- Home

- »

- Pharmaceuticals

- »

-

Drug Repurposing Market Size, Share, Industry Report, 2033GVR Report cover

![Drug Repurposing Market Size, Share & Trends Report]()

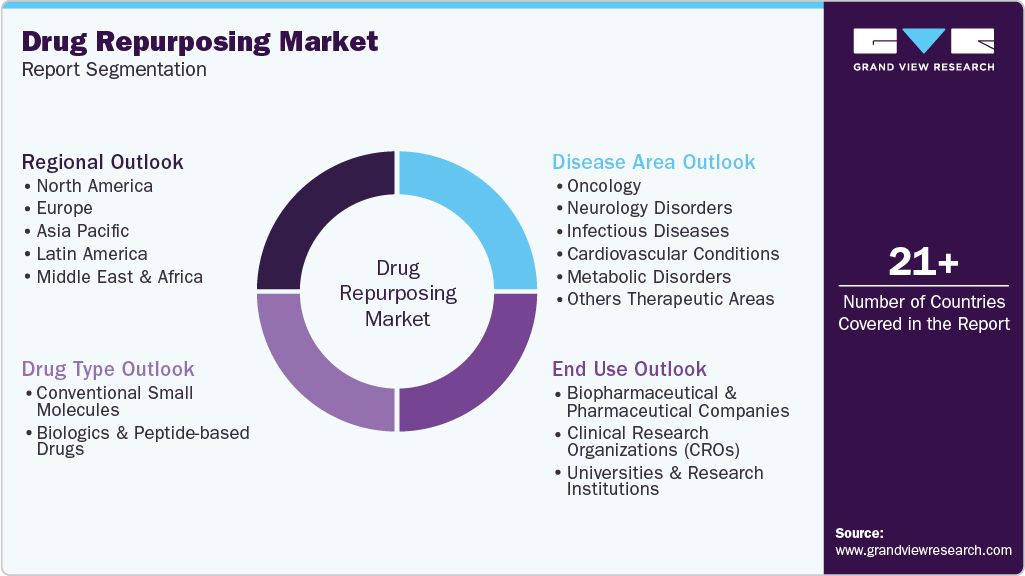

Drug Repurposing Market (2025 - 2033) Size, Share & Trends Analysis Report By Disease Area (Oncology, Neurology Disorders, Infectious Diseases, Cardiovascular Conditions, Metabolic Disorders), By Drug Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-760-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drug Repurposing Market Summary

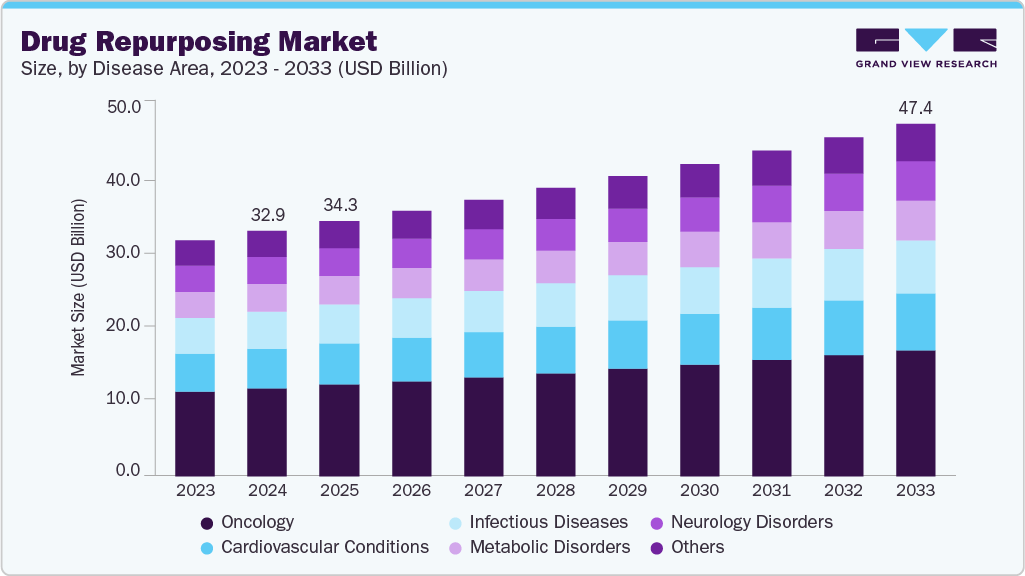

The global drug repurposing market size was estimated at USD 32.96 billion in 2024 and is projected to reach USD 47.40 billion by 2033, growing at a CAGR of 4.12% from 2025 to 2033. The market has gained significant traction, driven by the potential to offer both cost-effective and time-efficient solutions for pharmaceutical companies.

