- Home

- »

- Communications Infrastructure

- »

-

E-commerce Fulfillment Services Market Size Report, 2030GVR Report cover

![E-commerce Fulfillment Services Market Size, Share & Trends Report]()

E-commerce Fulfillment Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Bundling Fulfillment Services, Shipping Fulfillment Services), By Application, By Sales Channel, By Organization Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-082-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

E-commerce Fulfillment Services Market Summary

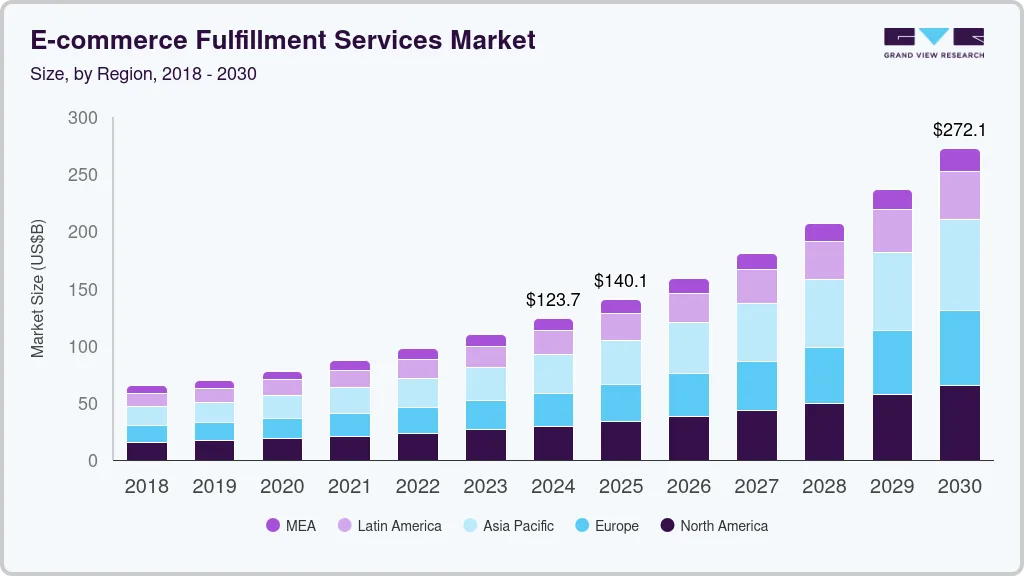

The global e-commerce fulfillment services market size was estimated at USD 123.68 billion in 2024 and is projected to reach USD 272.14 billion by 2030, growing at a CAGR of 14.2% from 2025 to 2030. The proliferation of electronic commerce and the resulting rise in the number of online buyers, especially in emerging economies, is anticipated to fuel the growth of the industry.

Key Market Trends & Insights

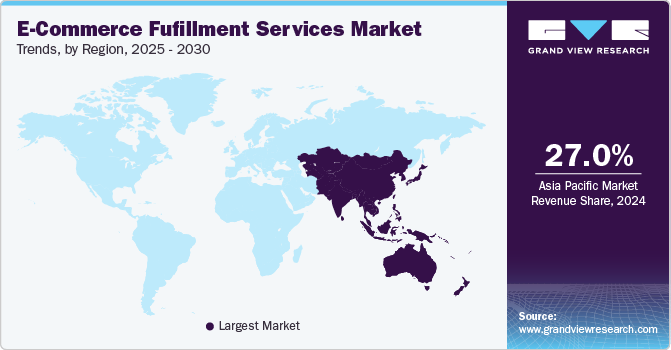

- The e-commerce fulfillment services market in Asia Pacific dominated the global industry and accounted for more than 27% of the global revenue share in 2024.

- China's e-commerce fulfillment services market commands a significant position within the Asia-Pacific region.

- By type, the e-commerce shipping fulfillment service segment led the market and accounted for more than 39.9% of the global revenue in 2024.

- By sales channel, the business-to-business segment dominated the overall market and accounted for a share of more than 60% of the global revenue in 2024.

- By application, the consumer electronics segment is expected to emerge as the fastest-growing segment, registering a CAGR of 16.5% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 123.68 Billion

- 2030 Projected Market Size: USD 272.14 Billion

- CAGR (2025-2030): 14.2%

- Asia Pacific: Largest market in 2024

Fulfillment service centers enable online merchants to outsource services, including bundling, warehousing, shipping, and other value-added services such as return management and urgent parcel service. A fulfillment center is ideal for merchants who do not have robust warehousing capabilities to manage inventory directly and do not want to invest additional efforts in shipping. Besides, e-commerce fulfillment services can be managed in-house by the online merchant too.

