- Home

- »

- Next Generation Technologies

- »

-

E-Commerce Market For Lighting Industry Size Report, 2033GVR Report cover

![E-Commerce Market For Lighting Industry Size, Share & Trends Report]()

E-Commerce Market (2025 - 2033) For Lighting Industry Size, Share & Trends Analysis Report By Application (Residential, Commercial, Industrial, Outdoor Lighting), By Distribution Channel, By Product Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-684-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

E-Commerce Market For Lighting Industry Summary

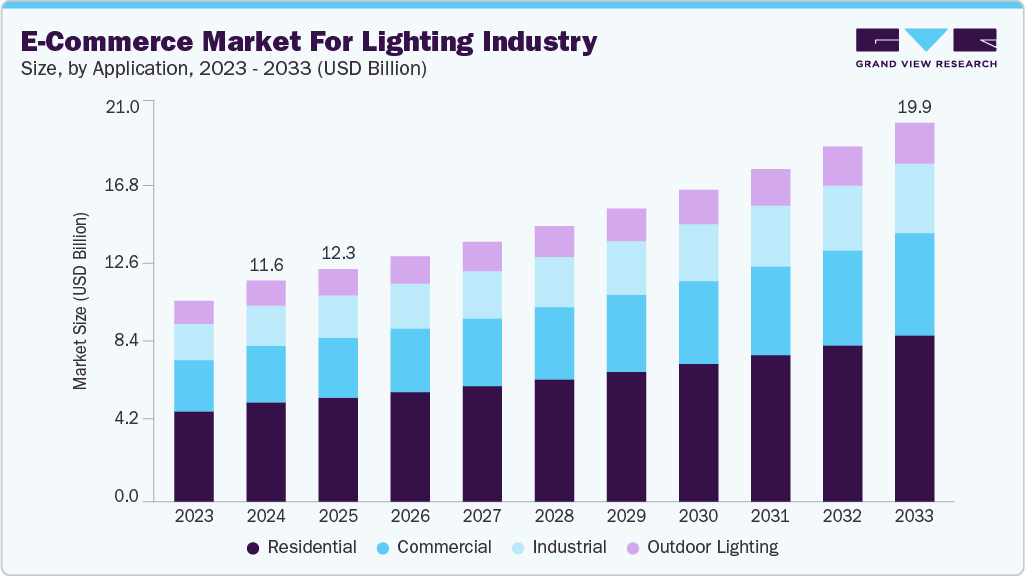

The global e-commerce market for lighting industry was estimated at USD 11.65 billion in 2024 and is projected to reach USD 19.97 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033. With digitalization reshaping the retail industry, the global lighting industry has seen a major shift toward online platforms.

Key Market Trends & Insights

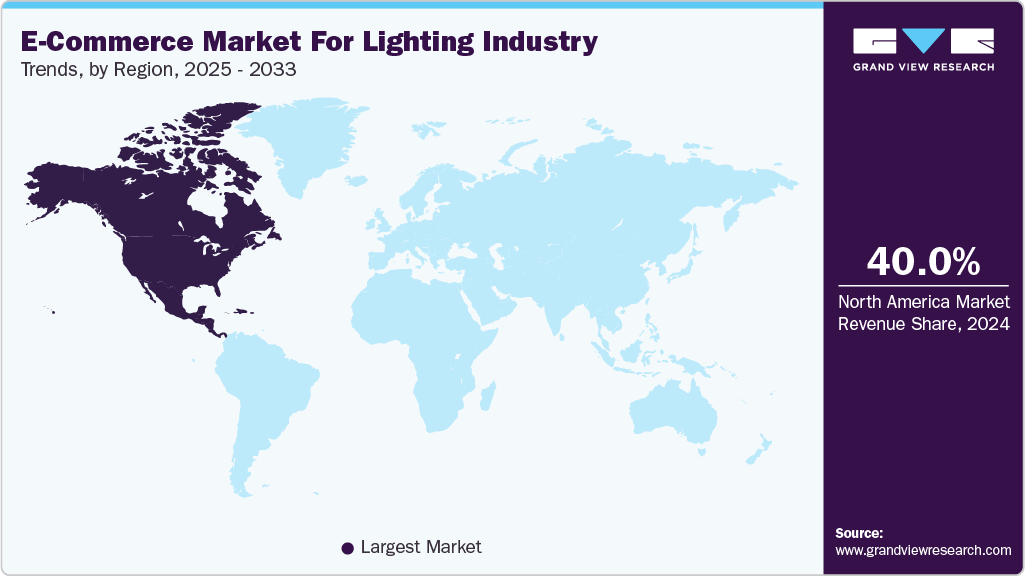

- North America e-commerce market for lighting industry dominated the global market with the largest revenue share of over 40.03% in 2024.

