- Home

- »

- Renewable Energy

- »

-

Distributed Solar Market Size & Share, Industry Report, 2033GVR Report cover

![Distributed Solar Market Size, Share & Trends Report]()

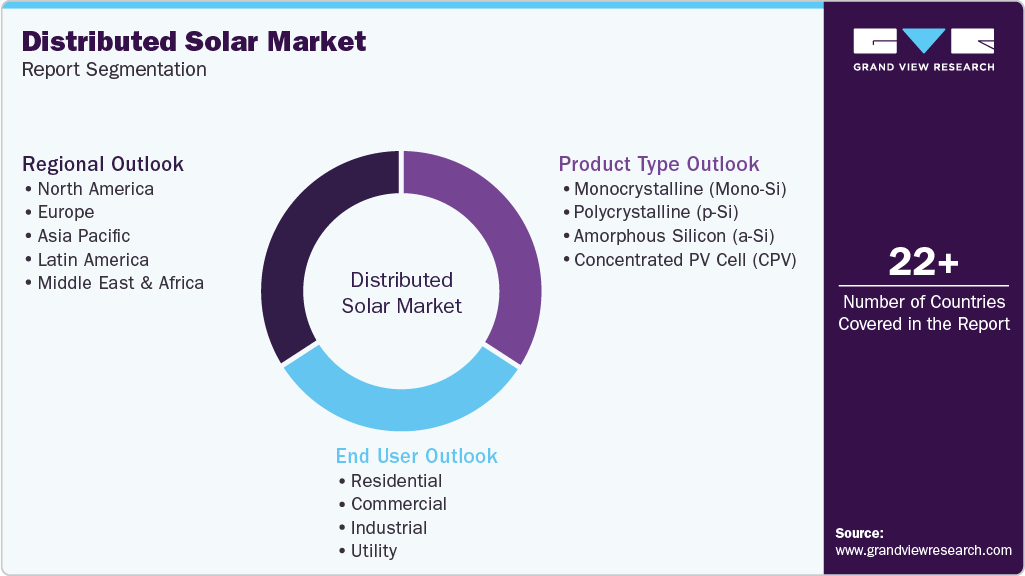

Distributed Solar Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Mono-Si, p-Si, a-Si, CPV), By End User (Residential, Commercial, Industrial, Utility), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-822-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Distributed Solar Market Summary

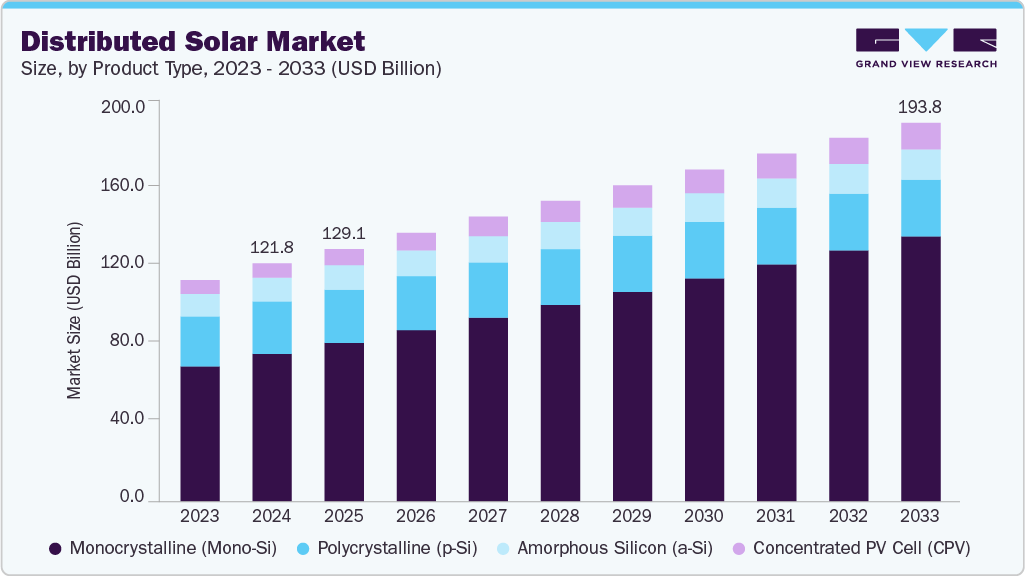

The global distributed solar market size was estimated at approximately USD 121.80 billion in 2024 and is projected to reach USD 193.83 billion by 2033, growing at a CAGR of 5.21% from 2025 to 2033. Market expansion is supported by rising electricity costs, growing consumer demand for decentralized clean power, and favorable policy frameworks across major economies.

