- Home

- »

- Power Distribution Systems

- »

-

Distribution Transformer Market Size, Industry Report, 2033GVR Report cover

![Distribution Transformer Market Size, Share & Trends Report]()

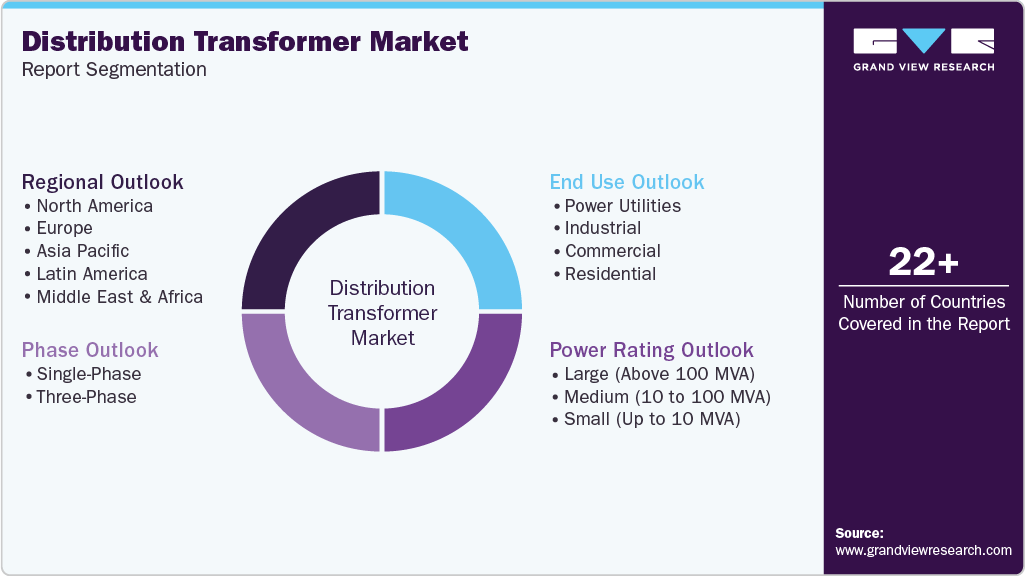

Distribution Transformer Market (2026 - 2033) Size, Share & Trends Analysis Report By Power Rating (Large (Above 100 MVA), Medium (10 To 100 MVA)), By Phase (Single-Phase, Three-Phase), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-846-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Distribution Transformer Market Summary

