- Home

- »

- Automotive & Transportation

- »

-

Third-party Logistics Market Size, Share, Industry Report 2033GVR Report cover

![Third-party Logistics Market Size, Share & Trends Report]()

Third-party Logistics Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (Dedicated Contract Carriage/Freight forwarding, Domestic Transportation Management), By End-use (Retail, Manufacturing), By Transport, By Region, And Segment Forecasts

- Report ID: 978-1-68038-346-1

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Third-party Logistics Market Summary

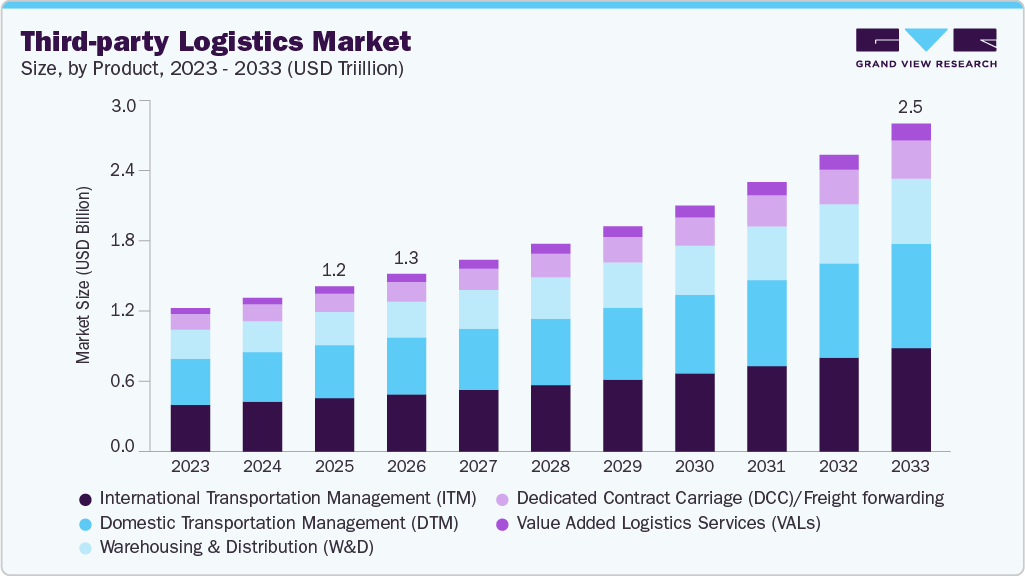

The global third-party logistics market size was estimated at USD 1,260.98 billion in 2025 and is projected to reach USD 2,502.22 billion by 2033, growing at a CAGR of 9.1% from 2026 to 2033. The development of transport infrastructure in Asia and the Middle East, the thriving growth of the e-commerce sector, and the development of new technologies are expected to significantly contribute to the market growth.

Key Market Trends & Insights

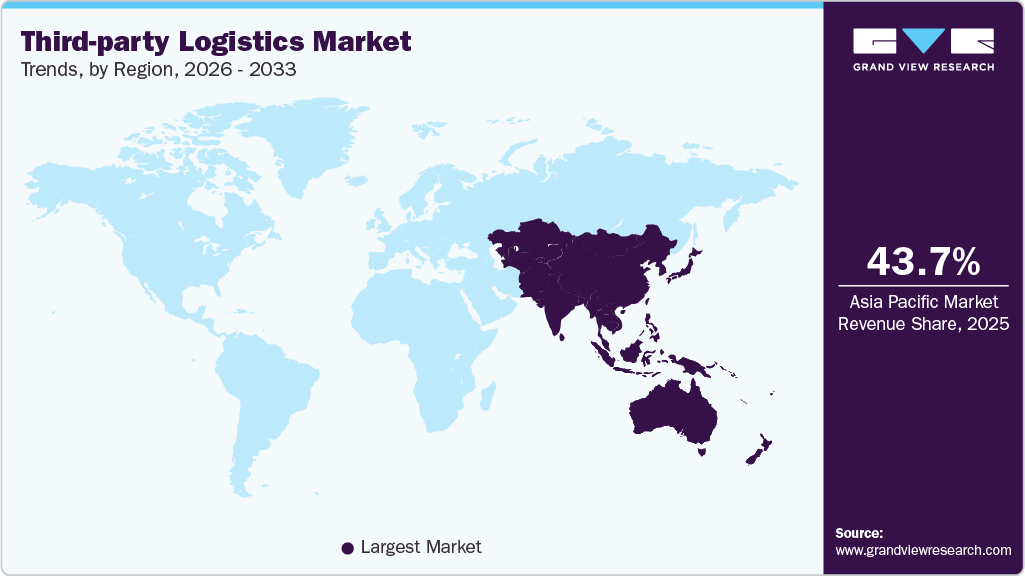

- Asia Pacific third-party logistics market accounted for a 43.7% share of the overall market in 2025.