Key Market Trends & Insights

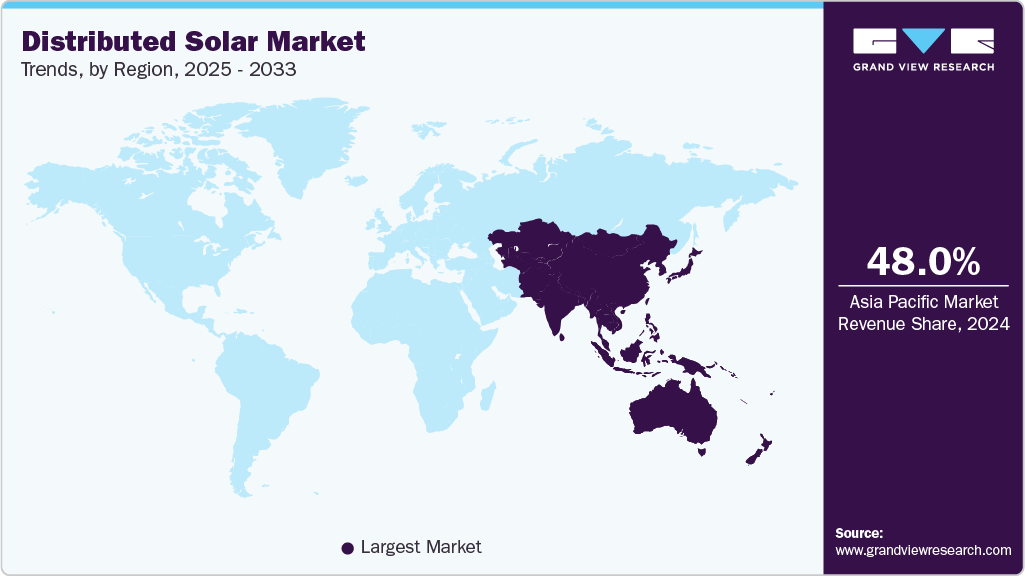

- Asia Pacific distributed solar market held the largest share of 48% of the global market in 2024.

- The distributed solar market in the U.S. is expected to grow significantly over the forecast period.

- By product type, monocrystalline (Mono-Si) held the highest market share of 62% in 2024.

- Based on the end-user, the residential segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 121.80 Billion

- 2033 Projected Market Size: USD 193.83 Billion

- CAGR (2025-2033): 5.21%

- Asia Pacific: Largest Market in 2024

Adoption is accelerating as commercial, industrial, and residential users increasingly deploy rooftop and onsite solar systems, benefiting from improvements in module efficiency, smart inverters, and the integration of energy storage. Government incentives, net-metering programs, and declining installation costs continue to improve the economic viability of distributed solar solutions. These developments, combined with advancements in digital energy management and grid-interactive technologies, are positioning distributed solar as a key enabler of long-term grid resilience and global renewable energy transition goals.In North America, the distributed solar market is expanding steadily, supported by strong federal and state-level clean energy policies, declining solar installation costs, and rising demand for resilient, decentralized power systems. The U.S. continues to lead regional adoption through Department of Energy (DOE) initiatives, net metering programs, investment tax credits (ITC), and utility-backed distributed generation strategies aimed at enhancing grid reliability. Growing participation from commercial and industrial users, along with corporate renewable procurement commitments and virtual power plant (VPP) programs, is further accelerating deployment.

