- Home

- »

- Pharmaceuticals

- »

-

DNA Repair Drugs Market Size, Share, Growth Report, 2030GVR Report cover

![DNA Repair Drugs Market Size, Share & Trends Report]()

DNA Repair Drugs Market Size, Share & Trends Analysis Report By Drug Type, By Application, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-171-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

DNA Repair Drugs Market Size & Trends

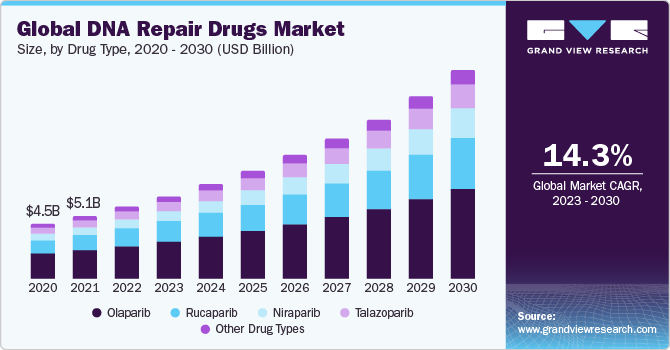

The global DNA repair drugs market size was valued at USD 5.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.34% from 2023 to 2030. The DNA recovery drugs market is driven by the increasing prevalence of cancer, with a rising number of new cancer cases diagnosed globally. Effective DNA repair drugs, particularly those targeting specific genetic mutations like PARP inhibitors, play a crucial role in the treatment of various cancers, contributing to the market growth. Advances in genomic research and personalized medicine further underscore the demand for DNA recovery drugs, as they offer targeted therapeutic options based on individual genetic profiles, enhancing treatment efficacy and patient outcomes.

The DNA recovery drugs market is fueled by the global prominence of cancer as a significant contributor to mortality. According to the WHO, cancer resulted in approximately 10 million deaths in 2020, representing approximately one in six deaths. Predominant cancers include breast, lung, colon, prostate, and rectum cancers. In low- and lower-middle-income countries, about 30% of cancer cases are attributed to cancer-causing infections, such as hepatitis and human papillomavirus (HPV).

Furthermore, in October 2022, Pfizer Inc. reported positive topline outcomes from the Phase 3 TALAPRO-2 trial evaluating TALZENNA (talazoparib), an oral poly ADP-ribose polymerase (PARP) inhibitor, in conjunction with XTANDI (enzalutamide) compared to placebo plus XTANDI in men with metastatic castration-resistant prostate cancer (mCRPC), irrespective of homologous recombination repair (HRR) gene mutations. The trial successfully met its primary endpoint, demonstrating a statistically significant and clinically meaningful improvement in radiographic progression-free survival (rPFS) compared to the placebo plus XTANDI group, surpassing the pre-specified hazard ratio of 0.696.

Drug Type Insights

On the basis of treatment, the DNA repair drugs market is segmented into talazoparib, olaparib, niraparib, rucaparib, and other drug types. The olaparib segment held the largest share in 2022. The dominance of the olaparib segment in the DNA recovery drugs market can be attributed to its efficacy as a poly ADP-ribose polymerase (PARP) inhibitor. Olaparib has shown promising results in the treatment of various cancers, particularly those associated with BRCA mutations. Its mechanism of action involves inhibiting PARP enzymes, leading to impaired DNA repair in cancer cells. This targeted approach makes olaparib a key player in DNA recovery drugs, especially for cancers with specific genetic characteristics, contributing to its dominance in the market.

Application Insights

On the basis of cause, the DNA repair drugs market is segmented into breast cancer, ovarian cancer, peritoneal cancer, fallopian tube cancer, and other applications. The ovarian cancer segment dominated the market in 2022. According to the Canadian Cancer Society, in 2022, it was projected that around 3,000 Canadian women would be diagnosed with ovarian cancer, with an estimated 1,950 fatalities. It emphasizes the substantial impact of ovarian cancer on the health of Canadian women, underscoring the imperative for prompt and efficacious treatments and interventions in this sphere.