Key Market Trends & Insights

- North America drug repurposing market held the largest share of 42.98% of the global market in 2024.

- The drug repurposing market in the U.S. is expected to grow significantly over the forecast period.

- By drug type, the conventional small molecules segment held the largest market share of 67.45% in 2024.

- By disease area, oncology accounted for the largest market share of 36.03% in 2024.

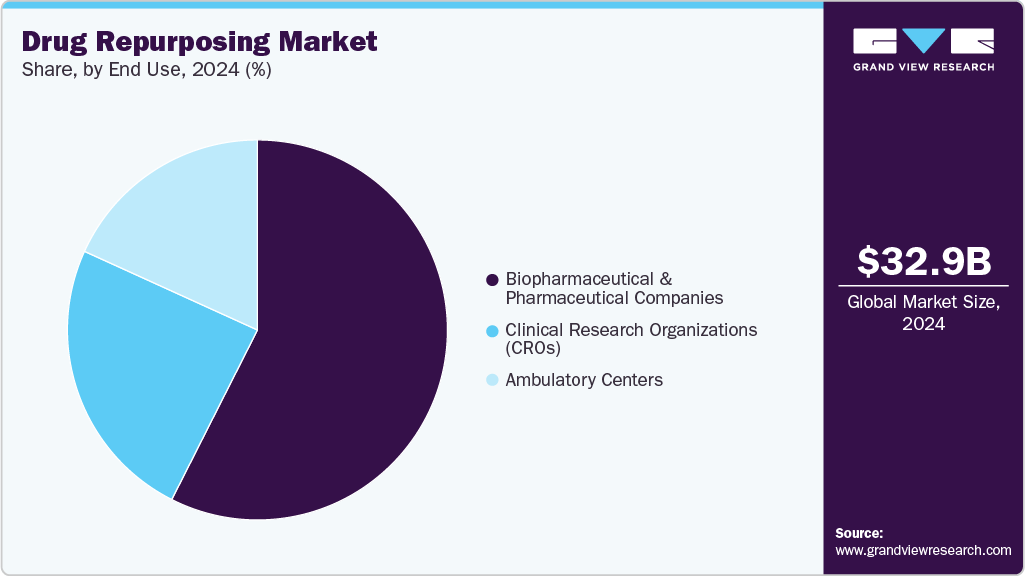

- By end use, the biopharmaceutical & pharmaceutical companies segment registered the largest market share of 57.45% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 32.96 Billion

- 2033 Projected Market Size: USD 47.40 Billion

- CAGR (2025-2033): 4.12%

- North America: Largest market in 2024

A critical driver of this growth is the opportunity to leverage existing drugs with well-established safety profiles, significantly reducing the need for lengthy preclinical trials and early-phase clinical development. For instance, in September 2023, the FDA approved empagliflozin (brand name Jardiance), a medication originally developed for type 2 diabetes, for the treatment of chronic kidney disease (CKD) in adults at risk of progression, regardless of diabetes status. Empagliflozin, developed by Boehringer Ingelheim and Eli Lilly, has shown promising results in clinical trials for reducing the risk of kidney function decline, kidney failure, cardiovascular death, and hospitalization for heart failure in CKD patients. While initially approved for type 2 diabetes, this approval extends its potential beyond diabetes management, demonstrating the growing trend of repurposing existing drugs for conditions with limited treatment options. This move highlights the increasing support for drug repurposing efforts and the significant benefits of leveraging established medications for new therapeutic indications.Furthermore, the rising prevalence of chronic and rare diseases has significantly contributed to the push for repurposed drugs. For example, in December 2022, the FDA approved cariprazine (brand name Vraylar) as an adjunctive treatment for major depressive disorder (MDD) in adults who have had an inadequate response to antidepressant therapy. Cariprazine was originally developed by Gedeon Richter and was first approved by the FDA in 2015 for the treatment of schizophrenia and bipolar I disorder. AbbVie acquired the rights to cariprazine through its acquisition of Allergan in 2020. This approval marks the fourth indication for Vraylar, underscoring the growing trend of repurposing existing medications to address conditions with limited treatment options.

