- Home

- »

- Healthcare IT

- »

-

Duodenoscopes Market Size & Share, Industry Report, 2030GVR Report cover

![Duodenoscopes Market Size, Share & Trends Report]()

Duodenoscopes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Reusable, Disposable), By Application (Diagnostics, Therapeutics/Treatment), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-556-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Duodenoscopes Market Size & Trends

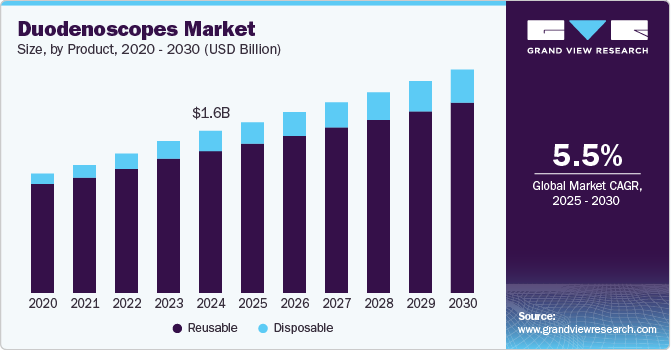

The global duodenoscopes market was valued at USD 1.60 billion in 2024 and is expected to expand at a CAGR of 5.53% from 2025 to 2030. The market growth is driven by increasing incidences of gastrointestinal disorders, technological advancements in endoscopic devices, rising acceptance of ERCP procedures, significant investments in research and development, and supportive regulatory frameworks. These factors contribute to market growth over the forecast period.

The key driver for market growth is the rising prevalence of gastrointestinal disorders, particularly cancers related to the pancreas and bile ducts. The increasing number of diagnoses related to pancreatic cancer, bile duct cancer, and other gastrointestinal diseases necessitate advanced diagnostic tools such as duodenoscopes. For instance, per the Anesthesia Patient Safety Foundation report published in October 2022, over 500,000 endoscopic retrograde cholangiopancreatography (ERCP) procedures are performed annually in the U.S.

Technological innovations play a crucial role in enhancing the capabilities and efficiency of duodenoscopes. For instance, in April 2024, Ambu A/S received U.S. FDA clearance for its new generation duodenoscopy tools, such as Ambu aBox 2 and Ambu aScope Duodeno 2, for use in ERCP procedures.

In addition, continuous advancements in imaging technology improve diagnostic accuracy and procedural outcomes. The introduction of flexible video duodenoscopes has significantly enhanced visualization during procedures, making them more effective than traditional non-video models. Furthermore, developments such as single-use duodenoscopes are emerging to address infection control issues associated with reusable devices.

The growing acceptance and demand for ERCP procedures contribute to market expansion. As healthcare providers increasingly recognize the benefits of minimally invasive techniques for diagnosing and treating conditions affecting the biliary tree and pancreas, the utilization rates for duodenoscopes are expected to rise. This trend is further supported by increased patients' awareness of available treatment options.

Research and development (R&D) investments drive innovation within the market. Companies focus on developing new technologies that enhance device safety and effectiveness while minimizing infection risks. The advancements in duodenoscope technology, particularly in imaging and safety, have led to the launch of new models. For instance, in June 2020, Olympus launched the TJF-Q190V duodenoscope, which received FDA clearance in January 2020 due to its innovative design that includes a sterile, disposable distal endcap to improve reprocessing and reduce contamination risks. This new model aims to facilitate safer ERCP procedures by providing physicians with advanced tools while adhering to stringent patient safety standards.

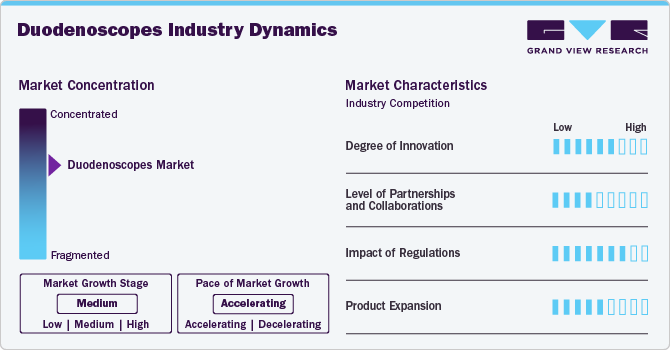

Market Concentration & Characteristics

The market is characterized by a high degree of innovation to improve patient safety and procedural efficiency. Manufacturers focus on single-use disposable devices to reduce cross-contamination risks associated with reusable scopes. For example, Boston Scientific Corporation's EXALT Model D, Single-Use Duodenoscope, Generation 4 eliminates the risk of patient-to-patient infection due to ineffective reprocessing and reduces reprocessing costs with a consistent performance physicians expect in a duodenoscope.

