- Home

- »

- Clinical Diagnostics

- »

-

Drug Of Abuse Testing Services Market Size Report, 2030GVR Report cover

![Drug Of Abuse Testing Services Market Size, Share & Trends Report]()

Drug Of Abuse Testing Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug (Alcohol, Cannabis/Marijuana, Cocaine, Opioids, Amphetamine & Methamphetamine, LSD), By Region And Segment Forecasts

- Report ID: GVR-2-68038-254-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drug Of Abuse Testing Services Market Summary

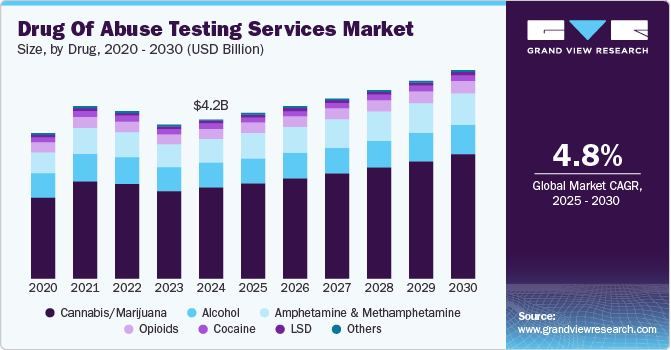

The global drug of abuse testing services market size was estimated at USD 4.17 billion in 2024 and is projected to reach USD 5.46 billion by 2030, growing at a CAGR of 4.8% from 2025 to 2030. The market is experiencing growth driven by the launch of new testing programs and an increasing prevalence of substance use disorders, including marijuana, and opioids across the workplace.

Key Market Trends & Insights

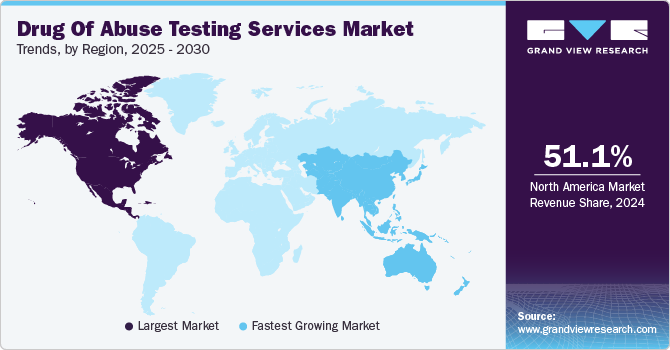

- North America drug of abuse testing services market dominated and accounted for a 51.1% share in 2024.

- The Asia Pacific drug of abuse testing services market is expected to experience the highest growth rate of 5.7% CAGR during the forecast period.

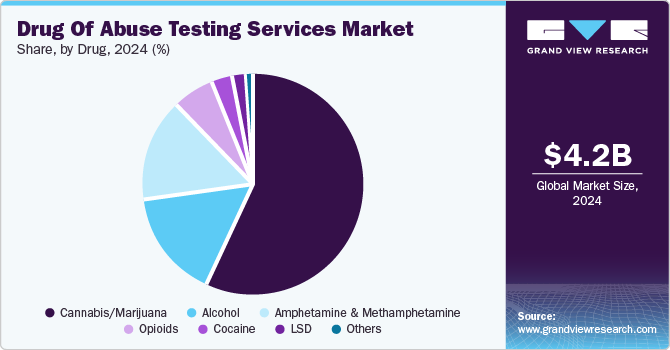

- Based on drug, the cannabis/marijuana segment captured the largest revenue share at 57.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.17 Billion

- 2030 Projected Market Size: USD 5.46 Billion

- CAGR (2025-2030): 4.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to the United Nations Office on Drugs and Crime (UNODC), over 270 million individuals worldwide used drugs in 2020, and the 2021 World Drug Report noted that more than 36 million people experienced substance use disorders.