The Asia Pacific region dominates the global distributed solar market, propelled by rapid urbanization, robust government targets for renewable energy expansion, and strong investment in decentralized power infrastructure. Countries such as China, India, Japan, and Australia are leading large-scale deployment through favorable rooftop solar policies, capital subsidies, time-of-day tariffs, and supportive net-metering regulations. China continues to set the pace with its extensive residential PV rollout, distributed energy trading pilots, and integration of distributed solar into smart grid modernization efforts. India is accelerating growth through rooftop solar schemes, corporate renewable power purchase agreements (PPAs), and large-scale solarization of commercial and industrial facilities. Japan and Australia are advancing the adoption of solar energy through high electricity prices, feed-in premium programs, and strong consumer demand for home solar-plus-storage systems.

Drivers, Opportunities & Restraints

The global distributed solar market is primarily driven by the accelerating shift toward decentralized renewable energy generation, growing electricity demand, and the increasing need for grid resilience amid rising climate-related disruptions. Expanding government support through net-metering policies, investment tax credits, feed-in tariffs, and community solar programs is significantly boosting adoption across residential, commercial, and industrial sectors. Declining photovoltaic module prices, advancements in inverter technologies, and the integration of energy storage systems are further strengthening the economic viability of small-scale solar installations.

Opportunities in the market are expanding rapidly as distributed energy resources (DERs) become integral to modern grid architecture and clean energy transitions. Increasing adoption of electric vehicles (EVs) is creating new synergies between rooftop solar, home charging stations, and bidirectional energy flows. Community solar programs, peer-to-peer energy trading models, and microgrid development offer strong potential for underserved or remote regions with limited grid access. The growing integration of distributed solar with battery energy storage, demand response platforms, and smart grid technologies is unlocking new revenue streams for both utilities and end users.

However, the distributed solar market faces several restraints, including grid integration challenges, intermittent generation issues, and varying regulatory frameworks across countries and jurisdictions. High upfront installation costs, despite declining module prices, continue to impact adoption in price-sensitive markets. Policy uncertainties such as revisions to net-metering rules, tariffs on imported solar components, and fluctuating incentive structures may hinder long-term investment planning. Technical limitations related to distributed grid hosting capacity, voltage management, and the need for advanced smart grid infrastructure pose additional hurdles.

Product Type Insights

The monocrystalline (Mono-Si) distributed solar segment accounted for the largest revenue share, around 62%, in 2024, owing to its high efficiency, superior performance in limited rooftop space, and longer operational lifespan compared to other photovoltaic technologies. Continued advancements in cell architectures such as PERC, TOPCon, and heterojunction technologies are further enhancing module efficiency, making monocrystalline panels the preferred choice for residential, commercial, and industrial installations. Their declining production costs, driven by economies of scale in Asia Pacific manufacturing hubs, have also strengthened global adoption. As consumers and businesses increasingly prioritize high-output, space-efficient solar solutions, the monocrystalline segment is expected to maintain its dominance throughout the forecast period.

The concentrated PV cell (CPV) segment is expected to witness significant growth, registering a robust CAGR of 6.56% from 2025 to 2033, driven by its ability to deliver exceptionally high conversion efficiencies through advanced optical concentrators and multi-junction solar cells. The increasing demand for high-performance solar technologies in regions with strong direct normal irradiance (DNI), such as parts of the Asia Pacific, the Middle East, and North America, is further supporting market expansion. Technological improvements in tracking systems, thermal management, and module durability are also enhancing CPV reliability and reducing the levelized cost of electricity (LCOE). As global efforts intensify toward clean energy diversification and high-efficiency solar solutions, CPV is poised to emerge as a promising growth segment in the distributed solar landscape.

End User Insights

The residential segment accounted for the largest market share, approximately 35%, in 2024, driven by the rising adoption of rooftop solar systems among households, attractive government incentives, and increasing consumer demand for energy independence. Declining solar module prices, simplified installation processes, and the growing availability of financing options such as solar loans, leases, and zero-down payment schemes have made residential solar more accessible to a wider customer base. Supportive policies, such as net-metering, feed-in tariffs, and residential tax credits, continue to strengthen uptake across major markets.

