- Home

- »

- Beauty & Personal Care

- »

-

Direct Selling Market Size & Share, Industry Report, 2033GVR Report cover

![Direct Selling Market Size, Share & Trends Report]()

Direct Selling Market (2026 - 2033) Size, Share & Trends Analysis Report, By Product (Health & Wellness, Cosmetics & Personal Care, Household Goods & Durables), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-928-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Direct Selling Market Summary

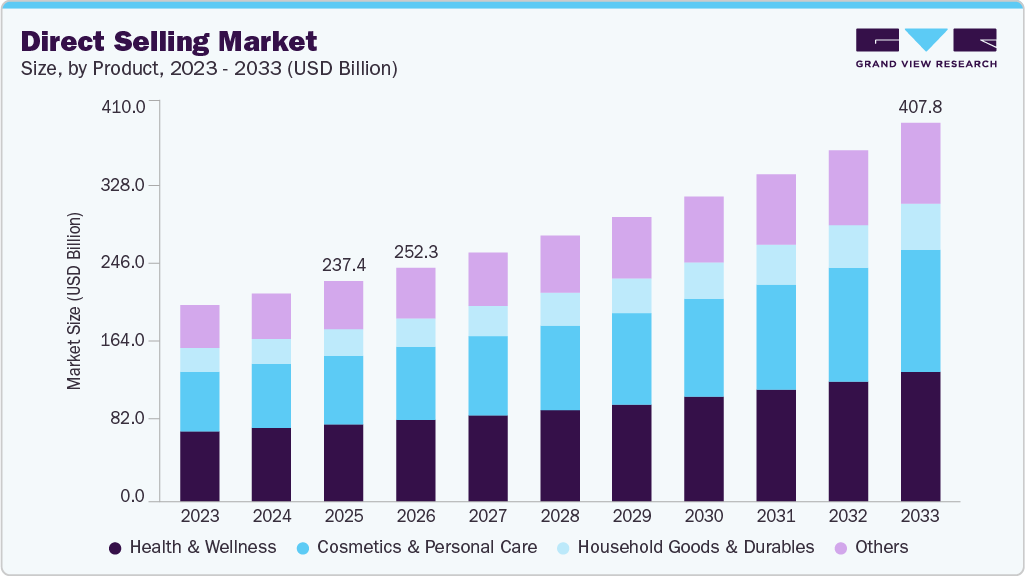

The global direct selling market size was estimated at USD 237.36 billion in 2025 and is projected to reach USD 407.80 billion, growing at a CAGR of 7.1% from 2026 to 2033. The growth is primarily driven by rising demand from consumers to check and validate a product before purchasing.

