- Home

- »

- Next Generation Technologies

- »

-

Earth Observation Market Size, Share, Industry Report, 2030GVR Report cover

![Earth Observation Market Size, Share & Trends Report]()

Earth Observation Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform, By Orbit Type (Low Earth Orbit, Medium Earth Orbit, Geostationary Orbit), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-607-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Earth Observation Market Summary

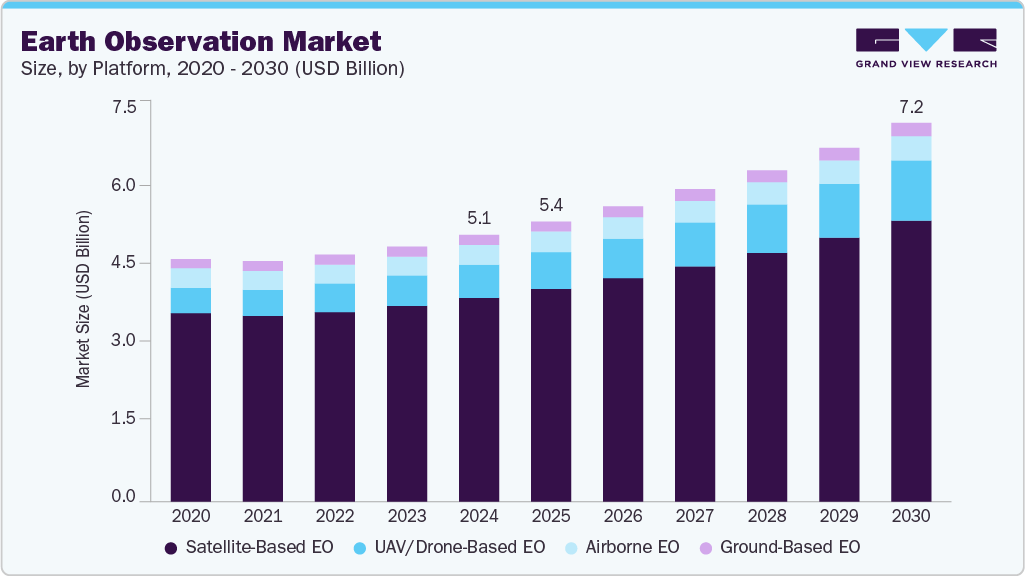

The global earth observation market size was valued at USD 5,101.8 million in 2024 and is projected to reach USD 7,238.4 million by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The market growth is primarily driven by various factors such as the increasing use of satellite imagery and remote sensing technologies.

Key Market Trends & Insights

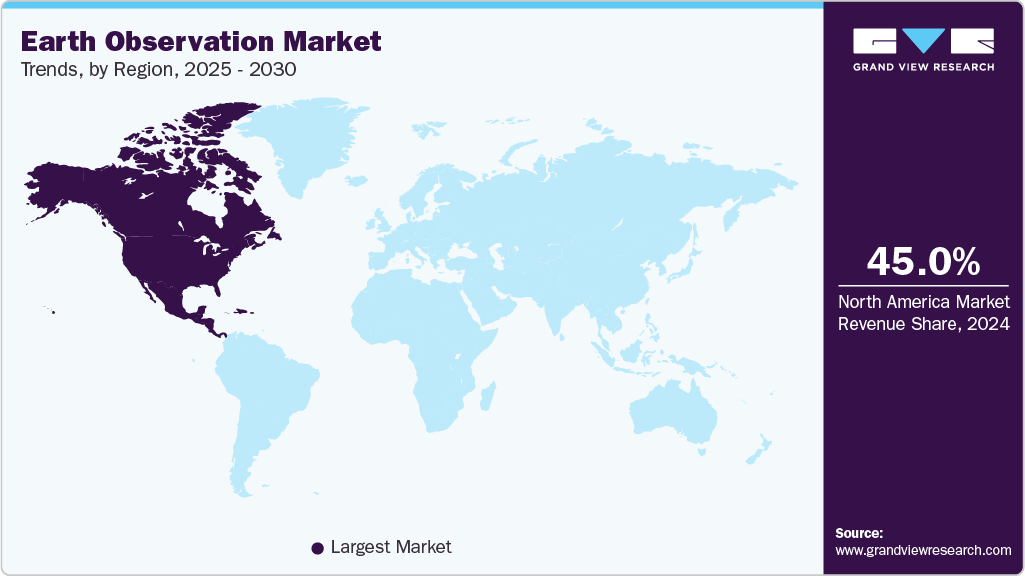

- North America accounted for the largest share of over 45% in 2024.

