- Home

- »

- Medical Devices

- »

-

Disposable Trocars Market Size, Share, Industry Report 2033GVR Report cover

![Disposable Trocars Market Size, Share & Trends Report]()

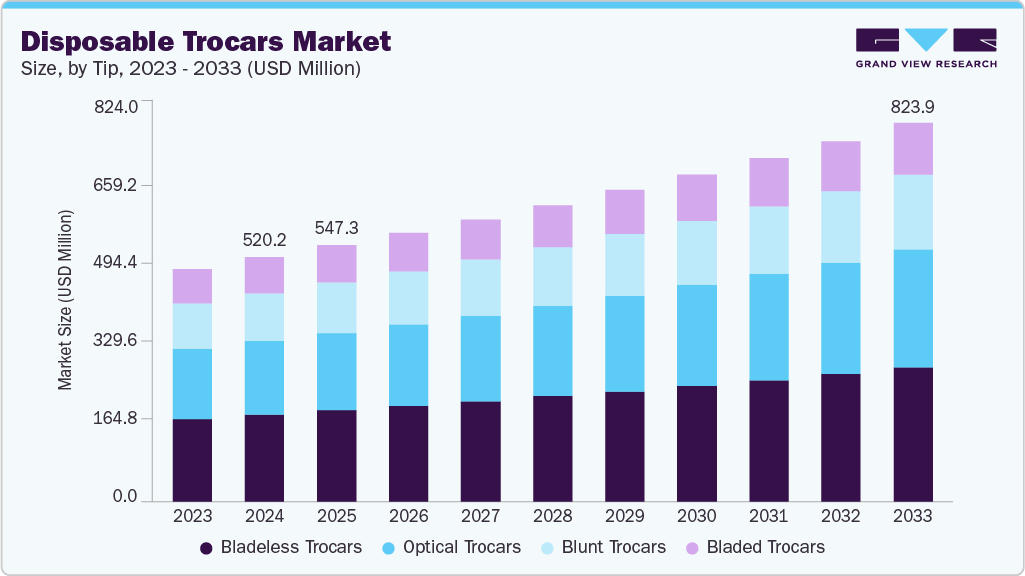

Disposable Trocars Market (2025 - 2033) Size, Share & Trends Analysis Report By Tip (Bladeless Trocars, Optical Trocars, Blunt Trocars, Bladed Trocars), By Application (General Surgery, Gynecological Surgery), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-695-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Trocars Market Summary

