- Home

- »

- Biotechnology

- »

-

DNA-encoded Library Market Size, Industry Report, 2030GVR Report cover

![DNA-encoded Library Market Size, Share & Trends Report]()

DNA-encoded Library Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service (Products, Services), By Therapeutic Area (Oncology, Infectious Diseases), By Application (Hit Generation / Identification), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-564-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA-encoded Library Market Summary

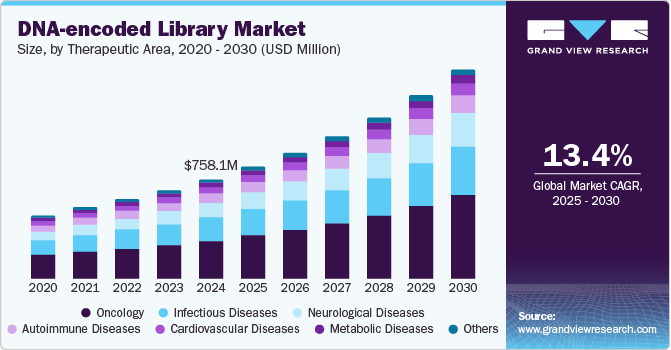

The global DNA-encoded library market size was estimated at USD 758.1 million in 2024 and is projected to reach USD 1.60 billion by 2030, growing at a CAGR of 13.4% from 2025 to 2030. The increasing demand for innovative drug discovery solutions drives the growth.

Key Market Trends & Insights

- North America dominated the DNA-encoded library market with a share of 44.66% in 2024.

- Asia Pacific is expected to exhibit the fastest CAGR in the DNA-encoded library industry during the forecast period.

- Based on therapeutic area, the oncology segment held the largest revenue share of 38.32% in 2024.

- Based on application, the hit generation/identification segment dominated the market in 2024, with a share of 42.52%.

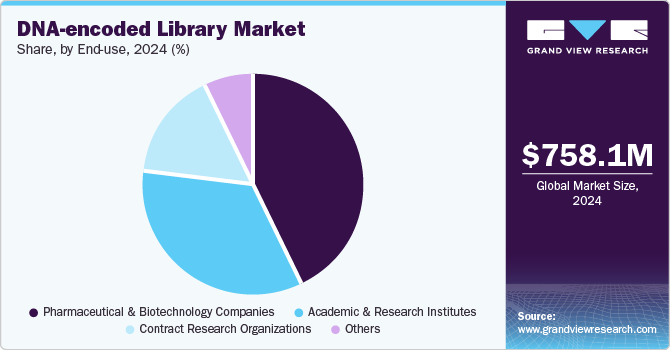

- Based on end use, the pharmaceutical and biotechnology companies segment accounted for the largest revenue share of 42.77% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 758.1 Million

- 2030 Projected Market Size: USD 1.60 Billion

- CAGR (2025-2030): 13.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Pharmaceutical and biotechnology companies continuously seek more efficient, cost-effective methods for identifying potential drug candidates. DNA-encoded Library (DEL) technology enables high-throughput screening of billions of compounds, improving the chances of finding lead molecules with therapeutic potential. The growing prevalence of chronic diseases such as cancer, neurological disorders, and infectious diseases is pushing the need for novel treatments. Advances in molecular biology and Next-Generation Sequencing (NGS) further enhance DNA-encoded library platforms' capabilities. These factors are driving market growth and increasing the adoption of this technology across research institutions and drug development companies.

The rising focus on precision medicine and personalized therapeutics fuels the demand for DNA-encoded library technology. Researchers are leveraging DEL platforms to identify highly selective and potent compounds that target specific disease pathways. The ability to design and screen vast chemical libraries with high accuracy improves drug discovery programs' efficiency. Integrating Artificial Intelligence (AI) and Machine Learning (ML) further optimizes data analysis and accelerates hit identification. For instance, in March 2025, Isomorphic Labs raised USD 600 million to expand R&D, grow its team, and advance its AI drug design engine. The DeepMind spinout partnered with Novartis and Eli Lilly, aiming for clinical trials by year-end. Automation in DNA-encoded library processes reduces time and labor costs, making it an attractive option for pharmaceutical firms. These advancements are improving success rates in drug discovery and enhancing the overall efficiency of R&D efforts.

