- Home

- »

- Medical Devices

- »

-

Digital X-ray Devices Market Size, Share & Growth Report 2030GVR Report cover

![Digital X-ray Devices Market Size, Share & Trends Report]()

Digital X-ray Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By End-user (Hospital, Diagnostic Imaging Centers), By Portability (Fixed, Mobile), By Application (Orthopedic, General Imaging), And Segment Forecasts

- Report ID: GVR-4-68040-003-2

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital X-ray Devices Market Summary

The global digital X-ray devices market size was valued at USD 3.6 billion in 2022 and is projected to reach USD 4.5 billion by 2030, growing at a compound annual growth rate (CAGR) of 3.0% from 2023 to 2030. The growth of the market is attributed to technological advancements, an increase in the prevalence of chronic diseases across the globe, and rising awareness among patients regarding early diagnostic techniques.

Key Market Trends & Insights

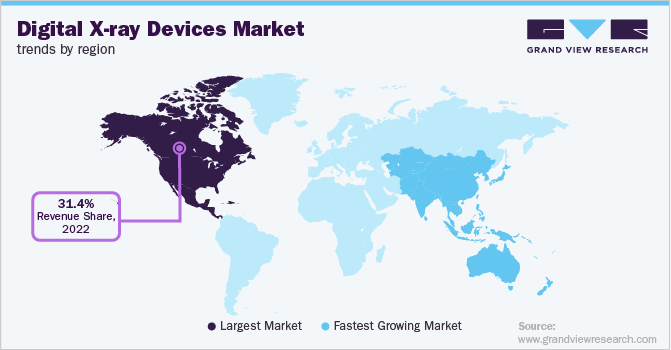

- North America dominated the global industry in 2022 and accounted for the maximum share of more than 31.40% of the overall revenue.

- Asia Pacific is estimated to register the fastest CAGR over the forecast period.

- Based on portability, the fixed digital X-ray devices segment dominated the global industry in 2022 and accounted for the largest share of the overall revenue.

- Based on application, the general imaging segment dominated the industry in 2022 and accounted for the largest share of the overall revenue.

- Based on end-use, the hospital segment dominated the industry in 2022 with a share of more than 36.15% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 3.6 Billion

- 2030 Projected Market Size: USD 4.5 Billion

- CAGR (2023-2030): 3.0%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Chronic disorders are becoming more common, including urological disorders, cancer, Cardiovascular Disorders (CVDs), lung disorders, neurovascular disorders, and other issues. As per the WHO, chronic diseases are responsible for about 74% of deaths globally. The benefits of digital X-ray devices have been a significant factor in their adoption by end-users.

Greater patient screening volumes are made possible by characteristics, such as minimal radiation dose, high speed & accuracy, higher image quality, and quick image viewing. For instance, in April 2021, U.S.-based Crouse Medical Imaging installed Philips DigitalDiagnost C90 VS a digital radiography technology. Moreover, in October 2021, Memorial Community Health, Inc. (MCHI) based in the U.S. announced the addition of a digital X-ray system in their Clay Center clinic location. Government initiatives are expected to further propel industry growth during the forecast period. In July 2022, the European Union (EU) and the WHO donated digital X-ray equipment to the Armenia Ministry of Health for use in the radiology departments of 7 hospitals.

The growing incidence of chronic disorders, such as cancer, cardiovascular, and neurological, is leading to a rise in screening for X-rays, as it is considered an initial imaging investigation. According to the U.K. government statistical data from the NHS in England, in June 2022 about 3.44 million imaging tests were reported to have taken place in England, of which Plain Radiography (X-ray) was the most common and accounted for about 1.71 million. Constant product developments and technological innovations, such as the integration of Artificial Intelligence (AI), low X-ray dose exposure, and high-resolution imaging, are contributing to the industry's growth.

