- Home

- »

- Clinical Diagnostics

- »

-

Drug Testing Market Size, Share And Growth Report, 2030GVR Report cover

![Drug Testing Market Size, Share & Trends Report]()

Drug Testing Market Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Sample (Urine Samples, Oral Fluid Samples), By Drug (Alcohol, Cannabis/Marijuana, Cocaine), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-364-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Drug Testing Market Size & Trends

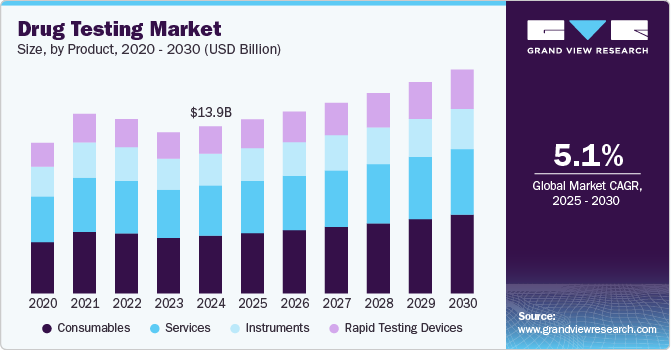

The global drug testing market size was estimated at USD 6.12 billion in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. Growing incidence of substance abuse across the globe led to an increase in the need for testing, which is expected to drive the demand for drug testing solutions. Stringent regulations by several government agencies mandating alcohol & drug testing for safety purposes and increasing government initiatives to monitor & combat substance abuse are further expected to support the market growth.

The growing prevalence of substance abuse across the globe has significantly increased the demand for drug testing solutions. According to the National Institution on Drug Abuse, in 2021, over 106,000 individuals in the U.S. died from overdose, including illegal drugs and prescription opioids. According to the data published by the U.S. Department of Justice, around 50% of workplace accidents and up to 40% of employee theft are caused due to substance abuse problems.

In December 2022, the U.S. government enacted the Consolidated Appropriations Act 2023 (Public Law 117-328) (CAA, 23). The CAA 23 granted funds to the Substance Abuse & Mental Health Services Administration (SAMHSA) for the financial year 2023 and included several provisions that strengthened, reauthorized, and expanded SAMHSA’s substance use disorder & mental health programs. The law builds upon previous laws, including the Substance Use-Disorder Prevention that encourages the Opioid Treatment & Recovery for Communities and Patients Act (SUPPORT Act), the Comprehensive Addiction and Recovery Act (CARA), and the 21st Century Cures Act. Furthermore, in August 2018, the Minister of Justice and Attorney General of Canada approved using roadside oral fluid screening equipment to detect drug-impaired drivers.

Various government initiatives to monitor and combat substance abuse are driving market growth. For instance, Health Canada’s Substance Use & Addictions Program (SUAP) offers funding and contributions for projects that address drug & substance use problems in Canada. This initiative supports substance use prevention, harm reduction, & treatment initiatives across Canada. Moreover, in December 2021, the UK government launched a 10-year drug plan to reduce crime and save lives. The plan to eliminate illegal drugs focuses on cutting off the supply of drugs by criminal groups and giving people with a drug addiction a course to a productive & drug-free life.

The overdose and addiction crisis with the COVID-19 pandemic has created challenges and opportunities within the healthcare landscape. Hence, the COVID-19 pandemic has positively impacted the market. Individuals with substance use disorders face high vulnerability to COVID-19, leading to risky health outcomes. However, the pandemic has encouraged innovative approaches in healthcare delivery, allowing for increased accessibility to services. Moreover, the U.S. government’s regulatory flexibility has enabled remote prescribing of buprenorphine and take-home dosing of methadone, essential medications for treating opioid use disorder. Despite limited data, there are indications of a significant surge in various drug use categories in the U.S. since March 2020.