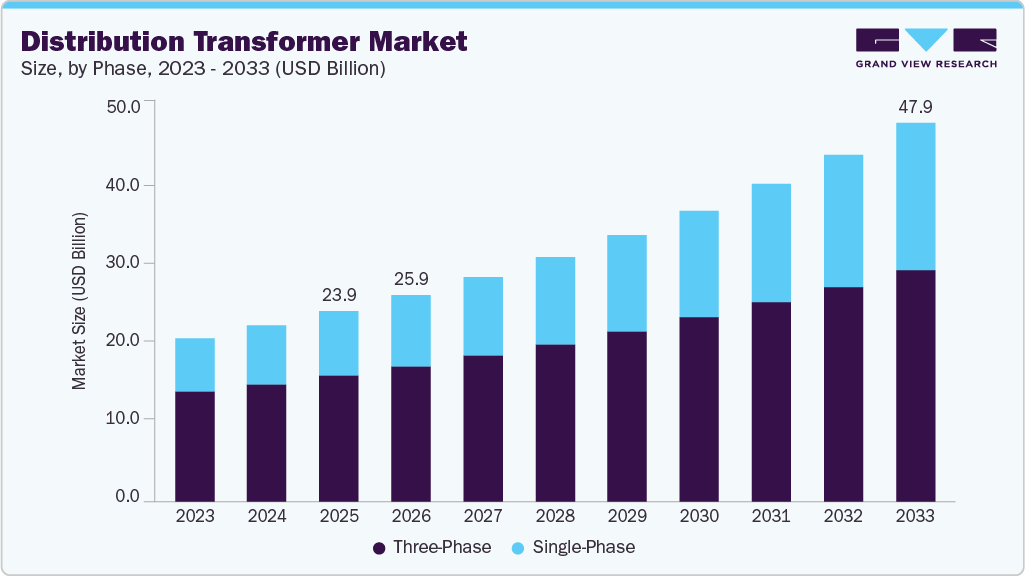

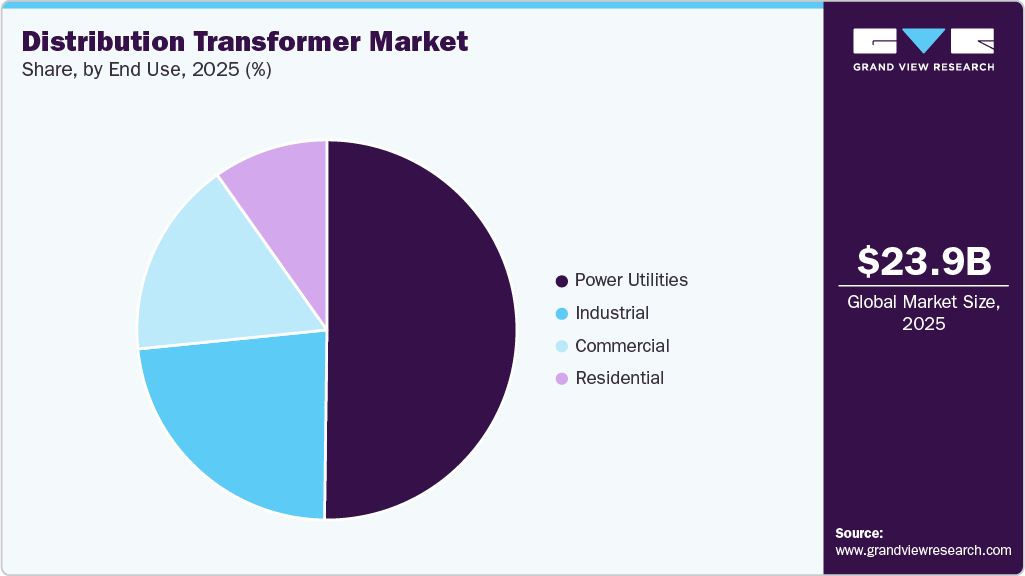

The global distribution transformer market size was estimated at USD 23.92 billion in 2025 and is projected to reach USD 47.69 billion by 2033, expanding at a CAGR of 9.1% from 2026 to 2033. The distribution transformer market is witnessing steady growth driven by the rapid expansion and modernization of power distribution infrastructure across both developed and emerging economies.

Key Market Trends & Insights

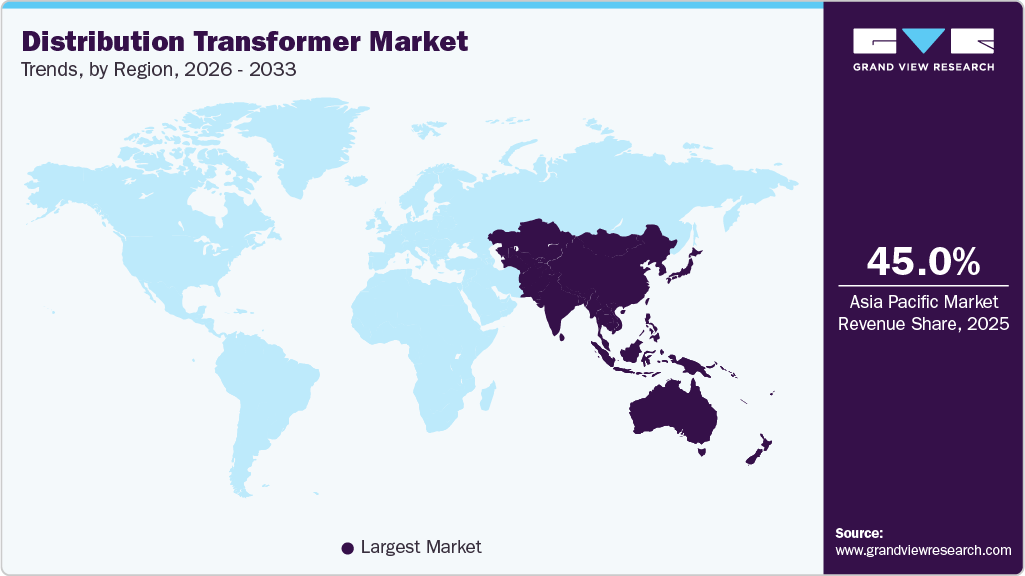

- Asia Pacific distribution transformer market held the largest share of over 45% of the global market in 2025.