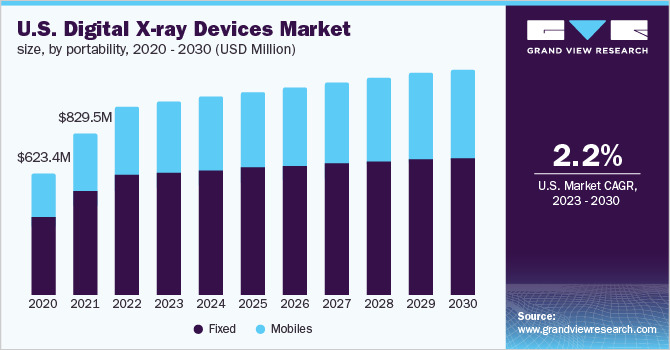

Portability Insights

Based on portability, the industry is further categorized into fixed and mobile devices. The mobile digital X-ray devices segment is anticipated to witness the fastest CAGR of 4.1% during the forecast period. Mobile imaging devices' contribution to patient care is the main factor driving healthcare facilities to adopt them. Images can be acquired at the patient's bedside with a mobile X-ray device in relatively less time than it would take to carry the patient to an X-ray room. In addition, this device is being adopted more widely as a result of market participants focusing on manufacturing novel and enhanced mobile X-ray devices. For instance, in April 2022, Samsung introduced the GM85 Fit, a mobile digital radiography device.

This system is anticipated to support effective and efficient patient care. The fixed digital X-ray devices segment dominated the global industry in 2022 and accounted for the largest share of the overall revenue. The demand for fixed X-ray devices is particularly high in developing nations where the uptake of new technologies is slower. Technological advancements in fixed X-ray systems are further expected to boost market growth. For instance, in October 2021, Samsung partnered with VUNO, a South Korean Artificial Intelligence (AI) medical software firm to integrate VUNO's AI-assisted solutions into Samsung's ceiling-type digital radiography system.

Application Insights

On the basis of applications, the global industry has been further segmented into general imaging, orthopedics, dental, and mammography. The general imaging segment dominated the industry in 2022 and accounted for the largest share of the overall revenue. The segment is projected to expand further at the fastest growth rate of more than 3.15% during the forecast period. This rapid growth can be attributed to the growing adoption of X-ray devices for general imaging. General imaging includes the chest, abdomen, kidney, ureter, bladder, intestinal, and other radiography.

Chest radiographs are the most often requested imaging test, according to the U.K. government statistical data from the NHS in England and Wales. The dental segment is also expected to witness a significant CAGR during the forecast period. The most frequent practice carried out in dental clinics is acquiring dental X-rays. Dental X-rays have several benefits in dentistry, including the ability to diagnose cavities, impacted teeth, the presence of infection, and many other conditions. There has been a growing demand for better dental technology owing to the awareness about oral health.

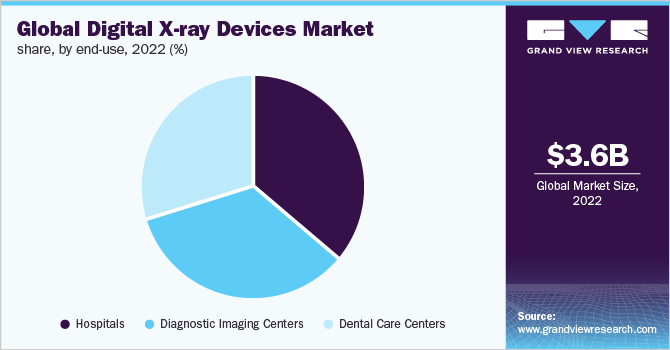

End-use Insights

On the basis of end-uses, the industry has been further categorized into Hospitals, diagnostic imaging centers, and dental care centers. In 2022, the hospital segment dominated the industry with a share of more than 36.15% of the overall revenue. This is due to the adoption of technologically advanced medical imaging devices by hospitals. The adoption of advanced medical technology is supported by the fact that hospitals get an advantage over other hospitals in the region by receiving more referrals. Moreover,a rise in the cases of individuals with chronic illnesses seeking medical attention in hospitals is further expected to accelerate segment expansion.

The diagnostic imaging centers segment is anticipated to witness a significant CAGR over the forecast period. Hospitals have numerous departments, but diagnostic imaging focuses on imaging services and can provide patients with a more individualized experience. Hospital-based institutions have longer waiting times for appointments (days or even weeks), whereas diagnostic imaging facilities provide same-day appointments. The majority of hospitals lack the room essential for specialized imaging equipment, which also demands large investments and regular maintenance. Thus, the above-mentioned factors are expected to drive the diagnostic imaging centers’ segment growth over the forecast period.