In March 2023, the FDA approved leniolisib (brand name Joenja), a medication originally developed for activated phosphoinositide 3-kinase delta syndrome (APDS), for the treatment of activated PI3K delta syndrome, a rare immune disorder. Leniolisib is a selective inhibitor of the PI3Kδ enzyme, which plays a crucial role in immune cell function. The approval of leniolisib highlights the growing trend of repurposing existing drugs to address rare and orphan diseases, where the development of new drugs can be cost-prohibitive and time-consuming. This strategic move underscores the increasing support for drug repurposing efforts to encourage the development of treatments for conditions with limited therapeutic options.

In drug repurposing, Pfizer has been actively engaged in advancing treatments for prostate cancer. In July 2021, Pfizer entered into a global collaboration with Arvinas to co-develop and co-commercialize ARV-471, an investigational oral PROTAC® (PROteolysis TArgeting Chimera) estrogen receptor protein degrader. This partnership aims to leverage existing treatments to address complex and underserved cancers, aligning with Pfizer's broader strategy to expand its oncology portfolio. Additionally, in April 2024, Arvinas entered into a separate licensing and asset-sale agreement with Novartis, valued at over USD 1 billion, for the development and commercialization of ARV-766, a second-generation androgen receptor degrader for prostate cancer. This move underscores the growing interest and investment in repurposing existing drugs to enhance treatment options for prostate cancer patients.

In January 2025, Bayer submitted an sNDA to the U.S. Food and Drug Administration (FDA) seeking approval for Kerendia to treat adult patients with heart failure (HF) and a left ventricular ejection fraction (LVEF) of ≥40%, including both mildly reduced ejection fraction (HFmrEF) and preserved ejection fraction (HFpEF). The FDA accepted the application and granted Priority Review designation. The FDA approved this new indication on July 14, 2025, following the agency’s Priority Review of its supplemental New Drug Application (sNDA

Pipeline Analysis

The drug repurposing pipeline is becoming a significant focus in pharmaceutical development, with multiple clinical trials underway across various therapeutic areas. Numerous organizations and initiatives are actively advancing this field. For instance, Cures Within Reach (CWR) supports over 50 active repurposing research projects, spanning across oncology, neurology, rare diseases, and more, with trials conducted in over 12 countries. Additionally, advancements in AI are playing a pivotal role in accelerating drug repurposing efforts. AI-driven clinical trials are being initiated to test existing therapies in new indications, leveraging AI-generated data to identify potential drug candidates for repurposing.

Moreover, a study published in August 2025 reportedly identified more than 19,500 potential drug pairs for repurposing through the analysis of biomedical literature, underscoring the extensive exploration of existing drugs for new therapeutic uses. These efforts illustrate the growing recognition of drug repurposing as a cost-effective strategy to tackle healthcare challenges, particularly in therapeutic areas with limited treatment options. While it is challenging to ascertain the exact number of drug repurposing trials globally, the continuous momentum in this space highlights its increasing importance in drug development.

Opportunity Analysis

The drug repurposing market presents substantial opportunities for pharmaceutical companies, particularly as the industry focuses on addressing unmet medical needs with more efficient and cost-effective strategies. Repurposing existing drugs for new indications allows companies to utilize established safety profiles, significantly reducing the need for lengthy clinical trials. This approach can accelerate development timelines compared to traditional drug discovery, offering a faster route to market. Regulatory frameworks such as the FDA’s 505(b)(2) application process also support this strategy, allowing pharmaceutical companies to submit new drug applications based on existing clinical data, thus reducing the overall time and cost of development.

Additionally, there is an increasing demand for treatments in therapeutic areas such as oncology, cardiovascular diseases, and rare conditions, where drug repurposing offers a practical solution. Repurposing enables the rapid development of therapies for conditions with few effective treatment options. Strategic collaborations among pharmaceutical companies, research institutions, and nonprofit organizations are fostering the progress of these initiatives, further advancing repurposed drugs through clinical trials. This growing focus on repurposing reflects its potential to address critical health needs while optimizing resources and expediting the availability of new therapies.

