- Home

- »

- Next Generation Technologies

- »

-

Distributed Acoustic Sensing Market Size, Industry Report, 2019-2025GVR Report cover

![Distributed Acoustic Sensing Market Size, Share & Trends Report]()

Distributed Acoustic Sensing Market Size, Share & Trends Analysis Report, By Fiber Type (Single-mode Fiber, Multimode Fiber), By Vertical (Oil & Gas, Power & Utility, Transportation), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-939-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Technology

Industry Insights

The global distributed acoustic sensing market size was valued at USD 360.8 million in 2018 and is anticipated to expand at a CAGR of 11.5% from 2019 to 2025. In recent times, the Distributed Acoustic Sensing (DAS) system has emerged as a passive sensing technology used for detecting sound signals. DAS technology has more advantages than traditional sensing systems for sound waves, such as relatively slim cable, lower cost, and easier installation process. DAS systems can measure the complete vertical coverage of a well without any fiber movement. Therefore, it ensures data continuity due to its thin cable.

Fiber optic-based products are being progressively used in several upstream, midstream, and downstream applications in the oil and gas industry. They are used to provide infrastructure and high-bandwidth telecommunications for Supervisory Control and Data Acquisition (SCADA). They are more used for sensing temperature, pressure, and strain along downhole and subsea pipelines. Also, they defer third-party intrusion into plant facilities and pipelines, which is one of the significant advantages of fiber optic products in the oil and gas industry.

In the early time, the distributed acoustic sensing systems have been used in the border and security industry, owing to the need for real-time intrusion detection and monitoring. But now, the distributed acoustic sensing systems are being massively used in the oilfield services for in-well monitoring and several other applications. It helps to detect leakages and external interference. They are also being used for monitoring and profiling the hydraulic fracturing of shale-gas and tight-sand reservoirs. This DAS-based technology is much reliable to monitor the in-well activities during the fracture-stimulation treatment.

Distributed acoustic sensing system has replaced the production logging tools for the measurement of injection flow performance or downhole production. It uses a digital optoelectronics detection technique which can acquire the phase and amplitude of the generated and propagated sound waves in a wellbore. It can process a large array of acoustic data to monitor the inflow at multiple zones. Since the traditional production logging tool doesn’t acquire the well surveillance data due to the high costs along with significant operational risks, distributed acoustic sensing applications have evolved as a better alternative.

Fiber Type Insights

The fiber type segment of the distributed acoustic sensing market is classified into single-mode fiber and multimode fiber. The single-mode fiber segment is expected to have a significant share owing to the limited external interference. The single input mode allows for limiting the light scattering, which reduces the light waste and increases the transmission of data. These benefits encourage the companies to adopt single-mode fiber for vibration sensing.

Furthermore, the single-mode fiber is thinner than multimode fiber, which makes it more efficient for in-well monitoring applications. Also, it is highly adopted for long-distance applications for increased bandwidth capacity. However, a single-mode type is costlier than multimode type. But its higher efficiency of intrusion detection and a more extended range of telecommunication applications boosts the growth of single-mode optic fiber in the market.

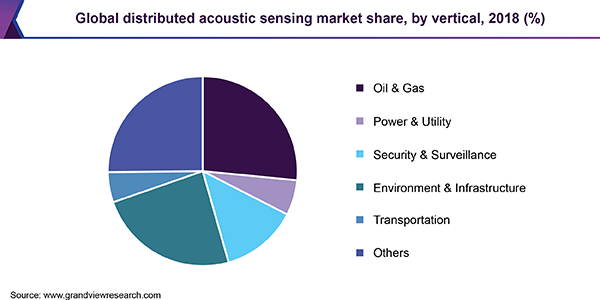

Vertical Insights

The vertical segment is classified into oil and gas, power and utility, security and surveillance, environment and infrastructure, transportation, and others. The oil and gas segment is expected to have a significant share among verticals. In this industry, distributed acoustic sensing technology is used for multiple purposes, such as pipeline monitoring, downhole good sensing, flow monitoring, intrusion detection, and asset management, among others. Since oilfield operations require unobtainable levels of precision, reliability, and granularity in terms of monitoring the vibration-related events, driving the adoption of the technology.

Fiber optics allow data transmission for considerably long ranges. Advances in this technology have enabled the use of distributed acoustic sensing systems in the high-temperature and high-pressure environments of wellbores. Such potential of vibration sense is projected to boosts the market growth in the oil and gas industry in near future. Pipeline monitoring is one of the major applications of DAS systems, driving the market growth.

Regional Insights

North America accounted for more than 34% market share in 2018, owing to the region's leading oil and gas production industry. The region is characterized by the focus of regional governments on in-house optic fiber production and the presence of a large number of oil and gas producing players. Also, shale gas exploration in this region is anticipated to encourage the growth of this industry. Since vibration sensing has become an integral part of the oilfield industry, therefore significant shares in the oil and gas industry boost the growth of the distributed acoustic sensing systems market in this region.

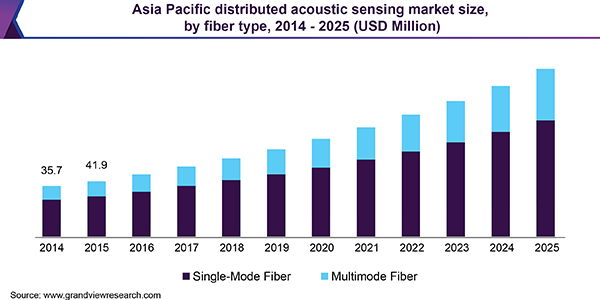

Asia Pacific is expected to demonstrate the fastest CAGR in the future, attributed to the growing adoption of fiber optics in telecommunications. Also, the increasing adoption of this technology in the healthcare industry is catapulting the market growth. Besides, the government regulations concerning toxic waste are also encouraging strict pipeline management and other DAS-based applications in the end-user industries.

Distributed Acoustic Sensing Market Share Insights

The key market participants include OptaSense; Halliburton; Schlumberger Limited; Baker Hughes, a GE Company LLC; Future Fibre Technologies; Northrop Grumman Corporation; Fotech Solutions Ltd.; Omnisens, Silixa Ltd; and Ziebel. Most companies focus on increasing the customer base to gain a competitive edge, through several strategic initiatives, such as collaborations, acquisitions and mergers, and partnerships. For instance, in November 2019, Halliburton signed an agreement with the Advanced Remanufacturing and Technology Center (ARTC) for anchor membership. Under this membership, Halliburton can collaborate across various industries with advanced next-generation technologies-related R&D projects. The company has become the only oilfield services-based company in association with the ARTC.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million and CAGR from 2019 to 2025

Region scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, and Brazil

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report provides forecasts for revenue growth at the global, regional, and country levels and analyses of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global distributed acoustic sensing market report based on fiber type, vertical, and region:

-

Fiber Type (Revenue, USD Million, 2014 - 2025)

-

Single-mode Fiber

-

Multimode Fiber

-

-

Vertical (Revenue, USD Million, 2014 - 2025)

-

Oil & Gas

-

Power & Utility

-

Security & Surveillance

-

Environmental & Infrastructure

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."