- The U.S. earth observation market is expected to grow at a CAGR of over 5% from 2025 to 2030.

- By platform, the satellite-based EO segment accounted for the largest market share of over 76% in 2024.

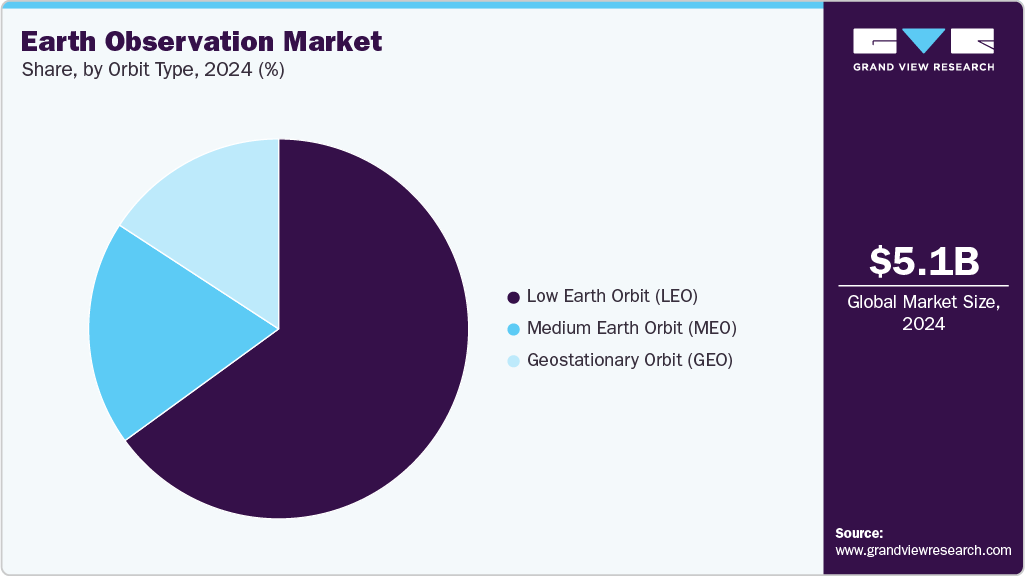

- By orbit type, the low earth orbit segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,101.8 Million

- 2030 Projected Market Size: USD 7,238.4 Million

- CAGR (2025-2030): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rise of climate change concerns has amplified the need to accurately monitor deforestation, ice melt, and atmospheric conditions, relying on the Earth observation industry. The expansion of smart cities and infrastructure projects is accelerating the integration of satellite data into planning and operational workflows. The growing commercialization of space and lower launch costs make satellite data more accessible, significantly contributing to the expansion of the market.The increasing demand for real-time geospatial data is significantly influencing the growth of the Earth observation industry. Governments, defense agencies, and commercial sectors rely more on satellite-based Earth observation to monitor environmental changes, urban development, and infrastructure planning. The ability to gather high-resolution imagery and geospatial intelligence in real time enables stakeholders to make informed decisions for disaster management. This growing need for actionable intelligence is fueling investments in Earth observation technologies.

AI and machine learning advancements are also propelling the Earth observation industry forward. The integration of these technologies allows for more efficient data processing, pattern recognition, and predictive analytics. Satellite data is being transformed into meaningful insights with greater speed and accuracy, enabling crop health monitoring and climate change modeling applications. Automating data interpretation reduces operational costs and broadens accessibility, making Earth observation solutions viable for a wider range of users.

Furthermore, the commercialization of space and the reduction in satellite launch costs are reshaping the Earth observation industry. The emergence of small satellite constellations and reusable launch vehicles has drastically lowered the entry barrier for new players. Private companies are increasingly launching their own Earth observation satellites, expanding the availability of data and creating new service offerings in areas such as precision agriculture, environmental monitoring, and smart city planning. This trend is expected to continue to accelerate the market's growth.