- Based on power rating, the small (up to 10 MVA) segment held the highest market share in 2025.

- Based on phase, the three-phase segment held the highest market share in 2025.

- Based on end use, the power utilities segment held the highest market share of over 50% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 23.92 Billion

- 2033 Projected Market Size: USD 47.69 Billion

- CAGR (2026-2033): 9.1%

- Asia Pacific: Largest market in 2025

Rising electricity demand from residential, commercial, and industrial users is prompting utilities to upgrade aging grid infrastructure with efficient, reliable transformers. Many countries are investing heavily in strengthening last-mile connectivity to reduce transmission and distribution losses, improve voltage stability, and ensure uninterrupted power supply, thereby directly supporting greater deployment of distribution transformers. Expanding cities, new housing projects, metro rail systems, data centers, and commercial complexes require robust and localized power distribution networks. Distribution transformers play a critical role in stepping down voltage for safe end use, making them essential for urban power planning. As smart cities and integrated townships gain momentum, demand for compact, efficient, and digitally enabled distribution transformers continues to rise.The accelerating integration of renewable energy sources into power grids is significantly influencing the distribution transformer market. Solar rooftops, wind farms, and distributed generation systems require transformers capable of handling bidirectional power flow and fluctuating load conditions. Utilities are increasingly deploying advanced distribution transformers to maintain grid stability while accommodating renewable energy penetration. This transition toward cleaner energy systems are creating sustained demand for technologically advanced transformer solutions.

Government policies and regulatory initiatives focused on energy efficiency and grid reliability are further driving market growth. Many regions have introduced stringent efficiency standards and loss-reduction targets, encouraging the replacement of conventional transformers with energy-efficient, low-loss models. Financial incentives, rural electrification programs, and grid expansion schemes are also boosting transformer installations, especially in developing economies where electrification efforts are still ongoing.

Technological advancements in transformer design and materials are also strengthening market expansion. The adoption of smart transformers with monitoring, diagnostics, and communication capabilities enables predictive maintenance and reduces downtime for utilities. Improvements in core materials, insulation systems, and cooling technologies enhance transformer lifespan and operational efficiency. These innovations support utilities and industries in optimizing power distribution networks, thereby reinforcing the long-term growth prospects of the distribution transformer market.

Drivers, Opportunities & Restraints

The distribution transformer market is primarily driven by rising electricity consumption, grid expansion, and the need to modernize aging power infrastructure. Rapid urbanization, industrial growth, and increasing electrification in rural and semi-urban areas are placing pressure on utilities to strengthen distribution networks. Integration of renewable energy sources at the distribution level is further increasing demand for advanced transformers capable of handling variable loads and bidirectional power flow. Regulatory emphasis on energy efficiency and reduction of technical losses is also encouraging the replacement of old transformers with high-efficiency models.

The market presents strong opportunities through smart grid development and digitalization of power distribution systems. Deployment of smart transformers equipped with sensors and monitoring technologies allows utilities to improve grid reliability, enable predictive maintenance, and reduce operational costs. Growing investments in electric vehicle charging infrastructure, data centers, and decentralized power generation create additional demand for reliable distribution transformers. Emerging economies offer significant growth potential as governments focus on electrification programs, grid upgrades, and expansion of power access to underserved regions.

Despite positive growth prospects, the market faces certain restraints that may limit expansion. High initial capital investment and long procurement cycles can discourage utilities from replacing transformers rapidly. Volatility in raw material prices, particularly copper, aluminum, and electrical steel, affects manufacturing costs and profit margins.