Strategic collaborations and partnerships between biotech firms and Contract Research Organizations (CROs) are expanding the reach of DNA-encoded library technology. Companies are outsourcing drug discovery services to specialized CROs that offer expertise in DEL-based screening. This trend is reducing operational costs and increasing access to diverse chemical libraries. Investments in research infrastructure and expansion of laboratory capabilities are strengthening the market landscape. The development of novel DNA-encoded scaffolds and improved encoding techniques is enhancing the quality of compound screening. These innovations are positioning DNA-encoded library technology as a critical tool in modern drug discovery, driving its adoption across the pharmaceutical sector.

Growing Demand for Drug Discovery & Development

The pharmaceutical and biotechnology industries increasingly adopt DNA-encoded libraries to enhance drug discovery efforts. DNA-encoded library technology allows researchers to screen billions of small molecules efficiently, significantly reducing the time required to identify potential drug candidates. The rising prevalence of chronic diseases and the urgent need for new therapeutics drive demand for faster, more cost-effective drug discovery methods. Companies and research institutions benefit from the DNA-encoded library’s ability to improve hit identification rates while lowering overall research and development costs. As a result, the DNA-encoded library industry is experiencing significant growth, attracting investments from major pharmaceutical firms and biotech startups.

Advancements in DNA-Encoded Library Technology & AI Integration

Continuous improvements in DNA barcoding, sequencing technologies, and chemical synthesis are enhancing the efficiency and accuracy of DNA-encoded library screening. Integrating Artificial Intelligence (AI) and Machine Learning further revolutionizes the analysis of large chemical libraries, improving hit validation and lead optimization. AI-driven DNA-encoded library platforms enable the rapid identification of potential drug candidates by predicting molecular interactions with high precision. These advancements help overcome traditional challenges in medicinal chemistry, such as high attrition rates and false positives. As technology evolves, more companies leverage AI-driven DNA-encoded library solutions to accelerate their drug discovery pipelines.

Complexity in Data Management & Analysis

DNA-encoded library technology generates vast amounts of data, requiring sophisticated computational tools and expertise for effective analysis. Managing and interpreting billions of molecular interactions is a complex process that demands advanced bioinformatics and machine learning algorithms. Small and mid-sized companies often struggle with limited computational resources and expertise, making extracting meaningful insights from DNA-encoded library experiments difficult. The risk of false positives and the need for extensive validation further complicate the process. Without strong data management solutions, researchers may face challenges in optimizing the efficiency and reliability of DNA-encoded library-based drug discovery.

High Initial Investment & Technical Challenges

Setting up and maintaining a DNA-encoded library platform requires significant financial investment in sequencing technology, automation, and skilled personnel. The cost of establishing a DNA-encoded library system, including DNA encoding, chemical synthesis, and high-throughput screening infrastructure, can be prohibitive for smaller companies. In addition, technical challenges such as chemical stability issues, DNA-encoded compound diversity limitations, and hit validation difficulties can slow down progress. The need for extensive optimization and validation of hits increases the complexity and cost of using DNA-encoded library technology in drug discovery. These financial and technical barriers can limit the widespread adoption of DNA-encoded libraries, particularly among emerging biotech firms and academic institutions.

Market Concentration & Characteristics

The DNA-encoded library market is highly innovative, driven by advancements in combinatorial chemistry, artificial intelligence, and automation. Continuous improvements in library design and screening efficiency enable faster drug discovery. AI-driven analytics further enhances target identification, making DNA-encoded library technology increasingly attractive to pharmaceutical and biotech firms. Innovation in DNA tagging and decoding techniques continues to expand the scope of applications in early-stage drug discovery.

