- Home

- »

- Distribution & Utilities

- »

-

Distributed Energy Generation Market Size Report, 2033GVR Report cover

![Distributed Energy Generation Market Size, Share & Trends Report]()

Distributed Energy Generation Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Wind Turbine, Solar Photovoltaic, Reciprocating Engine, Gas & Steam Turbine, Fuel Cell), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-027-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Distributed Energy Generation Market Summary

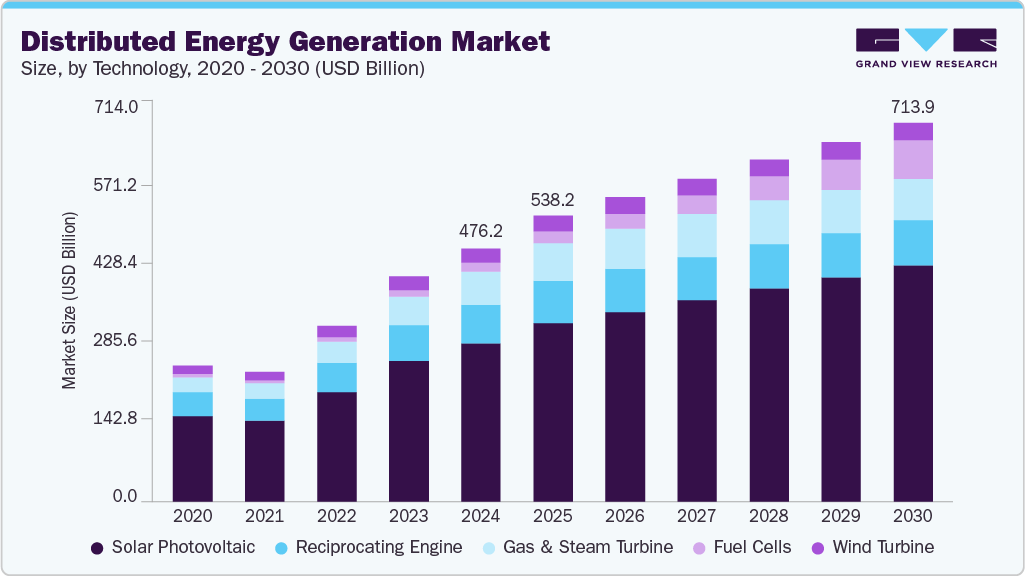

The global distributed energy generation market size was estimated at USD 538.2 billion in 2025 and is projected to reach USD 884.8 billion by 2033, growing at a CAGR of 6.4% from 2026 to 2033. Distributed energy generation refers to decentralized power production systems such as solar PV, wind turbines, fuel cells, microturbines, and combined heat and power (CHP) units installed near the point of consumption.