The market is characterized by medium partnership and collaborationactivity, owing to several factors, including the desire to expand the business to cater to the growing demand for duodenoscopes to maintain a competitive edge. For instance, in August 2024, Advanced Sterilization Products (ASP) collaborated with PENTAX Medical to announce that the U.S. FDA had granted clearance for a new ULTRA GI Cycle in their product, the STERRAD 100NX Sterilizer featuring ALLClear Technology. This ULTRA GI Cycle is designed to reprocess duodenoscopes effectively using hydrogen peroxide gas plasma sterilization.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) have established guidelines encouraging manufacturers to innovate while ensuring patient safety. Compliance with these regulations often leads to improved product designs that better serve healthcare providers' needs. Although stringent regulations can pose challenges, they ultimately foster a safer environment for both patients and practitioners.

The market is experiencing growth, driven by factors such as rising gastrointestinal issues and technological advancements. Companies such as Pentax Medical and Olympus are expanding their product lines, including single-use and reusable options.

Product Insights

By product, the reusable segment held a significant revenue share of 87.63% in 2024. This is attributed to the increasing demand for advanced gastrointestinal endoscopic procedures, particularly endoscopic retrograde cholangiopancreatography (ERCP). As healthcare providers seek to improve patient outcomes and procedural efficiency, reusable duodenoscopes have become essential tools due to their ability to perform complex interventions in the biliary and pancreatic systems. Moreover, technological advancements have enhanced the design and functionality of reusable duodenoscopes, making them more effective in clinical settings.

The disposable segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing concerns over infection transmission associated with reusable devices, particularly in high-risk procedures such as endoscopic retrograde cholangiopancreatography (ERCP). Infections associated with contaminated duodenoscopes have revealed serious shortcomings in existing cleaning and disinfection methods, leading healthcare facilities to look for safer alternatives. The intricate design of duodenoscopes, featuring elements such as elevators and various channels that are hard to clean completely, has led to ongoing contamination problems. Consequently, regulatory agencies such as the FDA have suggested moving towards innovative designs, including single-use options or discarded components after each use. Moreover, key advantages include high patient acceptance rates, reduced pain, cost-effectiveness, and lower chances of complications. NIH data from January 2023 indicates an increasing trend of ambulatory minimally invasive procedures in the U.S., which raises the demand for disposable endoscopes in these settings.

Application Insights

By application, the therapeutics/treatment segment held a significant revenue share of 69.18% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This is attributed to the increasing prevalence of gastrointestinal disorders, advancements in medical technology, and a shift toward minimally invasive procedures. As gastrointestinal diseases such as pancreatic cancer, bile duct obstructions, and chronic pancreatitis become more common, the demand for practical diagnostic and therapeutic tools such as duodenoscopes has surged. The American Association for Cancer Research reported that around 26,890 individuals are diagnosed with gastric cancer annually in the U.S. In 2024, it's anticipated that 10,880 people in the U.S. are expected to lose their lives to this disease. Moreover, healthcare providers increasingly prefer minimally invasive techniques due to their associated benefits, such as reduced recovery times and lower complication rates than traditional surgical methods.

The diagnostics segment is anticipated to grow at a lucrative CAGR over the forecast period owing to the diagnostic capabilities of duodenoscopes, which allow therapeutic interventions during the same procedure. This dual functionality means that conditions can be diagnosed and treated immediately, reducing the need for multiple procedures and improving patient outcomes. Integrating duodenoscopes into clinical practice represents a significant advancement in gastrointestinal diagnostics and therapeutics, providing essential tools for managing complex pancreaticobiliary diseases effectively.

