- Home

- »

- Advanced Interior Materials

- »

-

Global Doctor Blade Market Size, Share, Industry Report, 2019-2024GVR Report cover

![Doctor Blade Market Size, Share & Trends Report]()

Doctor Blade Market Size, Share & Trends Analysis Report By Application (Flexographic Printing, Rotogravure Printing, Offset Printing), By Type (Metal, Plastic, Composite), By Region, And Segment Forecasts, 2019 - 2024

- Report ID: GVR-4-68038-009-5

- Number of Report Pages: 59

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Advanced Materials

Industry Insights

The global doctor blade market size was valued at USD 163.89 million in 2018 and is anticipated to expand at a CAGR of 2.3% from 2019 to 2024. High demand for paints and coatings and rotogravure, flexographic, and offset printing in packaging and publication arenas is expected to drive the growth. The new trend of manufacturing nanotechnology enhanced doctor blades is expected to further boost the demand. Using nanoparticles in the polymer resin matrix manipulates the molecular matrices and produces smoother, corrosion-resistant, and highly efficient edges. These blades are engineered for applications requiring a high level of precision and where removing ink is particularly challenging.

Doctor blades are used for removing excess ink from the smooth and non-engraved areas of image carrier in the printing process. Product manufacturing is majorly concentrated in Europe. On the other hand, the low quality of steel and plasticity has led to the limited production of the doctor blade in the developing countries of Asia Pacific.

Among key applications, the flexography segment occupied 57.2% of the global revenue share of the doctor blade market in 2018. Gravure is the second most popular application as it is largely used in paper publishing. Offset is the traditional and economical printing method, commonly used for newspapers, books, magazines, brochures, and pamphlet printing.

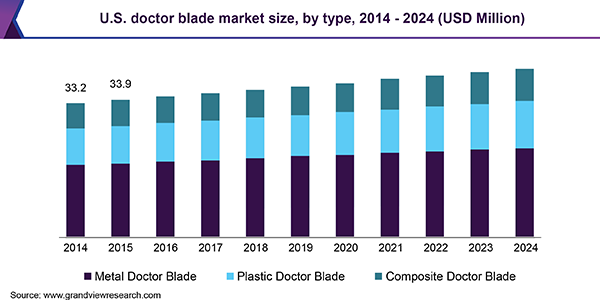

The doctor blade is a thin piece of metal, plastic, rubber, or composite material. Plastic blades are expected to witness the fastest growth in terms of demand in the forthcoming years. They are highly preferred as compared to metal and composite blades because they are ultra-smooth and light, hence safer to use. Composite materials include the use of glass or carbon fibers infused with synthetically prepared polymer resin by the pultrusion method.

Packaging, publishing, and promotional printings are the major end uses of the product. The packaging is the most important downstream industry followed by publishing. The global market is predominantly concentrated with the presence of a large number of small to medium-scale manufacturers.

Type Insights

The three most widely used materials for manufacturing blades include metals, plastics, and composites. Metal holds the major market share, while plastic counterparts such as polyethylene, polyester, and polyacetal are expected to witness the fastest growth from 2019 to 2024. The demand for plastic doctor blade is increasing compared to metal and composites as they are safe to handle and can perform operations at greater speed.

The cross-section of the doctor blade working edge is primarily divided into a wedge, round, and lamellar. The wedge blades have a round or flattened working edge with the cross-section area in the form of trapezium i.e. two angles at 90 degrees. Similarly, lamellar have the round edge but rectangular cross-sectional area i.e. all angles at 90 degrees with a concave cut from one corner.

Application Insights

Currently, flexography holds the largest market share. In the printing industry, packaging registers the majority of demand followed by the publishing and promotion industry. Flexographic printing dominates the packaging segment with more than 40% of the market share. It has been a choice of many business sectors since its invention.

The use of a chambered doctor blade system is the current trend in the flexography system. In a chambered system, two blades are used, one of them acts as a metering instrument that controls the amount of ink flowing and the other act as a seal that prevents leakage of ink out of the chamber.

Rotogravure printing is the second most popular application. It is a largely used method in paper printing. Although new technologies have increased the efficiency of gravure printers, the system is facing increasing competition from digital inkjet printers. This acts as a crucial challenge currently faced by the industry participants.

Another important application of the doctor blade is offset printing. It is commonly used methods for printing newspapers, books, magazines, stationeries, brochures, and pamphlets. It is a comparatively economical and low maintenance method compared to its counterparts.

Regional Insights

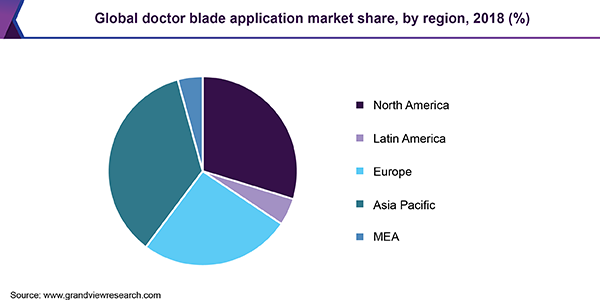

The Asia Pacific is expected to register a relatively higher pace over the forecast period. The region showcased high demand for packaging from multiple end-use industries, such as pharmaceutical, food and beverage processing, and transportation, resulting in an increased demand for doctor blade across key countries including China, Japan, and India. The region is expected to expand at a CAGR of 2.8% over the forecast period.

European countries such as Sweden, Switzerland, Germany, Italy, and Denmark are the leading producers of doctor blade owing to their highly developed steel industries. These countries majorly export the product to Southeast Asian and Latin American countries.

North America is the second-largest region with the U.S. and Canada as the major consumers, due to their flourishing high-quality packaging industry. The North American market is dominated by flexographic printing. In the U.S., almost 70% of packages produced are printed using flexography systems. Although the product holds a small market share in the countries from Latin America and the Middle East and Africa, the demand in these regions is increasing due to the robust growth of the flexible packaging industry.

Doctor Blade Market Share Insights

The global market is dominated by major players such as Kadant, Inc.; FUJI SHOKO CO., LTD.; PrimeBlade Sweden AB; Swedev AB; and TRESU Group. These multinational companies have differentiated product offerings, a strong customer base, and a strong distribution network across the globe. For example, PrimeBlade Sweden AB has distribution partners in over 120 countries, Swedev AB has a presence in 85 countries, while Rochling Leripa Paperecth GmbH & Co. KG has customers in around 70 countries.

The demand for a doctor blade has witnessed a strong consolidation in different regions due to mergers, acquisitions, new product developments, and expanding distribution channels. In May 2018, PrimeBlade Sweden AB entered into Latin America marketspace by collaborating with Grupo Brasal. This strategy was aimed at strengthening the sales channel of the company in Panama, Trinidad and Tobago, and Puerto Rico.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2024

Market representation

Revenue in USD Million & CAGR from 2019 to 2024

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the global and regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2024. For this study, Grand View Research has segmented the global doctor blade market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million; 2014 - 2024)

-

Metal Doctor Blade

-

Plastic Doctor Blade

-

Composite Doctor Blade

-

-

Application Outlook (Revenue, USD Million; 2014 - 2024)

-

Flexographic Printing

-

Rotogravure Printing

-

Offset Printing

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2014 - 2024)

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."