Key Market Trends & Insights

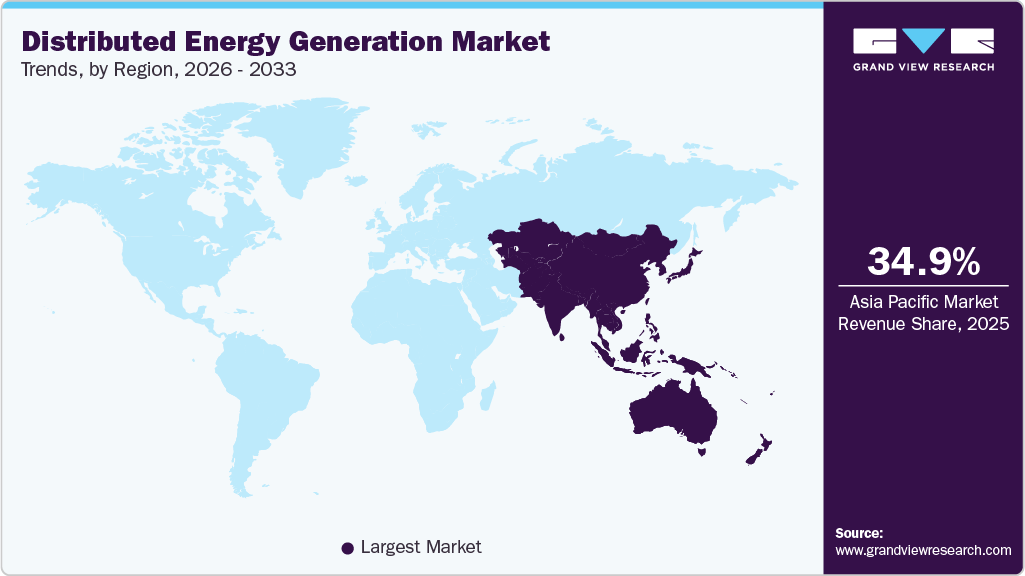

- Asia Pacific distributed energy generation market held the largest share of 34.9% of the global market in 2025.

- The distributed energy generation market in the China is expected to grow significantly over the forecast period.

- By technology, solar photovoltaic segment held the highest market share of 61.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 538.2 Billion

- 2033 Projected Market Size: USD 884.8 Billion

- CAGR (2026-2033): 6.4%

- Asia Pacific: Largest market in 2025

- Latin America: Fastest growing market

These systems enhance grid resilience, reduce transmission losses, and support the integration of renewable energy sources. Growing global emphasis on energy transition, decarbonization strategies, and grid modernization initiatives is accelerating investments in distributed generation technologies across residential, commercial, and industrial sectors. The market is witnessing increased support from governments and utilities through net metering policies, feed-in tariffs, tax incentives, and renewable portfolio standards aimed at promoting decentralized power infrastructure. Advancements in smart grid technologies, battery energy storage systems, digital monitoring platforms, and microgrid solutions are improving operational efficiency and economic viability. The declining cost of solar photovoltaic modules and lithium-ion batteries further strengthens the adoption of distributed systems, positioning them as a critical component of modern energy networks.

In addition, the rising demand for reliable and uninterrupted power supply across data centers, healthcare facilities, manufacturing units, and commercial buildings is expected to support long-term market expansion. As organizations seek cost-competitive and low-carbon energy alternatives, distributed energy generation offers enhanced energy security, reduced electricity bills, and lower greenhouse gas emissions, reinforcing its strategic importance in the evolving global power landscape.

Drivers, Opportunities & Restraints

The primary driver of the distributed energy generation market is the accelerating global transition toward decarbonized and resilient energy systems. Governments and utilities are increasingly promoting decentralized renewable installations such as rooftop solar PV, wind turbines, and combined heat and power (CHP) units to reduce transmission losses and enhance grid stability. Supportive regulatory frameworks, including net metering, tax incentives, renewable portfolio standards, and feed-in tariffs, are strengthening investment confidence. In addition, the declining cost of solar modules and battery energy storage systems is making distributed generation economically attractive across residential, commercial, and industrial applications.

A major opportunity lies in the rapid expansion of smart grids, microgrids, and energy storage integration. Advancements in digital energy management platforms, AI-based load optimization, and virtual power plant (VPP) models are enabling more efficient coordination of decentralized assets. Emerging economies in the Asia Pacific, Latin America, and Africa present strong growth potential due to rising electricity demand and the need for reliable off-grid or hybrid power solutions. Furthermore, increasing corporate commitments to sustainability and onsite clean power procurement are expected to create long-term demand for distributed generation systems.

However, the market faces restraints related to high initial installation costs, grid interconnection complexities, and regulatory inconsistencies across regions. Variability in renewable power generation and challenges in integrating distributed assets into existing grid infrastructure may impact system stability without adequate storage or advanced grid management solutions. In addition, policy uncertainty and changing subsidy structures in certain markets could influence investment decisions and slow adoption rates in the short term.

Technology Insights

Based on technology, solar photovoltaic (PV) accounted for the largest market revenue share of 61.3% in 2025, driven by its cost competitiveness, scalability, and widespread adoption across residential, commercial, and industrial sectors. The declining prices of PV modules, coupled with supportive government incentives such as net metering and tax credits, have significantly accelerated installations globally. Solar PV systems offer modular deployment, low maintenance requirements, and seamless integration with battery energy storage systems, making them a preferred choice for decentralized power generation.

