- Home

- »

- Next Generation Technologies

- »

-

Edge AI Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Edge AI Market Size, Share & Trends Report]()

Edge AI Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End Use Industry (Consumer Electronics, Smart Cities, Manufacturing, IT & Telecom, Retail, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-050-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Edge AI Market Summary

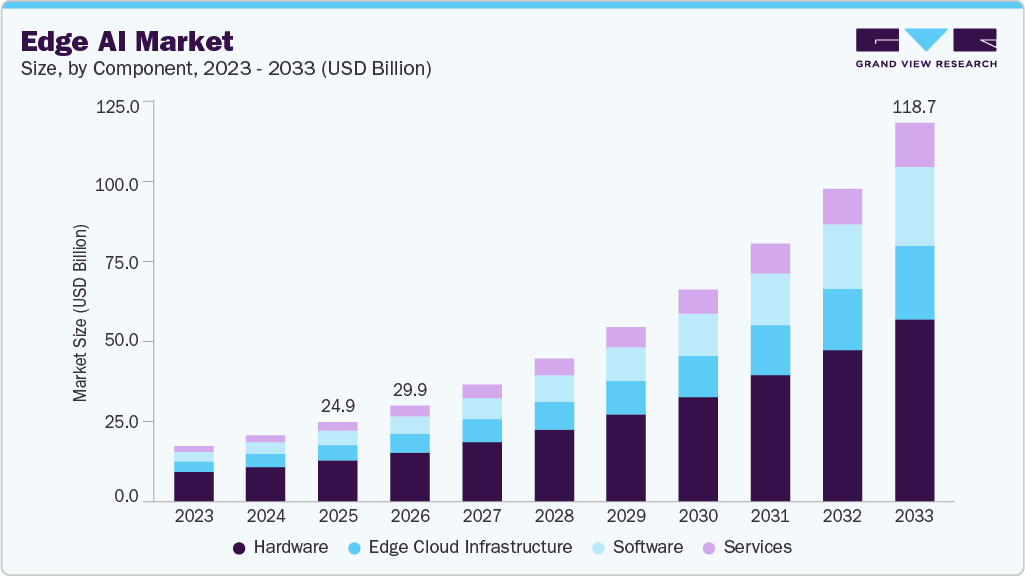

The global edge AI market is anticipated to grow from USD 24.91 billion in 2025 and is projected to reach USD 118.69 billion by 2033, growing at a CAGR of 21.7% from 2026 to 2033. The market is experiencing significant growth driven by the rapid expansion of IoT and connected devices, increasing demand for real-time and low-latency data processing, growing adoption of AI-enabled automation across industries, and rising focus on data privacy and localized intelligence at the network edge.