- The e-commerce market for lighting industry in U.S. is expected to grow significantly over the forecast period.

- By application, residential led the market and held the largest revenue share of 44.80% in 2024.

- By distribution channel, the marketplace platforms segment led the market and held the largest revenue share in 2024.

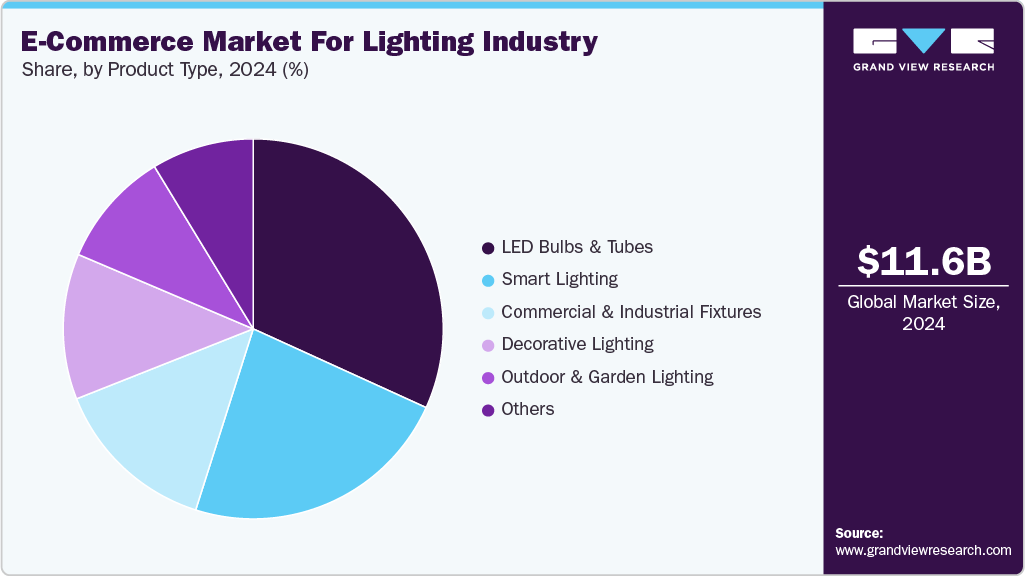

- By product type, the LED bulbs and tubes segment dominated the market and held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.65 Billion

- 2033 Projected Market Size: USD 19.97 Billion

- CAGR (2025-2033): 6.3%

- North America: Largest market in 2024

E-commerce has become a vital sales channel, offering consumers convenience, variety, and access to smart lighting solutions. This transformation has fueled rapid growth in the market, driven by increased internet penetration, smart home adoption, and improved logistics, making online lighting purchases more accessible and appealing across residential and commercial sectors. As the adoption of IoT and smart home devices grows, consumers are actively seeking intelligent lighting options that provide convenience, automation, and energy savings. Smart bulbs, app-controlled fixtures, and voice-activated systems integrated with platforms like Alexa and Google Assistant are now widely available online. This digital-first approach is changing how lighting products are marketed and sold. Brands such as Philips Hue, Yeelight, and Wipro are taking advantage of this trend by offering their smart lighting systems directly through e-commerce channels, enabling seamless updates, remote setup, and access to integrated ecosystems. E-commerce platforms help these brands showcase product features, provide comparison tools, and offer installation guidance, making them more appealing to tech-savvy consumers. As smart homes become common worldwide, the demand for online smart lighting solutions is expected to rise, further enhancing the digital lighting retail market.

Enhanced logistics and fulfillment have been essential in driving the growth of e-commerce in the lighting industry. The availability of fast, dependable delivery services has made it easier to ship large, fragile, or complex lighting products safely and efficiently. Companies now collaborate with specialized logistics providers to ensure minimal transit damage and on-time delivery. Additionally, many brands and retailers offer white-glove services, including in-home delivery, unpacking, and professional installation for intricate fixtures like chandeliers or ceiling lights. These improved services not only increase customer satisfaction but also boost consumer confidence in buying high-value lighting products online, further supporting market growth.

The presence of counterfeit and low-quality lighting products on open e-commerce marketplaces remains a major concern. Global platforms like Amazon, Alibaba, and others often feature third-party sellers, some of whom list unauthorized or imitation products that mimic well-known brands. These fake products typically lack proper safety certifications, deliver poor performance, and can pose safety risks. This not only erodes consumer trust but also harms the reputation and sales of genuine lighting brands. While many platforms are implementing stricter seller verification, quality checks, and customer review monitoring, counterfeit listings still exist due to the vast scale of online inventory. Addressing this issue is essential for maintaining long-term e-commerce market credibility.

