- Home

- »

- Automotive & Transportation

- »

-

E-Bike Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![E-Bike Market Size, Share & Trends Report]()

E-Bike Market (2026 - 2033) Size, Share & Trends Analysis Report By Drive (Belt Drive, Chain Drive), By Battery (Lead-acid Battery, Lithium-ion Battery), By End-use (Personal, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-920-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

E-Bike Market Summary

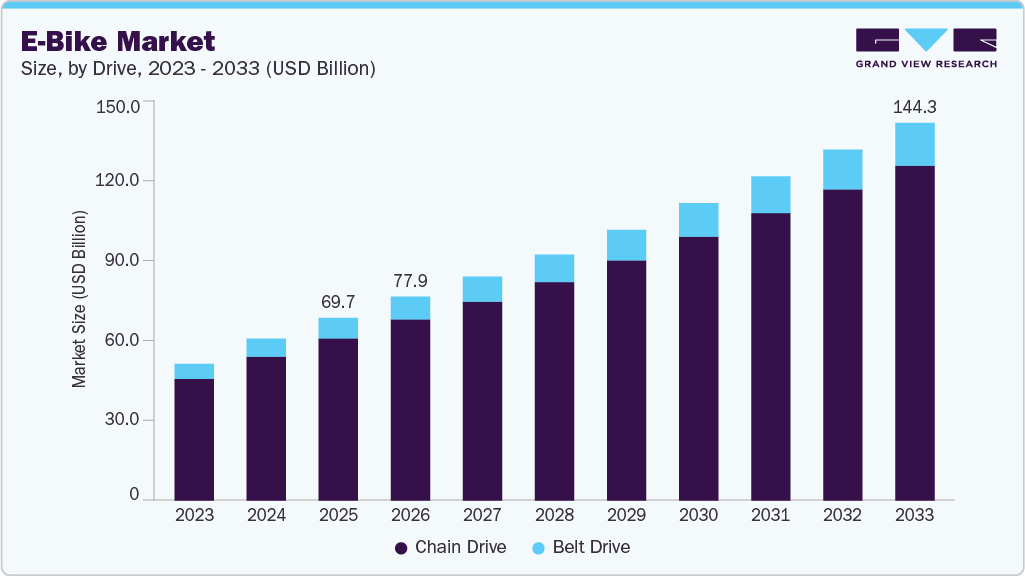

The global e-bike market size was estimated at USD 69.73 billion in 2025 and is projected to reach USD 144.33 billion by 2033, growing at a CAGR of 9.2% from 2026 to 2033. The market has experienced significant growth, driven by increasing consumer preference for sustainable mobility solutions, urbanisation, and government incentives promoting clean transportation.

Key Market Trends & Insights

- The Asia Pacific e-bike market accounted for a 58.7% share of the overall market in 2025.

- The e-bike market in China dominates the APAC market, accounting for the largest global share in production and consumption.

- By drive, the chain drive segment accounted for the largest share of 88.9% in 2025.

- By battery type, the lithium-ion battery segment held the largest market share in 2025.

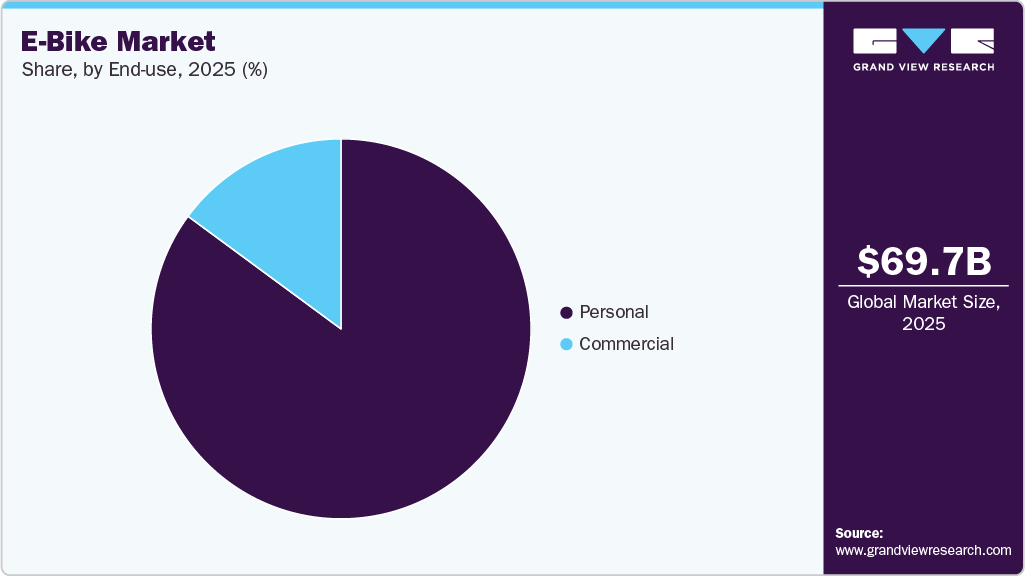

- By end-use, the personal segment led the market with the largest revenue share of 85.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 69.73 Billion