Key Market Trends & Insights

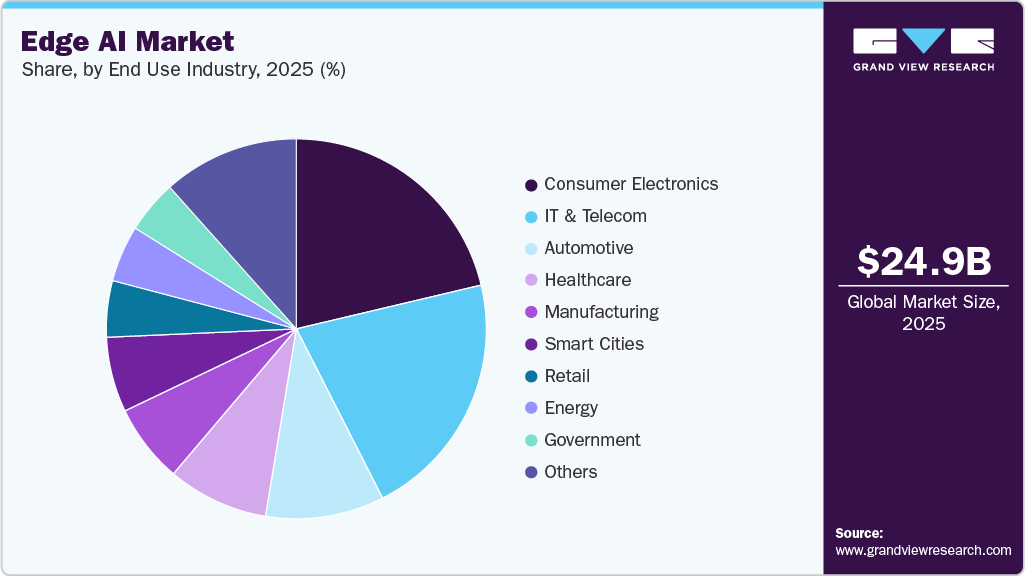

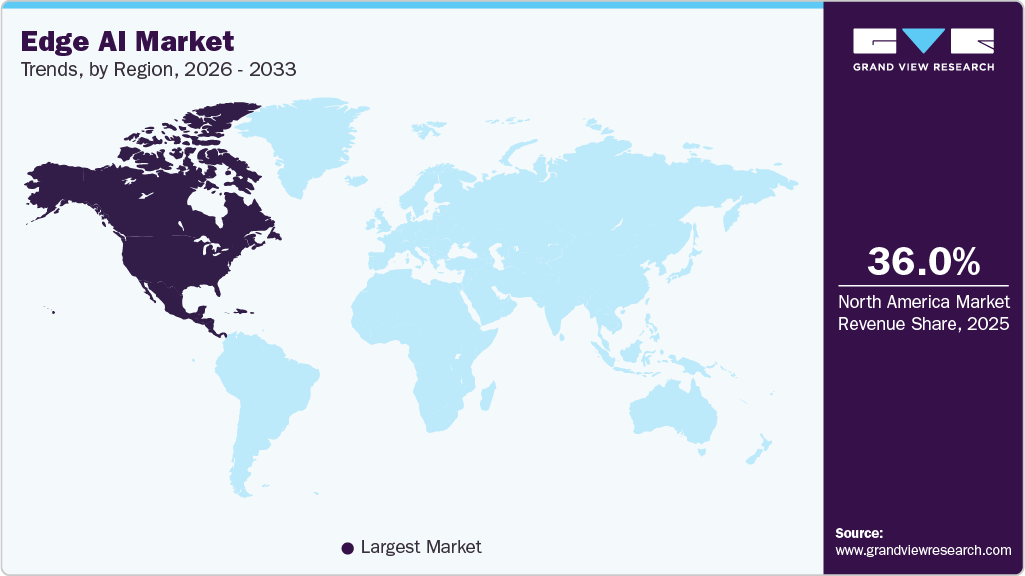

- North America dominated the global edge AI (Artificial Intelligence) market with the largest revenue share of 36% in 2025.

- The edge AI market in the U.S. accounted for the largest market revenue share in North America in 2025.

- By component, the hardware segment led the market with the largest revenue share of 51.8% in 2025.

- By end use industry, the manufacturing segment is expected to grow at the fastest CAGR of 23.0% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 24.91 Billion

- 2033 Projected Market Size: USD 118.69 Billion

- CAGR (2026-2033): 21.7%

- North America: Largest market in 2025

The rising demand for distributed computing resources that support real-time data processing and storage at the network edge is a key driver of market growth.Enterprises are increasingly adopting edge cloud infrastructure to enable low-latency connectivity and improve operational efficiency across digital operations. The rapid expansion of smart cities and IoT ecosystems is further accelerating the need for scalable and resilient edge cloud solutions to manage large volumes of data generated by devices.

By processing data closer to the source, organizations can achieve faster response times while reducing bandwidth and centralized cloud costs. This shift positions edge cloud infrastructure as a critical enabler of enhanced performance, scalability, and improved user experiences across multiple applications.

