- Home

- »

- Clothing, Footwear & Accessories

- »

-

E-commerce Apparel Market Size, Share & Growth Report 2030GVR Report cover

![E-commerce Apparel Market Size, Share & Trends Report]()

E-commerce Apparel Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Women’s Apparel, Men’s Apparel, Children’s Apparel), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-925-1

- Number of Report Pages: 71

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

E-Commerce Apparel Market Summary

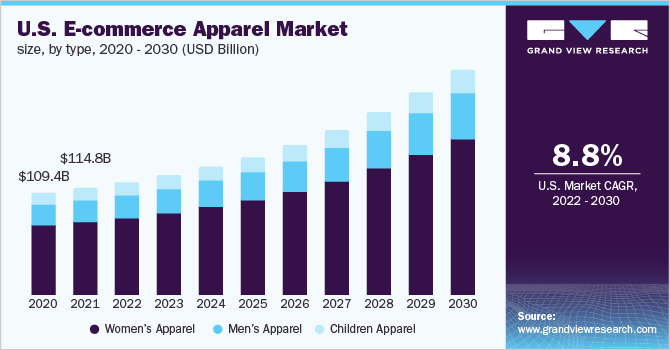

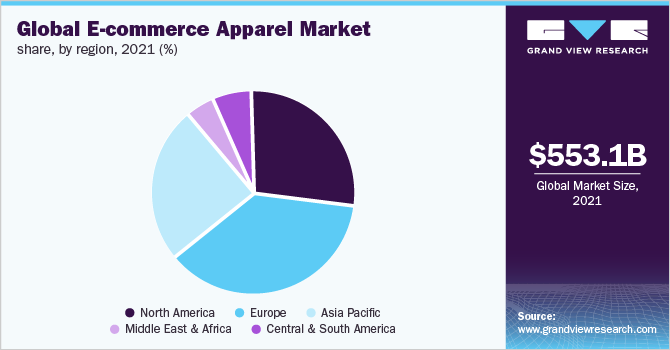

The global e-commerce apparel market size was valued at USD 553.1 billion in 2021 and is projected to reach USD 1,160.56 billion by 2030, growing at a CAGR of 8.6% from 2022 to 2030. This can be attributed to the growing demand for the apparel products on e-commerce platforms from developed regions such as Europe and North America.

Key Market Trends & Insights

- In Asia Pacific, the market is expected to witness the fastest CAGR of 9.4% from 2022 to 2030.

- Europe dominated the market and accounted for the revenue share of more than 36.0% in 2021.

- based on type, Women’s apparel accounted for the largest share of 68.5% of the global revenue in 2021.

Market Size & Forecast

- 2021 Market Size: USD 553.1 Billion

- 2030 Projected Market Size: USD 1,160.56 Billion

- CAGR (2022-2030): 8.6%

- Europe: Largest market in 2021

- Asia Pacific: Fastest growing market

The growth is also accredited to evolving fashion trends, a growing number of working women, rising female population, and the surplus spending power of the shoppers. Moreover, constant product innovations in the market and improving standards of living will drive the demand further. Additionally, rising influence of the celebrities and social media are the factors driving apparel manufacturers to constantly introduce new styles and designs. These factors are expected to drive the apparel market through e-commerce platforms during the forecast period.

Rising awareness about the availability of a variety of products, such as boot cut, high rise, cropped, skinny, tapered, and regular fit jeans, is also contributing to the market expansion. During the pandemic, online sales of the apparel witnessed a significant increase. In-store sales, on the other hand, declined at the peak of the pandemic and remained lower than pre-COVID-19 levels. Since clothing stores were subject to social distancing measures, customer buying behavior in major countries like the U.S. and the U.K was impacted, driving people away from the brick-and-mortar stores and resulting in increased online sales during the pandemic.

As per the research conducted by retaileconomics.co.uk in 2020, consumers across all European markets were expected to visit clothing and footwear stores, less frequently, than in pre-pandemic times.

Type Insights

Women’s apparel accounted for the largest share of 68.5% of the global revenue in 2021 based on type. An upsurge in the number of working women has led to augmented spending on apparel, which is expected to drive the segment growth in the coming years. Also, the leading manufacturers in this segment are concentrating on the introduction of new patterns and styles in formal wear as a result of the growing engagement of women in the workforce.

For instance, in May 2022, Travis Mathew launched the brand's first-ever apparel collection made for women. The new collection takes an elevated approach to the casualization trend-made for the women who do it all-and is a bridge between comfort and fashion.

