- Home

- »

- Clinical Diagnostics

- »

-

Dried Blood Spot Collection Cards Market Size Report, 2030GVR Report cover

![Dried Blood Spot Collection Cards Market Size, Share & Trends Report]()

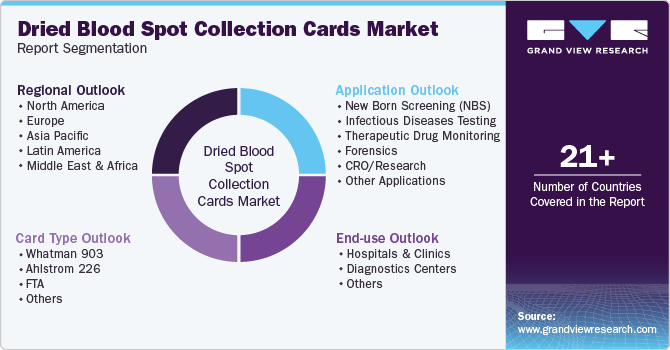

Dried Blood Spot Collection Cards Market Size, Share & Trends Analysis Report By Application (Newborn Screening, Infectious Disease Testing, Forensics), By Card Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-057-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

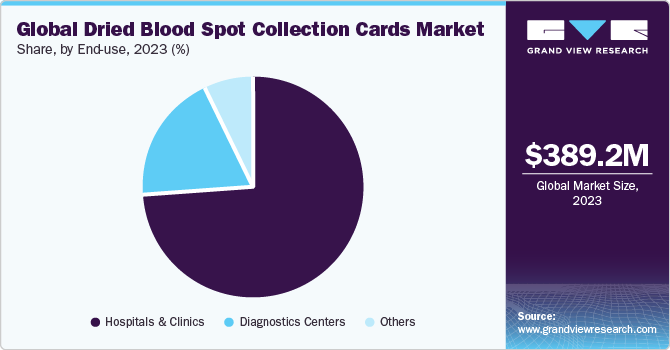

The global dried blood spot collection cards market size was estimated at USD 389.2 million in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The use of dried blood collection cards is majorly observed in newborn screening programs and testing of infectious diseases. However, it has been gaining significant traction in the fields of forensics, toxicology, and therapeutic drug monitoring. Dried Blood Spot (DBS) is increasingly being used in HIV and hepatitis testing. Such factors are expected to offer favorable growth opportunities to the market. In addition, the growing population, along with a supportive framework from local governments for NBS, is a key factor fueling the growth of the market.

DBS collection cards are widely utilized for serologic testing of viruses and provide an alternative method to collect blood when conventional labs and phlebotomy testing are inaccessible. COVID-19 serology is important for seroprevalence studies, identifying negative molecular results cases, and conducting diagnostic assessments. A study to determine the feasibility of a commercial COVID-19 assay to measure the level of antibodies from the DBS card was conducted by the Viral Hepatitis Care Network, University of Toronto, University Health Network, and other individual authors. The study found that plasma on DBS cards offered near-identical results to plasma samples, helping detect antibodies in 88% of people’s plasma.

DBS cards have been used in a variety of toxicology applications, including toxicokinetics & epidemiological, environmental, and forensic toxicology. These cards may be employed as a sample preparation technique in forensic toxicology, and it has the ability to preserve evidence for closed cases cost-effectively. Screening processes and markers for follow-up of forensic or clinical interest are further applications in toxicology, where these cards may be progressively utilized. The employment of these cards also facilitates raised sample stability, enabling samples to be stored for a longer duration, thereby constructing a safer work environment for analysts and sample collectors, as only a minimal sample volume is required. In addition, this technology enables first responders to obtain a simple finger-prick sample at a crime scene, such as a drug-facilitated or sexual assault case, without waiting for subsequent collection at the hospital post-admission of a victim, saving significant time as well as additional efforts.

