- Home

- »

- Animal Health

- »

-

Dog Vaccines Market Size & Share, Industry Report, 2030GVR Report cover

![Dog Vaccines Market Size, Share & Trends Report]()

Dog Vaccines Market (2025 - 2030) Size, Share & Trends Analysis Report By Vaccine Type, By Disease Type, By Route Of Administration (Injectables, Oral), By Duration Of Immunity, By Component (Combined Vaccines, Mono Vaccines), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-156-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dog Vaccines Market Summary

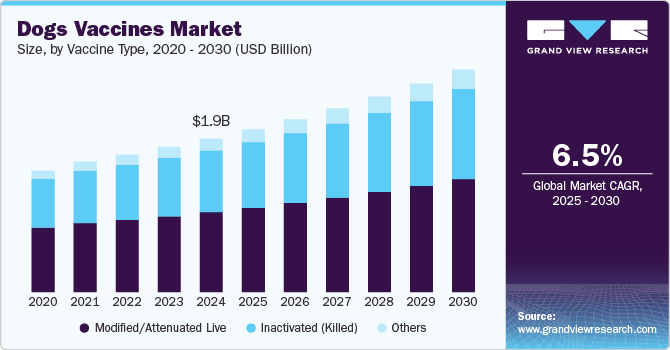

The global dog vaccines market size was estimated at USD 1.99 billion in 2024 and is projected to reach USD 2.88 billion by 2030, growing at a CAGR of 6.45% from 2025 to 2030. Rising pet ownership and pet humanization, which promotes treating pets like family members and giving them the best care and comfort, are responsible for the market growth.

Key Market Trends & Insights

- The North America dogs vaccine market dominated the global market and accounted for more than 38% in 2024.

- The dogs vaccine market in the U.S. held a significant share of the North America market in 2024.

- Based on vaccine type, the modified/attenuated live segment accounted for the largest revenue share of 52.03% in 2024.

- Based on disease type, the canine infectious respiratory disease complex segment accounted for the largest revenue share of over 27% in 2024.

- Based on component, the combined vaccine segment held the largest revenue share of over 65% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.99 Billion

- 2030 Projected Market Size: USD 2.88 Billion

- CAGR (2025-2030): 6.45%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The 2023-2024 APPA National Pet Owners Survey estimates that 86.9 million households, or 66% of all households in the United States, own a pet. With pets regarded as family members, owners are more willing to invest in vaccines and veterinary care, driving demand for both core and non-core vaccines. Pet humanization leads to better-informed pet owners who understand the importance of vaccination schedules, ensuring dogs receive timely and necessary immunizations.

As more individuals becoming aware of the importance of vaccinations in dogs, the global industry is also anticipated to grow over the forecast period. Various governmental and non-governmental organizations are launching initiatives to vaccinate dogs and promote awareness. In September 2022, for example, the World Health Organization reported that Bangladesh has reduced the number of rabies cases by over 50% in the past decade. Increased mass canine vaccination campaigns in a number of regions are anticipated to increase product demand. The Ministry of Health & Family Welfare, the Ministry of Fisheries & Livestock, the Ministry of Local Government, the Ministry of Rural Development & Cooperative, and the Ministry of Education all collaborated together to contribute to this outcome.

Furthermore, increased pet ownership among millennials, as well as the focus on preventative healthcare for dogs, are likely to be significant factors driving the industry growth. Millennials had the highest percentage of pet owners (33%), according to the American Pet Products Association, Inc.'s 2023-2024 National Pet Owners Survey. According to another article published in May 2023 by Women's Health (Hearst UK), 63% of millennials were spending more money on their dogs than on themselves, according to a survey conducted amongst dog owners. This is anticipated to contribute even more to this industry growth.

Stringent regulations can drive the dog vaccines market by ensuring higher standards for vaccine production, distribution, and administration. Regulations often mandate rigorous testing and approval processes, leading to the development of safer and more effective vaccines. This boosts consumer trust and encourages vaccine adoption. According to NOAH, All licensed veterinary medicines, including vaccines, readily accessible in the UK, must initially go through a rigorous regulatory clearance process before being granted a Marketing Authorisation, also referred to as a product licence for sales and shipment. Strict scrutiny by independent regulatory bodies, the European Medicines Agency (EMA) in the EU and the Veterinary Medicines Directorate (VMD) in the UK, guarantees that every approved vaccination satisfies the necessary high standards of safety, quality, and efficacy.

