- Home

- »

- Plastics, Polymers & Resins

- »

-

Dunnage Packaging Market Size, Industry Report, 2030GVR Report cover

![Dunnage Packaging Market Size, Share & Trends Report]()

Dunnage Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Raw Material (Corrugated Plastic, Molded Plastic, Aluminum), By Application (Automotive, Aerospace, Electronics, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-925-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dunnage Packaging Market Size & Trends

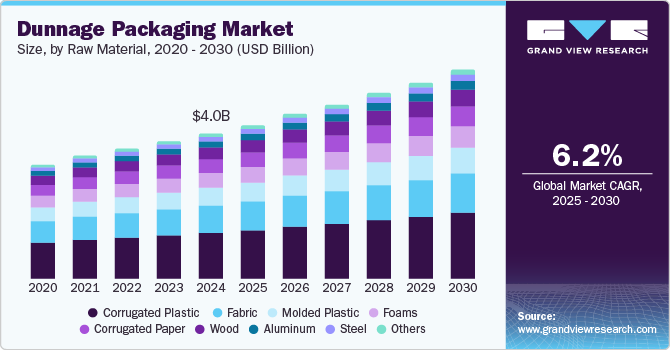

The global dunnage packaging market was estimated at USD 4.0 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030. The increasing growth of e-commerce has led to a higher demand for protective packaging solutions as businesses seek to ensure the safe delivery of products to customers. Dunnage packaging is particularly important for protecting goods during shipping, especially for high-volume and large-scale shipments. Expanding global supply chains and logistics networks further drive the need for efficient packaging that minimizes damage during transit. As logistics operations grow, companies require cost-effective and reusable packaging, making dunnage packaging a preferred choice. This shift toward safer, more sustainable packaging solutions is boosting the demand for the dunnage packaging industry.

The increasing need to protect fragile or high-value products during shipping drives the demand for dunnage packaging. Products such as electronics, glass, automotive parts, and pharmaceuticals require extra care to avoid damage during transit, and dunnage packaging provides an effective solution. In addition, the rise in returns, especially in e-commerce sectors such as electronics and fashion, has highlighted the importance of using protective packaging to reduce damage and minimize return costs. As businesses seek to reduce these costs and ensure products reach consumers in perfect condition, the demand for reliable packaging solutions grows. This growing need for product protection is significantly contributing to the growth of the dunnage packaging industry.

In addition, technological advancements in packaging design have led to the development of more efficient, lightweight, and cost-effective dunnage packaging solutions. These innovations allow for better customization, ensuring that packaging fits various product-specific needs and improving the overall packaging experience. Moreover, integrating smart technologies, such as sensors and RFID, into dunnage packaging enables real-time monitoring of goods during transit. These enhance safety, reduce losses, and ensure that products arrive optimally. These advancements are playing a key role in the growth of the dunnage packaging industry.

Raw Material Insights

The corrugated plastic segment dominated the market and accounted for the largest revenue share of 30.3% in 2024, driven by its lightweight, durable, and protective qualities during transportation. This material is well-suited to safeguard goods, especially in industries such as automotive and electronics, due to its ability to withstand moisture and impact. As companies seek more sustainable packaging options, the demand for recyclable corrugated plastics is increasing. This preference for eco-friendly packaging solutions further strengthens corrugated plastics' market position. As a result, corrugated plastics play a significant role in the growth of the dunnage packaging industry.

The foams segment is expected to grow at a significant CAGR over the forecast period due to their versatility and effectiveness in cushioning products during transit. Foams provide superior shock absorption and are widely used in various applications, including electronics and fragile goods. As e-commerce expands, the need for reliable packaging solutions that prevent damage during shipping is driving the demand for foam materials.