Application Insights

The residential segment led the market, capturing a revenue share of 44.80% in 2024. The adoption of smart home technology is greatly driving the residential e-commerce lighting market. As more households adopt automation, the demand for app-controlled and voice-activated lighting solutions increases. Consumers are choosing smart bulbs, dimmers, and lighting kits that easily connect with platforms like Amazon Alexa, Google Assistant, and Apple HomeKit. These products provide added convenience, energy savings, and customization options. The availability of smart lighting through e-commerce channels, along with rising digital literacy and DIY-friendly options, is fueling strong consumer interest and online sales in this sector.

The commercial segment is expected to grow at the highest CAGR of 6.9% throughout the forecast period. Growth in commercial real estate, including retail expansions, coworking spaces, and office renovations, is fueling increased demand for modern and energy-efficient lighting solutions. Businesses are increasingly turning to e-commerce platforms for their lighting needs because of the convenience of quick procurement, competitive prices, and a wide selection of products. Online channels make it easy for commercial buyers to compare features, review certifications, and place bulk orders. This trend is particularly strong among companies looking to modernize their workspaces while cutting costs and reducing energy use.

Distribution Channel Insights

The marketplace platforms segment led the market and held the largest revenue share in 2024. High consumer traffic and brand visibility on global marketplaces like Amazon, Alibaba, Flipkart, Wayfair, and eBay are key factors in driving lighting sales. These platforms attract millions of daily visitors, giving lighting brands and resellers access to a large, ready-to-shop audience. This extensive reach boosts product visibility, brand awareness, and customer trust. For new or mid-tier lighting brands, marketplaces offer an efficient way to gain exposure without heavy marketing costs, resulting in higher conversions and quicker market entry in both domestic and international e-commerce markets.

The B2B portals segment is expected to grow at a significant CAGR during the forecast period. Streamlined procurement is a key benefit of B2B e-commerce portals in the lighting industry. Platforms like Alibaba, Grainger, Uline, and Rexel simplify bulk purchasing for commercial buyers by offering features such as volume-based pricing, purchase order management, and flexible payment terms. These tools lower administrative burdens and speed up the procurement cycle, especially for businesses managing large-scale lighting needs. Centralized ordering, order tracking, and integration with internal systems further boost efficiency, making B2B portals an essential channel for contractors, facility managers, and enterprises sourcing lighting solutions at scale.

Product Type Insights

The LED bulbs and tubes segment dominated the market and held the largest revenue share in 2024. Increasing awareness of energy efficiency is a major factor driving LED bulb and tube sales in the e-commerce lighting market. Consumers and businesses are increasingly focusing on energy savings and environmental impact, moving away from traditional incandescent and CFL lighting. LED options provide lower energy use, longer lifespans, and lower electricity bills. E-commerce platforms support this trend by clearly displaying energy ratings, usage calculators, and comparison tools. This transparency helps buyers make informed decisions, promoting widespread adoption of LED lighting through convenient online channels.

The smart lighting segment is projected to grow at a significant CAGR during the forecast period. Increasing demand for automation and convenience is fueling growth in the smart lighting part of the e-commerce market. Smart lighting devices provide advanced features like remote control, scheduling, dimming, motion sensing, and color customization, allowing users to personalize their lighting for comfort, security, and energy efficiency. These features attract tech-savvy consumers who want to improve their homes. E-commerce platforms make these products very accessible, enabling shoppers to compare options, read reviews, and find compatible devices easily, which further encourages online adoption of smart lighting solutions.

Regional Insights

North America dominated the global market with the largest revenue share of 40.03% in 2024. North America’s mature e-commerce ecosystem significantly supports the online lighting market. The region benefits from reliable logistics, secure and widespread digital payment systems, and high consumer trust in online shopping. These factors make purchasing lighting products online fast, convenient, and hassle-free. Consumers can easily access a wide range of lighting options, compare features, and receive timely deliveries, driving strong growth in e-commerce-based lighting sales across both residential and commercial sectors.

U.S. E-Commerce Market For Lighting Industry Trends

The e-commerce market for lighting industry in the U.S. is expected to grow significantly at a CAGR of 5.5% from 2025 to 2033. The U.S. is a global leader in smart home adoption, driving strong demand for smart lighting solutions such as app-controlled bulbs, smart switches, and connected lighting systems. Consumers increasingly seek convenience, automation, and energy efficiency. Popular brands like GE Lighting (Savant), Philips Hue, and LIFX successfully leverage platforms like Amazon, Best Buy, and D2C websites to reach tech-savvy buyers, fueling consistent growth in online smart lighting sales.