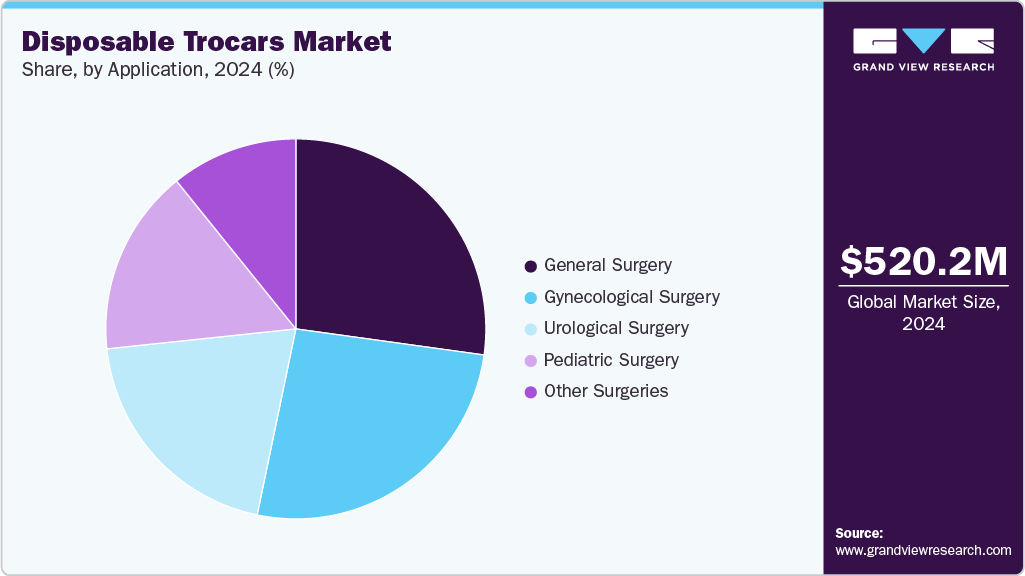

The global disposable trocars market size was estimated at USD 520.17 million in 2024 and is projected to reach USD 823.99 million by 2033, growing at a CAGR of 5.26% from 2025 to 2033. The growth of the market is attributed to the growing adoption of minimally invasive surgical (MIS) techniques, which demand safer, more efficient, and infection-resistant access devices.

Key Market Trends & Insights

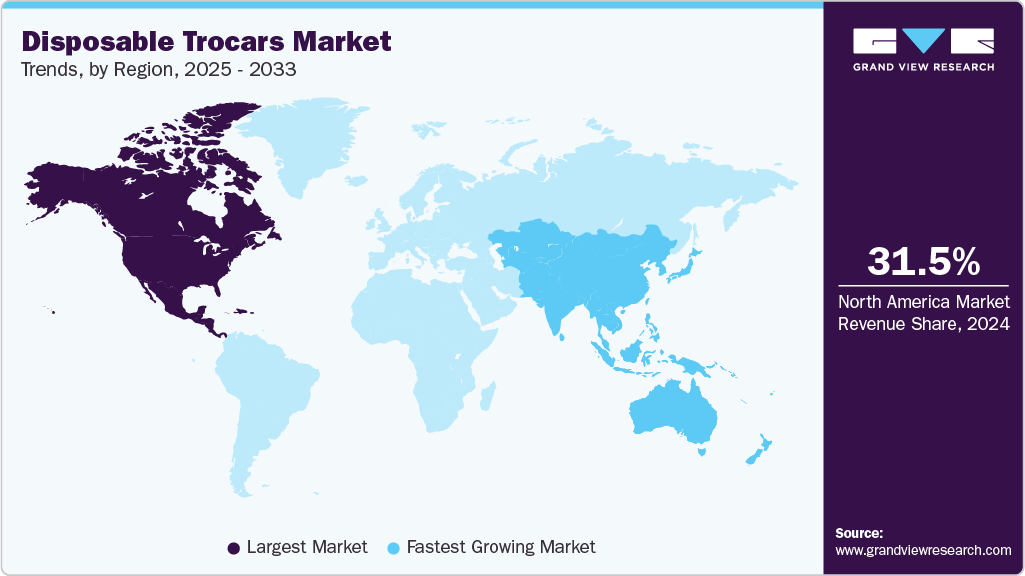

- North America dominated the disposable trocars market with the largest revenue share of 31.53% in 2024.

- The disposable trocars market in the U.S. accounted for the largest revenue share of 82.37% in North America in 2024.

- Based on tip, the bladeless trocars segment led the market with the largest revenue share of 35.38% in 2024.

- Based on application, the general surgery segment led the market with the largest revenue share of 27.19% in 2024.

Market Size & Forecast

- 2024 Market Application: USD 520.17 Million

- 2033 Projected Market Application: USD 823.99 Million

- CAGR (2025-2033): 5.26%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rising surgical volumes globally, especially in laparoscopic, gynecological, and bariatric procedures, have increased the need for single-use trocars that reduce the risk of cross-contamination and eliminate the costs and complexities of sterilization. Technological advancements, including miniaturized designs, enhanced sealing mechanisms, and ergonomic features, further boost their clinical utility. The shift toward outpatient surgeries and strong regulatory support for infection control in healthcare settings also propel market growth. Disposable trocars eliminate the need for sterilization, significantly reducing the risk of cross-contamination and hospital-acquired infections (HAIs). There has been a notable shift toward single-use surgical instruments in response to stricter infection control protocols enforced by healthcare institutions and regulatory authorities, especially after the COVID-19 pandemic. As a result, disposable trocars are increasingly favored for their safety, efficiency, and cost-effectiveness, aligning with the evolving standards in hospital hygiene and patient care.

