- Home

- »

- Conventional Energy

- »

-

Oilfield Services Market Size, Share & Growth Report, 2030GVR Report cover

![Oilfield Services Market Size, Share & Trends Report]()

Oilfield Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Onshore), By Service (Workover & Completion Services), By Type (Equipment Rental, Field Operation), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-692-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oilfield Services Market Summary

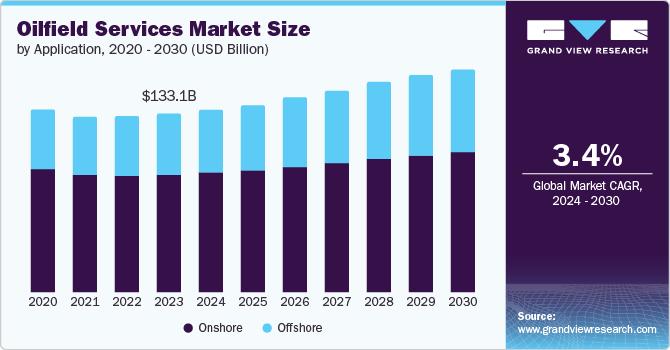

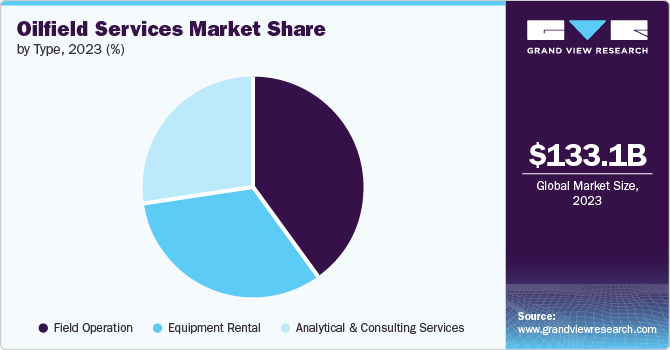

The global oilfield services market size was estimated at USD 133.1 billion in 2023 and is projected to reach USD 166.4 billion by 2030, growing at a CAGR of 3.4% from 2024 to 2030. The market is driven by the increasing production and exploration activities in the oil and gas industry.

Key Market Trends & Insights

- The North American oilfield services market dominated with a revenue share of 31.95% in 2023.

- The U.S. oilfield services market dominated the North American market with a share of 75.07% in 2023.

- By application, the onshore segment dominated the market and accounted for the largest revenue share of 65.9% in 2023.

- By service, the workover & completion services segment accounted for the largest revenue share of 20.34% in 2023.

- By type, the field operation segment dominated the market and accounted for the largest revenue share of 39.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 133.1 Billion

- 2030 Projected Market Size: USD 166.4 Billion

- CAGR (2024-2030): 3.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The rapid growth in shale gas development and increasing demand for improved oil recovery are the drivers contributing to the market growth. Moreover, the technological developments have improved production yield in oilfield services fueling the market growth.

The increased oil and gas production volume has boosted extraction activities, driving the demand for oilfield services. This surge in production necessitates more exploration, drilling, and maintenance services. Consequently, the oilfield services market is experiencing significant growth. For instance, Canada oil and gas extraction industry surged in 2021 after a difficult 2020. Revenue surged 85.7% to USD 174.0 billion in 2021, up from USD 93.7 billion in 2020. This increase was driven by a rebound in economic activity, rising energy prices, and increased production.

The market is expected to grow at an increasing rate due to increased shale gas extraction and rising oil and gas output. Shale gas extraction by hydraulic fracturing and horizontal drilling is increasing, speeding the market growth. For instance, the U.S. oil production surged in 2018, jumping 33% alongside a near 50% rise in gas flaring. This surge was concentrated in shale oil basins such as Bakken (up 29% production) and Permian (40% increase).

The market increased demand for oil and gas from offshore regions drives the demand for oilfield services. Reduced oilfield service costs and higher production output are driving the market growth. In addition, the range of customized packages offered by major upstream service companies results in cost savings for the operators and production and exploration activities, owing to rising demand and investment opportunities in the oil and gas industry.

The demand for oil and gas is increasing, and the energy demand is rising. Growing urbanization, industrialization, and technological advancements have significantly contributed to the market growth. Moreover, energy consumption in emerging countries is rising, especially in transportation, power generation, and other industries. For instance, a report by the International Energy Forum predicted a 22% increase in annual oil & gas investments by 2030, reaching USD 738 billion, to meet rising demand and inflation.

