- Home

- »

- Healthcare IT

- »

-

eHealth Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![eHealth Market Size, Share & Trends Report]()

eHealth Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Telemedicine, Health Information Systems), By End-use (Providers, Payers), By Region, And Segment Forecasts

- Report ID: 978-1-68038-614-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

eHealth Market Summary

The global ehealth market size was estimated at USD 343,038.9 million in 2023 and is projected to reach USD 1,116,825.9 million by 2030, growing at a CAGR of 18.4% from 2024 to 2030. The increasing need to manage regulatory compliance and rising healthcare costs is fueling the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Canada is expected to register the highest CAGR from 2024 to 2030.

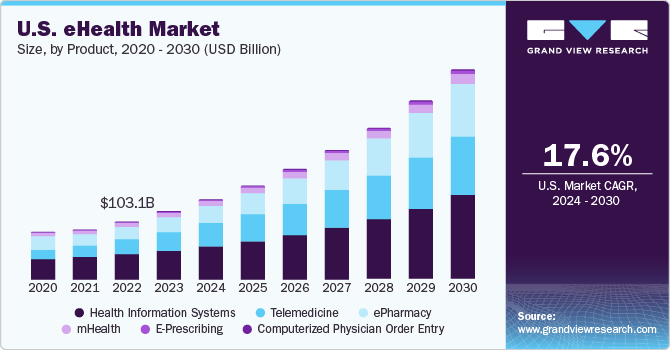

- In terms of segment, health information systems accounted for a revenue of USD 132,657.4 million in 2023.

- E-Prescribing is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 343,038.9 Million

- 2030 Projected Market Size: USD 1,116,825.9 Million

- CAGR (2024-2030): 18.4%

- North America: Largest market in 2023

According to data published by the Peter G. Peterson Foundation in January 2024, the United States ranks among the countries with the highest healthcare expenditures globally.

In 2022, healthcare spending in the U.S. amounted to USD 4.5 trillion, equating to an average of USD 13,493 per capita. Moreover, the increasing prevalence of chronic disease, rising adoption of digital healthcare, and growing need for patient-centric healthcare delivery also contribute to the market growth.

The growing sedentary lifestyle has led to an increase in lifestyle-related disorders, including hypertension and diabetes, which is driving market growth. For instance, according to data published by WHO in March 2023, around 1.28 billion adults aged between 30 to 79 years of age globally suffer from hypertension, with the majority (around two-thirds) residing in middle- and low-income nations. These conditions necessitate continuous monitoring of key physiological metrics, including blood pressure and glucose levels. Integrating healthcare information with mobile devices enables real-time data transmission to healthcare providers, enhancing data accuracy and driving industry demand.

The growing awareness and acceptance of eHealth among healthcare professionals, supported by evidence of its efficiency, are projected to drive significant industry growth. Nonetheless, the increasing need for secure data privacy infrastructure and heightened security concerns will likely impede this expansion during the forecast period. Furthermore, the absence of technologically advanced infrastructure in developing economies is anticipated to limit industry growth.

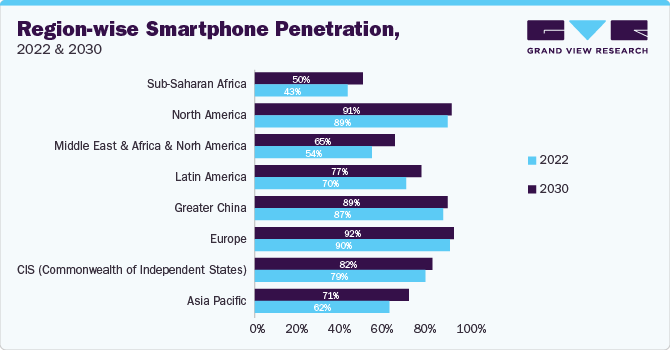

The increasing penetration of smartphones contributes to market growth. According to the GSM Association (GSMA) report statistics published in the Mobile Economy 2023 report, around 5.4 billion people across the globe subscribed to mobile services in 2022, and the number of unique mobile subscribers is expected to reach 6.3 billion by 2030 (73% of the global population). Similarly, as per the Mobile Economy 2023 report, smartphone penetration was around 55% in 2021 and is expected to reach 64% by 2025. Hence, the growing adoption of smartphones is expected to drive market growth over the forecast period.