- 2033 Projected Market Size: USD 144.33 Billion

- CAGR (2026-2033): 9.2%

- Asia Pacific: Largest market in 2025

- North America: Fastest market

Several governments are undertaking initiatives to mitigate carbon footprints by encouraging electric vehicles, bikes, and bicycles. The increasing awareness about the harmful effects of vehicles that run on fossil fuels also boosts this trend. Furthermore, governments are focused on constructing bicycle-friendly streets, encouraging individuals to choose bicycles as their mode of transport. Advancements in battery technology have been pivotal to the e-bike industry. The integration of lithium-ion batteries, which offer longer life cycles, faster charging, and greater energy density, has significantly enhanced e-bike performance. Emerging battery chemistries like Lithium-Iron Phosphate (LFP) are gaining traction for their safety and durability.

Simultaneously, innovations in motor technology, including mid-drive motors that provide better weight distribution and torque, are transforming the user experience. Connectivity features, such as app-based monitoring for performance and GPS navigation, are also becoming standard, aligning with the broader trend of smart mobility. Another transformative trend is the development of lightweight materials and aerodynamic designs. Manufacturers are leveraging carbon fiber frames and modular components to reduce the overall weight of e-bikes, making them more efficient and appealing to a broader customer base. In addition, integration with IoT-enabled systems is enabling real-time diagnostics and remote assistance, further enhancing the reliability and convenience of e-bikes.

Despite the market's growth potential, high upfront costs remain a significant barrier to adoption, particularly in developing regions. The reliance on premium materials, advanced battery systems, and sophisticated electronics drives up production costs, resulting in elevated retail prices. Furthermore, inadequate charging infrastructure and limited awareness in certain markets hinder broader adoption.

These trends are particularly reinforcing demand within the broader e-bike market, with pronounced impact across performance-oriented segments such as the e-mountain bike market, where high-torque motors, advanced suspension compatibility, and high-capacity batteries are essential for off-road and rugged terrain applications. Similarly, the e-trekking bike market is emerging as a key growth contributor to the overall e-bike market, supported by improvements in battery efficiency, lightweight frame designs, and ergonomic configurations that enable longer riding ranges and enhanced comfort for urban commuting and long-distance travel.

In parallel, continuous innovation in battery chemistry, energy density, and safety standards is strengthening the foundation of the e-bike market, with the e-bike battery market playing a critical enabling role. Manufacturers are increasingly focused on extending range, reducing charging time, and improving battery lifecycle performance to support diverse use cases across mountain, trekking, and urban e-bikes, thereby accelerating overall market adoption.

Drive Insights

The chain drive segment dominated the market in 2025 with the largest revenue share of 88.9%. The dominance of the chain drive segment in the market is attributed to its proven reliability, cost-effectiveness, and widespread familiarity among manufacturers and consumers. Efficient power transmission is offered by chain drives, making them suitable for diverse riding conditions, including steep terrains and long-distance commutes. Maintenance is simplified due to their modular design, which also ensures compatibility with existing bicycle frameworks.

The belt drive segment is expected to expand at the fastest CAGR during the forecast period. The segment's growth is driven by superior durability, minimal maintenance, and a quieter riding experience. Operated without lubrication, belt drives reduce wear and ensure cleaner performance, appealing to urban and premium users. Advancements in carbon-reinforced belts have enhanced strength and longevity, making them competitive. Their compatibility with mid-drive motors and integration into modern designs further support their adoption, especially in high-end e-bikes. Demand for low-maintenance solutions continues to drive this segment's expansion.

Battery Insights

Based on battery, the lithium-ion battery segment held the largest market share in 2025 and is anticipated to grow at the fastest rate during the forecast period. The growth can be attributed to its superior energy density, lightweight design, and long lifecycle compared to traditional battery technologies. Its ability to deliver extended range and faster charging has made it the preferred choice for manufacturers and consumers alike. Ongoing advancements in battery chemistry, including improved thermal stability and safety, have further strengthened its position in the market. In addition, decreasing production costs and expanding battery recycling initiatives are driving broader adoption, particularly in premium and mid-range e-bike models, solidifying lithium-ion's dominance in the market.