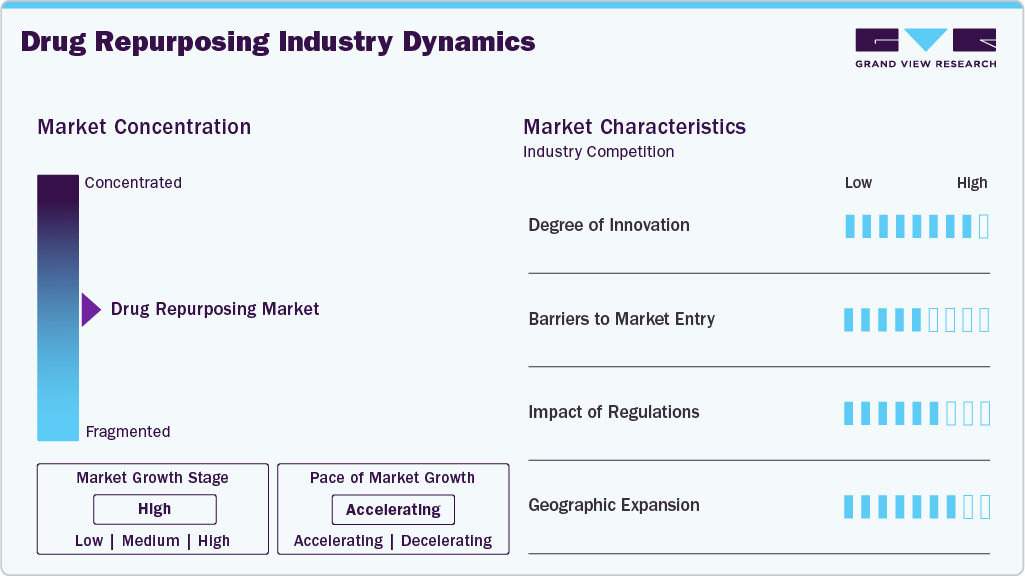

Market Concentration & Characteristics

The industry is characterized by a relatively moderate concentration, with both large pharmaceutical companies and smaller biotech firms participating. Large companies leverage their existing portfolios and resources to repurpose drugs, while smaller companies often focus on niche therapeutic areas. The market is driven by the increasing need for cost-effective, accelerated drug development and a growing focus on unmet medical needs. This has led to an increase in collaborations, partnerships, and licensing agreements to enhance drug development pipelines, especially in areas like oncology, neurology, and cardiovascular diseases.

The degree of innovation in the market is significant but varies across therapeutic areas. While repurposing existing drugs offers a faster route to market, it often requires adapting and modifying existing formulations to meet new indications. Innovations typically involve identifying new disease pathways and therapeutic targets for approved drugs. Research into novel uses for older drugs-particularly in oncology, cardiovascular, and neurodegenerative diseases-demonstrates substantial potential. However, compared to developing entirely new drugs, the innovation is more incremental, with the focus on adapting existing treatments rather than creating entirely new molecules.

Barriers to entry are relatively low compared to traditional drug development, but challenges still exist. Small biotech firms and startups may struggle with access to capital, regulatory knowledge, and the infrastructure needed to conduct clinical trials. For large pharmaceutical companies, market barriers primarily involve competition and the regulatory complexity of repurposing drugs. While repurposing can shorten development timelines, companies must still navigate the approval process for new indications, often requiring additional clinical data and trials. Furthermore, intellectual property issues and the need to establish partnerships for specific therapeutic areas can also pose barriers.

Regulatory frameworks play a critical role in shaping the market. The FDA’s 505(b)(2) application process provides a pathway for drug repurposing, allowing pharmaceutical companies to rely on existing clinical data to support new drug indications. This helps reduce the costs and time involved in the approval process. However, despite regulatory support, repurposed drugs often require additional clinical trials to demonstrate efficacy and safety in new indications. Regulatory agencies in other regions, such as the EMA in Europe, also have processes to streamline the approval of repurposed drugs; however, requirements can vary between markets, affecting global development strategies.

Geographical expansion in the global market is influenced by the regulatory landscape and market demand in different regions. The United States and Europe are leading markets due to supportive regulatory frameworks, such as the FDA’s 505(b)(2) process. However, emerging markets in Asia, Latin America, and Africa present growth opportunities for repurposed drugs, especially for conditions with high unmet needs. These regions often have less competition and can benefit from cost-effective therapies. Companies are increasingly targeting these regions to introduce repurposed drugs, though local regulatory approvals and market conditions need to be navigated carefully for successful expansion.