The commercial segment is anticipated to experience significant growth, with a CAGR of 4.79% from 2025 to 2033, driven by the increasing adoption of rooftop and onsite solar systems among businesses seeking to reduce operational costs and meet their corporate sustainability goals. Growing interest in long-term power purchase agreements (PPAs), coupled with rising electricity tariffs and the need for predictable energy expenses, is further accelerating commercial installations. Supportive policies, including investment tax credits, accelerated depreciation benefits, and utility-supported distributed generation programs, are strengthening the business case for commercial solar. As companies prioritize carbon reduction, energy security, and operational optimization, the commercial segment is positioned to remain a key driver of distributed solar market expansion.

Regional Insights

Asia Pacific Distributed Solar Market Trends

Asia Pacific accounted for the largest share, approximately 48%, of the global distributed solar market in 2024, driven by rapid urbanization, strong government-backed renewable energy targets, and extensive deployment of rooftop and distributed PV systems across major economies. China continues to lead the region with large-scale residential solar rollouts, supportive subsidies, and accelerated efforts to modernize its grid. India is also a significant contributor, driven by national rooftop solar initiatives, favorable net-metering regulations, and increasing demand from commercial and industrial (C&I) sectors for low-cost, clean power. Markets such as Japan and Australia further strengthen regional dominance through high electricity prices, mature rooftop solar ecosystems, and strong consumer preference for home solar-plus-storage solutions. Growing investments in smart grids, digital energy management, and community solar programs are reinforcing the Asia Pacific’s leadership in distributed solar adoption.

North America Distributed Solar Market Trends

The North America distributed solar market continues to expand steadily, supported by favorable policy frameworks, declining installation costs, and rising demand for resilient, decentralized clean energy solutions. The U.S. remains the regional leader, driven by federal incentives such as the Investment Tax Credit (ITC), state-level net-metering programs, and growing adoption of community solar and virtual power plant (VPP) models. Increasing participation from commercial and industrial consumers, along with strong corporate sustainability commitments, is further boosting distributed solar deployment across key states.

U.S. Distributed Solar Market Trends

The U.S. distributed solar market is growing rapidly, driven by federal incentives such as the Investment Tax Credit (ITC), strong state-level net-metering programs, and rising consumer demand for reliable and affordable clean energy. Higher electricity prices, interest in solar-plus-storage systems, and ongoing grid modernization efforts are strengthening the value proposition for households and businesses. With utilities expanding distributed generation programs and corporations pursuing ambitious sustainability commitments, the U.S. remains one of the most dynamic markets for distributed solar globally.

Europe Distributed Solar Market Trends

The Europe distributed solar market is growing rapidly, driven by strong decarbonization policies, rising electricity prices, and heightened energy-security priorities. Supportive measures, such as RED III, EU rooftop solar mandates, and national incentives, including feed-in tariffs and self-consumption schemes, are accelerating the adoption of residential and commercial PV. Germany, the Netherlands, Italy, and Spain continue to lead the way in installations through robust rooftop programs, community solar initiatives, and smart grid integration. The increasing uptake of solar-plus-storage systems, digital energy management, and peer-to-peer trading pilots is further boosting deployment. As Europe moves toward its 2030 and 2050 climate goals, distributed solar is solidifying its role in building a decentralized, resilient, low-carbon energy landscape.

Latin America Distributed Solar Market Trends

The Latin America distributed solar market is expanding steadily, driven by high solar resources, rising electricity costs, and supportive distributed generation policies. Brazil leads the region with a robust regulatory framework for micro- and mini-generation, rapid adoption across both residential and commercial sectors, and enhanced access to financing. Mexico is witnessing an increase in rooftop solar adoption among commercial and industrial users, who seek cost savings and enhanced energy security, while Chile continues to promote distributed solar through community energy projects and progressive clean energy targets. As grid modernization advances and solar-plus-storage solutions become more affordable, the adoption of distributed solar across Latin America is expected to accelerate.

