- Home

- »

- Pharmaceuticals

- »

-

Opioids Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Opioid Market Size, Share & Trends Report]()

Opioid Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (IR/ Short Acting Opioids, ER/Long-Acting Opioids), By Application (Pain Relief, Anesthesia), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-131-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Opioid Market Summary

The global opioid market size was estimated at USD 22.8 billion in 2022 and is projected to reach USD 25.3 billion by 2030, growing at a CAGR of 1.4% from 2023 to 2030. Increasing approval and the launch of new opioid medicines to treat patients with chronic pain are the factors expected to drive market growth.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 63.7% in 2022.

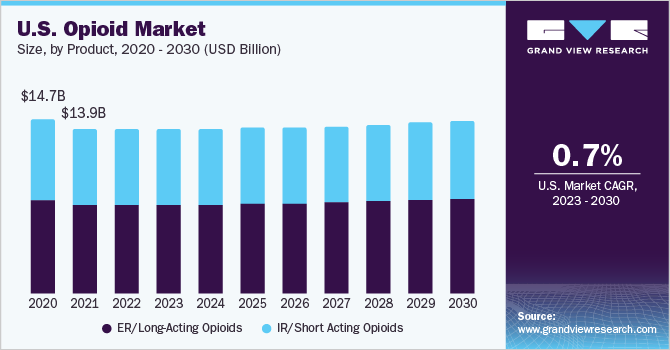

- By product, the ER/long-acting opioids segment accounted for the largest revenue share of 54.2% in 2022.

- By application, the pain relief segment accounted for the largest revenue share of 66.4% in 2022.

- By route of administration, the injectable segment accounted for the largest revenue share of 54.1 in 2022.

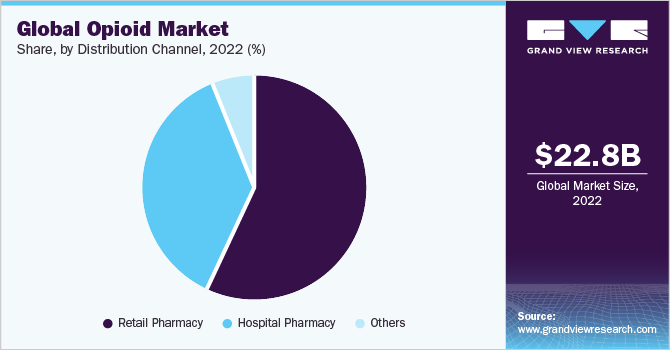

- By distribution channels, the retail pharmacy accounted for the largest revenue share of 57.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 22.8 Billion

- 2030 Projected Market Size: USD 25.3 Billion

- CAGR (2023-2030): 1.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

For instance, in August 2020, the Food and Drug Administration in the U.S. approved Olinvyk (oliceridine), an injection developed by Trevena, Inc., for treating adults with acute pain. Olinvyk is an opioid agonist administrated intravenously to patients and costs around USD 194 for a supply of 10 mL. During the initial phase of COVID-19, the market for opioids was negatively impacted due to the low hospitalization rate, COVID-19-mandated changes in policy, decline in surgeries and dental procedures led to a reduction in opioid prescriptions. According to the National Library of Medicine report (July 2022), the prescription-based opioid purchasing rate declined by 23.8% in the five years before the pandemic. Developed countries like the U.S. and Canada witnessed a decline in opioids prescription after March 2020.

Elder population is at high risk of chronic diseases such as cardiovascular diseases, arthritis, and cancer due to the high comorbid conditions. According to the World Health Organization (WHO), the geriatric population increased from 1.0 million in 2020 to 1.4 million in 2021. Declining fertility and mortality rates are some factors contributing to the geriatric population's rise. The impact of chronic pain increases with age and is highest among adults aged 65 years and above. Therefore, the rising geriatric population is anticipated to increase the demand for opioid drugs to manage chronic pain.

