- Home

- »

- Alcohol & Tobacco

- »

-

Draught Beer Market Size, Share & Growth Report, 2030GVR Report cover

![Draught Beer Market Size, Share & Trend Report]()

Draught Beer Market (2025 - 2033) Size, Share & Trend Analysis Report By Type (Keg Beer, Cask Beer), By Category (Super Premium, Premium, Regular), By End Use, By Production, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-326-6

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Draught Beer Market Size & Trends

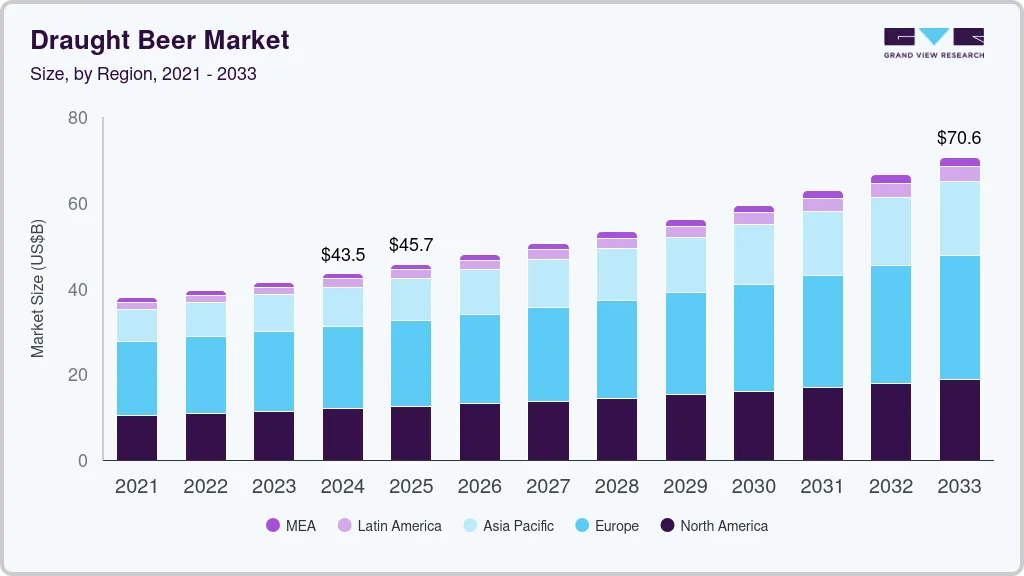

The global draught beer market size was estimated at USD 43.48 billion in 2024 and is expected to expand at a CAGR of 5.6% from 2025 to 2033. Draught beer is often perceived as superior to bottled or canned beer due to its fresh taste and the traditional brewing techniques often associated with it. Consumers are becoming more discerning, seeking out unique and artisanal beers, which draught offerings from local and craft breweries frequently provide. This trend aligns with a broader movement towards supporting local businesses and enjoying handcrafted products.

Beer is one of the largest-selling alcoholic beverages across the globe and is also the most consumed alcoholic beverage compared to spirits, wines, and others. The increasing number of local breweries is a key factor driving the draught beer market. Beer is often consumed among groups of friends and other social groups, which tends to influence the drinking preferences and behavior of individuals. Furthermore, consumer trends regarding the consumption of beer are changing. Consumers are trying out new flavors, which is expected to present key opportunities for market growth.

Furthermore, advancements in technology and innovation within the hospitality industry are also propelling the draught beer market. Improved kegging systems and refrigeration technology have made it easier for establishments to offer a wider variety of draught beers, including those from small-scale breweries. This variety is attractive to consumers who enjoy trying new and diverse beer styles. Additionally, the rise of beer tourism and events such as beer festivals and brewery tours have increased exposure to draught beer, further stimulating demand.

In addition, high global consumption of alcohol is a key factor driving the market for alcoholic beverages, including draught beers. In various countries and regions, the consumption of alcohol is frequent and substantial, resulting in increased demand for a variety of beers, with draught beer/craft beer being a prominent choice. This phenomenon is deeply rooted in social and cultural practices, where alcohol often holds significant symbolic value in rituals, celebrations, and communal gatherings.

Moreover, millennials and Gen Z comprise a significant percentage of alcohol consumers, and this pattern is anticipated to continue over the forecast period. According to data published by the Penn State Extension, an educational organization, millennials, and gen Z drinkers consume various alcohols for relaxing, getting a buzz, and having a good time. Moreover, according to the same article, in the 52 weeks ending in May 2021, 90% of Millennials bought alcohol. Millennials have likely influenced the growth of the overall alcohol market, including draught beer.