Key Market Trends & Insights

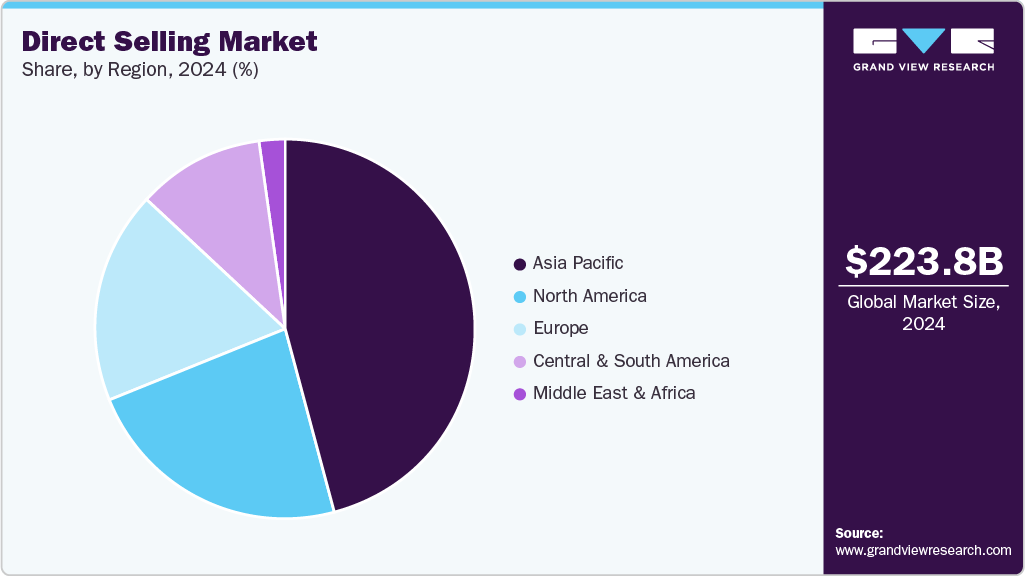

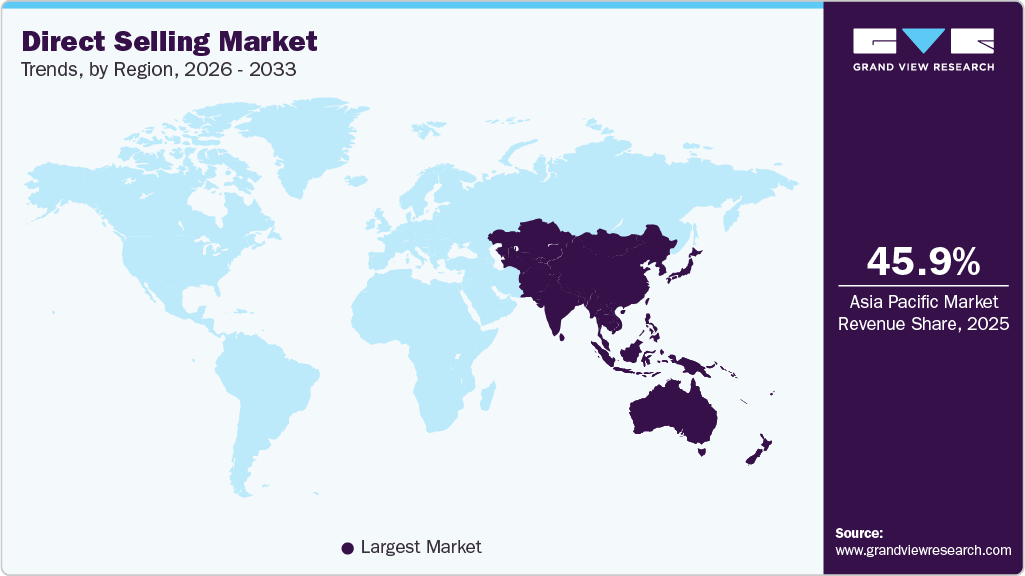

- By region, Asia Pacific led the market with a share of 45.9% in 2025.

- Direct selling market in the U.S. is expected to grow at a CAGR of 6.4% from 2025 to 2033.

- By product, health & wellness led the market and accounted for a share of 35.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 237.36 Billion

- 2033 Projected Market Size: USD 407.80 Billion

- CAGR (2026-2033): 7.1%

- Asia Pacific: Largest market in 2025

New business models have emerged as a result of the internet ecosystem and shifting customer requirements, leading to the rise of direct-to-consumer (D2C) distribution channels. Direct selling is a dynamic and quickly growing route of distribution for product and service marketing. Direct selling offers numerous individuals additional income opportunities and fosters micro-entrepreneurship. According to the 2024 “Global Direct Selling Statistical Data Report”, the WFDSA reports global independent sales representatives (direct sellers) at 102.9 million in 2023. Direct selling not only provides revenue opportunities but also imparts transferable sales and management skills that can be applied outside of the direct selling business.Over the past several years, direct selling companies have successfully introduced new items on a regular basis to reach a broad segment of the consumer base. Organizations have also been creating new product versions to meet the shifting wants of today's consumers. Direct selling companies have been able to appeal to a broad audience with diverse product preferences by expanding their brand offerings. This has attracted new consumers and contributed to the direct selling market growth.

Apart from monetary rewards, direct selling companies recognize that offering additional incentives to their direct sellers is the most effective way to drive them to expand their businesses successfully. As a result, many organizations have started offering extra rewards to their sellers and retailers. These extra incentives have not only helped firms attract employees to the direct selling industry, but they have also kept their salesforce motivated to set higher goals and achieve them. However, the growth of the global market is being hindered by the increasing demand for online purchasing and the expansion of the e-commerce industry.

Consumer Insights

The desire for personalized and trustworthy shopping experiences increasingly shapes consumer preferences toward direct selling. Unlike traditional retail, direct selling enables consumers to receive personalized product recommendations tailored to their specific needs, lifestyle habits, and personal concerns. Whether it is skincare, nutrition, wellness, or home care, shoppers value the one-on-one consultations and demonstrations offered by direct sellers, which help them better understand how the product works and whether it fits their requirements. This sense of personalization builds confidence and reduces purchase hesitation.