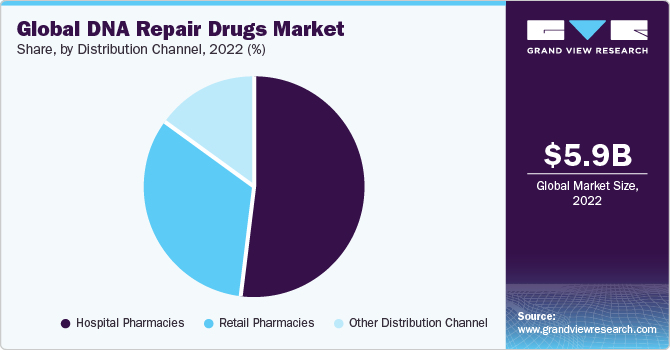

Distribution Channel Insights

On the basis of distribution channels, the DNA repair drugs market is segmented into hospital pharmacies, retail pharmacies, and other distribution channels. The hospital pharmacies segment dominated the market in 2022. However, the retail pharmacies segment is expected to grow at the fastest CAGR over the forecast period. The retail pharmacies segment is experiencing rapid growth in the DNA repair drugs market due to increased accessibility and convenience for consumers. Retail pharmacies provide a convenient channel for individuals to access DNA repair drugs, ensuring a more widespread distribution. This growth is also fueled by the rising awareness of DNA repair drugs and their potential in treating various conditions, prompting more consumers to seek these medications from easily accessible retail outlets. Additionally, the expansion of retail pharmacy networks and the trend of self-medication contribute to the segment's accelerated growth in the DNA repair drugs market.

Regional Insights

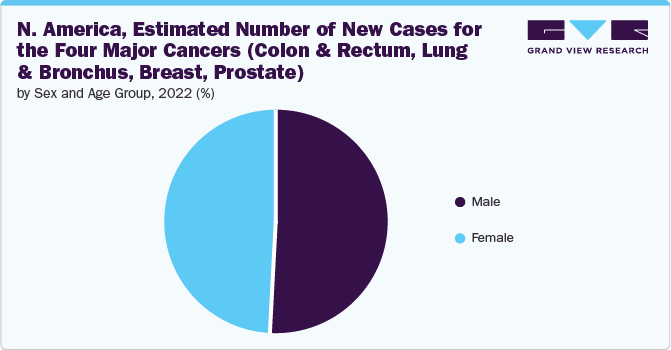

North America held the largest market share in 2022. The high prevalence of new cancer cases, estimated at 1.9 million, and the substantial number of cancer-related deaths, projected to be 609,360, in the U.S. in 2022 highlight the significant demand and potential for growth in the DNA repair drugs market in North America. As cancer remains a major health concern, the market for drugs targeting DNA repair mechanisms is driven by the imperative need for effective treatment options and interventions to address the challenges posed by cancer-related morbidity and mortality. On the other hand, Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

Key Companies & Market Share Insights

Key players operating in the market are AstraZeneca Plc, Onxeo, Johnson & Johnson, FoRx Therapeutics, AbbVie, Artios Pharma Limited, Pfizer Inc., Breakpoint Therapeutics, Luciole Pharmaceuticals, Merck KGaA, ClovisOncology Inc., and GlaxoSmithKline plc. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In April 2023, the European Commission authorized the marketing of AKEEGA (abiraterone acetate [AA] and niraparib), presented as a dual-action tablet (DAT) in combination with prednisone or prednisolone. This approval from Janssen Pharmaceutical Companies of Johnson & Johnson is for treating metastatic castration-resistant prostate cancer (mCRPC) in adults with BRCA1/2 mutations (somatic and germline) where chemotherapy is not clinically indicated.

-

In December 2022, MSD and AstraZeneca's Lynparza (olaparib), in combination with prednisone and abiraterone or prednisolone, received approval in the European Union for treating metastatic castration-resistant prostate cancer (mCRPC) in adult men not eligible for chemotherapy. The European Commission granted approval based on findings from the PROpel Phase III trial, following a positive recommendation from the Committee for Medicinal Products for Human Use in November 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."