Market Concentration & Characteristics

The degree of innovation in the market is notably high, driven by advancements in brewing technology, sustainability practices, and consumer preferences. Innovations include the use of smart kegs equipped with sensors to monitor freshness and consumption, eco-friendly packaging solutions, and the development of new beer styles and flavors to cater to diverse tastes. Breweries are also leveraging digital platforms for personalized customer experiences and implementing energy-efficient brewing processes. This continuous innovation not only enhances product quality and variety but also addresses environmental concerns and evolving market demands, making the draught beer sector highly dynamic and competitive.

The level of mergers and acquisitions (M&A) activities in the draught beer industry is currently moderate. As technology matures and market demand grows, companies are increasingly exploring strategic partnerships, acquisitions, and collaborations to enhance their capabilities, expand their product offerings, and gain a competitive edge.

Type Insights

Keg draught beer accounted for a share of over 63.82% of the global revenues in 2023. Kegs are ideal for maintaining the beer's freshness and carbonation over extended periods, making them a popular choice in bars, restaurants, and events where high volumes are served. Additionally, the standardized keg sizes facilitate easy storage, transportation, and use with existing tap systems, thereby enhancing operational efficiency and reducing waste. This combination of quality preservation, convenience, and cost-effectiveness drives the preference for keg beer in the draught market.

Cask draught beer is anticipated to grow at a CAGR of 4.0% from 2024 to 2030. It offers a fresher, more natural taste because it is unfiltered and unpasteurized, allowing for the development of complex flavors through secondary fermentation in the cask. Additionally, the resurgence of traditional brewing methods and the increasing demand for artisanal and locally produced beverages have driven its popularity. This trend aligns with the broader consumer movement towards craft and specialty beers, enhancing the appeal and growth of cask beer in the market.

Brew manufacturers are capitalizing on this opportunity by highlighting custom brews crafted in distinct casks. In February 2024, Norwich-based Woodforde’s Brewery unveiled a fresh lineup of cask beers called the Brewers Signature range, showcasing custom brews crafted by individual brewers within the team. The new range will feature a unique cask ale designed by a different brewery team member each month for the remainder of the year, exclusively available for on-trade customers.

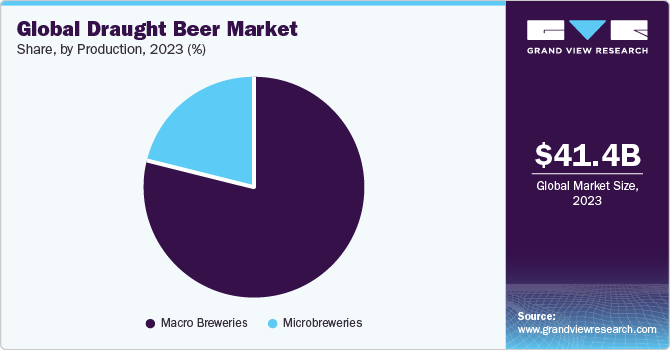

Production Insights

Draught beer manufactured through macro breweries accounted for a share of 79.13% of the global revenues in 2023. These large breweries can produce beer at a lower cost per unit, allowing them to offer competitive pricing and ensure widespread availability in bars and restaurants. Additionally, their established brand recognition and ability to invest in advanced brewing technologies and quality control further drive the market.

Draught beer manufactured through microbreweries is anticipated to grow at a CAGR of 6.3% from 2024 to 2030 due to its emphasis on unique, high-quality, and locally-produced beers that appeal to consumers' desire for distinctive and authentic drinking experiences. The craft beer movement has fuelled a demand for diverse flavors and styles, which microbreweries excel at providing. Additionally, the trend towards supporting local businesses and the personalized customer experiences offered by microbreweries contribute significantly to their rapid growth in the market.

Category Insights

Regular draught beer accounted for a share of over 51.70% of the global revenues in 2023. Regular beers are often perceived as the standard or classic choice, offering a balanced taste profile that appeals to a wide range of palates. This versatility makes them a go-to option for bars and restaurants looking to cater to diverse customer preferences. Additionally, regular beers typically benefit from strong brand recognition and loyalty, bolstered by extensive marketing and distribution networks, further driving the market.