NBS is also vital for the diagnosis of congenital diseases in infants. Over a span of time, the market has been witnessing an increase in the adoption of DBS in NBS for research purposes in various regions. For instance, a study published in BMC Med Ethics in November 2022 stated that parents in Hong Kong provide their consent to store and use residual DBS from NBS for biomedical research, with the understanding that parents’ autonomy and privacy will be protected. This increases the need for a transparent access policy and accountable governance to manage parents’ requirements and emerging opportunities in research by Residual Dried Blood Spots (rDBS).

Furthermore, DBS testing has primarily been employed to diagnose infectious diseases, specifically in resource-constrained regions, or to screen newborns for hereditary metabolic issues with a range of novel and innovative DBS products. Growing advantages and research studies for DBS testing for diagnostic purposes are expected to fuel market growth in the forecast period. In addition, the WHO recently recommended DBS for the diagnosis of hepatitis B & C and HIV due to the benefits of DBS in blood collection and transport. Rising initiatives by various government organizations and private-public partnerships or collaborations for enhancing usage as well as spreading awareness about diagnostic products, will boost the market demand in the coming years.

However, one of the major factors restraining the growth of the market is the contamination caused by DBS collection cards. It has been observed that the use of DBS collection cards causes issues such as cross-contamination and sample exposure for pathologists/clinicians handling specimens. A research study published by the NCBI states that the use of FTA cards for HIV detection yielded false-positive results when a high concentration of HIV was used. Similarly, it has been witnessed that DBS collection cards are vulnerable to cross-contamination or contamination by consumers, the environment, the equipment, and other collection cards during sample processing.

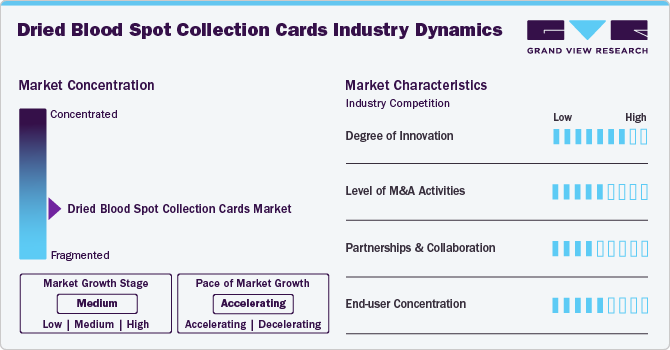

Market Concentration & Characteristics

The degree of innovation is high in the market, particularly around the development of technologically advanced blood collection solutions. For instance, in September 2022, Capitainer, a Swedish startup, announced the highly positive results of its qDBS card. It is a volumetric DBS sampling device that showcases accurate outcomes for phenylketonuria. The new technology addresses the concern of the fluctuation in volume and hematocrit of blood in conventional cards.

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in March 2021, Home Access Health was acquired by Everlywell, Inc., a healthcare and medical device company. This acquisition was expected to enhance the company’s at-home testing services for improving diagnostic care services.

The stringent regulatory framework for dried blood spot collection cards is a major restraint on the industry, delaying innovation and increasing development costs. The regulatory framework for screening products is very stringent in countries where the industry has a high potential to grow due to the availability of a large patient pool.

The market shows a high end-user concentration, with a significant portion of revenue generated from a limited number of key customers, primarily in hospitals, clinics, and diagnostics centers. This concentration is driven by the dominance of a few major players.

Application Insights

The New Born Screening (NBS) segment dominated the market in 2023 with a revenue share of 24.03%. Advancements in research technologies to improve newborn screening are a major factor driving the market growth. Newborn screening is typically designed for the identification of pre-symptomatic conditions to plan an effective early intervention. Clinical laboratories are performing prospective pilot studies to ensure efficient workflow and analytical performance of screening tests. The study involves newborn screening for Fragile X syndrome, a monogenic neurodevelopmental disorder. The study is conducted using customized analysis software and a high-throughput PCR system designed for the detection of fragile X mental retardation 1 gene repeat expansions from DBS samples. In the U.S., various agencies are supporting research studies on neonatal screening data. For instance, in May 2022, NHS England announced launch of its updated guidelines for NBS screening, which specifically focuses on diagnosis of cystic fibrosis (CF) in the UK.