Another major trend is the growing reliance on peer-to-peer trust and community-based buying. Consumers today place more trust in recommendations from friends, family, or familiar micro-influencers than in mass advertising. Direct selling thrives on these relationships, creating a comfortable and reliable environment where the buyer feels assured that the advice they receive is genuine and experience-based. This trust-driven approach has significantly strengthened repeat purchases and long-term loyalty.

Convenience is also a key factor behind the adoption of direct selling. With busy lifestyles, consumers appreciate effortless shopping experiences, doorstep delivery, in-home product demos, and seamless reordering through WhatsApp or online links. At the same time, digital transformation has modernized direct selling, allowing sellers to connect with customers through social media, video tutorials, and online consultations. This blend of digital convenience with personal interaction has expanded its appeal to younger demographics, especially women and working professionals.

Product Insights

The health & wellness segment dominated the global market with the largest market share of 35.3% in 2025. The growth of the segment is primarily driven by the rising prevalence of chronic diseases among the global population. Consumers' sedentary and hurried lifestyles have led to an increase in stress, anxiety, cancer, diabetes, and other health problems. Furthermore, a lack of a suitable diet has resulted in a lower intake of key nutrients and minerals needed for the human body's healthy and active functioning. This has resulted in a rise in the adoption of health and wellness products, including vitamins & supplements, and other nutritional products.

The cosmetics and personal care segment is expected to grow at a CAGR of 7.6% from 2026 to 2033. Rising awareness of skincare routines, as well as new product branding and advertising methods, are major drivers propelling the growth of the segment. Growing innovations in sustainable and green cosmetics are opening new potential for business expansion.

Consumers, particularly women, prefer to utilize cosmetic items that are convenient and quick to apply when traveling or attending social gatherings. Furthermore, using organic substances for cosmetics manufacturing is a common approach used by manufacturers to attract more clients. This also aids in the growth of income for businesses in this area.

Regional Insights

The direct selling industry in North America is expected to grow at a CAGR of 6.6% from 2026 to 2033. The growth is driven by the presence of numerous players and the intensifying inclination towards direct selling for extra income opportunities. In addition, rising disposable income, together with government efforts, is likely to boost the regional market growth in the coming years. Direct selling is well-known across the world for providing additional career opportunities to people with no formal education. This is one of the factors that has fueled the industry's recent growth in North America.

U.S. Direct Selling Market Trends

The direct selling industry in the U.S. is expected to grow at a CAGR of 6.4% from 2026 to 2033, primarily due to shifting consumer preferences toward personalized, relationship-based buying experiences and the continued rise of flexible, home-based micro-entrepreneurship. As more consumers seek trusted recommendations, especially for wellness, beauty, and household products, direct selling offers a level of authenticity and personal guidance that traditional retail often lacks. At the same time, millions of Americans are drawn to the low-barrier income opportunities offered by direct selling, supported by digital tools, social media, and online party formats that make it easier to reach customers.

Europe Direct Selling Market Trends

The direct selling industry in Europe is expected to grow at a CAGR of 6.2% from 2026 to 2033, as consumers seek personalized, trust-based purchasing experiences at a time when traditional retail feels increasingly impersonal. Rising interest in wellness, beauty, home care, and nutrition products categories, where direct sellers excel, has expanded the addressable market. Additionally, flexible earning opportunities are attracting more micro-entrepreneurs, especially women and part-time workers, who prefer low-barrier income models. Digital transformation has also modernized direct selling: social-commerce tools, livestreams, and online product demonstrations now enable distributors to reach a wider audience without the need for physical meetings.

Asia Pacific Direct Selling Market Trends

The direct selling industry in the Asia Pacific accounted for a share of 45.9% in 2025, driven by rising spending on healthcare and cosmetics products. Direct sellers are gaining traction in emerging economies, particularly in China, India, and Indonesia's lower-tier cities. The nature of the direct selling companies resonates well with this market group due to the lack of physical stores and a less educated population in some areas. Consumers prefer getting personalized health and beauty product recommendations from salespeople. Consumer health and beauty, as well as personal care, are the leading product categories driving development in the region. Consumers in the Asia Pacific are paying more attention to their health and appearance. Weight loss, vitamins, and skincare with natural ingredients are just a few of the products gaining popularity among customers.