Mergers and Acquisitions (M&A) play a significant role in the DNA-encoded library industry, with large pharmaceutical companies acquiring biotech firms specializing in DEL technology. Strategic partnerships and acquisitions are driven by the need to access proprietary libraries and expertise in DNA-encoded library-based drug discovery. Companies seek to integrate DNA-encoded libraries into their early-stage pipeline to improve hit identification rates. The increasing demand for novel therapeutic targets has intensified M&A activity, fostering market consolidation.

Regulatory frameworks impact the market for DNA-encoded libraries by setting guidelines for drug discovery and preclinical validation. While DNA-encoded library platforms streamline hit identification, regulatory compliance regarding data integrity, safety, and validation remains crucial. Stringent FDA and EMA guidelines ensure reliability in compound screening and candidate selection. Regulatory policies on intellectual property rights influence market competition, shaping how companies leverage their DNA-encoded library technology assets.

The DEL industry is experiencing rapid product and service expansion, with companies developing more diverse libraries and novel screening platforms. Advances in chemical space coverage and target specificity enhance the scope of DNA-encoded library-based discovery. The emergence of AI-assisted drug screening further expands product capabilities. In addition, integrating DNA-encoded libraries with other screening technologies, such as fragment-based drug discovery, has opened new opportunities for therapeutic innovation.

Leading companies in the DNA-encoded library market are expanding their presence across key regions to enhance their global footprint. Major players like WuXi AppTec and HitGen have established operations in North America, Europe, and Asia to cater to the growing demand for DNA-encoded library-based drug discovery. Companies such as X-Chem have strengthened their European presence through collaborations with biotech firms, while Chinese firms are increasingly partnering with Western pharmaceutical companies to provide DNA-encoded library screening services. Expansion into emerging markets, particularly in Asia Pacific, is driven by rising investments in biotech infrastructure and government-backed research initiatives.

Product & Service Insights

The services segment led the DNA-encoded library market in 2024, generating the highest revenue, driven by the increasing outsourcing of drug discovery research. Pharmaceutical companies are partnering with service providers to access advanced screening technologies without significant infrastructure investments. The rising complexity of drug discovery has fueled the demand for specialized expertise. Customized library synthesis and hit-to-lead optimization services have gained traction in recent years. The growing need for cost-effective and time-efficient screening solutions has expanded the market. Small and mid-sized biotech firms' increasing adoption of contract research services has also contributed to growth. Technological sequencing and data analytics advancements have enhanced service efficiency, further supporting market expansion.

The products segment is expected to grow at a significant CAGR over the forecast period, due to the rising demand for novel drug discovery tools. Pharmaceutical and biotechnology companies are increasingly adopting DNA-encoded library technologies to enhance screening efficiency and reduce development costs. For instance, major pharmaceutical companies such as Amgen, GSK, Pfizer, Roche, Novartis, AstraZeneca, Bristol Myers Squibb, Sanofi, and Janssen have integrated DNA-encoded library technology into their drug discovery processes to enhance screening efficiency and reduce development costs. Advances in DNA barcoding and molecular tagging have significantly improved compound identification. The growing investment in high-throughput screening solutions has further strengthened market growth. The increasing availability of diverse chemical libraries has expanded research opportunities. Integration with artificial intelligence has streamlined compound selection, improving hit rates. These factors collectively contributed to the dominance of the products segment.

Therapeutic Area Insights

The oncology segment held the largest revenue share of 38.32% in 2024, primarily due to the high demand for targeted cancer therapies. DNA-encoded library technology has rapidly identified potential small-molecule inhibitors for oncogenic targets. The increasing prevalence of cancer worldwide has intensified research efforts in this domain. Expanding genomic data has facilitated the discovery of novel biomarkers for personalized treatments. The need for innovative and cost-effective drug discovery methods has further driven DNA-encoded library adoption in oncology. Growing investment by pharmaceutical companies in immuno-oncology research has also supported market growth. The emergence of new drug candidates in preclinical and clinical pipelines has reinforced segment dominance.