Middle East & Africa Distributed Solar Market Trends

The Middle East & Africa distributed solar market is growing steadily, supported by abundant solar resources, rising energy demand, and government initiatives to diversify power generation away from fossil fuels. Countries such as the UAE, Saudi Arabia, and South Africa are leading adoption through rooftop solar programs, net-metering frameworks, and incentives aimed at promoting distributed generation for homes, businesses, and industrial facilities. In the Gulf region, high electricity consumption and ambitious national renewable energy targets are driving increased investment in commercial and industrial rooftop systems. In Africa, distributed solar energy is expanding rapidly in off-grid and rural areas, where mini-grids and solar home systems are providing reliable and affordable electricity access. As solar-plus-storage technologies become more accessible and policy frameworks strengthen, the region is positioned for continued growth in decentralized clean energy solutions.

Key Distributed Solar Company Insights

Some of the key players operating in the global distributed solar market include First Solar and SunPower Corporation, among others.

-

First Solar is a leading American solar technology company recognized for its advanced thin-film photovoltaic (PV) modules, which are widely used in both utility-scale and distributed solar applications. The company specializes in cadmium telluride (CdTe) solar technology, offering high energy yield, strong performance in high-temperature and low-light conditions, and a competitive cost structure. With vertically integrated manufacturing, rigorous sustainability practices, and a strong global footprint, First Solar delivers reliable, bankable solar solutions to commercial, industrial, and energy service providers. The company’s commitment to innovation, large-scale production capacity, and environmentally responsible manufacturing processes positions it as a major player in the global distributed solar market.

-

SunPower Corporation is a leading U.S.-based solar technology and energy services provider known for its high-efficiency photovoltaic modules and integrated residential solar solutions. With a strong focus on the distributed solar segment, the company offers advanced solar panels, energy storage systems, and smart energy management platforms designed to optimize home energy production and consumption. SunPower leverages its extensive dealer network, innovative system designs, and premium product portfolio to serve residential customers across North America. The company’s long-standing expertise in solar technology, combined with its emphasis on sustainability, performance, and customer-centric services, positions it as a key player in the global distributed solar market.

Key Distributed Solar Companies:

The following are the leading companies in the distributed solar market. These companies collectively hold the largest market share and dictate industry trends.

- First Solar

- JinkoSolar

- Trina Solar

- Canadian Solar

- LONGi Green Energy

- JA Solar

- Hanwha Q CELLS

- SunPower Corporation

- Enphase Energy

- SMA Solar Technology

Recent Developments

- In July 2025, the U.S.-based First Solar entered a long-term partnership with UbiQD to integrate quantum-dot materials into its panels, enhancing module efficiency, supporting large-scale commercialization, and advancing the country’s competitiveness in next-generation distributed solar technologies.

Distributed Solar Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 129.11 billion

Revenue forecast in 2033

USD 193.83 billion

Growth rate

CAGR of 5.21% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

First Solar; JinkoSolar; Trina Solar; Canadian Solar; LONGi Green Energy; JA Solar; Hanwha Q CELLS; SunPower Corporation; Enphase Energy; SMA Solar Technology

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distributed Solar Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global distributed solar market report on the basis of product type, end user, and region.

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Monocrystalline (Mono-Si)

-

Polycrystalline (p-Si)

-

Amorphous Silicon (a-Si)

-

Concentrated PV Cell (CPV)

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Utility

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global distributed solar market size was estimated at USD 121.80 billion in 2024 and is expected to reach USD 193.83 billion in 2025.

b. The global distributed solar market is expected to grow at a compound annual growth rate of 5.21% from 2025 to 2033 to reach USD 193.83 billion by 2033.

b. Based on the product type segment, monocrystalline (Mono-Si) held the largest revenue share of more than 62% in 2024.

b. Some of the key players operating in the global Distributed Solar market include First Solar; JinkoSolar; Trina Solar; Canadian Solar; LONGi Green Energy; JA Solar; Hanwha Q CELLS; SunPower Corporation; Enphase Energy; SMA Solar Technology.

b. The distributed solar market is primarily driven by rising electricity costs, growing demand for energy independence, supportive government policies, declining solar module prices, and increasing adoption of rooftop and commercial solar-plus-storage solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.