As illustrated in the figure below, Europe and North America witnessed the highest smartphone penetration accounting for 90% and 89% in 2022, respectively. Moreover, mobile penetration is nearing saturation across global markets, particularly among adults and across urban demographics. Across the globe, the primary growth in the new subscribers category is anticipated from younger consumers and rural residents.

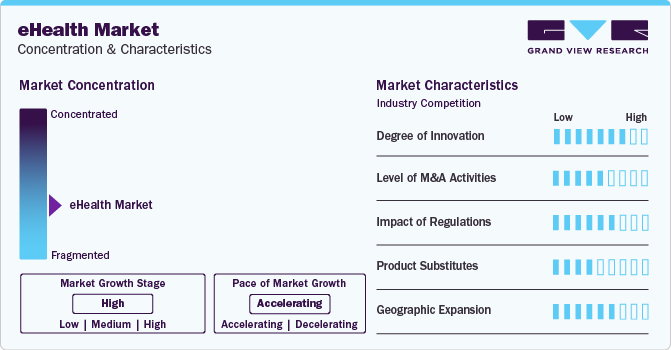

Market Concentration & Characteristics

The market growth is high and accelerating. The market is characterized by the growing aging population, increasing prevalence of chronic diseases, rising adoption of digital healthcare, technological advancements, evolving government policies and regulations, and patient-centered care approaches.

The market is marked by a high degree of innovation due to technological progress, influenced by developments in artificial intelligence (AI), machine learning, and robust network infrastructures. For example, in April 2023, Oracle and Zoom Video Communications, Inc. expanded their partnership to enhance telemedicine services, aiming for increased speed, efficiency, and ease of use. This environment fosters the continuous emergence of innovative AI applications, presenting fresh opportunities for participants in the global market.

Key players are implementing strategic initiatives, such as geographical expansion, innovations, collaborations, and partnerships, to strengthen their market presence. For instance, in April 2023, 3M Health Information Systems entered into a partnership with Amazon Web Services to advance the development of 3M M*Modal ambient intelligence technology. This collaboration will leverage AWS's Machine Learning and generative AI capabilities, utilizing tools such as Amazon Comprehend Medical, Amazon Bedrock, and Amazon Transcribe Medical. The goal is to enhance, streamline, and expand the deployment of 3M’s ambient clinical documentation and virtual assistant solutions.

The market is characterized by a moderate level of merger and acquisition activity by prominent players. This is due to factors including the need to sustain in a rapidly growing market and the desire to gain access to new technologies and advancements. For instance, in February 2023, MediBuddy, a Virtual health company, acquired Aetna's teleHealth business in India.

Market players focus on geographical expansion to capture the untapped market. The expansion is generally done by launching manufacturing facilities in new geographies or partnering with companies at the target location.

Product Insights

The health information systems segment held the market with the largest revenue share of 38.95% in 2023. Increasing healthcare spending and enhancements in its IT infrastructure primarily propel the market growth. In addition, the rising need for remote patient monitoring significantly influences adoption rates. According to an OECD report, between 2015 and 2030, per capita health expenditure is expected to grow at an average annual rate of 2.7%. Furthermore, health expenditure's GDP percentage is expected to rise to 10.2% by 2030, up from 8.8% in 2015.

The e-prescribing segment is expected to grow at a fastest CAGR of 26.8% over the forecast period. The market is anticipated to grow, driven by the rising adoption of electronic prescribing for controlled substances (EPSC) and supportive government regulations. Notably, the SUPPORT for Patients and Communities Act (H.R. 6), enacted by Congress in October 2018, mandates electronic prescriptions for controlled substances within Medicare Part D starting January 1, 2021. In addition, increased awareness concerning patient safety is expected to further propel market growth.