The neurological diseases segment is expected to grow at the fastest CAGR of 15.31%, fueled by the rising demand for effective treatments against neurodegenerative disorders. The complexity of central nervous system drug discovery has increased the reliance on DNA-encoded library-based screening. The surge in research efforts for Alzheimer’s, Parkinson’s, and other neurological diseases has expanded market opportunities. Advances in blood-brain barrier permeability studies have improved target specificity. The rising aging population has led to a higher prevalence of neurological conditions, increasing the need for novel drug candidates. Pharmaceutical companies are actively investing in DNA-encoded library technology to accelerate hit identification. Integrating computational modeling with DNA-encoded library platforms has enhanced drug discovery precision, further driving growth.

Application Insights

The hit generation/identification segment dominated the market in 2024, with a share of 42.52% due to the growing need for efficient lead discovery solutions. DNA-encoded library technology has provided a cost-effective and scalable approach to screening large chemical libraries. The rising focus on early-stage drug discovery has accelerated the adoption of high-throughput screening methods. The ability to rapidly identify potential drug candidates with high specificity has strengthened market penetration. Continuous advancements in DNA barcoding techniques have improved the accuracy of compound selection. Pharmaceutical and biotech firms are increasingly integrating DNA-encoded library-based screening into their R&D processes. These factors have contributed to the segment’s leading revenue share.

The hit validation/optimization segment is projected to expand at the fastest CAGR of 14.63% over the forecast period, driven by the increasing need to refine potential drug candidates. Pharmaceutical companies prioritize optimization to enhance drug efficacy and safety. Advances in structure-based drug design have improved hit validation accuracy. The integration of artificial intelligence has streamlined the analysis of binding affinities and structure-activity relationships. The growing importance of reducing late-stage drug failures has intensified the focus on optimization processes. The adoption of DNA-encoded libraries in combination with computational modeling has improved success rates. These advancements have fueled market growth in this segment.

End Use Insights

Pharmaceutical and biotechnology companies accounted for the largest revenue share of 42.77% in 2024, primarily due to their extensive investment in drug discovery programs. The increasing demand for novel therapeutics has led to the widespread adoption of DNA-encoded library screening. Pharmaceutical firms are leveraging DNA-encoded library technology to accelerate the identification of promising drug candidates. The ability to explore vast chemical space efficiently has improved research productivity. Continuous advancements in combinatorial chemistry have strengthened drug pipeline development. Large-scale collaborations with technology providers have expanded the accessibility of DNA-encoded library platforms. These factors have collectively reinforced the dominance of this end user segment.

The Contract Research Organizations (CROs) segment is anticipated to witness the fastest CAGR of 14.94% over the forecast period, driven by the growing trend of outsourcing drug discovery research. Pharmaceutical and biotech companies increasingly rely on CROs to access specialized expertise and advanced screening platforms. The rising need for cost-effective and time-efficient research solutions has accelerated market expansion. CROs invest in DNA-encoded library technology to enhance service offerings and attract a broader client base. The growing complexity of drug discovery has increased the demand for external research partnerships. Advancements in sequencing and data analytics have further strengthened CRO capabilities. These factors have contributed to the rapid growth of this segment.

Regional Insights

North America is dominant in the DNA-encoded library industry, primarily due to its biotechnology sectors and robust pharmaceutical industry. The region is home to major industry players actively investing in innovative drug discovery technologies. A well-established research infrastructure supports extensive R&D activities, facilitating the adoption of DNA-encoded library platforms. Collaborations between academic institutions and pharmaceutical companies further enhance market growth. Advanced technological capabilities accelerate the development and implementation of DNA-encoded library services. Therefore, North America will maintain its market share in the coming years.

U.S. DNA-encoded Library Market Trends

The U.S. held a significant share of the DNA-encoded library industry in 2024, driven by a concentration of leading pharmaceutical firms. Extensive investment in biotechnology research raises the development of novel drug discovery methods. The country's advanced healthcare infrastructure supports integrating cutting-edge technologies like DNA-encoded libraries. Academic and research institutions actively partner with industry players, promoting innovation. A favorable regulatory environment encourages the adoption of DNA-encoded library platforms.