The growing adoption of AI technologies across enterprises is driving increased demand for consulting, training, and support services to enable effective digital transformation. Organizations are seeking expert guidance to define AI implementation strategies, manage complexity, and adopt best practices that align with their operational objectives. At the same time, training and continuous support services are becoming critical as companies invest in upskilling their workforce to leverage AI-driven solutions fully. As AI adoption expands across industries such as manufacturing, healthcare, and automation, the need for ongoing optimization and lifecycle support is expected to rise. By delivering industry-specific, tailored service offerings, providers play a crucial role in ensuring the successful deployment of edge AI and long-term value creation.

The edge AI industry is driven by a rapid transition toward omnichannel retail strategies aimed at enhancing the overall customer experience. Retailers are increasingly leveraging edge AI to deliver personalized offerings through real-time analysis of consumer behavior across physical stores and digital platforms. AI-powered solutions enable retailers to gain deeper insights into customer journeys, supporting improved inventory management, accurate demand forecasting, and optimized in-store operations. The growing integration of IoT devices further underscores the importance of real-time edge analytics in maintaining optimal stock levels and operational efficiency. In addition, edge AI supports dynamic pricing, instant customer feedback analysis, and adaptive promotions, ultimately strengthening profitability, customer satisfaction, and long-term brand loyalty.

Component Insights

The hardware segment led the market with the largest revenue share of 51.8% in 2025, owing to the rising demand for real-time data processing across IoT devices, autonomous vehicles, and smart city applications. Enterprises are increasingly adopting advanced edge hardware to reduce latency, enhance operational efficiency, and enable localized decision-making with reduced reliance on centralized cloud infrastructure. The rapid proliferation of IoT deployments across healthcare, manufacturing, and agriculture is further driving demand for specialized AI processors, GPUs, and edge-optimized systems that can handle complex workloads. In addition, the shift toward decentralized computing and the integration of AI capabilities into edge devices are making hardware solutions indispensable for time-sensitive and mission-critical applications.

The software segment is projected to grow at the fastest CAGR over the forecast period, primarily driven by the rising demand for real-time analytics and machine learning capabilities deployed at the edge. Organizations are increasingly prioritizing edge-focused software solutions to extract AI-driven insights while minimizing dependence on centralized cloud infrastructure. Advancements in agile development, DevOps practices, and enterprise AI platforms such as IBM watsonx.ai are accelerating the development and deployment of scalable, edge-ready software applications. In addition, growing investments in customized software aligned with specific operational requirements and digital transformation initiatives are expected to propel software adoption across industries further.

End Use Industry Insights

The consumer electronics segment accounted for the largest market revenue share in 2025, driven by the increasing integration of Artificial Intelligence into everyday devices such as smartphones, smart speakers, and wearables. Edge AI enables these devices to process data locally, supporting advanced features such as voice recognition, personalized recommendations, and real-time analytics, which significantly enhance the user experience. The growing adoption of smart home devices further accelerates segment growth, as consumers increasingly prefer intelligent products that offer faster response times, greater automation, and reduced reliance on constant cloud connectivity. Privacy benefits associated with localized data processing are also strengthening consumer acceptance of edge AI-enabled electronics. In addition, sustained investments in R&D by leading manufacturers to develop energy-efficient, high-performance AI-enabled devices continue to reinforce the segment’s market leadership.

The manufacturing segment is projected to grow at the fastest CAGR over the forecast period, owing to the industry’s rapid shift toward Industry 4.0 practices that emphasize automation, connectivity, and data-driven decision-making. Edge AI enables real-time monitoring, predictive maintenance, and localized analytics on the factory floor, significantly improving operational efficiency and reducing unplanned downtime. The integration of edge AI with industrial IoT and smart automation systems enables proactive quality control, optimizes production processes, and enhances supply chain visibility. As manufacturers increasingly deploy AI-powered robotics and edge platforms to boost productivity and minimize human error, demand for edge AI solutions is expected to accelerate steadily.

Regional Insights

North America dominated the global edge AI market with the largest revenue share of 36% in 2025, driven by early technology adoption and strong digital infrastructure. The region benefits from the widespread deployment of edge AI across various industries, including healthcare, retail, manufacturing, and autonomous systems. High investments in AI research, cloud-edge integration, and advanced semiconductor development further support market leadership. The presence of major technology providers and a mature ecosystem continues to accelerate innovation and commercialization of edge AI solutions.