Application Insights

The onshore segment dominated the market and accounted for the largest revenue share of 65.9% in 2023. Rising global energy needs fuel the onshore oilfield services market, as these fields rely on advanced tech (drilling, storage) and infrastructure to meet demand. Shale oil and gas further drive this market due to their dependence on specialized onshore extraction methods. For instance, in April 2024, Petrobras was expected to restart onshore oil & gas production in Bahia and Amazonas. They were hiring rigs capable of drilling 4,000-meter-deep wells in these states, with operations beginning in the second half of 2025. This marks a renewed focus on onshore production in Brazil.

The offshore segment is expected to grow at the fastest CAGR of 4.7% over the forecast period, owing to the development of new offshore oilfields and the growing investment in subsea oil and gas assets. For instance, in April 2024, Exxon Mobil Corporation announced the development of a new offshore oilfield project in the country, bringing the total number of offshore oil and gas plants to 6.

Service Insights

The workover & completion services segment accounted for the largest revenue share of 20.34% in 2023, owing to accessibility of advances in infrastructural developments and technology such as pipelines, transportation networks, hydraulic fracturing, horizontal drilling, and enhanced oil recovery, make workover and completion services more efficient and cost-effective. For instance, in May 2022, the SPM Simplified Frac Iron System was launched by SPM Oil & Gas to tackle inefficiencies in hydraulic fracturing. This innovation streamlines the process by reducing complex setups and numerous connection points typically found in conventional systems.

The seismic services segment is expected to grow at the fastest CAGR of 6.7% over the forecast period. Seismic services help companies by giving more informed decisions about trap oil and gas. The increasing global population and rising demand for energy necessitate continuous exploration for new forms of energy, such as oil and gas, making seismic services more important for identifying crucial energy resources.

Type Insights

The field operation segment dominated the market and accounted for the largest revenue share of 39.9% in 2023. Field operation services involve workforce personnel who work on offshore projects such as drilling rigs, production platforms, and other oil and gas departments to ensure all processes run efficiently and safely. These services are critical for ensuring production operations run smoothly and safely.

The analytical and consulting segment is expected to witness the fastest CAGR growth of 4.4% over the forecast period. Fueled by the rising demand for energy and innovation in technology, firms are increasingly seeking ways to reduce their energy consumption and utilize renewable energy sources. Rising investment in the production and exploration of oil and gas is expected to harness the growth of analytical and consulting services. For instance, renewables are rising, and the International Energy Agency (IEA) predicted that wind and solar energy will be the world's top electricity sources by 2025, surpassing coal. By 2028, 68 countries will rely on renewables as their main power source.

Regional Insights

The North American oilfield services market dominated with a revenue share of 31.95% in 2023, owing to the increasing demand for oil and gas production and technological advancements. The region is home to some of the world’s largest oil and gas producers. The U.S. and Canada drive most of the market in the region, and the increasing number of projects is also driving the market growth. For instance, indigenous involvement in Canadian oil & gas is rising with the launch of Indigena Drilling in 2024, a new company co-founded by the Indian Resource Council. This partnership aims to bring economic benefits to over 155 Indigenous nations in Canada.

U.S. Oilfield Services Market Insights

The U.S. oilfield services market dominated the North American market with a share of 75.07% in 2023 due to the increasing number of advancements and development of oilfield infrastructure. The U.S. is a major crude oil and natural gas producer and exporter. For instance, the U.S. was the third largest country in oil exports and the world’s largest liquefied natural gas (LNG) exporter globally.

Europe Oilfield Services Market Insights

Europe oilfield services market was identified as a lucrative region in 2023, owing to the rising energy needs, eco-friendly exploration tech, and major companies. Norway's growing oilfields are a key contributor to the region growth. According to the International Trade Administration (ITA), Norwegian gas meets approximately 25% of the EU's gas demand and supplies nearly 40% of the UK's gas consumption. In addition, Norway delivers significant quantities of gas to Germany and France. Norway also exports electricity to Northern Europe via interconnections.

The oilfield services market in Germany holds a significant share in 2023, owing to a surge in energy demand and investment in the oilfield industry. In addition, the market is in flux, driven by both a need for cleaner energy sources and the presence of major companies exploiting existing resources. Moreover, in March 2024, the United Arab Emirates (UAE) agreed to sell Liquefied natural gas (LNG) to Germany for 15 years, which would further cement Europe’s fossil fuel use.

The UK oilfield services market is expected to grow significantly over the forecast period, driven by increased oil and gas production, investment, and the country’s well-developed infrastructure. The UK has significant oil reserves in the North Sea, which are significant in meeting the country’s energy demand. For instance, in April 2024, an energy company in the UK, EnQuest, planned to begin drilling for oil and gas in the North Sea, anticipating it would yield the highest amount of oil there in the past 20 years.

