Market Size & Trends

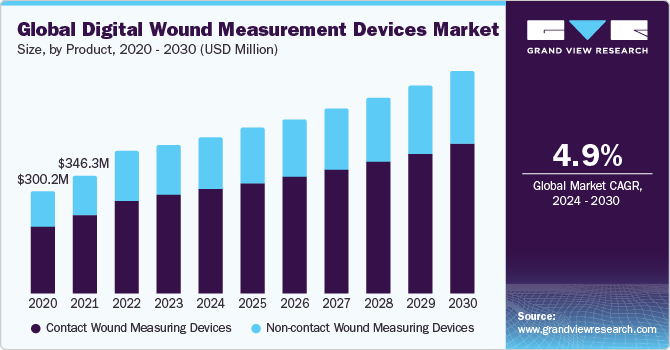

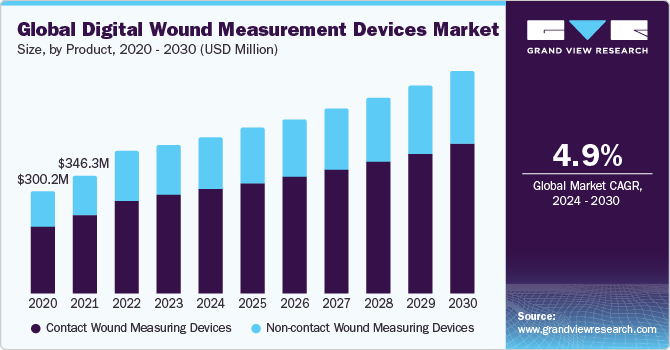

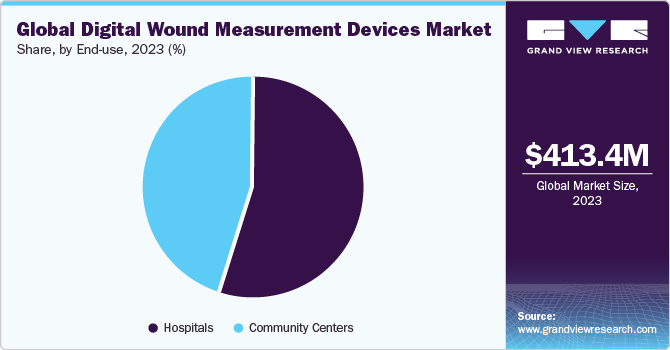

The global digital wound measurement devices market size was valued at USD 413.4 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.97% from 2024 to 2030. The market is expected to grow as a result of factors such as the rise in demand for non-invasive procedures, the rising prevalence of diabetic ulcers and chronic wounds, and the increased awareness of digital wound measurement devices among patients and healthcare professionals.

The increase in the prevalence of chronic wounds and diabetic ulcers is one of the major drivers for the digital wound measurement device market. Chronic wounds are a significant burden on the healthcare system, with an estimated 5.7 million people suffering from chronic wounds, such as venous leg ulcers, pressure ulcers, and diabetic foot ulcers in the U.S. alone. Digital wound measurement devices provide an objective and accurate way to assess and monitor chronic wounds, including diabetic foot ulcers. These enable healthcare professionals to track changes in wound size, depth, and healing progress, which is crucial in treatment decisions and in preventing complications.