The global demand for drug testing services is likely to increase, supported by significant marijuana usage, estimated at 158.8 million users, representing more than 3.8% of the global population, according to United Nations data. Additionally, the National Survey on Drug Use and Health (NSDUH) by SAMHSA indicated that in 2021, around 61.2 million people aged 12 or older, about 21.9% of the U.S. population used illicit drugs in 2020, with 52.5 million of them using marijuana. This rise in cannabis and marijuana use, particularly among young people, is boosting demand for testing services.

The COVID-19 pandemic further amplified the need for drug testing, with overdose-related fatalities in the U.S. reaching 91,799 in 2020. Overdose deaths rose by 31% from 2019 to 2020, with a further increase to 106,699 deaths in 2021, an age-adjusted rate of 32.4 per 100,000 people. These trends support the urgency for comprehensive drug testing services, especially amid the pandemic.

Awareness is growing about the importance of addressing addiction and misuse of illicit drugs among both youth and adults, driving market expansion for drug abuse testing services. In response, companies are increasingly developing targeted services and initiatives. For instance, in March 2022, Texas Health & Human Services launched a $23.2 million public awareness campaign to prevent substance abuse disorders and improve access to treatment and support services.

Drug Insights

The cannabis/marijuana segment captured the largest revenue share at 57.3% in 2024. Cannabis remains one of the most commonly consumed illicit substances globally. According to recent reports, millions of people use cannabis recreationally and medicinally, and this high prevalence has spurred demand for cannabis-specific testing. Legalization initiatives in many countries and U.S. states have led to an increase in consumption, especially among young adults, which has raised public health concerns around impairment, driving safety, and workplace productivity.

The expansion of cannabis testing is further fueled by employer mandates and government regulations. Many workplaces, educational institutions, and even sports organizations require regular drug screening to ensure safety and compliance, particularly in safety-sensitive roles. Additionally, law enforcement agencies increasingly need reliable testing solutions due to driving under the influence (DUI) cases related to cannabis use. Advances in rapid, accurate testing technologies have also made cannabis detection more accessible, contributing to the segment’s market dominance. Collectively, these factors position the cannabis segment as a key driver within the drug testing services industry.

The cannabis/marijuana segment is also likely to grow at a fastest CAGR of 5.5% over the forecast period. The World Health Organization estimates that about 147 million people, roughly 2.5% of the global population, use cannabis annually, significantly higher than the 0.2% who consume opioids or cocaine. Consequently, cannabis-related testing is expected to see increased demand, as it is widely utilized in criminal justice, rehabilitation centers, workplace safety initiatives, and clinical screening programs, among other settings.

Regional Insights

North America drug of abuse testing services market dominated and accounted for a 51.1% share in 2024. The demand for drug testing is increasing due to factors like rising addiction rates, greater drug use in workplaces, and a higher incidence of accidents, along with established healthcare infrastructure. The National Council on Alcoholism & Drug Dependence (NCADD) estimates that 70% of the 14.8 million Americans who misuse substances are employed. Similarly, the National Drug-Free Workplace Alliance reports that over 74% of individuals using illegal drugs have jobs, contributing to up to 40% of industrial fatalities in the U.S. Additionally, data from the Ministry of Foreign Affairs of China shows that among U.S. drug users, 46% have used cannabis and prescription stimulants, 36% opioids and methamphetamine, 31% other prescription stimulants, 15% heroin, and 10% cocaine. Consequently, drug testing has become an essential approach in the region for maintaining workplace safety and employee well-being.

U.S. Drug Of Abuse Testing Services Market Trends

The U.S. drug of abuse testing services market is projected to grow significantly during the forecast period, driven by rising substance abuse rates and the increasing demand for workplace drug testing programs. Government initiatives, such as the Substance Abuse and Mental Health Services Administration's (SAMHSA) efforts to curb opioid and drug abuse, drive growth by promoting testing accessibility. Additionally, advancements in rapid testing technology and the expansion of testing in schools, hospitals, and criminal justice systems are contributing factors.