However, the side effects associated with drug addiction and misuse may restrain the market growth. According to the WHO, around 0.5 million people died due to the misuse of drugs in 2021. Furthermore, the Millennium Health's Signals report (2020) revealed that there was a rise in non-prescribed fentanyl by 32.0%, methamphetamine by 20.0% and Cocaine by 10.0% from March to May 2020. Thus, the implementation of strict regulation on the use of opioids is expected to restrain the market growth during the forecast period.

Product Insights

Based on product, the global opioids market is segmented into IR/short-acting opioids and ER/long-acting opioids. The ER/long-acting opioids segment accounted for the largest revenue share of 54.2% in 2022 and is expected to grow at the fastest CAGR of 1.7% during the forecast period. This dominance is attributed to the wide availability of extended-release long-acting opioids. Some commonly prescribed ER/long-acting opioids include Oxycodone, Hydrocodone, Methadone, Fentanyl, Morphine, and Oxymorphone. Fentanyl is a synthetic opioid approved for treating severe chronic pain that arises in advanced-stage cancer patients. Thus, the rising incidence of chronic diseases is expected to fuel segment growth.

According to the Centers for Disease Control and Prevention (CDC), about six in ten people in the U.S. suffer from chronic diseases such as cancer, stroke, cardiovascular diseases, and diabetes. Patients with these chronic diseases witness severe pain, increasing demand for extended-release tablets for pain relief, driving the segment's growth.

Application Insights

Based on application, the global is segmented into anesthesia, pain relief, cough suppression, de-addiction, and diarrhea suppression. The pain relief segment accounted for the largest revenue share of 66.4% in 2022. This growth can be attributed to the increased demand for opioids to manage postoperative pain. According to the National Library of Medicine (2020), globally, around 310.0 million surgeries are performed annually, of which 20.0 million and 40.0 to 50.0 million were performed in Europe and the U.S., respectively. Thus, increasing surgical operations augment the demand for medicines to manage postoperative pain.

The anesthesia segment is expected to grow at the fastest CAGR of 2.0% over the forecast period. Intravenous opioids are commonly used to provide analgesia and supplement sedation during general anesthesia. Thus, increasing anesthesia practices are anticipated to boost demand for intravenous opioids, thereby driving market growth.

Route Of Administration Insights

Based on the route of administration, the market is segmented into oral, injectables, and others. The injectable segment accounted for the largest revenue share of 54.1 in 2022. This can be attributed to the increasing approval of novel opioid injectables. For instance, in April 2021, the U.S. FDA approved morphine sulfate injection, an opioid analgesic for managing severe pain arising from different conditions. This approval is anticipated to drive segment growth.

The oral segment is expected to grow at the fastest CAGR of 2.1% over the forecast period. The oral segment is anticipated to be the fastest-growing segment during the forecast period due to the approval of opioid tablets. For instance, in October 2021, the U.S. FDA approved celecoxib and tramadol hydrochloride (Seglentis), a combined non-steroidal anti-inflammatory and opioid agonist, for treating adults with acute pain. Such approvals and the introduction of the products are expected to fuel segment growth.

Distribution Channel Insights

Based on distribution channels, the market is segmented into hospital pharmacies, retail pharmacies, and others. The retail pharmacy accounted for the largest revenue share of 57.0% in 2022. and is also expected to grow at the fastest CAGR of 1.7% due to the easy availability of medicines at retail pharmacies and the high opioid dispensing rate.

According to the CDC, around 142.81 million opioid prescriptions were registered in the U.S., with an opioid dispensing rate of 43.3 per 100 people in 2020. Thus, the high prescription registration is also anticipated to segment growth.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 63.7% in 2022. This dominance can be attributed to the increasing approval of opioid-based medicines to meet the growing unmet medical needs in the region. For instance, in May 2020, Hikma Pharmaceuticals launched a generic version of Buprenex, a Buprenorphine Hydrochloride Injection; in the U.S., Buprenex is a prescription opioid for treating patients with moderate to severe pain. This injection helps in severe pain management. It costs around USD 89 for a 5mL solution of injection administrated intravenously.