The growing prevalence of chronic conditions such as obesity, cancer, and gastrointestinal disorders is driving a steady rise in surgical procedures worldwide. Additionally, the expanding elderly population, more prone to requiring surgical interventions, further amplifies the demand for efficient surgical tools like trocars. In this context, disposable trocars offer a quick, sterile, and reliable solution, making them ideal for high-volume clinical settings. Their use supports healthcare systems in handling larger patient loads while maintaining high safety, hygiene, and procedural efficiency standards.

Global Cancer Incidence Prediction from 2022 - 2025

Cancer Type

2022

2025

Leukaemia

487,294

515,145

Multiple myeloma

187,952

201,903

Breast Cancer

2,296,840

2,454,864

Brain, central nervous system

321,731

340,751

Trachea, bronchus and lung

2,480,675

2,661,254

All cancers

19,976,499

21,325,245

Source: IARC, Grand View Research

Population ages 65 and above from 2021 - 2023

Country

2021

2022

2023

China

186,512,604

194,624,975

201,958,336

India

92,570,827

95,489,097

99,540,924

Japan

36,720,387

36,790,059

36,809,376

Germany

18,415,067

18,820,111

18,979,549

France

14,281,423

14,550,496

14,851,943

Thailand

9,677,473

10,112,375

10,553,348

Mexico

9,683,081

9,961,433

10,361,855

Canada

7,067,591

7,375,348

7,762,172

Australia

4,302,098

4,441,967

4,634,398

South Africa

3,834,457

3,968,282

4,118,346

Sweden

2,103,659

2,133,243

2,163,847

Denmark

1,185,879

1,204,263

1,225,083

New Zealand

820,189

841,595

877,407

Kuwait

149,286

126,058

143,310

Source: IARC, Grand View Research

The rising adoption of minimally invasive surgeries (MIS) is a key factor driving the growth of the disposable trocars market, as these procedures require precise and sterile access tools. Laparoscopic, gynecological, and bariatric surgeries, among the most common MIS types, rely on trocars for instrument insertion and gas insufflation. Disposable trocars are preferred in these settings due to their ready-to-use, sterile design, which minimizes the risk of infection and eliminates the need for reprocessing. As MIS procedures offer faster recovery, reduced complications, and shorter hospital stays, their popularity continues to increase globally. This, in turn, drives consistent demand for single-use trocars that align with the procedural efficiency, safety, and hygiene requirements of MIS.

Bariatric and Metabolic Surgery Procedure Estimates in U.S. from 2021 - 2023

Procedure Type

2023

2022

2021

Sleeve

157,254

160,609

152,866

RYGB

63,132

62,097

56,527

Band

773

2,500

1,121

BPD-DS

3,775

6,096

5,525

Revision

32,267

30,894

31,021

SADI

2,387

1,567

1,025

OAGB

555

1,057

1,149

Other

3,898

6,189

7,339

ESG

4,587

4,600

2,220

Balloons

1,461

4,358

4,100

Total

270,089

279,967

262,893

Source: ASMBS, Grand View Research

The detailed standards and testing protocols for disposable trocars are key market drivers, ensuring high product quality, safety, and clinical reliability. Compliance with regulations such as YYT 1710-2020 and rigorous assessments of sealing, gas barrier performance, and connection firmness promote consistent performance in surgical settings. These quality benchmarks increase surgeon and hospital confidence, supporting broader adoption of disposable trocars. Moreover, the use of specialized testing instruments and defined performance criteria fosters innovation and product differentiation, further driving demand in a safety-focused, quality-conscious medical device market.