During the COVID-19 pandemic, this market suffered due to global supply chain disruptions and the concern of acquiring an illness. In addition, the pandemic raised people's awareness of health issues and the adoption rate of pets, both of which are predicted to support the market growth across the world. Over two million people in the UK adopted a pet during the COVID-19 pandemic, according to an article published by Health For Animals.

Vaccine Type Insights

The modified/attenuated live segment accounted for the largest revenue share of 52.03% in 2024. The market for the attenuated live vaccination is driven by its ability to offer long-term immunity and protection against illness and infection. Attenuated live vaccines are available for all parvoviruses and canine adenovirus-2, including canine adenovirus type 2 (CAV-2). Protecting against infectious hepatitis is made easier by the CAV-2 vaccine. For example, Nobivac, a attenuated live vaccine from Merck & Co., Inc. is intended for for immunization of dogs against canine distemper virus (CDV), canine adenovirus type 1 (ICH), canine parvovirus (CPV) and canine parainfluenza virus (CPi).

The other segment is anticipated to grow at the fastest CAGR of 8.5% over the forecast period. The advancement of the dog vaccination has resulted in the development of new and more effective canine vaccines, such as recombinant vaccines, which integrate a pathogen gene into the virus with other antigens. For example, Boehringer Ingelheim International GmbH introduced the recombinant vaccine Recombitek to guard against leptospirosis, distemper, and other illnesses. These vaccines utilize advanced recombinant DNA technology to provide effective and targeted protection against various infectious diseases in dogs.

Disease Type Insights

The canine infectious respiratory disease complex segment accounted for the largest revenue share of over 27% in 2024. The existence of several causal agents for CIRDC has encouraged the development of new vaccines. For instance, in September 2022, Nobivac Intra-Trac Oral BbPi, the very first and only oral Bordetella bronchiseptica-canine parainfluenza virus vaccine providing mucosal protection with simple oral administration, was introduced by Merck Animal Health, a division of Merck & Co., Inc. that is known as MSD Animal Health. Since both bordetella and parainfluenza are part of the canine infectious respiratory illness complex, limiting their transmission is essential to safeguarding social dogs' respiratory health and reducing the likelihood of future outbreaks.

The canine rabies segment is estimated to register the fastest CAGR of 7.3% over the forecast period from 2025 to 2030. This growth can be attributed to the initiatives undertaken by mature players. These efforts help increase awareness about the importance of vaccinating dogs, particularly in regions with limited access to veterinary care. For instance, in September 2024, Merck & Co., Inc donated more than six million NOBIVAC rabies vaccines for use in canine vaccination campaigns in rabies-endemic communities through the Company’s Afya Program.

Component Insights

The combined vaccine segment held the largest revenue share of over 65% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2030. The administration of combination vaccines helps guard against more than one disease and reduces the number of shots a dog requires for various diseases. It is anticipated that this will increase demand in the dog vaccine market by making the vaccination processes less stressful and more convenient. For example, Merck & Co., Inc.'s Nobivac Puppy DP is a vaccination that protects against both canine parvovirus and canine distemper.

Moreover, administering one vaccine to protect against multiple diseases reduces veterinary costs for materials, labor, and consultations. It is more economical for pet owners compared to individual vaccines for each disease. Also, combined vaccines minimizes the stress and discomfort for the dog. Less stressful experiences make pet owners more likely to bring their pets in for vaccinations on time.

Route Of Administration Insights

Injectables held the highest revenue share in 2024 as they are the most popular among doctors and pet owners due to their precise dose administration. MSD Animal Health (Merck & Co., Inc.) introduced Nobivac Respira Bb, an injectable vaccine, in March 2021 to prevent Bordetella bronchieseptica. Dogs can be protected against illness with a single dose of the vaccine for seven months following the initial course and for a full year following the booster dose.of over 75% in 2024. Injectable immunizations are the most popular among doctors and pet owners because they allow for precise dose. MSD Animal Health (Merck & Co., Inc.) introduced Nobivac Respira Bb, an injectable vaccine, in March 2021 to prevent Bordetella bronchieseptica. Dogs can be protected against illness with a single dose of the vaccine for seven months following the initial course and for a full year following the booster dose.