Solar photovoltaic is also expected to register the fastest CAGR of 8.3% during the forecast period, supported by continuous advancements in panel efficiency, bifacial modules, and smart inverters. Increasing rooftop installations, expansion of community solar projects, and growing demand for on-site renewable energy solutions among corporates are further strengthening segment growth. In addition, integration with digital monitoring platforms and microgrid infrastructure is enhancing system reliability and performance, positioning solar PV as the dominant and fastest-growing technology in the distributed energy generation market.

Regional Insights

Asia Pacific accounted for the largest revenue share of 34.9% in 2025, driven by rapid urbanization, rising electricity demand, and strong government support for renewable energy deployment. Countries across the region are actively promoting rooftop solar programs, distributed wind installations, and hybrid microgrid systems to improve energy access and reduce dependence on centralized coal-based generation. Expanding manufacturing capabilities for solar modules and batteries further enhances cost competitiveness and large-scale adoption.

The region is also witnessing robust investments in smart grid infrastructure and distributed storage integration, particularly in industrial and commercial sectors. Increasing electrification initiatives in rural and semi-urban areas are accelerating decentralized power installations, positioning the Asia Pacific as the dominant regional market.

China Distributed Energy Generation Market Trends

China represents a major contributor to regional growth, supported by aggressive renewable energy targets and large-scale distributed solar deployment programs. The country has significantly expanded rooftop photovoltaic installations across residential, commercial, and industrial buildings under supportive subsidy mechanisms and grid parity initiatives.

Strong domestic manufacturing capacity for solar panels, inverters, and lithium-ion batteries enables cost efficiency and rapid project execution. In addition, investments in smart grids, energy storage systems, and distributed wind projects are enhancing grid flexibility and supporting China’s transition toward a cleaner and more decentralized power ecosystem.

Europe Distributed Energy Generation Market Trends

Europe is witnessing steady expansion in the distributed energy generation market, supported by ambitious decarbonization targets and long-term climate neutrality commitments. Favorable regulatory frameworks, feed-in tariffs, and energy efficiency directives are encouraging widespread adoption of rooftop solar, CHP systems, and community energy projects.

Growing investments in energy storage, digital grid management, and cross-border power integration are strengthening system reliability. Increasing consumer awareness and corporate sustainability initiatives are expected to sustain long-term distributed energy deployment across the region.

North America Distributed Energy Generation Market Trends

North America accounted for a significant share of the global distributed energy generation market, supported by strong policy frameworks promoting renewable integration, grid modernization, and decentralized power systems. Federal and state-level incentives, renewable portfolio standards, and tax credits have encouraged large-scale deployment of rooftop solar, small wind, and combined heat and power (CHP) systems.

The region benefits from advanced grid infrastructure, high penetration of battery energy storage systems, and increasing investments in microgrids to enhance resilience against extreme weather events. Growing demand for reliable onsite power across commercial facilities, healthcare institutions, and data centers is further strengthening regional market growth.

Latin America Distributed Energy Generation Market Trends

Latin America is expected to register the fastest CAGR of 14.5% during the forecast period, driven by rising electricity demand, expanding urban infrastructure, and supportive distributed solar regulations. Countries across the region are implementing net metering schemes and distributed generation incentives to improve energy access and reduce grid congestion.

Declining solar installation costs and increasing private sector participation are accelerating rooftop and small-scale solar projects, particularly in commercial and residential segments. As governments focus on diversifying energy mixes and enhancing grid resilience, Latin America is emerging as the fastest-growing regional market for distributed energy generation.

Middle East & Africa Distributed Energy Generation Market Trends

The Middle East & Africa market is experiencing gradual growth as countries seek to diversify their energy portfolios and reduce reliance on centralized fossil fuel generation. Distributed solar installations and hybrid microgrids are gaining traction in remote and off-grid areas to improve electricity access.

Although infrastructure limitations and financing challenges persist in certain countries, increasing foreign investments and public-private partnerships are expected to support market development. Growing focus on sustainability and energy security will likely encourage further adoption of distributed energy systems across the region.