Asia Pacific is expected to grow at the fastest CAGR of 5.5% during the forecast period. The region's growth can be attributed to the initiatives undertaken by the government to control opioid misuse in the region. For instance, in February 2022, the New Zealand Medicines and Medical Devices Safety Authority (Med Safe) was planning to issue warning labels about the risk associated with opioid overdose on opioid medicines. This measure may increase the prescription rate for high-quality opioids intended for pain management, thereby driving the opioids market growth.

Key Companies & Market Share Insights

Major players are adopting strategies such as mergers & acquisitions for regional expansion and greater market share. For instance, in August 2022, Adalvo acquired Onsolis, a branded opioid product, from a U.S.-based pharmacy company. This opioid is indicated for the management of chronic pain in cancer. This acquisition strengthens the company's opioid product portfolio and offers a high growth opportunity for the company. In January 2022, Trevena, Inc. announced that the Chinese National Medical Products Administration (NMPA) accepted the application of a New Drug Application for oliceridine injection, approved by the Food and Drug Administration in the United States for use in young people for the treatment of chronic pain that is so severe to be treated with an intravenous opioid analgesic. In August 2022, Adalvo announced the acquisition of Onsolis, a branded opioid medicine. The drug is recommended for the treatment of chronic pain in cancer patients. This acquisition aided in the expansion of the company's opioid product range. The following are some of the major participants in the global opioid market:

-

Purdue Pharma L.P.

-

Johnson & Johnson Services, Inc.

-

Hikma Pharmaceuticals PLC

-

Pfizer, Inc.

-

AbbVie Inc.

-

Sanofi

-

Sun Pharmaceutical Industries Ltd

-

Grünenthal

Opioid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.9 billion

Revenue forecast in 2030

USD 25.3 billion

Growth rate

CAGR of 1.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Purdue Pharma L.P.; Johnson & Johnson Services, Inc.; Hikma Pharmaceuticals PLC; Pfizer, Inc.; AbbVie Inc.; Sanofi; Sun Pharmaceutical Industries Ltd; Grünenthal

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Opioid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global opioid market report based on product, application, route of administration, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

IR/Short Acting Opioids

-

Immediate- Release/Short-Acting Opioid by Product

-

Codeine

-

Oxycodone

-

Hydrocodone

-

Fentanyl

-

Morphine

-

Hydroxymorphone

-

Oxymorphone

-

Propoxyphene

-

Other IR

-

-

Immediate- Release/Short-Acting Opioid by Application

-

Pain relief

-

Anesthesia

-

Cough Suppression

-

Diarrhea Suppression

-

De-addiction

-

-

-

ER/Long-Acting Opioids

-

Extended-Release/Long-Acting Opioid by Product

-

Codeine

-

Oxycodone

-

Hydrocodone

-

Fentanyl

-

Morphine

-

Hydroxymorphone

-

Oxymorphone

-

Propoxyphene

-

Other IR

-

-

Extended-Release/Long-Acting Opioid by Application

-

Pain relief

-

Anesthesia

-

Cough Suppression

-

Diarrhea Suppression

-

De-addiction

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain relief

-

Anesthesia

-

Cough Suppression

-

Diarrhea Suppression

-

De-addiction

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global opioid market size was valued at USD 22.8 billion in 2022 and is expected to reach USD 22.9 billion in 2023.

b. The global opioid market is expected to witness a compound annual growth rate of 1.4% from 2023 to 2030, to reach USD 25.3 billion by 2030.

b. North America held the largest share of 63.6% in 2022 due to higher consumption in this region. However, the region is likely to witness a decline in its market share over the forecast period owing to rising government initiatives to combat the crisis in the U.S.

b. Some of the key market players are Purdue Pharma L.P.; Allergan; West-Ward Pharmaceuticals Corporation; Janssen Pharmaceuticals, Inc.; Pfizer, Inc.; Egalet Corporation; and Sun Pharmaceutical Industries Limited.

b. Key factors driving the opioid market are approval of new drugs such as Olinvyk and rising incidence of target diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.