The oral vaccine segment is expected to grow at the fastest CAGR from 2025 to 2030. Oral immunizations are considered more convenient because pet owners may administer themselves. Additionally, since oral vaccinations don't need to be kept in a cold chain as strictly, they are very simple to supply. This will probably promote the production of these vaccinations and raise the level of adoption. For example, Merck Animal Health (Merck & Co., Inc.) introduced the first oral vaccine against Bordetella bronchiseptica and the parainfluenza virus in September 2022.

Duration Of Immunity Insights

The one-year segment held the largest revenue share of 51.2% in 2024. By providing a year of immunity, the vaccine can help in preventing common infections without requiring regular booster shots. Dog owners now have an easy option, and this is probably going to encourage more market growth. Many core vaccines for dogs, such as those for distemper, parvovirus, and adenovirus, typically provide immunity for about a year. This duration of immunity ensures that dogs require annual booster shots to maintain protection against these serious diseases.

The other segment is anticipated to grow at the fastest CAGR of 7.4% over the forecast period. Certain canine vaccinations may need booster shots, while others might offer immunity for more than three to seven years. By lowering the frequency of clinic visits, vaccines with extended durations may offer extra advantages. According to a National Library of Medicine study, the rabies vaccine can provide immunity for almost three years without the need for repeated booster shots.

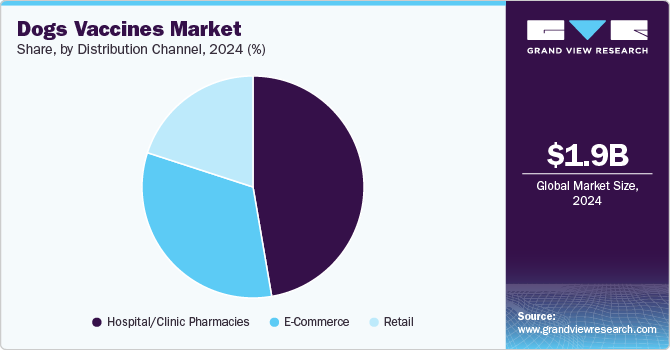

Distribution Channel Insights

Hospital/Clinic pharmacies dominated the market with the largest share of 45% in 2024. Hospital and clinic pharmacies are key distribution points for vaccines, making them easily accessible to pet owners. They often work directly with pharmaceutical suppliers to stock the necessary vaccines for various canine diseases, such as rabies, parvovirus, distemper, and more. In many cases, these pharmacies are integrated with veterinary hospitals and clinics, where trained professionals administer the vaccines. This ensures proper handling, storage, and administration, which are crucial for the efficacy of the vaccines.

E-commerce segment is the fastest-growing segment and is expected to grow at a CAGR of over 8% over the forecast period. E-commerce platforms enable pet owners and veterinarians to easily access a wide range of dog vaccines. This convenience is particularly valuable for individuals in rural or underserved areas who may not have easy access to physical stores or clinics offering vaccines. Vaccine manufacturers and distributors can expand their market reach by listing their products online. E-commerce platforms provide a cost-effective way to reach a broader audience, including pet owners and clinics that may not have been aware of certain products.

Regional Insights

The North America dogs vaccine market dominated the global market and accounted for more than 38% of the total revenue share in 2024. Several major players in the dog vaccine industry operate in the region. In addition, growing pet ownership rates and increased awareness of preventive healthcare for pets are key factors propelling this market growth. For example, in October 2022, Merck & Co., Inc., Petco Love, and an NGO had collaborated to provide one million free pet immunizations.

U.S. Dogs Vaccine Market Trends

The dogs vaccine market in the U.S. held a significant share of the North America market in 2024. The local presence of major industry players, such as Zoetis, Virbac, Elanco, and Merck & Co., Inc., has positively influenced the market. These companies are heavily invests in R&D to produce novel veterinary medicines to cater to the growing market demand. Moreover, strategic moves of these players such as acquisition or paternership further contribute to the market growth. For instance, Zoetis offers VANGUARD PLUS 5L4, vaccine tailored for dogs. These vaccines offersbroad-spectrum protection against several canine diseases.