Moreover, increasing environmental concerns and global climate commitments are presenting valuable opportunities for Earth observation technologies. Governments and international organizations are leveraging satellite data to track greenhouse gas emissions, monitor deforestation, and manage natural resources. The emphasis on achieving sustainability goals is prompting investments in Earth observation programs that support environmental protection and compliance tracking. This global push for climate resilience is anticipated to remain a major driver of market expansion in the coming years.

Platform Insights

The satellite-based EO segment accounted for the largest market share of over 76% in 2024, driven by the increasing demand for high-resolution geospatial data. The ability of satellites to cover vast geographic areas with consistent data quality makes them indispensable. The growing need for near real-time insights, especially in climate change tracking and disaster management, is accelerating the adoption of satellite EO platforms. Global industries continue to digitize and rely on data-driven strategies, thereby the satellite-based EO segment remains dominant in the Earth observation industry.

The UAV/drone-based EO segment is expected to witness the highest CAGR of over 10% from 2025 to 2030. This growth is primarily driven by the increasing global demand for real-time, high-resolution geospatial data. UAVs offer unmatched flexibility, lower operational costs, and rapid deployment capabilities compared to traditional satellite systems, making them ideal for localized and time-sensitive applications. The rising number of natural disasters and the global focus on climate monitoring and sustainable development are boosting the need for a dynamic and agile Earth observation industry, reinforcing the rapid adoption of UAV/drone-based EO solutions.

Orbit Type Insights

The low Earth orbit (LEO) segment accounted for the largest market share in 2024, owing to its cost-effective deployment and higher-resolution imaging capabilities. The increasing demand for near-real-time Earth monitoring, particularly in applications such as disaster management, agriculture, and environmental monitoring, is driving the preference for LEO-based satellites. Technological advancements in miniaturized satellites and reusable launch vehicles have made launching into LEO more economical and scalable, thereby contributing to the segment's dominance in the Earth observation industry.

The medium Earth orbit (MEO) segment is expected to witness a significant CAGR from 2025 to 2030. The growing global demand for uninterrupted and high-resolution geospatial data is a primary driver for increased investment in MEO-based satellite systems. Industries such as agriculture and defense increasingly rely on Earth observation, and the scalability and stability provided by MEO satellites are becoming more attractive. The convergence of lower launch costs and advancements in satellite miniaturization is expected to further drive robust growth in this segment.

Technology Insights

The optical imaging segment accounted for the largest market share in 2024, owing to its widespread adoption in areas such as environmental monitoring, urban planning, and disaster management. Optical imaging technology provides high-resolution and multispectral data that is critical for interpreting the land. The simplicity of data interpretation and the availability of commercial optical satellites make it a preferred choice. Advancements in sensor technology, satellite miniaturization, and image processing capabilities make optical systems more cost-effective and accurate, further boosting their dominance in Earth observation.

The radar imaging (synthetic aperture radar) segment is expected to witness the highest CAGR from 2025 to 2030, driven by its ability to capture high-resolution images regardless of weather. Technological advancements, including compact SAR systems and AI-powered data analytics, are improving image accuracy and reducing processing times. Rising investments in small satellite constellations with SAR sensors enhance accessibility and cost-efficiency. These factors contribute to the rapid growth of the radar imaging segment in the global Earth observation industry.

Application Insights

The environmental monitoring segment accounted for the largest market share in 2024, driven by the increasing global focus on sustainability, climate change mitigation, and natural disaster preparedness. The growing number of climate-related agreements and regulations has further amplified the demand for accurate, real-time environmental data. This widespread adoption across regions contributes to the environmental monitoring segment's dominance in the global Earth observation industry.

The agriculture and forestry segment is expected to witness the highest CAGR from 2025 to 2030. The growing demand for precision agriculture and sustainable farming practices is significantly driving the use of the Earth observation industry. In forestry, satellite data is being utilized for deforestation tracking and forest fire management. The increased accessibility to affordable small satellites and open data platforms, along with supportive government initiatives promoting digital agriculture, are accelerating the adoption of the Earth observation industry in the agriculture and forestry sectors.