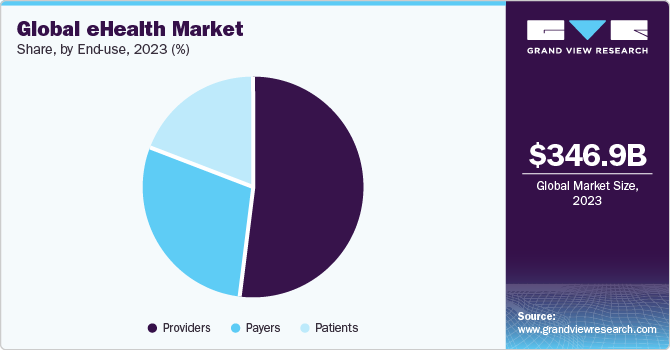

End-use Insights

Based on end-use, the providers segment led the market with the largest revenue share of 51.82% in 2023. Adopting health information systems in hospitals is expected to enhance the efficiency of healthcare professionals and facilitate streamlined patient care. These systems support the management of administrative, financial, and clinical operations, thereby improving the organization of hospital inventory and patient records. Furthermore, advancements in cloud-based technologies are anticipated to drive eHealth adoption in healthcare facilities.

The payers segment is anticipated to witness the fastest CAGR of 19.0% from 2024 to 2030. Healthcare payers are increasingly adopting eHealth solutions to streamline operations, improve member engagement, and enhance outcomes. One major trend is integrating digital tools for claims processing, billing, and payment systems, reducing administrative burdens and costs. Payers are also investing in telehealth services to expand access to care, especially in remote areas.

Regional Insights

North America dominated the eHealth market with the revenue share of 38.95% in 2023. The market growth is primarily driven by the region's advanced healthcare infrastructure and the robust presence of leading industry participants. These companies are engaging in strategic actions to expand their market presence. Factors such as the rising adoption of home care by patients, the growing demand for mobile health technologies, and an increase in healthcare spending are anticipated to propel market growth through the forecast period. For example, the National Health Expenditure (NHE) Fact Sheet indicates that healthcare spending in the U.S. reached USD 4.5 trillion in 2022.

U.S. eHealth Market Trends

The eHealth market in the U.S. is expected to dominate the North America region over a forecast period. The increasing prevalence of chronic disease, increasing healthcare cost and growing need for patient-centric healthcare delivery is fueling the market growth.

The Canada eHealth market is anticipated to grow at a significant CAGR during the forecast period, owing to increase in the number of people suffering from chronic disease. Moreover, several initiatives are being undertaken by the government to create awareness regarding benefits associated with the adoption of eHealth.

Asia Pacific eHealth Market Trends

The eHealth market in Asia Pacific is anticipated to witness at the fastest CAGR of 19.5% from 2024 to 2030. The region has a large patient pool and geriatric population. Lifestyle changes are leading to an increase in the prevalence of various diseases, such as cancer, diabetes, and autoimmune diseases. As a result, the demand for eHealth services is expected to increase.

The Japan eHealth market is expected to grow at a significant CAGR during the forecast period, owing to increasing aging population in the region. As per the data published by Ministry of Internal Affairs and Communications in October 2023, the people aged 65 and above as of September 15, 2023, stood at 36.2 million.

The eHealth market in China held significant market share in 2023, owing to factors such as rising geriatric population, increasing per capita healthcare expenditure, and growing prevalence of chronic disease. Moreover, increasing investment by prominent players in the technological advancements of eHealth solutions is also contributing to the market growth.

The India eHealth market is anticipated to grow at the fastest CAGR during the forecast period. An increase in in hypertension and diabetes is expected to drive the market growth in India over the forecast period. According to the data published by the Indian Council of Medical Research-India Diabetes (ICMR INDIAB) in 2023, around 1.2 million people have diabetes.In addition, the growing prevalence of cancer in India is likely to improve the adoption of eHealth services over the forecast period.

Key eHealth Company Insights

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. Market players such as CVS Health, Teladoc Health, Inc., American Well, iCliniq, Veradigm LLC, Koninklijke Philips N.V, UNITEDHEALTH GROUP, and Medtronic dominated the market. These key players have been developing novel solutions to cater to different end-use applications.