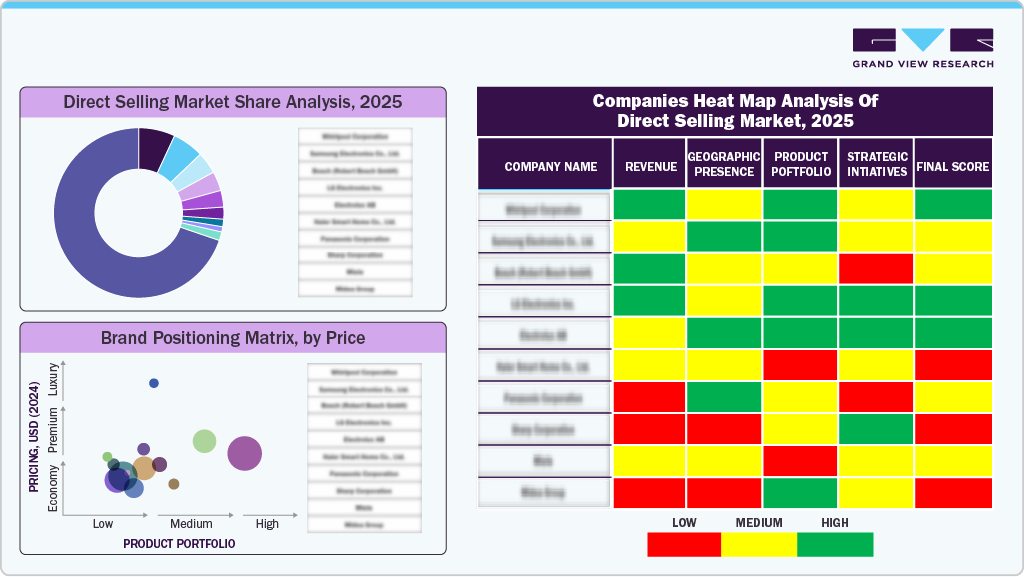

Key Direct Selling Company Insights

Major players operating in the global market are taking various initiatives to gain a larger market share and serve consumers effectively. To support organic growth and market share, leading industry participants are investing in R&D activities. Companies are also developing new products to diversify and reinforce their existing portfolios, while attracting new customers. To develop eco-friendly and cruelty-free products and gain a competitive advantage over their competitors, businesses utilize mergers and acquisitions, as well as strategic partnerships.

Key Direct Selling Companies:

The following are the leading companies in the direct selling market. These companies collectively hold the largest market share and dictate industry trends.

- Amway Enterprises Pvt. Ltd.

- Herbalife Nutrition Ltd.

- Natura & Co.

- Vorwerk

- Nu Skin Enterprises

- Tupperware Brands Corporation

- Torrent Pharmaceuticals Ltd.

- Oriflame Holding AG

- Belcorp Corporation

- Mary Kay Inc.

- Cutco Corporation

Direct Selling Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 252.31 billion

Revenue forecast in 2033

USD 407.80 billion

Growth Rate, Value

CAGR of 7.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy Spain; China; India, Japan; Australia; Indonesia; UAE; Brazil

Key companies profiled

Amway Enterprises Pvt. Ltd.; Herbalife Nutrition Ltd.; Natura & Co.; Vorwerk; Nu Skin Enterprises; Tupperware Brands Corporation; Oriflame Holding AG; Belcorp Corporation; Mary Kay Inc.; Cutco Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Direct Selling Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global direct selling market report on the basis of product and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Billion, 2021 - 2033)

-

Health & Wellness

-

Cosmetics and Personal Care

-

Household Goods & Durables

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global direct selling market was estimated at USD 237.36 billion in 2025 and is expected to reach USD 252.31 billion in 2026

b. The global direct selling market is expected to grow at a compound annual growth rate of 7.1% from 2026 to 2033 to reach USD 407.80 billion by 2033.

b. Health & wellness segment dominated the global market with the largest market share of 35.3% in 2025. The growth of the health and wellness segment is mainly driven by the increased prevalence of chronic disorders among the global population. Consumers' sedentary and hurried lifestyles have led to an increase in stress, anxiety, cancer, diabetes, and other health problems.

b. Some key players operating in the direct selling market include Amway Enterprises Pvt. Ltd.; Herbalife Nutrition Ltd.; Natura & Co.; Vorwerk; Nu Skin Enterprises; Tupperware Brands Corporation; Oriflame Holding AG; Belcorp Corporation; and Mary Kay Inc.

b. Key factors that are driving the direct selling market growth include rising demand from consumers to check and validate products before purchasing, growth of direct-to-consumer (D2C) distribution channels, and encouragement for micro-entrepreneurship.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.