- Home

- »

- Petrochemicals

- »

-

Drilling Lubricants Market Size, Share & Trends Report, 2030GVR Report cover

![Drilling Lubricants Market Size, Share & Trends Report]()

Drilling Lubricants Market (2024 - 2030) Size, Share & Trends Analysis Report By Technique (Down The Hole Drills/Rotary Air Blast Drilling, Diamond Drilling), By End-use (Mining, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-067-8

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drilling Lubricants Market Size & Trends

The global drilling lubricants market size was estimated at USD 2.64 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2030. This growth is aided by the extensive usage of drilling lubricants in the oil and gas sector on account of the growing industry shift toward deeper reserves and unconventional resources. The drilling sector is extremely competitive and is evolving constantly, aided by technological developments and changing market scenarios. The industry can be mainly classified into two segments - onshore and offshore drilling. The former involves drilling wells on land, while the latter concerns drilling wells in the sea as well as other water bodies. Offshore drilling is usually more expensive and technically challenging owing to the harsh marine environment.

The drilling industry has witnessed several challenges over the past few years, such as low oil prices, falling production levels, and growing regulatory requirements. Still, there are notable growth opportunities, including strong demand for natural gas, development of unconventional oil and gas resources, and adoption of technologies such as digitalization and automation. This is anticipated to fuel the market growth of drilling lubricants over the forecast period.

Raw materials involved in manufacturing these products include vegetable oil, crude oil, and additives. Crude oil is also utilized for manufacturing base oils and synthetic oils, which are used in product manufacturing. Vegetable oils such as castor oil, rapeseed, and sunflower oil, among others, are being extensively used as raw materials in the manufacturing process.

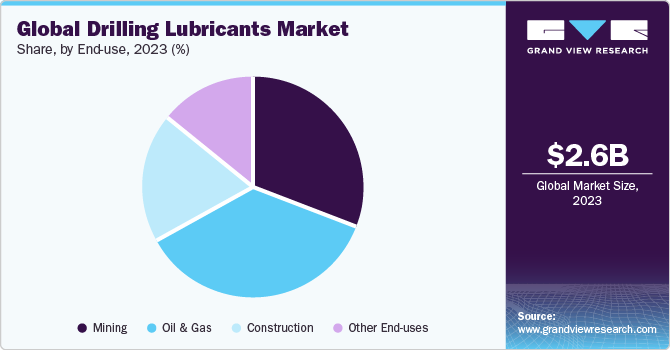

End-use Insights

In terms of end-use, the market is classified into oil & gas, mining, construction, and other end-use areas. The oil & gas segment led the market with a revenue share of more than 36.0% in 2023. This share is on account of the rising significance of this industry as it is one of the crucial industries in the energy sector and is a primary fuel source globally. As per the Organization of Petroleum Exporting Countries, the global oil demand is expected to increase by 38 million barrels per day to 115 mb/d by 2025. This factor is projected to drive product demand during the assessment period.

Mining accounted for the second-largest segment share and is expected to expand at a strong CAGR during the forecast period. Segment growth is aided by a rising demand for metals and minerals, improved technologies, and rising investments in exploration and production activities. Mining is a major sector that is vital to the global economy. It involves extracting metals, minerals, and other valuable resources from the Earth's crust, which are then used in various applications, such as manufacturing, construction, and energy production. Other applications include water wells, geothermal, and military operations. Drilling is deployed in the construction sector to build foundations for bridges, buildings, and other structures. This includes creating holes for pilings, caissons, and piers.

Market Dynamics

Drilling lubricants are majorly used in mining, oil & gas, and construction industries to reduce friction and wear & tear in drilling equipment. Thus, expanding global end-use sectors such as oil & gas and mining are enabling the demand for these lubricants. As per BP Plc, oil consumption experienced a growth of 5.3 million barrels/day in 2021, as compared to 2020. This growth is mainly due to the high diesel and gasoline consumption globally, as they accounted for 1.3 million barrels/day and 1.8 million barrels/day respectively, with the U.S., Europe, and China witnessing major growth.

The advancing mineral industry is another factor anticipated to drive demand for drilling lubricants over the forecast period. According to the Federal Ministry Republic of Australia, the global mining industry witnessed a production of 17.9 billion metric tons in 2019, with Asia Pacific accounting for around 58.9% of total production.

Regional Insights

The Asia Pacific region dominated the global market and held a revenue share of over 40% in 2023. The growth is attributed to the rapid regional rise of several end-use industries, including oil & gas and construction. As per the International Energy Agency, the number of refineries in this region is expected to grow by 60% by 2050. Moreover, the regional oil demand is predicted to increase by 9 million barrels per day by 2040.