- The ongoing development of supply chain infrastructure and increasing emphasis on transportation practices in India are expected to propel the market growth in the country.

- By service, the international transportation management (ITM) segment held the largest market share of 32.3 % in 2025.

- By transport, the roadways segment dominated the 3PL market with a share of over 57.3% in 2025.

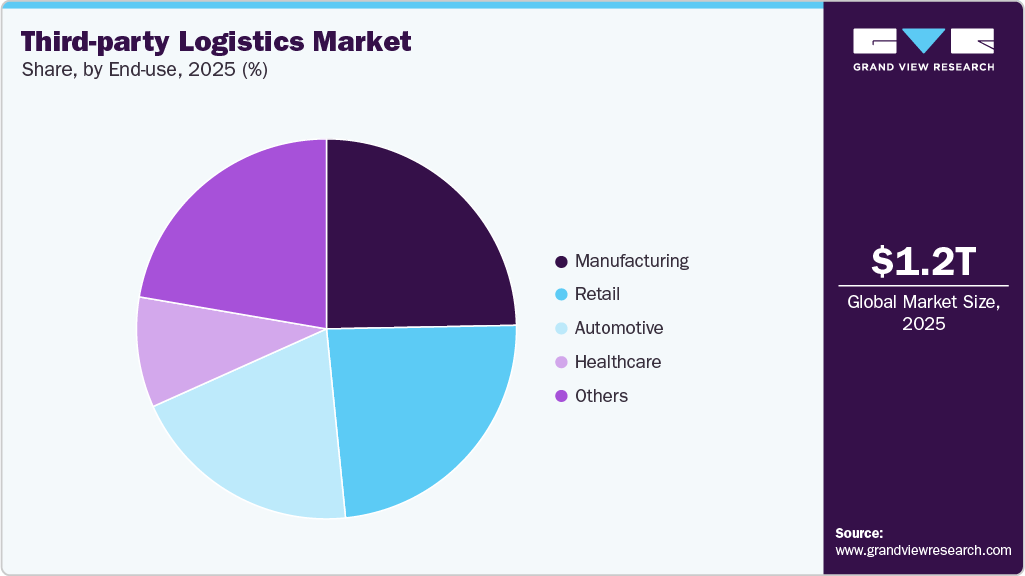

- By end-use, the manufacturing sector held the largest revenue share of 24.7% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1,260.98 Billion

- 2033 Projected Market Size: USD 2,502.22 Billion

- CAGR (2026-2033): 9.1%

- Asia Pacific: Largest market in 2025

Shippers are focusing on outsourcing the transport activity to enhance their operations and cost-effectiveness. The increased working capital and globalization have led to the demand for efficient inventory management services. Moreover, the restructuring of the brick and mortar business model continues to provide dynamic growth to the industry.The changing global supply chain to become more customer-centric enables the companies to outsource their supply chain activities to focus on adaptability and responsiveness. Moreover, the volatile international documentation procedure and customs rules & regulations require the expertise to handle the complex supply chain activity. As a result, small and medium-sized businesses are also leveraging 3PL services.

The rise of e-commerce and digital phenomenon, also called 'The Amazon Effect', has changed consumer expectations and buying behavior. End-users are seeking unparalleled expectations in terms of convenience, cost, control, and choice. Omni-channel operation demands reliable, fast, and free shipping services, which has resulted in companies adopting a new business model to provide low-cost and on-demand delivery services. 3PL companies embrace various modifications in supply chain management to address the notable transformations and challenges that e-commerce presents.

The 3PL companies are shifting their focus from long-haul delivery to just-in-time delivery. The suppliers are also transitioning from multiple storage facilities to a single warehouse location. To accommodate an increase in last-mile delivery, 3PL companies invest in smaller trucks and vans, which can support shorter and more frequent deliveries. In the coming years, last-mile delivery is presumed to be one of the key areas of focus for logistics companies.