Regional Insights

North America accounted for the largest share of over 45% in 2024, primarily driven by the region’s advanced space infrastructure, strong presence of commercial satellite operators, and significant government funding. The growing demand for real-time geospatial intelligence in sectors such as agriculture, disaster management, and urban planning is fueling market growth. North America’s proactive stance on climate change and sustainability, coupled with its leadership in AI and data analytics, is driving the adoption of the market.

U.S. Earth Observation Market Trends

The U.S. Earth observation market is expected to grow at a CAGR of over 5% from 2025 to 2030, driven by the country's strong investments in space technology and national security applications. The rapid rise of commercial space companies and public-private partnerships is accelerating innovation in satellite imaging and data analytics. The U.S. government's support for open data policies and space commercialization further enhances market accessibility, fostering a robust ecosystem for startups in the Earth observation industry.

Europe Earth Observation Market Trends

The Europe Earth observation is expected to grow at a CAGR of over 4% from 2025 to 2030. In Europe, the Earth observation market is being significantly driven by government initiatives promoting environmental monitoring and climate resilience. The stringent EU regulations regarding land use, emissions monitoring, and disaster response are prompting increased adoption of geospatial intelligence. The integration of remote sensing technologies into agriculture, forestry, urban planning, and maritime surveillance is also fueling market growth.

The UK Earth observation market is expected to grow at a significant rate in the coming years. The country's robust space technology sector is driving investments in the Earth observation industry. The growing demand for high-resolution satellite imagery to support urban planning and climate monitoring is further accelerating market growth. Strategic collaborations between academic institutions, government bodies, and private enterprises are also fostering advancements in the global Earth observation market.

The Germany Earth observation market is fueled by the country's strategic investments in digital infrastructure and geospatial intelligence. Germany’s commitment to climate monitoring and environmental sustainability is leading to increased adoption of Earth observation technologies. The country’s strong presence in aerospace and engineering also supports the development of cutting-edge satellite systems and remote sensing tools.

Asia Pacific Earth Observation Market Trends

Asia Pacific Earth observation is expected to grow at a CAGR of over 9% from 2025 to 2030, driven by rapid urbanization and increased investment in satellite technologies. The expansion of smart city projects and infrastructure monitoring is fueling demand for high-resolution geospatial data. The proliferation of private space-tech startups, supported by favorable regulatory environments and public-private partnerships, further stimulates innovation in the Earth observation industry.

The Japan Earth observation market is gaining traction, fueled by the country’s strong emphasis on technological innovation. Japan’s geographic vulnerability to natural disasters such as Earthquakes, tsunamis, and typhoons has led to significant investments in Earth observation systems for real-time monitoring. Japan’s leadership in precision engineering and robotics enables the integration of Earth observation data, further contributing to the expansion of the Earth observation market in the country.

The China Earth observation market is rapidly expanding. The country's focus on enhancing national security, environmental monitoring, and agricultural productivity through satellite-based data is fueling the demand for Earth observation capabilities. These factors, combined with robust government funding and a growing commercial space sector, are positioning China as a leading player in the global Earth observation market.

Key Earth Observation Company Insights

Some of the key players operating in the market include AIRBUS and Maxar Technologies, among others.

-

AIRBUS is a global leader in the market, offering a wide array of satellite imagery and geospatial data solutions through its division, Airbus Defence and Space. With a robust fleet of high-resolution optical and radar satellites, Airbus supports applications across defense, agriculture, environment monitoring, and urban planning. Its long-standing partnerships with governmental and commercial clients, along with continuous innovation in AI-powered analytics, solidify its dominant position in the global Earth observation industry.

-

Maxar Technologies is a key player in the market and is known for its high-resolution satellite imagery and advanced geospatial analytics. The company operates the WorldView and GeoEye satellite constellations, delivering critical data for defense, intelligence, disaster response, and commercial mapping. Strong ties to the U.S. government and cutting-edge AI integration into its data services, Maxar plays a central role in driving innovation and decision-making.

Planet Labs PBC and ICEYE are some of the emerging market participants in the Earth observation market.

-

Planet Labs PBC is emerging as a disruptive force in Earth observation with its fleet of small, agile satellites. The company provides daily global imagery, enabling near real-time monitoring for agriculture, forestry, climate change, and logistics. Its cloud-based analytics and open-access model make it a favorite among environmental researchers, commercial users, and government agencies looking for affordable and responsive Earth observation solutions.