Super premium draught beer is anticipated to grow at a CAGR of 6.9% from 2024 to 2030. As disposable incomes rise and more consumers seek premium products, there's a notable shift towards artisanal and specialty beers that offer distinct taste profiles and a sense of exclusivity. Additionally, the trend towards supporting local breweries and the demand for authentic, high-quality ingredients further drive the growth of the super-premium draught beer market.

Manufacturers are seizing this opportunity to introduce super-premium draft beer crafted using unfiltered brewing techniques, resulting in vibrant flavors. In February 2022, Stella Artois, a valued member of Budweiser Brewing Group, unveiled the Stella Artois Unfiltered. This new offering features the natural, unfiltered brewing techniques of the past. The beer maintains a golden haze, enabling the vibrant flavors to shine through fresh and unadulterated.

End Use Insights

Commercial use accounted for a share of over 87.88% of the global revenues in 2023, due to its significant presence in bars, pubs, and restaurants, where draught beer is a staple offering. The expansion of the pub and bar industry has played a pivotal role in driving the demand for draught beer in commercial use. As more pubs and bars have opened or expanded their operations, the need for efficient and cost-effective beer brewing systems has increased. According to research conducted by Co-Operatives UK in October 2023, there has been a remarkable 62.6% increase in community-owned pubs over the past five years in the UK The results represent a noteworthy growth of pubs in the UK despite the record closures within the broader pub industry.

Home use draught beer is anticipated to grow at a CAGR of 5.9% from 2024 to 2030. Advances in home beer dispensing technology, like compact kegerators and user-friendly beer taps, have made it easier for consumers to replicate the bar experience at home. Additionally, the rise of social gatherings and events hosted at home has fueled this trend, making it a convenient and appealing option for beer enthusiasts.

Regional Insights

The North America draught beer market is expected to grow at a CAGR of 5.0% from 2024 to 2030. Draught beer is often perceived as fresher and of higher quality compared to packaged alternatives. Consumers in the U.S., Canada, and Mexico increasingly appreciate the sensory experience of freshly poured draught beer, contributing to its popularity. Brewpubs, taprooms, and bars often prioritize offering a rotating selection of draught beers to cater to this demand. In January 2023, Stable Craft Brewing, a Virginia-based farm brewery, announced its latest flagship beer: Stable Craft Amber Lager. Stable Craft Amber Lager has a distinct flavor profile, featuring notes of honey intertwined with subtle caramel undertones, complemented by hints of biscuits and a mild bready character.

U.S. Draught Beer Market Trends

The draught beer market in the U.S. held a market share of 87.96 of the North America market in 2023. The rise of the craft beer movement in the U.S. has led to a renewed interest in beer culture and appreciation for diverse beer styles. Many craft beer enthusiasts are drawn to home brewing as a way to experiment with and create unique flavors. According to the published information by the American Homebrewers Association, there are approximately 1.1 million dedicated homebrewers in the U.S. This number reflects the substantial size of the homebrewing community and its impact on the draught beer culture.

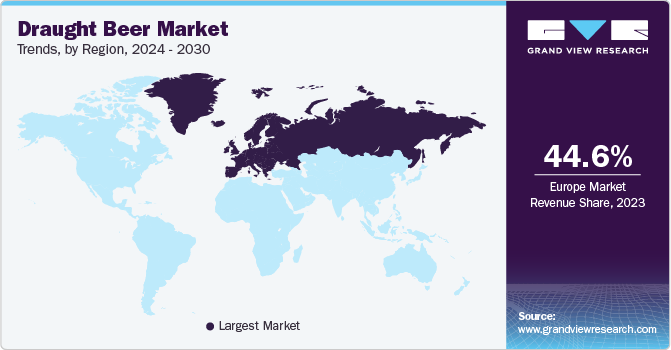

Europe Draught Beer Market Trends

Europe draught beer market held a share of 44.56% of the global market in 2023. Countries like Germany, UK, and France, have centuries-old traditions of brewing and consuming beer, which have fostered a strong preference for fresh, locally produced draught beer. Additionally, Europe's regulatory environment supports small breweries and local pubs, further boosting the popularity and availability of draught beer. This cultural significance, combined with a well-established infrastructure for beer production and distribution is driving the market in this region.