Fourth-Party Logistics (4PL) is the step ahead that can manage resources, infrastructure, technology, and even external 3PL to provide a holistic supply chain solution. The 4PL companies offer comprehensive consulting services in addition to transport operations. The service includes logistics strategy, inbound and outbound logistics, inventory planning and management, business planning, and analytics. Deloitte, Accenture plc, BDP International, and DB Schenker Logistics are some of the companies that are offering 4PL services. 4PL is a relatively new concept, but it is expected to gain momentum in the coming years from medium and large businesses seeking a complete transportation solution.

Service Insights

The international transportation management (ITM) segment held the largest market share of 32.3 % in 2025. ITM services are widely adopted for managing cross-border freight, customs coordination, multimodal routing, and compliance across complex global trade lanes. Growth in this segment is driven by expanding international trade volumes, rising outsourcing of freight forwarding activities, and increasing regulatory complexity across regions. Additionally, shippers are prioritizing end-to-end visibility and cost optimization, accelerating demand for integrated ITM solutions. Leading 3PL providers are focusing on digital freight platforms, advanced transportation management systems, and strategic carrier partnerships to enhance network efficiency. Companies such as DHL Supply Chain, Kuehne+Nagel, DB Schenker, and CEVA Logistics continue to strengthen their international transportation capabilities through technology investments and expanded global networks.

The continued growth in global economic activities and a rise in the e-commerce sector have led to an increase in demand for international transportation management services. Trade liberalization policies and cross-border transport activities have increased international trade, thereby propelling the segment's growth. Free Trade Agreements (FTAs) are driving the demand for international transportation. The African Continental Free Trade Area (AfCFTA) and Progressive Trans-Pacific Partnership (CPTPP) are the two recent examples of rising multilateral free-trade agreements. Several bilateral free-trade agreements, such as the Costa Rica- South Korea FTA and the Indonesia-Australia comprehensive economic partnership agreement, are influencing the demand for international transportation services.

Transport Insights

The roadways segment dominated the 3PL market with a share of over 57.3% in 2025. The growing public-private partnerships model and increased emphasis on supply chain infrastructure are expected to drive the growth of roadways over the forecast period. Besides, several government initiatives are fueling the growth of the road transportation segment. The recent regulations imposed by the Federal Motor Carrier Safety Administration that allow the use of the cameras as a substitute for rearview mirrors are expected to benefit the truck drivers in terms of safety.

The waterways segment is expected to emerge as the fastest-growing segment, expanding at a CAGR of 10.1% over the forecast period. This growth is driven by rising cross-border bulk and containerized trade, cost advantages over road and air transport, and increasing investments in port infrastructure and inland waterways. Also, sustainability initiatives and lower carbon emissions associated with water transport are encouraging shippers and 3PL providers to shift freight volumes toward waterways.

End-use Insights

The manufacturing sector held the largest revenue share of 24.7% in 2025. Manufacturing and logistics go hand in hand as the industry has a complex supply chain process. The manufacturing sector involves the procurement of raw materials and other parts from different resources across the regions. The involvement of various suppliers and distributors makes the transport activity a tedious job. Thereby, the manufacturing sector is outsourcing the transportation activities owing to the benefits offered in terms of reduced transportation cost, supply chain visibility, inventory and vendor management, business process development, and improved customer services. The buoyant manufacturing sector in the U.S., Mexico, China, and India has witnessed an increase in outsourced transportation activities. The local manufacturing sector in India is growing with several tax reform policies and government initiatives, such as 'Made in the USA' and 'Make in India' projects.

The automotive sector is expected to emerge as the fastest-growing segment, expanding at a CAGR of 10.1% over the forecast period. Transportation and supply chain management are the backbone of the modern retail industry, playing a crucial role in same-day delivery and fulfillment capabilities. E-retailing and dedicated transportation services have paved the way for medium-scale companies to enter the third-party logistics market, thereby helping the retail companies to expand their operations and offerings in semi-urban areas. Furthermore, 3PL offers flexibility to retail businesses to develop new Transports, enhance capabilities, and expand their regional presence.

Regional Insights

Asia Pacific third-party logistics market accounted for a 43.7% share of the overall market in 2025 and is expected to emerge as the fastest-growing segment, expanding at a CAGR of 10.8% over the forecast period. The growing trans-regional trade corridors and gateways are expected to create a huge opportunity for the 3PL providers. The concentration of manufacturing and sourcing in China has led to the strategic shift of technology, pharmaceuticals, and the automotive sector in other countries. Such a shift is expected to propel the market growth in countries, including India, South Korea, Japan, and Vietnam.