Disease Area Insights

Oncology held the largest revenue share of 36.03% in 2024, driven by the prevalence of cancer and the substantial unmet medical need for effective treatments. Existing oncology drugs, including those approved for other indications, are being explored for new therapeutic uses, leveraging their established safety profiles to expedite development timelines. This approach reduces the time and cost associated with bringing new cancer therapies to market. For instance, in December 2024, researchers at UT Southwestern reported that an FDA-approved drug used to treat multiple myeloma and lymphoma also showed efficacy in shrinking tumors in non-small cell lung cancer with KRAS mutations. Additionally, the ReDO Project focuses on repurposing non-cancer drugs as new treatments for cancer, aiming to provide effective options with low toxicity.

The others therapeutic areas segment is expected to exhibit the fastest CAGR of 4.22% from 2025 to 2033. The increasing prevalence of rare and complex diseases, coupled with the high costs and lengthy timelines associated with traditional drug development, has led to a heightened interest in repurposing existing drugs for new indications. This approach offers a more efficient pathway to address unmet medical needs in these therapeutic areas. Furthermore, advancements in computational biology and bioinformatics have facilitated the identification of potential repurposing opportunities for diseases with limited treatment options. Medpace, a global full-service CRO, supported drug repurposing efforts through its advanced data management and clinical trial services. The company's ClinTrak® system played a pivotal role in managing clinical trials, particularly in repurposing apixaban (Eliquis) for COVID-19 complications. Their system ensured real-time data validation and regulatory compliance, crucial for efficient repurposing of existing drugs.

Drug Type Insights

The conventional small molecules held the largest revenue share of 67.45% in 2024. Small molecules possess well-established safety profiles, extensive historical data, and predictable pharmacokinetics, facilitating their repurposing for new indications. Their chemical synthesis allows for cost-effective production and scalability, making them attractive candidates for repurposing. To illustrate, the repurposing of Ritonavir for COVID-19 treatment occurred in December 2021, when the U.S. FDA issued an Emergency Use Authorization (EUA) for Paxlovid (the combination of ritonavir and nirmatrelvir) to treat mild to moderate COVID-19 in high-risk patients. The vast library of approved small molecule drugs provides a rich source for identifying potential treatments across various diseases, including cancer, neurological disorders, and infectious diseases.

Biologics and peptide-based drugs emerged as the fastest-growing segment in the market for drug repurposing in 2024. Advancements in biologics and peptides have expanded their therapeutic applications, particularly in oncology, metabolic disorders, and rare diseases. The increasing prevalence of chronic and complex diseases has heightened the demand for effective treatments, propelling the adoption of biologics and peptides. Technological innovations in drug delivery and formulation have enhanced the stability and efficacy of these therapies, facilitating their repurposing for new indications.

End Use Insights

Biopharmaceutical & Pharmaceutical Companies held the largest revenue share of 57.45% in 2024. These companies possess established infrastructure, extensive R&D capabilities, and regulatory expertise, enabling them to efficiently repurpose existing drugs for new indications. Their significant financial resources facilitate the funding of clinical trials and the acquisition of promising drug candidates. Furthermore, the increasing pressure to fill gaps in medical care and the demand for cost-effective therapies have prompted these companies to explore repurposing strategies. In May 2022, the U.S. Food and Drug Administration (FDA) approved baricitinib for the treatment of hospitalized adults requiring various degrees of respiratory support due to COVID-19. This approval followed an earlier Emergency Use Authorization (EUA) granted in November 2020 for the combination of baricitinib and remdesivir in treating hospitalized adults and pediatric patients with COVID-19. The approval was based on data from the Adaptive COVID-19 Treatment Trial (ACTT-2), which demonstrated that the combination therapy reduced recovery time and improved clinical outcomes in hospitalized patients.

Clinical Research Organizations (CROs) are projected to be the fastest-growing segment from 2025 to 2033. This growth is primarily driven by the increasing demand for outsourced research services, enabling pharmaceutical and biotechnology companies to expedite drug development processes while managing costs. CROs offer specialized expertise in conducting preclinical and clinical trials, regulatory affairs, and data management, which are essential for the successful repurposing of existing drugs. Their involvement allows sponsors to leverage established safety profiles of existing drugs, facilitating faster progression through clinical phases.

Regional Insights

The North American drug repurposing industry captured the largest revenue share of 42.98% in 2024, driven by strategic initiatives from pharmaceutical companies and a favorable regulatory environment. The region's leading pharmaceutical companies continue to explore repurposing existing drugs to address unmet medical needs, with a particular focus on oncology, cardiovascular, and neurological diseases. The U.S. Food and Drug Administration’s (FDA) support for drug repurposing through programs like the 505(b)(2) application process has facilitated the approval of repurposed drugs by leveraging existing clinical data, reducing the time and costs typically associated with new drug development.