End Use Insights

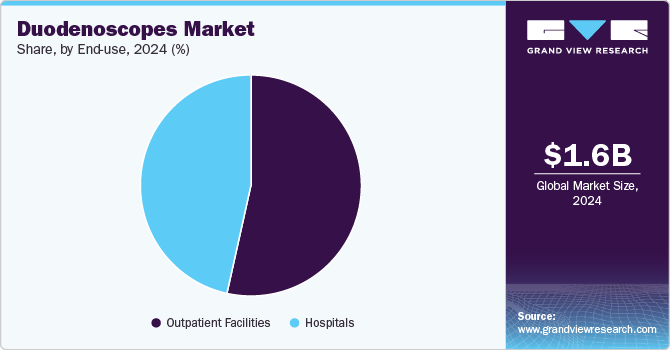

The outpatient facilities segment dominated the market with a revenue share of 53.47% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth of outpatient facilities in the duodenoscopes market is primarily driven by the increasing advancements in medical technology and changing patient preferences towards less invasive procedures. As more patients seek timely diagnosis and treatment for conditions such as pancreatic and bile duct cancers, outpatient facilities have become essential for providing efficient care. The convenience of outpatient settings allows quicker recovery times and reduced hospital stays, which appeal to patients and healthcare providers.

The hospitals segment is anticipated to grow significantly over the forecast period. The growth of hospitals in the duodenoscopes market is primarily driven by the rising technological advancements in duodenoscope design, such as improved imaging capabilities and single-use options that enhance procedural safety and efficacy, encouraging hospitals to adopt these devices more widely. The growing emphasis on infection control standards also compels healthcare facilities to invest in safer, more reliable duodenoscope solutions to mitigate risks associated with cross-contamination. Moreover, increased healthcare spending and investments in medical infrastructure contribute to expanding hospital services related to gastroenterology, further propelling the demand for duodenoscopes.

Regional Insights

North America dominated the duodenoscopes market with a revenue share of 45.64% in 2024. This is due to the increasing healthcare infrastructure. North America's healthcare infrastructure is highly developed, with substantial investments in medical technology and high healthcare expenditures facilitating the adoption of advanced medical devices such as duodenoscopes. In addition, the rising preference for minimally invasive procedures among patients and healthcare providers contributes to the increasing utilization of duodenoscopes. Thus, North America is projected to maintain its dominance in the global market, accounting for a significant share due to these combined factors.

U.S. Duodenoscopes Market Trends

The duodenoscopes market in the U.S. dominated the North American region in 2024, owing to the country's growing government regulations and product developments. For instance, in July 2020, Ambu received FDA clearance for its sterile, single-use duodenoscope, such as the aScope Duodeno. This innovative device is designed specifically for endoscopic retrograde cholangiopancreatography (ERCP) procedures and aims to enhance patient safety by eliminating the risk of cross-contamination associated with reusable duodenoscopes. This advancement addresses significant concerns regarding infection risks in gastrointestinal procedures, which affect approximately 2 million patients annually in the U.S.

Europe Duodenoscopes Market Trends

The duodenoscopes market in Europe is expected to grow significantly over the forecast period due to the availability of advanced products in the region. For instance, the EXALT Model D Duodenoscope is available to hospitals across Europe as an altern ative to traditional reusable duodenoscopes. Its introduction into the market aims to improve patient care by ensuring physicians have access to sterile equipment without the complications associated with cleaning and maintaining reusable devices.

The UK duodenoscopes industry is expected to grow significantly during the forecast period. In the UK, news related to duodenoscopes primarily focuses on the introduction and impact of single-use devices, particularly EXALT Model D, and the ongoing efforts to improve infection control in endoscopy procedures. Cambridge University Hospital was the first hospital in the UK to use the EXALT Model D, which significantly reduces the risk of bile duct infections. In addition, there are ongoing discussions and research regarding the cost-effectiveness of single-use duodenoscopes and the importance of accurate infection risk estimates.

Asia Pacific Duodenoscopes Market Trends

The duodenoscopes industry in Asia Pacific is expected to register the fastest growth rate over the forecast period. Key market players are developing strategies to expand their business in this region. Market growth is expected to be driven by favorable initiatives undertaken by private players, such as training healthcare professionals and increasing R&D investments to develop advanced endoscopes. The growing awareness of pancreatic health and the need for early diagnosis also contribute significantly to market expansion.

India duodenoscopes market is anticipated to register considerable growth over the forecast period. The market in India is primarily driven by the increased preference for minimally invasive surgeries, the availability of favorable reimbursement plans by private insurance companies, and rising disposable income. Furthermore, the high burden of chronic diseases in India and the availability of cancer screening programs are expected to impact market growth positively.

Latin America Duodenoscopes Market Trends

The duodenoscopes industry in Latin America is expected to witness considerable growth over the forecast period due to increasing awareness of the benefits of duodenoscopes and the rising incidence of gastrointestinal disorders. Technological advancements, such as single-use duodenoscopes and integrated technologies for improved safety, are also fueling market expansion.