Key Distributed Energy Generation Company Insights

Some of the key players operating in the global distributed energy generation market include Tesla, Inc., Siemens AG, Schneider Electric SE, General Electric, ABB Ltd., Enel Green Power, SMA Solar Technology AG, Bloom Energy Corporation, NextEra Energy, Inc., and Honeywell International Inc. These companies are actively focused on expanding decentralized energy infrastructure, integrating renewable technologies, and enhancing grid flexibility to support the global transition toward low-carbon power systems.

Their strategic initiatives primarily involve deploying rooftop solar PV systems, battery energy storage solutions, microgrids, fuel cells, and advanced energy management platforms. Market participants are also investing in smart grid technologies, digital monitoring systems, and virtual power plant (VPP) models to optimize distributed asset performance. Partnerships with utilities, commercial enterprises, and government bodies are accelerating project execution and improving grid integration capabilities.

As global demand for reliable, cost-competitive, and sustainable electricity increases across residential, commercial, and industrial sectors, these companies are prioritizing innovation in energy storage, automation, and distributed generation technologies. Their continued investments in research and development, infrastructure expansion, and digitalization are expected to strengthen decentralized energy networks, enhance energy resilience, and support the long-term growth of the distributed energy generation market worldwide.

Key Distributed Energy Generation Companies:

The following key companies have been profiled for this study on the distributed energy generation market.

- ABB Ltd.

- Bloom Energy Corporation

- Enel Green Power

- General Electric (GE)

- Honeywell International Inc.

- NextEra Energy, Inc.

- Schneider Electric SE

- Siemens AG

- SMA Solar Technology AG

- Tesla, Inc.

Recent Developments

-

In January 2025, Siemens AG announced the expansion of its decentralized energy solutions portfolio through enhanced microgrid and distributed energy management platforms. The company strengthened its grid software capabilities to support real-time optimization of distributed energy resources (DERs), enabling utilities and commercial facilities to improve grid resilience and integrate higher shares of renewable power.

-

In March 2025, Tesla, Inc. expanded deployments of its Megapack battery energy storage systems across North America and the Asia Pacific to support large-scale distributed solar integration. The company reported increased adoption of its integrated solar-plus-storage solutions among commercial and industrial customers, reinforcing its position in decentralized energy infrastructure and virtual power plant (VPP) development.

Distributed Energy Generation Market Report Scope

Report Attribute

Details

Market definition

The distributed energy generation market refers to the global revenue generated from the deployment, installation, and integration of decentralized power generation systems such as solar photovoltaic (PV), wind turbines, fuel cells, microturbines, and combined heat and power (CHP) units across residential, commercial, and industrial applications to enhance energy efficiency, grid resilience, and low-carbon electricity production.

Market size value in 2026

USD 572.1 billion

Revenue forecast in 2033

USD 884.8 billion

Growth rate

CAGR of 6.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in GW, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Tesla, Inc.; Siemens AG; Schneider Electric SE; General Electric; ABB Ltd.; Enel Green Power; SMA Solar Technology AG; Bloom Energy Corporation; NextEra Energy, Inc.; Honeywell International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distributed Energy Generation Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global distributed energy generation market report on the basis of technology and region.

-

Technology Outlook (Volume, GW; Revenue, USD Billion, 2021 - 2033)

-

Wind Turbine

-

Solar Photovoltaic

-

Reciprocating Engine

-

Fuel Cells

-

Gas & Steam Turbine

-

-

Regional Outlook (Volume, GW; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global distributed energy generation market size was estimated at USD 476.18 billion in 2024 and is expected to reach USD 538.16 billion in 2025.

b. The global distributed energy generation market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 713.90 billion by 2030.

b. Based on the technology segment, Solar Photovoltaic held the largest revenue share of more than 62.47% in 2024.

b. Some key players operating in the distributed energy generation market Vestas Wind Systems A/S, Capstone Turbine Corporation, Caterpillar, Ballard Power Systems Inc, Doosan Heavy Industries & Construction, Rolls-Royce plc, Sharp Corporation, Suzlon Energy Limited, General Electric, Siemens, Schneider Electric, ENERCON GmbH, First Solar Mitsubishi Electric Corporation Toyota Turbine and Systems Inc.

b. Key factors driving the distributed energy generation market growth include growing environmental awareness, increasing government policies and greenhouse gas emission reduction targets, and growing demand for energy across nations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.