North America is increasingly adopting collaborative approaches with academic institutions and contract research organizations (CROs) to identify new indications for existing drugs. This partnership model enhances the efficiency of the drug repurposing process and accelerates market entry. Furthermore, technological advancements, particularly in data analytics and AI, are enabling the identification of potential repurposing opportunities by analyzing large datasets of existing drugs and diseases.

U.S. Drug Repurposing Market Trends

The U.S. drug repurposing industry is witnessing significant growth, driven by increased demand for cost-effective treatments and a strong regulatory framework that supports repurposing initiatives. In addition, the U.S. pharmaceutical industry has been increasingly leveraging existing drug libraries to address unmet medical needs, particularly in oncology, cardiovascular diseases, and neurological disorders. This strategy enables companies to maximize the utility of their existing portfolios while accelerating the availability of new treatments.

In recent years, the U.S. has seen strategic investments in drug repurposing, with pharmaceutical giants like Pfizer expanding their portfolios through acquisitions of companies specializing in repurposed drugs. For instance, In September 2025, Pfizer's announcement of a USD 7.3 billion acquisition of Metsera for obesity treatments highlighted the growing focus on repurposing existing therapies for emerging conditions. Moreover, innovations in AI and machine learning are driving the identification of potential repurposing opportunities. Initiatives such as ARPA-H's funding for Every Cure's AI-driven platform for repurposing medications for rare diseases reflect the increasing role of advanced technologies in reshaping the U.S. drug repurposing landscape.

Europe Drug Repurposing Market Trends

The Europe drug repurposing industry is experiencing robust growth, influenced by strategic initiatives, regulatory developments, and collaborative efforts. Growth is driven by the increasing prevalence of complex and rare diseases, which often lack effective treatment options, prompting the exploration of existing drugs for new indications.

Regulatory support plays a pivotal role in the EU's drug repurposing landscape. The European Medicines Agency (EMA) has initiated pilot programs to facilitate the repurposing of authorized medicines, particularly for not-for-profit organizations and academia. These initiatives aim to address unmet medical needs by identifying new therapeutic uses for existing, off-patent medications. Furthermore, the EU is revising its pharmaceutical legislation to enhance the security of medicine supply and support the attractiveness of the EU pharmaceutical industry by fostering research and innovation. These legislative reforms are expected to streamline the regulatory pathways for drug repurposing, making it more accessible for stakeholders across the region.

The drug repurposing industry in the UK is influenced by factors such as the increasing prevalence of chronic diseases, the need for cost-effective treatment options, and advancements in research methodologies. Collaborations among pharmaceutical companies, academic institutions, and healthcare providers are facilitating the identification of new therapeutic uses for existing medications.

However, the market faces challenges, including regulatory hurdles and the need for robust clinical evidence to support the efficacy of repurposed drugs. The suspension of the NHS Medicines Repurposing Programme in April 2025, after four years of operation, has raised concerns about the continuity of support for repurposing initiatives. Despite these challenges, the UK remains a significant player in the global drug repurposing landscape, with ongoing efforts to overcome barriers and capitalize on the potential of repurposed therapies.

The German drug repurposing industry is experiencing substantial growth, driven by strategic initiatives, regulatory support, and technological advancements. Expansion is attributed to the increasing demand for cost-effective and time-efficient therapies, leveraging existing drugs to address unmet medical needs. Germany's pharmaceutical infrastructure, characterized by significant investments in research and development, supports the growth of the market for drug repurposing.

The drug repurposing industry in France is experiencing growth, driven by several key factors. The French pharmaceutical market is actively engaged in identifying new therapeutic uses for existing drugs, aiming to address unmet medical needs and optimize resource utilization. This approach is particularly relevant in the context of rising healthcare costs and the need for more efficient drug development processes. Collaborations between pharmaceutical companies, academic institutions, and research organizations are facilitating the exploration of repurposing opportunities across various therapeutic areas.