Innovation in trocar technology has led to developing products with sharper tips, bladeless entry mechanisms, ergonomic handles, and advanced sealing systems. These improvements enhance procedural efficiency, reduce tissue trauma, and offer better control to surgeons. Introducing specialty trocars for specific procedures, such as pediatric or robotic surgeries, also expands the application range. Such advancements improve clinical outcomes and drive surgeon preference for disposable options, accelerating market demand.

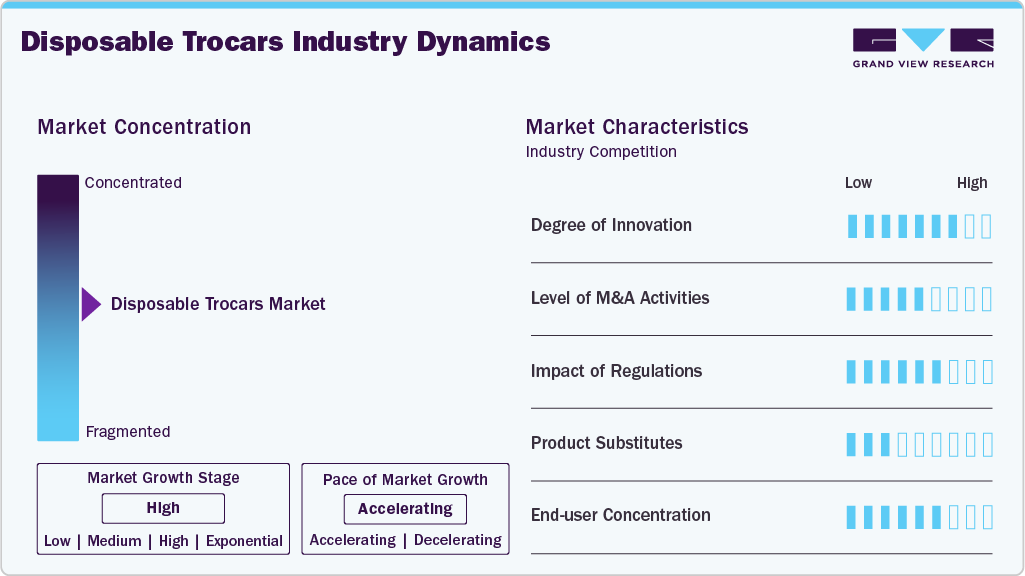

Market Concentration & Characteristics

The disposable trocars market exhibits a moderate to high degree of innovation, driven by the evolving needs of minimally invasive surgeries and heightened focus on patient safety. Recent advancements include developing bladeless entry systems, radially expandable designs, integrated safety shields, and universal sealing valves that accommodate various instrument sizes. These innovations enhance surgical precision, reduce tissue trauma, and support faster procedures with lower infection risks. Moreover, the trend toward ergonomically designed, specialty-specific trocars, such as those for robotic or pediatric applications, reflects continuous product refinement and functional differentiation, strengthening the market's innovation landscape.

Regulation significantly impact the disposable trocars market, influencing product development, approval timelines, and market entry. Regulatory bodies such as the U.S. FDA and the European Medicines Agency (EMA) require stringent evaluations of safety, performance, and sterilization standards before allowing commercialization. Compliance with ISO standards, CE marking, and adherence to Good Manufacturing Practices (GMP) are essential for market access. While these regulations ensure patient safety and product reliability, they can also increase time-to-market and development costs. However, clear regulatory frameworks and pathways, like FDA 510(k) clearance, can facilitate innovation and drive adoption by providing trust and credibility within clinical settings.

The level of mergers and acquisitions (M&A) activity in the disposable trocars market is moderate, with strategic consolidation primarily driven by larger medical device companies aiming to expand their minimally invasive surgery portfolios. While not as aggressive as in other medtech segments, M&A in this space often focuses on acquiring innovative startups or niche players with proprietary trocar technologies or a strong regional presence. For instance, in August 2022, Teleflex Incorporated announced the acquisition of Standard Bariatrics, Inc. Standard Bariatrics is known for its medical technologies, including devices used in bariatric surgery. The acquisition will expand Teleflex's surgical portfolio. These acquisitions enable companies to broaden their product offerings, enhance R&D capabilities, and strengthen distribution networks. Additionally, integration of trocar solutions with complementary laparoscopic or robotic surgical tools is encouraging cross-segment consolidation, further shaping the competitive landscape.