Europe Dogs Vaccines Market Trends

The European dogs vaccine market holds a second largest market share. The high companion population in the region is anticipated to contribute to steady growth over the predicted period. For example, the FEDIAF 2022 research estimates that 90 million homes in the EU have a pet (46%) and that there are around 90 million dogs. Additionally, action plans have been initiated by the European Medicines Agency (EMA) and its regulatory network partners to enhance and expand the accessibility of biologics and animal medications in Europe. To promote animal welfare and public health, several initiatives are being carried out. Over the years, the EMA has taken a number of steps to promote prompt access to animal vaccinations on the European market.

The dogs vaccine market in Germany is expected to grow significantly over the forecast period. In Germany, stringent regulations and the importance of vaccination play a significant role in driving the dog vaccine market. For instance, according to Veterinarian Karlsruhe, the country has well-established regulations aimed at ensuring animal health and safety, which require pets to be vaccinated against various diseases, such as rabies, distemper, parvovirus, and leptospirosis. These regulations create a strong demand for vaccines as pet owners must comply with vaccination schedules to meet legal requirements for pet travel, breeding, and general well-being.

Asia Pacific Dogs Vaccines Market Trends

The Asia Pacific dogs vaccine market is expected to grow at the fastest CAGR over the forecast period. The region has the presence of several emerging economies, such as India and China. For instance, in 2023, Boehringer Ingelheim International GmbH conducted immunization campaigns in endemic countries and provided 43.2 million rabies vaccinations. This includes vaccinating approximately 7,000 dogs. These actions help address changing consumer demands, improve operational efficiency, and enhance customer satisfaction. Such initiatives by key players helps the market to grow in near future.

The dogs vaccine market in China is growing at a significant rate and held a significant share in 2024. The substantial share can be attributed to the presence of large number of hospitals and clinics in the country. For instance as of 2023, there are around 28 thousand veterinary clinics in the country.With more hospitals and clinics available, pet owners have greater access to veterinary services, including vaccinations. This helps ensure that dogs receive timely vaccinations to prevent diseases, contributing to the overall growth of the market.

Latin America Dogs Vaccines Market Trends

The Latin American dogs vaccine market is anticipated to grow at a CAGR of over 6% over the forecast period. Countries like Brazil and Mexico are part of the Latin America. The region's market is expanding quickly due to a number of important factors, including the existence of untapped potential, quick economic development, and rising pet health awareness. The dog population is the largest pet population in both Argentina and Brazil. The most popular dog breeds are little ones like Chihuahua, Pug, Schnauzer, Yorkshire Terrier, and Bulldog. Additionally, as pet owners become more aware of the importance of vaccination in maintaining their pets' health, the market for dog vaccines expands.

The dogs vaccine market in Brazil exhibits high growth potential, due to increasing adoption of subunit vaccines in Brazil. Subunit vaccines, which protect dogs against diseases like rabies and parvovirus, have become increasingly popular. For example, the usage of subunit vaccines to protect dogs from rabies has grown by more than 15% a year in recent years in Brazil. The growing awareness among pet owners about the importance of preventive care and vaccination is pushing the adoption of advanced vaccine options like subunit vaccines. This leads to more pet owners opting for these vaccines to ensure their dogs are protected from diseases like parvovirus, distemper, and hepatitis.

Middle East And Africa Dogs Vaccines Market Trends

The Middle East and Africa dogs vaccine market growth is driven by several factors such as increasing awareness of zoonotic diseases, urbanization and changing lifestyles, and expansion of veterinary services. With growing urbanization, the trend toward pet humanization is rising. People are more likely to treat their pets as family members, which includes ensuring their health through regular vaccinations. Moreover, efforts to control diseases like rabies, which pose significant risks to both animals and humans, are encouraging vaccination programs. Governments often promote dog vaccination campaigns to address these concerns.