Europe DNA-encoded Library Market Trends

Europe exhibits steady growth in the DNA-encoded library industry due to a strong emphasis on innovation and research. The region hosts numerous pharmaceutical and biotech companies investing in advanced drug discovery technologies. Collaborative efforts between countries enhance the development and application of DNA-encoded library platforms. A well-established academic and research community contributes to ongoing advancements in the field. The focus on personalized medicine drives the demand for efficient compound screening methods. Europe's commitment to scientific excellence ensures its continued relevance in the market.

The UK DNA-encoded library marketcontributes significantly to the regional share, with a thriving pharmaceutical sector. The country's focus on research and development fosters the adoption of innovative technologies. Leading universities and research institutions contribute to advancements in DNA-encoded library methodologies. Strategic partnerships between academia and industry facilitate knowledge transfer and commercialization. The emphasis on precision medicine increases the demand for targeted compound libraries. These elements collectively support the UK's position in the DNA-encoded library landscape.

The DNA-encoded library market in Germany is a key contributor to the Europe market. Germany is known for its strong industrial base. The country's pharmaceutical and biotech industries invest heavily in research and development. Collaborations between research institutions and companies drive innovation in drug discovery. Germany's focus on technological advancement supports the integration of DNA-encoded library platforms. The growing interest in personalized healthcare solutions fuels the demand for efficient screening technologies. These factors underscore Germany's significant role in the market.

Asia Pacific DNA-encoded Library Market Trends

Asia Pacific is expected to exhibit the fastest CAGR in the DNA-encoded library industry during the forecast period, driven by increasing investments in pharmaceutical research. Emerging economies are enhancing their biotech capabilities, leading to greater adoption of DNA-encoded library technologies. The presence of a large patient population necessitates the development of new therapeutics. Collaborations with international pharmaceutical companies bring advanced technologies to the region. The rise of Contract Research Organizations (CROs) offering DNA-encoded library services supports market expansion. These dynamics position Asia Pacific as a rapidly growing market for DNA-encoded library.

China DNA-encoded library market is expected to grow during the forecast period. China expanding pharmaceutical sector and substantial investments in biotechnology research position it as a key market player. The country's focus on innovative drug discovery methods accelerates the adoption of DNA-encoded library platforms. Collaborations between Chinese biotech firms and international partners enhance research capabilities. Integrating advanced technologies, such as artificial intelligence, streamlines compound screening processes. China's commitment to advancing healthcare solutions supports the growth of DNA-encoded library applications. These factors underscore China's significant role in the Asia Pacific market.

The DNA-encoded library in Japan is poised for growth during the forecast period. Japan maintains a strong position in the market, supported by its advanced pharmaceutical industry. The country's commitment to research and development fosters innovation in drug discovery. Collaborations between academic institutions and pharmaceutical companies enhance technological advancements. Japan's focus on addressing complex diseases drives the demand for efficient screening methods. The integration of artificial intelligence with DNA-encoded library platforms is gaining traction. These elements collectively reinforce Japan's role in the DNA-encoded library landscape.

Middle East and Africa DNA-encoded Library Market Trends

Middle East and Africa (MEA) is an emerging market for DNA-encoded library technologies, with increasing investments in healthcare infrastructure. Countries such as Saudi Arabia and Kuwait focus on enhancing their pharmaceutical research capabilities. Collaborations with international biotech firms facilitate the transfer of knowledge and technology. The region's interest in innovative drug discovery methods supports the gradual adoption of DNA-encoded library platforms. Investments in education and training contribute to building a skilled workforce for research and development. These factors collectively indicate a growing potential for the DNA-encoded library industry in MEA.

Saudi Arabia DNA-encoded library market is anticipated to grow during the forecast period. Saudi Arabia is investing in biotechnology as part of its economic diversification efforts. The development of research centers supports advancements in drug discovery technologies. Partnerships with international biotech firms facilitate knowledge transfer. The focus on improving healthcare outcomes drives interest in innovative therapeutics. Initiatives to enhance education in life sciences are building a skilled workforce. These efforts position Saudi Arabia as a potential market for DNA-encoded library technologies.