The draught beer market in Germany held a market share of 9.95% of the Europe market in 2023. The popularity of draught beer in Germany has been fueled by the numerous beer festivals held in the country, such as the world-famous Oktoberfest. These festivals attract millions of visitors every year, who come to experience traditional German culture and delicious draught beer. These festivals are also a great way to showcase the variety of draught beers available in Germany, with each region having its unique brew.

In recent years, independent brewing companies have taken note of the popularity and spirit of Oktoberfest and have started to capitalize on it by launching limited-edition draught beers. In August 2022, Tröegs Independent Brewing announced its latest addition to the lineup: the Oktoberfest Lager. The seasonal beer is ideal for those looking for a toasty, crisp, and festive drink to enjoy during the fall season. To create this timeless German-style beer, Tröegs utilized a traditional brewing method known as decoction. Oktoberfest Lager joined two of Tröegs’ beloved year-round beers, the Troegenator Double Bock and Sunshine Pilsner, as part of its Long Live Lagers celebration. The event celebrated the growing popularity of lagers in the craft beer world and showcased Tröegs’ expertise in brewing these styles.

Asia Pacific Draught Beer Market Trends

Asia Pacific draught beer market is expected to grow at a CAGR of 7.1% from 2024 to 2030. There has been a growing influence of Western culture and lifestyle trends across Asia Pacific, including the consumption of beer and other alcoholic beverages. While traditional beer markets in Asia Pacific have been dominated by mass-produced lagers, there is a growing demand for craft beer and specialty brews, including draft varieties. This diversification of the beer market appeals to consumers who seek unique and flavorful beer options beyond mainstream offerings.

Beer companies and beverage distributors are employing innovative marketing strategies to promote draft beer and attract consumers. Global beer brands are expanding their footprint in Asia Pacific by establishing new macro brewing facilities. In October 2022, Budweiser APAC inaugurated a new brewery in Putian, China, dedicated to crafting high-quality beers to bolster economic development and address the evolving demands of consumers in the region. This facility stands as one of Budweiser's largest craft breweries in the Asia Pacific region and marks the debut of craft brewing in the Fujian province. It serves as the production hub for acclaimed craft beer brands like Goose Island and Boxing Cat and introduces a new locally-inspired label named 059 Coastline Craft.

Central and South America Draught Beer Market Trends

The draught beer market in Central and South America is expected to grow at a CAGR of 6.7% from 2024 to 2030. Popular breweries in the region have been making waves in the beer industry with their innovative approach to data utilization. The data-driven approach has helped them understand consumer behavior and preferences better, allowing them to create new and innovative products that cater to the evolving tastes of their customers across the region.

Middle East and Africa Draught Beer Market Trends

Middle East and Africa draught beer market is expected to grow at a CAGR of 6.0% from 2024 to 2030. Changing government regulations in the Middle East have had a considerable impact on the overall alcoholic beverages market, including draught beer. In 2021, Abu Dhabi introduced a regulation permitting license holders to ferment alcoholic beverages for on-site consumption. Capitalizing on this opportunity, Craft by Side Hustle, a Balmaghie Beverage Group venture, established a first-of-its-kind microbrewery in the UAE that features a unique blend of crafted brews and spirits

Key Draught Beer Company Insights

Anheuser-Busch InBev, Heineken International B.V., Carlsberg, and Asahi Group Holdings, Ltd. are some of the dominant players operating in the draught beer market.

-

Anheuser-Busch InBev (AB InBev) is one of the world's largest and most dominant brewing companies, with a vast portfolio of well-known beer brands. The company offers a wide-ranging portfolio comprising over 500 beer brands, spanning global favorites such as Budweiser, Corona, Stella Artois, and Michelob Ultra.

-

Heineken International B.V. is one of the world's leading breweries, known for its iconic green bottles and signature red star logo. Heineken's portfolio includes some of the most well-known and loved beer brands in the world, such as Amstel, Dos Equis, Tecate, and Desperados.

-

Asahi Group Holdings, Ltd is a manufacturer, marketer, and global distributor of beer, spirits, soft drinks, and food businesses. The company’s liquor business is responsible for selling alcoholic beverages, which include a wide range of brands offering different products.

-

China Resources Snow Breweries, Carlsberg, and New Belgium Brewing Company are some of the emerging market players functioning in the draught beer market.