According to the Government of Canada, China has around 1,500 major mining operations and produces over USD 400 million per year. The country has around 40,000 mines. 1,254 mining companies have been listed on the National Green Mine Directory as of 2021. China has 163 proven reserves of minerals and has discovered around 173 minerals. The flourishing mining industry in the country is expected to drive product demand over the projected period.

Europe held a revenue share of over 18.0% in 2023. The construction industry in Europe is among the largest sectors in the region and accounts for around 9% of total GDP. The regional construction industry is also embracing digitalization and innovation to improve efficiency, reduce costs, and minimize environmental impact. This includes using Building Information Modelling (BIM), 3D printing, and other digital technologies. This is expected to boost the construction industry, thereby having a positive impact on market growth in the coming years.

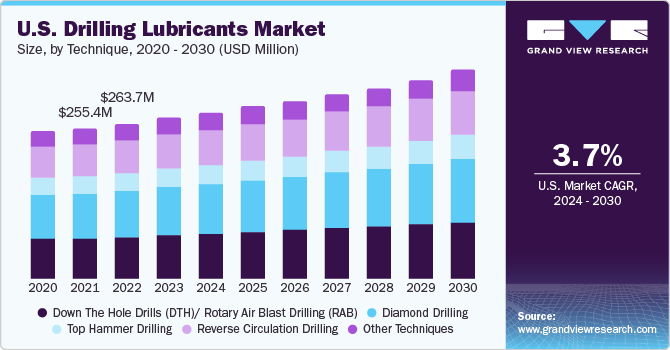

Technique Insights

Based on technique, the market is segmented into down-the-hole drills/rotary air blast drilling, diamond drilling, reverse circulation drilling, hammer drilling, and other techniques. The diamond drilling segment dominated the market and held a revenue share of over 30% in 2023. This is attributed to the sampling obtaining technique being uncontaminated and high-quality in nature. This technique can drill holes in all directions and has the ability to penetrate compact and hard rock formations. Drilling up to 1200 meters to 1800 meters is common in this technique, which enables drilling at higher depths.

The down-the-hole drills/rotary air blast technique segment held the second-largest market share in 2023. The growth is attributed to its properties such as faster, cheaper, and larger sample volumes. The technique uses a pneumatic reciprocating hammer, which is piston-driven to drive a heavy drill bit in rock. It can drill holes of diameter up to 20 cm and depth of 100 to 150 meters. Other techniques include top hammer drilling, reverse circulation drilling, auger drill, calyx drill, and rotary drill. The reverse circulation technique is relatively cheap as compared to diamond drilling and is able to drill holes up to a depth of 350 meters.

Key Companies & Market Share Insights

The market is fragmented and characterized by the adoption of various strategic initiatives such as new product developments, collaborations, and technology partnerships to gain a competitive edge. For instance, in 2021, Schlumberger Limited announced its collaboration with NOV Inc., an American multinational engaged in providing equipment used in oil & gas drilling and production and oilfield services, to accelerate the adoption of its automated drilling solutions. This will enable its customers to combine Schlumberger Limited’s downhole and surface drilling automation solutions with NOV Inc.’s rig automation platform to deliver superior well construction performance. In addition, in 2023, Petro-Canada Lubricants launched a product named PRODURO TO-4+ UHP to improve the performance of construction and mining equipment that operates in extreme conditions.

Key Drilling Lubricants Companies:

- Imdex Limited

- SINO MUD

- Baroid Industrial Drilling Products

- Baker Hughes, Inc.

- Halliburton, Inc.

- Chevron Corporation

- Schlumberger Limited

Drilling Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.73 billion

Revenue forecast in 2030

USD 3.43 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Imdex Limited; SINO MUD; Baroid Industrial Drilling Products; Baker Hughes, Inc; Halliburton, Inc; Chevron Corporation; Schlumberger Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drilling Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drilling lubricants market report based on technique, end-use, and region:

-

Technique Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Down The Hole Drills (DTH)/ Rotary Air Blast Drilling (RAB)

-

Diamond Drilling

-

Top Hammer Drilling

-

Reverse Circulation Drilling

-

Other Techniques

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mining

-

Oil & Gas

-

Construction

-

Others End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global drilling lubricants market size was estimated at USD 2.64 billion in 2023 and is expected to reach USD 2.73 billion in 2024.

b. The global drilling lubricants market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 3.43 billion by 2030.

b. Asia Pacific dominated the drilling lubricants market with a share of over 40% in 2023. This is attributable to the rapid growth of several end-use industries including oil & gas and construction industry in the region.

b. Some key players operating in the drilling lubricants market include Imdex Limited, SINO MUD, Baroid Industrial Drilling Products, Baker Hughes, Inc, Halliburton, Inc, Chevron Corporation, Schlumberger Limited, and others

b. Key factors that are driving the drilling lubricants market growth include the growing utilization of drilling lubricants in the oil & gas sector due to the increasing pace of the industry towards deeper reserves and unconventional resources.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.