Several consumers prefer ordering products online over in-store shopping due to several benefits offered in terms of convenience, cost, variety of choices, and lead time. E-commerce businesses significantly depend upon warehousing and shipping capabilities to get products transported from manufacturing units/ retailers to end-users in a shorter lead time. Traditionally warehousing was highly labor-intensive; however, in recent years, merchants have begun automating operations within the aisles of modern warehouses to minimize human intervention and thereby improve fulfillment productivity and reduce order delivery time. For instance, Amazon.com, Inc. uses robots in its fulfillment centers to assist associates in performing operations and drive faster shipping times.

With the majority of online purchasing sales coming from the urban area, and consumers increasingly demanding product delivery in the shortest possible turnaround time, the location of a fulfillment center is of strategic importance to e-commerce companies. Having centers near major cities that not only house products, but also perform other fulfillment services like sorting, bundling, labeling, and shipping helps players in the electronic commerce market to deliver products in a shorter turnaround time and win customer’s confidence. Thus, fulfillment centers remain a preferred choice for e-commerce companies that require efficient partners for their fulfillment operations.

COVID-19 Impact

The COVID-19 pandemic has severely impacted the world economy, leading to unprecedented wealth destruction of businesses and individuals. Governments worldwide took/are taking varied measures to contain the spread of the infection, such as mandatory lockdowns and restrictions on movement and transportation activities, and border restrictions. These restrictions have taken a severe toll on businesses across every sector, curbing profits and drying up cash flows and financial reserves.

E-commerce companies and fulfillment centers are no exception to this, as the industry suffered a minor setback during the initial phases of the pandemic due to supply chain disruptions and labor shortages. The relaxation of norms to permit the resumption of logistics and transportation services for essential products during lockdowns helped increase the demand for e-commerce fulfillment services. Increased preference for e-commerce services, which helped reduce the rate of spreading infection by providing online delivery of products and services, worked in favor of the e-commerce fulfillment services market in 2020 and continues to drive the market. In addition to e-commerce companies, supermarkets also started delivering online door-to-door services to their consumers, helping prevent the risk of infection from in-store visits. This has further given a boost to online payments and reduced in-person cash transactions.

Service Type Insights

The e-commerce shipping fulfillment service segment led the market and accounted for more than 39.9% of the global revenue in 2024. The trade liberalization policies and cross-border shipment agreements have resulted in increased trade and shipping activities. With the proliferation of the e-commerce industry, e-commerce companies prefer to outsource shipping services to third-party service providers and concentrate on other key business operations. Thus, shipping services account for the largest revenue share in the market.

The warehouse and storage fulfillment service segment also held a considerable revenue share in 2024. The introduction and adoption of automated robots and Augmented Reality (AR) technology in warehouses is significantly improving operational efficiency and consequently contributing towards segmental growth as players in the online sales market worldwide continue to outsource these services in a bid to reduce the delivery time.

Sales Channel Insights

The business-to-business segment dominated the overall market and accounted for a share of more than 60% of the global revenue in 2024. B2B order fulfillment services are involved with the delivery of goods from one business to another business. In other words, they deliver large, bulk shipments to a destination company. These services enable businesses to pre-store materials needed to carry out day-to-day operations. Furthermore, B2B fulfillment services are critical to a company's ability to meet orders on time.

The business-to-customer segment is anticipated to register the fastest CAGR over the forecast period. The B2C fulfillment services consist of packing and picking the items for smaller, one-time purchases or subscriptions that are delivered on a recurring basis. Additionally, B2C fulfillment services offer greater order accuracy to the customer owing to fewer items per order which are shipped and directly delivered to the customers.

Application Insights

The consumer electronics segment is expected to emerge as the fastest-growing segment, registering a CAGR of 16.5% from 2025 to 2030. The growth is attributed to the burgeoning demand for consumer electronics coupled with the need for careful handling of fragile electronic products. Consumer electronics such as mobile phones, tablets, and televisions, among others often need special care while packaging. Since the majority of consumer electronics are extremely fragile, they are required to be packed carefully to reduce the risk of damage. Additionally, the shipping boxes/cartons should also be appropriately sealed to prevent moisture from getting in and affecting the product.

E-commerce fulfillment centers not only manage the specific requirements of packaging but also offer bundling and assembly services. Several electronic products come with accessories such as controllers, extra cables, headphones, and speakers that consumers wish to order together as a kit. The center procures separate products and bundles them for selling as a complete set. To focus on their core business operations, e-commerce companies outsource their storage, processing, and shipping requirements to third-party service providers. Besides, the clothing and footwear segment held the largest share in 2024. Among all the product categories available on e-commerce platforms, sales from the clothing and footwear segment were the highest in 2024.