In the disposable trocars market, product substitutes include reusable trocars, which are commonly made from durable materials like stainless steel and are designed for repeated sterilization and use. While they offer long-term cost savings, reusable trocars require rigorous reprocessing protocols, increasing the risk of cross-contamination if not appropriately handled. Additionally, alternative surgical access methods, such as natural orifice transluminal endoscopic surgery (NOTES) and single-incision laparoscopic surgery (SILS), may reduce the reliance on multiple traditional trocars. However, despite these alternatives, the growing emphasis on infection control, convenience, and procedural efficiency continues to favor the adoption of disposable trocars in many clinical settings.

The disposable trocars market exhibits a high end-user concentration, with hospitals and ambulatory surgical centers (ASCs) accounting for most product usage. These facilities perform a large volume of minimally invasive procedures, such as laparoscopic, bariatric, and gynecological surgeries, which heavily rely on disposable trocars for sterile and efficient access. Large hospitals, especially those in urban centers or with specialized surgical departments, tend to drive the bulk of demand due to higher patient turnover and stricter infection control protocols. Additionally, the growing role of ASCs, offering cost-effective, outpatient surgical solutions, further reduces end-user demand within a few key healthcare settings, influencing purchasing patterns and supplier relationships.

Tip Insights

The bladeless trocars segment held the largest revenue share in 2024. This growth can be attributed to their safety-focused design that minimizes tissue trauma and reduces the risk of organ or vascular injury during insertion. Unlike traditional bladed trocars that cut through tissue, bladeless variants use a conical or radially expanding tip to gently separate muscle and fascia layers, which enhances healing and lowers postoperative complications. For instance, Medtronic’s VersaOne Bladeless Trocar and Ethicon’s ENDOPATH XCEL Bladeless Trocar are widely used in laparoscopic and gynecological surgeries due to their proven ability to reduce insertion force and improve surgical outcomes. Their broad acceptance among surgeons, combined with growing procedural volumes in minimally invasive surgery, has solidified bladeless trocars as the leading choice in the tip segment.

Optical trocars segment is expected to witness the fastest growth over the forecast period. This growth is driven by their ability to enhance safety through real-time, direct visualization during insertion. These trocars allow the integration of an endoscope within the cannula, enabling surgeons to monitor tissue separation visually. This significantly reduces the risk of inadvertent injury to internal structures, particularly in obese patients or during reoperations. Applied Medical's Kii Optical Access System is a key instance that is widely adopted in advanced laparoscopic and bariatric procedures. Its popularity stems from its clear cannula design and compatibility with various endoscopes, offering superior control and accuracy. As the number of complex minimally invasive surgeries rises globally, the demand for optical trocars continues to surge, making them the fastest-growing segment in trocar tip technology.

Application Insights

The general surgery segment held the largest revenue share in 2024 and is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the high volume and broad range of procedures performed under this category. General surgeries, including appendectomies, cholecystectomies (gallbladder removal), hernia repairs, and colorectal procedures, frequently utilize laparoscopic techniques that require multiple trocar insertions.

For instance, according to a report by NIH, in April 2023, gallbladder disease remains one of the most frequently treated conditions in the U.S., with over 1.2 million cholecystectomy procedures performed each year. The rising preference for minimally invasive approaches in general surgery has increased demand for disposable trocars, which offer enhanced sterility, reduced infection risk, and improved procedural efficiency. Additionally, the widespread availability of laparoscopic equipment in public and private hospitals has supported consistent utilization in general surgical settings, reinforcing the dominance of this segment in 2024.