Market Concentration & Characteristics

The degree of innovation in the market is characterized by moderate-to-high level, including point-of-care and rapid testing solutions. There is a growing emphasis on the innovation of new testing technologies and growing investments in product development. For instance, in March 2023, Singapore Ministry of Home Affairs (MHA) announced a new plan to deploy new saliva test kit for detection of drugs at roadblocks and checkpoints. The new test is capable of providing accurate results in about 10 minutes.

The market is characterized by leading players with a moderate level of new product launches and merger and acquisition (M&A) activities. Such market players include F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc. and others. For instance, in September 2023, BRITISH CANNABIS announced a strategic acquisition of PhytoVista Laboratories, a specialized cannabinoid laboratory in the UK.

The regulatory framework for product approvals has always been one of the major restraining factors in the pharmaceutical, biotechnology, and medical technology industries. The regulatory framework for the diagnostic sector is very stringent in countries where the drug market has a high potential to grow due to the availability of a larger application and research area.

The level of substitution is generally moderate for the market, as advanced breathalyzers tests, and sweat patch test might replace traditional alcohol detection methods & tools. For instance, sweat patch method involves wearing an adhesive patch that collects sweat over a prolonged period (typically a week or two), which can then be analyzed for the presence of drugs or their metabolites.

End user concentration is high with regards to research and diagnostics industry as drug testing is widely done in R&D in pharmaceutical, food, and environmental industries workplaces owing to its need to conduct emergency room drug tests to ensure proper treatment of patients in various places.

Product Insights

The consumables segment dominated the market with a share of 36.2% in 2023 as consumables, including various kits, reagents, columns, calibrators, blue dye tablets, specimen & temperature test strips, and controls play an important role in drug testing. Consumables are widely used for improving confirmation testing. In June 2023, almost 100,000 xylazine test strips were procured after the introduction of a new statewide ordering system by the Office of Addiction Services and Supports. This would enable the public & clinicians to obtain the essential damage mitigation tool to combat the hazards linked to xylazine and its growing illegal trade by offering free test strips. Such initiatives are expected to drive market growth.

Rapid testing devices are anticipated to witness the fastest growth over the forecast period, owing to the increasing use of substance use products like opioids. According to WHO estimates, there would be about 296 million people worldwide who consumed drugs at least once in 2021. Of this, about 60 million consumed opioids. Thus, rising consumption of opioids and other drugs is projected to fuel demand for rapid testing devices during the forecast period. Strategic initiatives like new product launches, partnerships, and mergers & acquisitions are being carried out by government & nongovernment bodies to curb the use of drugs, contributing to the market growth. For instance, in October 2023, the Kerala Police launched a handheld rapid drug testing device system, SoToxa Mobile Test, to identify people who took drugs even 2 days before. This rapid device system uses human saliva as a sample, giving results in just 5 minutes.

Sample Insights

The urine sample dominated the market and accounted for the largest share of 40.1% in 2023. This can be attributed to increasing urine collection for testing purposes. A crucial tool for adhering to a prescribed regimen and preventing substance misuse or abuse is Urine Drug Monitoring (UDM). UDM is a tool for screening patients receiving opioid therapy for adherence and spotting potential abuse & misuse. Urine sample testing is one of the only methods approved for testing by the Department of Health and Department of Transportation. These samples can be used for point-of-care and laboratory diagnostic conditions.

The oral fluid segment is also expected to register the fastest growth over the forecast period. Oral fluid samples are used in oral fluid testing to detect concentration that correlates to plasma concentration. These samples are advantageous in detecting under-influence cases and depicting recent use. This type of sample requires specialized collection devices to maintain sample stability. Moreover, quantification is an issue in oral fluid samples as many devices tend to absorb the collected oral fluid, thus giving poor drug identification results. However, advancements in products and the launch of specialized collectors, such as Oral-Eze, facilitate the use of oral fluid sample collection.

Drug Insights

The cannabis/marijuana dominated the market and accounted for the largest share of 24.6% in 2023. This can be attributed to the increasing use of marijuana or cannabis as an illicit drug in the world, creating a demand for its testing kits and instruments. Furthermore, cannabis/marijuana is most frequently used in important markets, which drives up demand for testing supplies and equipment.

