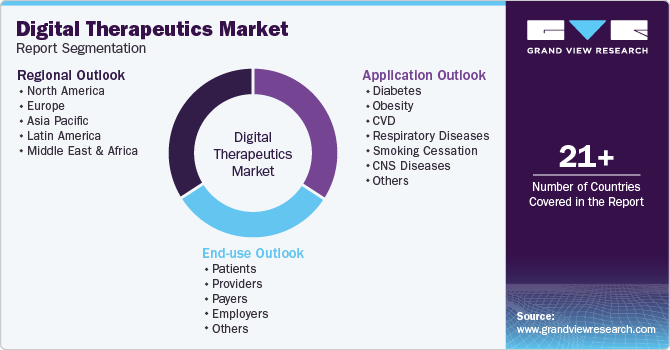

Global Digital Therapeutics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital therapeutics market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetes

-

Obesity

-

CVD

-

Respiratory Diseases

-

Smoking Cessation

-

CNS Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Employers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global digital therapeutics market size was estimated at USD 7.67 billion in 2024 and is expected to reach USD 9.55 billion in 2025.

b. The global digital therapeutics market is expected to grow at a compound annual growth rate of 27.77% from 2025 to 2030 to reach USD 32.52 billion by 2030.

b. The diabetes segment dominated the global digital therapeutics market and held the largest revenue share of more than 29.75% in 2024.

b. The patient's segment dominated the global digital therapeutics market and held the largest revenue share of more than 34.50% in 2024.

b. North America dominated the digital therapeutics market with a share of 40.11% in 2024. This is attributable to the growing number of reforms to curb the increase in healthcare spending in the country coupled with a drive to focus on a patient-centric healthcare approach.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.