Europe Drug Of Abuse Testing Services Market Trends

The Europe drug of abuse testing services market is likely to emerge as a lucrative region in the industry. Governments across Europe are increasingly implementing policies that require drug testing in workplaces and public institutions to address safety concerns and improve public health. Enhanced technology for quicker, more reliable testing and the rise in point-of-care testing availability further contribute to growth.

The UK drug of abuse testing services market is projected to grow during the forecast period. Employers are increasingly adopting drug testing to maintain workplace safety and productivity, especially in industries like transportation and construction. Additionally, NHS initiatives and local government programs aiming to curb drug-related incidents contribute to market expansion

The France drug of abuse testing services market is expected to show steady growth over the forecast period, driven by increasing concerns over substance abuse and its societal impact. The French government has implemented various health initiatives aimed at reducing drug-related harm, which includes promoting drug testing in both workplace and healthcare settings. Moreover, the rise in opioid and cannabis use has heightened the need for effective testing solutions.

The Germany drug of abuse testing services market is projected to expand during the forecast period. The German government has implemented strict regulations and guidelines around drug testing in workplaces and educational institutions, fostering a proactive approach to substance abuse prevention.

Asia Pacific Drug Of Abuse Testing Services Market Trends

The Asia Pacific drug of abuse testing services market is expected to experience the highest growth rate of 5.7% CAGR during the forecast period. Countries like Australia, Japan, and India are implementing stringent regulations and policies aimed at curbing drug misuse, driving demand for testing services in workplaces, healthcare, and rehabilitation centers. The rise of synthetic drugs and opioids has intensified the need for effective drug testing solutions.

The China drug of abuse testing services market is projected to expand throughout the forecast period, driven by increasing public awareness of drug-related health risks and the societal impacts of addiction contribute to market demand. The expansion of testing technologies, including rapid testing kits and improved laboratory services, further supports the growth of the market in China, alongside investments in prevention and rehabilitation programs.

The Japan drug of abuse testing services market is anticipated to grow during the forecast period, due to rising concerns about substance abuse, particularly with opioids and new psychoactive substances. The Japanese government has intensified its efforts to combat drug misuse, implementing stricter regulations and increasing funding for drug prevention and rehabilitation programs. This has led to a growing demand for drug testing in workplaces, schools, and healthcare settings.

Latin America Drug Of Abuse Testing Services Market Trends

The Latin America drug of abuse testing services market is expected to experience significant growth throughout the forecast period. This growth is fueled by the expanding footprint of major industry players in the region. Numerous prominent companies have established testing laboratories in countries like Brazil and Mexico to strengthen their competitive position. Furthermore, the growing incidence of substance use disorders is expected to generate significant opportunities within the market.

The Brazil drug of abuse testing services market is anticipated to grow during the forecast period, mainly due to the high rates of drug abuse in the country. This increasing prevalence is likely to drive substantial demand for drug testing services. To meet this rising need, several major players in the industry are entering the Brazilian market, utilizing both organic and inorganic growth strategies to strengthen their presence and enhance their capabilities.

Saudi Arabia Drug Of Abuse Testing Services Market Trends

The Saudi Arabia drug of abuse testing services market is anticipated to experience substantial growth during the forecast period. This growth can be attributed primarily to the rising rates of substance abuse and the increasing adoption of workplace drug testing services. For example, in September 2022, Saudi authorities seized amphetamine pills worth USD 47 million. Over the past few decades, pre-employment drug screening has become a standard requirement in numerous workplaces. In Saudi Arabia, government-accredited laboratories process around 46,000 samples each year for pre-employment screenings, highlighting the significant demand for drug testing services in the region.

Key Drug Of Abuse Testing Services Company Insights

The major players in the market are actively pursuing strategic initiatives, including product launches, mergers and acquisitions, and partnerships, to enhance their competitive positioning. Additionally, many companies are concentrating on developing new testing services, thereby increasing demand. For instance, in December 2022, Omega Laboratories announced the launch of urine drug of abuse testing services in Canada. Furthermore, starting in January 2023, the laboratory will introduce urine testing to complement its existing molecular testing offerings, showcasing their commitment to expanding service capabilities and meeting market needs.