The French government introduced the 2025 LFSS (Social Security Financing Law) and the latest CEPS (Economic Committee for Health Products) annual activity report, which provide insights into the evolving pharmaceutical pricing and market access environment. These policy updates aim to enhance the efficiency of drug reimbursement systems and support the sustainability of healthcare expenditures. Besides, the French pharmaceutical industry is focusing on strengthening its production capabilities domestically, with companies like Sanofi investing in expanding drug production facilities in France.

Asia-Pacific Drug Repurposing Market Trends

The Asia-Pacific drug repurposing industry is experiencing significant growth, driven by increasing healthcare investments, rising chronic disease prevalence, and expanding pharmaceutical research and development activities. For instance, in January 2025, Every Cure expanded its collaboration with Google Cloud to enhance AI-driven drug repurposing, aiming to accelerate the discovery and global distribution of treatments for diseases with limited or no therapies.

The region's leadership is further bolstered by significant investments from both public and private sectors, fostering a vibrant ecosystem for drug discovery and innovation. Countries such as China, India, and Japan are actively involved in drug repurposing initiatives, with a focus on addressing unmet medical needs in oncology, neurology, and infectious diseases. In addition, the expansion of CROs and strategic partnerships for clinical trials is propelling market growth. With a growing focus on rare diseases and unmet medical needs, repurposed drugs are emerging as key solutions, particularly in oncology and neurology, where new treatment options are urgently needed.

The drug repurposing industry in Japan is experiencing growth, driven by factors such as the need for cost-effective drug development, the presence of a strong pharmaceutical industry, and the increasing focus on finding new therapeutic uses for existing drugs. Regulatory agencies in Japan are supportive of drug repurposing initiatives, providing a streamlined pathway for the approval of repurposed drugs. With a growing aging population and rising healthcare costs, drug repurposing offers a promising approach to bring new treatments to market quickly and efficiently, driving the growth of the market in Japan.

The market is experiencing a prominent trend towards leveraging technologies to identify new uses for existing drugs. This approach helps in reducing the time and costs associated with traditional drug development processes. Additionally, there is a growing emphasis on collaborative efforts between pharmaceutical companies, research institutions, and regulatory bodies to expedite the repurposing of drugs for new indications.

The China drug repurposing industry is experiencing considerable growth, fueled by several key factors. The Chinese government has implemented policies to promote drug repurposing, including streamlining the regulatory approval process and providing financial incentives for research and development. For instance, in December 2024, the Chinese government introduced Circular No. 53, implementing a series of policy incentives aimed at accelerating drug repurposing. Key measures include expedited clinical trial approvals, enhanced marketing exclusivity for orphan and pediatric drugs, regulatory data protection, and the inclusion of innovative drugs in reimbursement systems. These reforms streamline the regulatory process, provide financial incentives, and encourage the repurposing of existing therapies, thereby fostering innovation and improving market access for repurposed drugs. These initiatives aim to accelerate the availability of new treatments and reduce healthcare costs. Additionally, the increasing prevalence of chronic diseases and the rising demand for cost-effective therapies are propelling the adoption of drug repurposing strategies.

Latin America Drug Repurposing Market Trends

The Latin American drug repurposing industry is experiencing growth, driven by the increasing prevalence of chronic diseases and the need for cost-effective therapeutic solutions. This growth is attributed to factors such as rising healthcare expenditures, advancements in research and development, and the adoption of innovative technologies in drug discovery.

Key players in the region, including Eurofarma and Raia Drogasil, are actively involved in drug repurposing initiatives. Eurofarma, a Brazilian multinational corporation, has expanded its portfolio through acquisitions and investments in research, while Raia Drogasil, the largest drugstore company in Latin America, leverages its extensive retail network to promote health and wellness. In August 2023, Eurofarma established Eurofarma Ventures, a corporate fund with an investment of up to USD 100 million, focusing on early-stage biotech companies. The fund aims to support the discovery and development of innovative therapies, including repurposed drugs, by investing in startups specializing in areas such as oncology, autoimmune diseases, and neurodegenerative disorders.

The drug repurposing industry in Brazil is evolving, influenced by regulatory advancements, strategic investments, and increasing interest in cost-effective therapeutic solutions. Regulatory developments have also played a significant role in shaping the drug repurposing landscape in Brazil. In 2024, the Brazilian Health Regulatory Agency (ANVISA) implemented Normative Instruction No. 289/2024, allowing the use of evaluations from equivalent foreign regulatory authorities to streamline the approval process for drug products, biological products, and vaccines. This initiative aims to optimize the analysis of marketing authorization and post-approval change applications, potentially accelerating the availability of repurposed drugs in the Brazilian market.