-

ICEYE is gaining attention in the Earth observation space for its innovative use of synthetic aperture radar (SAR) technology. Unlike traditional optical satellites, ICEYE's SAR satellites can capture high-resolution imagery regardless of conditions or lighting. The company's rapid deployment of small satellites and its focus on real-time data delivery for disaster management, maritime monitoring, and infrastructure assessment positions it as a rising player in the market.

Key Earth Observation Companies:

The following are the leading companies in the earth observation market. These companies collectively hold the largest market share and dictate industry trends

- AIRBUS

- Maxar Technologies

- Planet Labs PBC.

- Lockheed Martin Corporation.

- L3Harris Technologies, Inc.

- Northrop Grumman.

- ICEYE

- Thales

- SARsat Arabia

- ImageSat International NV

Recent Developments

-

In May 2025, Airbus secured a significant contract with Vietnam, including deals for Earth observation satellites as part of a broader agreement covering aviation, defense, nuclear energy, and transportation sectors. This strategic partnership strengthens Airbus’s position in the Asia-Pacific Earth observation market and underscores the growing demand for advanced satellite technologies to support Vietnam’s industrial and environmental monitoring needs.

-

In February 2025, Thales Alenia Space signed a significant contract with NIBE Space to supply a high-resolution optical satellite, marking the launch of India's first private Earth observation constellation. The deal represents the first operational step in NIBE's Earth observation capabilities, and the satellite is aimed at being deployed soon.

-

In January 2025, ICEYE successfully launched and deployed four new SAR satellites aboard SpaceX’s Transporter-12 Rideshare mission, enhancing its capabilities in the Earth observation industry. The deployment aims to strengthen ICEYE’s position as a global leader in synthetic aperture radar (SAR) satellite operations, supporting high-fidelity Earth observation, persistent monitoring, and disaster management solutions. The new satellites have already established communication and have begun early routine operations, signaling a significant step forward in ICEYE’s satellite constellation expansion.

Earth Observation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,357.3 million

Revenue forecast in 2030

USD 7,238.4 million

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, orbit type, technology, application, and region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AIRBUS; Maxar Technologies; Planet Labs PBC.; Lockheed Martin Corporation.; L3Harris Technologies, Inc.; Northrop Grumman.; ICEYE; Thales; SARsat Arabia; ImageSat International NV

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Earth Observation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Earth observation market report based on platform, orbit type, technology, application, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Satellite-Based EO

-

UAV/Drone-Based EO

-

Ground-Based EO

-

Airborne EO

-

-

Orbit Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Earth Orbit (LEO)

-

Medium Earth Orbit (MEO)

-

Geostationary Orbit (GEO)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical Imaging

-

Radar Imaging (Synthetic Aperture Radar)

-

Thermal Imaging

-

LiDAR Technology

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Environmental Monitoring

-

Disaster Management

-

Agriculture and Forestry

-

Urban Planning and Infrastructure

-

Maritime Surveillance

-

Energy and Power Sector

-

Climate Change Research

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global earth observation market was estimated at USD 5.10 billion in 2024 and is expected to reach USD 5.36 billion in 2025.

b. The global earth observation market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 7.24 billion by 2030.

b. The Asia Pacific earth observation is expected to grow at a CAGR of over 9.6% from 2025 to 2030, driven by rapid urbanization and increased investment in satellite technologies. The expansion of smart city projects and infrastructure monitoring is fueling demand for high-resolution geospatial data. The proliferation of private space-tech startups, supported by favorable regulatory environments and public-private partnerships, further stimulates innovation in the earth observation industry.

b. The key players in the earth observation market are AIRBUS, Maxar Technologies, Planet Labs PBC., Lockheed Martin Corporation., L3Harris Technologies, Inc., Northrop Grumman., ICEYE, Thales, SARsat Arabia, and ImageSat International NV.

b. Key drivers of earth observation market growth include increasing demand for geospatial analytics, advancements in satellite and sensor technologies, rising applications in climate and environmental monitoring, expanding commercial use cases across industries, and supportive government and international initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.