The cannabis/marijuana segment is also expected to register the fastest growth during the forecast period. In the U.S., marijuana is categorized under the Controlled Substances Act as a hallucinogen. It is illegal under federal law; however, some states have legalized its recreational use. Countries such as Canada, the U.S. (only in some states), and Uruguay have legalized the recreational use of cannabis. As marijuana or cannabis is the most commonly used illicit drug worldwide, the demand for its testing solutions is expected to remain high over the forecast period. One of the main reasons for the market's expansion has been the rising demand for legal Cannabis/Marijuana. Many nations have recently made it legal to use medical marijuana to treat a range of conditions. Numerous studies have demonstrated the effectiveness of medical marijuana and its derivatives in treating the symptoms of a range of substance use disorders.

End-use Insights

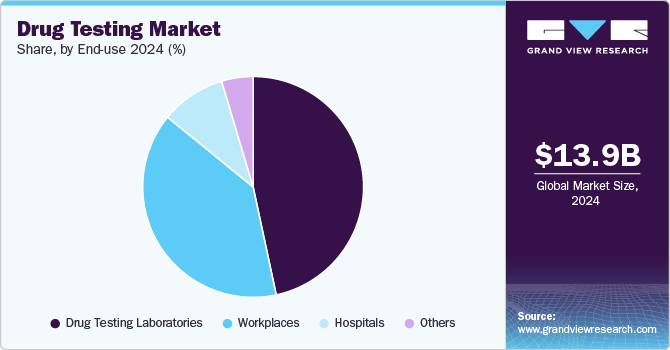

The drug testing laboratories segment dominated the end use segments with the largest market share of 36.0% in 2023. This is attributable to the testing laboratories’ large presence and offerings. However, the workplace segment is expected to witness significant growth over the forecast period owing to strict regulation undertaken by public and private organizations to maintain substance drug use-free environment. Moreover, laboratories can test for any drug’s presence, which is not possible with rapid tests. In addition, strict certification processes make results from laboratories more accurate. Hence, laboratory testing is requested to initiate appropriate treatment based on drug use and overdose.

The workplace segment is anticipated to grow at the fastest growth rate over the forecast period. Workplaces are key end users of drug testing as most organizations conduct pre-employment drug tests and tests during employment. Urine samples are one of the most common types of testing sample collection methods used by government agencies and employers. Typical drugs that are screened during pre-employment procedures include amphetamines & marijuana, methamphetamines, cocaine, Phenylcyclohexyl Piperidine (PCP), and opiates. Workplace drug testing is rising rapidly to ensure drug-free premises for companies.

Regional Insights

North America drug testing market dominated and accounted for a 39.5% share in 2023. This high share is attributable to the local presence of key global market players, such as Bio-Rad Laboratories, Laboratory Corporation of America Holdings, Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd. and others. Moreover, the growth of the drug testing market in North America can majorly be attributed to the increasing incidence of abuse, stringent government regulations, and active screening programs. The governments are actively engaged in controlling the consumption of hazardous drugs to minimize the cost burden associated with it. In addition, the authorities are focusing on formulating new policies. For instance, in September 2023, San Francisco Human Services Agency (SFHSA) announced a new initiative that would need people suffering from substance use disorder who wish to gain access to county funds to enroll in treatment and services.

U.S. Drug Testing Market Trends

The drug testing market in the U.S. is expected to grow over the forecast period due to increasing alcohol consumption. Moreover, according to data published by the National Center for Drug Abuse Statistics (NCDAS) in February 2023, around 46% of the U.S. drug users have reported consumption of cannabis and prescription stimulants, which includes 10% of the population consuming cocaine, 36% using opioids & methamphetamine, and 15% heroin. The authorities are taking these steps to control the spread of illicit drugs.

Europe Drug Testing Market Trends

Drug testing market in Europe was identified as a lucrative region in this industry. Growth is attributable to the rising emphasis on workplace safety, increasing awareness of substance abuse issues, and efforts to ensure public safety, especially in transportation and heavy industries. Furthermore, the increasing incidence of illicit drug trade is expected to offer growth opportunities for market growth during the forecast period.