Key Drug Of Abuse Testing Services Companies:

The following are the leading companies in the drug of abuse testing services market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics

- Abbott

- Clinical Reference Laboratory (CRL), Inc.

- Laboratory Corporation of America Holdings

- Cordant Health Solutions

- Legacy Medical Services

- DrugScan

- Omega Laboratories, Inc.

- Psychemedics Corporation

- Millennium Health, LLC

Recent Developments

-

In September 2024, Quest Diagnostics acquired select laboratory assets from Allina Health. The objective of the agreement is to give patients and physicians in Minnesota and western Wisconsin better access to reasonably priced, highquality laboratory services.

-

In August 2024, Quest Diagnostics, a leading supplier of diagnostic information services, and University Hospitals, one of the nation's leading nonprofit health systems and academic medical centers, signed an agreement for Quest to purchase select assets of University Hospitals' outreach laboratory services business

-

In May 2024, Omega Laboratories announced a partnership with Cannabix Technologies Inc. to integrate Cannabix’s advanced THC breathalyzer into Omega’s drug testing services. This collaboration made Omega the exclusive provider of laboratory services for Cannabix, enhancing its drug testing accuracy & efficiency.

Drug Of Abuse Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.32 billion

Revenue forecast in 2030

USD 5.46 billion

Growth Rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa.

Key companies profiled

Quest Diagnostics; Abbott; Clinical Reference Laboratory (CRL), Inc.; Laboratory Corporation of America Holdings; Cordant Health Solutions; Legacy Medical Services; DrugScan; Omega Laboratories, Inc.; Psychemedics Corporation; Millennium Health, LLC; Mayo Clinic Laboratories; Precision Diagnostics; American Substance Abuse Professionals (ASAP), Inc.; United States Drug Testing Laboratories (USDTL), Inc.; LGC Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

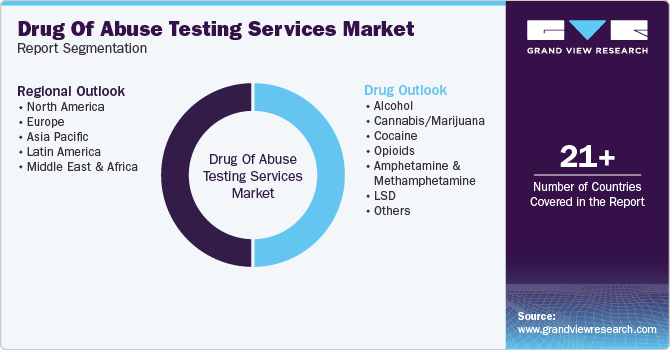

Global Drug Of Abuse Testing Services Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drug of abuse testing services market report on the basis of drug and region:

-

Drug Outlook (Revenue, USD Million; 2018 - 2030)

-

Alcohol

-

Cannabis/Marijuana

-

Cocaine

-

Opioids

-

Amphetamine & Methamphetamine

-

LSD

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global drug of abuse testing services market size was estimated at USD 4.17 billion in 2024 and is expected to reach USD 4.32 billion in 2025.

b. The global drug of abuse testing services market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030 to reach USD 5.46 billion by 2030.

b. The cannabis segment dominated the drug of abuse testing services market with a share of 57.3% in 2024. This is attributable to the increased cannabis abuse in key regions such as North America and Europe.

b. Some key players operating in the drug of abuse testing services market include Laboratory Corporation of America Holdings (LabCorp); Alere Inc.; United States Drug Testing Laboratories, Inc. (USDTL); and Quest Diagnostics, Inc.

b. Key factors that are driving the drug of abuse testing services market growth include the rising prevalence of drug abuse, the introduction of advanced drug testing solutions, and increasing government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.