Europe E-Commerce Market For Lighting Industry Trends

The E-Commerce market for lighting industry in Europe is anticipated to register considerable growth from 2025 to 2033. In Europe, there is growing consumer demand for decorative and designer lighting, particularly in countries like Italy, the UK, and Denmark where modern and Scandinavian styles are highly valued. E-commerce platforms enable easy exploration of various aesthetics, allowing users to browse by style, space, or brand. Online tools such as AR visualizations and style filters help consumers envision how designer lighting will enhance their interiors, driving higher online engagement and sales.

The UK e-commerce market for lighting industry is expected to grow rapidly in the coming years. The UK ranks among the top in Europe for smart home adoption, driving high demand for smart lighting solutions like app-controlled bulbs, motion-activated systems, and smart switches. Tech-savvy consumers prefer the convenience and automation these products offer. Online platforms such as Amazon UK, Currys, and direct-to-consumer websites provide easy access, competitive pricing, and detailed product information, making e-commerce the preferred channel for purchasing smart lighting in the UK

The Germany e-commerce market for lighting industry held a substantial market share in 2024. Germany’s strong focus on energy efficiency and sustainability drives demand for LED and smart lighting. Policies like the Energiewende and EU regulations support this shift. E-commerce platforms promote eco-friendly lighting by showcasing energy labels and certifications, influencing environmentally conscious consumers to make informed, sustainable lighting choices online.

Asia Pacific E-Commerce Market For Lighting Industry Trends

Asia Pacific e-commerce market for lighting industry held a significant share in the global market in 2024. Lighting manufacturers in Asia Pacific are increasingly adopting direct-to-consumer (D2C) websites and B2B e-commerce platforms to streamline operations and boost profitability. By bypassing traditional distributors, they can reduce costs, offer competitive pricing, and maintain direct control over branding and customer experience. This shift is gaining momentum in markets like China, India, and Southeast Asia, where digital adoption is high and businesses seek more efficient, scalable procurement and sales channels.

The Japan e-commerce market for lighting industry is expected to grow rapidly in the coming years. Japanese consumers prefer domestic lighting brands like Panasonic, Toshiba, and Iris Ohyama due to their reputation for quality, reliability, and innovation. These brands maintain strong online visibility and offer eco-friendly, durable products. This aligns with Japan’s national emphasis on sustainability, driving higher e-commerce demand for environmentally conscious lighting solutions.

The China e-commerce market for lighting industry held a substantial market share in 2024. China's dominance in LED manufacturing provides significant cost advantages and rapid innovation. This robust supply base enables lighting brands to quickly list, customize, and fulfill products on e-commerce platforms. As a result, consumers benefit from competitive pricing, broad product choices, and faster delivery across both domestic and export markets.

Key E-Commerce Market For Lighting Industry Company

Key players operating in the E-Commerce market for lighting industry are Dialight PLC, Nichia Corporation, Savant Systems Inc., Osram Licht Ag (AMS OSRAM AG), Signify NV, Zumtobel Group AG, Panasonic Corporation, Acuity Brands Inc., Hubbell Incorporated, BestBuy, IKEA, Bajaj Electricals, Amazon Basics, Wayfair, Walmart, BulbAmerica, and Alibaba. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In November 2023, Signify India launched a direct-to-consumer (D2C) website for Philips lighting products to strengthen its presence in the e-commerce market. The platform provides a wide variety of lighting solutions, allowing consumers to purchase directly from the brand with greater convenience, assurance of product authenticity, and access to exclusive online deals.

-

In November 2023, Legrand India launched its D2C platform, the Legrand E-shop, aiming to enhance customer experience and expand its digital footprint. The e-commerce site offers a range of electrical and lighting solutions with features like free delivery, chatbot support, and personalized shopping, targeting both end consumers and electricians across India.

Key E-Commerce Market For Lighting Industry Companies:

The following are the leading companies in the e-commerce market for lighting industry. These companies collectively hold the largest market share and dictate industry trends.

- Dialight PLC

- Nichia Corporation

- Savant Systems Inc.

- Osram Licht Ag (AMS OSRAM AG)

- Signify NV

- Zumtobel Group AG

- Panasonic Corporation

- Acuity Brands Inc.