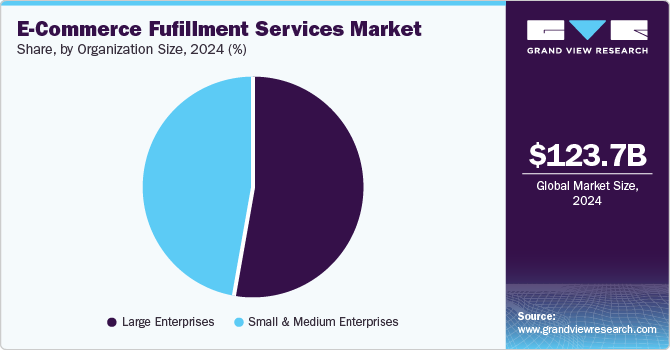

Organization Size

The large enterprises segment dominated the overall market and accounted for a share of more than 53% of the global revenue. According to the Organization for Economic Co-operation and Development (OECD), large enterprises comprise at least 250 employees. Large enterprises widely utilize e-commerce fulfillment services due to larger business volumes and higher-paying capabilities. Furthermore, these services offer large enterprises several benefits, such as increased revenue generation, lower investment in warehouse infrastructure, and reduction in shipping costs, among others.

The small and medium enterprises segment is projected to exhibit a robust CAGR from 2025 to 2030. Small enterprises comprise up to 50 employees, and medium-sized enterprises comprise 50-249 employees. E-commerce fulfillment services are valuable since they free small businesses of additional labor and obligation. Furthermore, such services serve as a go-between, managing all elements of shipping and logistics.

Regional Insights

North America e-commerce fulfillment services market is projected to exhibit a strong CAGR from 2025 to 2030. The growth is characterized primarily by the presence of key market participants in the region, such as Red Stag Fulfillment, Shipfusion Inc., and Amazon.com, Inc., among others. Greater adoption of automation technologies for efficient management of fulfillment services has won the trust of e-commerce companies in the region, leading to market growth. Besides, after China, the U.S. has emerged as the second-largest market for online sales globally, driving the demand for fulfillment services.

U.S. E-commerce Fulfillment Services Market Trends

The e-commerce fulfillment services market in the U.S. has witnessed a remarkable surge in the demand for e-commerce fulfillment services, primarily driven by the rapid expansion of online shopping. As per the Census Bureau of the Department of Commerce, in the third quarter of 2024 alone, retail e-commerce sales reached USD 288.8 billion. This growth reflects the increasing adoption of digital platforms, fueled by rising internet penetration and evolving consumer behaviors. With this surge, the need for efficient and scalable fulfillment solutions has become more pronounced to handle the rising volume of online orders.

Asia Pacific E-commerce Fulfillment Services Market Trends

The e-commerce fulfillment services market in Asia Pacific dominated the global industry and accounted for more than 27% of the global revenue share in 2024. The region is anticipated to continue its dominance over the forecast period on the back of increasing internet penetration and growth prospects offered by relatively untapped markets in the region (rural areas and second-tier cities). Additionally, countries such as China, Japan, and South Korea are among the top 10 exporters of merchandise and account for a large portion of global online sales. Thus, the strong growth prospect of the e-commerce industry in the region is the major factor supporting regional market growth.

China's e-commerce fulfillment services market commands a significant position within the Asia-Pacific region, contributing approximately 33.5% to the market share. This dominance is underpinned by the adoption of cutting-edge technologies such as automation, artificial intelligence (AI), and data analytics. These innovations have significantly enhanced the efficiency and accuracy of order processing, allowing e-commerce platforms to keep pace with the surging demand from China's expansive online consumer base. JD.com, for instance, has leveraged AI to achieve a 92% increase in profits by optimizing its fulfillment processes.

Europe E-commerce Fulfillment Services Market Trends

The e-commerce fulfillment services market in Europe is driven by omnichannel retailing. Retailers increasingly offer options like buy-online-pickup-in-store (BOPIS) and curbside pickup, which require advanced inventory synchronization across multiple sales channels. This trend necessitates seamless fulfillment solutions to ensure inventory availability and timely customer service across digital and physical platforms. Additionally, the rise of small and medium-sized enterprises (SMEs) in the e-commerce space has amplified demand for outsourced fulfillment services. SMEs often lack the resources to manage logistics internally and rely on third-party providers to handle warehousing, packaging, and shipping processes. Outsourcing allows these businesses to remain competitive while focusing on their core operations.

The UK e-commerce fulfillment services market is expected to grow at a significant CAGR from 2025 to 2030. The rising demand for e-commerce fulfillment services in the U.K. is driven by the rapid growth of online shopping, evolving consumer expectations for swift and reliable delivery, and technological innovations in logistics. The integration of technology, including automation, artificial intelligence (AI), and data analytics, has become a key enabler in fulfillment operations. AI tools are widely applied for demand forecasting, inventory management, and optimizing delivery routes, reducing operational inefficiencies and enhancing delivery accuracy. These factors collectively underscore the critical role of efficient fulfillment services in sustaining and enhancing the UK's e-commerce ecosystem.