-

China Resources Beer Company Limited operates as the parent company of China Resources Snow Breweries Limited. As the foremost beer manufacturer, distributor, and seller in China, CR Beer is primarily engaged in beer brewing, product sales, and brand promotion. The company has cultivated a diverse portfolio of mainstream, mid-market, and high-end beers to cater to a wide range of consumer preferences.

-

Carlsberg's brand portfolio includes a diverse range of beers covering different segments of the market. Some of its key brands include Carlsberg, Tuborg, Kronenbourg 1664, Grimbergen, and Somersby cider. The company also offers a variety of specialty and craft beers. The company's beer portfolio comprises over 140 brands and a wide range of offerings, including core beer brands, craft and specialty beers, and alcohol-free brews.

Key Draught Beer Companies:

The following are the leading companies in the draught beer market. These companies collectively hold the largest market share and dictate industry trends.

- Anheuser-Busch InBev

- Boston Beer Company

- Heineken International B.V.

- Anadolu Efes

- Asahi Group Holdings, Ltd.

- Molson Coors Beverage Company

- China Resources Snow Breweries

- Carlsberg

- New Belgium Brewing Company

- Castel Frères

- Constellation Brands, Inc.

Recent Developments

-

In January 2024, New Belgium Brewing invested in the local startup Open Brewing. Open Brewing characterizes its Open Beer as a "crisp pilsner-style lager with a light body," featuring alcohol by volume (ABV) of 4.4%. It is sold in 12 oz (355ml) cans.

-

In January 2024, Molson Coors Beverage Company announced the introduction of Madrí Excepcional in Canada, bringing over the UK's rapidly expanding beer brand. Madrí Excepcional will be available on tap at selected on-premise venues, where it will be presented in its distinctive glassware, as well as in six- and 12-packs of 473-milliliter cans at major retail outlets across Canada.

-

In December 2023, Anadolu Efes, a Turkish brewery, signed an agreement to purchase AB InBev's share in a Russian joint venture valued at USD 1.3 billion. This move highlighted Turkey's ongoing strong corporate connections with Russia at a time when Western companies face challenges in divesting their assets in the region.

-

In June 2023, Heineken acquired full ownership of the Amsterdam-based craft brewery Oedipus. Having previously held a minority stake in the brewery, Heineken completed the purchase of the remaining shares.

Draught Beer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.65 billion

Revenue forecast in 2033

USD 70.55 billion

Growth rate (Revenue)

CAGR of 5.6% from 2025 to 2033

Actual data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Billion, and CAGR from 2025 - 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, category, end use, production, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada,; Mexico; Germany; UK; Spain; Italy; Ireland; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Anheuser-Busch InBev; Boston Beer Company; Heineken International B.V.; Anadolu Efes; Asahi Group Holdings, Ltd.; Molson Coors Beverage Company; China Resources Snow Breweries; Carlsberg; New Belgium Brewing Company; Castel Frères; Constellation Brands, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Draught Beer Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global draught beer market report based on type, category, end use, production, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Keg Beer

-

Cask Beer

-

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Use

-

Home Use

-

-

Production Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Microbreweries

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Ireland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global draught beer market size was estimated at USD 41.45 billion in 2023 and is expected to reach USD 43.48 billion in 2024.

b. The global draught beer market is expected to grow at a compounded growth rate of 5.3% from 2024 to 2030 to reach USD 59.39 million by 2030.

b. Keg draught beer accounted for a share of over 63.82% of the global revenues in 2023. Kegs are ideal for maintaining the beer's freshness and carbonation over extended periods, making them a popular choice in bars, restaurants, and events where high volumes are served. Additionally, the standardized keg sizes facilitate easy storage, transportation, and use with existing tap systems, thereby enhancing operational efficiency and reducing waste. This combination of quality preservation, convenience, and cost-effectiveness drives the preference for keg beer in the draught market

b. Some key players operating in the draught beer market are Anheuser-Busch InBev, Boston Beer Company, Heineken International B.V., Anadolu Efes, Asahi Group Holdings, Ltd., Molson Coors Beverage Company, China Resources Snow Breweries, Carlsberg, New Belgium Brewing Company, Castel Frères, Constellation Brands, Inc.

b. Draught beer is often perceived as superior to bottled or canned beer due to its fresh taste and the traditional brewing techniques often associated with it. Consumers are becoming more discerning, seeking out unique and artisanal beers, which draught offerings from local and craft breweries frequently provide. This trend aligns with a broader movement towards supporting local businesses and enjoying handcrafted products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.