Power Rating Insights

The small distribution transformer segment rated up to 10 MVA is primarily driven by rising electricity demand at the distribution level due to rapid urban expansion and growth of commercial and light industrial infrastructure. These transformers are widely used in residential neighborhoods, commercial buildings, small manufacturing units, and utility feeders, where flexibility and ease of installation are critical. Ongoing investments in distribution network expansion, replacement of aging assets, and rural electrification programs continue to support steady demand, as utilities prefer standardized, lower capacity transformers that reduce capital expenditure while ensuring reliable last mile power delivery.

The large distribution transformer segment with capacities above 100 MVA is driven by the rapid expansion of high load industrial infrastructure and bulk power distribution requirements. Heavy industries such as steel, cement, petrochemicals, mining, and large data centers require transformers that can handle very high power loads, operate over long duty cycles, and maintain high reliability. Utilities also deploy these high capacity units at major substations to support dense urban centers and industrial corridors, where power demand concentration continues to rise due to economic growth and infrastructure development.

Phase Insights

The three-phase segment is driven by its widespread adoption across industrial, commercial, and high-density urban power networks. Three-phase transformers are essential for efficiently transmitting and distributing power where loads are higher and more balanced, such as manufacturing facilities, commercial complexes, metro rail systems, and large residential developments. As industrialization accelerates and urban infrastructure becomes more power-intensive, utilities and private operators increasingly rely on three-phase configurations to ensure stable voltage regulation, higher power handling capability, and improved operational efficiency across distribution networks.

The single-phase segment is primarily driven by expanding electrification in rural and semi-urban areas, where power demand is relatively low and dispersed. These transformers are widely used to supply electricity to individual households, small shops, agricultural loads, and remote communities due to their simple design, lower installation cost, and ease of maintenance. Government-led rural electrification initiatives and grid extension programs continue to create steady demand for single-phase transformers, especially in developing economies where access to basic electricity infrastructure is still expanding.

End Use Insights

The power utilities segment is driven by continuous expansion and reinforcement of electricity distribution networks to meet rising demand. Utilities are investing heavily in new substations, feeder extensions, and capacity upgrades to support urban growth, industrialization, and increasing household electricity consumption. Distribution transformers remain a critical component for voltage step down and network reliability, which keeps utility driven procurement strong, particularly for grid expansion and asset replacement programs.

The residential segment is anticipated to register the fastest CAGR over the forecast period, driven by steady growth in housing construction and ongoing urban expansion across both developed and emerging economies. Rising population, increasing urban migration, and government supported affordable housing programs are leading to higher electricity demand at the neighborhood level. Distribution transformers are essential for stepping down voltage to safe levels for household consumption, which supports consistent demand as utilities expand residential feeders and develop new housing clusters.

Regional Insights

Asia Pacific Distribution Transformer Market Trends

Rapid urbanization and fast-paced industrial growth across the Asia Pacific are driving a surge in electricity demand, which in turn is expanding the need for distribution transformers to connect new residential areas, commercial hubs, and industrial parks to the grid. Large-scale rural electrification programs and capacity additions in countries such as India and China are increasing the volume of low and medium-voltage distribution assets required, while utilities are executing network extension projects to reduce losses and improve reliability. Evidence from regional market studies shows significant investment and steady market valuations that reflect these demand-side forces.

North America Distribution Transformer Market Trends

In North America, the market is expanding as utilities and grid operators invest heavily in modernizing aging electricity infrastructure. Many transformers in service across the United States and Canada are decades old, prompting replacement programs that boost sales volumes even where demand growth is modest. This drive to enhance reliability and reduce outages aligns with broader grid upgrade plans supported by federal and state funding under infrastructure initiatives aimed at strengthening power networks and integrating advanced monitoring technologies.