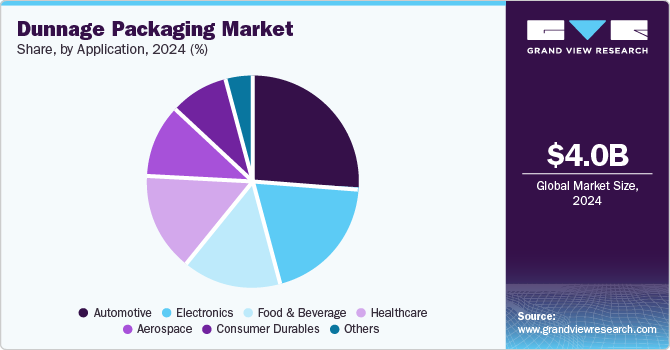

Application Insights

The automotive segment dominated the market with the largest revenue share in 2024, which can be attributed to the rising need for protective packaging to ensure the safe transport of automotive parts and components. As production volumes in the automotive industry increase, the reliance on dunnage packaging to prevent damage during shipping also grows. Manufacturers are focused on maintaining quality and safety standards, which makes dunnage solutions essential for their operations. Tailored dunnage packaging solutions are being increasingly adopted to meet the specific needs of the automotive sector. This growing demand for specialized packaging is contributing to the expansion of the dunnage packaging industry.

The electronics segment is projected to grow at the highest CAGR over the forecast period due to the rising demand for secure packaging that protects sensitive electronic components. As technology advances and consumer electronics become more sophisticated, the need for effective dunnage solutions that minimize risks during transportation is becoming crucial. This growth is further fueled by the expanding e-commerce sector, which requires reliable packaging to ensure products arrive in perfect condition.

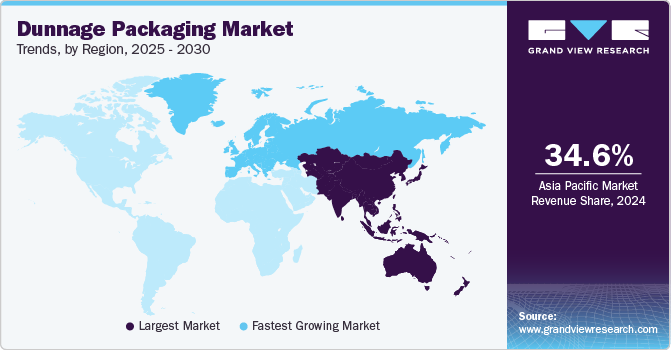

Regional Insights

The North America dunnage packaging market held a substantial market share in 2024, fueled by advancements in packaging technology and a strong focus on supply chain optimization. The region's robust manufacturing base and high levels of e-commerce activity contribute significantly to the demand for effective dunnage solutions. In addition, businesses increasingly recognize the importance of protecting their products during transit, which bolsters the market's growth.

Asia Pacific Dunnage Packaging Market Trends

Asia Pacific dunnage packaging market held the highest revenue share of 34.6% in 2024, driven by rapid industrialization and a booming e-commerce sector. The region's strong manufacturing capabilities necessitate effective packaging solutions to safeguard products during shipping. Furthermore, increasing consumer awareness regarding product protection has led businesses to invest in high-quality dunnage materials that ensure safe deliveries.

The China dunnage packaging market dominated the Asia Pacific with a significant revenue share in 2024 due to its expansive manufacturing sector and thriving e-commerce industry. China's position as a global manufacturing hub drives demand for efficient dunnage solutions that protect goods during transit. The country's commitment to sustainability also promotes adopting eco-friendly dunnage materials, aligning with global trends toward environmentally responsible packaging.

Europe Dunnage Packaging Market Trends

Europe dunnage packaging market is expected to register a significant CAGR over the forecast period, which can be attributed to increasing investments in sustainable packaging practices across various industries. The region's focus on reducing environmental impact drives companies to adopt recyclable and biodegradable dunnage materials. Moreover, expanding sectors such as food and beverage, automotive, and pharmaceuticals enhance demand for effective protective packaging solutions.

Dunnage packaging market in Germany dominated Europe with a significant revenue share in 2024 driven by its strong automotive sector. As Germany is recognized for its engineering excellence, there is a growing need for effective dunnage solutions that protect sensitive automotive components during transportation. The export-oriented nature of Germany's automotive industry further amplifies the demand for reliable packaging that ensures products reach their destinations without damage.