Gynecological surgery segment is expected to witness a significant CAGR over the forecast period. This growth can be attributed to the increasing adoption of minimally invasive procedures for conditions such as endometriosis, uterine fibroids, ovarian cysts, and hysterectomies. The rise in women's health awareness, advancements in laparoscopic techniques, and growing preference for outpatient and day-care surgeries are fueling this trend. Procedures like laparoscopic hysterectomy and ovarian cystectomy require precise and safe abdominal access, making disposable trocars essential for maintaining sterility and minimizing infection risk. Additionally, the expansion of fertility clinics and the integration of robotic-assisted systems in gynecological procedures further contribute to the segment's rapid growth.

Regional Insights

North America disposable trocars market dominated the global market with the largest revenue share of 31.53% in 2024. The growth is driven by the widespread adoption of minimally invasive surgeries (MIS), the expansion of ambulatory surgical centers (ASCs), and the integration of advanced robotic-assisted surgical systems. Surgeons increasingly prefer disposable bladeless and optical trocars for their safety, sterility, and compatibility with modern surgical technologies. The region’s strong regulatory framework, particularly FDA 510(k) clearances, encourages product design innovation, including enhanced sealing systems and ergonomic features. Additionally, the high surgical volume and growing demand for outpatient procedures in the U.S. are further propelling market expansion.

U.S. Disposable Trocars Market Trends

The U.S. disposable trocars market is primarily driven by the rising volume of minimally invasive surgeries, including laparoscopic, bariatric, and gynecological procedures, which demand sterile and efficient access solutions. According to The American Society of Plastic Surgeons’ Procedural Statistics 2023, around 1,575,244 cosmetic surgeries were performed in 2023 compared to 1,498,361 surgeries in 2022, recording a growth of 5% in a single year. The surge in such procedures boosts the need for advanced laparoscopic devices such as trocars. Moreover, the rapid expansion of ambulatory surgical centers (ASCs), prioritizing infection control and fast patient turnover, further boosts the need for single-use trocars.

Europe Disposable Trocars Market Trends

The Europe disposable trocars market is witnessing steady growth, driven by the increasing adoption of minimally invasive surgical procedures across general surgery, gynecology, and urology. Rising demand for laparoscopic interventions in countries like Germany, France, and the UK is accelerating the use of disposable trocars due to their sterility and efficiency. The region’s strong emphasis on infection prevention protocols, reinforced by EU healthcare policies, pushes hospitals to shift from reusable to single-use surgical instruments. Additionally, growing investments in robotic surgery programs and established surgical infrastructure across Western Europe support the adoption of advanced trocar systems, such as optical and bladeless variants. The rising elderly population and expanding day-care surgery services contribute to procedural volumes, further driving market growth.

The UK disposable trocars market is driven by the country’s growing adoption of minimally invasive and laparoscopic procedures, supported by the NHS’s focus on reducing hospital stays and surgical complications. As healthcare providers increasingly prioritize infection prevention and cost-effective surgical solutions, using single-use trocars has risen sharply, particularly in outpatient and day-case surgeries. The expansion of ambulatory surgical units across the UK and increasing volumes of gynecological and bariatric procedures are also accelerating demand. Additionally, integrating robotic surgical platforms in primary NHS trusts and private hospitals drives the need for advanced trocar technologies, such as optical and bladeless variants, offering enhanced precision and sterility.

Asia Pacific Disposable Trocars Market Trends

The Asia Pacific disposable trocars market is experiencing the fastest CAGR of 6.32% from 2025 to 2033. Fueled by the rising prevalence of chronic diseases, growing surgical volumes, and rapid adoption of minimally invasive surgical (MIS) techniques across countries like China, India, Japan, and South Korea. Increasing government investments in healthcare infrastructure and expanding private hospitals and day-care surgery centers are boosting demand for sterile, single-use surgical instruments. Surgeons and hospitals in the region are increasingly shifting toward disposable trocars to reduce infection risks and avoid the logistical burden of reprocessing reusable devices. Moreover, the growing availability of robotic and laparoscopic surgery systems, medical tourism, and improved access to advanced surgical care in emerging economies further support market expansion.