The forensic application segment is expected to register the fastest CAGR over the forecast period. An increase in government initiatives to enhance the adoption of DBS in drug abuse testing is a major factor expected to impact market growth significantly in the near future. In October 2019, the World Anti-Doping Agency (WADA) signed a MoU with approximately seven Anti-Doping Organizations (ADOs) for implementation and development of DBS testing. WADA collaborated with the ADOs to enhance the implementation and development of DBS in the field of sports. A meeting organized in March 2019 included WADA, the International Testing Agency (ITA), the International Olympic Committee (IOC), and various National Anti-Doping Organizations (NADOs); the meeting was conducted to oversee the progress of this project.

Card Type Insights

The Whatman 903 segment dominated the market with a share of 32.33% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Whatman paper is a specific filter paper that is applied extensively in qualitative analysis. Among the various types of paper, Whatman 903 filter paper is FDA-approved as an in vitro Class II medical device, and it is utilized in the majority of newborn screening programs globally; however, it is considered to be a relatively expensive ready-to-use card. The filter paper comprises cellulose fibers. It is developed from high-quality cotton linters. These filter papers are available in a wide range of grades. They are divided into grades according to their thickness, weight, and particle retention capabilities. In addition, these filter papers shows high wet strength, thus segregating significant impurities.

The FTA cards segment is expected to register a considerable CAGR during the forecast period. The adoption of FTA cards is considered an attractive approach for fieldwork that involves molecular characterization and detection of viral pathogens, mostly when cheap and simple sample transport and collection systems are required. Also, the stability of the RNA genomic material of various viruses under different conditions additionally enhances the advantages of using FTA cards; this is also true in the case of metagenomics analysis. Therefore, an increase in the number of applications for FTA cards is the major factor expected to boost market growth over the forecast period.

End-use Insights

The hospitals and clinics segment dominated the market in 2023 with a share of 73.67%. Hospitals and clinics were key end-users of DBS collection card in 2023, owing to mandatory newborn screening in various regions. In the U.S., approximately 98% of women give birth in hospitals. An increase in the capacity of hospitals and clinics is anticipated to boost demand for DBS collection cards. For instance, the government of Australia announced a USD 70.12 billion (AUD 104.1 billion) budget for 2022-2023 on healthcare, which is an increase of 5.7% from the last year. The budget allocated USD 26.27 million to support newborn screening programs in the region.

Diagnostic centers are expected to register a considerable CAGR during the forecast period. Diagnostics centers are also important users of DBS collection cards in the market. Hence, increase in number of diagnostics laboratories coupled with rise in diagnostic testing of HIV and HCV is expected to boost market growth. As of August 2022, there were 24,802 diagnostic and medical labs in the U.S., with an average of 0.8% growth in the business of diagnostics and medical labs.

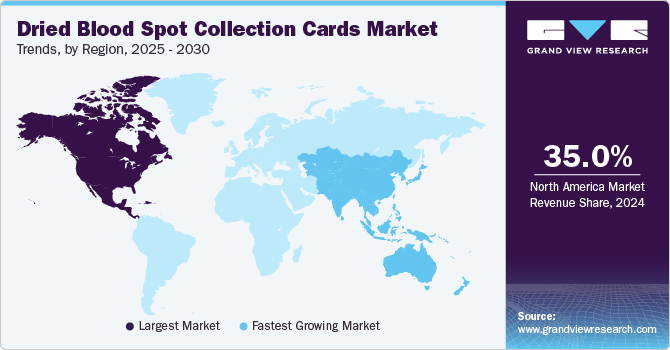

Regional Insights

The North America dried blood spot (DBS) collection cards market reported the largest global revenue share of 35.15% in 2023. The dominant share can be attributed to the presence of a large number of manufacturers and well-established childcare facilities. In addition, DBS procedure guidelines issued by public organizations ensure high-quality products, thus resulting in greater reliance on researchers & clinicians, thereby contributing to the overall demand for the market across North America. Furthermore, presence of well-established healthcare infrastructure and availability of government funding for research are among the factors anticipated to augment market growth in this region. In July 2020, NIH invested USD 248.7 million in development of new technologies to address challenges associated with testing for COVID-19.