U.S. Edge AI Market Trends

The edge AI market in the U.S. accounted for the largest market revenue share in 2025. The market is experiencing robust growth driven by strong demand for real-time data processing across IoT, defense, healthcare, and smart infrastructure applications. Enterprises are increasingly adopting edge AI to enhance operational efficiency, reduce latency, and strengthen data security. Significant investments in AI startups, edge hardware, and software platforms are accelerating deployment at scale. Supportive government initiatives and strong collaboration between industry and research institutions further reinforce market expansion.

Europe Edge AI Market Trends

The edge AI market in Europe is experiencing significant growth, driven by increasing adoption of Industry 4.0 practices and smart manufacturing initiatives. The rising emphasis on data privacy, regulatory compliance, and localized data processing is driving the deployment of edge-based AI solutions. Key industries such as automotive, energy, and industrial automation are leveraging edge AI for predictive maintenance and process optimization. In addition, growing investments in smart cities and sustainable digital infrastructure are supporting long-term market growth.

Asia Pacific Edge AI Market Trends

The edge artificial intelligence market in Asia Pacific is anticipated to grow at the fastest CAGR throughout the forecast period, driven by rapid industrialization and large-scale adoption of IoT technologies. Countries such as China, Japan, and South Korea are investing heavily in smart manufacturing, robotics, and connected infrastructure. The expansion of consumer electronics production and rising demand for AI-enabled devices further contribute to market momentum. Strong government support for digital transformation and smart city development is expected to sustain high growth across the region.

Key Edge AI Company Insights

Some of the key players operating in the market include Amazon.com, Inc., and Intel Corporation, among others.

-

Amazon is a prominent player in the edge AI industry, driven by AWS Greengrass and its integrated AI and cloud ecosystem that enables seamless edge-to-cloud deployment. The company’s strength lies in combining scalable cloud infrastructure with AI-enabled IoT and real-time edge processing capabilities. Amazon competes primarily with Microsoft Azure and Google Cloud, while also facing indirect competition from specialized AI hardware providers such as Intel and NVIDIA. However, data security concerns, regulatory scrutiny, and the need for continued investment in AI chips and edge security remain key challenges.

-

Intel holds a prominent position in the edge AI industry through its AI accelerators, OpenVINO toolkit, and FPGA-based solutions supporting real-time edge inference. Its competitive advantage is rooted in the integration of AI processing with high-performance computing, serving industries such as healthcare, automotive, and industrial automation. Intel’s Xeon processors and AI-optimized chips enable low-latency, enterprise-grade edge computing deployments. Nonetheless, rising competition from NVIDIA’s GPU leadership and the shift of major players toward in-house silicon development continue to pressure Intel’s market position.

Key Edge AI Companies:

The following are the leading companies in the edge artificial intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- ADLINK Technology Inc.

- Alphabet Inc.

- Amazon.com, Inc.

- Gorilla Technology Group

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Nutanix, Inc.

- Synaptics Incorporated

- Viso.ai

Recent Developments

-

In January 2025, Qualcomm Technologies, Inc., a U.S.-based semiconductor company, and Amazon.com, Inc. collaborated to enhance in-car experiences using Qualcomm’s Snapdragon Cockpit Platform and Amazon’s AI and cloud capabilities, enabling more intuitive, personalized, and AI-powered solutions. The collaboration provides automakers with a virtual development environment.

-

In January 2025, ADLINK Technology Inc. launched the DLAP Supreme Series, an edge generative AI platform powered by Phison’s aiDAPTIV+ technology, which overcomes memory limitations and enhances performance on edge devices, making generative AI more accessible and cost-effective. This breakthrough enables enterprises to deploy large language models and accelerate the adoption of AI.