Key eHealth Companies:

The following are the leading companies in the eHealth market. These companies collectively hold the largest market share and dictate industry trends.

- CVS Health

- Teladoc Health, Inc.

- American Well

- iCliniq

- Veradigm LLC

- Koninklijke Philips N.V

- UNITEDHEALTH GROUP

- Medtronic

- Epocrates

- Telecare Corporation

- Medisafe

- Set Point Medical

- IBM

- Doximity, Inc.

- LiftLabs

Recent Developments

-

In January 2024, Eli Lilly introduced LillyDirect, a digital platform designed to streamline purchasing specific medications for patients with prescriptions addressing conditions like diabetes, obesity, and migraine. This platform offers direct access to medications by linking patients with independent teleHealth providers and providing resources for disease management, eliminating the traditional steps of obtaining a prescription from a physician

-

In October 2023, ZS, an international management consultancy and technology firm, introduced the ZAIDYN Connected Health solution under its ZAIDYN by ZS platform. This AI-powered tool is designed to assist pharmaceutical firms, healthcare providers, and insurers in innovating to identify unaddressed needs, enhance patient engagement, and bolster health outcomes

-

In October 2023, Samsung Electronics Co., Ltd. announced a new open initiative in in San Francisco at the Samsung Developer Conference 2023 (SDC23). The company will collaborate with Tulane University School of Medicine, MIT Media Lab, Brigham & Women’s Hospital, and Samsung Medical Center to explore enhancements in the digital health ecosystem and wellness approaches

-

In March 2023, Fujitsu introduced a cloud-based platform to facilitate the secure aggregation and utilization of health-related data, aiming to support digital transformation initiatives within the healthcare sector. This platform is a component of Fujitsu's commitment to fostering a healthier society, aligned with its "Healthy Living" vision under the Fujitsu Uvance umbrella, which focuses on sustainability. It features capabilities for automatically converting data from electronic medical records in healthcare institutions to comply with the HL7 FHIR standards framework, thus streamlining the integration and management of health-related data

eHealth Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 411.04 billion

Revenue forecast in 2030

USD 1,123.26 billion

Growth rate

CAGR of 18.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; UAE; South Africa; Saudi Arabia; Kuwait

Key companies profiled

CVS Health; Teladoc Health, Inc.; American Well; iCliniq, Veradigm LLC; Koninklijke Philips N.V; UNITEDHEALTH GROUP; Medtronic; Epocrates; Telecare Corporation; Medisafe; Set Point Medical; IBM; Doximity Inc.; LiftLabs

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global eHealth Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the eHealth market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Telemedicine

-

Health Information Systems

-

Electronic Health Record

-

Electronic Medical Record

-

Patient Engagement Solution

-

Population Health Management

-

-

mHealth

-

Monitoring services

-

Diagnosis services

-

Healthcare Systems Strengthening Services

-

Others

-

-

ePharmacy

-

E-Prescribing

-

Computerized Physician Order Entry

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Providers

-

Payers

-

Patients

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global eHealth market size was estimated at USD 346.87 billion in 2023 and is expected to reach USD 411.04 billion in 2024.

b. The global eHealth market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 1,123.26 billion by 2030.

b. North America dominated the eHealth market with a share of 38.95% in 2023. The market growth is primarily driven by the region's advanced healthcare infrastructure and the robust presence of leading industry participants. These companies are engaging in strategic actions to expand their market presence. Factors such as the rising adoption of home care by patients, the growing demand for mobile health technologies, and an increase in healthcare spending are anticipated to propel market expansion through the forecast period.

b. Some key players operating in the eHealth market are CVS Health, Teladoc Health, Inc., American Well, iCliniq, Veradigm LLC, Koninklijke Philips N.V, UNITEDHEALTH GROUP, Medtronic, Epocrates, Telecare Corporation, Medisafe, Set Point Medical, IBM, Doximity, Inc., LiftLabs.

b. Key factors that are driving the eHealth market growth include increasing awareness amongst people about eHealth and rising acceptance level among healthcare professionals coupled with evidence of the efficiency of using this technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.