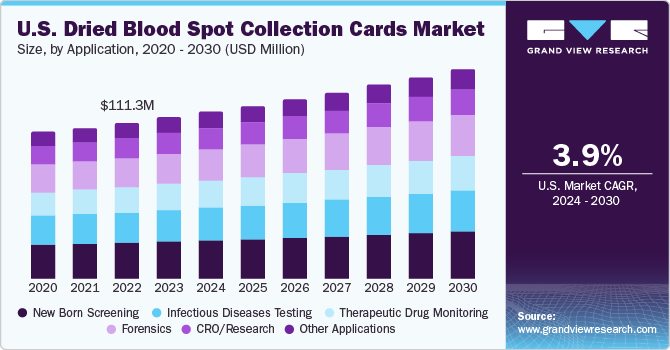

U.S. Dried Blood Spot Collection Cards Market Trends

The dried blood spot collection cards market in the U.S. is expected to grow over the forecast period, attributed to the high adoption of advanced DBS collection cards, favorable reimbursement scenarios, and an increase in the prevalence of infectious diseases & newborn disorders.

Europe Dried Blood Spot Collection Cards Market Trends

The dried blood spot collection cards market in Europe was identified as a lucrative region in this industry. The market's growth in the region can be attributed to the rise in the prevalence of chronic and infectious diseases and growing investments in the development of advanced diagnostics solutions.

The UK dried blood spot collection cards market is growing primarily due to high demand for diagnostics, which can be attributed to an increase in the prevalence of infectious diseases.

The dried blood spot collection cards market in France is expected to grow over the forecast period, which is attributed to presence of strong healthcare systems, well-established healthcare insurance policies, continuous government support to manage healthcare, and increasing prevalence of infectious diseases, drug abuse, & preterm births.

The Germany dried blood spot collection cards market is expected to witness substantial growth owing to supportive healthcare policies in the country. According to the European Commission, Germany spends more per person on health as compared to other European countries, thus providing good access to care.

Asia Pacific Dried Blood Spot Collection Cards Market Trends

The dried blood spot collection cards market in Asia-Pacific is expected to witness the fastest CAGR over the projected period. This growth is attributed to the presence of a large target population in countries such as China and India. Moreover, increasing awareness regarding newborn screening is also expected to have a positive impact on the Asia Pacific market by 2030. In addition, the growing adoption of advanced laboratory procedures & techniques, such as DBS collection cards, for rapid diagnosis & investigations is one of the key factors driving market growth. Moreover, the introduction of innovative DBS collection cards is among the factors driving growth.

The China dried blood spot collection cards market is expected to grow over the forecast period, owing to the presence of a large target population and continuous government initiatives to expand the diagnostics industry in the country.

The dried blood spot collection cards market in Japan is expected to grow over the forecast period. The presence of a well-established healthcare system and high adoption of advanced technology for early diagnosis & treatment of infectious & chronic diseases are expected to boost the market in the country.

Latin America Dried Blood Spot Collection Cards Market Trends

The dried blood spot collection cards market in Latin America was identified as a lucrative region in this industry. High incidence of life-threatening diseases, such as infectious diseases, including the COVID-19 outbreak, in key countries such as Brazil, Argentina, & Mexico is anticipated to drive market growth.

The Brazil dried blood spot collection cards market is expected to grow over the forecast period owing to the presence of established healthcare infrastructure and favorable healthcare reimbursement scenarios as compared to other Latin American countries.

MEA Dried Blood Spot Collection Cards Market Trends

The dried blood spot collection cards market in the MEA was identified as a lucrative region in this industry. The market in this region is driven by ongoing government initiatives focused on improving early diagnosis and treatment of various life-threatening diseases in the MEA region.