China disposable trocars market is driven by rising healthcare demand, increased surgical volumes, and government initiatives promoting minimally invasive surgeries (MIS) in public hospitals. As China faces a growing burden of chronic diseases such as obesity, cancer, and gastrointestinal disorders, the need for laparoscopic procedures is rapidly increasing. Additionally, national infection control policies and heightened awareness following the COVID-19 pandemic have accelerated the shift toward single-use surgical instruments, including disposable trocars, to minimize cross-contamination.

Latin America Disposable Trocars Market Trends

The Latin America disposable trocars market is showing steady growth, driven by the increasing adoption of minimally invasive surgeries (MIS) across countries like Brazil, Mexico, and Argentina. The region gradually shifts from traditional open surgeries to laparoscopic and endoscopic procedures, particularly in gynecology, general surgery, and bariatrics. Rising awareness about infection control and post-pandemic emphasis on patient safety has led to a higher demand for single-use surgical instruments like disposable trocars. While cost constraints and uneven healthcare infrastructure remain challenging, expanding private healthcare facilities, growing medical tourism in Brazil and Argentina, and government efforts to improve surgical care access support market growth.

Middle East Africa Disposable Trocars Market Trends

The Middle East & Africa disposable trocars market is experiencing moderate growth, driven by increasing surgical procedure volumes, expanding healthcare infrastructure, and rising adoption of minimally invasive techniques across countries like the UAE, Saudi Arabia, and South Africa. Governments and private healthcare providers are investing in modern operating rooms and laparoscopic equipment to improve surgical outcomes and reduce hospital stays. The push for infection control and sterility, especially in premium private hospitals and medical tourism hubs like the UAE, is encouraging the use of single-use trocars over reusable alternatives. Although high device costs and limited access in rural regions pose challenges, the ongoing growth of day surgery centers, the adoption of robotic surgery, and partnerships with global medtech suppliers are contributing to increasing trocar usage across the region.

Key Disposable Trocars Company Insights

The disposable trocars market is extremely fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in the disposable trocars market, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the disposable trocars market is predicted to grow during the forecast period.

Key Disposable Trocars Companies:

The following are the leading companies in the disposable trocars market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Ethicon (Johnson & Johnson)

- B. Braun SE

- Applied Medical Resources Corporation

- CooperSurgical, Inc.

- Teleflex Incorporated

- CONMED Corporation

- Zhejiang Geyi Medical Instrument Co., Ltd

- Purple Surgical

- Lepus Medical Technology(Beijing) Co., Ltd.

- Xion Medical

- Ningbo Yaoming Medical Technology Co., Ltd.