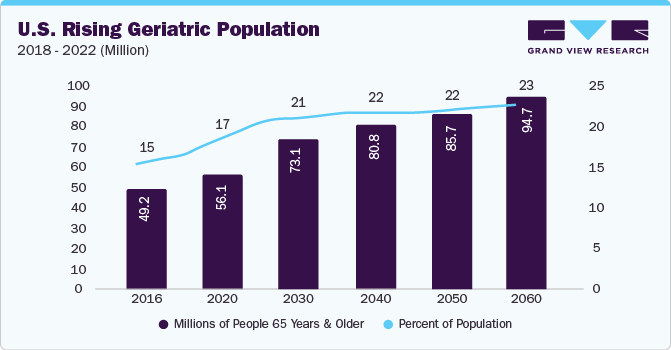

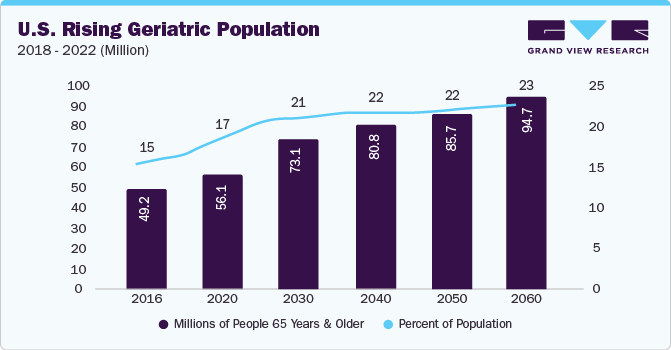

The market for digital wound measurement devices is growing due to the aging population and an increase in the prevalence of chronic illnesses, including diabetes, obesity, and other lifestyle-related issues. The benefits of digital wound assessment technology and a rise in public knowledge of ways to cut healthcare expenses further contribute to the market's expansion. However, these devices' drawbacks, such as their inability to offer information regarding wounds, could prevent the industry from expanding. On the other hand, large unmet wound care needs in developing countries are anticipated to propel the market growth for the forecast period.

Product Insights

Based on the product, the digital wound measurement devices market is segmented into non-contact wound measuring devices and contact wound measuring devices. The non-contact wound measuring devices segment held the largest market share in 2023. It is expected to grow at the fastest CAGR during the forecast period, as it provides detailed images of wounds for documentation.

Wound Type Insights

Based on wound type, the market is segmented into chronic wounds and acute wounds. The chronic wounds segment dominated the market in 2023 and is anticipated to continue with its dominance during the forecast period. This is due to an increase in incidences of chronic wounds such as diabetic foot ulcers, pressure ulcers, arterial ulcers and venous leg ulcers. Chronic wounds are further sub-segmented into pressure ulcers, diabetic foot ulcers, venous leg ulcers, and arterial ulcers.

End-Use Insights

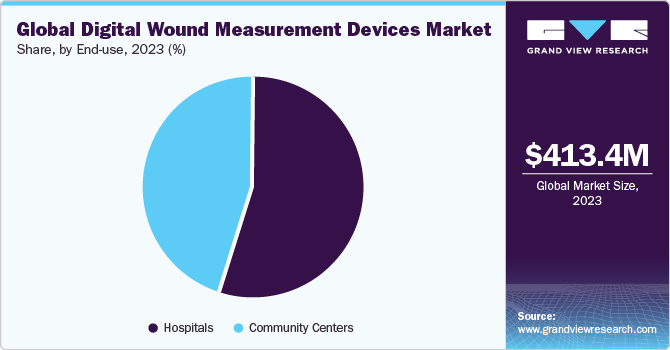

Based on end use, the digital wound measurement devices market is segmented into hospitals and community centers. The hospital segment dominated the market in 2023 and is expected to be the fastest-growing segment during the forecast period. This is due to a rise in patient admissions for the treatment of both acute and chronic wounds, there has been a spike in the usage of digital wound assessment devices in hospitals. Additionally, the growing number of patients needing wound care is anticipated to have a beneficial impact on healthcare practitioners' adoption of chronic wound devices.

Regional Insights

North America dominated the market in 2023. A large patient pool and the presence of established manufacturers are anticipated to strengthen market growth in this region further. Rapid technological advancement due to the increased frequency of chronic illnesses. As the prevalence of diabetes mellitus among people increases, diabetic foot ulcers are becoming more prevalent. Asia-Pacific is expected to witness the fastest CAGR over the forecast period.

Growth in the target population in emerging nations, improvement in health awareness, development of healthcare infrastructure, growth in the number of laboratories with cutting-edge medical facilities and rise in demand for digital wound monitoring instruments are among the key factors driving the Asia Pacific digital wound measurement devices market.

Competitive Insights

Key players operating in the market are Health (Tissue Analytics, Inc), Arnaz Medical Limited, eKare Inc., Kent Imaging Inc., Net, Perceptive Solutions, Inc., BioVisual Technologies LLC, Smith & Nephew Plc., WoundRight Technologies, LLC, WoundMatrix, Inc., and WoundVision, LLC. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In July 2022, Smith & Nephew plc. announced the launch of the WOUND COMPASS clinical support application. The application is a compressive digital supporting tool designed for healthcare professionals to guide wound evaluation and decision-making.

-

In June 2022, Premier, Inc. and MolecuLight Corp. announced a group purchasing arrangement that unites 225,000 additional providers and over 4,400 hospitals in the U.S.