Key E-commerce Fulfillment Services Company Insights

The industry is fragmented and is expected to experience increased competition due to the presence of several key players. Major players are significantly investing in research and development to incorporate advanced technologies into their fulfillment operations. This has intensified the competitive landscape as companies strive to enhance their service offerings and operational efficiencies. Notable players in the market include Amazon.com, Inc., FedEx, ShipBob, Inc., and United Parcel Service of America, Inc., among others. These companies are also collaborating with local & regional players to gain a competitive edge over their peers and capture a significant market share.

Some of the key companies operating in the industry include United Parcel Service of America, Inc., FedEx, and Amazon.com, Inc.

-

Amazon.com, Inc. is a leading American multinational technology company specializing in e-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence. The company's fulfillment services encompass warehousing, packaging, shipping, and returns management, facilitating efficient order processing and delivery. Through its Fulfillment by Amazon (FBA) program, Amazon enables third-party sellers to store products in Amazon's fulfillment centers. Amazon then handles picking, packing, shipping, and customer service for these products, allowing sellers to benefit from Amazon's logistics expertise and extensive distribution network. The company operates over 110 active fulfillment centers in the U.S. alone, facilitating rapid order processing and delivery.

ShipBob, Inc. and Rakuten Super Logistics are some of the emerging companies in the target industry.

-

ShipBob, Inc., founded in 2014, is a technology-driven fulfillment company that provides comprehensive logistics solutions for e-commerce businesses. Headquartered in Chicago, Illinois, ShipBob operates multiple fulfillment centers across the U.S., enabling efficient and timely order fulfillment for its clients. The company’s platform integrates seamlessly with various e-commerce platforms, enabling businesses to manage orders, track shipments, and monitor inventory from a single dashboard. This integration streamlines operations and provides valuable insights into sales and fulfillment metrics.

Key E-commerce Fulfillment Services Companies:

The following are the leading companies in the E-commerce fulfillment services market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- eFulfillment Service, Inc.

- Ingram Micro, Inc.

- Rakuten Super Logistics

- Red Stag Fulfillment

- ShipBob, Inc.

- Shipfusion Inc.

- Xpert Fulfillment

- Sprocket Express

- FedEx

- United Parcel Service of America, Inc.

E-commerce Fulfillment Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 140.07 billion

Revenue forecast in 2030

USD 272.14 billion

Growth Rate

CAGR of 14.2% from 2025 to 2030

Historic year

2017 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, application, sales channel, organization size, region

Regional scope

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Russia, China, India, Japan, South Korea, Australia, Brazil, UAE, KSA, and Saudi Arabia

Key companies profiled

Amazon.com, Inc., eFulfillment Service, Inc., Ingram Micro, Inc., Rakuten Super Logistics, Red Stag Fulfillment, ShipBob, Inc., Shipfusion Inc., Xpert Fulfillment, Sprocket Express, FedEx, United Parcel Service of America, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-commerce Fulfillment Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global e-commerce fulfillment services market report based on service type, application, sales channel, organization size, and region:

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Warehousing and Storage Fulfillment Services

-

Bundling Fulfillment Services

-

Shipping Fulfillment Services

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Beauty & Personal Care

-

Books & Stationery

-

Consumer Electronics

-

Healthcare

-

Clothing & Footwear

-

Home & Kitchen Application

-

Sports & Leisure

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Direct to Customer

-

Business to Customer

-

Business to Business

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small and Medium Enterprises

-

Large Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global e-commerce fulfillment services market size was estimated at USD 123.69 billion in 2024 and is expected to reach USD 140.07 billion in 2025.

b. The global e-commerce fulfillment services market is expected to grow at a compound annual growth rate of 14.2% from 2025 to 2030 to reach USD 272.14 billion by 2030.

b. Some key players operating in the e-commerce fulfillment services market include Red Stag Fulfillment, Shipfusion Inc., Amazon.com, Inc., ShipBob, Inc., and Ingram Micro Services, among others.

b. The growth of the e-commerce fulfillment services market is primarily driven by the rapid proliferation of e-commerce platforms and the surge in online shopping globally. Factors such as increasing internet penetration, the convenience of digital payments, and changing consumer preferences toward quick and reliable delivery services have significantly boosted demand. Additionally, advancements in logistics technologies, including automation and real-time tracking, along with the expansion of cross-border e-commerce, are further propelling the market's growth.

b. The e-commerce fulfillment services market in Asia Pacific dominated the global industry and accounted for more than 27% of the global revenue share in 2024

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.