The men’s apparel segment is anticipated to witness strong growth during the forecast period. Men have become increasingly conscious of the most recent fashion trends and are more interested in their looks and overall appearance. According to a study conducted by Ad glow in 2021, the average internet shopper is predominantly male, aged between 25 and 49 years.

Regional Insights

Demand for apparel sold online in North America is being driven by a rise in the number of consumers, who are aware of stylish and comfortable clothing options. Men across the region are slowly becoming additional well-versed with the most recent fashion trends. Consequentially, this is anticipated to increase manufacturers' potential in the market. Additionally, it is expected that rising disposable income levels particularly in lucrative markets like the U.S. and Canada, will boost consumption of apparel through e-commerce channels and will drive the market growth in the future.

Europe is expected to dominate the e-commerce apparel market during the forecast period due to the rising demand for women’s clothing and increased spending on fashionable and luxury clothing across the U.K., France, and Germany. The customers’ willingness to purchase apparel, footwear, and other accessories for personal usage has boosted the sales of e-commerce shopping in Europe. According to the IMRG Capgemini Online Retail Index, the U.K. online clothing retailers witnessed sales rising by 14.0% in May 2022, as compared to the same period last year.

Asia Pacific is anticipated to be the fastest-growing region in terms of the e-commerce apparel and witness substantial growth owing to increasing demand for the clothing and footwear in the countries such as China, Japan, and India. Also, increasing adoption of the smart phones and the wide availability of 4G has led to a surge in mobile internet usage. Increase in the number of smart phones and mobile internet subscribers are expected to play a key role in driving demand for the e-commerce platforms in Asia Pacific region. For instance, according to the 2021 GSM Association report, 1.22 billion people subscribed to mobile services in China by the end of 2020.

Key Companies & Market Share Insights

The global e-commerce apparel market is highly competitive and fragmented with a large number of players. Major players are investing in research & development to build on innovative technologies to make instruments that are easy to use and of better quality in terms of sound quality. Furthermore, companies are also implementing strategies such as mergers & acquisitions, joint ventures, training workshops for the schools or organizations, and expansions to increase sales.

For instance, in March 2022, Wal-Mart, Inc. announced that Zee kit, a subsidiary of Wal-Mart, had introduced a game-changing technology for Walmart customers dynamic virtual fitting room platform. Zee kit technology has been rolled out to Wal-Mart app and Walmart.com users, beginning with the Choose My Model experience. This feature offers customers the ability to select from 50 models ranging between 5’2” to 6’0” in height and sizes ranging from XS to XXXL.

In May 2022, Lanvin announced an agreement with Shopify Inc. to build a digital platform to explore new growth opportunities in North America. The new digital platform powered by Shopify will allow company to focus on the products and customers, supporting its expansion in the years to comeSome of the prominent players in global e-commerce apparel market include:

-

Wal-Mart Inc.

-

Amazon, Inc.

-

JD.com, Inc.

-

Alibaba Group Holding Limited

-

EBay Inc.

-

Shopify Inc.

-

Rakuten Group, Inc.

E-Commerce Apparel Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 582.91 billion

Revenue forecast in 2030

USD 1,160.56 billion

Growth rate

CAGR of 8.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Germany, U.K., France, China, Japan, Brazil, South Africa

Key companies profiled

Wal-Mart Inc.; Amazon, Inc.; JD.com, Inc.; Alibaba Group Holding Limited; eBay Inc.; Shopify Inc.; Rakuten Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-Commerce Apparel Market Segmentation

This report forecasts revenue growth at the global, regional, & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global e-commerce apparel market report based on the type, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Women’s Apparel

-

Men’s Apparel

-

Children Apparel

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global e-commerce apparel market size was estimated at USD 553.1 billion in 2021 and is expected to reach USD 582.91 billion in 2022.

b. The global e-commerce apparel market is expected to grow at a compound annual growth rate of 7.9% from 2022 to 2030 to reach USD 1,160.56 billion by 2030.

b. Europe dominated the e-commerce apparel market with a share of 36.9% in 2021. This is attributable to the rising demand for women’s apparel from developed nations such as the UK, France, and Germany coupled with rising fashion trends usually originating from Europe.

b. Some key players operating in the e-commerce apparel market include Walmart, Inc.; Amazon, Inc.; JD.com; Alibaba; eBay.com; Flipkart; and Shopify.

b. Key factors that are driving the e-commerce apparel market growth include constantly evolving fashion trends, a growing number of working women, a constantly growing fashion industry, and the surplus spending power of shoppers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.