Brazil duodenoscopes industry is anticipated to register considerable growth during the forecast period. The market in Brazil is experiencing significant growth, driven by the growing trend towards minimally invasive surgical techniques. Further supports this growth, as duodenoscopes offer a less invasive alternative to traditional surgical methods, resulting in reduced recovery times and lower complication rates. Furthermore, increased healthcare access and rising consumer awareness regarding gastrointestinal health contribute to a growing acceptance and demand for these devices among healthcare providers and patients. These factors collectively position the market for robust expansion in Brazil over the coming years.

Middle East & Africa Duodenoscopes Market Trends

The duodenoscopes market in the Middle East and Africa is anticipated to witness considerable growth over the forecast period. As healthcare infrastructure improves across the region, particularly in countries including Saudi Arabia and the UAE, there is a growing emphasis on advanced medical technologies that facilitate minimally invasive procedures. Additionally, government initiatives aimed at enhancing healthcare access and funding for cancer treatment are further propelling market growth.

Saudi Arabia duodenoscopes industry is anticipated to register considerable growth during the forecast period. Initiatives are undertaken to train healthcare professionals in advanced endoscopy techniques. As part of the Saudi-Japan 2030 initiative, a collaboration between the governments of Saudi Arabia and Japan, medical training for endoscopy techniques is included, supporting the advancement of the market.

Key Duodenoscopes Company Insights

Key participants in the duodenoscopes industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Duodenoscopes Companies:

The following are the leading companies in the duodenoscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Ambu A/S

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Ottomed Endoscopy

- SonoScape Medical Corp.

Recent Developments

-

In August 2024, PENTAX Medical, a division of HOYA Group, received clearance from the U.S. Food and Drug Administration (FDA) for a new duodenoscope that incorporates advanced sterilization technology. This development is significant in the medical field, particularly for procedures involving endoscopic retrograde cholangiopancreatography (ERCP).

-

In April 2024, Fujifilm unveiled Tracmotion, its Red Dot Award-winning Endoscopic Submucosal Dissection (ESD) device, during Endocon 2024 held in Delhi.

Duodenoscopes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.69 billion

Revenue forecast in 2030

USD 2.20 billion

Growth rate

CAGR of 5.53% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ambu A/S; Olympus Corporation; Boston Scientific Corporation; PENTAX Medical (Hoya Corporation); FUJIFILM Holdings Corporation; Ottomed Endoscopy; SonoScape Medical Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Duodenoscopes Market Report Segmentation

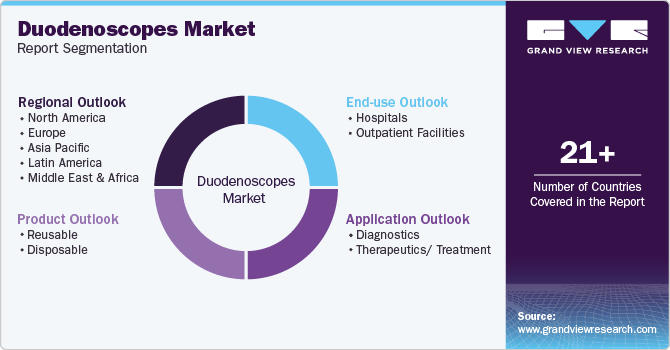

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global duodenoscopes market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Flexile

-

Rigid

-

-

Disposable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Therapeutics/ Treatment

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global duodenoscopes market size was valued at USD 1.60 in 2024 and is expected to reach USD 1.69 billion in 2025.

b. The global duodenoscopes market is expected to grow at a compound annual growth rate of 5.53% from 2025 to 2030, reaching USD 2.20 billion by 2030.

b. The reusable segment dominated the duodenoscopes market with a share of 87.63% in 2024. This is attributed to the increasing demand for advanced gastrointestinal endoscopic procedures, particularly endoscopic retrograde cholangiopancreatography (ERCP).

b. Some key players operating in the duodenoscopes market include Ambu A/S, Olympus Corporation, Boston Scientific Corporation, PENTAX Medical (Hoya Corporation), FUJIFILM Holdings Corporation, Ottomed Endoscopy, and SonoScape Medical Corp.

b. The growth of the duodenoscope market is driven by increasing incidences of gastrointestinal disorders, technological advancements in endoscopic devices, rising acceptance of ERCP procedures, significant investments in research and development, and supportive regulatory frameworks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.