The lead-acid battery segment is experiencing slow growth in the market, hindered by its heavier weight, shorter lifespan, and lower energy density compared to lithium-ion alternatives. However, its low cost continues to make it a viable option for entry-level e-bikes in price-sensitive regions, particularly in emerging markets. In addition, its widespread availability and established recycling infrastructure provide some growth momentum. Despite these factors, environmental concerns and the market's shift toward advanced battery technologies limit its overall potential in the evolving e-bike landscape.

End-use Insights

The personal segment dominated the market with the largest revenue share of 85.1% in 2025. The dominance is driven by increasing consumer preference for convenient, cost-effective, and eco-friendly transportation solutions. E-bikes are widely adopted for urban commuting, fitness, and recreational purposes, offering flexibility and independence to individual users. Technological advancements, such as long-range batteries and lightweight designs, have further enhanced their appeal, particularly in densely populated cities. In addition, rising fuel costs and the shift toward sustainable mobility have amplified demand for the adoption of e-bikes for daily commutes, fueling the segment.

The commercial segment is expected to expand at the fastest CAGR during the forecast period. The increasing adoption of e-bikes for last-mile delivery, logistics, and public transportation services drives the segment's growth. Businesses are turning to e-bikes as an efficient, cost-effective, and environmentally friendly alternative to traditional delivery vehicles, particularly in urban areas where traffic congestion and environmental regulations are significant concerns. The rise of e-commerce and demand for faster, more sustainable delivery solutions have accelerated the adoption of e-bikes in commercial fleets. In addition, government incentives and the development of specialized e-bikes for cargo and delivery further fuel the expansion of the commercial segment.

Regional Insights

Asia Pacific dominated the e-bike market in 2025 and accounted for 58.7%. The region benefits from a strong manufacturing base, cost-effective production, and high population density. Governments in countries like India and Japan are promoting e-bike adoption through subsidies and infrastructure development. Urban congestion and rising environmental concerns are further driving the market, with lightweight and foldable e-bikes gaining popularity in metropolitan areas.

China E-Bike Market Trends

The e-bike market in China dominates the APAC market, accounting for the largest global share in production and consumption. The government's push for electric vehicles to combat pollution, combined with a well-established supply chain, drives growth. Affordable pricing and extensive adoption in urban and semi-urban areas make e-bikes the preferred mode of transportation for daily commutes. The development of high-tech e-bikes with advanced battery systems and connectivity features is further strengthening China's market position.

North America E-Bike Market Trends

The e-bike market in North America is witnessing the fastest growth during the forecasted period, fueled by increasing environmental consciousness and government incentives to promote sustainable transportation. Urban commuting and recreational use are key drivers, with a strong emphasis on e-mountain bikes and city bikes. The market benefits from improving cycling infrastructure and the rising adoption of e-bikes among fitness enthusiasts. While the U.S. leads the region in terms of revenue, challenges like high upfront costs and limited awareness in certain demographics persist.

The U.S. e-bike market accounts for a significant share of North America, driven by growing interest in micro-mobility solutions and rising fuel costs. The demand is concentrated in urban areas, where e-bikes are increasingly seen as viable alternatives to traditional commuting methods. Premium e-bike brands dominate, although entry-level models are gaining traction among first-time buyers. State-level subsidies and tax credits are further accelerating adoption, particularly in states such as California and New York.

Europe E-Bike Market Trends

The e-bike market in Europe represents one of the fastest-growing global markets, supported by government policies promoting eco-friendly transportation and expanding cycling infrastructure. The adoption of e-bikes spans urban commuting, leisure, and cargo transportation, with Germany and the UK leading the charge. High disposable incomes, coupled with a strong focus on sustainable living, have fueled demand for premium and mid-range e-bikes. Robust distribution networks and a preference for high-performance models also support the market.

The UK e-bike market is growing rapidly, driven by increasing investments in cycling infrastructure and rising consumer awareness of eco-friendly mobility. The demand for e-bikes is particularly strong in urban areas, where they are used for commuting and delivery services. Government incentives, such as subsidies and cycling-to-work schemes, are further accelerating adoption. Premium e-bike brands dominate the market, with a growing emphasis on lightweight and foldable models to cater to urban riders.

The e-bike market in Germany stands as the largest in Europe, bolstered by strong consumer demand and a mature cycling culture. The country leads in innovation, with manufacturers focusing on high-performance e-bikes equipped with advanced motor systems and long-range batteries. Cargo e-bikes are gaining significant traction in the logistics sector, driven by rising urbanization and the need for efficient delivery solutions. Favorable government policies and a well-established cycling infrastructure further support market growth.