The U.S. distribution transformer market is being driven by the urgent need to replace ageing grid infrastructure and meet rising electricity demand across residential, commercial, and industrial sectors. A large portion of existing distribution transformers and other grid assets are beyond or near their useful life, prompting utilities to upgrade feeders and substations to improve reliability and reduce outages. The national push for grid modernization under various federal and state programs has led to significant utility spending on advanced distribution equipment. For example, California’s Independent System Operator has ordered replacement of more than a thousand transformers at energy storage facilities with smart models capable of managing variable renewable inputs, and the Electric Reliability Council of Texas has invested millions in digital transformers for large battery projects. These initiatives highlight how grid resilience improvements and funding for innovative transformer technologies are stimulating market demand.

Europe Distribution Transformer Market Trends

In Europe, the market is gaining momentum because countries are investing in grid upgrades to support the region’s ambitious energy transition goals. Expansion of renewable energy, such as offshore wind farms in the North Sea, large solar installations in Southern Europe, and rising electrification, is increasing the complexity of distribution networks and requiring more transformer capacity to manage variable power flows and stabilise voltage levels.

Middle East & Africa Distribution Transformer Market Trends

In the Middle East & Africa, the market is gaining traction as governments, utilities, and private investors push to strengthen electricity networks to support economic growth and energy transition goals. Rapid expansion of power infrastructure to meet rising demand from urbanisation and industrialisation requires expansion and replacement of transformers on distribution networks, especially in fast-growing Gulf economies such as Saudi Arabia, the UAE, and Egypt.

Key Distribution Transformer Company Insights

Some of the key players operating in the global distribution transformer market include Schneider Electric, Siemens, General Electric, Eaton, ABB, Mitsubishi Electric, Toshiba, among others. These companies are actively expanding their market footprint through product innovation, strategic acquisitions, and collaborations to enhance their global distribution networks and technology capabilities.

Key Distribution Transformer Companies:

The following key companies have been profiled for this study on the distribution transformer market.

- Schneider Electric

- Siemens

- General Electric

- Eaton

- ABB

- Mitsubishi Electric

- Hitachi Industrial Equipment Systems Co., Ltd.

- Toshiba

- CG Power and Industrial Solutions

- Hammond Power Solutions

- Fuji Electric Co., Ltd.

Recent Developments

-

In April 2024, Hitachi Industrial Equipment Systems Co., Ltd. and Mitsubishi Electric Corporation announced an agreement to transfer Mitsubishi Electric's distribution transformer business from its Nagoya Works to Hitachi Industrial Equipment Systems.

Distribution Transformer Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the total revenue generated from the manufacturing and sale of distribution transformers, including oil-immersed and dry-type units, across utility, industrial, and commercial end-use applications worldwide during the defined period.

Market size value in 2026

USD 25.96 billion

Revenue forecast in 2033

USD 47.69 billion

Growth rate

CAGR of 9.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million, CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Power rating, phase, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Schneider Electric; Siemens; General Electric; Eaton; ABB; Mitsubishi Electric; Hitachi Industrial Equipment Systems Co., Ltd.; Toshiba; CG Power and Industrial Solutions; Hammond Power Solutions; Fuji Electric Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distribution Transformer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global distribution transformer market report on the basis of power rating, phase, end use and region.

-

Power Rating Outlook (Revenue, USD Million, 2021 - 2033)

-

Large (Above 100 MVA)

-

Medium (10 to 100 MVA)

-

Small (Up to 10 MVA)

-

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-Phase

-

Three-Phase

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Power Utilities

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The key players in the global distribution transformer market are Schneider Electric, Siemens, General Electric, Eaton, ABB, Mitsubishi Electric, Toshiba, CG Power and Industrial Solutions, Hammond Power Solutions, Fuji Electric Co., Ltd. and others.

b. The key factors driving the distribution transformer market include rapid urbanization, expansion of electricity distribution networks, rising investments in renewable energy integration, grid modernization initiatives, growing electrification in emerging economies, and increasing demand for reliable power supply from residential, commercial, and industrial sectors.

b. The global distribution transformer market size was estimated at USD 23.92 billion in 2025 and is expected to reach USD 25.96 billion in 2026.

b. The global distribution transformer market is expected to grow at a compound annual growth rate of 9.1% from 2026 to 2033 to reach USD 47.69 billion by 2033.

b. Based on the end use segment, power utilities held the largest revenue share of over 50% in the distribution transformer market in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.