The DNA-encoded library market in Kuwait represents a smaller but potentially growing space within the MEA region. This growth is anticipated due to increasing investments in improving the healthcare sector and raising scientific research. Research institutions and potential pharmaceutical initiatives within Kuwait may explore the benefits of a DNA-encoded library for their drug development efforts. As the country continues investing in its healthcare infrastructure and research capabilities, the adoption of innovative technologies such as DNA-encoded libraries could increase. This focus on healthcare advancement suggests a future for the Kuwait market.

Key DNA-encoded Library Company Insights

Partnerships, collaborations, and product launches were the most adopted strategies by key players. Companies such as Aurigene Pharmaceutical Services Ltd. and Vipergen ApS formed a strategic partnership to offer integrated drug discovery services and DNA-Encoded Library screening to expand their market reach globally.

Key DNA-encoded Library Companies:

The following are the leading companies in the DNA-encoded library market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- GenScript

- Pharmaron

- WuXi Biology

- Aurigene Pharmaceutical Services

- BOC Sciences

- LGC Bioresearch Technologies

- SPT Labtech Ltd

- Life Chemicals

- Charles River Laboratories

Recent Developments

-

In April 2024, Vipergen announced a strategic partnership with Aurigene Pharmaceutical Services Ltd. to offer integrated drug discovery services. The collaboration aimed to enhance hit identification by screening over a billion small-molecule compounds using Vipergen’s DNA-Encoded Library technology. They also planned to co-develop novel DNA-encoded libraries with improved chemical diversity and drug-likeness.

-

In April 2024, Aurigene Pharmaceutical Services Ltd. and Vipergen ApS formed a strategic partnership to offer integrated drug discovery services and DNA-Encoded Library screening. The partnership aimed to improve success rates and reduce timelines by screening over a billion small-molecule compounds in cells or purified proteins. They also planned to co-develop novel DNA-encoded libraries with enhanced drug-likeness and chemical diversity.

-

In September 2023, WuXi AppTec announced the launch of DNA-encoded libraryman, an automatic DNA-Encoded Library screening device. The device featured an advanced fluidics system and embedded protocols, enabling users to conduct DNA-encoded library screenings within 1.5 to 2 hours with minimal human intervention. DNA-encoded libraryman was designed to democratize DNA-encoded library access, allowing researchers to perform screenings directly in their labs.

DNA-encoded Library Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 851.0 million

Revenue forecast in 2030

USD 1.60 billion

Growth rate

CAGR of 13.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, therapeutic area, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, Kuwait, UAE, and South Africa

Key companies profiled

Merck KGaA; GenScript; Pharmaron; WuXi Biology; Aurigene Pharmaceutical Services; BOC Sciences; LGC Bioresearch Technologies; SPT Labtech Ltd; Life Chemicals; Charles River Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DNA-encoded Library Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DNA-encoded library market report based on product & service, therapeutic area, application, end use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Kits & Reagents

-

Encoded Libraries

-

Others

-

-

Services

-

Design & Synthesis Services

-

Screening Services

-

Others

-

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Infectious Diseases

-

Cardiovascular Diseases

-

Neurological Diseases

-

Autoimmune Diseases

-

Metabolic Diseases

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hit Generation / Identification

-

Hit to Lead

-

Hit Validation / Optimization

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA-encoded library market size was estimated at USD 758.1 million in 2024 and is expected to reach USD 851.0 million in 2025.

b. The global DNA-encoded library market is expected to grow at a compound annual growth rate of 13.41% from 2025 to 2030 to reach USD 1.60 billion by 2030.

b. North America dominated the DNA-encoded library market with a share of 44.66% in 2024. This is attributable to the region's increasing drug discovery and development activities and the growing need for advanced technologies within the drug development space.

b. Some key players operating in the DNA-encoded library market include Merck KGaA; GenScript; Pharmaron; WuXi Biology; Aurigene Pharmaceutical Services; BOC Sciences; LGC Bioresearch Technologies; SPT Labtech Ltd; Life Chemicals; Charles River Laboratories

b. Key factors that are driving the market growth include the increasing demand for efficient drug discovery, high-throughput screening, cost-effective hit identification, and advancements in DNA tagging technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.