Key E-Bike Company Insights

Some of the key companies in the market include Yadea Technology Group Co., Ltd., Giant Manufacturing Co., Ltd, Accell Group N.V., Pedego Electric Bikes, Yamaha Motor Company, and others. Prominent players in the market adopt various growth strategies, such as geographic expansion and new product launches, to strengthen their market presence. Moreover, they focus on enhancing their existing product offerings and improving brand awareness to gain a competitive edge in the market. Leading players also take initiatives such as mergers and acquisitions, agreements and contracts, and partnerships with technology companies.

-

Yadea Technology Group Co., Ltd. manufactures electric two-wheelers, including electric motorcycles, mopeds, bicycles, and kick scooters. The company’s extensive product range is designed to cater to the growing demand for eco-friendly transportation solutions. The company has successfully expanded its market presence to over 100 countries. The company has a network of more than 4,000 distributors and 40,000 retailers.

-

Giant Manufacturing Co. Ltd. is a global manufacturer of bicycles, e-bikes, and related products. The company has expanded its portfolio to include e-bikes, with advanced designs and technologies that cater to urban commuters, fitness enthusiasts, and cyclists seeking high-performance models. The company has a strong global presence, with production facilities in Asia, Europe, and the U.S., and continues to lead the market through its commitment to sustainability, cutting-edge designs, and technological advancements in cycling.

Key E-Bike Companies:

The following are the leading companies in the e-bike market. These companies collectively hold the largest market share and dictate industry trends.

- Giant Manufacturing Co. Ltd.

- Yadea Group Holdings Ltd.

- Pedego Electric Bikes

- Merida Industry Co. Ltd

- Trek Bicycle Corporation

- Accell Group N.V.

- Brompton Bicycle Ltd.

- Yamaha Motor Company

- Pon.Bike

- Aima Technology Group Co., Ltd.

Recent Developments

-

In December 2024, Segway revealed two new e-bikes, the Xafari and Xyber, boasting futuristic designs and extensive tech features such as integrated smart technology, full suspension, and long-range capabilities. The Xafari is more cycling-focused, featuring a rear rack, while the Xyber leans into a mini-moto style. Segway's U.S. expansion includes building a dealer network to support these models. The bikes are scheduled to launch in Q1 2025.

-

In April 2024, Pedego introduced its new Fat Tire Trike e-bike, featuring a low-step frame design and three tires for enhanced stability and comfort. This model is equipped with advanced propulsion software, PEDALSENSE. The software offers riders multiple assistance options, including torque assist, throttle drive, and cruise assist. These features aim to provide a customizable and smooth riding experience for a variety of users, making it suitable for both leisure and practical commuting.

E-Bike Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 77.88 billion

Revenue forecast in 2033

USD 144.33 billion

Growth rate

CAGR of 9.2% from 2026 to 2033

Base year of estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Drive, battery, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Giant Manufacturing Co. Ltd.; Yadea Group Holdings Ltd.; Pedego Electric Bikes; Merida Industry Co. Ltd.; Trek Bicycle Corporation; Accell Group N.V.; Brompton Bicycle Ltd.; Yamaha Motor Company; Pon.Bike; Aima Technology Group Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-Bike Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global e-bike market report based on drive, battery, end-use, and region:

-

Drive Outlook (Revenue, USD Million, 2021 - 2033)

-

Belt Drive

-

Chain Drive

-

-

Battery Outlook (Revenue, USD Million, 2021 - 2033)

-

Lead-acid Battery

-

Lithium-ion Battery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global e-bike market size was estimated at USD 69.73 billion in 2025 and is expected to reach USD 77.88 billion in 2026.

b. The global e-bike market is expected to grow at a compound annual growth rate of 9.2% from 2026 to 2033 to reach USD 144.33 billion by 2033.

b. The Asia Pacific dominated the e-bike market with a share of 58.7% in 2025. This is attributable to increasing consumer preferences toward convenient and fuel-efficient vehicles.

b. Some key players operating in the e-bikes market include Accell Group N.V., Pedego Electric Bikes, Merida Industry Co. Ltd., Pon.Bike, Yadea Group Holdings Ltd., Giant Manufacturing Co., Ltd., and Yamaha Motor Company.

b. Key factors that are driving the e-bikes market growth include initiatives undertaken by various governments to mitigate their carbon footprints by encouraging the use of electric vehicles, electric bikes, and bicycles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.