Key Dunnage Packaging Company Insights

Key companies in the global dunnage packaging industry are Nefab Group; UFP Technologies, Inc.; Reusable Transport Packaging; mjsolpac Ltd, and Ckdpack. These players adopt numerous strategies to improve their competitive edge. Strategic partnerships are formed to leverage complementary strengths, improve product offerings, and expand distribution networks. In addition, mergers and acquisitions enable companies to consolidate resources, enter new markets, and diversify their product lines. Furthermore, new product launches focus on innovation and meeting evolving consumer preferences, allowing companies to capture market share.

-

Nefab Group offers a range of dunnage packaging solutions designed to enhance product protection during transportation. Its product lineup includes wooden pallet collars, collapsible wooden crates, foldable no-nail boxes, and foam cushioning to ensure secure packing. The company also provides specialized options such as VCI packaging for corrosion protection and ESD containers for electronic components.

-

UFP Technologies, Inc. offers various dunnage packaging products and solutions to protect goods during transportation and storage. Its offerings include foam inserts, pallet cushions, and airbags, which provide effective cushioning to prevent damage to fragile items. The company specializes in customized packaging solutions to meet customer needs and ensure optimal application protection.

Key Dunnage Packaging Companies:

The following are the leading companies in the dunnage packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Nefab Group

- UFP Technologies, Inc.

- Reusable Transport Packaging

- mjsolpac Ltd

- Ckdpack

- GWP Group

- Interior Packaging Design, LLC.

- Packaging Corporation of America

- Dunnage Engineering

- ORBIS Corporations

Recent Developments

-

In July 2023, Nefab announced the opening of a new manufacturing facility in Mexico. This facility enhanced its production capabilities and better served its customers in North America. It focused on producing wood and plywood crating and thermoformed and corrugated packaging solutions. The expansion is designed to improve operational efficiency and reduce lead times to meet growing market demands.

-

In May 2023,Orbis Corporation announced the addition to its product lineup of a new heavy-duty BulkPak container measuring 48x45 inches. This innovative container is designed to enhance the efficiency of bulk handling and storage, catering specifically to the needs of various industries. The new BulkPak is constructed to withstand rigorous use, providing a durable solution for transporting goods while optimizing space and reducing costs.

Dunnage Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.3 billion

Revenue forecast in 2030

USD 5.8 billion

Growth Rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, France, UK, Spain, Netherlands, China, India, Japan, Australia, Brazil, Argentina, UAE

Key companies profiled

Nefab Group; UFP Technologies, Inc.; Reusable Transport Packaging; mjsolpac Ltd; Ckdpack; GWP Group; Interior Packaging Design, LLC.; Packaging Corporation of America; Dunnage Engineering; ORBIS Corporation.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

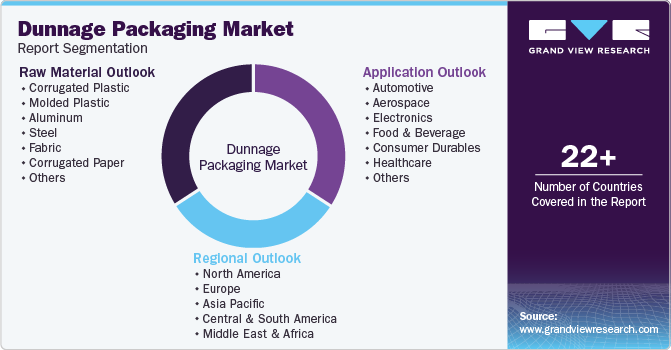

Global Dunnage Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global dunnage packaging market report based on raw material, application, and region.

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Corrugated Plastic

-

Molded Plastic

-

Aluminum

-

Steel

-

Fabric

-

Corrugated Paper

-

Wood

-

Foams

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Electronics

-

Food & Beverage

-

Consumer Durables

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.