The dried blood spot collection cards market in Saudi Arabia is expected to grow over the forecast period. The increasing disposable income and collaborative agreements with international organizations, such as WHO & UN, are expected to boost the market in the country by attracting key players.

Key Dried Blood Spot Collection Cards Company Insights

Some of the leading players operating in the market include F. Hoffmann-La Roche Ltd, QIAGEN, and Perkin Elmer. Key players are incorporating advanced medical technologies, with a high focus on delivering economic value to customers, further fulfilling unmet needs. Moreover, companies are focusing on undertaking various strategic initiatives with other major distributors and players to strengthen their market presence.

ArchimedLife and Eastern Business Forms are some of the emerging market participants. These companies focus on improving health outcomes by receiving funding support from healthcare organizations and government bodies, aided by novel product launches, to capitalize on untapped avenues.

Key Dried Blood Spot Collection Cards Companies:

The following are the leading companies in the dried blood spot collection cards market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- PerkinElmer

- Roche

- Shimadzu Corporation

- Ahlstrom-Munksjö

- Pall Corporation

- Eastern Business Forms, Inc

- Archimed Life Science Gmbh

- Centogene N.V.

Recent Developments

-

In January 2024, Capitainer launched miQro Lab Solutions, a new U.S. laboratory in Warwick, Rhode Island. This initiative emphasizes the company’s goal to incorporate its innovative self-sampling technologies more swiftly into the U.S. healthcare framework. The establishment of miQro Lab Solutions is to expedite the adoption of Capitainer’s efficient and user-friendly solutions.

-

In September 2022, Neoteryx, a brand of Trajan Scientific, launched a program to support micro-sampling pilot studies. Under this program, the company provided a free Mitra micro-sampling device to scientists in healthcare and research organizations for a micro-sampling study. The program provided opportunities to determine the feasibility of remote sampling approaches in different environments.

-

In September 2022, Capitainer, a Swedish startup, announced the highly positive results of its qDBS card. It is a volumetric dried blood spot sampling device that showcases accurate outcomes for phenylketonuria. The new technology addresses the concern of fluctuation in volume and hematocrit of blood in conventional cards.

Dried Blood Spot Collection Cards Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 404.9 million

Revenue forecast in 2030

USD 523.2 million

Growth Rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, card type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Hemaxis; Danaher Corporation; Shimadzu; PerkinElmer, Inc.; QIAGEN; Eastern Business Forms, Inc.; Ahlstrom, ARCHIMED Life Science GmbH; CENTOGENE N.V.; Spot On Sciences; Everlywell, Inc.; Neoteryx; Advance DX

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dried Blood Spot Collection Cards Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dried blood spot collection cards market report based on application, card type, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

New Born Screening (NBS)

-

Infectious Diseases Testing

-

Therapeutic Drug Monitoring

-

Forensics

-

CRO/Research

-

Other Applications

-

-

Card Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Whatman 903

-

Ahlstrom 226

-

FTA

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostics centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dried blood spot collection cards market size was estimated at USD 371.9 million in 2022 and is expected to reach USD 393.0 million in 2023.

b. The global dried blood spot collection cards market is expected to grow at a compound annual growth rate of 4.0% from 2023 to 2030 to reach USD 517.2 million by 2030.

b. Newborn screening held the largest dried blood spot collection cards market share of 24.15% in 2022 owing to various attributes such as its low cost, short diagnosis period, minimally invasive procedure, high precision, reproducibility, simple transportation, easy collection & storage, reduced biohazard risks, among other blood collection techniques.

b. Some major players catering to the dried blood spot collection cards market growth include Qiagen, PerkinElmer, Roche, Shimazdu (Novilytic Labs), Ahlstrom-Munksjö, Pall Corporation, Eastern Business Forms, Inc., ARCHIMEDlife, and Centogene AG among others.

b. Use of DBS cards for applications such as newborn screening (NBS), therapeutic drug monitoring, HIV surveillance, clinical chemistry application, biomarker validation, biomarker development, drug discovery & development, systems biology, and forensic science among others driving the dried blood spot collection cards market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."