-

In January 2025, Synaptics Incorporated formed a strategic partnership with Broadcom, Inc., a U.S.-based semiconductor manufacturing company, to integrate advanced technologies such as UWB, Wi-Fi 8, Wi-Fi 7, Bluetooth, and next-gen GPS/GNSS into its wireless product portfolio. This collaboration strengthens Synaptics' Edge AI capabilities and broadens its market reach within the IoT and Android ecosystems.

Edge AI Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 29.98 billion

Revenue forecast in 2033

USD 118.69 billion

Growth rate

CAGR of 21.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion & CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

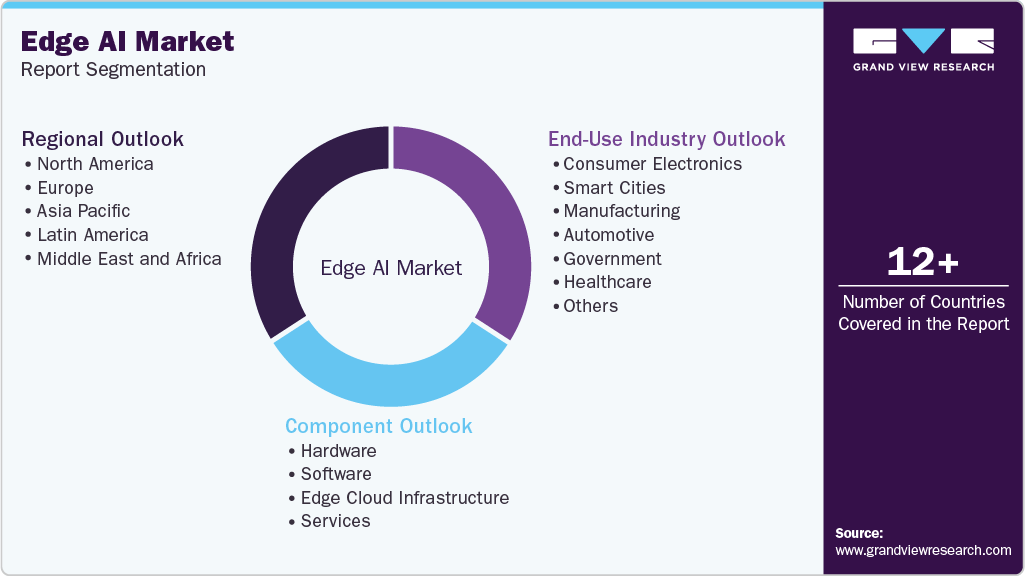

Segments covered

Component, end use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ADLINK Technology Inc.; Alphabet Inc.; Amazon.com, Inc. ; Gorilla Technology Group; Intel Corporation; International Business Machines Corporation; Microsoft Corporation; Nutanix, Inc.; Synaptics Incorporated; Viso.ai

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edge AI Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global edge artificial intelligence market report based on the component, end-use industry, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Edge Cloud Infrastructure

-

Services

-

-

End-Use Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Smart Cities

-

Manufacturing

-

Automotive

-

Government

-

Healthcare

-

IT & Telecom

-

Energy

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global edge AI market size was estimated at USD 24.91 billion in 2025 and is expected to reach USD 29.98 billion in 2026.

b. The global edge AI market is expected to grow at a compound annual growth rate (CAGR) of 21.7% from 2026 to 2033, reaching USD 118.69 billion by 2033.

b. North America dominated the edge AI market, accounting for a share of over 36% in 2025, driven by early technology adoption and strong digital infrastructure. The region benefits from the widespread deployment of edge AI across various industries, including healthcare, retail, manufacturing, and autonomous systems.

b. Some key players operating in the edge AI market include ADLINK Technology Inc., Alphabet Inc., Amazon.com, Inc., Gorilla Technology Group, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Nutanix, Inc., Synaptics Incorporated, Viso.ai

b. Key factors driving the edge AI market growth include the growing use of edge AI applications such as Smart AI Vision, Smart Energy, AI Healthcare, Smart Factory, and Intelligent transportation systems is attributed to the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.