The ongoing development of supply chain infrastructure and increasing emphasis on transportation practices in India are expected to propel the market growth in the country. For instance, the National Highways Authority of India (NHAI) and the National Highways Development Project (NHDP) have taken several initiatives for highway development. Under the Logistics Efficiency Enhancement Program (LEEP) set by the Government of India, the Ministry of Road Transport & Highways (MoRTH) is developing the multi-modal logistics parks. The Vietnamese government proposed the Vietnam Sea Transport Development Plan, vision to 2030, to escalate the maritime freight transportation. Under this plan, the government planned to invest in developing the deepwater port, transit port, and international gateway ports.

North America Third-party Logistics Market Trends

North America third-party logistics market held a significant share in 2025, with the U.S. spearheading the regional market growth. The tight truck capacity across the U.S. has led the shippers to move towards dedicated contract carriage services. Besides, the rising demand for cold storage in the region is expected to boost the third-party logistics market.

Moreover, the presence of key players, including C.H. Robinson Worldwide (CHRW) Inc., XPO Logistics, Inc., UPS Supply Chain Solutions Inc., and Expeditors International of Washington, Inc., aids the regional market growth.

Key Third-party Logistics Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Burris Logistics and FedEx, among others.

-

Burris Logistics is a U.S.-based family-owned and privately held logistics company having expertise in refrigerated warehousing, food-service redistribution, and retail specialty work. The company uses its in-house software for logistical operations, thereby reducing the time and cutting down costs.

-

FedEx offers a vast portfolio of e-commerce, transportation, and business services. The company’s operations and activities are categorized under four reportable business segments, namely FedEx Freight, FedEx Express, FedEx Services, and FedEx Ground.

DB Schenker Logistics and CEVA Logistics are some of the emerging market participants in the target market.

-

DB Schenker Logistics, a German company, is involved in providing integrated service solutions. The company specializes in the exchange of goods in ocean and air freight, land transport, and contract logistics.

-

CEVA Logistics is a Dutch logistics company formed by the merger of EGL Global Logistics and TNT Logistics. CEVA is a non-asset-based supply chain management company that offers several services based on its Contract Logistics and Freight Management expertise, either on a stand-alone basis or in combination.

Key Third-party Logistics Companies:

The following are the leading companies in the third-party logistics market. These companies collectively hold the largest Market share and dictate industry trends.

- BDP International

- Burris Logistics

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- DSV

- DB Schenker Logistics

- FedEx

- J.B. Hunt Transport, Inc.

- Kuehne + Nagel

- Nippon Express

- United Parcel Service of America, Inc.

- XPO Logistics, Inc

- Yusen Logistics Co. Ltd.

Recent Developments

-

In November 2025, RG Group partnered with Nexterus to enhance logistics management and supply chain optimization. Under the agreement, Nexterus provides end-to-end domestic and international freight management, supported by its transportation management system and customer service teams, enabling RG Group to strengthen supply chain efficiency and support future growth.

-

In May 2025, CEVA Logistics renewed long-term contracts with Magneti Marelli Parts & Services in Italy and Poland, extending spare parts warehousing and distribution operations. The renewals strengthened CEVA’s role in optimizing automotive 3PL networks through expanded facilities, improved efficiency, and multi-year operational continuity across key European markets.

-

In May 2025, Circle K entered a third-party logistics partnership with McLane Company, under which McLane will operate three dedicated Midwest distribution centers. The agreement supports Circle K’s merchandise supply chain by improving inventory management, delivery reliability, and network agility across approximately 1,600 stores in 14 U.S. states.

-

In May 2025, JD.com announced plans to launch third-party logistics operations in South Korea, focusing on warehousing and delivery services for local retailers. The company outlined the establishment of logistics centers in Incheon and Icheon, signaling a strategy to build logistics infrastructure first before expanding into direct product sourcing and retail operations.

-

In December 2023, Yusen Logistics partnered with Pickle Robot Company to deploy robotic container unloading systems at its Long Beach transloading facility. The collaboration introduced autonomous unloading under a robotics-as-a-service model, improving worker safety, reducing manual labor, and enhancing operational efficiency across high-volume 3PL transloading operations.

-

In September 2023, C.H. Robinson Worldwide, Inc announced the opening of a new warehouse facility of 400,000 sq. ft. The warehouse is equipped with 154 dock doors and has the capacity to accommodate up to 700 trailers. This expansion enabled the company to extend its presence for trades along the Mexico border and diversify supply chains to ensure efficient transportation and logistics operations along The Port of Laredo.