Regional Insights

North America dominated the global industry in 2022 and accounted for the maximum share of more than 31.40% of the overall revenue. The region’s growth can be attributed to the presence of key players, significant government funding in the development of cutting-edge medical devices, and the introduction of novel medical imaging systems. Moreover, companies in the region are adopting different strategies, such as mergers, acquisitions, partnerships, and strengthening distribution networks to fuel their growth and expansion goals. For instance, in February 2022, NeuroLogica Corp., the Samsung healthcare subsidiary in the U.S, announced that its Digital Radiography and Ultrasound (DR & US) business, will operate under the name Boston Imaging.

Asia Pacific is estimated to register the fastest CAGR over the forecast period mainly due to growth in health reforms in the region. Additional factors supporting this include the increasing population, better healthcare infrastructure, and a rising number of companies entering the market. The growing prevalence of various chronic disorders is also expected to support regional market growth. According to the International Agency for Research on Cancer, about 95,03,710 new cancer cases were reported in Asia in 2020 and the number is expected to rise to 2,06,06,063 by 2025. Moreover, according to the National Center for Biotechnology Information, CVD is the primary cause of death worldwide and it is estimated that Asia accounts for half of all CVD cases. Thus, the usage of screening tests for such disorders has increased in the region in the past few years due to growing government initiatives and patient awareness.

Key Companies & Market Share Insights

Key players are implementing various strategies including partnerships through mergers & acquisitions, geographical expansions, product launches, government approvals, and strategic collaborations to expand their industry presence. For instance, in September 2021, GE Healthcare launched the Definium Tempo, a fixed, Overhead Tube Suspension (OTS) digital X-ray system. This system is intended to be a personal assistant for radiologists and technologists. It uses automation to lighten workloads and support radiology departments in providing the best patient care possible. Some of the prominent players operating in the global digital X-ray devices market include:

-

GE Healthcare

-

Siemens Healthineers AG

-

Philips Healthcare

-

Canon Medical Systems Corp.

-

Carestream Health

-

Fujifilm

-

Mindray Medical International

-

Shimadzu International

-

Samsung Medison

-

Boston Imaging

Digital X-ray Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.72 billion

Revenue forecast in 2030

USD 4.5 billion

Growth rate

CAGR of 3.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Portability, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Columbia; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Siemens Healthineers AG; Philips Healthcare; Canon Medical Systems Corp.; Carestream Health; Fujifilm; Mindray Medical International; Shimadzu International; Samsung Medison; Boston Imaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

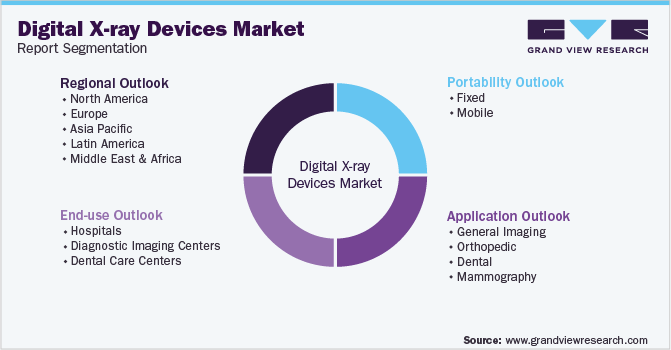

Global Digital X-ray Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global digital X-ray devices market report on the basis of portability, application, end-use, and region:

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Mobile

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Imaging

-

Orthopedic

-

Dental

-

Mammography

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Dental Care Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The digital X-ray devices market size was estimated at USD 3.6 billion in 2022 and is expected to reach USD 3.72 billion in 2023.

b. The digital X-ray devices market is expected to grow at a compound annual growth rate of 3.0% from 2023 to 2030 to reach USD 4.5 billion by 2030.

b. North America dominated the market with a share of 31.61% in 2022 owing to the presence of key players, significant government funding in the development of medical devices, and the early introduction of novel medical imaging systems.

b. Some key players operating in the market include GE HealthCare, Siemens Healthineers AG, Philips Healthcare, Canon Medical Systems Corporation, Carestream Health, Fujifilm, Mindray Medical International, Shimadzu International, Samsung Medison, and Boston Imaging.

b. Key factors that are driving the digital X-ray devices market growth include technological advancements, an increase in the prevalence of chronic diseases and growing awareness among patients regarding early diagnostic techniques.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.