The drug testing market in the UK is expected to grow over the forecast period due to the increased government focus and substantial investments to control drug abuse. For instance, in August 2023, the Office for Life Sciences, UK, awarded funding of USD 6.24 million to develop new technologies, which can improve testing services. Additionally, government authorities are focusing on controlling deaths caused by addiction and overdose.

France Drug Testing Market is anticipated to witness significant growth over the forecast period owing to rising consumption of illicit drugs, misuse of prescriptions, and stringent government regulations. Furthermore, the growing illegal handling and supply of illicit drugs is projected to have a positive impact on the market. In addition, an increase in government initiatives to boost drug abuse testing is anticipated to propel the demand for testing solutions in France.

The drug testing market in Germany is expected to grow over the forecast period due to ongoing developments in the country, such as, implementation of stringent government regulations, evolving societal attitudes toward substance use, and advancements in testing technologies. The country places a strong emphasis on employee rights and privacy, influencing the adoption of testing practices within legal boundaries. In August 2023, the German Federal Cabinet approved a new draft for the controlled use of cannabis. The new regulation will focus on the utilization of cannabis for medicinal purposes, its supply, and issues related to cannabis handling.

Asia Pacific Drug Testing Market Trends

Asia Pacific drug testing market is anticipated to witness the fastest growth of 5.6% CAGR over the forecast period. Several key trends are reshaping the landscape of the drug testing market in the Asia Pacific. One prominent trend is the increasing focus on preventing the consumption of illicit drug consumption. Healthcare providers as well as government authorities in Asia Pacific recognize the importance of spreading awareness about the harmful effects of illicit drugs. Moreover, there is a growing emphasis on the innovation of new testing technologies and growing investments in product development. In March 2023, Singapore Ministry of Home Affairs (MHA) announced a new plan to deploy a new saliva test kit for the detection of drugs at roadblocks and checkpoints. The new test is capable of providing accurate results in about 10 minutes

The drug testing market in China is expected to grow over the forecast period due to the rise in drug abuse, especially alcohol and illicit drug abuse, which is very common among youngsters. Moreover, the growth of the market can also be attributed to the increasing number of product launches and growing availability of rapid test kits. For instance, in March 2021, the Hong Kong police force deployed DrugWipe 6 S Ketamine for rapid screening tests for roadside drug screening.

Japan Drug Testing Market is expected to grow over the forecast period. This is attributable to the government making collaborative efforts to boost drug testing in the region. In October 2023, the Japanese government dispensed drug testing kits to the Maldives Customs Service and Maldives National Defense Force (MNDF). Moreover, in April 2023, the Metropolitan Police Department (MPD) introduced and deployed Japan's very first simple test kit for detection of "date rape drugs.”

Latin America Drug Testing Market Trends

Latin America drug testing market is anticipated to grow at a substantial growth rate over the forecast period. The growth can be attributed to the increasing penetration of key players in the region. Several key players have established their testing laboratories in countries such as Brazil and Mexico to gain a competitive edge. High consumption in several Latin American countries and increased prevalence of substance use disorder in the region are anticipated to create lucrative opportunities in the market.

The drug testing market in Brazil is expected to grow over the forecast period. The high prevalence of drug abuse in Brazil is anticipated to be a major factor boosting the demand for testing in the region. To fulfill the growing demand for testing, several key players operating in the market are entering the Brazilian drug testing market by implementing organic and inorganic growth strategies.

Saudi Arabia Drug Testing Market Trends

The drug testing market in Saudi Arabia is expected to grow over the forecast period. This can be attributed to the increase in the incidence of substance abuse and growth in the trend of workplace drug testing in the country. In September 2022, Saudi authorities seized amphetamine pills worth USD 47 million. In the past few decades, pre-employment testing has become a common mandatory practice in the workplace. Pre-employment testing laboratories accredited by the Saudi Arabian government generally test around 46,000 samples per year. However, low funding for specialized health programs, such as drug addiction treatment, is expected to hamper the market growth.