-

In June 2023, Honor Foods, a subsidiary of Burris Logistics, completed the acquisition of Sunny Morning Foods, a renowned dairy brand and foodservice redistributor based in Florida. This strategic initiative enabled Honor Foods to strengthen its presence in the dairy industry and enhance its entire supply chain solutions. Moreover, this acquisition allowed Honor Foods to expand its operations to the Southeast region, including select areas in Latin America and the Caribbean. Honor Foods is better positioned to cater to the needs of customers in these regions while also gaining a competitive edge in the market.

Third-party Logistics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,356.69 billion

Revenue forecast in 2033

USD 2,502.22 billion

Growth rate

CAGR of 9.1% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, transport, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

BDP International; Burris Logistics; C.H. Robinson Worldwide, Inc.; CEVA Logistics; DSV; DB Schenker Logistics; FedEx; J.B. Hunt Transport, Inc.; Kuehne + Nagel; Nippon Express; United Parcel Service of America, Inc.; XPO Logistics, Inc.; Yusen Logistics Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Third-party Logistics Market Report Segmentation

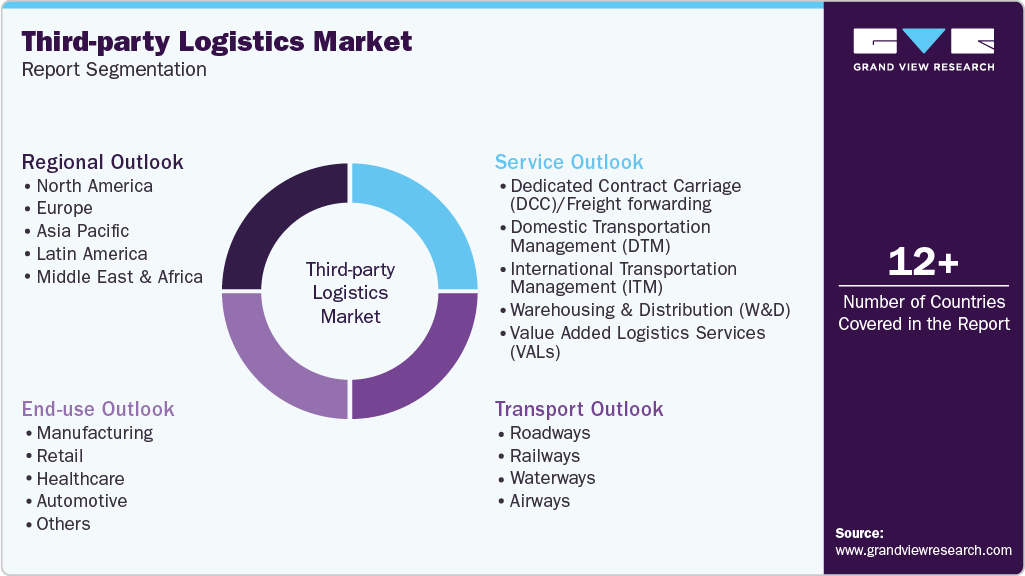

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global third-party logistics market report based on service, transport, end-use, and region:

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Dedicated Contract Carriage (DCC)/Freight forwarding

-

Domestic Transportation Management (DTM)

-

International Transportation Management (ITM)

-

Warehousing & Distribution (W&D)

-

Value Added Logistics Services (VALs)

-

-

Transport Outlook (Revenue, USD Billion, 2021 - 2033)

-

Roadways

-

Railways

-

Waterways

-

Airways

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manufacturing

-

Retail

-

Healthcare

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global third-party logistics market size was estimated at USD 1,260.98 billion in 2025 and is projected to reach USD 2,502.22 billion by 2033.

b. The Asia Pacific region accounted for the maximum revenue share in 2025 and is expected to emerge as the fastest-growing regional market from 2026 to 2033.

b. Some of the key players in the global 3PL market include Deutsche Post AG (DHL Group); Kuehne + Nagel; C.H. Robinson Worldwide, Inc.; United Parcel Service of America, Inc.; and FedEx.

b. The global third-party logistics market is expected to grow at a compound annual growth rate of 9.1% from 2026 to 2033, reaching USD 2,502.22 billion by 2033.

b. The development of logistics infrastructure in the Asia Pacific region and the Middle East, the rapid growth of the global e-commerce sector, and the development of new technologies are expected to significantly contribute to the 3PL market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.