- Hubbell Incorporated

- BestBuy

- IKEA

- Bajaj Electricals

- Amazon Basics

- Wayfair

- Walmart

- BulbAmerica

- Alibaba.com

E-Commerce Market For Lighting Industry Report Scope

Report Attribute

Details

Market size in 2025

USD 12.26 billion

Revenue forecast in 2033

USD 19.97 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Application

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, product type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Dialight PLC; Nichia Corporation; Savant Systems Inc.; Osram Licht Ag (AMS OSRAM AG); Signify NV; Zumtobel Group AG; Panasonic Corporation; Acuity Brands Inc.; Hubbell Incorporated; BestBuy; IKEA; Bajaj Electricals; Amazon Basics; Wayfair; Walmart; BulbAmerica; Alibaba.com

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

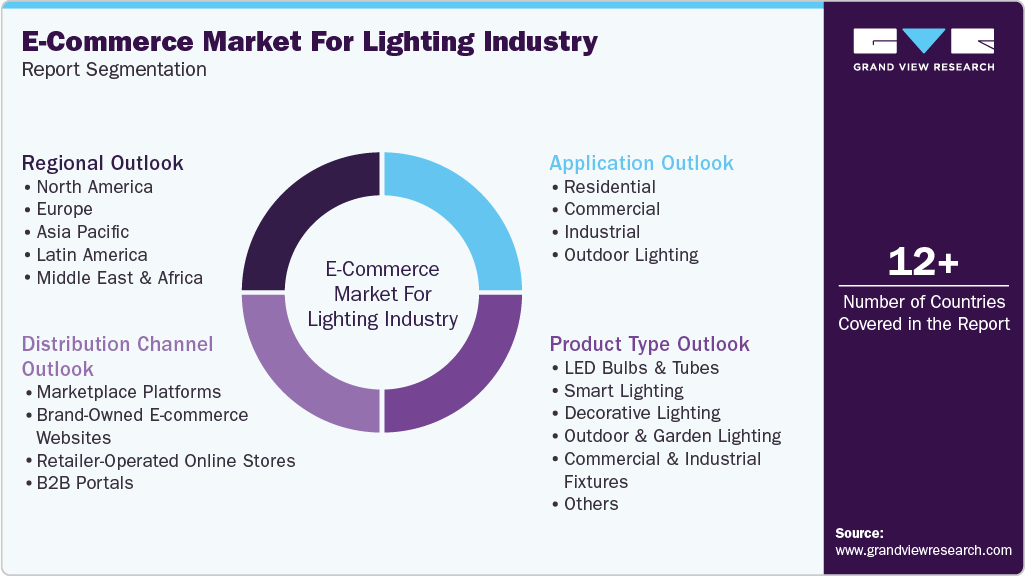

Global E-Commerce Market For Lighting Industry Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the E-Commerce market for lighting industry report based on application, distribution channel, product type, and region:

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Outdoor Lighting

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Marketplace Platforms

-

Brand-Owned E-commerce Websites

-

Retailer-Operated Online Stores

-

B2B Portals

-

-

Product Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

LED Bulbs & Tubes

-

Smart Lighting

-

Decorative Lighting

-

Outdoor & Garden Lighting

-

Commercial & Industrial Fixtures

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global E-commerce market for lighting industry size was estimated at USD 11.65 billion in 2024 and is expected to reach USD 12.26 billion in 2025.

b. The global E-commerce market for lighting industry is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 19.97 billion by 2033.

b. The marketplace platforms segment dominated the market and accounted for the largest revenue share of 50.80% in 2024. High consumer traffic and brand visibility on global marketplaces like Amazon, Alibaba, Flipkart, Wayfair, and eBay play a crucial role in driving lighting sales. These platforms attract millions of daily visitors, offering lighting brands and resellers access to a vast, ready-to-shop audience. This extensive reach enhances product visibility, brand awareness, and customer trust.

b. Key players operating in the E-Commerce market for lighting industry are Dialight PLC, Nichia Corporation, Savant Systems Inc., Osram Licht Ag (AMS OSRAM AG), Signify NV, Zumtobel Group AG, Panasonic Corporation, Acuity Brands Inc., Hubbell Incorporated, BestBuy, IKEA, Bajaj Electricals, Amazon Basics, Wayfair, Walmart, BulbAmerica, and Alibaba.

b. With digitalization reshaping the retail industry, the global lighting industry has seen a major shift toward online platforms. E-commerce has become a vital sales channel, offering consumers convenience, variety, and access to smart lighting solutions. This transformation has fueled rapid growth in the E-commerce Lighting Market, driven by increased internet penetration, smart home adoption, and improved logistics, making online lighting purchases more accessible and appealing across residential and commercial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.