Asia Pacific Oilfield Services Market Trends

The oilfield services market in Asia Pacific is expected to grow at the fastest CAGR of 3.9% over the forecast period, owing to the surging energy demand and exploration in countries such as India and China. Advanced tech adoption for production is expected to fuel this growth further. For instance, in March 2024, JX Nippon Oil & Gas Exploration Corporation and Chevron Corporation are exploring a carbon capture and storage (CCS) project in Asia-Pacific. They aim to capture CO2 emissions from Japanese industries, ship them to storage sites potentially in Australia, and develop necessary policies and storage infrastructure across the region.

China oilfield services market is expected to grow rapidly in the coming years due to the rising energy demand, increasing oil and gas investments, and exploration and production of new oil and gas fields. For instance, in July 2024, Hengli Group, a Chinese refiner, announced an investment of USD 1.3 billion to expand its shipbuilding business in northeast China two years after buying assets from South Korean shipyard STX.

The oilfield services market in India held a substantial market share in 2023 due to rapid urbanization and a growing energy appetite. Government investments and initiatives are propelling exploration and production activities. Technological advancements such as digitalization and automation further boost efficiency and reduce costs in the sector.

Key Oilfield Services Company Insights

Some of the key companies in the oilfield services market include Baker Hughes Company, HALLIBURTON, SLB, Weatherford, Superior Energy Services, NOV., China Oilfield Services Limited, ARCHER OILFIELD ENGINEERS, Expro Group, and TechnipFMC plc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Baker Hughes Company is an American energy company based in Houston. It provides products and services for reservoir consulting, completion, formation evaluation, oil well drilling, and production. Baker Hughes operates in over 120 countries and has research and manufacturing facilities.

-

China Oilfield Services Limited offers services such as well completion, geotechnical surveying, pipe inspection and repair, rig management, directional drilling, cementing, casing and tubing, logging, and subsea engineering.

Key Oilfield Services Companies:

The following are the leading companies in the oilfield services market. These companies collectively hold the largest market share and dictate industry trends.

- Baker Hughes Company

- HALLIBURTON

- SLB

- Weatherford

- Superior Energy Services

- NOV.

- China Oilfield Services Limited

- ARCHER OILFIELD ENGINEERS

- Expro Group

- TechnipFMC plc

Recent Developments

-

In March 2024, Azad Engineering Limited, a manufacturer of precision machined components, secured a significant five-year deal with Baker Hughes Company, an oilfield services company. This agreement entails supplying Baker Hughes with medium-high-complexity precision machined parts crucial for their oilfield operations. The contract has the potential to be extended for three more years, bringing potential long-term benefits to Azad Engineering.

-

In November 2023, HALLIBURTON and Oil States Industries partnered to offer innovative solutions for safe and efficient deepwater drilling projects.

-

In June 2023, Azule Energy granted TechnipFMC a major contract to provide subsea production systems for the Block 18 Infills project off the coast of Angola.

Oilfield Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 135.8 billion

Revenue forecast in 2030

USD 166.4 billion

Growth Rate

CAGR of 3.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 – 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, service, type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Spain, Russia, Netherlands, Norway, China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Thailand, Brazil, Argentina, Venezuela, South Africa, Saudi Arabia, UAE, Kuwait, Qatar, Oman

Key companies profiled

Baker Hughes Company; HALLIBURTON; SLB; Weatherford; Superior Energy Services; NOV.; China Oilfield Services Limited; ARCHER OILFIELD ENGINEERS; Expro Group; TechnipFMC plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oilfield Services Market Report Segmentation

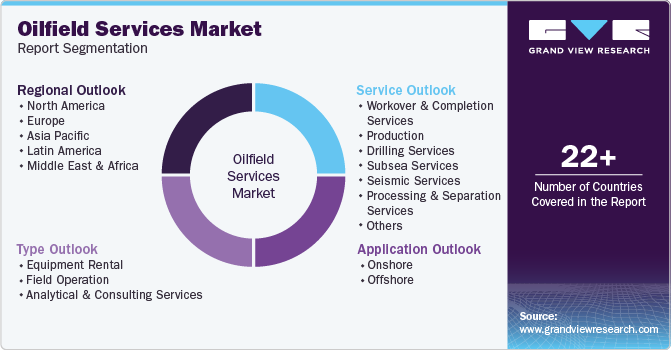

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oilfield services market report based on application, service, type, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Workover & completion services

-

Production

-

Drilling Services

-

Subsea Services

-

Seismic Services

-

Processing & Separation Services

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment Rental

-

Field Operation

-

Analytical & Consulting Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Russia

-

Netherlands

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.