Key Drug Testing Company Insights

Several leading players that dominated the drug testing market include Quest Diagnostics Incorporated, Abbott, F. Hoffmann-La Roche Ltd., Quidel Corporation, Thermo Fisher Scientific, Inc., Siemens Healthcare GmbH, and Bio-Rad Laboratories, Inc. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New product developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Emerging companies such as Clinical Reference Laboratory, Inc. and Cordant Health Solutions focus on collaborating with the governments of different countries, workplaces, and schools & colleges.

Key Drug Testing Companies:

The following are the leading companies in the drug testing market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics Incorporated

- Abbott

- F. Hoffmann-La Roche Ltd.

- Quidel Corporation

- Thermo Fisher Scientific, Inc.

- Siemens Healthcare GmbH

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Laboratory Corporation of America Holdings

- Clinical Reference Laboratory, Inc.

- Cordant Health Solutions

Recent Developments

-

In February 2024, Swiss sample collection company Capitainer, announced fund raising of USD 7.7 million via a Series A financing round. This funding aims at expanding and scaling up production capacity, solidifying sales of its self-sampling blood sample products in the EU and US, and initiating key collaborations.

-

In February 2024, Veriteque announced a new distributor agreement with OraSure Technologies, a leading manufacturer of in vitro diagnostic products. Under this agreement, the company will utilize OraSure's rapid point-of-care (POC) tests for infectious diseases, including HIV, HCV, and syphilis, in [specific regions/countries]. The partnership will enable healthcare providers and patients in these regions to access these life-saving tests more easily and efficiently.

-

In December 2023, Quest Diagnostics announced the launch of its new 88-Compound Novel Psychoactive Substance (NPS) Test Panel, a comprehensive test designed to detect and identify novel psychoactive substances (NPS) in urine samples. The 88-Compound NPS Test Panel is designed to help healthcare providers, laboratories, and law enforcement agencies detect and monitor the use of NPS, which are increasingly being used as alternatives to illegal drugs.

-

In October 2023, ProciseDx Inc. received de novo FDA clearance for its groundbreaking therapeutic drug monitoring (TDM) tests for adalimumab and infliximab innovative tests, called Procise ADL and Procise IFX, which enable healthcare professionals to accurately quantify the levels of adalimumab and infliximab in patients suffering from inflammatory bowel diseases (IBD) who are undergoing treatment with these medications.

-

In July 2023, Siemens Healthineers launched its Atellica RX Series and CI analyzer, a next-generation immunoassay analyzer that can perform high-volume testing for toxicology and other clinical chemistry applications.

Drug Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.38 billion

Revenue forecast in 2030

USD 8.45 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sample, drug, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Quest Diagnostics Incorporated; Abbott; F. Hoffmann-La Roche Ltd.; Quidel Corporation; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Laboratory Corporation of America Holdings; Clinical Reference Laboratory Inc.; Cordant Health Solutions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drug Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drug testing market report based on product, sample, drug, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Instruments

-

Rapid Testing Devices

-

Services

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Urine Samples

-

Oral Fluid Samples

-

Hair Samples

-

Other Samples

-

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Alcohol

-

Cannabis/Marijuana

-

Cocaine

-

Opioids

-

Amphetamine & Methamphetamine

-

LSD

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Testing Laboratories

-

Workplaces

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global drug testing market size was estimated at USD 6.12 billion in 2023 and is expected to reach USD 6.38 billion in 2024.

b. The global drug testing market is expected to grow at a compound annual growth rate of 4.79% from 2024 to 2030 to reach USD 8.45 billion by 2030.

b. The consumables segment dominated the drug testing market in 2023 with a revenue share of 36.16%.

b. The urine samples segment dominated the drug testing market and accounted for the largest revenue share of 40.07% in 2023.

b. The cannabis/marijuana segment dominated the market for drug testing and accounted for the largest revenue share of 24.85% in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."