Middle East & Africa Drug Repurposing Market Trends

The Middle East & Africa drug repurposing industry remains underdeveloped but is poised for growth due to several regional dynamics. The region presents unique opportunities for growth driven by increasing healthcare investments and awareness of drug repurposing. Strategic initiatives are emerging to support drug repurposing in the region.

The drug repurposing industry in Saudi Arabia is experiencing growth, influenced by several key factors. The increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, has heightened the demand for effective treatment options. Government initiatives, including Vision 2030, aim to enhance healthcare infrastructure and promote research and development, creating a conducive environment for drug repurposing activities. Collaborations between pharmaceutical companies and research institutions are on the rise, facilitating the identification and development of new therapeutic uses for existing drugs.

Key Drug Repurposing Company Insights

The global market for drug repurposing is driven by major players such as Eli Lilly, Pfizer, Roche, and Novartis, each contributing to the expansion of this sector through innovative strategies. Eli Lilly has made significant strides with the repurposing of baricitinib for COVID-19 and continues to explore new indications for its drugs. Pfizer has been proactive in acquiring companies like Metsera, bolstering its portfolio with promising weight-loss treatments. Roche, with its acquisition of 89bio, is focused on metabolic and liver disease treatments, while Novartis continues its efforts in antimicrobial resistance and AI-driven drug repurposing.

Bayer and GSK are investing heavily in repurposing drugs for heart disease, neurological disorders, and liver conditions.Other players like Amgen, Biogen, Teva, and Vertex Pharmaceuticals continue to lead in repurposing drugs for oncology, inflammation, and genetic disorders. These companies leverage existing infrastructures, financial resources, and regulatory expertise to drive forward the repurposing of drugs for new indications.

Key Drug Repurposing Companies:

The following are the leading companies in the drug repurposing market. These companies collectively hold the largest market share and dictate industry trends.

- Eli Lilly and Company

- Pfizer Inc.

- Roche Holding AG

- Novartis AG

- Bayer AG

- GSK plc

- Amgen Inc.

- Biogen Inc.

- Teva Pharmaceutical

- Vertex Pharmaceuticals

Recent Developments

-

In January 2025, Every Cure expanded its collaboration with Google Cloud to enhance AI-driven drug repurposing, aiming to accelerate the discovery and global distribution of treatments for diseases with limited or no therapies.

-

In July 2025, The BMJ published an article highlighting the suspension of the NHS medicines repurposing programme in England, which had been established in 2021 to support the repurposing of established medicines and facilitate drug licence extensions. The programme's suspension in April 2025 was attributed to fewer opportunities for repurposing than anticipated.

Drug Repurposing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.31 billion

Revenue forecast in 2033

USD 47.40 billion

Growth rate

CAGR of 4.12% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Disease area, drug type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Eli Lilly and Company; Pfizer Inc.; Roche Holding AG;

Novartis AG; Bayer AG; GSK plc; Amgen Inc.; Biogen Inc.; Teva Pharmaceutical; Vertex Pharmaceuticals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drug Repurposing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global drug repurposing market report based on Disease Area, drug type, end use, and region :

-

Disease Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Neurology Disorders

-

Infectious Diseases

-

Cardiovascular Conditions

-

Metabolic Disorders

-

Others Therapeutic Areas

-

-

Drug Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional Small Molecules

-

Biologics and Peptide-based Drugs

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical & Pharmaceutical Companies

-

Clinical Research Organizations (CROs)

-

Universities & Research Institutions

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global drug repurposing market size was estimated at USD 32.96 billion in 2024 and is expected to reach USD 34.31 billion in 2025.

b. The global drug repurposing market is projected to grow at a CAGR of 4.12% from 2025 to 2033 to reach USD 47.40 billion by 2033.

b. Based on disease area, oncology holds the largest revenue share of 36.03% in the drug repurposing market in 2024, driven by several key factors. The high prevalence of cancer and the substantial unmet medical need for effective treatments contribute to the significant focus on oncology within drug repurposing efforts.

b. Key players in the drug repurposing market are Eli Lilly and Company,Pfizer Inc., Roche Holding AG, Novartis AG and Bayer AG.

b. Key factors driving the market growth include the growing need for cost-effective treatments, rapid clinical trial phases for repurposed drugs, advancements in computational biology, and rising investments in drug repurposing research by both private and public sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.