- LaproSurge

Recent Developments

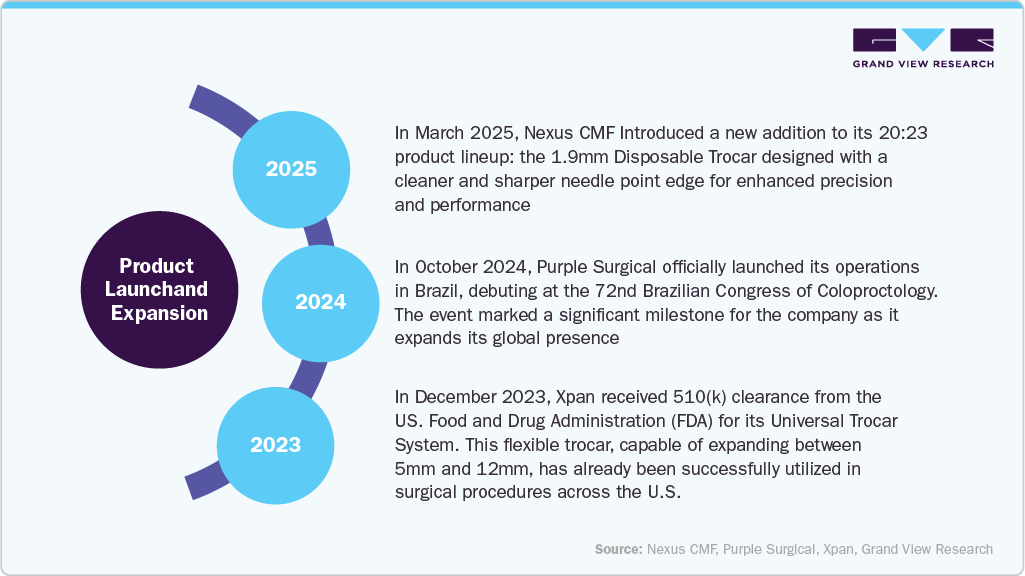

-

In March 2025, Nexus CMF introduced a new addition to its 2023 product lineup: the 1.9mm Disposable Trocar, designed with a cleaner and sharper needle point edge for enhanced precision and performance.

-

In October 2024, Purple Surgical officially launched its operations in Brazil, debuting at the 72nd Brazilian Congress of Coloproctology. The event marked a significant milestone for the company as it expanded its global presence.

-

In December 2023, Xpan received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Universal Trocar System. This flexible trocar, capable of expanding between 5mm and 12mm, has already been successfully utilized in surgical procedures across the U.S.

-

In August 2022, Teleflex Incorporated announced the acquisition of Standard Bariatrics, Inc. Standard Bariatrics is known for its medical technologies, including devices used in bariatric surgery. The acquisition will expand Teleflex's portfolio in the surgical space.

Disposable Trocars Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 547.29 million

Revenue forecast in 2033

USD 823.99 million

Growth rate

CAGR of 5.26% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tip, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait and UAE.

Key companies profiled

Medtronic; Ethicon (Johnson & Johnson); B. Braun SE; Applied Medical Resources Corporation; CooperSurgical, Inc.; Teleflex Incorporated; CONMED Corporation; Zhejiang Geyi Medical Instrument Co., Ltd ; Purple Surgical; Lepus Medical Technology(Beijing)Co., Ltd.; Ningbo Yaoming Medical Technology Co., Ltd.; LaproSurge; Xion Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Trocars Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global disposable trocars market report based on tip, application, and region:

-

Tip Outlook (Revenue, USD Million, 2021 - 2033)

-

Bladeless Trocars

-

Optical Trocars

-

Blunt Trocars

-

Bladed Trocars

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

General Surgery

-

Gynecological Surgery

-

Urological Surgery

-

Pediatric Surgery

-

Other Surgeries

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global disposable trocars market size was estimated at USD 520.17 million in 2024 and is expected to reach USD 547.29 million in 2025.

b. The global disposable trocars market is expected to grow at a compound annual growth rate of 5.26% from 2025 to 2033 to reach USD 823.99 million by 2033.

b. North America dominated the disposable trocars market with a share of 31.53% in 2024. This is attributable to the widespread adoption of minimally invasive surgeries (MIS), the expansion of ambulatory surgical centers (ASCs), and the integration of advanced robotic-assisted surgical systems.

b. Some key players operating in the disposable trocars market include Medtronic; Ethicon (Johnson & Johnson); B. Braun SE; Applied Medical Resources Corporation; CooperSurgical, Inc.; Teleflex Incorporated; CONMED Corporation; Zhejiang Geyi Medical Instrument Co.,Ltd; Purple Surgical; Lepu Medical Technology(Beijing)Co.,Ltd.; Ningbo Yaoming Medical Technology Co. Ltd.; LaproSurge; Xion Medical.

b. Key factors driving the market growth include the growing adoption of minimally invasive surgical (MIS) techniques, which demand safer, more efficient, and infection-resistant access devices. Rising surgical volumes globally, especially in laparoscopic, gynecological, and bariatric procedures, have increased the need for single-use trocars that reduce the risk of cross-contamination and eliminate the costs and complexities of sterilization.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.