The dogs vaccine market in South Africa growth is anticipated to grow at a steady rate over the forecast period. This growth is attributed to the presence of leading organisations offering canine vaccines. For instance, Zoetis, a leading animal health company offers Defensor 3, a vaccine used for the prevention of natural rabies infection. The vaccine is prepared from cell-culture-grown, chemically inactivated rabies virus and is admistered subcutaneously or intramuscularly.

Key Dog Vaccines Company Insights:

To enhance the revenue share, leading players in this industry are engaging in approaches such as new product and trial launches, mergers and acquisitions, and partnerships and collaborations. For example, MebGenesis Inc. and Boehringer Ingelheim International GmbH partnered in June 2023 to create monoclonal antibodies for dogs. In a similar vein, Zoetis Services LLC purchased Basepaws Inc. in June 2022, which is probably going to enhance its precision animal health product offerings. This market is expected to rise as a result of these advancements.

Key Dogs Vaccines Companies:

The following are the leading companies in the dogs vaccines market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Boehringer Ingelheim International GmbH

- Merck & Co., Inc.

- Elanco

- Virbac

- Bioveta a.s

- Hester Biosciences Limited

- Brilliant Bio Pharma

- Heska Corporation

- Zendal Group

Recent Developments

-

In March 2024, Zendal group introduced CSIC-developed vaccine against canine leishmaniasis, a recombinant vaccine to combat canine leishmaniasis, a parasite that causes skin ulcers to severe inflammation of the liver and spleen.

-

In June 2024, Merck & Co., Inc., introduced the NOBIVAC NXT Rabies portfolio in Canada, which includes NOBIVAC NXT Canine-3 Rabies and NOBIVAC NXT Feline-3 Rabies, as part of the company's continued commitment to rabies prevention.

-

In January 2022, Boehringer Ingelheim collaborated with MabGenesis, a biopharmaceutical company, to discover novel monoclonal antibodies in canines.

-

In November 2021, Ceva created a new cryogenic storage facility in Monor by investing in its European vaccine production capacity to meet the rapidly growing demand for vaccines.

Dogs Vaccines Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 2.11 billion

The revenue forecast in 2030

USD 2.88 billion

Growth rate

CAGR of 6.45% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vaccine type, disease type, route of administration, duration of immunity, component, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boehringer Ingelheim International GmbH; Zoetis Services LLC; Merck & Co., Inc.; Elanco; Hester Biosciences Limited; Virbac; Bioveta a.s; Brilliant Bio Pharma; Heska Corporation; Zendal Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Dogs Vaccines Market Report Segmentation

This report forecasts revenue growth at globa, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global dogs vaccines market report based on the vaccine type, disease type, route of administration, duration of immunity, component, distribution channel, and region.

-

Vaccine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Disease type Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine Distemper

-

Canine Infectious Respiratory Disease Complex (CIRDC)

-

Canine Parvovirosis/ Parvovirus Disease

-

Canine Leptospirosis

-

Canine Lyme Disease

-

Infectious Canine Hepatitis

-

Canine Rabies

-

Other Diseases

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectables

-

Intranasal

-

Oral

-

-

Duration of Immunity Outlook (Revenue, USD Million, 2018 - 2030)

-

1 Year

-

3 Year

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Combined Vaccines

-

Mono Vaccines

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/Clinic Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia-Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global dog vaccines market size was estimated at USD 1.99 billion in 2024 and is expected to reach USD 2.10 billion in 2025.

b. The global dog vaccines market is expected to grow at a compound annual growth rate of 6.45% from 2025 to 2030 to reach USD 2.88 billion by 2030.

b. North America dominated the dog vaccines market with a share of over 38% in 2024. The rising awareness regarding preventive healthcare for pets and increasing pet ownership rates are significant growth drivers of this market.

b. Some key players operating in the dog vaccines market include Boehringer Ingelheim International GmbH, Zoetis Services LLC, Merck & Co., Inc., Elanco, Hester Biosciences Limited, Virbac, Bioveta a.s, Brilliant Bio Pharma; Heska Corporation; Zendal Group

b. The growth of the dog vaccine market can be attributed to rising pet ownership and pet humanization, increasing concerns over zoonotic diseases, and technological advancements

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.